🌟 Gold price soaring

The gold market remains in absolute rally mode. After several days of strong gains, the price remains at an extremely high level - and the jump to an all-time high could happen at any time.

_________________________

💸 Fed interest rate cut boosts precious metals

The latest push is mainly due to the Fed's decision:

- ✔️ Fed rate cut this week

- ✔️ Prospect of continued loose monetary policy

- ✔️ Start of a new bond purchase program (USD 40 billion per month)

The whole thing acts as fuel for gold and silver, as neither yields any current interest - making them particularly attractive in periods of low interest rates.

_________________________

🏅 Gold price scratches the record

- Current price: USD 4,337 per ounce

- All-time high: USD 4,381

- ➡️ Only 44 dollars away!

Three strong trading days in a row have catapulted the market upwards. Silver is also close to its own record.

_________________________

📈 Reasons for the mega rally

Precious metals are a phenomenon in their own right in 2025:

- Gold: +60% since the beginning of the year

- Silver: more than doubled

- Best performance in sight since 1979

The whole thing is driven by:

- ✔️ massive central bank buying behavior

- ✔️ withdrawal of many investors from government bonds

- ✔️ Increasing fear of currency devaluation (debasement trade)

- ✔️ geopolitical uncertainties

_________________________

🔮 Outlook: 2026 could be even hotter

According to market analyst Hebe Chen (Vantage Markets):

- The rally is likely to continue until 2026

- Central banks remain buyers

- ETF inflows pick up speed again

- Fed leaves "unusual room for surprises" - creating more volatility

The World Gold Council confirms:

→ Gold ETF holdings to rise almost every month in 2025

→ Silver additionally benefits from shortages and supply disruptions

_________________________

💹 Market overview (Friday morning)

- Gold: USD 4,337 (+ slightly)

- Silver: USD 63.63 (sideways)

- Platinum: slightly weaker

- Palladium: up

- Dollar index: stable after -0.3% the previous day

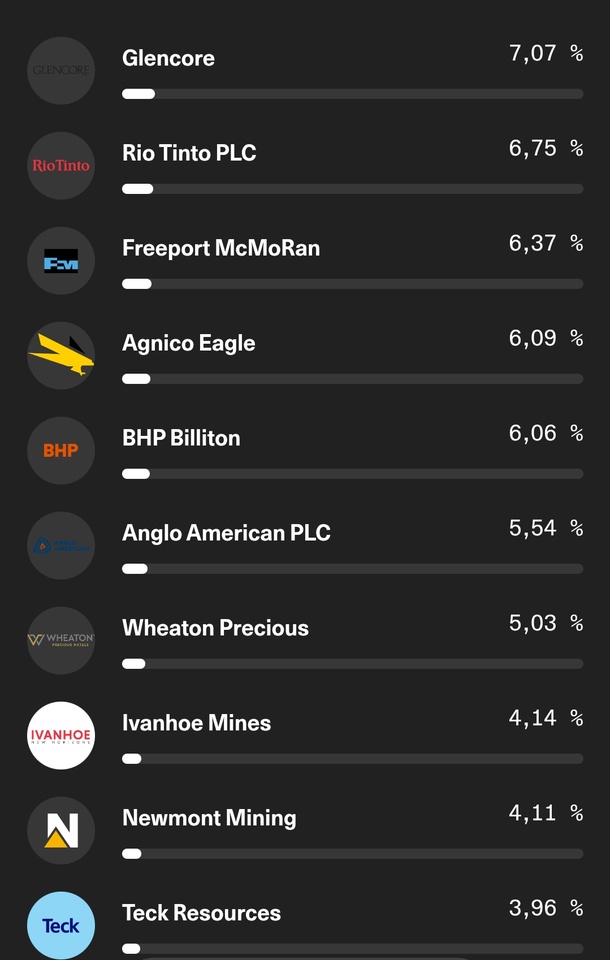

$4GLD (+1,46%)

$GLDA (+1,56%)

$GOLD

$GOLD (+2,31%)

$NEM (-2,5%)

$ABX

$AEM (+1,78%)

Source:

https://finanzmarktwelt.de/goldpreis-nimmt-rekordhoch-ins-visier-fed-sorgt-fuer-auftrieb-373384/?amp