$4GLD (+0,68%)

$GLDA (+0,81%)

$GOLD (-0,45%)

$GOLD

$DE000EWG0LD1 (+1,15%)

$NEM (+0,31%)

#gold #silver

Other Global X Physical Gold

Price

Discussão sobre GOLD

Postos

19🇻🇪 Venezuela quake on the oil market - Who are the profiteers of the upheaval? 🛢️🚀💰

Good morning everyone and a green start to the first full trading week of 2026!

The year is barely five days old and there have already been numerous events around the world.

Probably the most eventful event (can you write it like that? 🤔) is the one at the weekend surrounding Maduro's arrest.

While the oil price remains volatile due to the global oversupply, clear winners are emerging today (05.01.2026) from the US intervention.

1. the "top dog": Chevron $CVX (-0,83%)

🏗️

Chevron is the clear favorite today. As the only US company to remain operational in the country, they have the "first mover" advantage.

If the sanctions are lifted, the billions will flow into repairs first.

_________________________

2. the service giants: SLB $SLB (-1,68%)

& $HAL (-1,11%)

🛠️

No matter who is producing: The plants in Venezuela are dilapidated. Schlumberger is currently benefiting massively from speculation on major technology contracts.

Without Western know-how, Venezuela will not be able to significantly increase production.

_________________________

3. the US refineries: Marathon Petroleum $MPC (-1,14%)

& Valero $VLO (-1,96%)

⛽

The US Gulf Coast specializes in "heavy" crude oil from Venezuela. A return of this oil improves the margins of Marathon Petroleum and Valero massively, as expensive import alternatives are eliminated.

_________________________

4. US defense: Lockheed Martin $LMT (-0,97%)

🛡️

Instead of European second-line stocks, the industry leader Lockheed Martin is moving into focus. The US intervention underlines the military presence in the region. very Such geopolitical tensions secure the group's long-term political backup for defense budgets.

_________________________

5. the "safe haven" effect: gold breaks records 🏆✨

Gold is the absolute rock in the surf today. Due to the uncertainty, the spot price fell by over 2 % upwards this morning and has passed the 4,420 USD per ounce!

- Barrick Gold $ABX (+1,06%)

& Newmont $NEM (+0,31%)

: Mining stocks rally strongly.

- Background: Venezuela is sitting on gold reserves worth around USD 22 billion - the question of who will have access to them is also driving speculation.

_________________________

What's your situation? Have you already invested in one of the stocks? Or are you planning to?

🏅Gold brings a joyful start to the new year 😌

Two months ago, I was delighted to receive my first Onebagger - gold.

Today I can be happy again - the 10k have been cracked 🥳

I bought my last gold several years ago. Since then, it's been gaining value by stubbornly "lying around". What more could you want 😁

Tomorrow there will be a final update on the Tenbagger community project. And then we'll see you again in the new year.

$IGLN (+0,96%)

$4GLD (+0,68%)

$GDXJ (+1,97%)

$SGLD (+0,82%)

$GLDA (+0,81%)

$GOLD

$GOLD (-0,45%)

$DE000EWG0LD1 (+1,15%)

$GOLD (-0,57%)

Gold, baby gold!

Gold is also constantly being bought up. Yes, I know, above the spot price - but they are old physical coins, which is why I consciously pay more!

Do you also have $GOLD in your portfolio?

🏅Gold reaches all-time high

Gold broke its previous all-time high of just over $4,400 today.

On that note, have a good start to the last full week of 2025 😌

$GLDA (+0,81%)

$GOLD

$4GLD (+0,68%)

$GOLD (-0,45%)

$GDXJ (+1,97%)

$GDXJ (+0%)

$EWG2 (+0,79%)

🏆 Gold just 44 dollars short of its all-time high - will we break the record today? 🚀

🌟 Gold price soaring

The gold market remains in absolute rally mode. After several days of strong gains, the price remains at an extremely high level - and the jump to an all-time high could happen at any time.

_________________________

💸 Fed interest rate cut boosts precious metals

The latest push is mainly due to the Fed's decision:

- ✔️ Fed rate cut this week

- ✔️ Prospect of continued loose monetary policy

- ✔️ Start of a new bond purchase program (USD 40 billion per month)

The whole thing acts as fuel for gold and silver, as neither yields any current interest - making them particularly attractive in periods of low interest rates.

_________________________

🏅 Gold price scratches the record

- Current price: USD 4,337 per ounce

- All-time high: USD 4,381

- ➡️ Only 44 dollars away!

Three strong trading days in a row have catapulted the market upwards. Silver is also close to its own record.

_________________________

📈 Reasons for the mega rally

Precious metals are a phenomenon in their own right in 2025:

- Gold: +60% since the beginning of the year

- Silver: more than doubled

- Best performance in sight since 1979

The whole thing is driven by:

- ✔️ massive central bank buying behavior

- ✔️ withdrawal of many investors from government bonds

- ✔️ Increasing fear of currency devaluation (debasement trade)

- ✔️ geopolitical uncertainties

_________________________

🔮 Outlook: 2026 could be even hotter

According to market analyst Hebe Chen (Vantage Markets):

- The rally is likely to continue until 2026

- Central banks remain buyers

- ETF inflows pick up speed again

- Fed leaves "unusual room for surprises" - creating more volatility

The World Gold Council confirms:

→ Gold ETF holdings to rise almost every month in 2025

→ Silver additionally benefits from shortages and supply disruptions

_________________________

💹 Market overview (Friday morning)

- Gold: USD 4,337 (+ slightly)

- Silver: USD 63.63 (sideways)

- Platinum: slightly weaker

- Palladium: up

- Dollar index: stable after -0.3% the previous day

$4GLD (+0,68%)

$GLDA (+0,81%)

$GOLD

$GOLD (-0,45%)

$NEM (+0,31%)

$ABX (+1,06%)

$AEM (+0,61%)

Source:

https://finanzmarktwelt.de/goldpreis-nimmt-rekordhoch-ins-visier-fed-sorgt-fuer-auftrieb-373384/?amp

🏆 Gold just 44 dollars short of its all-time high - will we break the record today? 🚀

🌟 Gold price soaring

The gold market remains in absolute rally mode. After several days of strong gains, the price remains at an extremely high level - and the jump to an all-time high could happen at any time.

_________________________

💸 Fed interest rate cut boosts precious metals

The latest push is mainly due to the Fed's decision:

- ✔️ Fed rate cut this week

- ✔️ Prospect of continued loose monetary policy

- ✔️ Start of a new bond purchase program (USD 40 billion per month)

The whole thing acts as fuel for gold and silver, as neither yields any current interest - making them particularly attractive in periods of low interest rates.

_________________________

🏅 Gold price scratches the record

- Current price: USD 4,337 per ounce

- All-time high: USD 4,381

- ➡️ Only 44 dollars away!

Three strong trading days in a row have catapulted the market upwards. Silver is also close to its own record.

_________________________

📈 Reasons for the mega rally

Precious metals are a phenomenon in their own right in 2025:

- Gold: +60% since the beginning of the year

- Silver: more than doubled

- Best performance in sight since 1979

The whole thing is driven by:

- ✔️ massive central bank buying behavior

- ✔️ withdrawal of many investors from government bonds

- ✔️ Increasing fear of currency devaluation (debasement trade)

- ✔️ geopolitical uncertainties

_________________________

🔮 Outlook: 2026 could be even hotter

According to market analyst Hebe Chen (Vantage Markets):

- The rally is likely to continue until 2026

- Central banks remain buyers

- ETF inflows pick up speed again

- Fed leaves "unusual room for surprises" - creating more volatility

The World Gold Council confirms:

→ Gold ETF holdings to rise almost every month in 2025

→ Silver additionally benefits from shortages and supply disruptions

_________________________

💹 Market overview (Friday morning)

- Gold: USD 4,337 (+ slightly)

- Silver: USD 63.63 (sideways)

- Platinum: slightly weaker

- Palladium: up

- Dollar index: stable after -0.3% the previous day

$4GLD (+0,68%)

$GLDA (+0,81%)

$GOLD

$GOLD (-0,45%)

$NEM (+0,31%)

$ABX (+1,06%)

$AEM (+0,61%)

Source:

https://finanzmarktwelt.de/goldpreis-nimmt-rekordhoch-ins-visier-fed-sorgt-fuer-auftrieb-373384/?amp

🚨 Market Alert: Tech Tumble After FED and $ORCL Earnings

Global markets are showing caution this morning, following a combination of a divided Federal Reserve (FED) decision and disappointing corporate news from the technology sector.

$GOLD & $BTC (-3,07%) Risk-Off Trend

Both traditional and digital safe-haven assets are seeing a pullback:

$BTC : Down approximately -1.8% (24h). $BTC is tracking the Nasdaq, behaving as a risk asset.

$GOLD Down approximately -0.4%. $GOLD is seeing minor profit-taking/caution despite the Dollar's weakness.

The cautious stance from the FED, which projected only one rate cut in 2026, reduces expectations for aggressive easing. This scenario pulls investors away from speculative assets like $BTC which is struggling to hold the $90,000 USD level, and leads to slight selling pressure on $GOLD as immediate inflation concerns subside.

📉 Pressure on $NVDA (-0,61%)

Current Change: $NVDA is down approximately -1.8% in Pre-Market trading.

NVIDIA is struggling to maintain momentum, dragged down by an overall negative sentiment in the Artificial Intelligence space. The immediate trigger appears to be the earnings disappointment and cautious outlook from Oracle ($ORCL).

The Oracle Effect: $ORCL 's poor Q2 results and its plans for massive CapEx (capital expenditure) for AI development fueled investor concern about the actual profitability and return on investment within the entire AI ecosystem. As Oracle is a major purchaser of GPUs from companies like $NVDA, its troubles are sparking broader doubts about the pace of AI monetization.

The FED Factor: The reduced outlook for rate cuts further limits liquidity expectations, hitting high-growth, high-valuation stocks like $NVDA and $ORCL the hardest.

🏛️ The FED's Divided Message

The key takeaway from the latest FOMC meeting is division.

The FED cut rates by 25 basis points (to 3.50% -3.75%), as widely expected.

However, the consensus was fragmented, and the 2026 outlook implies a significant slowdown in the easing cycle. This translates to higher uncertainty and increased short-term volatility.

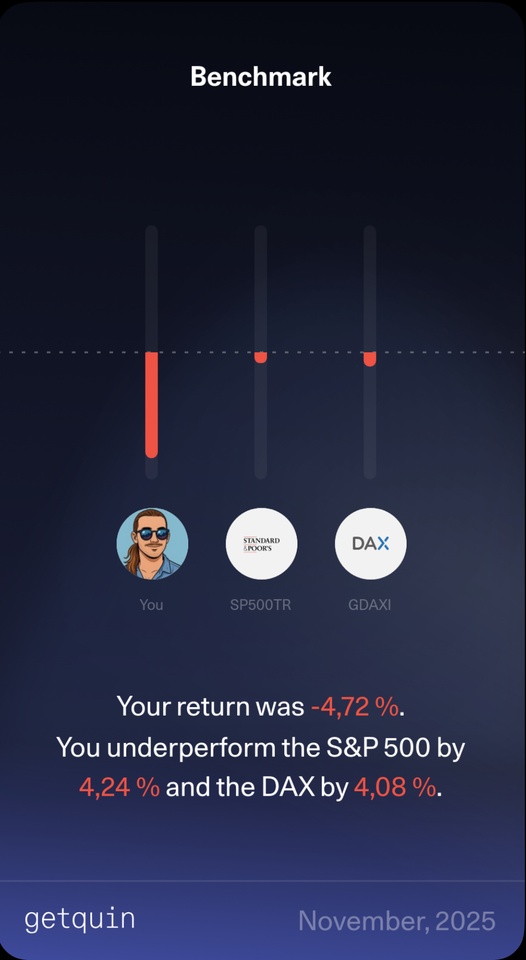

Community project & crypto gnaw at returns

I also have to show a red November.

Both the community project "Tenbagger of the future", consisting of $IREN (-3%)

$HIMS (-1,69%)

$PNG (-2,19%)

$SOFI (-1,53%) and $RKLB (-2,89%) as well as the two crypto assets $BTC (-3,07%) and $ETH (-4,25%) have not exactly led to a positive return - quite the opposite. Thanks to $GOLD however, the month was not quite so red. Fortunately.

Let's see how December turns out 😁

Thanksgiving Market Status & Portfolio Recalibration! 🚀

Hey guys!

Quick update from Europe—it's Thanksgiving, so Wall Street is completely closed today! 🚫🇺🇸 No US premarket action, but our markets here are open and trading cautiously after a strong close in Asia, driven by renewed Fed rate cut hopes.

$GOLD is still pushing hard, consolidating its impressive position above $4,100 an ounce, confirming that defensive assets are still very much in play. Oil is seeing a slight dip. $BTC (-3,07%) is relatively stable this morning, holding steady after a wild week of price swings.

I’ve been using this quieter time to focus on the roadmap for my new business venture, which has been consuming most of my attention.

📈 Major Callout: JPMorgan Bullish on S&P 500

Speaking of strategy, JPMorgan analysts just dropped a huge prediction: they believe the $SPX500 could hit 8,000 points by 2026! That’s a massive call from current levels and definitely something to factor into long-term planning.

🎯 Strategy Update: Recalibration Coming

I’m thrilled with the current strategy, but I’m already looking ahead. I plan to consolidate a few positions in December to perform a full portfolio recalibration for Q1. Specifically, I'm looking to add an allocation to Europe and potentially Asia to capture some broader global growth and diversify away from the US.

Despite those future adjustments, the current strategy delivered awesome results. Looking back at the numbers:

Year-to-Date (YTD): My eToro portfolio hit an incredible +46.98%, which is more than double the returns of both the $NSDQ100 (+19.44%) and $SPX500 (+16.38%) over the same period!

Last 6 Months: The portfolio was equally strong, delivering +23.49%, crushing the major indices and easily avoiding the deep loss we saw in $BTC. Only the stellar $GOLD run (+26.37% YTD) kept the top spot.

It proves that a selective, strategic approach can really pay off in volatile times.

What are your thoughts on that $SPX500 8,000 forecast? What are your views on adding Euro exposure right now?

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Invest with caution

There it is - my first doubler 😍📈🏅

Together with @Klein-Anleger1 I can also be happy about my first doubler today 😊

Starting in 2008 with the first 1/10 ounce from Dad (for €69, I remember exactly), I bought small tranches of gold at regular and irregular intervals until about 3 years ago. Sometimes from birthday money, sometimes from my training salary. Sometimes a 5g bar, sometimes 1/4 ounce. In an emergency, I had to sell a not inconsiderable amount - which fortunately is not a problem with #gold fortunately not a problem.

The rest has been lying dormant ever since - and is now worth twice its purchase price.

Am I annoyed about having sold part of it? No, I'm much happier that I didn't have to sell everything despite the situation at the time.

Let's see when I can look forward to another doubling of my gold 🌚

Títulos em alta

Principais criadores desta semana