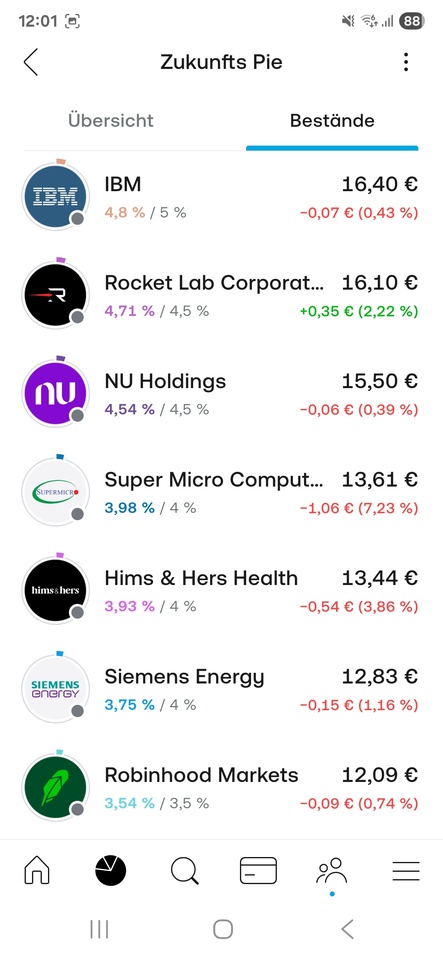

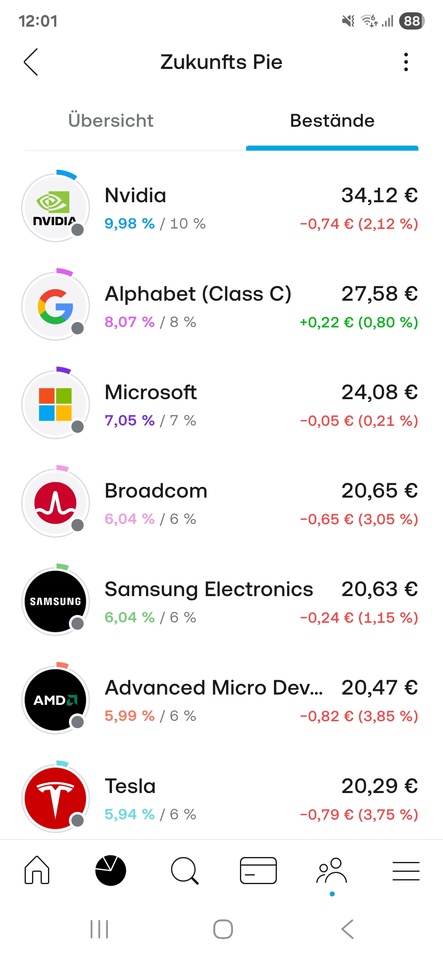

$OHB (-1,38%)

$AIR (-1,3%)

$KKR (-0,49%) (@Simpson ). $MTX (-1,13%)

The new German government has brought space travel more into focus. Until a few months ago, the industry was more or less working away in the shadows, but now it has powerful political advocates. Walther Pelzer sits on the board of the German Aerospace Center and is beaming from ear to ear. The new German government has raised the topic of space travel "to a political level that was previously only found in Italy, France, Japan and the USA".

One area is becoming increasingly important: security and defense in and from space. After all, today's conflicts are no longer only fought on Earth. A few months ago, NATO Secretary General Rutte expressed concern that Russia could station weapons in space to combat satellites. Space is a crucial part of critical infrastructure. A satellite failure could have fatal consequences in modern life, from cell phone outages to plane crashes and non-functioning bank transfers.

Defense Minister Boris Pistorius (SPD) remarked in his speech at the congress: "39 Chinese and Russian reconnaissance satellites are flying over us as I speak to you here alone". And for the first time, he mentions a concrete figure that the industry has been waiting a long time for: the German government is planning to spend 35 billion euros on space projects by 2030. It's about "networked satellites for military reconnaissance, it's about tracking missiles". "We are investing in spacecraft, which sounds like science fiction to many people out there," says Pistorius.

My dear OHB has a good chance of taking a slice of the cake.

(With a P/E ratio of 29, it's no longer quite so cheap, but compared to Rheinmetall etc. perhaps still rather undiscovered. And due to the new growth, there is certainly still potential)

Feel free to write your opinion in the comments.

Just a few meters away at the "Space Congress" of the Federation of German Industries (BDI) is the stand of an established traditional company. OHB is one of the largest space companies in Europe, a medium-sized family business headquartered in Bremen. OHB is 44 years old these days and builds everything from satellite systems and small rockets to security technology, explains Sabine von der Recke. She is a member of the Management Board of OHB-System AG.

She describes the many new start-ups such as The Exploration Company, Isar Aerospace and Rocket Factory Augsburg as "innovation providers", while she sees her own company as a "start-up of the 80s". OHB would also know what the small companies are going through, which is why it promotes and supports the newcomers.

At the end of the day, however, it is not enough just to have a good idea, says von der Recke. "You also have to run a company that is economically viable." Some of the smaller companies will certainly manage this very well, others will have a dry spell and a few may not make it, predicts the OHB board member. But she believes that a broad-based network is important for the space industry in Germany and Europe.

Airbus and OHB are regarded as important German companies involved in the space and satellite industry. Other well-known companies are MT Aerospace AG, Jena-Optronik and Tesat-Spacecom, which focus on specific technologies such as satellite systems, optics and rocket development. Growth in the field of small satellites and micro-launchers is being driven by companies such as Isar Aerospace and Rocket Factory Augsburg.

$MTX (-1,13%) (I am invested here myself)

MTU Aero Engines develops and manufactures key components for rockets and spacecraft, often as part of international partnerships.

MTU Aero Engines works closely with other companies such as MT Aerospace, a subsidiary of OHB SE, and international partners to further develop its activities in the space sector.

@EpsEra Are you also involved or invested in this sector?

$KKR (-0,49%)

The jump in the share price is primarily due to the low free float of around six percent. The US financial investor KKR took over the Bremen-based space company as part of a public takeover bid in summer 2024. The Fuchs family, which previously held a majority stake in OHB, remained the majority shareholder with a good 65 percent, while KKR holds around 28.6 percent of the shares as a strategic partner.

https://www.tagesschau.de/wirtschaft/technologie/raumfahrt-branche-weltraum-astronauten-100.html