I have looked at my portfolio review of 2025 and my start to 2026 - not just "how much", but above all: why and what I have learned from it. I am happy to share this with you and look forward to discussion & feedback and, above all, your views: what was the result and also your perception of your stock market year 2025 - and what set-up are you starting the new year with?

Time to reflect 🧘♂️

1) Change of mood at the end of 2024

After a rather sobering (for me) stock market year 2024, there was a clear turnaround in sentiment in November 24: on the day of Trump's election victory in Nov 24, the market jumped significantly (Dow +3.57 %, S&P 500 +2.53 %, Nasdaq +2.95 %). This made the "risk-on" narrative credible again - and you could see it in the behavior of many portfolios. At least in mine, if I'm honest with myself ;)

2) Q1/Spring 2025: Unusually Europe-friendly

The first few weeks of 2025 were indeed unusually Europe-heavy: in the first six weeks of 2025, the STOXX 600 was up >5.5%, while the S&P 500 was only up +2.7% in the same period.

This also became clear later in hindsight: in 2025, defense and banks were extremely strong drivers in Europe at times. I was also right in this upswing ($DHL (+0,66%) , $GBF (-1,27%) , $RIO (-2,06%) ) but unfortunately also some disastrous ($NESN (-0,23%) , $MC (+0,65%) , $NKE (+1,12%) ,$NOVO B (-1,09%) ) decisions were made. Partly also trend- and community-driven -> yes, you are to blame ;)

3) Beginning of April: Bad times

Then came the break: The strong start to the year was literally "wiped out" in just a few sessions, partly due to the customs/trade war shock. YTD turned completely negative, and by April 7 the STOXX 600 was around 12% below the closing price on April 2. $TSLA (-1,91%) and $NVDA (-7,92%) purchases. I also $PEP (-0,37%) I bought cheaply, but a real breakout is still a long way off.

4) Shortly afterwards: fireworks

Then a tailwind came back in the US from the middle/end of April, when the market repriced parts of the Trump escalation in the direction of "negotiations/de-escalation". The Donald kept a few election promises that were perhaps not quite official .-)

5) H2/late year: AI + interest rates as a "macro tailwind"

Towards the end of the year, the environment was then more strongly characterized by two factors: AI-driven risk assets and falling interest rates. It was an AI-driven rally, which also supported sentiment and inflows into US equity again.

And on the interest rate side: the Fed set the key interest rate at 3.50 % to 3.75 % in December after a further cut.

At the end of the year, the major benchmarks were also closer together again: STOXX 600 +16.66 % in 2025, S&P 500 ~+17 %.

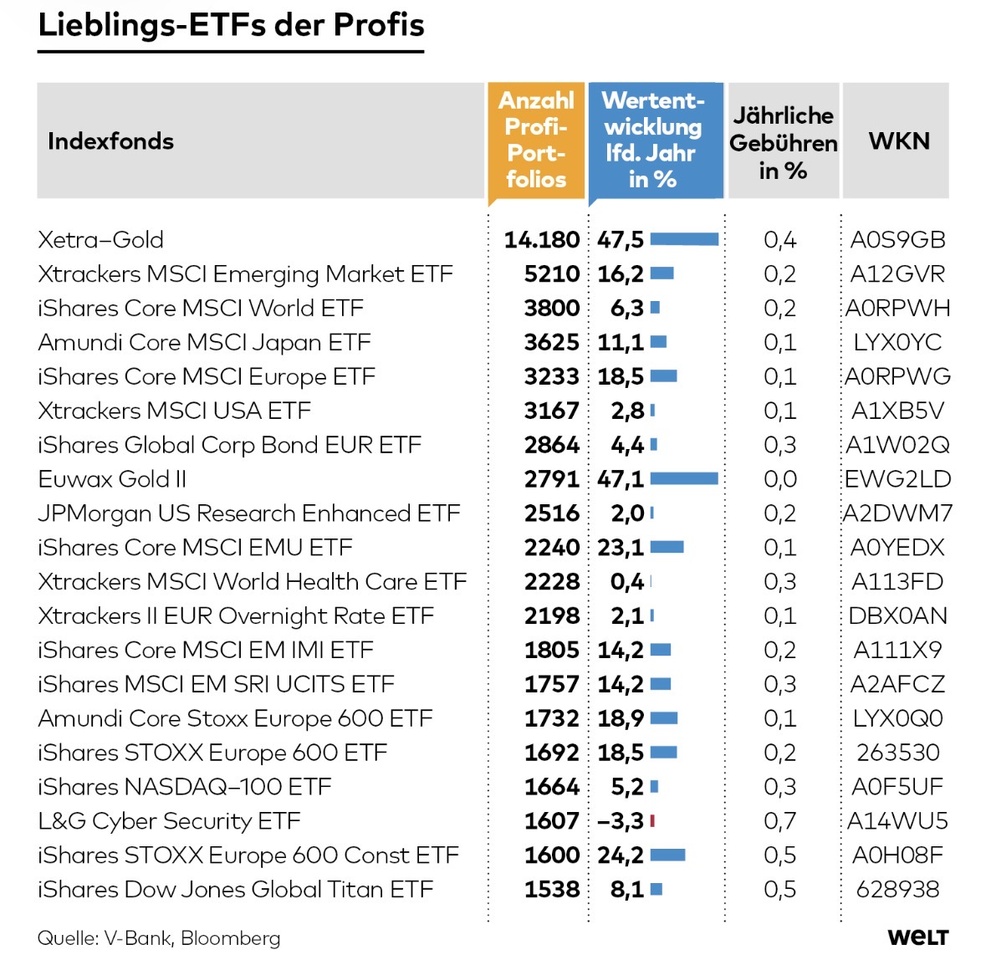

6) Golden times 🥇🏅

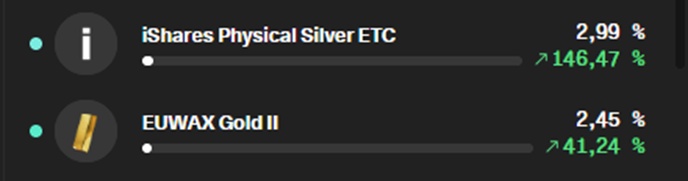

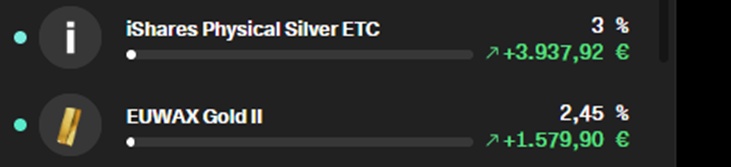

Then there was the beautiful gold (u.W.). 2025 was a real exclamation mark: spot gold was up around 66% over the year (according to Reuters, the strongest increase since 1979).

Silver was even more extreme at around +168 % per year.

I have already written about gold in more detail here on getquin - if you are interested in the topic, you can find the article in my profile.

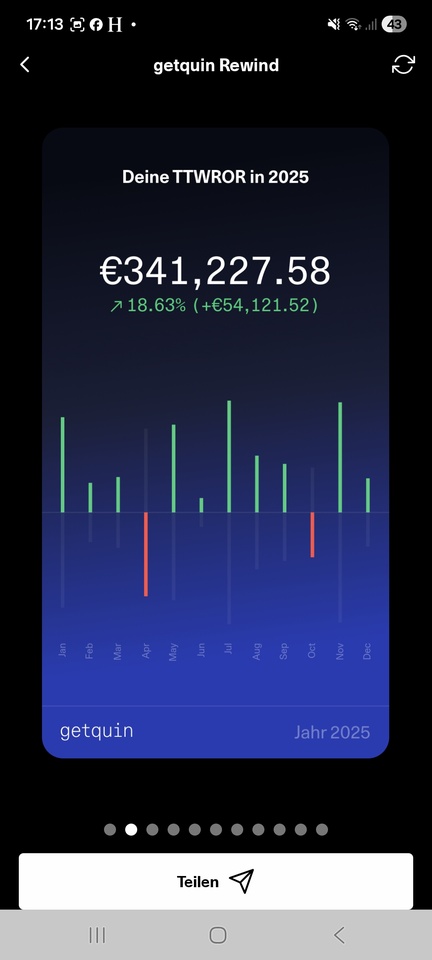

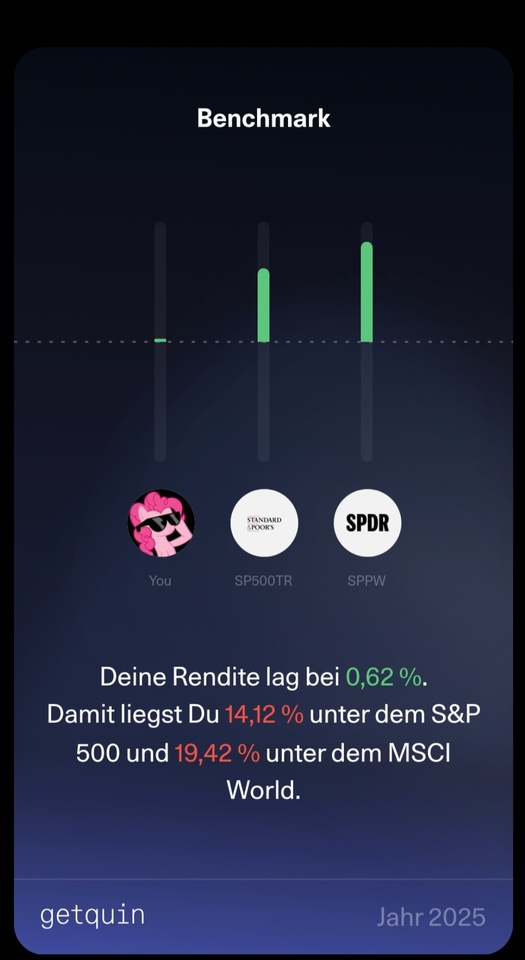

Personal performance 2025

- Internal rate of return: approx. +10 %

- TTWROR: approx. -33 %

- Dividend yield: approx. 1.3 % p.a.

The figures confirm what I described above: in my opinion, I made very good operational decisions (realized profits, used tax aspects, built up cash flow). At the same time, the TTWROR shows quite clearly that the portfolio structure was too volatile and too strongly growth/trend-oriented in the meantime. Too often, I have taken the "falling knife".

Before the turn of the year, I invested in $NVDA (-7,92%) , $TSLA (-1,91%) , $GBF (-1,27%) and $DHL (+0,66%) - each with positive returns - for the following reasons:

- Utilize saver's allowance

- Reduce tech-heaviness

- Cash generation (you can read why below)

Starting point Jan 2026:

Brief overview of the 2026 start setup

Asset mix

- Individual shares: 71.4 %

- ETFs: 16.0 %

- Gold: 9.2 %

- Crypto: 3.4 %

Regional breakdown

- North America: approx. 45.7 %

- Europe developed: approx. 26.0

- Rest of the world (including EM/Asia/Australasia): approx. 22.5 %

Sector structure

- Financial services: 20.5 %

- Consumer goods (cyclical): 19,2 %

- Consumer staples: 15.7

- Information technology: 14.8

- Materials: 7.9

- Healthcare: 4.7

Start to the new year

Parallel to the sales at the end of 2025, I reallocated or increased my holdings in January, including in $O (+1,03%), $VNA (+0,64%) and $ZAL (+1,76%)- with the logic:

- Strengthen cash flow/dividend components

- Turnaround opportunities as a limited admixture

- Reduce volatility in the portfolio

Why I am thinking more defensively in 2026

Next week, the purchase of an apartment on beautiful Lake Tegernsee 🏝️ will be notarized. This is a step into a completely new asset class for me, as it's my first property of my own. - In addition to construction financing, it will of course also be a liquidity issue over the next few weeks.

I may make a separate post about this, perhaps some of you are also currently facing this step?

I can mentally cope well with drawdowns. But: being able to bear risk does not automatically mean having to bear risk.

My portfolio should fit in with this new phase of my life.

What I will do differently in 2026

Because a new asset class will be added to my portfolio in 2026 with the purchase of an apartment, I want to position my portfolio more defensively in future - without completely foregoing opportunities for returns : risk. Otherwise we would be completely wrong on the stock market :)

1) ETF core should dominate

I want my portfolio to be dominated by my ETFs in future. My target scenario is therefore

Important! This is a start-in-2026 setup

Of course, as always in life, a plan is there to be thrown overboard - so you have to wait and see how assets perform in the year ahead and reassess regularly.

2) Stocks yes - but with more discipline

Turnaround/opportunity stocks and trends remain part of my approach, but clearly limited. I want these positions to be what they should be again: An addition, not a foundation.

I will reduce (basic) consumption and strengthen healthcare. And tech?

3) Tech: more controlled

Tech will remain a driver of returns in 2025 - but I want to build it up again in a controlled manner after my sales. I will monitor the trend from a distance for the first few weeks and possibly months and bet on corrections. You can't do without it - as you can see from the Mag-7 performance in 2025:

- $GOOGL (-1,42%) : +65,3 %

- $NVDA (-7,92%) : +38,9 %

- $MSFT (+0,27%) : +14,7 %

- $META (+0,61%) : +12,7 %

- $TSLA (-1,91%) : +11,4 %

- $AAPL (-0,45%) : +8,6 %

- $AMZN (-1,45%) : +5,2 %

On that note, happy new year!

$VWRL (-0,41%)

$EWG2 (+0,2%)

$O (+1,03%)

$PEP (-0,37%)

$MSFT (+0,27%)

$P911 (+0,43%)

$BLK (+0,28%)

$NKE (+1,12%)

$RIO (-2,06%)

$MC (+0,65%)

$NOVO B (-1,09%)

$NESN (-0,23%)

$ZAL (+1,76%)

$COMM (+0,11%)

$IEMS (-0,16%)

$BTC (-1,39%)

$ETH (-2,63%)

$XRP (-3,94%)

$PEPE (-9,15%)