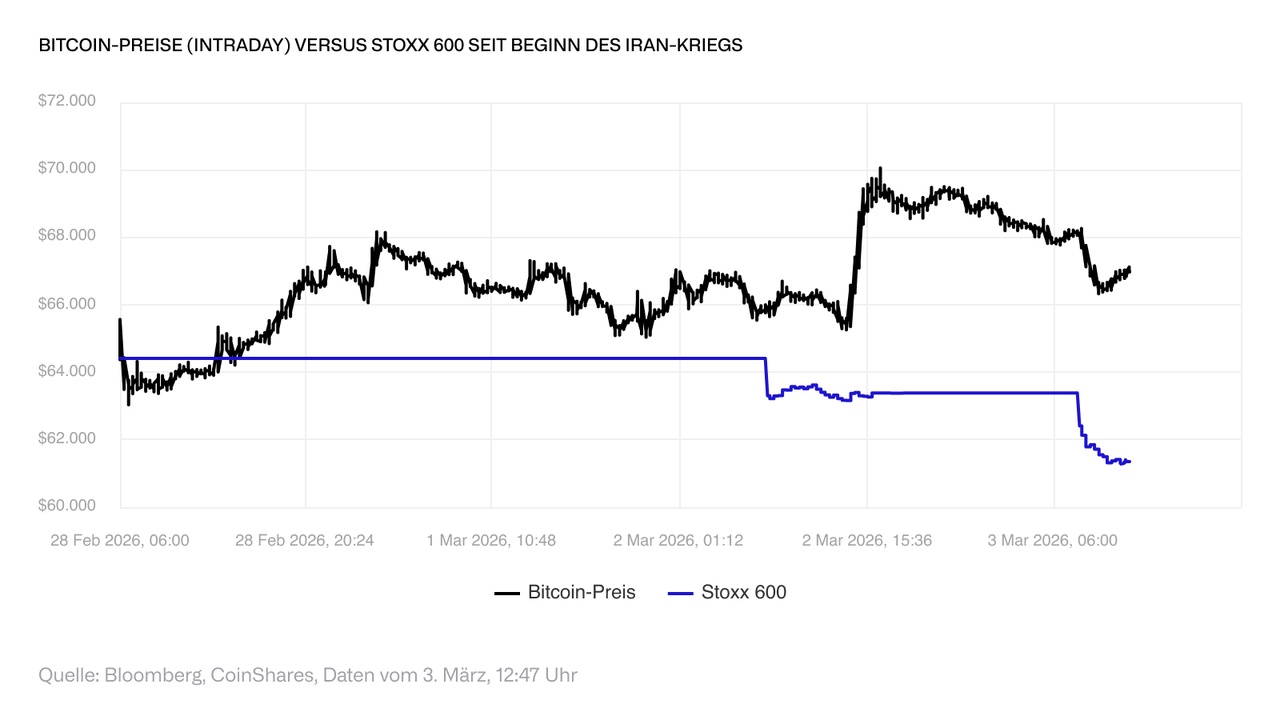

The war could give the $BTC (+3,28%)-price for reasons that go beyond simple safe-haven demand.

Consider, for example, a scenario that now seems at least plausible: a prolonged disruption to shipping traffic through the Strait of Hormuz, combined with rising energy prices and increasing pressure on the public finances of energy-importing countries. In such an environment, confidence in the reliability of the global financial infrastructure itself becomes a relevant variable.

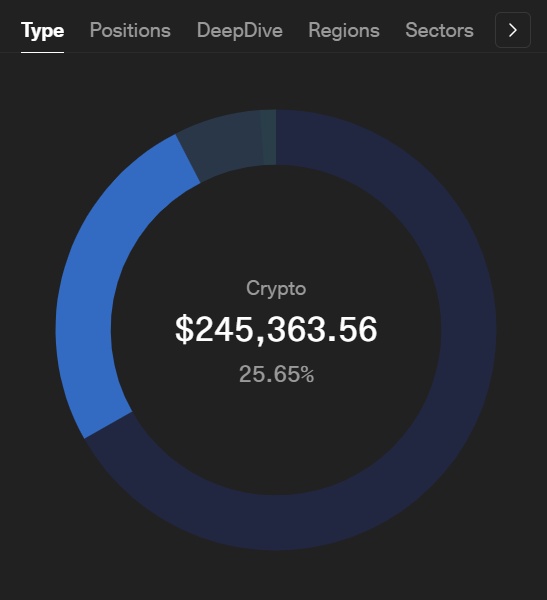

2022 has shown that even the currency reserves of AAA-rated countries can be frozen overnight for political reasons. The structural characteristics of $BTC (+3,28%) - no sovereign issuer, no counterparty and settlement that works independently of the correspondent banking infrastructure - turn from theoretical advantages to practical ones precisely when this infrastructure comes under pressure.

Gold has always reacted to such developments, which is why the price has recently risen by 3.5 percent. Increasingly #bitcoin institutional investors are taking a similar view - this week's capital inflows provide clear evidence of this. The current conflict did not create the safe haven thesis of $BTC (+3,28%) but it has provided the clearest practical test so far in this market cycle.