$DPZ (-0,38%)

$HIMS (-0,67%)

$KTOS (-9,24%)

$DOCN (-4,89%)

$FME (+1,61%)

$KDP (+1,54%)

$AMT (+1,11%)

$HD (+0,84%)

$WDAY (-1,52%)

$FSLR (+2,98%)

$TEM (-2,07%)

$O (+1,13%)

$MELI (-0,16%)

$HPQ (+0,9%)

$LCID (-1,81%)

$DRO (-0,77%)

$HSBA (+1,43%)

$FRE (-0,06%)

$AG1 (+2,62%)

$CRCL (+2,48%)

$UTHR (-1,54%)

$LDO (+0,24%)

$IDR (+1,17%)

$NTNX (-3,65%)

$PARA (-1,35%)

$NVDA (+1%)

$TTD (+0,14%)

$AI (-2,75%)

$CRM (-0,11%)

$SNPS (-0,54%)

$SNOW (-3,7%)

$PSTG (+0,82%)

$ZIP (+11,17%)

$ZM (-0,43%)

$NU (+1,09%)

$RR. (+1,31%)

$MUV2 (+0,8%)

$BIDU (-1,12%)

$CELH

$DTE (+0,29%)

$STLAM (+2,73%)

$WBD (+0,08%)

$HAG (+0,69%)

$QBTS (-7,11%)

$LKNCY (+0,91%)

$BABA (+0%)

$G24 (+1,36%)

$HTZ (-1%)

$PUM (+0,37%)

$AIXA (-0,54%)

$RUN (+1,53%)

$INTU (-0,11%)

$WULF (-2,68%)

$MNST (+1,52%)

$SQ (+0,2%)

$ADSK (-1,05%)

$MP (-5,53%)

$RKLB (-6,56%)

$SOUN

$SMR

$CRWV (-9,31%)

$CPNG (+1,03%)

$DUOL

Hensoldt

Price

Discussão sobre HAG

Postos

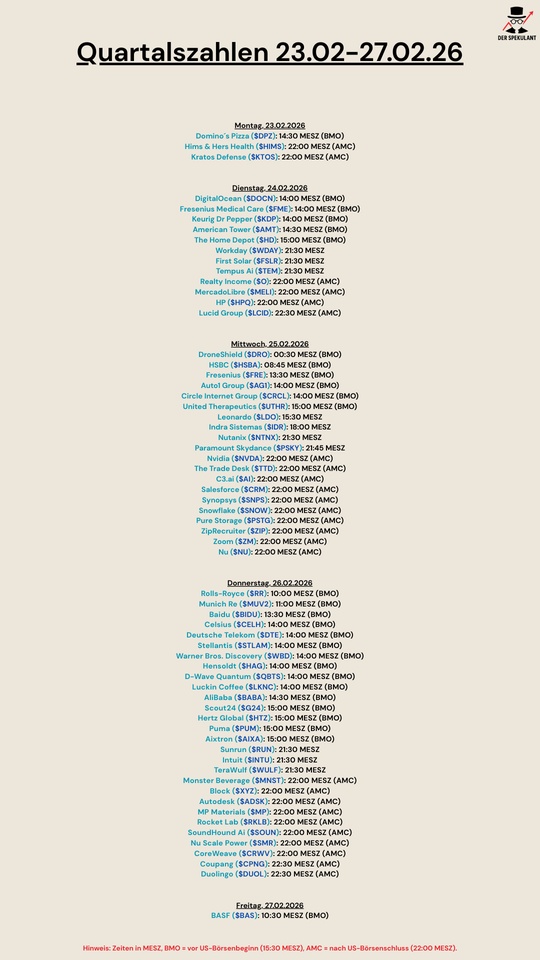

75Quartalszahlen 23.02-27.02.2026

Hensoldt receives orders from KNDS for digital tank optronics

$HAG (+0,69%) Hensoldt has received orders from KNDS to equip combat and infantry fighting vehicles with digital optronics. The MDAX company put the total volume at more than 400 million euros. The focus is on an order worth around 290 million euros to equip the Schakal wheeled infantry fighting vehicle. In addition, Hensoldt is to equip the Leopard 2 A8 main battle tank with digital vision systems. According to further information, this order has a volume of more than 110 million euros.

Mildef: Unvaluable defense stock?

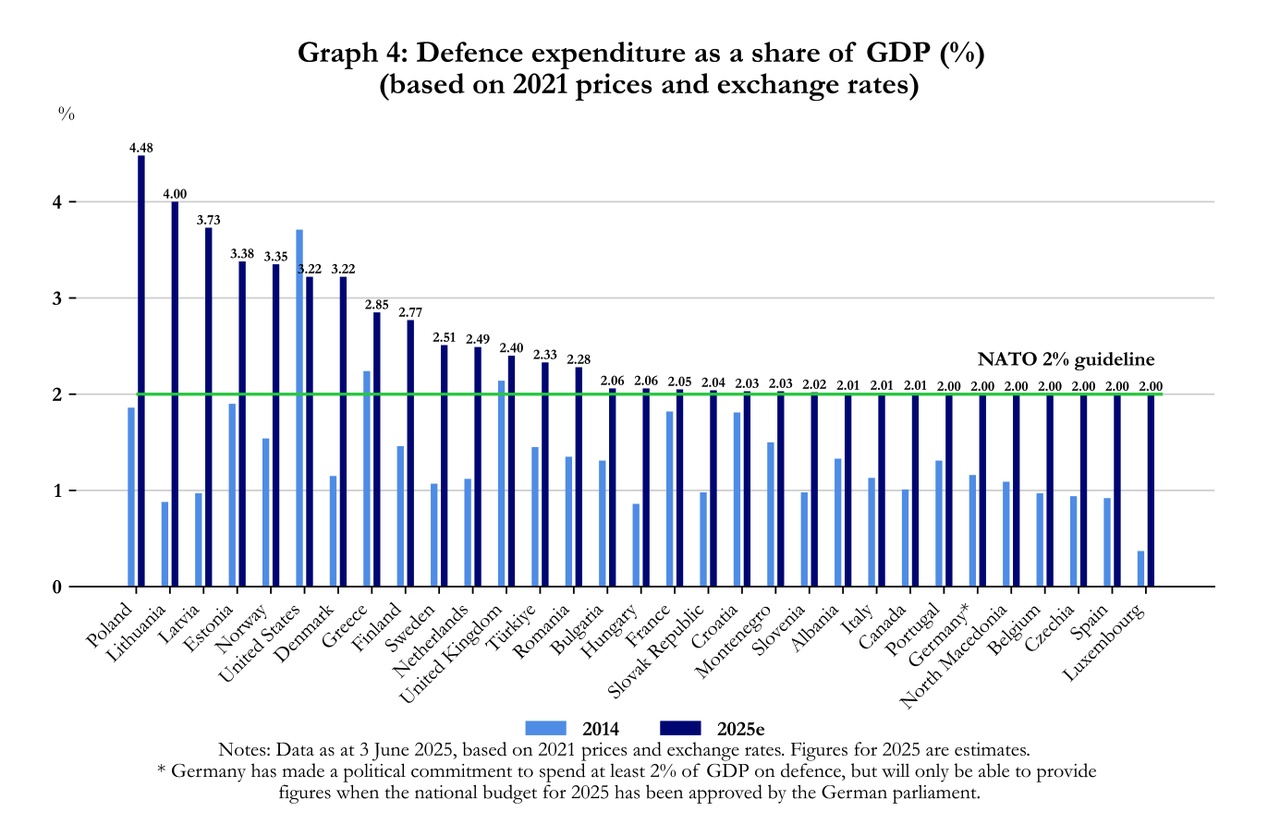

What happens if you invest too little for years? There is a need to catch up.

And that is exactly what happened to many countries within NATO. When Russia's war of aggression made it clear that even the theoretical investment target for armaments of 2% was far too low, the countries were completely overwhelmed.

As a result, all companies only remotely involved in armaments went up: $RHM (-0,17%)

$ONDS (-11,34%)

$MILDEF (-2,54%)

$AIR (+0,87%)

$BA. (+0,02%)

$HAG (+0,69%)

But even before the Russian war, there was already a problem with security spending within the EU: "capital formation" spending, which primarily includes long-lived military expenditure, was around 20% within Europe for a long time. In the USA, which is regarded as a model pupil for security spending, this figure is 40%.

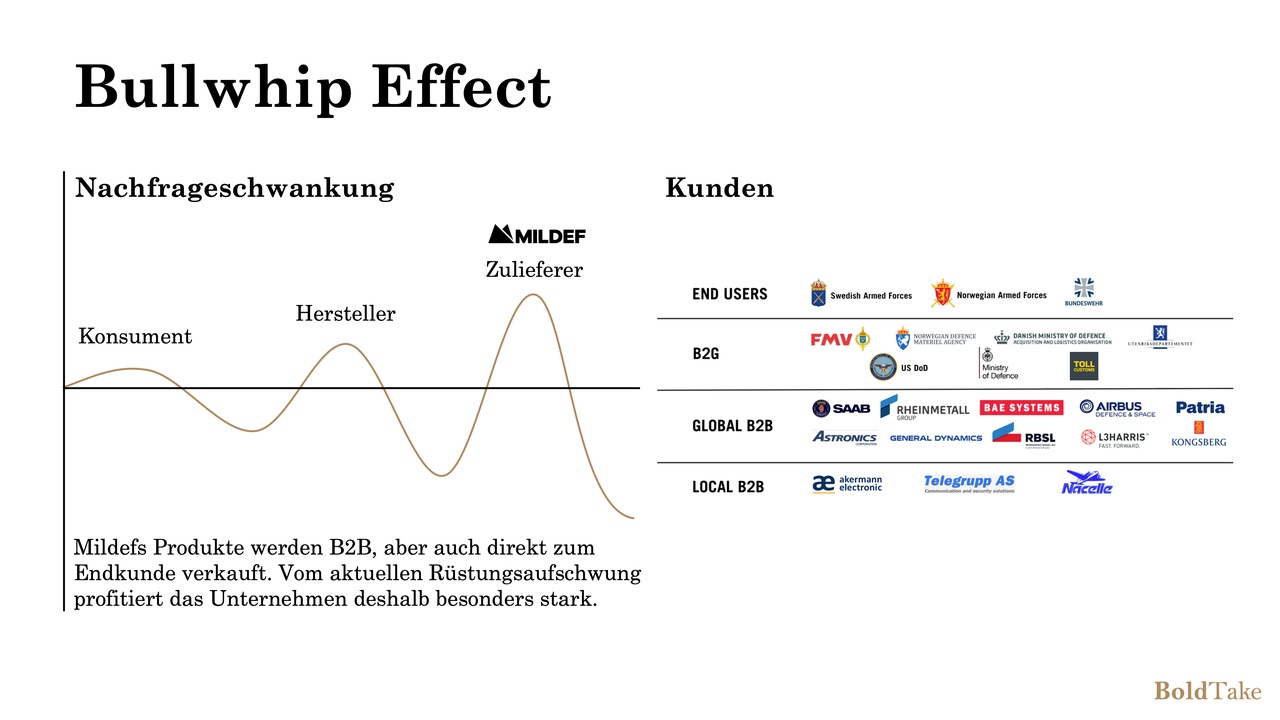

And this is where Mildef comes into play. A Scandinavian company that, in my eyes, still flies somewhat under the radar. Mildef produces IT hardware for the military and defense (which is part of the 20%). As the company itself describes its business model very well, here is the graphic from the investor presentation:

What is not shown is the fluctuation in demand, which is caused by being relatively at the beginning of the value chain:

This bullwhip effect can also be seen in many other sectors, especially in industry, where many value creation steps build on each other. We are currently at a peak in demand from the consumer side. This has already been priced into the stock market for many companies, but not yet to the same extent for Mildef. In addition, spending is set to rise from 1% of GDP to 5% in many countries. Of course, these tasks will also flow into the countries' infrastructure, but I think it will quickly become clear that there is a need to catch up AND that there is long-term sustainable demand.

Mildef: Small but mighty

Mildef occupies a small niche within the defense industry with its products. It is not worthwhile for many large corporations to enter niches, as the investments are greater than the revenue opportunities. In addition, Mildef has little competition from smaller companies. Why?

The industry is strictly controlled. Although anyone can take part in a military tender, there are special regulations that are difficult to fulfill without special expertise. There is no cheap competition from Asia, as suppliers from Europe are preferred for security products. This is the reason for EBIT margins of more than 10%.

Regional distribution of sales

Sales are generated primarily in the Nordic countries. However, a new acquisition will soon change this. More on this in a moment.

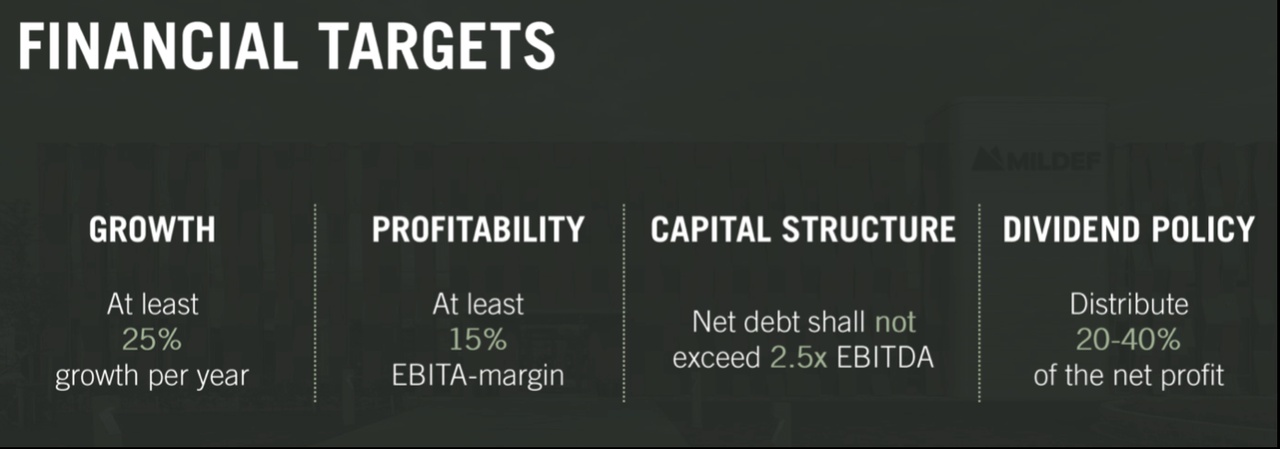

Growth targets

The management has ambitious growth targets. In recent years, these have been achieved or significantly exceeded. Average sales growth over the last three years has been over 40% per year. I also expect sales growth of more than 40 % YoY for the current financial year. This is due to the Roda acquisition. More on this in a moment.

The EBIT margin of over 15% has not yet been achieved. Mildef likes to calculate with highly adjusted figures. However, the deviations from reality are so great that I would rather regard the 15% as a long-term target. EBIT is not particularly stable overall, but this is justifiable in view of the growth ambitions. However, this makes it more difficult for the valuation.

Roda takeover

Roda will bring further significant growth in FY 2025. The business model is similar to that of Mildef. Since a large part of the sales for 2025 is already known, I have tried to estimate the total growth and arrive at around 57% growth with the current 9M figures, Q4 from 2025 and a quarter of Roda's annual sales. The calculation is highly simplified. Sales could grow much faster in the last quarter.

Financial impact of the Roda takeover

Although debt has doubled, at around 1× EBITDA it is completely 1× EBITDA, however, it is completely within reasonable limits. This is due to the fact that the takeover was partly financed with new shares. Shareholders were diluted by 18%. As an investor, you don't like to see that at first, but the takeover was strategically very important: Mildef was previously mainly active in Scandinavia. The Roda takeover gives the company better access to the rest of Europe.

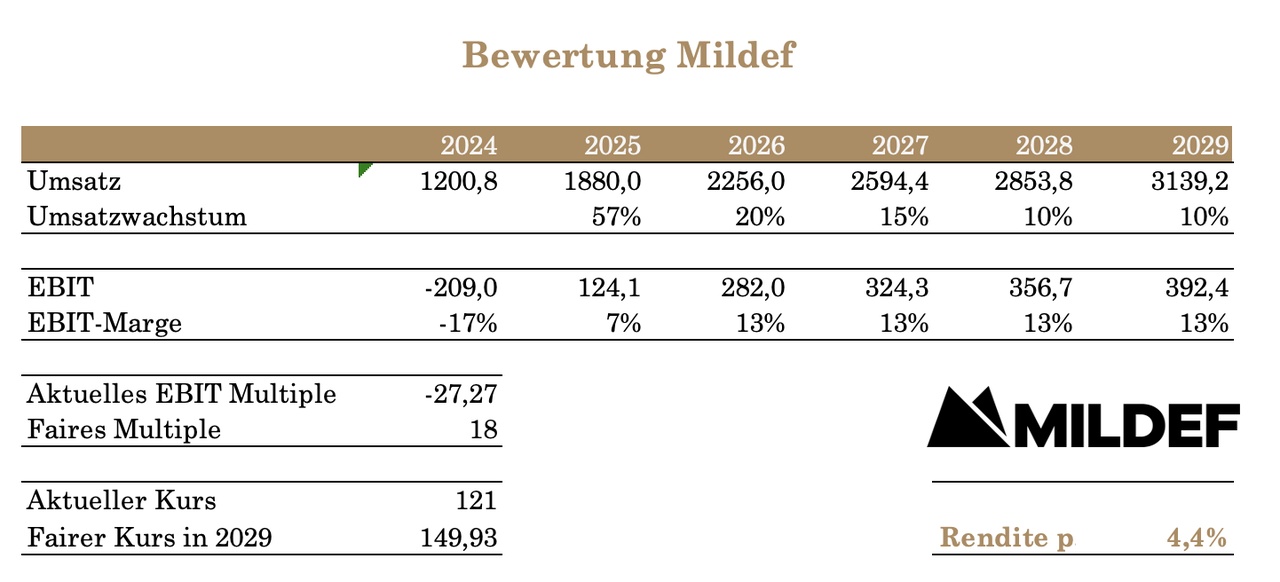

Valuation

Valuing Mildef is not easy. This is not because future sales are difficult to estimate. Backlog and conservative assumptions make it easy to do.

The problem, however, is choosing a sensible multiple. Typically, you are looking for

- a constant, predictable key figure (such as EV/sales, P/E ratio, etc.)

- Companies from the same market

- Companies with similar growth

Due to the Roda acquisition and the generally strong growth the EBIT margin fluctuates strongly. I do not wish to use the adjusted management figures as they are adjusted accordingly.

There are also hardly any comparable companies. Mildef is active in a niche market. Although there are similar companies, they either lack growth or have lower margins. Both factors directly influence the multiple paid on the stock exchange.

In the end, I opted for a P/E valuation. However, this method has weaknesses, mainly because turnover is a very simple key figure.

In my model, I arrived at an expected return of 18.7 %. What is important here is that the growth assumptions for the future are significantly lower than those of the management.

I used EBIT as a second valuation approach. This resulted in a return of only 4.4 % per year. However, as already mentioned, EBIT is not stable and therefore probably not a suitable estimation parameter.

So which valuation makes sense?

I do not know. However, it is clear that the return will be very low or very high depending on the assumptions. Hence my question to the community: Which valuation method makes sense here? Perhaps you know an approach that fits better?

Thank you very much for reading. I wish you a Merry Christmas and a relaxing break from the stock market🎄

As always, I look forward to your feedback. Criticism is also welcome, after all, we all want to improve :)

p.s: I always find the overview of long posts here not so good, so I try to keep the introductions short. There is of course a lot more to say about Mildef. How do you see it? Do you prefer detailed posts or do you like it a bit clearer?

+ 5

CEO buys in but analyst gives thumbs down

$HAG (+0,69%) has to cope with a small slump after an analyst from JPM lowered his thumb. The CEO sees it differently and buys for 220k.

https://www.boerse-express.com/news/articles/hensoldt-aktie-vertane-chancen-840496

For me it's a clear case. Wait and see and add if necessary. Let's see where the bottom is today. I would find €80 very attractive. What do you think?

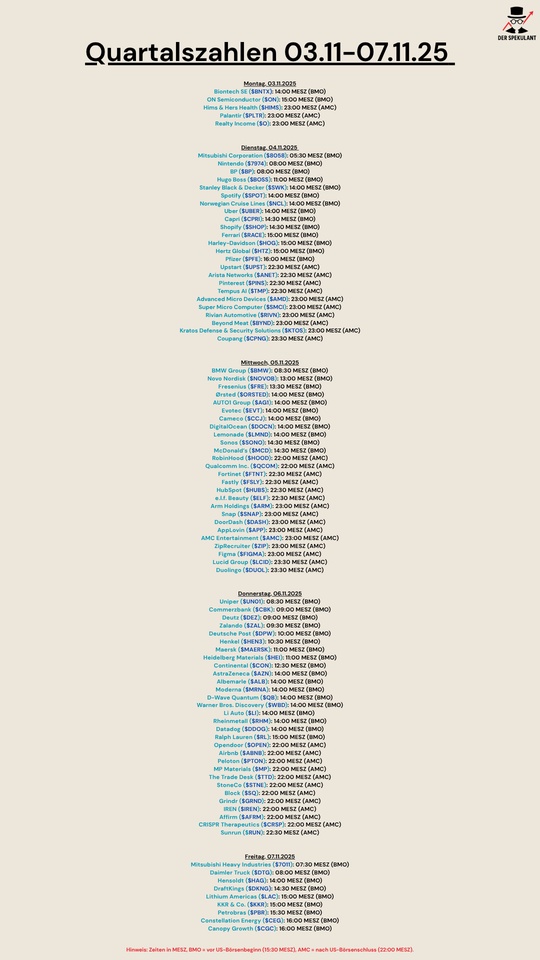

Quartalszahlen 03.11.25-07.11.15

$BNTX (-0,32%)

$ON (+2,06%)

$HIMS (-0,67%)

$PLTR (+0,16%)

$O (+1,13%)

$8058 (-0,12%)

$7974 (+0,29%)

$BP. (-1,45%)

$BOSS (+0,57%)

$SWK (+2,41%)

$SPOT (+1,17%)

$N1CL34

$UBER (+0,99%)

$CPRI (+3,64%)

$SHOP (+2,19%)

$RACE (-0,43%)

$HOG (-0,93%)

$HTZ (-1%)

$PFIZER

$UPST (-4,3%)

$ANET (-3,29%)

$PINS (+5,61%)

$TEM (-2,07%)

$AMD (-1,53%)

$SMCI (+0,62%)

$RIVN (-1,6%)

$BYND (-7,46%)

$KTOS (-9,24%)

$CPNG (+1,03%)

$BMW (+0,52%)

$NOVO B (-2,32%)

$FRE (-0,06%)

$ORSTED (+1,5%)

$AG1 (+2,62%)

$EVT (-0,36%)

$CCO (+2,34%)

$DOCN (-4,89%)

$LMND (-7,45%)

$SONO (-1,73%)

$MCD (+0,34%)

$HOOD (+1,08%)

$QCOM (+1,33%)

$FTNT (-1,83%)

$FSLY (+0,79%)

$HUBS (-2,72%)

$ELF (+3,54%)

$ARM (-0,93%)

$SNAP (+2,58%)

$DASH (+0,21%)

$APP (-5,89%)

$AMC (-1,9%)

$ZIP (+11,17%)

$FIG (+1,84%)

$LCID (-1,81%)

$DUOL

$UN0 (+1,93%)

$CBK (+1,34%)

$DEZ (+0,83%)

$ZAL (-0,93%)

$HEN (-0,43%)

$MAERSK A (+1,53%)

$HEI (+0,44%)

$CON (+0,82%)

$AZN (+0,3%)

$ALB (-0,08%)

$MRNA (+0,22%)

$QBTS (-7,11%)

$WBD (+0,08%)

$LI (-0,64%)

$RHM (-0,17%)

$DDOG (-4,15%)

$RL (+3,3%)

$OPEN (-5,9%)

$ABNB (+1,55%)

$PTON (-0,81%)

$MP (-5,53%)

$TTD (+0,14%)

$STNE (+5,13%)

$SQ (+0,2%)

$GRND (+3,25%)

$IREN (-6,41%)

$AFRM (-1,14%)

$CRISP (-0,03%)

$RUN (+1,53%)

$7011 (+2,44%)

$DTG (+1,76%)

$HAG (+0,69%)

$DKNG (-0,68%)

$LAC (-2,04%)

$KKR (+0,32%)

$PETR3 (+0,64%)

$CEG

$WEED (+1%)

Is HENSOLD the first choice and profiteer in the anti-drone fight?

My dears, what do you think?

Unfortunately, I sold the share far too early.

Europe's defense is reshaping itself

Europe's defense against unmanned threats is taking shape with the EU's "Drone Wall" initiative and immediate national programs. HENSOLDT already supplies technologies that turn individual solutions into an interoperable overall picture.

The debate about the growing threat posed by drones has gained considerable momentum in recent weeks. A wide range of experts have recently warned of an "imminent danger" for Germany. The background to this is not only the experiences from Ukraine and the Middle East, but also over 500 suspicious drone sightings in German airspace in the first quarter of 2025 alone. At the same time, there has already been official talk of "hybrid attacks" in Denmark following several incidents at airports and suspected Russian hybrid operations.

The threat situation is evident on several levels: Drones paralyze airports for hours, as recently in Copenhagen and Aalborg; in Ukraine, FPV drones cause millions of dollars worth of damage for a few hundred dollars; in Israel, more than 1,300 drones have been deployed within a year. Germany itself is confronted with security-relevant overflights on an almost daily basis.

Against this backdrop, the EU has fleshed out the "Drone Wall" initiative that has been under discussion for months. The aim is not to erect a physical barrier along the external borders, but to establish a graduated defense system against unmanned threats. Similar to the European Sky Shield Initiative (ESSI) in the area of ground-based air defence, the "Drone Wall" is to be understood as a pan-European program that networks existing national capabilities, incorporates stationary and mobile systems and significantly increases the number of operational C-UAS solutions.

This brings the issue of deliverable systems and interoperable software even more into focus.

You can find the full article on Hensold technology at ⬇️

https://www.hartpunkt.de/der-anti-drohnen-kampf-europas-verteidigung-formt-sich-neu/

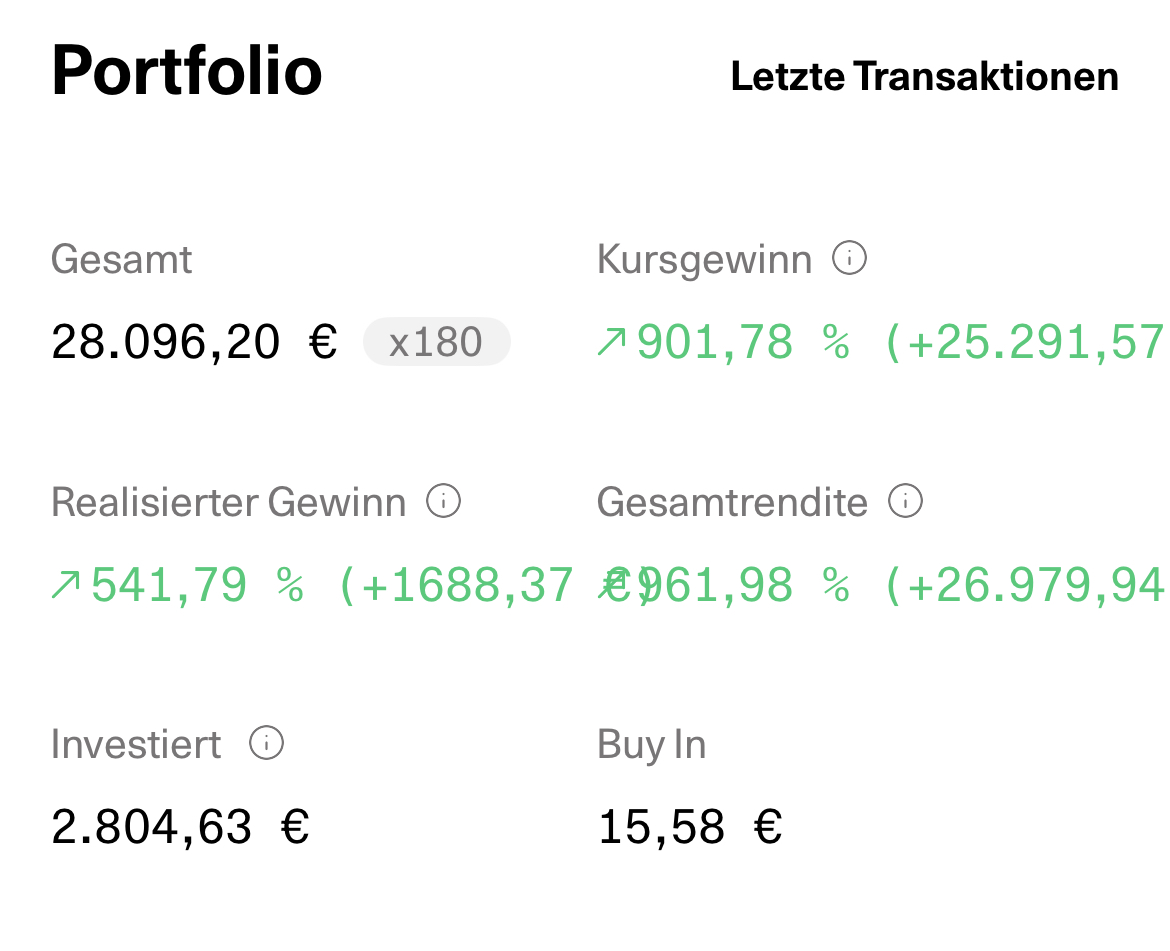

2. tenbagger

After $HAG (+0,69%) now also $PLTR (+0,16%) with a Tenbagger. Last time I had written that $HAG was faster but apparently I had overlooked the ATH of $PLTR (+0,16%) overlooked 😅

All the better that the price is picking up again.

We don't need to talk about the adventurous valuation. I'm curious to see if the company can actually grow into it.

I took out part of my stake in January at a price of €100. If things continue like this, I will probably sell another 30 shares at a price of €200. For the remaining 150 shares it's HODL.

Congratulations to all those who got in earlier and with more capital, e.g. @Techaktien

All in all, my portfolio has taken a bit of a hit due to the stock, but you have to accept that 🤗

That should be it in my portfolio with Tenbagger, no other candidates available.

It's really bad when investors think about who can profit from all the drone sightings

Sightings over barracks, airports and at countless other locations. Investments will probably be made quite quickly so that we don't have to secure our infrastructure with an IrisT and an old Gepard.

All three companies are active in precisely the area that is needed for drone defense.

I therefore expect all three shares to rise further and have added Droneshield (Australia) and Frequentis (Austria) to the Hensoldt (Germany) position

Títulos em alta

Principais criadores desta semana