The mining giant reports stable annual profits, supported by a doubling of the copper result. The strategic shift towards copper and lithium is underpinned by an investment offensive in Canada.

The figures for the 2025 financial year are on the table - and they reveal a remarkable development: while the iron ore business is weakening, copper of all things is stepping into the breach. The world's largest iron ore producer today reported a profit of 10.87 billion dollars, exactly the same as the previous year. But behind this stable façade, a fundamental change in the business mix is taking place.

The operating result (EBITDA) climbed by 9 percent to 25.4 billion dollars - driven by an impressive 8 percent increase in production in copper equivalents. The Oyu Tolgoi mine in Mongolia is finally running at full speed and catapulted copper production up by a whopping 61%. At the same time, the Pilbara iron ore mines in Western Australia have been delivering record volumes since April.

Iron ore loses, copper gains

The shift in the portfolio is striking: iron ore profits slumped by 11 percent as benchmark prices fell by 6 percent. In contrast, copper EBITDA more than doubled - a clear signal of where the strategic journey is heading. CEO Simon Trott confirmed the growth target of 3 percent per year until 2030, supported by major projects such as the Simandou iron ore in Guinea and lithium expansions.

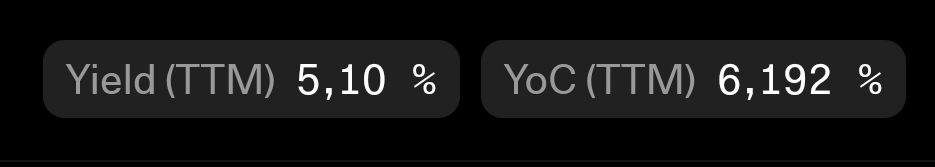

At 2.54 dollars per share, the dividend is slightly lower than in the previous year (2.55 dollars), but remains at the usual payout ratio of 60 percent. For the tenth time in a row, Rio Tinto has maintained this ratio at the upper end of the range - a statement for investors who rely on reliable cash flows.

Lithium offensive in Canada picks up speed

Alongside the annual report, a strategic announcement was made today: Rio Tinto is increasing its stake in Nemaska Lithium in Canada to 53.9 percent. The Quebec government holds the remaining 46.1 percent. The plan is to create an integrated lithium value chain from mining to chemical processing - especially for the North American electric car industry.

The Group plans to invest over 300 million dollars in Nemaska in 2026 alone, with Quebec contributing a further 200 million. The investment stems from the Arcadium takeover at the beginning of 2025, which was completed ahead of schedule. Rio Tinto is targeting a capacity of 200,000 tons of lithium carbonate equivalent by 2028. The share reacted in Sydney with a plus of 2 percent to 169.63 Australian dollars.

Net profit fell by 14 percent to 9.97 billion dollars - burdened by higher debt and one-off effects from acquisitions. However, the operating strength is intact: 16.8 billion dollars cash inflow from operating activities, an increase of 8 percent. However, net debt climbed to 14.4 billion dollars, more than twice as much as a year ago. A tribute to the aggressive expansion strategy, which has yet to prove itself.

Source: www.boerse-express.com

What do you think?

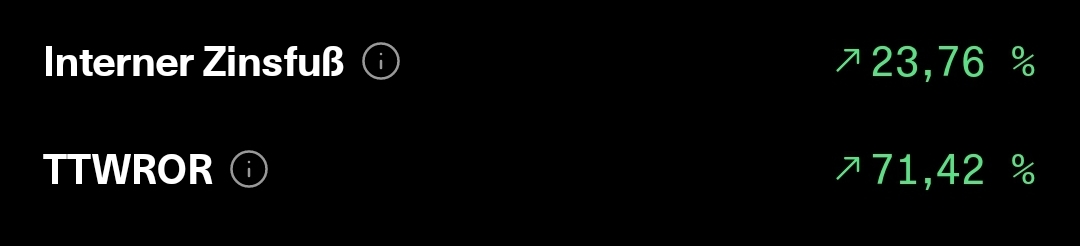

Personally, I'm not worried about the iron ore, rather I see a great opportunity in the rising copper prices, as you can see in the report. I think there is still potential there. Stable dividend, even if it was unfortunately not increased. But it is a nice constant cash flow for investors. Further opinions are welcome. Kind regards