$DPZ (+2,92%)

$HIMS (-4,35%)

$KTOS (-4,07%)

$DOCN (-7,65%)

$FME (+0,34%)

$KDP (+1,64%)

$AMT (+1,58%)

$HD (-1,47%)

$WDAY (-5,97%)

$FSLR (+0,88%)

$TEM (-2,01%)

$O (+0,91%)

$MELI (-6,75%)

$HPQ (-1,08%)

$LCID (-1,23%)

$DRO (-4%)

$HSBA (-0,54%)

$FRE (-0,25%)

$AG1 (-1,25%)

$CRCL (-2,98%)

$UTHR (+0,12%)

$LDO (-1,71%)

$IDR (-2,49%)

$NTNX (-6,03%)

$PARA (+0,55%)

$NVDA (+1,1%)

$TTD (-4,03%)

$AI (-6,23%)

$CRM (-3,99%)

$SNPS (-4,51%)

$SNOW (-8,84%)

$PSTG (-7,87%)

$ZIP (-3,52%)

$ZM (-4,52%)

$NU (-7,06%)

$RR. (-0,26%)

$MUV2 (+0,54%)

$BIDU (-1,39%)

$CELH

$DTE (+1,5%)

$STLAM (-1,49%)

$WBD (+0,82%)

$HAG (-2,92%)

$QBTS (-0,07%)

$LKNCY (-2,42%)

$BABA (-1,07%)

$G24 (-1,34%)

$HTZ (-4,29%)

$PUM (-1,84%)

$AIXA (-1,02%)

$RUN (-1,56%)

$INTU (-6,57%)

$WULF (+3,93%)

$MNST (+0,52%)

$SQ (-4,86%)

$ADSK (-3,48%)

$MP (+0,32%)

$RKLB (-2,07%)

$SOUN

$SMR

$CRWV (+2,8%)

$CPNG (-0,79%)

$DUOL

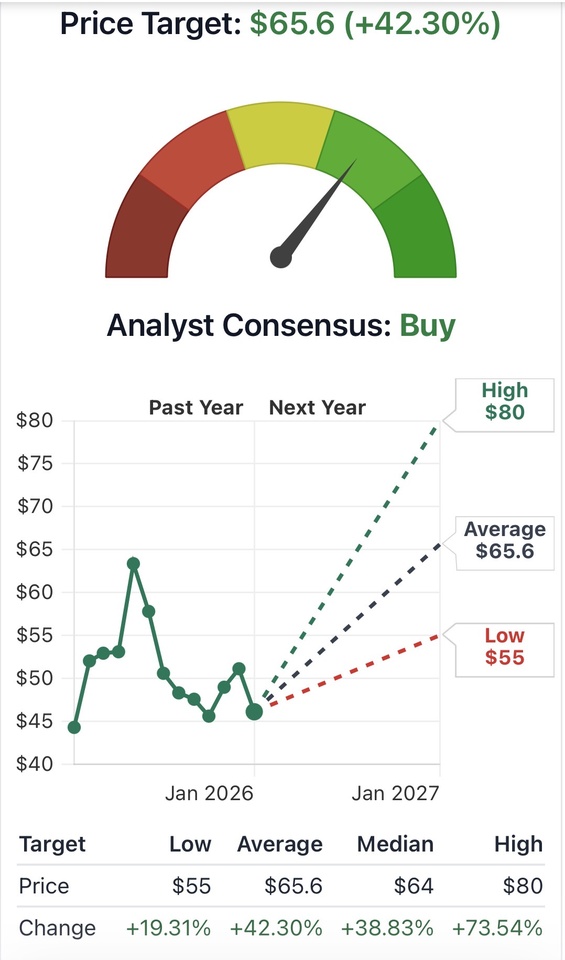

Munich Re

Price

Discussão sobre MUV2

Postos

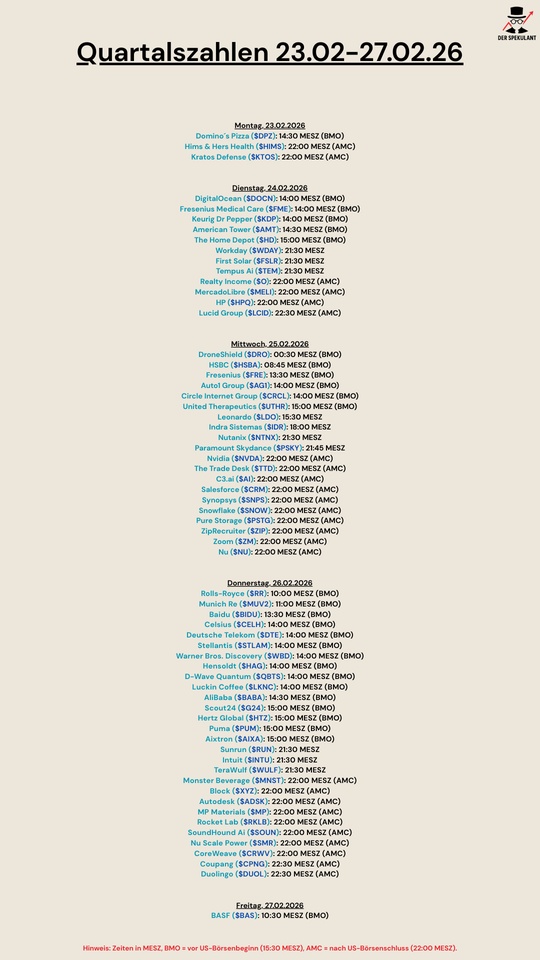

180Quartalszahlen 23.02-27.02.2026

New addition

Stable cash machine for my dividend portfolio.

- No reduction for 50 years

- Outlook of annual earnings growth of over 8%

- lowers my USA lump in the portfolio to 47%

Currently still have $CJLU in view for similar reasons. Considering entering here soon as well.

🛠️ Automatix introduces itself

Salvete, investors!

My name is Automatix - the name says it all.

Like my namesake from the Gallic village, I prefer to focus on craftsmanship, substance and consistency rather than magic potions or short-term success.

I'm 37 (turning 38 this year) and have only been actively investing in the capital market since the end of 2024 - a pretty bumpy journey so far

But my goal has now become clear to me:

long-term wealth accumulation with a focus on dividends.

I am aware that it is ambitious - perhaps even unrealistic - to live entirely from dividends one day.

But it is precisely this idea that drives me, not my promise.

Professionally, I have been working full-time for a large German tech company for 15 years.

Here I have worked my way up from the very bottom - call center supporter to key account manager to my current position as senior project manager - so structured work, long-term thinking and risk assessment are part of my everyday life.

At the same time, I run a family farm as a sideline

- approx. 80% horse boarding (yes, I also ride 🏇)

- approx. 20 % forestry business

This combination of technology, project work and real economic substance also characterizes my investment approach.

Before I became intensively involved with shares, my first major investments were in real assets:

- two apartments (already paid off & rented out)

- a plot of land (financed by rental income) on which one or two apartment buildings are to be built for rent in the future

For me, shares are therefore not a substitute, but a supplement to existing tangible assets.

I invest at least €750 per month, usually more, and focus on:

- 🌍 global ETFs $VWRL (-0,66%) & $TDIV (+0,26%) as a stable foundation

- 🏗️ Individual stocks, deliberately selected, with a focus on Germany & Europe

For individual stocks, I prefer healthy, growing companies.

I prefer dividend growth to high initial yields without substance.

The core of my portfolio will be $SIE (-1,69%) supplemented by stocks such as

$ALV (-0,01%) , $DTE (+1,5%) , $SAP (-2,82%) , $MUV2 (+0,54%) and $DB1 (+0,41%) .

Each position is built up gradually - first €500, then €1,000, and significantly more in the long term.

No more hectic reallocations, no more chasing - just buy and hold!

I was a silent reader here for a long time, but would like to share my thoughts, decisions and learnings in the future - objectively & long-term (if there is interest)

No trading, no noise -

but patience, discipline and a stable anvil 🛠️

I am looking forward to your feedback - constructive criticism is always welcome.

Here's to a good exchange!

Stocks for February: Why I'm watching these 3 stocks closely now!

Which stocks are of particular interest to you in February? My portfolio is groaning for dividends, is the $MUV2 (+0,54%) and $SANOFI stock make sense? And I have my eye on a growth stock - $BRZE (-7,97%) . What do you think of the 3 stocks? Have fun with the quick check.

Best regards,

Angelo

Aktien für Februar: Warum ich diese 3 Aktien jetzt genau beobachte! - YouTube

Munich re Entry

Does anyone know why Munich Re is so low right now?

There is no growth left from last year.

I'm thinking about taking the plunge. But as I've already fallen into the trap a few times, I'm still waiting to see if the €500 mark holds

Share presentation SKYWARD SPECIALITY INSURANCE

🛡️ Skyward Specialty Insurance $SKWD

- The niche king in the insurance sector

Hello my dears,

There have been a lot of great companies featured here lately like from @Shiya with $DCTH (-0,3%) or$HROW or stock presentations from dear @Tenbagger2024

Many ideas in the health sector or technologies

Today I would like to introduce you to a company, especially in a sector that not many people think about. The insurance sector 😬 and I have my eye 👀 on this small-cap company. small-cap company thrown.

TODAY IT'S ABOUT SKYWARD SPECIALTY INSURANCE $SKWD

$SKWD Skyward Specialty is not a traditional car or household insurer. The company is active in the Specialty Property & Casualty (P&C) where risks are complex, difficult to assess and often underinsured.

1. the business model: "Rule Our Niche" 🎯

The company pursues a clear strategy: Specialization instead of mass.

* Focus: They insure niches such as renewable energies, media criminal law, life sciences, construction and professional liability.

- Technology focus: Skyward makes extensive use of data analytics and AI (partnering with Sixfold) to price risks more accurately than large, sluggish competitors.

Agility: Due to its smaller size compared to giants like $CB (+0%) or $AIG (-0,57%) they can react more quickly to changes in the market.

- The "Apollo Group Holdings Limited" takeover (January 2026)

For the start of the new year 2026, they have acquired "Apollo Group Holdings Limited" for further growth drivers. Apollo (a Lloyd's of London syndicate) for further growth! This means for $SKWD

- Access to the world's most important marketplace for specialty insurance (Lloyd's).

- An immediate global presence instead of being limited to the US market.

The company offers insurance solutions for complex risks that are often avoided by standard insurers. They operate in eight core areas, including:

🏗️Bauwesen & Energy: Specialized solutions for high-risk industries.

🩺👨⚖️👷♂️ Professional liability: For doctors, lawyers and architects.

🌾Special programs: Tailor-made packages for very specific industries (e.g. transportation, agriculture).

- Transactional E&S: "Excess & Surplus" lines, i.e. risks that cannot be insured via the regular market.

👤 Management: who pulls the strings?

The success of an insurer stands and falls with discipline in underwriting (risk assessment). This is where the CEO comes into play:

- CEO: Andrew Robinson

- He took the helm in 2020🤝

- Robinson is an industry heavyweight. He previously held senior positions at The Hanover Insurance Group and as a consultant at Oak HC/FT.

- His strategy: He has radically trimmed Skyward for technology and data analytics. His focus is not on "size at any cost", but on profitability in segments that other insurers find too complicated.

2. the key figures📊

- Market capitalization: Approx. USD 2.1 billion.

- Share price: current share price approx. USD 50.00

- P/E ratio (P/E ratio): approx. 13 - 15 (attractively valued for a growth stock in the insurance sector).

- Combined ratio: Is constant at approx. 91-92 %.

- For information: Anything below 100% means that the insurer is operating profitably (premiums > claims & costs). 91 % is an excellent value.

- Growth: Gross sales (written premiums) recently rose by over 50 % year-on-year (Q3 2025).

🟢 Growth turbo (revenue growth): In the last quarter (Q3 2025), gross premiums rose by a whopping 51,6 % compared to the previous year. This is exceptionally high organic growth for an insurer.

🟢 Profitability (combined ratio): With a value of 89,2 % in Q3 2025, Skyward has set a new company record. As a reminder: the lower this value is below 100%, the more profitable the core business is.

🟢Return on equity (ROE): The annualized return on equity currently stands at 19,3 %. This shows that the management is making highly efficient use of shareholders' capital (the benchmark in the sector is often closer to 12-15%).

🟢Increase in book value: The book value per share increased to September 2025 to 23,75 $ - an increase of 20 % since the beginning of 2025.

🟢Earnings per share (EPS) of 1.10 were massively above analysts' estimates (approx. 0.85). The main drivers were:

1. Strong new business in the areas of agriculture, credit insurance and specialty programs.

2. Higher investment income: Due to the interest rate environment, Skyward earned significantly more on its USD 1.6 billion portfolio (primarily bonds).

3. Lower catastrophe losses: Compared to the previous year, there were fewer claims from severe storms.

3. why is the share exciting? 🚀

1. Enormous profit growth: Analysts expect profit growth of over 35% for 2026. The company regularly beats expectations✅

2.Skyward Speciality is currently delivering a rare combination of hyper-growth (premiums +50%) and operational excellence (combined ratio < 90 %) ✅

3.while established players such as $RLI (-1,93%) or $KNSL (-0,28%) , $WRB (-0,13%) are growing moderately (often in the single-digit or low double-digit range), Skyward is growing at +50 % is an absolute outlier. This shows that $SKWD is gaining massive market share.✅

4. High return on equity (ROE): With an ROE of over 17%, Skyward works very efficiently with shareholders' money.✅

5. Interest profit: As an insurer, Skyward holds billions in fixed-interest securities. The higher interest rate level ensures bubbling investment income.✅

6.Acquisition turbo: The integration of Apollo opens up access to the global Lloyd's market.✅

7.experienced management: Andrew Robinson has transformed the company from a problem child to a high performer in just 4 years.✅

4. risks ⚠️

- Inflation risk: Rising costs for repairs or legal proceedings (loss inflation) could squeeze margins.❗️

- Catastrophe risk: Although Skyward occupies niche markets, extreme weather events can weigh on results.❗️

- Interest rate sensitivity: If interest rates fall extremely quickly, investment returns from the portfolio will fall.❗️

5. conclusion & analyst rating 🧐

$SKWD Skyward Specialty is a classic growth growth story in a conservative sector. The share has significantly outperformed the S&P 500 in recent years.

Analysts' price target: The consensus is approx. 63 - 70 USDwhich corresponds to an upside potential of approx. 25-35 % ⬆️entspricht.

My personal conclusion ?

$SKWD is not a dividend payer like e.g. now a $ALV (-0,01%) or $MUV2 (+0,54%) but is $SKWD a highly exciting "quality-growth" stock. If you are looking for growth, this small-cap company could be a very interesting candidate.

Despite the sharp rise in the share price, I think the valuation is $SKWD fair to slightly undervalued, which is why I'm toying with the idea of going in with a tranche🤫

But as far as I know, the share is not tradable with many NeoBrokers 😅

What is your opinion of the company?

Would the share be something for your portfolio?

+ 5

Podcast episode 125 "Buy High. Sell Low." 20 European dividend stocks

Novo Nordisk 3.0% $NOVO B (-15,64%) NVO

LVMH 2.0% $LVMH

Pernod Ricard 6.35% $RI (-2,16%)

Imperial Brands 5.5% $IMB (+1,83%)

BAT 6.2% $BATS (+0%)

Sunrise Communications 8.00%

Nestle 4.05% $NESN (+0,63%)

Roche 2.85% $ROG (+0,65%)

Novartis 3.07% $NOVN (+0,58%)

Shell 4.07% $SHEL (-0,01%)

German Post 3.86% $DHL (-0,9%)

Swisscom 3.75% $SCMN (+1,88%)

German Telekom 3.52% $DTE (+1,5%)

Strabag 2.72% $STR (+0,16%)

Vonovia 4.82% $VNA (+0,53%)

BASF 5.01% $BAS (+0,71%)

Puma 2.8% $PUMA

Hannover Re 3.62% $HNR1 (-0,16%)

Munich Re 3.8% $MUV2 (+0,54%)

Allianz 4.00% $ALV (-0,01%)

BP 5.76% $BP. (+0,72%)

Spotify

https://open.spotify.com/episode/1zt05UZlehInr81iaZMdY5?si=e676f0a812014943

YouTube

Appple Podcast

Two depots, one goal: peace, freedom and a predictable transition

Dear Community,

At the end of the year, I would like to share my portfolio and my strategy with you.

I am 38 years old, have been in the stock market since 2024 and am aiming for financial freedom at the age of 58. Time will tell whether that will work out... 😉 I'm not investing to maximize my profits, but to be able to live a relaxed life in the long term. To this end, I have deliberately separated my investments into two portfolios with a clear purpose.

Portfolio 1 - Growth (ING)

$VWCE (-0,74%) , $XNAS (-1,22%) , $WGLD (+2,5%) and as an admixture some Bitcoin via ETP $IB1T (-4,65%) .

This portfolio is saved monthly until 58 and then remains more or less untouched.

My savings rates would be:

800€ $VWCE (-0,74%)

375€ $XNAS (-1,22%)

150€ $WGLD (+2,5%)

0€ $IB1T (-4,65%) - Position is currently at 10% and should rest for the time being

Portfolio 2 - Cash flow (SC)

Here I am investing via 2 dividend ETFs ($VHYL (-0,16%) , $TDIV (+0,26%) ) and selected quality stocks to build up a steadily growing cash flow. All distributions are reinvested equally in the ETFs. Furthermore, a small cushion is built up here via $XEOD (+0,02%) is built up here.

My savings rates would be

250€ $XEOD (+0,02%)

200€ $VHYL (-0,16%) - Start January 26

200€ $TDIV (+0,26%) - Start January 26

425€ Individual assets (as required, no savings plan, no obligation)

My individual stocks:

Allianz $ALV (-0,01%)

Munich Re $MUV2 (+0,54%)

Procter & Gamble $PG (+2,87%)

PepsiCo $PEP (+2,05%)

Johnson & Johnson $JNJ (-0,2%)

Novo Nordisk $NOVO B (-15,64%)

Lime $LIN (-0,56%)

ADP $ADP (-3,54%)

Waste Management $WM (+0,14%)

Siemens $SIE (-1,69%)

Accenture $ACN (-5,89%)

Alphabet $GOOGL (-0,86%)

Itochu $8001 (+1,93%)

visas $V (-4,24%)

No speculation, no trading. For most people here, extremely boring... 😴 But hopefully the selection will bring some stability to the portfolio in turbulent times. 😉

For the time being, we will stick with these stocks and gradually buy more when good opportunities arise. Each individual position will of course be capped later and should make up between 2-3% of the portfolio (including the proportion within the ETFs). Alphabet would be an exception.

The reallocation idea

Nothing is invested from 58. The plan is to reallocate around 5 % annually from custody account 1 to custody account 2. In this way, growth is gradually converted into cash flow - without significant erosion of assets. And in the best-case scenario, my growth portfolio can continue to grow. I consciously accept taxes 😉

Thank you for reading and have a successful 2026.

P.S. My allocation doesn't fit yet because I've been focusing more on my individual stocks in recent weeks. Chart is also not meaningful because of ING Autosync and Itochu split 🥲

Also an exciting strategy.

I've also spent the last few evenings restructuring my portfolio. Simply because I can't keep my feet still and a few individual stocks just spice things up.

I think my portfolio could look similar without the dividend stocks. I will probably increase the core share instead and go for S&P and EU momentum. 👍

Nothing but expenses (dividend)

Hello everyone,

Here is my personal review of the year 2025.

First of all - my target for the year was achieved. I had aimed for 98k in the portfolio. This was clearly exceeded

Unfortunately, this was not due to my return. The bottom line is that only the dividends remained this year.

What happened? Amundi really annoyed me back in January. My Basisinvest was supposed to be merged and a tax event first of all made the German government's coffers full of money - so my exemption order was gone and my portfolio reduced accordingly. Thanks for that Amundi.

Well, what the heck - got a new World and continued to save diligently ;).

The aim this year was to restructure my portfolio somewhat and reduce my dependence on Bitcoin. A few new individual stocks were added to the portfolio for this purpose:

$PEP (+2,05%) one-time purchase

$MAIN (-1,26%) one-off purchase and savings plan

$V (-4,24%) one-off purchase and savings plan

$RR. (-0,26%) One-off purchase and savings plan

In the meantime I have then $ETH (-0,96%) my stake and moved it to $BTC (-1,21%) moved it to

Especially from October onwards, my portfolio suffered due to the high crypto share. But anyone who opts for crypto also has to deal with the volatility.

In Q4, I decided to sell one of my dividend ETFs $ISPA (-0,73%)

This was followed by

$MUV2 (+0,54%) and

Into the depot. Last but not least, I have also been saving the $LVWC (-1,8%) weekly since it was launched.

All in all, I'm still very satisfied with the year. Including dividend reinvestment, I have a savings rate of €1672 per month. Significantly higher than planned. This also compensates for the lack of performance.

I'm aiming for 128k in my portfolio in 2026.

My goal of no longer having to work at the age of 55 - if I want to - remains in focus (16 years to go).

The core of my strategy remains unchanged:

- ETFs as a basis

- Bitcoin

- Solid individual stocks (preferably with dividends)

Yes - my portfolio could be much "simpler" - but I feel comfortable with it.

Nevertheless, I am very happy about your feedback

Títulos em alta

Principais criadores desta semana