$DPZ (-0,38%)

$HIMS (-0,67%)

$KTOS (-9,24%)

$DOCN (-4,89%)

$FME (+1,61%)

$KDP (+1,54%)

$AMT (+1,11%)

$HD (+0,84%)

$WDAY (-1,52%)

$FSLR (+2,98%)

$TEM (-2,07%)

$O (+1,13%)

$MELI (-0,16%)

$HPQ (+0,9%)

$LCID (-1,81%)

$DRO (-0,77%)

$HSBA (+1,43%)

$FRE (-0,06%)

$AG1 (+2,62%)

$CRCL (+2,48%)

$UTHR (-1,54%)

$LDO (+0,24%)

$IDR (+1,17%)

$NTNX (-3,65%)

$PARA (-1,35%)

$NVDA (+1%)

$TTD (+0,14%)

$AI (-2,75%)

$CRM (-0,11%)

$SNPS (-0,54%)

$SNOW (-3,7%)

$PSTG (+0,82%)

$ZIP (+11,17%)

$ZM (-0,43%)

$NU (+1,09%)

$RR. (+1,31%)

$MUV2 (+0,8%)

$BIDU (-1,12%)

$CELH

$DTE (+0,29%)

$STLAM (+2,73%)

$WBD (+0,08%)

$HAG (+0,69%)

$QBTS (-7,11%)

$LKNCY (+0,91%)

$BABA (+0%)

$G24 (+1,36%)

$HTZ (-1%)

$PUM (+0,37%)

$AIXA (-0,54%)

$RUN (+1,53%)

$INTU (-0,11%)

$WULF (-2,68%)

$MNST (+1,52%)

$SQ (+0,2%)

$ADSK (-1,05%)

$MP (-5,53%)

$RKLB (-6,56%)

$SOUN

$SMR

$CRWV (-9,31%)

$CPNG (+1,03%)

$DUOL

Aixtron

Price

Discussão sobre AIXA

Postos

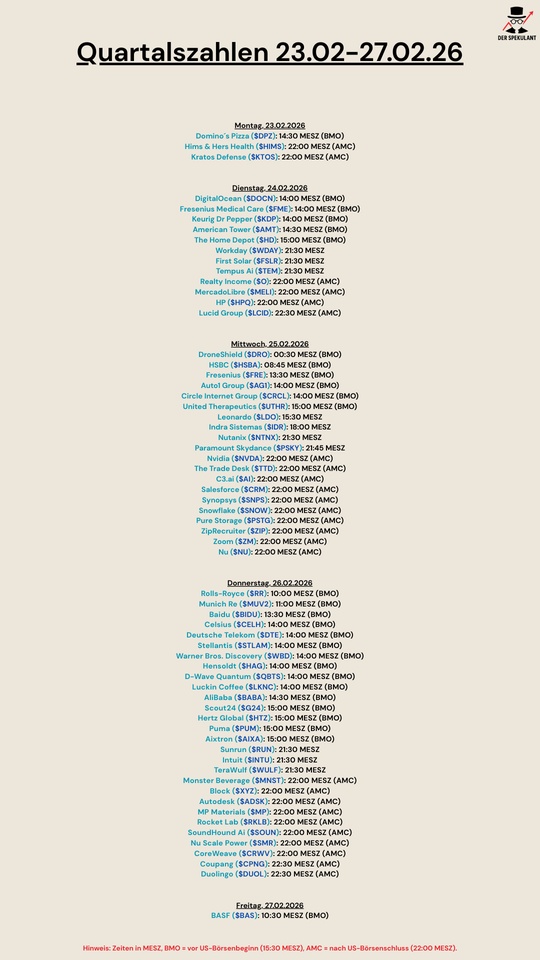

69Quartalszahlen 23.02-27.02.2026

UPDATE gq-Challenge 01/2026

Dear Community,

The Challenge is now in its third month and there have been some minor changes. I would like to tell you about them today.

First of all, some bad news for everyone who finds the experiment interesting, because I'm going to let it come to an end. Not because it has become a financial disaster, but because I don't have the time to look after it in a way that adds value for the community.

So here is something like a final report.

At the last update in November 2025, after the sales of $HIMS (-0,67%) and $3350 (+3,5%) and the purchase of $DEFI (-3,39%) the following stocks were still in the running:

$DEFI (-3,39%) with 245 shares

$LTMC (+0,69%) with 23 shares

$AIXA (-0,54%) with 36 shares

$CRCL (+2,48%) with 5 shares

Already on 06.01.2026 $LTMC (+0,69%) had to pack his bags as the regulatory issues had become too confusing for me.

Shortly afterwards, on 19.01.2026, I also had to $AIXA (-0,54%) had to leave the portfolio with a positive result.

This left only the two stocks $DEFI (-3,39%) and $CRCL (+2,48%) remained.

Unfortunately, both stocks were a reach for the ceramics and did not perform satisfactorily.

$DEFI (-3,39%) -62,21%

$CRCL (+2,48%) -45,95%

As a punishment, these two positions will be held until they reach € 0 or offer a surprise.

The result of this experiment is therefore sobering, but it was clear from the outset that it was a gamble and, as I wrote in the last post on this experiment, nobody who presented one of the stocks has anything to reproach themselves for!

Here is the final statement before deducting the positions that found a place in the experiment:

$HIMS (-0,67%) Buy € 546.92 Sell € 496.32 Result - € 50.60 -9.26%

$3350 (+3,5%) Purchase € 525.00 Sale € 459.00 Result - € 66.00 -12.58%

$LTMC (+0,69%) Purchase € 518.42 Sale € 522.56 Result +€ 4.14 +0.8%

$AIXA (-0,54%) Purchase € 503.64 Sale € 666.72 Result +€ 163.08 +32.38%

$DEFI (-3,39%) Purchase € 1,012.10 Current value € 382.52 Result -€ 629.58 -62.21%

$CRCL (+2,48%) Purchase € 555.00 Current value € 300.00 Result -€ 255.00 -45.95%

The bottom line is that € 2,827.12 of the € 3,661.08 invested in the course of the experiment, including the securities still in the portfolio of $DEFI (-3,39%) and $CRCL (+2,48%) have become.

This means a loss of € 833.96 or 22.78% within the three months of the experiment.

What do I take away from the experiment? That I lost money? No, that's the product, but not the insight, not what I take away.

For me, the insight is that you can be convinced of a share by an idea, but this is no guarantee that the company will perform in the same way.

The tips were not bad, but the market has its own rules. It may well be that each of these stocks will be worth many times more in 3 years' time. That's why I'm simply leaving the two remaining stocks in my portfolio - after all, they don't eat bread ;)

With any investment, you have to be aware that an investment can go either way. Therefore, in addition to a conviction in a company, a precise analysis of the fundamental data is also important. Very often, companies are presented here with an absolutely outstanding performance, including all the data. Many of these companies will certainly become multibaggers in the future with strong growth. Some will need a little more time, others a little less. But some of them may also end in a total loss.

My tips after the experiment:

Decide on stocks that are absolutely convincing to you and the figures "fit"

Set yourself limits up to which you can cope with losses

Don't forget the "safe" stocks, despite all the hope of making big gains in a short space of time

With this in mind, the rabbit wishes you a nice Sunday, even if he is looking a little sad at the moment, he is not in a bad mood and hopes that the experiment has also given you a little added value.

Your rabbit - André

I'm more of a buy and hold investor and dividend collector.

The result of your experiment reminds me of the saying: back and forth empties your pockets.

Of course, the tide could have turned again in a few weeks, but depending on which broker you invest with, the fees can be high.

Before the last Hoegh Autoliners dividend, I sold part of it via ING Bank to take the price gain or avoid the price discount after the ex-day. And what can I say, I was shocked by the settlement. There was almost nothing left of the profit. Next time I'll transfer the shares from ING to TR or Zero and sell them with significantly lower fees.

Some of my shares are also in the red here in the overview. But the truth is that for most of them the dividends I have received are higher in total than the price loss on paper. In other words, buy and hold is worthwhile for many dividend stocks. But everyone should also do some research on quality and not invest blindly. So thanks to the community members for all the great stock analyses. 👍

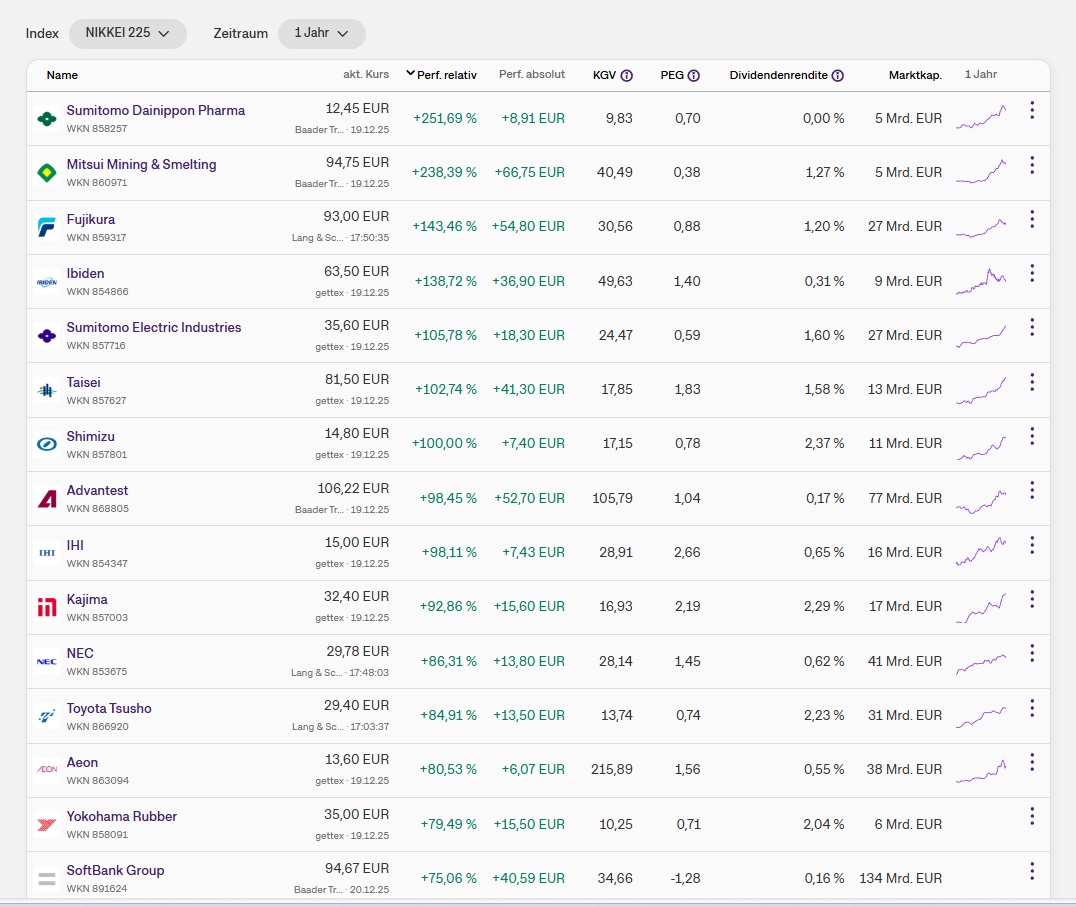

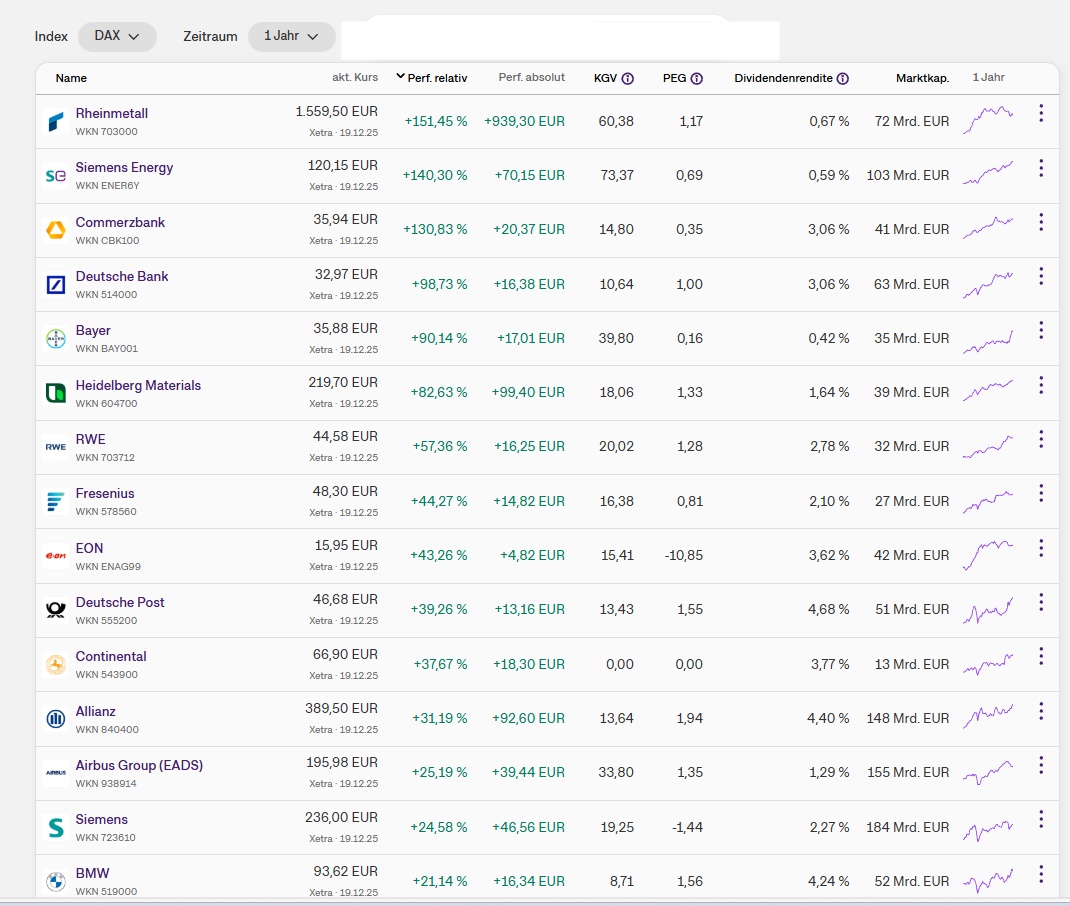

Annual TOP positions from the stock market indices

My dears, as we look ahead to the new year, I'm already taking a look around.

With the question of which values could be the winners in 2026.

Last year, I read comments from time to time. Which said that the top performers of 2024 will not perform next year or will even lose.

If I had listened to them, I wouldn't have stayed invested in AppLovin. And I would have missed out on the Tenbagger 2025.

Dear ones, how are you dealing with your TOP performers from this year?

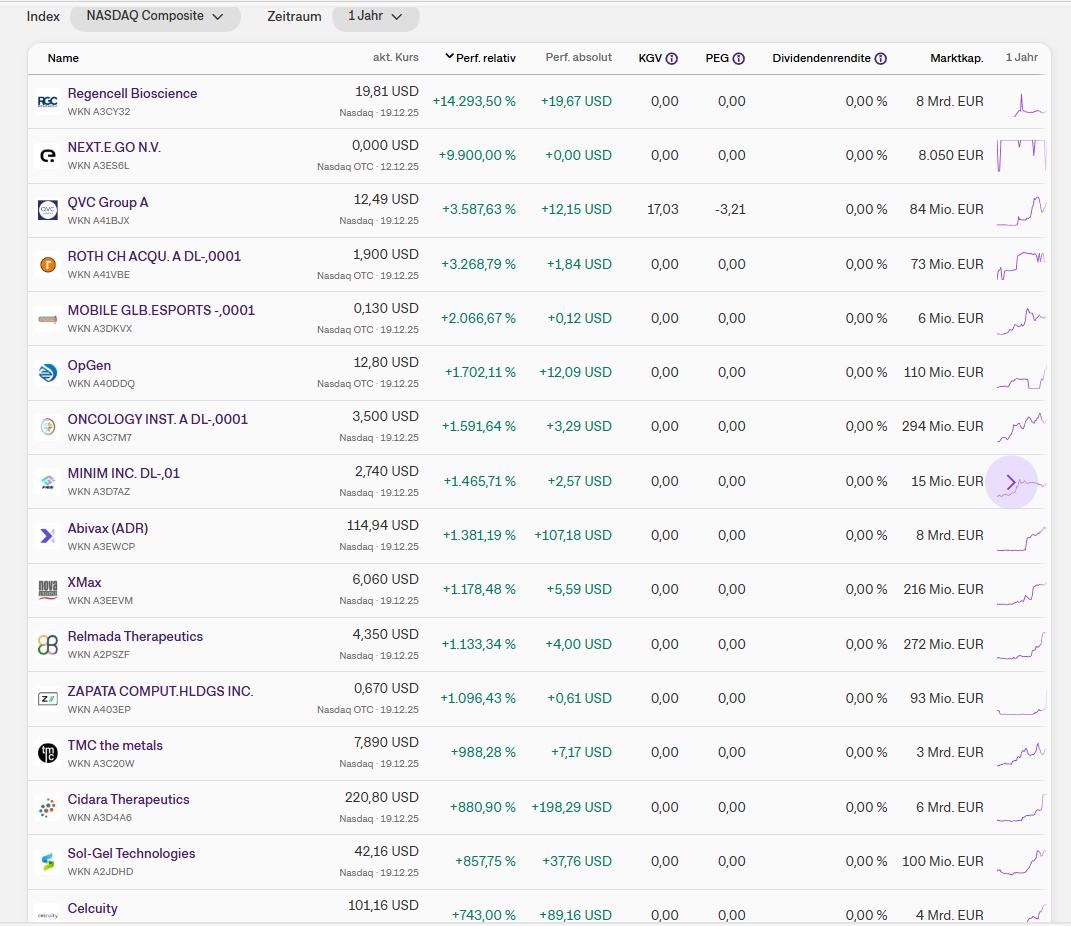

When looking at the TOPs from the indices, I keep noticing which pearls in the NASDAQ Composite are hidden.

My TOPs from this index are in the upper midfield.

It takes a lot of courage and risk to be among the best stocks here. Because as you can see, almost all of these stocks have no P/E ratio. That means they are not profitable.

But there are also these gems in the S and M DAX, and perhaps it is worth taking a closer look here. Even if we like to talk Germany down.

There are also a few surprises, so I wouldn't have bet a flower pot on SMA Solar and Nordex. Even a Tenbagger is off the mark 😂🙈. Or who of you would have expected these stocks to be at the top?

Which value is a surprise for you, and which values do you still see at the top?

After all, a turn of the year shouldn't put an end to momentum.

I am at least pleased to be among the winners in some indices. 😘

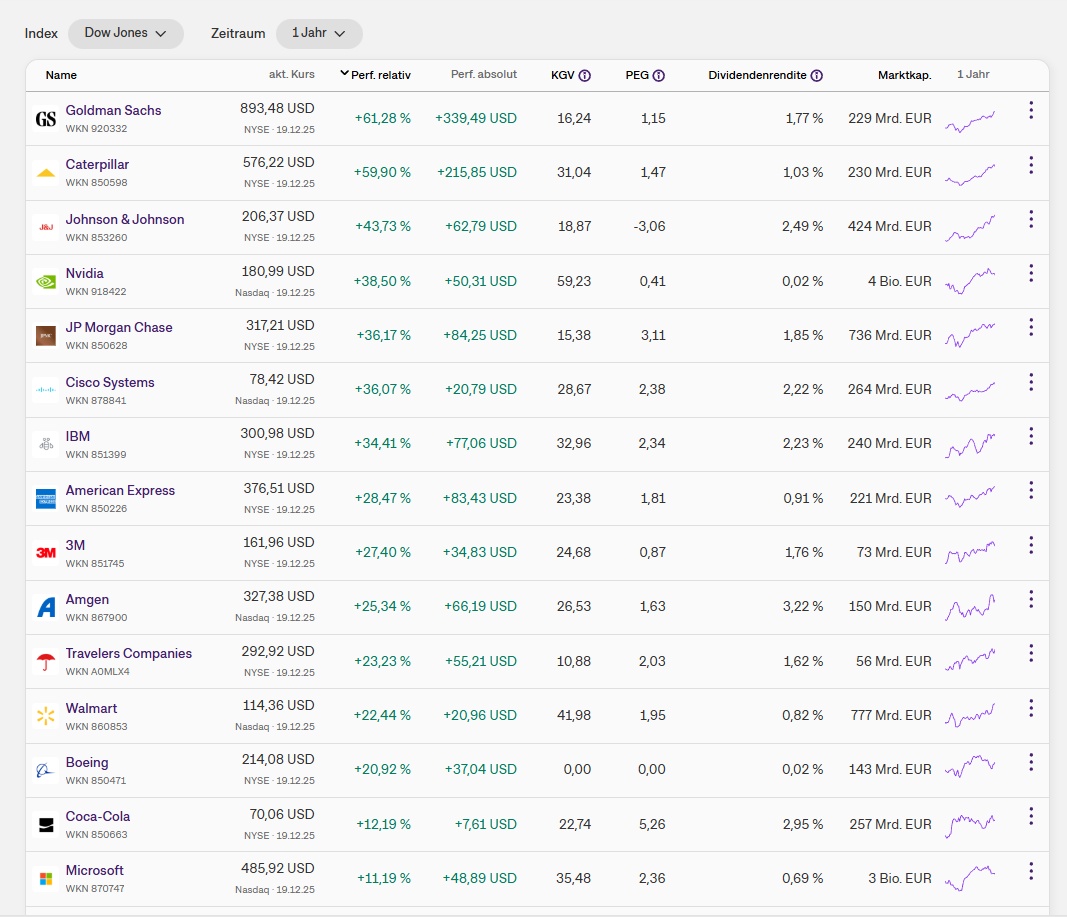

My TOPs from the stock market indices:

NASDAQ $MU (+2,55%) Micron 205.34 %

$APP (-5,89%) AppLovin 126.32 %

$GOOGL (+3,81%) Alphabet 62.94 %

DAX$SIE (+1,82%) Siemens 24.58 %

$ENR (+0,35%) Siemens Energy 140.30 %

Dow Jones$NVDA (+1%) NVIDIA 38.50 %

$MSFT (-0,3%) Microsoft 11.19 %

M DAX - - - - -

NIKKEI$6857 (+1,2%) Advantest 98.45 %

TecDAX$AIXA (-0,54%) Aixtron 17.87 %

SDAX -------

NASDAQ Composite

$FEIM (-3,96%) Frequency Electronics 159 %

$GILT (-1,57%)

Gilat Satellite Networks 102 %

$IESC (+2,56%)

IES Holdings 92,5 %

NASDAQ

DAX

Dow Jones

M DAX

NIKKEI

TecDAX

SDAX

NASDAQ Composite

+ 4

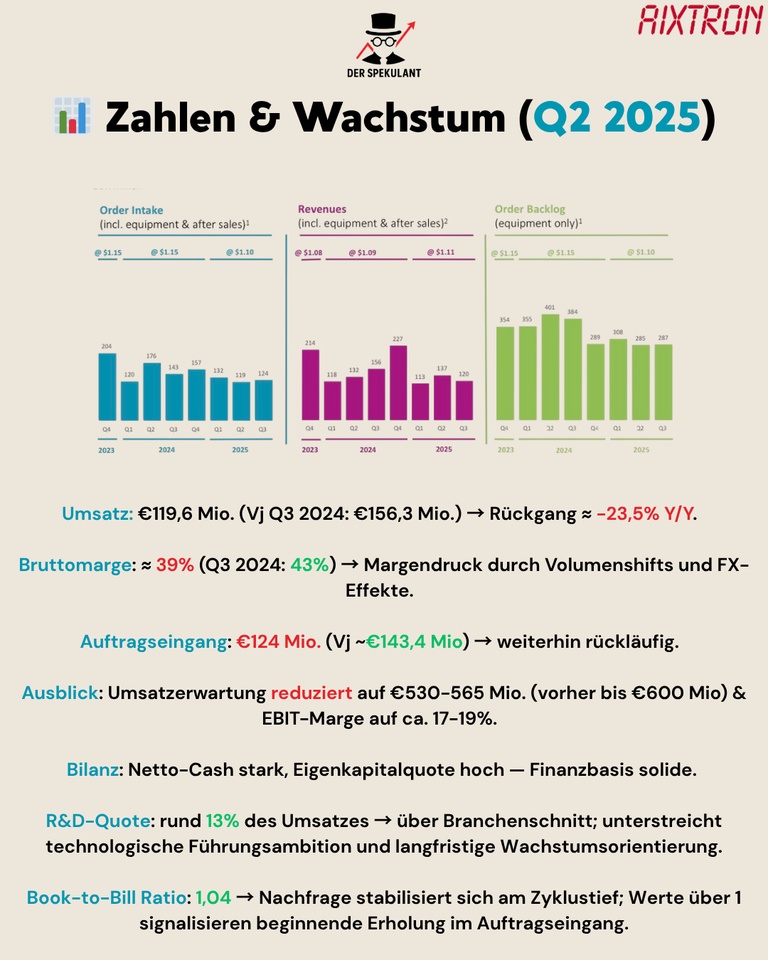

Deep Dive: Aixtron ($AIXA) - Cyclical champion with structural leverage 🇩🇪⚙️

German machine builder for semiconductor equipment - key player in SiC/GaN and optoelectronics. Aixtron ($AIXA (-0,54%) ) supplies the equipment on which the next generation of energy-efficient chips is manufactured - indispensable for AI data centers, electromobility and datacom.

⚙️ What does Aixtron do?

➡️ Specialist for MOCVD and CVD systems for the production of III-V semiconductors (e.g. GaN, SiC).

➡️ Core markets: Power electronics (SiC/GaN), optoelectronics (laser, datacom) and special applications (LEDs, micro-optics).

➡️ Sales basis: 78% equipment, 22% after sales - clear focus on AI & e-mobility growth markets.

➡️ Regions: 60% Asia, 17% Europe, 23% Americas.

➡️ Location: Herzogenrath (NRW), globally active with a focus on Asia, Europe & USA.

📊 Figures & growth (Q3 2025)

📉 Turnover: € 119.6 million (previous year € 156.3 million) → Decline ≈ -23.5 % Y/Y.

📉 Gross margin: ≈ 39% (Q3 2024: 43%) → Margin pressure due to volume shifts & FX effects.

📉 Incoming orders: € 124 million (previous year € 143.4 million) → further decline.

📊 Outlook for 2025: Sales € 530-565 million (previously up to € 600 million), EBIT margin 17-19%.

💰 Balance sheet: Net cash strong, equity ratio high - solid financial base.

🧩 R&D ratio: ~13% - above industry average, underlines technological leadership ambition.

📈 Book-to-bill ratio: 1.04 - shows start of recovery in incoming orders.

🟢 The opportunities

🧠 Technological leadership: Aixtron dominates the production of systems for GaN and SiC - key materials for the next generation of power electronics. This technology enables more efficient power conversion in e-mobility, charging infrastructure, wind energy and data centers.

🌐 Growth through AI & data center boom: Demand for high-speed lasers and optical data communication is growing at > 45% CAGR. Aixtron supplies the key equipment for InP-based laser chips, which are essential for AI servers and cloud networks.

🧱 Strong market position & barriers to entry: The new G10 portfolio offers up to ten times lower defect densities than previous models. High process complexity, patent protection and manufacturing expertise create high barriers for competitors such as Veeco or AMEC.

💸 Solid balance sheet & R&D power: With a 13% R&D share and robust cash position, Aixtron can continue to invest even in periods of weakness - the basis for long-term technological leadership.

📈 Cyclical turning point as an entry window: After the decline in demand in 2025, the valuation is moderate. Rising investments in SiC/GaN from 2026 could usher in the next cycle.

🔴 The risks

⚠️ Cyclicality & timing: Aixtron operates in a highly cyclical market environment. Demand for SiC and GaN equipment is currently declining as customers postpone their investments. A delayed upturn in power electronics could further dampen sales in 2025.

⚠️ High expectations: The market is already pricing in a turnaround for 2026. If this fails to materialize, there is a risk of valuation markdowns. Investors are currently expecting a rapid rebound - any delay will be disproportionately penalized.

⚠️ Currency and volume effectsPostponement of major orders to the fourth quarter and unfavorable exchange rates (especially USD/EUR) are putting pressure on margins and earnings. Short-term forecast deviations are therefore more likely than upside surprises.

⚠️ Technological competitionThe semiconductor equipment market is driven by innovation. Competitors such as Veeco and AMEC are investing heavily in GaN and SiC technologies. AIXTRON must consistently defend its technological leadership position - any lag in innovation could cost market share.

💡 Conclusion & outlook

Aixtron remains a strategically important player in energy efficiency and optoelectronics.

In the short term, the cycle is a burden, but in the long term the technology leadership offers a clear investment story.

🎯 Long-term goal:

Growth phase after 2026 with accelerated SiC/GaN investments.

💬 Community question:

Do you think Aixtron is a "turnaround entry" or the risky cyclical with high uncertainty?

+ 2

AIXTRON company presentation 📈

Following NVIDIA's $NVDA (+1%) 800-volt architectures (probably planned for 2027) in data centers for higher energy efficiency and scalability to meet the increasing power requirements of AI applications. I asked myself who COULD benefit from this. And that's when I came across AIXTRON $AIXA (-0,54%)

What does AIXTRON do?$AIXA (-0,54%)

- AIXTRON is a German manufacturer of deposition and epitaxy systems (mainly MOCVD = "Metal Organic Chemical Vapor Deposition") for the semiconductor and optoelectronics industry.

- Customers use AIXTRON equipment for the production of components such as LEDs, lasers, sensors, power semiconductors (e.g. with silicon carbide (SiC) or gallium nitride (GaN)), as well as opto/electronic components.

- The company is headquartered in Herzogenrath (Aachen region), Germany.

History in brief

- Founded in 1983 as a spin-off of RWTH Aachen University (then Institute for Semiconductor Technology) with the aim of commercializing MOCVD research systems.

- Since the 1990s fully focused on the production of systems for compound semiconductors (III-V materials).

- IPO in the mid-1990s (Neuer Markt) and later conversion to the European company form (SE).

Business model & technology focus

- AIXTRON develops, produces and installs equipment for material deposition (not only MOCVD, but also other processes) including services, training and support.

- The technologies address megatrends such as energy efficiency (e.g. power semiconductors with SiC/GaN), digitalization (data transmission, laser technology) and miniaturization (sensor technology, micro LEDs) - AIXTRON sees great market opportunities here.

- Investment in research and development is high - for example, around 14% of revenue is invested in R&D (2023) and the company holds hundreds of patent families.

Key figures & market position

- Number of employees approx. 1,200 (as of 2024) at various locations worldwide

- Turnover most recently e.g. in 2024 at around €633.2 million according to Wikipedia.

- AIXTRON is listed in the German TecDAX, among others, and is considered an important supplier in the semiconductor supply chain in the field of compound semiconductors.

Opportunities & challenges

Opportunities:

- The trend towards power semiconductors (SiC, GaN), for example for electric vehicles, charging infrastructure and data centers, opens up growth potential.

- The demand for energy-efficient and high-performance optoelectronic components (e.g. micro LEDs, laser systems) could benefit AIXTRON.

- The company can leverage competitive advantages through technological specialization.

Challenges:

- The semiconductor equipment market is cyclical and heavily dependent on end markets such as automotive, consumer and storage - weakness in these areas can affect AIXTRON.

- International trade and export controls (e.g. for high-tech equipment) and geopolitical risks can have a negative impact on business. For example, AIXTRON is affected by export/dual-use regulations.

- Competitive pressure from other manufacturers and the fast pace of technology require continuous innovation and investment.

Why should you pay attention to AIXTRON?

Because AIXTRON plays a key role in a highly innovative value chain: Compound semiconductor systems are important building blocks for modern technologies - from LED displays to POWER ELECTRONICS. So if you have an eye on future-oriented semiconductor equipment, you can't completely ignore AIXTRON.📈

Feel free to share your opinion on the share in the comments

Update gq-Challenge 11/2025

Dear friends and community,

After a month, here's a little update on the bunny challenge.

A few things have happened in the meantime, unfortunately not many of them positive.

Two of the 5 initial values have been dropped and one has been added.

$DEFI (-3,39%) Purchase 245 x € 2.085 = € 510.82

$HIMS (-0,67%) Purchase 11 x € 49.72 = € 546.92

$LTMC (+0,69%) Purchase 23 x € 22.54 = € 518.42

$3350 (+3,5%) Purchase 150 x € 3.59 = € 525.00

$AIXA (-0,54%) Purchase 36 x € 13.99 = € 593.64

Total investment = € 2,694.80

The disposals were:

$HIMS (-0,67%) Sale 11 x € 45.12 = € 496.32

$3350 (+3,5%) Sale 150 x € 3,06 = € 459,-

Loss € 116.60

Therefore the position was increased from $DEFI (-3,39%) increased

$DEFI (-3,39%) Purchase 263 x € 591.28

Gamble in between with $BE (-6,68%)

Buy 7x € 446.81

Sell 7x € 638.33

Profit € 191.52

New addition $CRCL (+2,48%)

Purchase 5x € 111,- = € 555,-

Unfortunately, the performance currently leaves a lot to be desired and the 🚀 are waiting for their start.

$DEFI (-3,39%) - 29,83%

$LTMC (+0,69%) - 14,90%

$AIXA (-0,54%) + 17,87

$CRCL (+2,48%) - 19,46

Unfortunately, the hare seems to have been taken in by the community's misconceptions about the company. But perhaps not and something will happen with the values that have fallen into negative territory.

VERY IMPORTANT:

This challenge is clearly intended as a gamble and a bit of fun for the community! It does not make the rabbit poor, even if it makes his current clothing look different.

No matter which of you introduced which of these companies that are now in the red: Don't take it negatively against your tip! The rabbit has decided whether the value for this challenge is of any use or not and it was clear from the start that it would be highly speculative.

The community and the tips are worth their weight in gold, even if these shares haven't made any money so far! ❤️

The bunny and I wish you all a great weekend 👍🏼

Lottomatica's figures were actually good. Perhaps the share was dragged down by the poor Draft King figures. In the long term, I am still positive.

Aixtron doesn't look bad on the chart. I hope there won't be any more bad news.

Stay brave and be patient my dear.

Kerrisdale Capital is long in Aixtron

The research describes Aixtron as the leading supplier for the production of GaN and SiC semiconductors - and a clear beneficiary of Nvidia's planned 800V data center architecture, which is targeted for 2027.

Share price +15 %.

Quarterly figures 27.10-31.10.25

$KDP (+1,54%)

$7751 (-0,62%)

$NXPI (+0%)

$WM (-1,44%)

$CDNS (-0,71%)

$BN (-1,14%)

$SOFI (-1,41%)

$UNH (-0,11%)

$AMT (+1,11%)

$UPS (+1,43%)

$BNP (+1,18%)

$NVS (-0,54%)

$DB1 (+1,23%)

$MSCI (+1,09%)

$ENPH (+4,71%)

$BKNG (+1,8%)

$LOGN (+0,5%)

$V (+0,55%)

$MDLZ (+0,12%)

$PYPL (-0,08%)

$000660

$MBG (+1,16%)

$BAS (+0,7%)

$UBSG (+0,03%)

$SAN (+2,7%)

$CVS (-0,72%)

$OTLY (-3,81%)

$GSK (-1%)

$ETSY (+7,31%)

$CAT (-0,15%)

$KHC (+1,13%)

$ADYEN (+0,81%)

$ADS (+1,94%)

$AIR (+0,87%)

$SBUX (+1,95%)

$CMG (-1,05%)

$META (+1,59%)

$KLAC (+1,83%)

$MELI (-0,16%)

$WOLF (-2,76%)

$GOOGL (+3,81%)

$EQIX (+1,04%)

$MSFT (-0,3%)

$CVNA (+1,39%)

$EBAY (+3,98%)

$005930

$6752 (+0,8%)

$KOG (+2,62%)

$VOW3 (+0,64%)

$GLE (+1,91%)

$LHA (+0,06%)

$STLAM (+2,73%)

$SPGI (-0,01%)

$MA (+1,25%)

$PUM (+0,37%)

$AIXA (-0,54%)

$FSLR (+2,98%)

$AAPL (+1,51%)

$REDDIT (-0%)

$AMZN (+2,51%)

$NET (-7,53%)

$MSTR (+1,9%)

$GDDY (+1,32%)

$TWLO (+1,26%)

$COIN (+3,15%)

$066570

$CL (+0,82%)

$ABBV (-0,21%)

$XOM (-2,45%)

Wolfspeed share shoots up by almost 1500 percent

My dears, have any of you been invested here?

Furious return to the stock market: the share price of the restructured US chip manufacturer Wolfspeed, which had once planned a plant in Saarland, has risen so rapidly that trading had to be interrupted several times.

29.09.2025, 20.05 hrs

US chip manufacturer Wolfspeed, which has been restructured following insolvency, has celebrated a spectacular return to the stock market. The company's shares shot up by around 1500 percent at times on Thursday before trading was suspended several times due to high volatility.

The New York Stock Exchange Nyse had previously announced that the company's old shares would be removed from trading as part of the insolvency proceedings. In return, investors will receive new shares in the restructured group, which will secure the company's continued stock market listing.

Wolfspeed shares once cost more than 120 dollars

Profits crumbled in the course of trading, but the shares were still up 1140 percent at just under 15 dollars. However, they are still a long way from their highs. Three years ago, the share price was still more than 120 dollars.

In June, Wolfspeed filed for protection from creditors under Chapter 11 of the US Bankruptcy Code, which allows the company to reorganize on its own. At the end of June, the shares were therefore trading at just under 40 US cents. The agreement with the creditors provided for a debt cut of 4.6 billion dollars and a financial injection of 275 million dollars.

Wolfspeed is a customer of Aixtron. Aixtron is a leading provider of deposition equipment for the semiconductor industry and supplies technologies for the manufacture of high-performance components, which are used by Wolfspeed for the production of semiconductors.

Update gq-Challenge

The rabbit now has its 5 community values together

The choice has fallen on

What do you think of the choice and do you see a chance of success for the first values?

If you are still interested in the challenge, follow the bunny. I will report regularly on how the challenge is progressing.

The bunny and I look forward to comments and discussions. 😊

+ 1

How long do you plan to hold the individual stocks? What were your selection criteria. I could name at least 3-4 other stocks that have attracted more attention here in the community. But that can be subjectively right and objectively wrong.

Títulos em alta

Principais criadores desta semana