Towards the war weekend? I treated myself to a derivative on $SN treated myself. The hot air fryer runs smoothly for us. 😂

Discussão sobre SN

Postos

8Canaccord raises its price target for SharkNinja to USD 138 and confirms its buy recommendation based on strong third-quarter results.

According to analysts, SharkNinja Inc (NYSE: SN ) is one of the most favorably valued US stocks. On November 7, Canaccord analyst Brian McNamara raised the price target for SharkNinja from USD 136 to USD 138 and confirmed the Buy recommendation. Despite the challenging US market, the company reported a strong third quarter in 2025, and this positive performance, coupled with optimistic expectations for the fourth quarter due to the upcoming holiday season, prompted the company to raise its financial guidance for 2025 again.

In the third quarter earnings report, SharkNinja reported a 14.3% year-on-year increase in net revenue to a total of USD 1.63 billion. This is the tenth consecutive quarter of double-digit organic growth driven by the company's international business units.

International sales alone rose by 25.8% to USD 530 million, mainly from the UK and Mexico. New product launches such as the Shark FacialPro Glow contributed significantly to this exceptionally high level of customer satisfaction. SharkNinja is forecasting net sales growth of 16 % for the fourth quarter.

SharkNinja Inc (NYSE:SN) is a product design and technology company that provides various solutions to consumers in the US, China and internationally.

Oct 31 / Novo Nordisk & SharkNinja — Two Very Different Buys

Ongoing conviction meets new curiosity

At the end of this week, I made two small but meaningful moves: one a doubling down, the other a new addition. Both fit different purposes in my portfolio but share one thing: strong fundamentals and misunderstood sentiment.

Starting with Novo Nordisk, a name I’ve talked about plenty over the last few weeks. I added a bit more to my position, taking advantage of what I think is one of the most ridiculous valuation disconnects in large-cap healthcare right now. The stock trades at a forward P/E of around 13, cheaper than Pepsi or FedEx (both mature, low-growth businesses). Meanwhile, Novo operates in the middle of a global obesity revolution, in a duopoly with Eli Lilly, with 55% gross margins, no major patent expirations before 2032, and a pipeline full of high-probability blockbusters like Cagrisema and Amycretin. Oral Wegovy’s FDA decision in Q4 could easily be another catalyst.

And yet, the market keeps finding reasons to hate it. The latest being the Metsera deal, where the stock is down without having done anything. For me, there are two likely scenarios: either Novo gets criticized for overpaying if they win, or for “missing out” if they don’t. It’s a lose-lose in the headlines, but long term, it’s exactly the kind of strategic optionality that keeps their dominance intact. It’s hard to find a setup this good at a P/E in the mid-teens. I’m not betting on Novo overshadowing Eli Lilly — after all, I hold both companies — just seizing the opportunity while others declare the end of the company.

The other stock I want to talk about is SharkNinja, my new buy. A completely different beast that is consumer-focused, innovative, and fast-growing. The moat here is execution and relentless product innovation. Revenue is growing north of 15%, net income in the mid-double digits, and debt is minimal. Forward P/E sits around 18 for FY25, falling to about 14 by FY27, while free cash flow yield approaches 5%. Growth is intact, the valuation more than fair, and management seems to understand its market extremely well. Execution and innovation are key for this company, and so far, they have proven they can deliver.

No, SharkNinja isn’t an S&P Global-like compounding fortress. It’s a satellite position — a smaller, higher-risk, higher-reward play. But it fits neatly alongside my larger, steadier core.

One unloved compounder and one nimble grower — two different lanes, both moving in the right direction.

A challenge to DeLonghi & Philips: new Ninja Luxe Pro coffee machine with €100 discount at rock-bottom price

Hello my dears,

This is not an advertisement.

Rather, I have been noticing more and more recently that I am seeing shark Ninja products in households. Or people talking about them and mentioning the products positively.

Now I'm even frequently seeing special offers like this.

The Ninja Luxe Pro is currently cheaper than ever on Amazon. Instead of 749 euros, the 3-in-1 coffee machine with integrated grinder and microfoam function costs just 488.99 euros. According to Geizhals, this is a historic low price since its market launch.

Is this already an aggressive market conquest?

In contrast to its competitors, it has already conquered the stock market with a decent performance. Even if the share has not been spared the 🍊 crash.

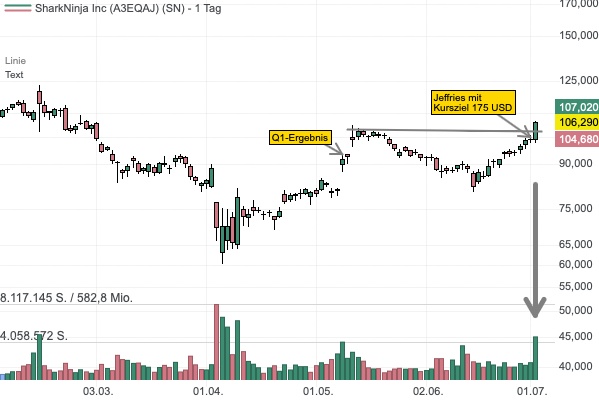

The good start of the movie F1 is a positive catalyst for SharkNinja - Jeffries sees 70 % potential!

SharkNinja back at the high as innovative strength convinces - JPMorgan sees upside potential to USD 144

The shares of SharkNinja (SN) are already back at their high. It is an innovation-driven company for household and kitchen appliances. Its core business is the development, production and global distribution of branded products that are characterized by high functionality and strong positioning in the premium segment. The business model focuses on rapid product innovation, effective marketing and the use of a wide range of distribution channels, including e-commerce and retail.

Sharkninja announced its figures for the latest quarter at its quarterly financial conference on August 7, 2025.

Earnings per share were put at USD 0.98. In the same quarter of the previous year, earnings per share amounted to USD 0.480.

Turnover increased by 15.71 percent to USD 1.44 billion. A year earlier, turnover had amounted to USD 1.25 billion.

Editorial finanzen.net

My dears,

With a current P/E ratio of 25.84, which will fall to a P/E ratio of 21.61 next year due to profit growth of 53.57%, I still see potential here.

As sales and profits will continue to rise steadily over the next few years, I even see it as a long-term investment.

Free cash flow increases from USD 688.00m to USD 975.50m.

The EbiT margin rises slightly from 15.12% to 15.45% despite some price wars.

12 analysts recommend to buy .

New 52-week highs for these 12 high-flyers

The following shares reached a new 52-week high in the course of yesterday:

Meta $META (-1,04%)

Netflix $NFLX (-0,86%)

Costco $COST (-0,7%)

Walmart $WMT (-0,39%)

Crowdstrike $CRWD (-0,94%) (forgot what happened in the summer)

Spotify $SPOT (-0,69%)

Hims & Hers $HIMS (-1,66%) (now the best stock YTD)

Duolingo $DUOL

Hilton $HLT (-0,75%)

Interactive Brokers $IBKR (-0,3%)

Moody's $MCO (+0%)

Sharkninja $SN

Congratulations to all investors and Happy Weekend!

All these stocks hit new 52 WEEK HIGHS at some point today

Visa $V (-0,95%)

Robinhood $HOOD (-2,52%)

Delta Airlines $DAL (-0,61%)

Trade Desk $TTD (-0,95%)

DoorDash $DASH (-1,12%)

United Airlines $UAL (-0,89%)

Wells Fargo $WFC (-0,6%)

Booking $BKNG (-1,22%)

Abbvie $ABBV (-0,42%)

Agnico Eagle $AEM (+1,07%)

Alaska Airlines $ALK (-0,29%)

Apollo $APO (-0,86%)

Applovin $APP (-2,29%)

Ares Capital $ARCC (-0,42%)

Celestica $CLS (-1,61%)

Coupang $CPNG (+1,11%)

Corteva $CTVA (-0,41%)

Carvana $CVNA (-0,76%)

Duolingo $DUOL

Garmin $GRMN (-0,48%)

Hilton $HLT

$ICE (-0,7%)

Incyte $INCY (-0,91%)

Leidos $LDOS (-0,87%)

Live Nation $LYV (-0,83%)

Madison Square Garden $MSGS (-0,72%)

Nasdaq $NDAQ (-0,26%)

Sprouts $SFM (-0,68%)

Nuscale $SMR

Sharkninja $SN

Synchrony $SYF (-0,22%)

Texas Roadhouse $TXRH (-1%)

VF Corp $VFC (-0,5%)

WellTower $WELL (-0,74%)

📣All these stocks hit new 52 WEEK HIGHS at some point today

📣All these stocks hit new 52 WEEK HIGHS at some point today

Alcon $ALC (+0,23%)

Applovin $APP (-2,29%)

Beigene $BGNE (-0,65%)

Boston Scientific $BSX (-0,31%)

British American Tobacco $BTI (-1,14%)

Carrier $CARR

Fair Isaac $FICO (-1,24%)

NextEra $NEE (-0,93%)

ServiceNow $NOW

Natera $NTRA

Public Service $PEG (-0%)

Insulet $PODD (-0,85%)

Sharkninja $SN

Squarespace $SQSP

Stryker $SYK (-0,85%)

I would be interested to hear your opinion on

interested?

Títulos em alta

Principais criadores desta semana