This portfolio is focused on aggressive long-term capital growth, built from very small initial capital and shaped by real market experience since 2024.

Early investments were mainly in ETFs and dividend-paying stocks, but with limited capital I quickly realized that dividends had almost no meaningful impact. This led to a full strategy shift toward capital appreciation and high-conviction positions.

During 2025, I made typical beginner mistakes:

Overtrading and excessive rotation

Early use of options and leveraged products

Small, low-conviction positions

Emotional exits

These mistakes limited returns but were essential for developing risk management, patience, and conviction.

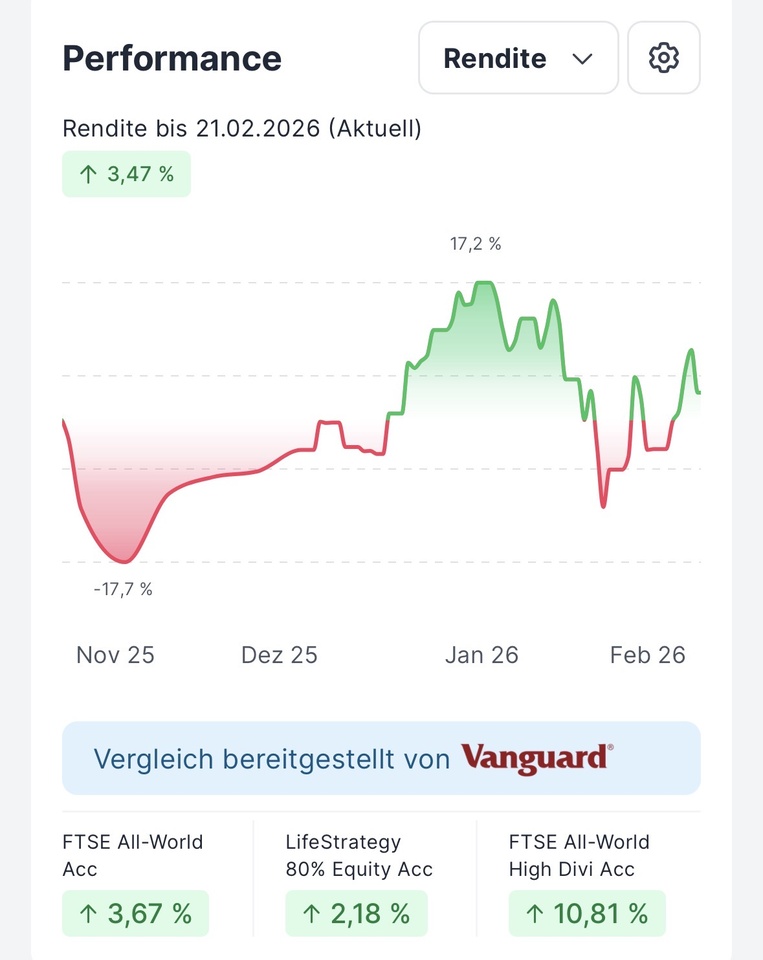

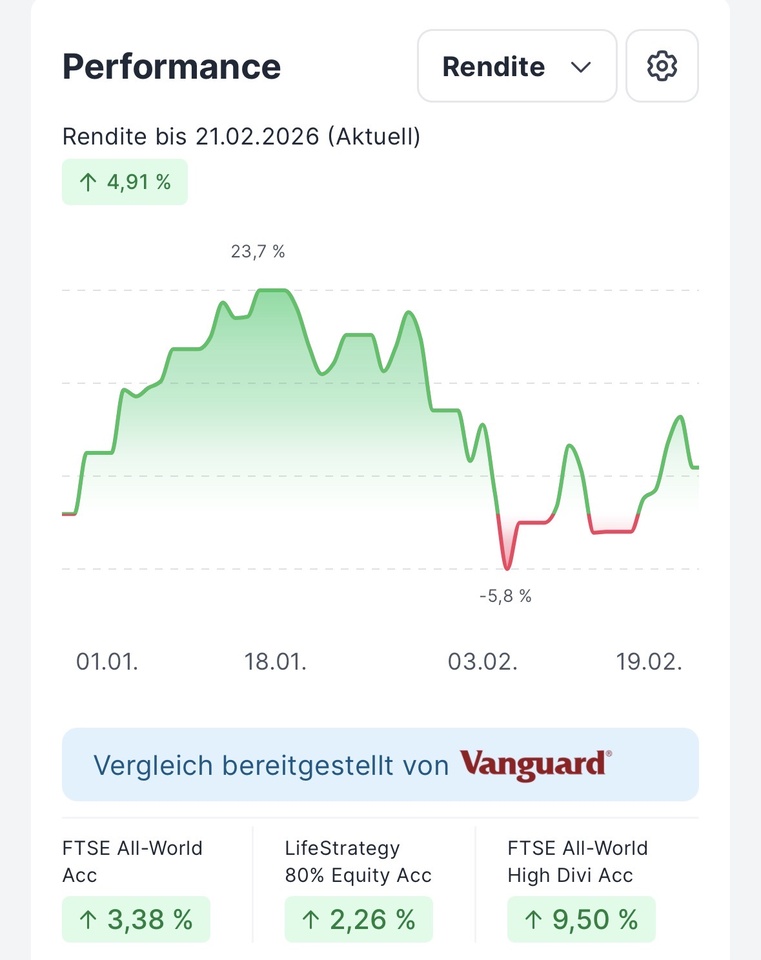

Since late 2025, the portfolio has been fully restructured with a much clearer strategy:

Focus on high-growth sectors (AI, tech, energy, crypto infrastructure)

Elimination of most speculative derivatives

Acceptance of volatility in exchange for higher expected returns

No focus on dividend yield at this stage

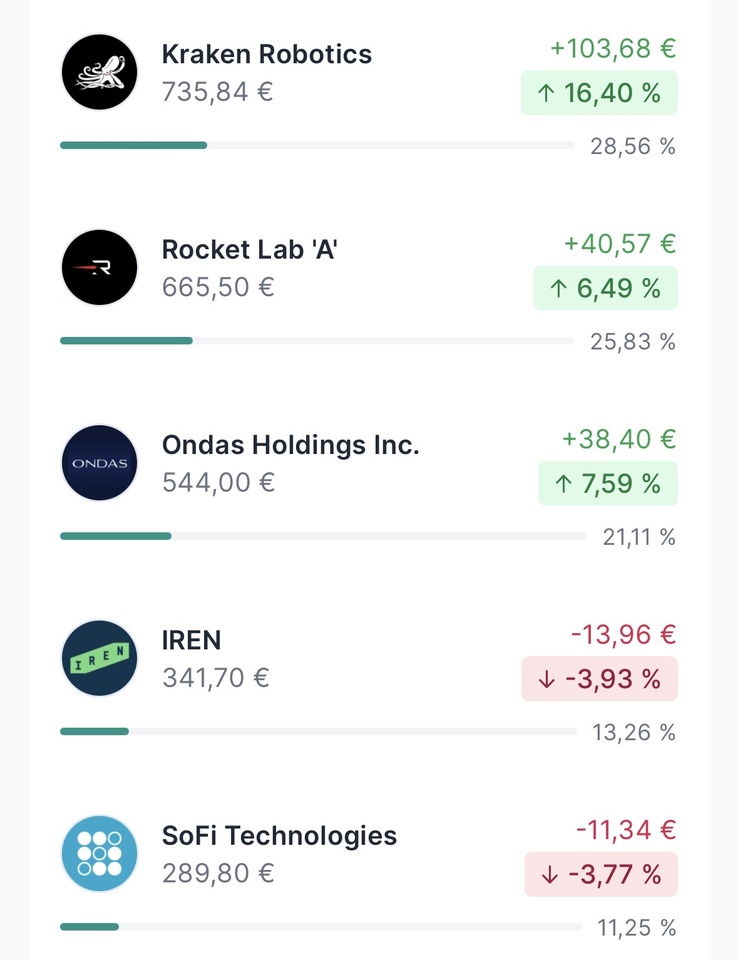

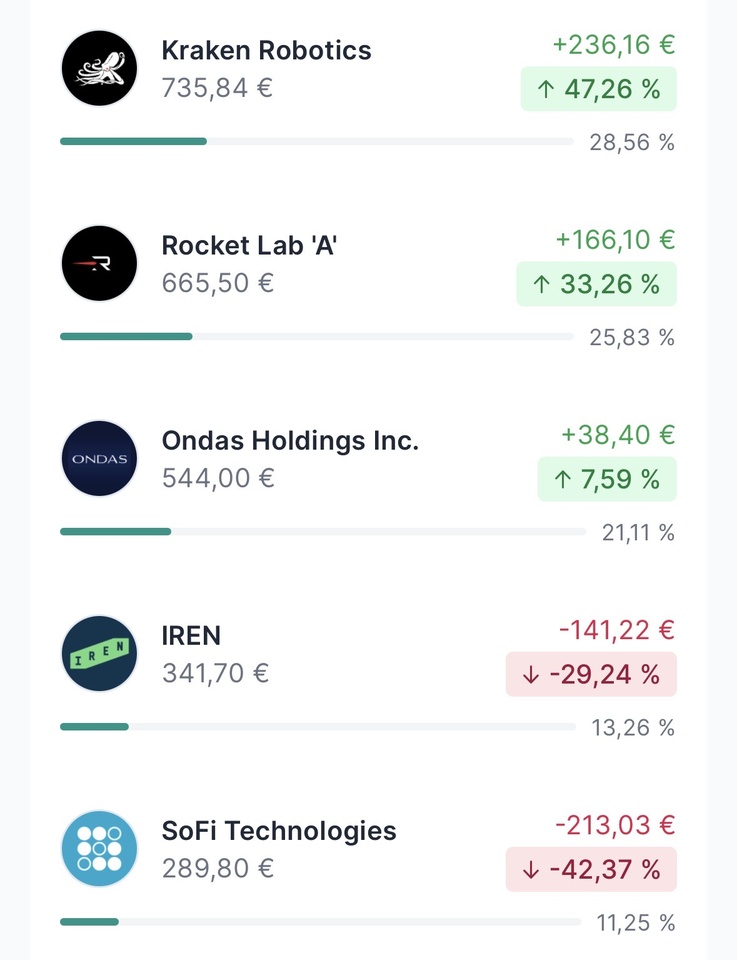

📊 Current Holdings

AST SpaceMobile $ASTS (-7,14%)

Iris Energy $IREN (-6,41%)

AMD $AMD (-1,53%)

Oracle $ORCL (-5,5%)

Palantir Technologies $PLTR (+0,16%)

Micro Strategy Inc. $MSTR (+1,9%)

Galaxy Digital $GLXY (-2,18%)

Current portfolio performance: ~ -10%, fully assumed as part of an aggressive growth strategy.

🎯 Objective

Maximize long-term capital growth by investing in high-conviction growth companies, accepting short- and medium-term volatility while continuously improving capital allocation and risk control.

This portfolio reflects real learning, mistakes, and evolution, not a perfect or theoretical investment track record.