$UCG (+1,16%)

$MNDY (-0,84%)

$KER (+1,36%)

$BARC (+1,39%)

$OSCR (-3,64%)

$CVS (-0,72%)

$SPOT (+1,17%)

$DDOG (-4,15%)

$BP. (-1,45%)

$SPGI (-0,01%)

$HAS (+0,27%)

$KO (+0,78%)

$JMIA (-0,25%)

$MAR (-0,64%)

$RACE (-0,43%)

$UPST (-4,3%)

$NET (-7,53%)

$LYFT (+0,25%)

$981 (+0%)

$NCH2 (-0,32%)

$DSY (-0,14%)

$1SXP (+0%)

$HEIA (+0,43%)

$ENR (+0,35%)

$DOU (+2,68%)

$OTLY (-3,81%)

$TMUS (+0,47%)

$SHOP (+2,19%)

$KHC (+1,13%)

$FSLY (+0,79%)

$HUBS (-2,72%)

$CSCO (+1,04%)

$APP (-5,89%)

$SIE (+1,82%)

$RMS (+4,02%)

$BATS (+2,33%)

$MBG (+1,16%)

$TKA (+5,16%)

$VBK (-2,02%)

$DB1 (+1,23%)

$NBIS (-9,32%)

$ALB (-0,08%)

$BIRK (+0,75%)

$ADYEN (+0,81%)

$ANET (-3,29%)

$PINS (+5,61%)

$AMAT (+1,53%)

$ABNB (+1,55%)

$TWLO (+1,26%)

$RIVN (-1,6%)

$COIN (+3,15%)

$TOM (+0%)

$OR (+1,71%)

$MRNA (+0,22%)

$CCO (+2,34%)

$DKNG (-0,68%)

Barclays

Price

Discussão sobre BARC

Postos

32Quarterly figures 09.02-13.02.26

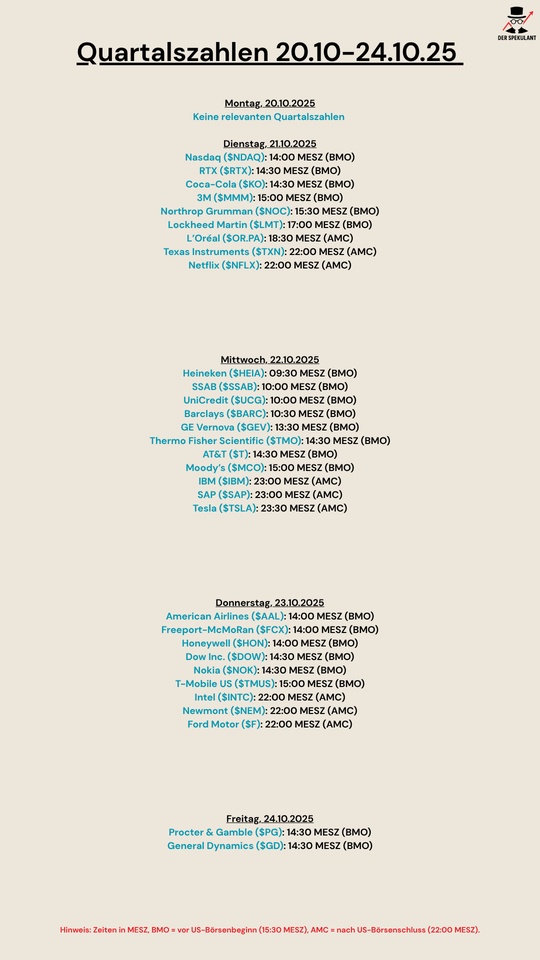

Quartalsberichte 21.10-24.10.25

$NDAQ (-0,3%)

$RTX (-0,09%)

$KO (+0,78%)

$MMM (+1,12%)

$NOC (-2,23%)

$LMTB34

$OR (+1,71%)

$TXN (+0,98%)

$NFLX (+1,88%)

$HEIA (+0,43%)

$SAAB B (-0,74%)

$UCG (+1,16%)

$BARC (+1,39%)

$GEV (-0,49%)

$TMO (-0,59%)

$T (+0,3%)

$MCO (+0,64%)

$IBM (+0,05%)

$SAP (+1,12%)

$TSLA (-0,19%)

$AAL (+1,14%)

$FCX (+2,99%)

$HON (+1,07%)

$DOW (-1,69%)

$NOKIA (+2,75%)

$TMUS (+0,47%)

$INTC (-1,11%)

$NEM (-2,5%)

$F (+1,37%)

$PG (+0,98%)

$GD (-0,45%)

HennRes | Possibly billions in losses due to Trump's tariffs

According to $JPM (+0,53%) the neuen Zölle

$GM (-0,12%) could cost up to 14 billion US dollars, which would eat up almost the entire forecast global EBIT of 12.5-14.5 billion US dollars for 2025. For $F (+1,37%) is expected to have an impact of around USD 6 billion, which corresponds to approximately 75% of the estimated global EBIT of USD 7.75 billion for 2025.

$GM (-0,12%) imports around USD 56 billion worth of vehicles annually from Mexico and Canada, resulting in estimated tariffs of around USD 10 billion on finished vehicles and an additional USD 4 billion on parts, totaling USD 14 billion.

The tariffs could increase vehicle prices by $3k to $12k, potentially reducing US sales by 500k units.

$JPM (+0,53%) has lowered the price target for $GM (-0,12%) from 64 US dollars to 53 US dollars and for $F (+1,37%) from 13 US dollars to 11 US dollars

$BARC (+1,39%) warns that the tariffs could make car manufacturers "structurally unprofitable" if they remain unchanged.

Day 2 | WEF 2025

$BARC (+1,39%) CEO C.S. Venkatakrishnan expects under Donald Trump a relaxation of regulations in the USA. For Barclayswhich generates a significant proportion of its revenues in the US market, these changes would be of great importance as they could promote "economic dynamism" and create new business opportunities.

He is also confident that this trend could spread to Europe and the UK. Governments there are increasingly beginning to recognize the developments in the USA and considering possible adjustments to their own regulations to provide economic stimulus.

Venkatakrishnan also spoke positively at the #wef2025 also positive about the outlook for M&A in the USA. The stabilized interest rates and the new government could create better framework conditions that could facilitate such activities.

Despite challenges in the UK, such as stagnating growth, high government debt and a weak pound, he sees potential. Barclays continues to focus on investments in the UK, as the infrastructure is considered stable and reliable. He sees the government's new economic program as a promising approach, but one that will need time to take full effect.

its full effect.

World Economic Forum 2025

January 20-24, 2025, Davos, Switzerland

The World Economic Forum (WEF) is an international organization founded by Klaus Schwab in Switzerland in 1971. It promotes cooperation between business, politics, science & civil society. The Annual Meeting takes place in Davos. The motto for this year:

"Cooperation in the age of intelligence"

The World Economic Forum 2025 is dedicated to a wide range of topics, including geopolitical tensions, economic growth and the transition to clean energy. At the same time, tech, AI, quantum computing & biotech also play an important role.

As always, there will be posts on all relevant topics from @HennRes & @Michael-official will be published. Under the #wef2025 you will be able to view all posts in chronological order.

Main topics:

- Rethinking growth: How can we tap into new sources of economic growth?

- How can companies respond to tech and geopolitical upheaval?

- What measures promote education, health & human capital?

- How can innovative partnerships & techs drive climate protection?

- How can cooperation be strengthened to overcome social divisions?

Participants from politics & business.

Over 350 government representatives, including 60 heads of state & government, 1600 people from the private sector, including 900 CEOs and over 170 people from NGOs, trade unions, academia and indigenous peoples are also present.

The key figures from politics are:

- 🇺🇸 Donald J. Trump(soon to be) President of the USA (via video link)

- 🇪🇺 Ursula von der Leyen, President of the European Commission

- 🇨🇳 Ding XuexiangVice Prime Minister of the People's Republic of China

- 🇦🇷 Javier MileiPresident of Argentina

- 🇩🇪 Olaf Scholz, Chancellor of Germany

- 🇿🇦 Cyril Ramaphosa, President of South Africa

- 🇪🇸 Pedro Sánchez, Prime Minister of Spain

- 🇨🇭 Karin Keller-Sutter, President of the Swiss Confederation 2025

- 🇺🇦 Volodymyr Zelenskyy, President of Ukraine

Executives from the private sector (who are expected/ not offical)

Technology sector

- 🇺🇸 $MSFT (-0,3%) (Microsoft) - Satya Nadella, CEO

- 🇺🇸 $AMZN (+2,51%) (Amazon) - Andy Jassy, CEO

- 🇺🇸 $IBM (+0,05%) (IBM) - Arvind Krishna, CEO

- 🇺🇸 $MSFT (-0,3%) (Microsoft) - Bill Gates, co-founder and head of the Bill and Melinda Gates Foundation

- 🌎 Cohere - Aidan Gomez, CEO

- 🌎 $META (+1,59%) (Meta) - Yann LeCun, AI scientist

- 🌎 OpenAI - Sam Altman, CEO

- 🇺🇸 $TSLA (-0,19%) (Tesla) - Elon Musk, CEO

Financial sector

- 🇪🇺 ECB - Christine Lagarde, President of the European Central Bank

- 🇫🇷 ECB - Francois Villeroy de Galhau, President of the French Central Bank

- 🇩🇪 German Bundesbank- Joachim Nagel, President

- 🇺🇸 $BLK (BlackRock) - Martin Lück, Chief Investment Strategist

- 🇳🇱 $ING (+2,43%) (ING) - Carsten Brzeski, Chief Economist at ING Germany

Banking sector

- 🇺🇸 $JPM (+0,53%) (JPMorgan Chase) - Jamie Dimon, CEO

- 🇨🇭 $UBSG (+0,03%) (UBS) - Sergio Ermotti, Group CEO

- 🇨🇭 $UBSG (+0,03%) (UBS) - Colm Kelleher, President

- 🇩🇪 $DBK (+2,11%) (Deutsche Bank) - Christian Sewing, CEO

- 🇺🇸 $GS (+0,66%) (Goldman Sachs) - David Solomon, Chairman and CEO

- 🇺🇸 $BAC (+0,56%) (Bank of America) - Brian Moynihan, CEO

- 🇺🇸 $C (+0,36%) (Citigroup) - Jane Fraser, CEO

- 🇬🇧 $HSBA (+1,43%) (HSBC) - Mark Tucker, Group Chairman

- 🇬🇧 $HSBA (+1,43%) (HSBC) - Michael Roberts, CEO of HSBC Bank

- 🇺🇸 $MS (+0,22%) (Morgan Stanley) - Ted Pick, CEO

- 🇬🇧 $BARC (+1,39%) (Barclays) - C.S. Venkatakrishnan, CEO

- 🇫🇷 $GLE (+1,91%) (Société Générale) - Slawomir Krupa, CEO

- 🇮🇹 $UCG (+1,16%) (UniCredit) - Andrea Orcel, CEO

- 🇦🇹 $BG (+0,93%) (BAWAG Group) - Anja E. M. W. Schreiber, CEO

- 🇦🇹 $EBS (-0,47%) (Erste Group) - Andreas Treichl, CEO

Industry sector

- 🇩🇪 $BAYN (-4,34%) (Bayer) - Bill Anderson, CEO

- 🇨🇭 $NESNE (Nestlé) - Mark Schneider, CEO

- 🇬🇧 $ULVR (+1,38%) (Unilever) - Hein Schumacher, CEO

- 🇨🇳 SHEIN - Donald Tang, Vice Chairman

- 🇮🇳 ADANIENT (Adani Enterprises) - Gautam Adani, Chairman

... and many more from the Tech, Banking, AI, Biotech, Pharma, Industrial, etc. sectors.

$BARC (+1,39%) sees rally after US elections 🙋♂️✌️

How do you think the markets will react after the election?

Barclays $BARC (+1,39%) today with a small setback 🙋♂️

Good purchase price in view of the latest figures 🚀🫡

Títulos em alta

Principais criadores desta semana