$UCG (+1,16%)

$MNDY (-0,84%)

$KER (+1,36%)

$BARC (+1,39%)

$OSCR (-3,64%)

$CVS (-0,72%)

$SPOT (+1,17%)

$DDOG (-4,15%)

$BP. (-1,45%)

$SPGI (-0,01%)

$HAS (+0,27%)

$KO (+0,78%)

$JMIA (-0,25%)

$MAR (-0,64%)

$RACE (-0,43%)

$UPST (-4,3%)

$NET (-7,53%)

$LYFT (+0,25%)

$981 (+0%)

$NCH2 (-0,32%)

$DSY (-0,14%)

$1SXP (+0%)

$HEIA (+0,43%)

$ENR (+0,35%)

$DOU (+2,68%)

$OTLY (-3,81%)

$TMUS (+0,47%)

$SHOP (+2,19%)

$KHC (+1,13%)

$FSLY (+0,79%)

$HUBS (-2,72%)

$CSCO (+1,04%)

$APP (-5,89%)

$SIE (+1,82%)

$RMS (+4,02%)

$BATS (+2,33%)

$MBG (+1,16%)

$TKA (+5,16%)

$VBK (-2,02%)

$DB1 (+1,23%)

$NBIS (-9,32%)

$ALB (-0,08%)

$BIRK (+0,75%)

$ADYEN (+0,81%)

$ANET (-3,29%)

$PINS (+5,61%)

$AMAT (+1,53%)

$ABNB (+1,55%)

$TWLO (+1,26%)

$RIVN (-1,6%)

$COIN (+3,15%)

$TOM (+0%)

$OR (+1,71%)

$MRNA (+0,22%)

$CCO (+2,34%)

$DKNG (-0,68%)

Monday.Com

Price

Discussão sobre MNDY

Postos

18Quarterly figures 09.02-13.02.26

Will the sell-off continue next week?

$MNDY (-0,84%)

$PGY

$APO (+0,94%)

$ON (+2,06%)

$AMKR (-0,78%)

$MEDP (+1,56%)

$UPWK (-1,15%)

$ACGL (+0,08%)

$ACM (+1,22%)

$KO (+0,78%)

$SPOT (+1,17%)

$CVS (-0,72%)

$DDOG (-4,15%)

$FI (-0,58%)

$SPGI (-0,01%)

$RACE (-0,43%)

$AZN (+0,3%)

$MAR (-0,64%)

$OSCR (-3,64%)

$HOOD (+1,08%)

$ALAB (-2,22%)

$F (+1,37%)

$LYFT (+0,25%)

$UPST (-4,3%)

$NET (-7,53%)

$GILD (+0,03%)

$EW (+1,01%)

$SHOP (+2,19%)

$VRT (+0,21%)

$HUM (-0,59%)

$KHC (+1,13%)

$MCD (+0,34%)

$9ZX1

$TMUS (+0,47%)

$APP (-5,89%)

$CSCO (+1,04%)

$ALB (-0,08%)

$HUBS (-2,72%)

$TYL (-1,25%)

$NBIS (-9,32%)

$BN (-1,14%)

$CROX (+3,57%)

$ZTS (+1,27%)

$BIRK (+0,75%)

$COIN (+3,15%)

$ANET (-3,29%)

$RIVN (-1,6%)

$TOST (-2,42%)

$AMAT (+1,53%)

$DKNG (-0,68%)

$WEN (-3,11%)

$CCO (+2,34%)

$ENB (-0,46%)

New year, same me🤷

For the contrarian investors only. My strategy is simple, buy good companies based on fundamentals that are selling at a low valuation due to bad sentiment and FUD. It’s a low risk, high reward strategy. It’s has done well for me.

I started the year strong in march buying ULTA and GOOG in April. Both went up so fast in a short amount of time, that I decided to take big profits. Also bought UNH and took smaller profits after seeing a better investment. Wallstreet finally showing some love to BABA helped my portfolio perform very well.

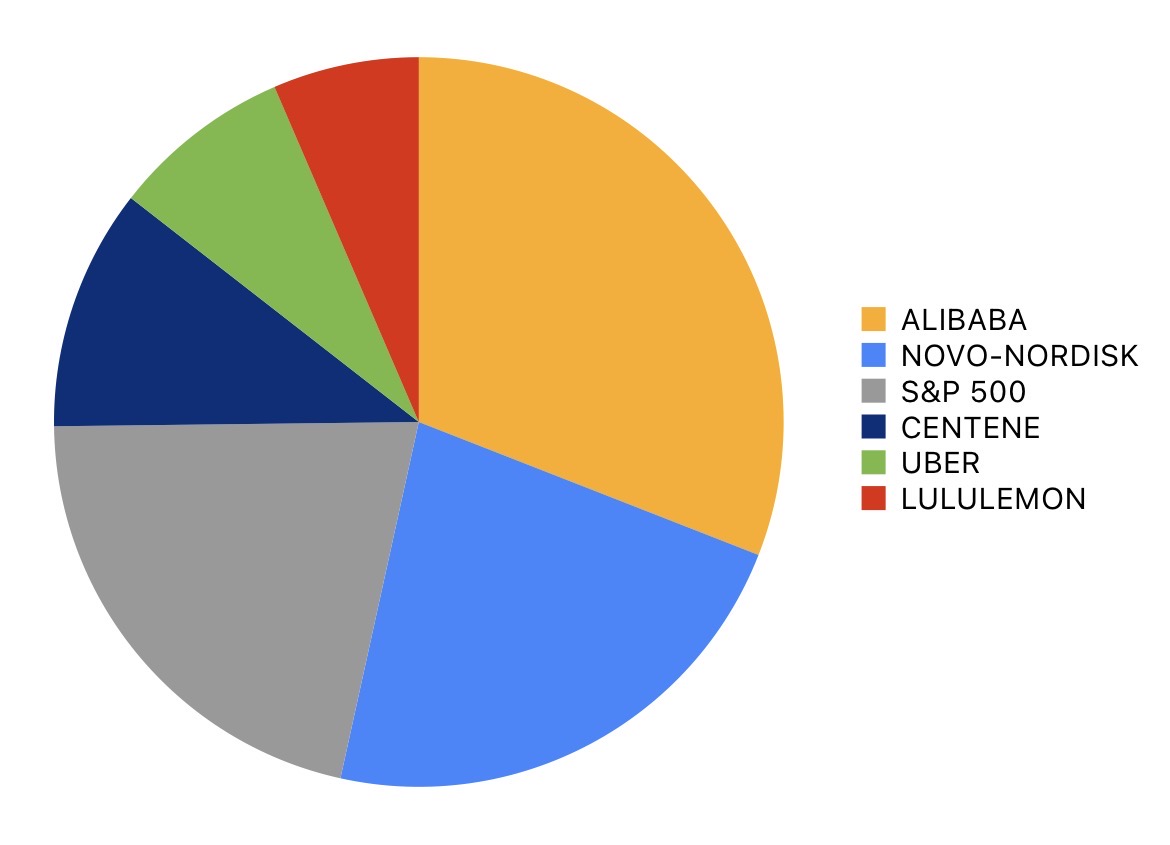

Now for the main portfolio I’ll take into 2026:

$BABA (+0%) : I’ve bought and held for many years, it’s definitely not an investment for everyone. This is my China tech, AI and e-commerce play. I will always have 12-15% of my portfolio in China, which means I’m ready to trim it down the next few years.

$NVO (-2,18%) : a newer position I added at the end of October. The sentiment is so bad for this stock that it presents a golden opportunity to buy a fast growing wide moat company at a huge discount. I’m not gonna say much more about novo because I’m sure you’ve seen thousands of people talk about it. This is a 5-10 year hold, but will trim if it pulls a quick recovery

S&P 500: The anchor. Forever hold.

$CNC (-0,86%) : Added at the end of July, part of the healthcare rebound play. Their earnings are expected to normalize and get back to good cashflow generation in 2026-27. This is a valuation play, but if they execute on FCF generation, this can turn into longterm hold!

$UBER (+0,99%) : New position added using the funds from UNH, they went from being a cash burner to a cash generator. Extremely undervalued. This is a 5-10 year hold, and will continue to DCA especially below 80.

$LULU (+1,5%) : Added this late September, but held off buying more because I thought NVO was even lower risk and higher reward. Because I wasn’t able to build a full position I will look to close it when it reaches my target price of 300-320. pure valuation play.

$MNDY (-0,84%) : this stock I don’t own, but will start accumulating shares this year. SaaS companies has been beaten down recently. Monday has strong cashflow generation and it’s a fast growing company. I believe it’s very undervalued based on their growth 🙂

Good lucky to all

monday Q3’25 Earnings Highlights

🔹 EPS: $1.16 (Est. $0.88) 🟢

🔹 Revenue: $316.9M (Est. $312.3M) 🟢; UP +26% YoY

Guide

🔹 Q4’25 Revenue: $328–$330M (Est. $333.8M) 🔴

🔹 FY25 Revenue: ~$1.23B (Est. $1.23B) 🟡

🔹 Q4’25 Adj OI: $36–$38M; Margin 11%–12%

🔹 FY25 Adj OI: $167–$169M; Margin ~14%

🔹 FY25 Adj FCF: $330–$334M; Margin ~27%

Q3 Product metrics:

🔹 New products (CRM, dev, service, campaigns): >10% of total ARR

🔹 monday campaigns launched; >200 accounts since September

🔹 ~60,000 apps built on monday vibe in ~3 months

Other Metrics

🔹 Net Dollar Retention (NDR): 111% overall; 115% (10+ users); 117% ($50k+ ARR); 117% ($100k+ ARR)

🔹 Customers (10+ users): 63,075; UP +7% YoY; now 81% of ARR (was 79%)

🔹 Customers ≥$50k ARR: 3,993; UP +37% YoY; now 40% of ARR (was 34%)

🔹 Customers ≥$100k ARR: 1,603; UP +48% YoY; now 27% of ARR (was 22%)

🔹 Customers ≥$500k ARR: 78; UP +73% YoY; now 6% of ARR (was 4%)

🔹 RPO: $747M; UP +36% YoY

🔹 Adjusted Free Cash Flow: $92.3M

CEO / CFO Commentary

🔸 “Strength of our execution moving upmarket while expanding the product suite.” – Co-CEOs Roy Mann & Eran Zinman

🔸 “Highest ever non-GAAP operating profit; focused on efficient, profitable growth.” – CFO Eliran Glazer

monday.com share: High margins and strong cash flow - buying opportunity after the setback?

I. Brief analysis:

The multiplier potential

monday.com ($MNDY (-0,84%) ) is a very successful software company that is characterized by excellent business figures. The company works very efficiently and is already earning a lot of real money (cash flow). It has good protection against the competition because customers are reluctant to switch.

Is the investment worthwhile?

The share is an investment in top quality with high growth, but at a high price. The multiplier potential (i.e. the possibility that the share price will multiply) is not because the share is cheap today. It is simply because the company can earn a lot more money in the next few years and, above all, win very large companies as customers.

The strengths lie in the super margin in the core business of almost 90% and the high generation of real money (cash flow margin 26-27%), as well as in the successful acquisition of large corporate customers (46% more major customers). The strong protection against competition due to high switching costs is also a plus. Negatives are the expensive valuation and slowing growth (from 40% in 2023 to planned 26% in 2025), and that the company is still loss-making on paper. There is also strong competition from giants such as Microsoft and Atlassian.

monday.com is a worthwhile long-term investment, but only for investors who are prepared to withstand short-term fluctuations. As the share is already very highly valued, the company cannot afford to make any mistakes, especially if growth slows down.

The business model:

The operating system for work (Work OS)

monday.com was founded in Israel in 2012 and offers software known as Work OS (Operating System). This is a cloud-based, visual system that helps teams to organize their work.

What makes it special is that it is like a construction kit. Customers can easily assemble flexible building blocks to build their own software applications or tools for work management. It serves as a connector for all other digital tools that a company uses. monday.com is therefore not just a project management tool, but a central infrastructure that around 245,000 customers use.

The product offering is broad: there is Monday Work Management (classic organization), Monday Dev (for software developers), Monday CRM (customer management) and Monday Service. This platform strategy is the best protection against the competition.

How the company earns money

The company earns money through recurring monthly or annual subscription fees.

The most important strategy is the focus on large companies ("upmarket"). This is where the company has been most successful: the number of customers paying more than USD 100,000 per year increased by 46% in the last quarter. These large customers already account for 24% of total sales. Management is deliberately foregoing faster growth with small customers in order to achieve more stable and profitable sales with large customers in the long term.

The management: founders with a clear vision

monday.com has been led by the two co-founders Roy Mann and Eran Zinman as co-CEOs since its foundation (since 2012 and 2020 respectively). This continuity at the top is a good sign and shows that a clear strategy is being pursued.

In addition to the founders, the Board of Directors also includes external experts such as Adi Soffer Teeni (from Meta) and Keren Levy (formerly Payoneer). This mix of the founders' vision and the know-how of industry experts helps the company to grow globally.

The moat: Protection from the competition

An economic moat describes advantages that protect a company against the competition in the long term. monday.com has two main sources for this:

The switching costs (The strongest protection)

This is the most important moat. Since monday.com is very deeply built into the daily and important processes of a company (it is a work OS after all), switching to the competition becomes extremely expensive and cumbersome.

Switching costs are: not only fees, but also the high cost of data transfer, employee training and the risk that the new software will not cover all previous processes. This anchoring in the company gives monday.com the power to enforce prices more effectively.

Network effects

The platform is designed for teams to work together. This means that the more departments within a company use monday.com, the more valuable the system becomes for everyone else because communication becomes easier. This makes customers very loyal. Customer loyalty, measured by the "Net Dollar Retention Rate", is a strong 117% for major customers.

Competition is very tough. The main competitors are Microsoft (Teams, Project), Atlassian (Jira, Trello) and direct rivals such as Asana and Smartsheet.

Finances, margins and growth

monday.com shows how well a modern software business can scale as it quickly transitions from growth to real profitability.

While the pace of growth has slowed from 40% (2023) to a planned 26% (2025), it is still very high with 27% revenue growth in the last quarter.

Customer loyalty is particularly strong: If you compare churn with the additional money spent by existing customers through upgrades, the figure is 112% (total) and 117% (key accounts). This means that existing customers automatically pay more and more, which creates very profitable growth.

The scalability of the business model is excellent. The gross margin (the profit that remains after deducting the direct costs of the product) is almost 90%. This shows that the company can sell its software very cheaply to a large number of customers.

The non-GAAP operating margin (the adjusted operating profit) is expected to be around 13% in 2025.

The most important financial point is that monday.com converts revenue into free cash flow (FCF) very efficiently. This is the money that actually ends up in the cash register. The free cash flow margin is a strong 26% to 27%.

Sales growth of around 26% to around USD 1.23 billion is expected for the full year 2025. The gross margin of almost 89.4% reflects the extremely low cost of the software. Customer loyalty (measured by NRR) is 117% for major customers, which means that existing customers are spending more money. The free cash flow margin is expected to be around 26.5%, which shows that a very large part of the turnover ends up as cash in the till.

The combination of 26% growth and 27% cash flow margin (together 53%) is well above the industry standard ("Rule of 40") and proves that monday.com is highly efficient.

Valuation and the multiplier potential

Because monday.com is so good, the share is traded at a premium price. The EV/Sales ratio (enterprise value to sales) is 12 to 13 times, which is much higher than most other software companies. The share is therefore not cheap.

The EV/FCF multiple, which takes cash generation into account, is more meaningful. Based on the forecasts for November 2025, this is approx. 25.6x.

The share is trading at a high premium: The EV/sales ratio is around 12x to 13x , while the peer group (comparable growth companies) is often only 8x to 10x. This shows that monday.com currently has to deliver perfect growth, as the valuation risk is high. The EV/FCF ratio (free cash flow) of around 25.6 times is acceptable for a cash flow margin of 27% and indicates high intrinsic value growth.

The potential for a multiplication of the share price depends on two things:

Management must prove that the company can continue to grow 25%+ going forward and increase the cash flow margin to over 30%.

The share price increases as free cash flow grows strongly.

As the valuation (the purchase price) is so high, there is a risk of so-called multiple compression. If growth suddenly falls below 20% or competition squeezes margins, the market could reprice the stock and lower the multiple from 12x EV/Sales to, say, 8x. Such a discount would cause the share price to fall sharply, even if operating profit increases.

Conclusion on the investment decision

monday.com is one of the best companies in the SaaS space, with a robust moat (switching costs) and excellent financial metrics (90% gross margin, 27% cash flow margin).

The company is a true quality stock. The multiplier potential is there, but is subject to strong conditions: Growth must remain high and management must successfully compete against giants such as Microsoft.

The share is interesting for long-term investors with a high risk appetite. However, due to the high valuation, a staggered entry (i.e. buying in several steps) is recommended. This reduces the risk of investing too much at an unfavorable time.

Quarterly figures 10.11-14.11.25

$MNDY (-0,84%)

$TSN (-0,73%)

$OXY (+0,48%)

$WULF (-2,68%)

$PLUG (-3,07%)

$RKLB (-6,56%)

$CRWV (-9,31%)

$9984 (-2,04%)

$IOS (+0,53%)

$MUV2 (+0,8%)

$SE (+0,41%)

$NBIS (-9,32%)

$RGTI (-4,09%)

$$BYND (-7,46%)

$OKLO

$IFX (-1,28%)

$EOAN (-0,64%)

$TME (+0%)

$VBK (-2,02%)

$HDD (+1,13%)

$ONON (+3,08%)

$JMIA (-0,25%)

$MRX (+1,34%)

$HTG (-0,69%)

$DTE (+0,29%)

$R3NK (-0,34%)

$HLAG (+0,9%)

$JD (+0,43%)

$700 (-0,38%)

$DIS (-0,28%)

$ENEL (+1,57%)

$AMAT (+1,53%)

$NU (+1,09%)

$ALV (+1,65%)

$SREN (+1,28%)

$BAVA (+0,4%)

Total collapse: entry opportunity at Monday.com?

AI - danger or opportunity for Monday.com?

At USD 1.09 per share, Q2 earnings were well above expectations of USD 0.84. With sales of USD 299 million, analysts' estimates of USD 293 million were also exceeded.

For the year as a whole, this corresponds to a 27% increase in sales and a 16% jump in profits.

Free cash flow improved by 26% to USD 64.1 million.

Strong customer loyalty

The net dollar retention rate was 111 %, which means that existing customers are constantly expanding their business with Monday.com.

The Net Dollar Retention Rate (NDR) is a measure of how much revenue a company generates from existing customers compared to the previous year - in this case 11 % more.

Furthermore, the net dollar retention rate is even higher for larger customers. Customers with more than 10 users have an NDR of 115%, customers with more than USD 50,000 ARR have an NDR of 116% and customers with more than USD 100,000 ARR have an NDR of 117%.

ARR in this case refers to the recurring revenue that Monday.com generates with the respective customers.

This is all the more pleasing as the area with major customers is also by far the fastest growing. The number of customers with an ARR of over USD 50,000 increased by 36% to 3,702 over the course of the year.

For customers with an ARR of over USD 100,000, the increase was as high as 46% to 1,472.

Outlook and valuation

One of the few fly in the ointment is the "disappointing" outlook for the coming quarter, for which Monday.com is forecasting sales of USD 311 - 313 and an operating margin of 11 - 12 %.

Previously, sales of USD 313m and an operating margin of 12% were expected.

In my view, this makes it difficult to justify the fall in the share price. This impression is reinforced if you take a closer look at what Monday.com has forecast for the following quarter in the past.

At the end of the first quarter, for example, the company forecast sales of USD 292 - 294 million for the quarter just ended and ended up delivering USD 299 million.

At the same time, Monday.com raised its forecast for the operating result this year from USD 144 - 150 million to USD 154 - 158 million.

The forecast for free cash flow was raised from USD 310 - 316 million to USD 320 - 326 million.

Call me old-fashioned if you like, but the full-year result is more important to me than a single quarter.

With a forward P/FCF of 28.4, Monday.com is certainly not a classic bargain, but the stock has never been valued anywhere near this low since the IPO.

Perhaps this would be the right time to set an example and decide to buy back shares, as Monday.com currently has cash reserves of USD 1.59 billion.

This corresponds to almost a fifth of the market capitalization. Monday could therefore afford extensive share buybacks, which in turn would sustainably increase earnings per share

Monday.com share: Chart from 13.08.2025, price: USD 172.15 - symbol: MNDY | Source: TWS

From a technical perspective, the situation is difficult. The long-term Aufwärtstrend has been broken.

From the bulls' point of view, the share must return above USD 180 as quickly as possible. If this succeeds, the situation would ease for the time being. However, clearly positive signals will only emerge above USD 200 and USD 225.

If it fails to return above USD 180, the losses can be expected to extend in the direction of USD 150 - 158

40k free cash. Where to put it?

I would be interested in your opinion: I still have 40k cash on hand.

I wanted to use the money for the Black Swan event but the dip doesn't come, the market runs away and FOMO kicks in. À la April lows at the tariff announcement of USA against the whole world.

My current PORTFOLIO ALLOCATION can be viewed in my profile, it is public.

Actually

I'm in a pretty solid position (my opinion) and would be happy to give you my opinion.

Would you stick to the plan or DCA into interesting stocks?

On my watchlist: $UNH (-0,11%) ; $TTD (+0,14%) ; $ADYEN (+0,81%) ; $TEAM (+3,88%) ; $UPST (-4,3%) & $MNDY (-0,84%)

What do you have on your watchlist and what would you advise me to do? Stick to the plan and wait for the big dip or go in in tranches?

Monday Q2’25 Earnings Highlights

🔹 Revenue: $299.0M (Est. $293M) 🟢; UP +27% YoY

🔹 Adj EPS: $1.09 (Est. $0.87) 🟢; UP +16% YoY

FY’25 Guide:

🔹 Revenue: $1.224B–$1.229B (Est. $1.22B) 😐; ~+26% YoY

🔹Non-GAAP Op. Income: $154M–$158M; margin ~13%

🔹Adj. FCF: $320M–$326M; margin 26–27%

Q3’25 Guidance:

🔹 Revenue: $311M–$313M (Est. $313M) 😐; UP +24–25% YoY

🔹 Non-GAAP Op. Income: $34M–$36M; margin 11–12%

Q2 Customer Metrics:

🔹 NDRR: 111% overall; 115% (>10 users); 116% (>$50K ARR); 117% (>$100K ARR)

🔹 Paid Customers >10 Users: 61,803; UP +8% YoY

🔹 Paid Customers >$50K ARR: 3,702; UP +36% YoY

🔹 Paid Customers >$100K ARR: 1,472; UP +46% YoY

🔹 Record net new >$100K ARR customers added in Q2

🔹 monday CRM ARR hit $100M in just 3 years

🔹 Adj Free Cash Flow: $64.1M

CEO Commentary:

🔸 “Continued revenue growth and rapidly growing enterprise demand, fueled by our AI innovation, are taking platform flexibility to the next level.”

🔸 “Our focus remains on efficient growth, expanding go-to-market reach, and delivering products people love.”

monday. com Q1'25 Earnings Highlights

🔹 Revenue: $282.3M vs. $276M est. 🟢

🔹 Adj EPS: $1.10 vs. $0.70 est. 🟢

🔹 Customers >$100K ARR: 1,328, up +46% y/y

FY25 Outlook:

🔹 Revenue: $1.22B–$1.23B (Est. $1.21B) 🟢

🔹 Non-GAAP Op Income: $144M–$150M (Prior: $134M–$142M)

🔹 Adj FCF: $310M–$316M (FCF Margin: 25%–26%)

Q2 Outlook:

🔹 Revenue: $292M–$294M (Est. $294.3M) 🟡

🔹 Non-GAAP Op Income: $32M–$34M (Margin: 11%–12%)

Key Commentary:

🔸 Record operating profit and FCF

🔸 Net dollar retention: 117% for >$100K customers

🔸 Strong AI feature adoption across platform

🔸 CEO: “Outstanding start to 2025... multi-product platform driving momentum”

Títulos em alta

Principais criadores desta semana