March has started off as one of the most challenging periods in global markets in recent memory.

The ongoing escalation between the United States, Israel, and Iran has driven widespread risk-off sentiment across equity markets, with oil and energy prices surging and stock indexes under pressure.

As a result, my portfolio is currently down around -2.5% for the month. This reflects the broader market reaction, where indices like the S&P 500 and Nasdaq have shown volatility and downside pressure as geopolitical tensions impact investor sentiment and inflation expectations.

Strategic Adjustments

In response to this environment, I’ve made several tactical adjustments:

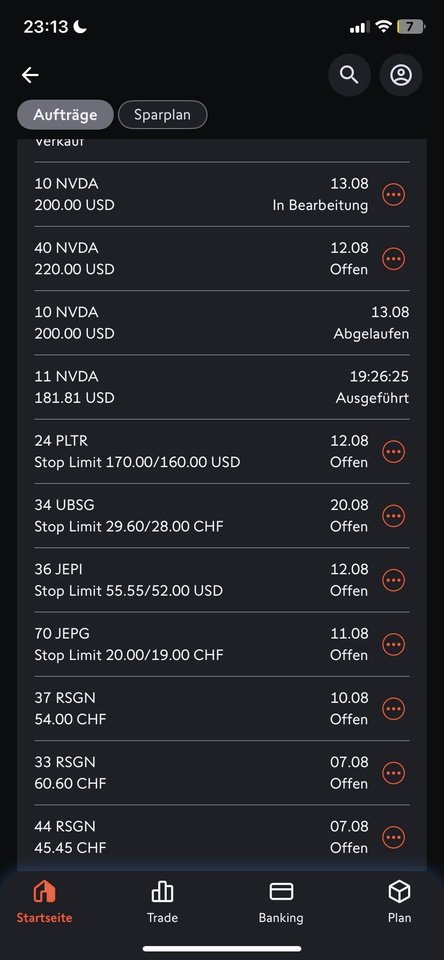

Reduced exposure in some positions and closed others to secure partial liquidity

Currently holding approximately 10% in cash, which provides flexibility and optionality

Diversified further across new positions — (e.g., $TCL (+2,95%)

$LOV (+0,38%)

$APA (+4,55%) , and from Swiss market $UBSG (+0,48%) )

These recent additions reflect my focus on quality names with strong fundamentals, diversified geographies and sectors rather than simply chasing index performance.

What this means for Copiers

We’re in a risk-off market regime, not a bear market per se — volatility is a natural response to major geopolitical uncertainty.

Panic selling is rarely the best course of action — losses can be locked in permanently, whereas disciplined investors can find opportunities in dislocations.

The current cash buffer gives us dry powder to scale into positions at more attractive prices if the market continues to sell off.

Broader Market Backdrop

The current sell-off is driven by the escalation of conflict involving the US, Israel and Iran, which has:

Pressured global equity markets and raised inflation and risk aversion concerns

Pushed oil prices sharply higher amid fears of supply disruptions

Increased demand for safe-haven assets such as gold and the US dollar

Led to broad risk-off behaviour across major benchmarks in Asia, Europe and the US

Moneycontrol

No one can predict with certainty how this geopolitical situation will unfold, or how markets will react in the short term. But history shows that volatility tends to be temporary, and well-selected exposures often recover and outperform when clarity returns.

Final Thought

This isn’t a time to exit the market, but rather a time to reassess where capital can be deployed most effectively, balancing risk with long-term opportunity. I’ll continue adjusting positions as conditions evolve and will keep transparency front and centre.

Let’s stay calm, focused, and strategic.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice

$NVDA (+2,5%)

$CSPX (+0,88%) $$GOLD

$TSLA (+1,03%)

$AAPL (+1,3%)

$PLTR (+0,5%)