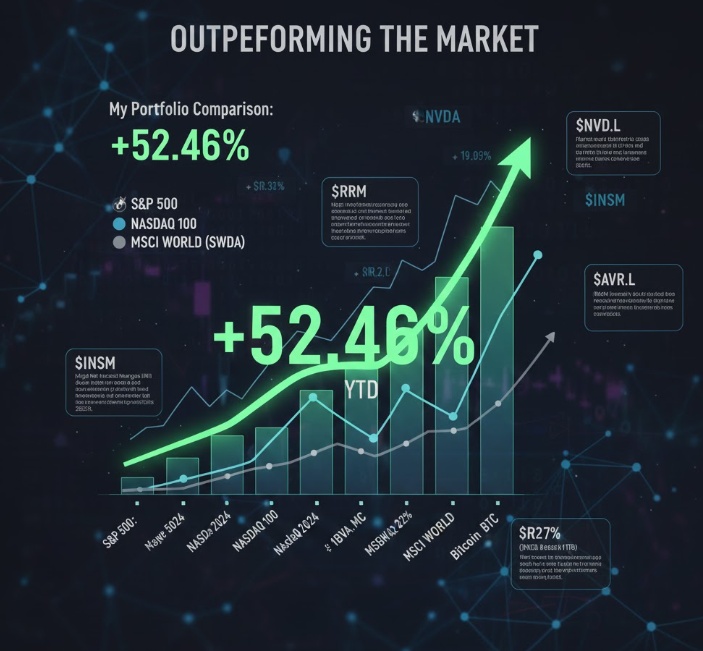

An extraordinary year comes to a close. The numbers speak for themselves: 2025 has been the year that confirmed my strategy, closing with a +52.46% return that significantly outperformed all major global benchmarks.

🏁 Benchmark Comparison:

🏆 My Portfolio: +52.46%

📊 S&P 500: +16.37%

💻 Nasdaq 100: +19.05%

🌍 MSCI World (SWDA): +14.50%

₿ Bitcoin (BTC): +35.20%

The strength of this portfolio lies not only in the total return but in its resilience. Despite natural market fluctuations, we maintained steady growth, closing almost every month in the green and managing the rare moments of drawdown with strict discipline.

📊 Monthly Performance:

📈 January 2025: +4.35%

📈 February 2025: +0.95%

📉 March 2025: −4.4%

📈 April 2025: +3.68%

📈 May 2025: +13.32%

📈 June 2025: +6.35%

📈 July 2025: +6.06%

📈 August 2025: +2.04%

📈 September 2025: +6.87%

📈 October 2025: +1.55%

📉 November 2025: -0.39%

📈 December 2025: +2.94%

Performance Summary: ✅ 2024: +4.75% ✅ 2025: +52.46% (YTD) 🔥 Since Inception (1.5 years): +59.7%

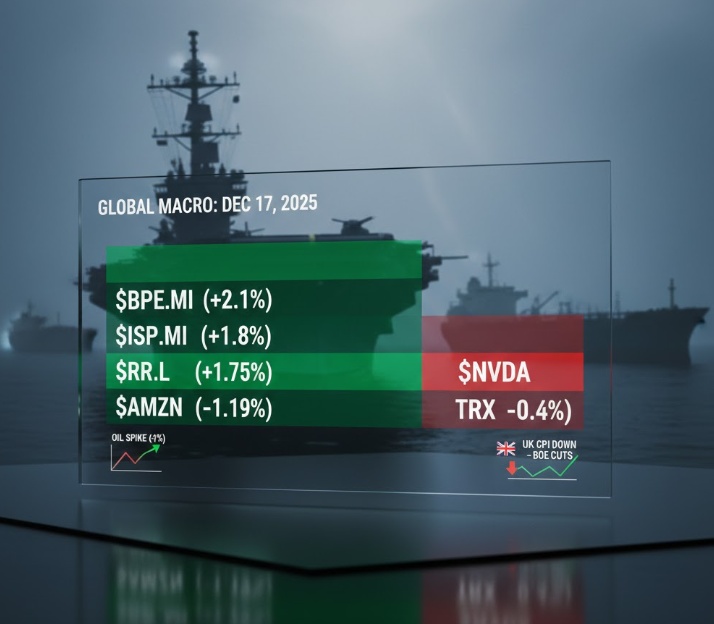

🏦 Focus: The Strategic Move on European Banks

Massive exposure to the European banking sector with stocks such as $UCG (+1,16%) , $BPE (+4,11%), $BBVA (+1,8%) , $ISP (+1,92%) , and $BMPS (+3,62%) was a primary key to our success. Here is why they performed so brilliantly:

Record Margins: Financial institutions fully capitalized on interest rates remaining elevated longer than expected, maximizing net interest margins.

Shareholder Returns: Aggressive dividend policies and massive buyback programs provided constant support to stock valuations.

Efficiency & Quality: Rigorous risk management kept non-performing loans (NPLs) at historic lows, while digitalization significantly reduced operational costs.

🔥 Top Performers: The Growth Engines

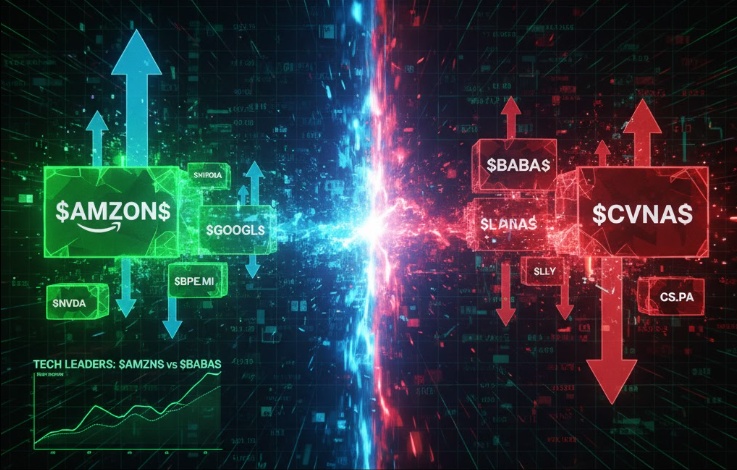

Beyond the banking sector, the portfolio was driven by exceptional assets:

$INSM (+3,7%): Performance fueled by the clinical and commercial success of ARIKAYCE and pipeline advancements in rare diseases, with 2025 revenue growth hitting 52%.

$RR. (+1,31%) A powerful industrial turnaround based on drastic restructuring, the global recovery of air travel (engine maintenance), and new defense sector contracts.

$NVDA (+1%) & $AVGO (-0,41%) : Undisputed leaders of the AI revolution. NVIDIA dominates data center infrastructure, while Broadcom benefits from record demand for custom AI chips and networking hardware.

🎯 Strategy for 2026

My objective remains the same: to outperform major global indices while maintaining a balanced risk profile. As you can see, our asset selection successfully captured the best of the bullish trend.

To those following me: thank you for your trust. If you are looking for a long-term investment aiming to consistently beat the benchmark, consider adding me to your copy traders in 2026—I intend to open this possibility soon.

Let's start 2026 with the same discipline! 🥂

⚠️ DISCLAIMER: All content in this post is for informational and entertainment purposes only. It does not constitute a solicitation for public savings, personalized financial advice, or an investment suggestion. Trading involves the risk of capital loss. Remember that past performance is no guarantee of future results. Before investing or copying a portfolio, do your own research (DYOR) and evaluate your risk tolerance.