Markets are displaying a mixed and cautious tonetoday, struggling to sustain the post-FOMC optimism. While the Fed's dovish signals offer support, earnings reports and sector-specific dynamics are creating significant divergence across the board.

🇺🇸 US Equities (Pre-market/Early Trading)

$SPX500 — Futures suggest a hesitant start, leaning slightly negative as tech weakness offsets gains elsewhere.

$DJ30 — Trading sideways, lacking clear direction amid ongoing sector rotation.

$NSDQ100 — Showing noticeable pressure, pulled down by declines in several major tech components.

💻 Tech & Growth Snapshot

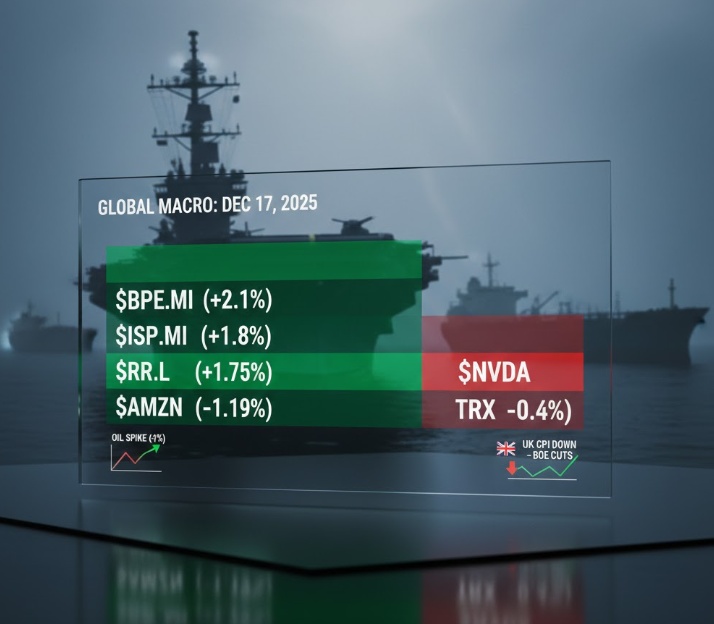

$NVDA (+1%) — Surging significantly higher, clearly outperforming the market and reinforcing its leadership in the AI space.

$GOOGL (+3,81%) — Trading moderately higher, participating in some tech strength but lagging behind leaders like NVDA.

$AVGO (-0,41%) — Experiencing a slight pullback, indicating mixed sentiment within the semiconductor sector.

$META (+1,59%) — Essentially flat, hovering around the previous close with little momentum.

$MSFT (-0,3%) — Trading sideways, showing stability but lacking strong buying interest.

$QBTS (-7,11%) — Likely pulling back sharply, mirroring the negative trend in other speculative quantum names.

$RGTI (-4,09%) — Undergoing a significant correction, suggesting sharp profit-taking is hitting the quantum computing sector.

$TSM (+2,62%) — Climbing steadily higher, demonstrating notable resilience and strength within the chip industry.

$$RR. (+1,31%) — Edging slightly lower, reflecting a cautious stance in the industrial and aerospace sector.

$RKLB (-6,56%) — Showing modest gains, indicating some investor interest in the space exploration theme.

🛍️ Retail & Commerce

$AMZN (+2,51%) — Drifting slightly lower, reflecting caution surrounding consumer-focused tech giants.

$BABA (+0%) — Falling sharply, significantly underperforming due to persistent pressures on Chinese equities.

$CVNA (+1,39%) — Experiencing a minor dip, continuing its recent pattern of weakness.

$SHOP (+2,19%) — Trading moderately lower, indicating pressure on e-commerce enablement platforms.

⚕️ Health & Pharmaceutical

$LLY (-1,18%) — Likely trading slightly down or flat, as investors rotate out of defensive pharma names.

$HIMS (-0,67%) — Holding steady, showing no significant price change.

$INSM (+3,7%) — Flat, the biotech sector remains cautious.

🇪🇺 Europe & Industrials

STOXX 600 — Mixed performance, struggling to maintain direction as different sectors diverge.

GER40 — Trading cautiously, reflecting the uncertain global sentiment.

$LDO (+0,24%) — Experiencing moderate declines, suggesting pressure on the defense sector.

$IBE (+0,92%) — Showing slight gains, with utilities attracting some buying interest as a defensive play.

$OKLO — Pulling back moderately, indicating profit-taking in the nuclear technology space.

$CS (+1,79%) — Trading moderately lower, reflecting broader caution across parts of the European financial sector.

🏦 Banking & Finance

$UCG (+1,16%) — Making solid gains, clearly participating in the positive Italian banking trend.

$ISP (+1,92%) — Climbing strongly higher, another standout performer among Italian banks today.

$BPE (+4,11%) — Surging dramatically higher, a standout rally significantly outpacing the market.

$CE (+1,02%) Registering strong gains, joining the broader surge in Italian banks.

$BBVA (+1,8%) — Advancing solidly, the Spanish bank continues its upward trajectory.

$AXP (+0,94%) — Edging slightly lower, reflecting caution in the payments sector ahead of data/earnings.

$V (+0,55%) — Experiencing a minor dip, mirroring the hesitation seen in other payment stocks.

🌏 Asia

$JPN225 / $KOSPI / $HK50 / $CHINA50$ — Likely closed mixed to positive, carrying over optimism from the prior session.

💱 Forex

$DXY — The Dollar Index is trading mixed to slightly firmeras overall risk appetite fades somewhat.

$EURUSD — Likely edging loweragainst a relatively stable Dollar.

$USDJPY — Likely trading slightly higherreflecting cautious sentiment.

💎 Commodities & Precious Metals

$GLD (+0,05%) — Holding steady, pausing after recent significant moves as markets digest Fed comments.

$CDE (+1,9%) — Flat, mirroring gold's lack of direction.

$BRENT / $WTI — Likely trading mixed or slightly downas growth concerns temper demand outlook.

💰 Crypto

$BTC (-0,51%) / $ETH (-1,02%) — Likely experiencing downward pressure, following the weakness in the Nasdaq and broader tech sentiment.

$TRX (+0,28%) — Holding steady, showing little movement.

$CRO (-2,7%) — Not shown, likely tracking the mixed/negative trend in crypto.

📈 Benchmark ETFs

$VOO (+0,05%) / $VG / $CNDX — Likely trading flat or slightly down, reflecting the mixed and cautious market action.

$BND (+0,04%) — Likely holding steady or slightly upas bond yields stabilize.

🔎 Deep Dive: Market Divergence Post-FOMC

The initial excitement after the Fed's dovish comments has waned, revealing a highly fragmented market. While potential rate stability provides underlying support, company earnings and sector rotation are the main performance drivers today. Tech shows a clear split: leaders like $NVDA (+1%) and $TSM (+2,62%) power ahead, while others including $META (+1,59%) , $BABA (+0%) , and speculative names like $RGT face significant selling. European banks, particularly Italian ones ($UCG (+1,16%)

$ISP (+1,92%)

$BPE (+4,11%) ) along with $BBVA (+1,8%) , display remarkable strength, contrasting sharply with the caution seen in US payments ($AXP (+0,94%) , $V (+0,55%) ). Gold ($GLD (+0,05%) ) is pausing, suggesting investors are neither fully embracing risk nor rushing to safety, but rather becoming highly selective.

Follow the Analysis:

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

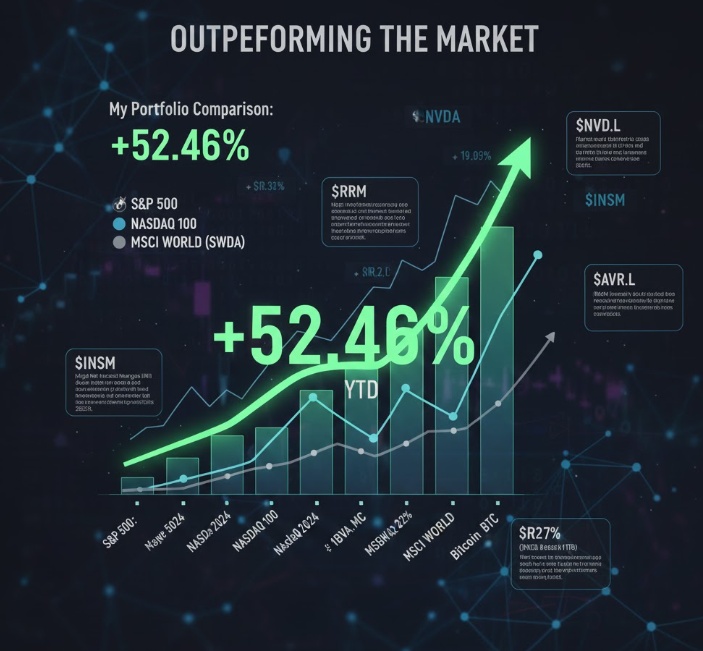

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.eToro.com/people/farlys]

⚠️ Disclaimer:Past performance is not indicative of future results. Investing involves risks, including the loss of capital.