Last week was quite hectic. There are no posts for the first week of February because I was focused on researching stocks, reading news, and evaluating position sizes instead of writing.

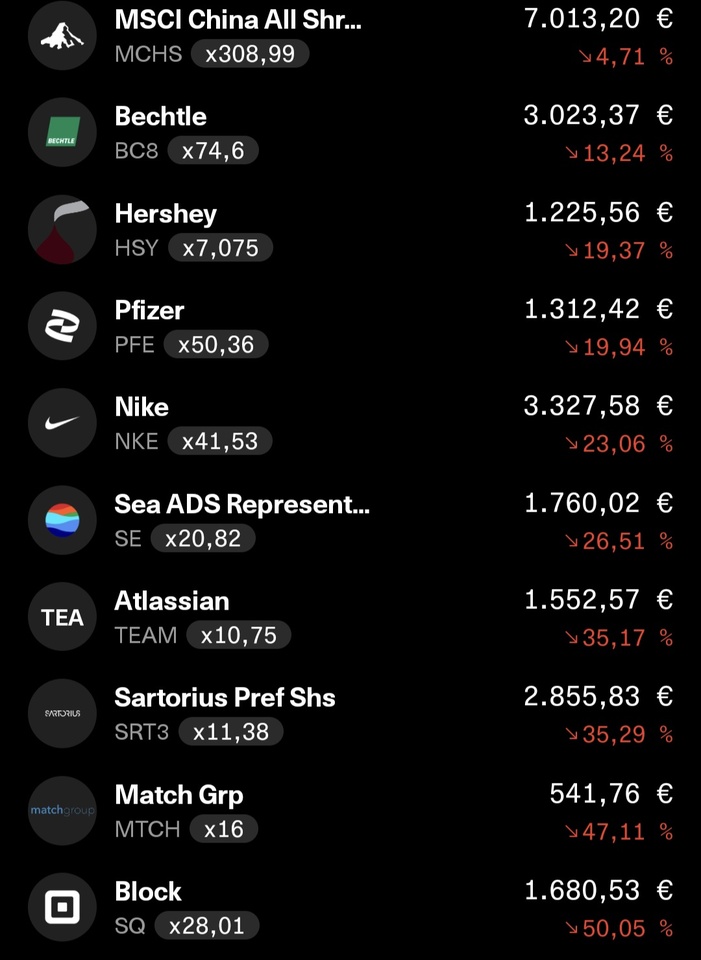

Performance-wise, it was a bad week, mainly driven by losses in software and fintech. But it was also one of the most productive weeks of the year so far in terms of portfolio positioning. I reshuffled a lot.

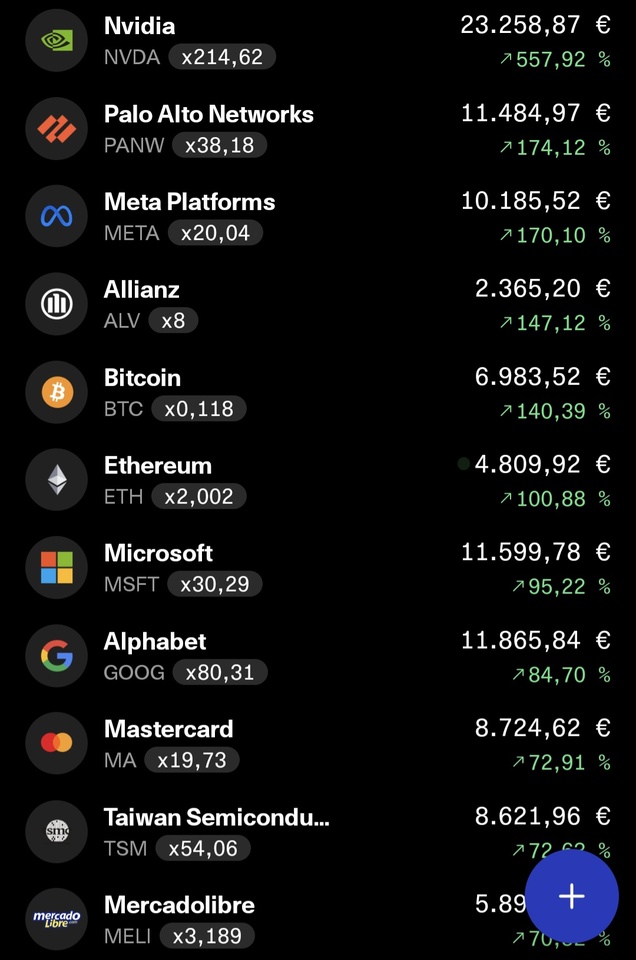

Let’s start with enterprise software. I exited both my Atlassian and Salesforce positions and reallocated that capital into higher-conviction, higher-quality names like ServiceNow and Microsoft, which I had already started adding to last month. I also added Amazon after earnings, but I will go into detail on that separately in the coming days.

During the almost indiscriminate software selloff, I had one clear objective: figure out who is a winner and who is a loser in an AI-driven world. Admittedly, I should have done that exercise earlier, maybe when some of those positions were still in the green. But then again, I would likely have bought other stocks too early. Timing is always imperfect.

As I mentioned before, seat-based pricing is a real issue for certain companies. That is why I rotated into more entrenched, diversified platforms like Microsoft and into clear AI beneficiaries with strong integration and accelerating growth like ServiceNow. Those are businesses that can embed AI into workflows rather than being disrupted by it.

Another sector that, in my view, should be one of the biggest long-term beneficiaries of AI is cybersecurity. I initiated positions in both Palo Alto Networks and Zscaler last week. Palo Alto is the largest player in the space and one of the established leaders. Zscaler is a cloud-native platform with explosive growth characteristics. Both trade at free cash flow yields above 6% based on FY27 estimates, but that is not even the core of the thesis.

The market is lumping them in with the broader software selloff and treating them as if they are collateral damage. That ignores the obvious. As AI accelerates automation and digitization, the attack surface expands dramatically. The more connected and autonomous systems become, the more valuable cybersecurity becomes. I understand that quant models may not distinguish between AI beneficiaries and AI victims during a red week. But as an investor, I have to.

I also exited Novo Nordisk after what I consider a terrible earnings report. The situation looks even worse when compared to Eli Lilly, which continues to execute flawlessly and beat across metrics. The contrast makes the winner in that sector increasingly obvious. I am not interested in staying invested in a business that is not just slowing, but actually declining, especially when the stock trades at roughly the same levels as before. The fact that management released such a disappointing report during regular market hours also did not inspire confidence, but felt poorly handled.

Lastly, I sold S&P Global shortly before the stock dropped sharply. That was pure luck on my part. I still believe it is an exceptional business. However, during last week’s drawdown, I saw better opportunities elsewhere than a single-digit growing compounder with a 30+ P/E ratio. But at around 20 times forward earnings, I would be seriously considering re-entering, and we are not far off that price right now.

Overall, it was a painful week on paper, but strategically important. I continued to reduce exposure to names with more ambiguous AI risk, increased exposure to clearer beneficiaries, and stayed flexible where conviction weakened.

$CRM (-3,99%)

$TEAM (+0%)

$NOW (-3,41%)

$AMZN (-2,4%)

$MSFT (-3,34%)

$PANW (-3,14%)

$ZS (-10,2%)

$NVO (-16,07%)

$NOVO B (-15,64%)

$LLY (+4,37%)

$SPGI (-2,29%)