Discussão sobre DOGE

Postos

77Biggest losers in 2025 (in euros 🐻)📉 Which ones do you see potential in?

-72% The Trade Desk $TTD (+0,14%)

-72% Fiserv $FI (-0,58%)

-65% Dogecoin $DOGE (-3,91%)

-65% Cardano

-61% Gerresheimer

-60% Enphase Energy $ENPH (+4,71%)

-59% CarMax $KMX (-0,26%)

-57% Strategy $MSTR (+1,9%)

-56% Deckers Outdoor

-56% Alexandria Real Estate

-50% Redcare Pharmacy

-50% PUMA $PUM (+0,37%)

-50% lululemon

-49% Dow

-49% Novo Nordisk $NOVO B (-2,32%)

-48% MARA $MARA (+0,14%)

-48% Molina Healthcare

-47% FactSet

-47% Charter Communications

-47% HelloFresh

-45% Wolters Kluwer

-43% Solana $SOL (-6,99%)

-43% Cocoa

-42% UnitedHealth $UNH (-0,11%)

-41% Atlassian

-41% Li Auto

-40% Copart

-40% Meituan

-38% PayPal

-38% Chipotle Mexican Grill

-36% TeamViewer

-35% GameStop $GME (-1,92%)

-35% Orsted $ORSTED (+1,5%)

-33% Pernod Ricard $RI (+3,49%)

-33% Evotec

-33% Symrise

-31% Marvell Technology $MRVL (-0,16%)

-30% Comcast

-30% Natural Gas

-30% Kraft Heinz $KHC (+1,13%)

-30% Adobe $ADBE (-0,23%)

-29% Salesforce $CRM (-0,11%)

-28% Nike $NKE (-0,41%)

-28% Adidas $ADS (+1,94%)

-27% Sugar

-27% XRP $XRP (-4,84%)

-26% Stellantis $STLAM (+2,73%)

-25% JD .com

-24% Procter & Gamble $PG (+0,98%)

-23% Arm $ARM (-0,93%)

-22% Ferrari $RACE (-0,43%)

-22% Porsche AG $P911 (+1,21%)

-21% Zalando $ZAL (-0,93%)

-21% NEL ASA $NEL (-0,11%)

-21% Ethereum $ETH (-5,08%)

-18% Bitcoin $BTC (-4,67%)

-16% Brent Oil

-16% Delivery Hero

-13% Vonovia $VNA (+0,18%)

-12% Coinbase $COIN (+3,15%)

-11% SAP $SAP (+1,12%)

-7% Amazon $ (+2,51%)AMZN (+2,51%)

2026 in the headlines

After hitting the bull's eye last year with my annual preview for 2025, I'm sharing the preview for 2026 with you today.

20.01. On taking office a year ago, Trump organizes a pompous celebration under the motto "1 year Trump, 49 more ahead". He signs an executive order converting the constitution into a non-binding letter of recommendation.

23.01. At the World Economic Forum, Trump announces punitive tariffs for all Democratic-ruled states in the USA. The S&P500 falls by double digits.

25.01. After the Trump cronies have stocked up on shares, Trump announces an agreement with the Democratic-ruled states and a temporary suspension of the tariffs. The S&P500 rises.

27.01. A video of Trump from 23.01. is leaked on X (formerly Twitter). Lip readers are sure that Trump whispers to JD Vance in this video: "Unbelievable, the trick is still working".

28.01. Trump explains in an address to the nation that by "trick" he meant Tony Hawk's kickflip. Despite his advanced age, Tony Hawk is "still great" 🇺🇸. The USA cheers. U S A. U S A. U S A.

14.02. Merz and Bärbel Bas are spotted making out in a Berlin hipster bar. The DAX swings wildly in all directions.

17.02. Exclusive interview with Merz and Bas in Bild "Yes, it's love". The DAX throws up.

07.03. Surprisingly, Musk himself becomes the first person to fly to Mars. Once there, he renames Mars X. And SpaceX. And himself. He also buys the letter X for 27,964 $TSLA (-0,19%) shares, which from now on can only be used in exchange for subscription fees. Xavier Naidoo destroys his aluminum hat in anger.

08.03. X realizes that his X rocket no longer has enough fuel to fly from X back to Earth. X then sends 50 women with X to X and writes on X that he will create a new colony on X and that he no longer needs all the bullshit on Earth. Tesla shares fall to three fifty. Trading with $DOGE (-3,91%) is suspended.

10.03. Nvidia buys Tesla. $NVDA (+1%) falls.

21.03. Holding hands, Merz and Bas announce the "summer of reforms". The DAX falls to -7 points.

01.04. During a flyover, an airplane discovers a shiny golden hut in the middle of the Amazon region. An April Fool's joke?

11.04. Nvidia buys $ZAL (-0,93%) (Zalando). Jen-Hsun Huang launches his own leather jacket collection. The fashion industry is beside itself with excitement. Nvidia with new ATH.

29.04. As predicted by @DonkeyInvestor predicted, reaches $BTC (-4,67%) reaches 50k after a boring, wave-like downward movement. @stefan_21 spends @DonkeyInvestor buys a beer.

14.05. A team of scientists has approached the golden hut in the Amazon. The hut is actually made of pure gold. It is inhabited by an oddball native who claims to be able to make gold from wood. The price of gold falls by 20%. Bitcoin rises to 100k.

16.05. getquin launches a new "Wealth Family" subscription. For just €500 a year, a whole family can enjoy the Wealth features. In addition, the deposits can be viewed among each other and child-friendly advertising with Checker Tobi is played.

20.05. Wealth Family is a success. However, the divorce rate among getquin users rises sharply, as many realize that their partner has leveraged the house.

25.05. A sensation. The Native American was not lying. He can produce gold by the kilogram from tiny amounts of wood. Scientists from all over the world are trying to understand how he does it. Gold falls to 0. Bitcoin rises to 150k - as predicted by @stefan_21 predicted.

10.06. In the run-up to the World Cup, Trump surprisingly announces punitive tariffs on goals scored by foreign teams. Every goal scored against the USA is subject to a tariff of 2 goals for the USA. Infantino gets a gold watch and nods his approval.

14.06. Out of anger over the soccer tariffs, a French customs official surnamed Zidane refuses Trump entry to the G7 summit. He headbutts Trump back into Air Force One.

14.06. Trump is furious. While still on the plane, he posts that he will leave the G7 and take over the chairmanship of the BRICS states. The S&P500 falls. Emerging markets rise.

19.07. The USA becomes soccer world champion for the first time. The last Italian witnesses to Italy's first World Cup title in 1934 applaud the well-deserved victory.

21.07. It is still not clear how the indigenous people manage to produce gold from wood. Gold regains some of its value.

04.08. Peter Schiff shoots the Native American, who takes his golden secret to his grave. Gold rises again to 2k. Bitcoin falls to 36k - as predicted by @Epi predicted.

20.08. In the middle of the summer slump, Olaf Scholz opens an escape room in a Berlin savings bank. Unfortunately, he has forgotten the exit.

20.09. In the election in Berlin, Trump is surprisingly elected Chancellor with 32 million votes. Something's not right. Geez Berlin, another election gone wrong.

03.10. On German Unity Day, Bas and Merz announce the result of the summer of reforms:

Private health insurance companies and all statutory health insurance funds will be merged into one fund. The share price of $ALV (+1,65%) (Allianz) falls.

With immediate effect, pension contributions are paid into a sovereign wealth fund that replicates the wikifolio of @Epi replicates. Olaf Scholz is angry, but immediately forgets why.

Every German has more than one vote in future elections. The number of votes corresponds to the remaining life expectancy in years.

Under the motto "performance must be worthwhile", inheritance tax is increased and wage tax is reduced by the same amount.

Nobody expected this. The DAX rises to a new ATH.

20.10. @DonkeyInvestor celebrates its birthday. Like every year, the party of the year and the whole of getquin is invited. All of getquin? No, @DividendenWaschbaer must stay outside.

03.11. getquin announces a new subscription: getquin Bugfree. For just 1,000 euros a year, subscribers get all bug fixes for free. Unfortunately, there are no more bug fixes for everyone else.

17.11. The BRICS countries, under the leadership of Trump, announce that they will use the Trump Coin $TRUMP (-5,41%) as a currency.

02.12. Trump pulls an exit scam on his own coin. All BRICS states go bankrupt. The USA barely survives due to the strategic Bitcoin reserve.

03.12. Trump announces that the break-up of the BRICS states has been planned for a long time and has always been his goal. Zidane is awarded the Medal of Freedom.

24.12. A warm light appears over all major American cities and over Grünheide. A Christmas miracle?

25.12. The lights turn out to be gigantic spaceships in the shape of an X. The S&P500 falls.

26.12. The spaceships are commanded by X, who has returned from X. He wants to take over the USA. He wants to take over the USA. And the mayoralty of Grünheide.

31.12. The USA, now called USX, surrenders without a fight. X is the new god-king of the USX for life. The S&P500 no longer cares about anything. 2027 will be wild.

What are your tips for 2026?

You can find the preview for 2025 here: https://getqu.in/MBdhb5/

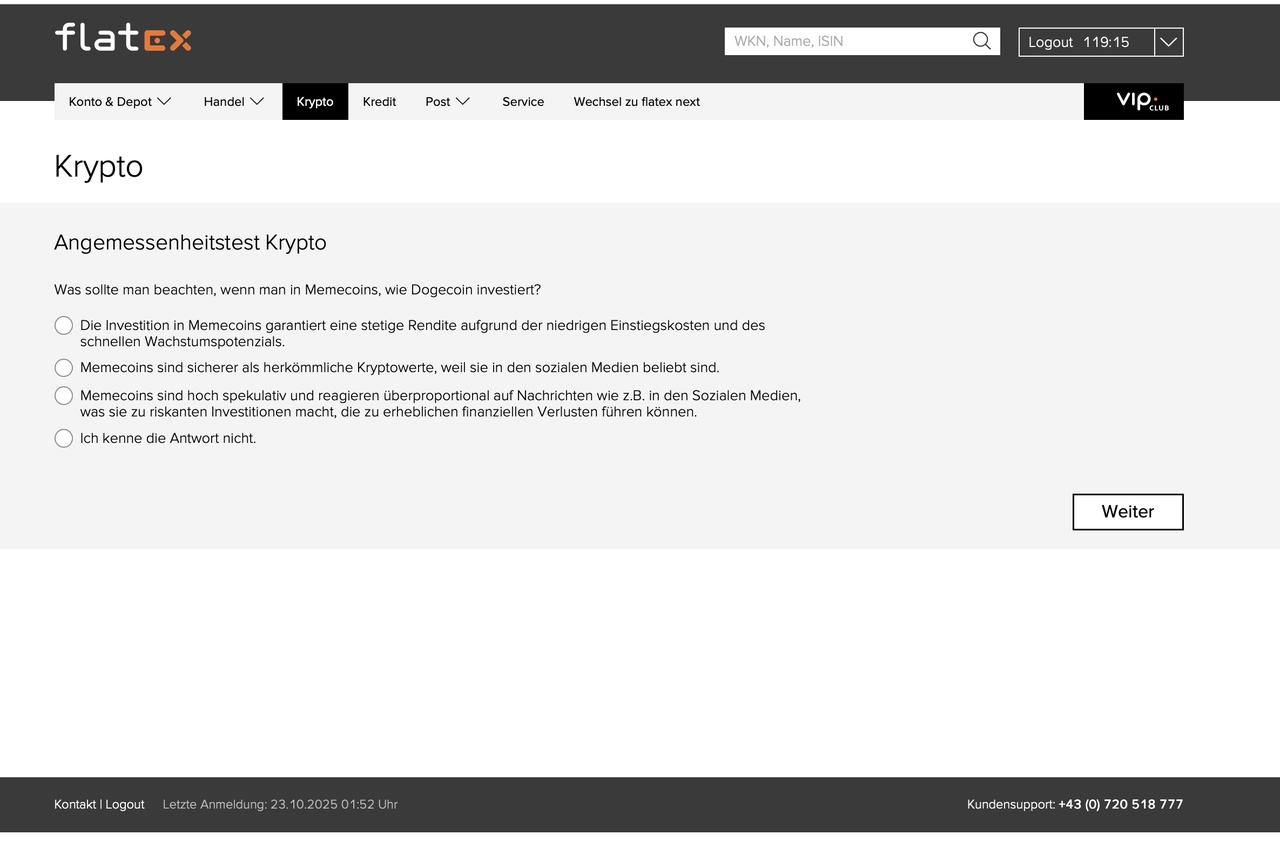

Flatex is now doing crypto, but before you can get started, you have to pass an aptitude test 🤓

That's really tricky. In this question, for example, I can't decide between the first and second answer. I assume that multiple answers are not possible due to a programming error. 🤪

In the event that I fail, can you recommend a cheaper provider? I only want to buy Solana and Ethereum.

But one thing is simple: if you can't decide between 1 and 2, take 4. 👍

You would have answered 4 correctly in any case and would have automatically moved on. 🤓

Grayscale is now bringing the meme coin to Wall Street!

Grayscale has officially filed an application for a spot Dogecoin ETF with the US Securities and Exchange Commission (SEC). The proposed fund will be called "Grayscale Dogecoin Trust ETF" and will be listed on the NYSE Arca under the ticker symbol GDOG.

The ETF would hold Dogecoin directly and offer investors the opportunity to invest in Dogecoin through regulated exchanges without having to own the cryptocurrency directly. The most recent S-1 filing was submitted on August 15, 2025.

The SEC has already approved the application and the approval process is currently underway.

This country is really punishing itself. 🙄

High Risk - High Reward

Currently hold 15,000 Dogecoin (~€3,000). If the altcoin season really picks up speed, this could quickly become a great opportunity.

For me, Doge remains the fun factor in the portfolio - at the moment, we'll have to wait and see whether it catapults upwards again during the season.

I will buy up to €5,000 on larger dips. Position currently slightly up.

but sometimes high risk is just high risk 😅

My path to wealth accumulation - feedback on my portfolio?

Hey everyone,

I'm currently 16 years old (soon to be 17), in the first year of my apprenticeship and have been actively saving and investing my money for about 5 months now.

Before that, I only had some money in a savings account at the savings bank - that was my starting capital. I started with 3000 split into 2000 initial purchases and 1000 in an interest-bearing account

Since then, I've been saving €500 every month.

Occasionally, I had to draw on my savings because I needed money at short notice. To make up for this, I'm currently paying in an additional €100 a month. This will continue for another 6-7 months. After that, I'll just save the normal €500 a month.

That's the plan from this point on:

- Invest €450 a month in the portfolio

- Put €50 a month into an interest account to benefit from compound interest and stay liquid.

I am aware that I will not be financially free in 3 years (duration of training). I'm taking a long-term view: my goal is to build up solid assets and create a good financial basis by the age of 30.

I recently took advantage of the big discounts during the market downturn and added to the portfolio - among other things, I picked up Nike about 1-2 weeks ago during the price drop.$NKE (-0,41%)

Another small comment:

I have a very small position in Cardano and Dogecoin, which came from "fun buys" - I had gotten €50 from my grandma for my vocational school certificate, which I put into Cardano$ADA (-4,81%) and some small change ended up in Dogecoin$DOGE (-3,91%) . I will sell these positions as soon as I am in the black.

I really appreciate any feedback, opinions or suggestions for improvement! Thank you all for taking the time!

My journey on the stock market: from a child fascinated by money to a modern investor

Dear friends of Getquin,

I'm usually a silent reader, but if everyone just reads, eventually there's no more reading material, is there? So today I want to share my story with you.

The beginnings:

It's hard for me to say exactly when my journey began, but I do know that I developed a fascination with money as a child. My first "investment" was when I was about 7 or 8 years old, when I bought an ounce of gold with my own pocket money. At that time, no one in my family had anything to do with investments, but I had seen it in my mother's bank when I often accompanied her there. I was fascinated by the shiny coins and wanted to know how I could have a piece myself.

Then, around the turn of the millennium, I saw my father, together with a "great" bank advisor, invest the entire family savings in the middle of the dotcom bubble. The result: a massive loss within a few months. But my mother, who was at home at the time, fought hard and was miraculously able to recoup the losses. I was about 9 or 10 years old at the time and watched her sit in front of the PC every day and look at the figures. From that moment on, I was hooked! I started using an Excel spreadsheet to track which shares I would have bought at what price and watched the performance of my fictitious investments with great interest every day after school.

The first few years:

My mother stopped day trading after about a year and went back to work. However, shares were no longer an issue for me until I was 26.

Getting into real shares:

In 2018, in the summer, as a die-hard Juventus fan, I read about an article on the transfer of CR7 and how Juventus shares went through the roof. I was there again! At that time, however, I only had a small income as a working student. My father, who had failed with his investments in the past, gave me €2,000 - and I bought Juventus shares. However, he made me promise him that I would never invest in shares again. How did the story end? The "trade" with Juventus was a success, but I had to pay taxes for the first time - and I still hate that to this day.

The first losses:

After my Juventus adventure, I began to delve deeper into the matter. I tried out recommendations from "Aktionär" and repeatedly bet on individual shares for smaller trades. It was more of a game, but I generally remained profitable - sometimes a few percent profit, sometimes a few percent loss. Thanks to the profits and additional deposits, I built up my portfolio to €18,000 until I was hit by Wirecard. In the end, I had to accept a loss of around €6,000. It was painful, but not life-threatening - and I learned a lot from this mistake. In particular, I made the mistake of constantly buying more. If I had left it at the original position of € 1,500, the loss would probably not have been so dramatic.

Don't give up:

After the Wirecard debacle, I radically rethought my strategy. I increasingly focused on conservative companies, regular dividend payers and low growth. But here, too, I realized that I was underperforming the market. So I adapted my strategy further and took a long-term approach. I have since been able to slowly recoup my losses.

The clean cut - a new start:

In the summer of 2023, I needed all my assets for a private housing project and decided to make a real "fresh start". I sold all the positions in my portfolio and only kept my ETF savings plans with TradeRepublic.

The new era:

When the housing project was completed, I wanted to build up a new portfolio with the money I had left over - and here you can see the result. My aim is to find companies that are growing strongly and have a solid moat. Dividends are nice, but not a must. My portfolio also contains defensive, boring stocks as a healthy addition. At the same time, I try to further expand my ETF positions through one-off purchases - I stopped my regular ETF savings plans at the end of January 2025. I have also invested a little in crypto and gold on the side. I have made further investments in Lego (€500), Pokémon (€1,000) and Counterstrike cases (€3,000), but these are not part of the public list - that would be too costly for me.

Fun fact:

My cash ratio has never been higher than €3,000 since I first entered the stock market (2018). This is currently an exception because I want to build up a cash reserve for the next generation.

Goal:

I don't have a specific, set goal when it comes to my investments. It's more of a hobby for me. I just enjoy seeing how my portfolio grows and how I can accompany exciting companies and be a small part of them as they develop. For me, it feels a bit like collecting: I enjoy discovering interesting companies, investing in them and watching them develop over the long term.

Thank you:

A big thank you goes to Goldesel Investing and Markus Koch, who have been with me since my first stock market steps. Without you, the share culture in German-speaking countries would certainly not be as strong! And of course a big thank you to Getquin - I've always dreamed of a platform like this! 0% bullshit, 100% investments.

Please let me know if you liked my story!

A small note: My Bitpanda portfolio has a longer history, but I was too lazy to enter everything manually. I also didn't want to take over the history because, as I said, I wanted to start a new chapter in my investment history in November 2023. Overall, however, my crypto track is up €3000-4000.

$CSPX (+0,58%)

$ETH (-5,08%)

$BLK (+1,63%)

$GS (+0,66%)

$XDWD (+0,7%)

$V (+0,55%)

$MC (+4,98%)

$MS (+0,22%)

$QCOM (+1,33%)

$JNJ (-0,5%)

$ASML (+0,76%)

$RBOT (+0,64%)

$LOCK (-0,02%)

$MRK (+0,19%)

$UNP (+1,06%)

$NKE (-0,41%)

$QDV5 (+1,98%)

$MA (+1,25%)

$TGT (+0,82%)

$PEP (+0,19%)

$NU (+1,09%)

$AAPL (+1,51%)

$TSLA (-0,19%)

$DOGE (-3,91%)

$BTC (-4,67%)

$BRK.B (+0,06%)

$PEPE (-3,47%)