$DPZ (-0,38%)

$HIMS (-0,67%)

$KTOS (-9,24%)

$DOCN (-4,89%)

$FME (+1,61%)

$KDP (+1,54%)

$AMT (+1,11%)

$HD (+0,84%)

$WDAY (-1,52%)

$FSLR (+2,98%)

$TEM (-2,07%)

$O (+1,13%)

$MELI (-0,16%)

$HPQ (+0,9%)

$LCID (-1,81%)

$DRO (-0,77%)

$HSBA (+1,43%)

$FRE (-0,06%)

$AG1 (+2,62%)

$CRCL (+2,48%)

$UTHR (-1,54%)

$LDO (+0,24%)

$IDR (+1,17%)

$NTNX (-3,65%)

$PARA (-1,35%)

$NVDA (+1%)

$TTD (+0,14%)

$AI (-2,75%)

$CRM (-0,11%)

$SNPS (-0,54%)

$SNOW (-3,7%)

$PSTG (+0,82%)

$ZIP (+11,17%)

$ZM (-0,43%)

$NU (+1,09%)

$RR. (+1,31%)

$MUV2 (+0,8%)

$BIDU (-1,12%)

$CELH

$DTE (+0,29%)

$STLAM (+2,73%)

$WBD (+0,08%)

$HAG (+0,69%)

$QBTS (-7,11%)

$LKNCY (+0,91%)

$BABA (+0%)

$G24 (+1,36%)

$HTZ (-1%)

$PUM (+0,37%)

$AIXA (-0,54%)

$RUN (+1,53%)

$INTU (-0,11%)

$WULF (-2,68%)

$MNST (+1,52%)

$SQ (+0,2%)

$ADSK (-1,05%)

$MP (-5,53%)

$RKLB (-6,56%)

$SOUN

$SMR

$CRWV (-9,31%)

$CPNG (+1,03%)

$DUOL

Rolls-Royce

Price

Discussão sobre RR.

Postos

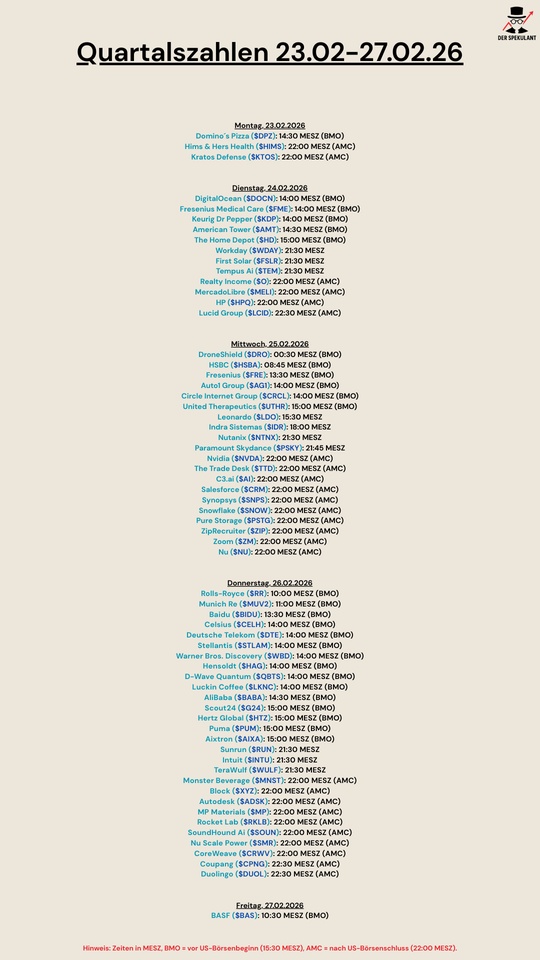

100Quartalszahlen 23.02-27.02.2026

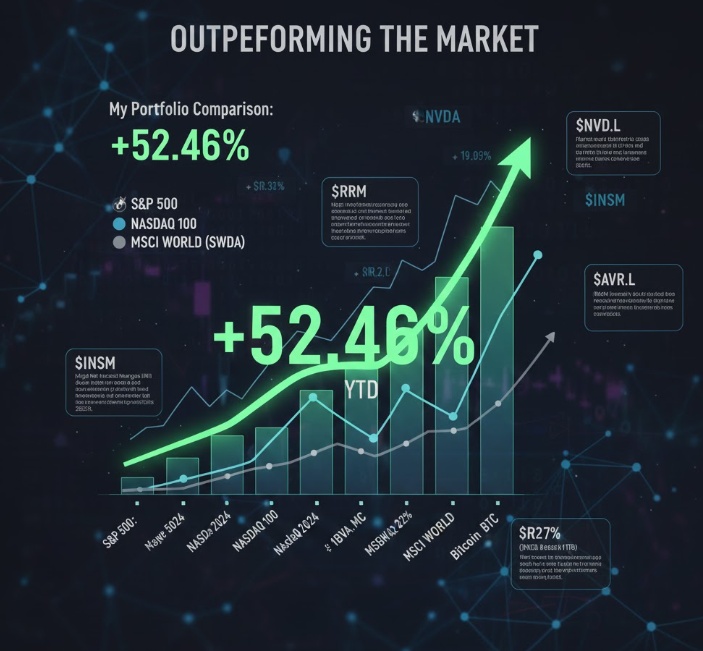

🚀 2025 eToro Recap: Outperforming the Market

An extraordinary year comes to a close. The numbers speak for themselves: 2025 has been the year that confirmed my strategy, closing with a +52.46% return that significantly outperformed all major global benchmarks.

🏁 Benchmark Comparison:

🏆 My Portfolio: +52.46%

📊 S&P 500: +16.37%

💻 Nasdaq 100: +19.05%

🌍 MSCI World (SWDA): +14.50%

₿ Bitcoin (BTC): +35.20%

The strength of this portfolio lies not only in the total return but in its resilience. Despite natural market fluctuations, we maintained steady growth, closing almost every month in the green and managing the rare moments of drawdown with strict discipline.

📊 Monthly Performance:

📈 January 2025: +4.35%

📈 February 2025: +0.95%

📉 March 2025: −4.4%

📈 April 2025: +3.68%

📈 May 2025: +13.32%

📈 June 2025: +6.35%

📈 July 2025: +6.06%

📈 August 2025: +2.04%

📈 September 2025: +6.87%

📈 October 2025: +1.55%

📉 November 2025: -0.39%

📈 December 2025: +2.94%

Performance Summary: ✅ 2024: +4.75% ✅ 2025: +52.46% (YTD) 🔥 Since Inception (1.5 years): +59.7%

🏦 Focus: The Strategic Move on European Banks

Massive exposure to the European banking sector with stocks such as $UCG (+1,16%) , $BPE (+4,11%), $BBVA (+1,8%) , $ISP (+1,92%) , and $BMPS (+3,62%) was a primary key to our success. Here is why they performed so brilliantly:

Record Margins: Financial institutions fully capitalized on interest rates remaining elevated longer than expected, maximizing net interest margins.

Shareholder Returns: Aggressive dividend policies and massive buyback programs provided constant support to stock valuations.

Efficiency & Quality: Rigorous risk management kept non-performing loans (NPLs) at historic lows, while digitalization significantly reduced operational costs.

🔥 Top Performers: The Growth Engines

Beyond the banking sector, the portfolio was driven by exceptional assets:

$INSM (+3,7%): Performance fueled by the clinical and commercial success of ARIKAYCE and pipeline advancements in rare diseases, with 2025 revenue growth hitting 52%.

$RR. (+1,31%) A powerful industrial turnaround based on drastic restructuring, the global recovery of air travel (engine maintenance), and new defense sector contracts.

$NVDA (+1%) & $AVGO (-0,41%) : Undisputed leaders of the AI revolution. NVIDIA dominates data center infrastructure, while Broadcom benefits from record demand for custom AI chips and networking hardware.

🎯 Strategy for 2026

My objective remains the same: to outperform major global indices while maintaining a balanced risk profile. As you can see, our asset selection successfully captured the best of the bullish trend.

To those following me: thank you for your trust. If you are looking for a long-term investment aiming to consistently beat the benchmark, consider adding me to your copy traders in 2026—I intend to open this possibility soon.

Let's start 2026 with the same discipline! 🥂

⚠️ DISCLAIMER: All content in this post is for informational and entertainment purposes only. It does not constitute a solicitation for public savings, personalized financial advice, or an investment suggestion. Trading involves the risk of capital loss. Remember that past performance is no guarantee of future results. Before investing or copying a portfolio, do your own research (DYOR) and evaluate your risk tolerance.

Nothing but expenses (dividend)

Hello everyone,

Here is my personal review of the year 2025.

First of all - my target for the year was achieved. I had aimed for 98k in the portfolio. This was clearly exceeded

Unfortunately, this was not due to my return. The bottom line is that only the dividends remained this year.

What happened? Amundi really annoyed me back in January. My Basisinvest was supposed to be merged and a tax event first of all made the German government's coffers full of money - so my exemption order was gone and my portfolio reduced accordingly. Thanks for that Amundi.

Well, what the heck - got a new World and continued to save diligently ;).

The aim this year was to restructure my portfolio somewhat and reduce my dependence on Bitcoin. A few new individual stocks were added to the portfolio for this purpose:

$PEP (+0,19%) one-time purchase

$MAIN (-1,19%) one-off purchase and savings plan

$V (+0,55%) one-off purchase and savings plan

$RR. (+1,31%) One-off purchase and savings plan

In the meantime I have then $ETH (-1,26%) my stake and moved it to $BTC (-0,53%) moved it to

Especially from October onwards, my portfolio suffered due to the high crypto share. But anyone who opts for crypto also has to deal with the volatility.

In Q4, I decided to sell one of my dividend ETFs $ISPA (+0,76%)

This was followed by

$MUV2 (+0,8%) and

Into the depot. Last but not least, I have also been saving the $LVWC (+1,62%) weekly since it was launched.

All in all, I'm still very satisfied with the year. Including dividend reinvestment, I have a savings rate of €1672 per month. Significantly higher than planned. This also compensates for the lack of performance.

I'm aiming for 128k in my portfolio in 2026.

My goal of no longer having to work at the age of 55 - if I want to - remains in focus (16 years to go).

The core of my strategy remains unchanged:

- ETFs as a basis

- Bitcoin

- Solid individual stocks (preferably with dividends)

Yes - my portfolio could be much "simpler" - but I feel comfortable with it.

Nevertheless, I am very happy about your feedback

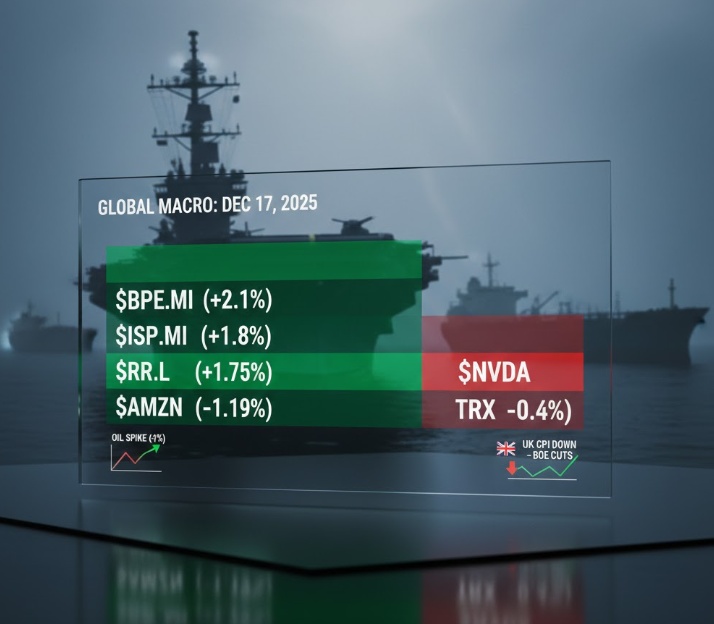

📈 MARKET UPDATE | DEC 17, 2025: BUYBACKS & BLOCKADES

The mid-week session is defined by an aggressive shift from overextended Tech into Financials and Aerospace.

🌍 THE MACRO SHOCK: TRUMP’S VENEZUELA BLOCKADE

The biggest geopolitical mover today is the U.S. naval blockade of sanctioned oil tankers into Venezuela.

The Impact: Crude prices spiked >1% instantly. This is providing a massive tailwind for energy and commodity-linked sectors.

The Shift: This "geopolitical premium" is forcing capital into hard assets. Silver just hit a record high above $66, with Gold following. 🛢️🔥🥈

🇪🇺 EUROPE: INFLATION COLLAPSE & CENTRAL BANK FEVER

EU indices are ripping because UK CPI fell sharper than expected this morning (3.2% vs 3.4% exp).

The Reaction: A shockwave through the bond market. Traders are now pricing in a near-certain Bank of England (BoE) rate cut tomorrow.

The "Trifecta": We are in a "relief rally" ahead of tomorrow’s massive data dump: ECB, BoE, and U.S. CPI. Markets are front-running a Dovish pivot from Lagarde. 🏦📉

🏦 THE ITALIAN BANKING RALLY

$$BPE (+4,11%) (+2.1%) | $ISP (+1,92%) (+1.8%) | $UCG (+1,16%) (+1.7%)

The Driver: Resilience in Net Interest Margins (NIM) as the ECB easing cycle appears slower than feared.

The Catalyst: Massive shareholder distribution. $UCG (+1,16%) and $ISP (+1,92%) are acting as "cash machines," using buybacks to floor the price against any macro noise.

⚙️ AEROSPACE & DEFENSE MOMENTUM

$$RR. (+1,31%) (+1.75%) | $LDO (+0,24%) (+1.4%) | $RKLB (-6,56%) (+1.3%)

The Driver: Rolls-Royce ($RR.L) just initiated a new £200M interim buyback starting Jan 2, immediately following their £1B 2025 program.

Context: Institutional accumulation in Defense is at peak levels as a structural hedge against 2026 geopolitical uncertainty.

📦 RETAIL & CLOUD RESILIENCE

$AMZN (+2,51%) (+1.19%)

The Driver: Wall Street is digesting the delayed Non-Farm Payrolls (64k added, but unemployment at 2021 highs).

The Sentiment: "Bad news is good news." A weakening labor market gives the Fed more ammo to cut. $AMZN (+2,51%) is catching the bid as BMO Capital hikes PT to $304, citing AWS cloud acceleration. 📊💼

⚠️ SECTOR ROTATION: THE "AI BUBBLE" PAUSE

$NVDA (+1%) (-0.25%) | $BTC (-0,53%) (~$86.7k) | $TRX (+0,07%) (-0.4%)

The Analysis: Pure profit-taking. Capital is bleeding out of high-beta Tech and Crypto to fund the rally in "Value" equities (Banks/Industrials).

The Risk: If $NVDA (+1%) loses its 20-day EMA at the US open, expect a broader drag on the Nasdaq. 🏛️➡️💻

My portfolio

Hi there 👋 My name is Cloo and I just turned 19 years old. This is my current portfolio. I am planning on cutting my positions in $1211 (-0,75%) , $IFX (-1,28%) and $RR. (+1,31%) in the short/medium term. For my other positions I have a time horizon of 10+ years. I would love to get your opinion/advice on my current portfolio 🫶

📊 Market Update (November 3, 2025)

The week kicks off with a strong, but highly selective, risk-on rally. Markets are piling into quality Tech and European Financials, while simultaneously selling off Chinese retail and speculative growth names.

🇺🇸 US Equities (Pre-market/Early Trading)

$SPX500 — Trading solidly higher, driven by strong performance in Tech and Financials.

$DJ30 — Moving up, following the broad positive sentiment.

$NSDQ100 — Leading the gains, as major tech components are firmly in the green.

💻 Tech & Growth Snapshot

$NVDA (+1%) — Advancing higher, leading the AI and semiconductor space.

$GOOGL (+3,81%) — Moving up, showing solid strength in the mega-cap tech space.

$AVGO (-0,41%) — Up moderately, participating in the semiconductor rally.

$META (+1,59%) — Showing strong gains, continuing its upward momentum.

$MSFT (-0,3%) — Up slightly, tracking the positive tech trend.

$TSM (+2,62%) — Up slightly, showing resilience in the chip sector.

$RR. (+1,31%) — Up moderately, the industrial/aerospace stock shows strength.

$RKLB (-6,56%) — Down slightly, underperforming as speculative growth faces pressure.

$RGTI (-4,09%) — Down sharply, quantum stocks are experiencing significant selling.

🛍️ Retail & Commerce

$AMZN (+2,51%) — Up moderately, participating in the mega-cap rally.

$BABA (+0%) — Falling sharply, the main source of weakness in the market today, dragging down the retail sector.

$CVNA (+1,39%) — Up moderately, recovering some ground.

$SHOP (+2,19%) — Down moderately, likely pulled down by the negative sentiment from $BABA$.

⚕️ Health & Pharmaceutical

$LLY (-1,18%) — Likely flat or slightly down, as investors rotate out of defensive pharma names.

$HIMS (-0,67%) — Holding steady, showing no significant price change.

$INSM (+3,7%) — Flat, the biotech sector remains cautious.

🇪🇺 Europe & Industrials

STOXX 600 — Trading higher, led by a strong rally in the banking sector.

GER40 — Trading cautiously higher, reflecting the positive sentiment.

$LDO (+0,24%) — Up strongly, the defense sector is showing significant strength.

$IBE (+0,92%) — Down slightly, utilities lag as investors move away from defensive assets.

$OKLO — Holding steady, the nuclear tech stock is flat.

$CS (+1,79%) — Up moderately, joining the rally in European financials.

🏦 Banking & Finance

$UCG (+1,16%) — Advancing higher, part of the strong European banking rally.

$ISP (+1,92%) — Up strongly, showing clear outperformance.

$BPE (+4,11%) — Surging higher, continuing its massive rally and leading the Italian banks.

$CE (+1,02%) — Up strongly, another standout performer in the Italian banking sector.

$BBVA (+1,8%) — Up strongly, the Spanish bank is showing significant gains.

$AXP (+0,94%) — Up moderately, the payments sector is positive.

$V (+0,55%) — Down slightly, counter-trending the financial sector's strength.

🌏 Asia

$JPN225 / $KOSPI / $HK50 / $CHINA50$ — Likely closed mixed to negative, heavily impacted by the sharp sell-off in $BABA$.

_p_ Forex

$DXY — The Dollar Index is trading loweras risk appetite favors other currencies.

$EURUSD — Moving higheragainst a weaker Dollar.

$USDJPY — Drifting loweras the Yen gains some ground.

💎 Commodities & Precious Metals

$GLD (+0,05%) — Holding steady, gold is flat as investors move into equities rather than safe havens.

$CDE (+1,9%) — Flat, mirroring gold's lack of direction.

$BRENT / $WTI — Likely trading higheron risk-onsentiment and a weaker Dollar.

💰 Crypto

$BTC (-0,53%) / $ETH (-1,26%) — Likely moving higher, following the Nasdaq and the risk-onmood.

$TRX (+0,07%) — Down slightly, underperforming the broader crypto sentiment.

$CRO (-2,83%) — Not shown, likely tracking the positive risk-ontrend.

📈 Benchmark ETFs

$VOO (+0,05%) / $VGT (+0,06%) / $CNDX — Holding steady (from image), but the underlying components signal they are trading higher.

$BND (+0,04%) — Flat, as bond yields likely rise (prices fall) in a risk-onmove.

🔎 Deep Dive: The "Quality Growth" Rally

Today is a "flight to quality growth." The market is not buying everything; it is highly selective. There is clear strength in established Tech ($NVDA, $GOOGL) and a massive rally in European Banks ($BPE.MI, $BBVA.MC). However, there is clear weakness in Chinese Retail ($BABA, $SHOP) and speculative Tech ($RGTI, $RKLB). This divergence signals that investors are willing to take risks, but only on assets with strong fundamentals or clear momentum, while dumping assets exposed to Chinese macro or high speculation.

Follow the Analysis:

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.eToro.com/people/farlys

⚠️ Disclaimer:Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

Share analysis aviation industry ✈️

Airbus

Air France-KLM

Boeing

Bombardier

Dassault Aviation

Embraer

Fraport

GE Aerospace

Honeywell

Lufthansa

MTU Aero Engines

Pratt & Whitney

RollsRoyce

Saffron

$AIR (+0,87%)

$BA (-0,81%)

$LHA (+0,06%)

$FRA (-1,1%)

$GE

$HON (+1,07%)

$MTX (+1,02%)

$RR. (+1,31%)

$EMBR3

📊 Market Update (October 31, 2025)

It's the last day of the month, and the market is exploding higher, in a strong risk-onmove driven by a series of stellar earnings in the Tech sector. The day is dominated by impressive rallies, although key divergences remain.

🇺🇸 US Equities (Pre-market/Open)

$SPX500 — Futures are moving decidedly higher, driven by the Mega-Cap rally.

$DJ30 — Up, as positive sentiment spreads.

$NSDQ100 — In a strong rally, the index is being pulled higher by $AMZN$ and $GOOGL$.

💻 Tech & Growth Snapshot

$NVDA (+1%) — In a solid rise, the stock is outperforming and leading the AI sector.

$GOOGL (+3,81%) — Rallying strongly, the market reacts with euphoria to its earnings, pushing the stock higher.

$AVGO (-0,41%) — Slightly down, counter-trending the sector, showing weakness.

$META (+1,59%) — Up, the stock is recovering lost ground and joining the positive sentiment.

$MSFT (-0,3%) — Slightly up, attempting a modest recovery along with the Nasdaq rally.

$TSM (+2,62%) — Slightly up, showing resilience in the chip sector.

$RR. (+1,31%) — Slightly down, the industrial/aerospace sector is weak.

$RKLB (-6,56%) — Slightly up, showing cautious optimism in the new techspace.

$RGTI (-4,09%) — Up, the quantum sector follows the speculative sentiment.

🛍️ Retail & Commerce

$AMZN (+2,51%) — Exploding higher, the stock is dominating the market with an impressive rally, clearly following earnings that beat all expectations.

$BABA (+0%) — Falling sharply, continuing its negative performance, crashing against the US tech trend.

$CVNA (+1,39%) — Up, the stock is participating in the risk-onmove and recovering ground.

$SHOP (+2,19%) — Stable, failing to benefit from the $AMZN rally.

⚕️ Health & Pharmaceutical

$LLY (-1,18%) — Slightly down, the defensive Pharma sector is being sold as capital rotates into Tech.

$HIMS (-0,67%) — Stable, awaiting catalysts.

$INSM (+3,7%) — Stable, the biotech sector is flat.

🇪🇺 Europe & Industrials

STOXX 600 — Mixed, Europe is not fully participating in the US rally.

GER40 — Mixed/Slightly down, reflecting uncertainty.

$LDO (+0,24%) — Slightly up, the defense sector shows some strength.

$IBE (+0,92%) — Slightly up, utilities are stable/positive.

$OKLO — Stable, the nuclear stock is flat.

$CS (+1,79%) — Down, the European financial sector is weak.

🏦 Banking & Finance

$UCG (+1,16%) — Slightly up, the Italian banking sector is mixed.

$ISP (+1,92%) — Slightly up, showing modest strength.

$BPE (+4,11%) — Solidly up, continuing its outperformance and positive trend.

$CE (+1,02%) Up, another strong performer in Italian banking.

$BBVA (+1,8%) — Up, the Spanish bank is recovering ground.

$AXP (+0,94%) — Slightly down, the payments sector is weak.

$V (+0,55%) — Down, following the weakness in $AXP$.

🌏 Asia

$JPN225 / $KOSPI / $HK50 / $CHINA50 — Closed mixed/negative, weighed down by weakness in Chinese stocks ($BABA$).

💱 Forex

$DXY — The Dollar Index is stable/slightly down, reflecting the conflicting sentiment.

$EURUSD — Stable/Slightly upagainst a weaker Dollar.

$USDJPY — Stable.

💎 Commodities & Precious Metals

$GLD (+0,05%) — Stable, gold is flat, not benefiting from the defensive sell-off or the tech risk-on.

$CDE (+1,9%) — Stable, following gold.

$BRENT / $WTI — Down, oil is dropping due to demand fears (e.g., $BABA data).

💰 Crypto

$BTC (-0,53%) / $ETH (-1,26%) — Up, crypto is following the risk-onrally led by $AMZN and $GOOGL.

$TRX (+0,07%) — Up, the altcoin sector is participating in the positive sentiment.

$CRO (-2,83%) — Up, in line with the sector.

📈 Benchmark ETFs

$VOO (+0,05%) / $VGT (+0,06%) / $CNDX — The real sentiment is being pulled higher by their main components.

$BND (+0,04%) — Stable, investors are also looking for safety in bonds.

🔎 Deep Dive: The Great Earnings Divergence

Today is the definition of a "stock market," not a "market of stocks." There is no single sentiment. Quarterly results are creating massive divergences:

1. The Winners: $AMZN (+2,51%) and $GOOGL (+3,81%) are on fire, saving the $NSDQ100 single-handedly.

2. The Losers: $BABA (+0%) is collapsing, signaling weakness in Chinese and speculative retail.

3. The Isolated Strong:Italian banks ($BPE (+4,11%) , $CE (+1,02%) ) and $BBVA (+1,8%) continue to outperform.

4. The Defensives:Gold ($GLD (+0,05%) ) is flat, while Pharma ($LLY (-1,18%) ) and European financials ($CS (+1,79%)

) are weak.

Follow the Analysis:

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.eToro.com/people/farlys

⚠️ Disclaimer:Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

📊 Market Update (October 30, 2025)

🇺🇸 US Equities (Pre-market/Early Trading)

$SPX500 — Indicating a sharp decline, as the collapse in major tech components weighs heavily on the index.

$DJ30 — Trading significantly lower, pulled down by the broad *risk-offsentiment.

$NSDQ100 — Falling sharply, dragged down by heavy losses in major tech names.

💻 Tech & Growth Snapshot

$NVDA (+1%) — Down slightly, showing significant resilience and holding up well compared to the broader tech wreck.

$GOOGL (+3,81%) — Surging dramatically higher, completely defying the market sell-off, likely on a stellar earnings report.

$AVGO (-0,41%) — Up moderately, showing strong relative strength in the semiconductor sector.$META (+1,59%) — Collapsing, in a sharp sell-off likely due to a major earnings miss.

$MSFT (-0,3%) — Falling sharply, a massive drop indicating a very negative reaction to its earnings, pulling the $SPX500$ down.

$QBTS (-7,11%) Not shown, but likely down significantly*in this *risk-offenvironment for speculative tech.

$RGTI (-4,09%) — Down moderately, following the negative sentiment in speculative tech.

$TSM (+2,62%) — Down slightly, giving back some recent gains.

$RR. (+1,31%) — Down moderately, the industrial/aerospace sector is weak.

$RKLB (-6,56%) — Up slightly, showing some resilience in the space sector.

🛍️ Retail & Commerce

$AMZN (+2,51%) — Down moderately, reflecting weakness in consumer-focused tech.

$BABA (+0%) — Down moderately, under pressure alongside other Chinese and e-commerce stocks.

$CVNA (+1,39%) — Falling sharply, continuing its pattern of high volatility and weakness.

$SHOP (+2,19%) — Down moderately, indicating pressure on e-commerce platforms.

⚕️ Health & Pharmaceutical

$LLY (-1,18%) — Likely flat or slightly down, as investors rotate out of defensive names or brace for the downturn.

$HIMS (-0,67%) — Holding steady, showing no significant price change.

$INSM (+3,7%) — Flat, the biotech sector remains cautious.

🇪🇺 Europe & Industrials

STOXX 600 — Trading lower, struggling as the US tech crash impacts global sentiment.

GER40 — Trading cautiously lower, reflecting the uncertain global sentiment.

$LDO (+0,24%) — Down moderately, suggesting pressure on the defense sector.

$IBE (+0,92%) — Down slightly, utilities are also facing some selling pressure.

$OKLO Down moderately, indicating profit-taking in the nuclear technology space.

$CS (+1,79%) — Down moderately, reflecting broader caution across parts of the European financial sector.

🏦 Banking & Finance

$UCG (+1,16%) — Down moderately, following the negative trend in European financials.

$ISP (+1,92%) — Down slightly, showing some weakness.

$BPE (+4,11%) — Making moderate gains, continuing its strong counter-trend rally.

$CE (+1,02%) — Up slightly, joining the isolated strength in Italian mid-cap banks.

$BBVA (+1,8%) — Falling sharply, showing significant weakness and vulnerability.

$AXP (+0,94%) — Down moderately, reflecting caution in the payments sector.

$V (+0,55%) — Down slightly, mirroring the hesitation seen in other payment stocks.

🌏 Asia

$JPN225 / $KOSPI / $HK50 / $CHINA50 — Likely closed mixed to negative*as the US tech crash sentiment spread.

💱 Forex

$DXY — The Dollar Index is likely trading higher*as investors flee to safety (cash).

$EURUSD — Likely edging lower*against a stronger Dollar.

$USDJPY — Likely trading higher*reflecting the strong Dollar.

💎 Commodities & Precious Metals

$GLD (+0,05%) — Holding steady, pausing as investors prefer the $DXY$ as the primary safe haven over gold.

$CDE (+1,9%) — Flat, mirroring gold's lack of direction.

$BRENT / $WTI (W&T Offshore Inc) — Likely trading down*as growth concerns spike, tempering demand outlook.

💰 Crypto

$BTC (-0,53%) / $ETH (-1,26%) — Likely experiencing significant downward pressure, following the Nasdaq crash.

$TRX (+0,07%) — Holding steady, though the broader crypto market is likely weak.

$CRO (-2,83%) — Likely tracking the negative trend in crypto.

📈 Benchmark ETFs

$VOO (+0,05%)

$VGT (+0,06%)

$CNDX — Holding steady (0.00%) in the image, likely reflecting a pre-market halt or lag, but they are clearly heading for a sharp drop*based on their components.

$BND (+0,04%) — Flat, as bond yields likely fall (prices rise) during the flight to safety.

🔎 Deep Dive: The Great Tech Divergence

Today's story is a brutal earnings-driven divergence. The market is split in two: $MSFT (-0,3%) and $META (+1,59%) are collapsing, pulling the entire $SPX500 and risk-onsentiment down with them. Retail stocks like $BABA and $AMZN are falling in sympathy.

However, $GOOGL (+3,81%) is surging dramatically, completely disconnecting from the sector on what must be a stellar earnings report. This divergence shows the market is differentiating between AI narratives: $NVDA (+1%) is also holding up remarkably well (down only slightly), while other tech ($TSM (+2,62%) , $AVGO (-0,41%) ) is mixed.

Away from tech, Italian banks ($BPE (+4,11%)) continue their isolated rally, but the overall mood is clearly *risk-off*.

Follow the Analysis:

For daily real-time market insights, *deep dives*, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.eToro.com/people/farlys

⚠️ Disclaimer:*Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

Títulos em alta

Principais criadores desta semana