$DPZ (+0.17%)

$HIMS (+0.53%)

$KTOS (+1.31%)

$DOCN (+0.52%)

$FME (+0.59%)

$KDP (+0.26%)

$AMT (+0.01%)

$HD (+0.06%)

$WDAY (+0.6%)

$FSLR (+0.19%)

$TEM (+0.23%)

$O (-0.26%)

$MELI (+0.74%)

$HPQ (+0.27%)

$LCID (+0%)

$DRO (+4.66%)

$HSBA (+0.67%)

$FRE (-3.01%)

$AG1 (-2.35%)

$CRCL (+0.11%)

$UTHR (-0.01%)

$LDO (-1.07%)

$IDR (+0.77%)

$NTNX (+0.22%)

$PARA (+0%)

$NVDA (+0.15%)

$TTD (+16.59%)

$AI (+0.43%)

$CRM (+0.43%)

$SNPS (-0.46%)

$SNOW (+0.11%)

$PSTG (-0.11%)

$ZIP (+0.33%)

$ZM (-0.04%)

$NU (+0.39%)

$RR. (+0.89%)

$MUV2 (-0.58%)

$BIDU (+0.2%)

$CELH

$DTE (+0.17%)

$STLAM (-0.02%)

$WBD (-0.36%)

$HAG (-1.9%)

$QBTS (+0.59%)

$LKNCY (+0%)

$BABA (-1.93%)

$G24 (-0.95%)

$HTZ (+0%)

$PUM (+2.56%)

$AIXA (+1.65%)

$RUN (-1.22%)

$INTU (+0.2%)

$WULF (+0.19%)

$MNST (-0.27%)

$SQ (+0.01%)

$ADSK (+0.27%)

$MP (+0.57%)

$RKLB (+0.81%)

$SOUN

$SMR

$CRWV (-0.44%)

$CPNG (+0.87%)

$DUOL

Discussion about AG1

Posts

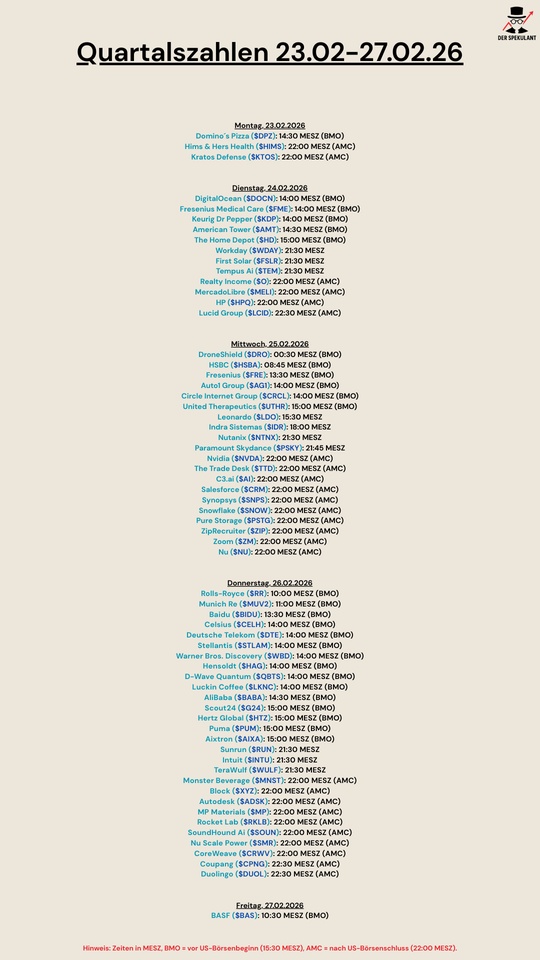

22Quartalszahlen 23.02-27.02.2026

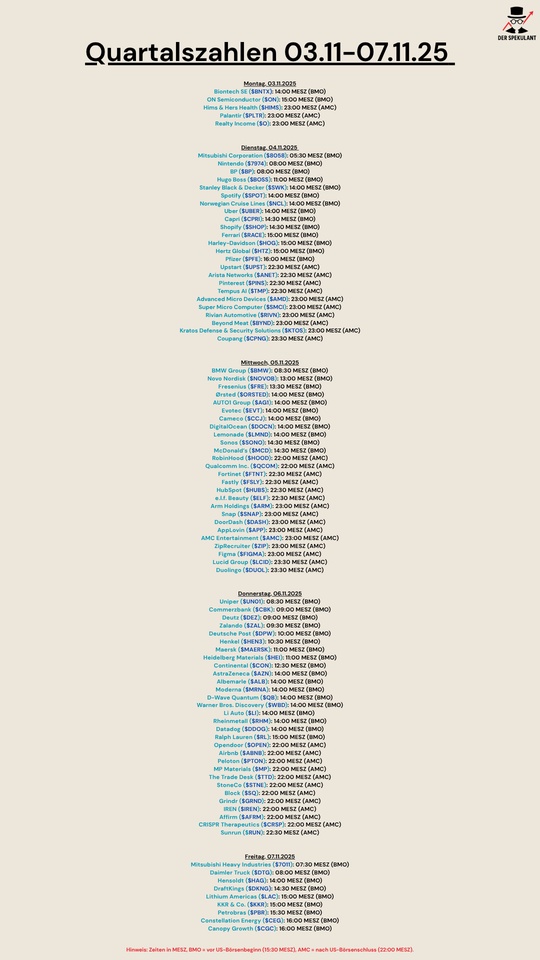

Quartalszahlen 03.11.25-07.11.15

$BNTX (-1.03%)

$ON (-0.67%)

$HIMS (+0.53%)

$PLTR (+0.81%)

$O (-0.26%)

$8058 (-0.95%)

$7974 (-3.07%)

$BP. (-0.3%)

$BOSS (-0.36%)

$SWK (+0.07%)

$SPOT (+1.07%)

$N1CL34

$UBER (+0.11%)

$CPRI (-0.52%)

$SHOP (+0.38%)

$RACE (-0.14%)

$HOG (+0.73%)

$HTZ (+0%)

$PFIZER

$UPST (+0.36%)

$ANET (+1.06%)

$PINS (+0.3%)

$TEM (+0.23%)

$AMD (-0.48%)

$SMCI (+0.5%)

$RIVN (+0.31%)

$BYND (-0.76%)

$KTOS (+1.31%)

$CPNG (+0.87%)

$BMW (+0.13%)

$NOVO B (+1.29%)

$FRE (-3.01%)

$ORSTED (+0.45%)

$AG1 (-2.35%)

$EVT (+0.28%)

$CCO (+0.01%)

$DOCN (+0.52%)

$LMND (+0.3%)

$SONO (-0.09%)

$MCD (-0.16%)

$HOOD (+0.66%)

$QCOM (-0.43%)

$FTNT (-0.48%)

$FSLY (-0.7%)

$HUBS (+0.12%)

$ELF (+0.28%)

$ARM (+0.28%)

$SNAP (-0.23%)

$DASH (+0.38%)

$APP (+1.67%)

$AMC (+0.69%)

$ZIP (+0.33%)

$FIG (+0.39%)

$LCID (+0%)

$DUOL

$UN0 (-0.66%)

$CBK (-0.37%)

$DEZ (+0.21%)

$ZAL (+0.13%)

$HEN (-0.49%)

$MAERSK A (-1.62%)

$HEI (+1.5%)

$CON (-2.32%)

$AZN (-0.6%)

$ALB (+0.77%)

$MRNA (-0.19%)

$QBTS (+0.59%)

$WBD (-0.36%)

$LI (-2.03%)

$RHM (-0.61%)

$DDOG (+0.05%)

$RL (-0.43%)

$OPEN (-0.24%)

$ABNB (-0.38%)

$PTON (-0.06%)

$MP (+0.57%)

$TTD (+16.59%)

$STNE (+0.1%)

$SQ (+0.01%)

$GRND (+0.26%)

$IREN (-2.71%)

$AFRM (+0.32%)

$CRISP (+3.99%)

$RUN (-1.22%)

$7011 (-1.4%)

$DTG (+0.28%)

$HAG (-1.9%)

$DKNG (+0.13%)

$LAC (+0.13%)

$KKR (-0.07%)

$PETR3 (+1.52%)

$CEG

$WEED (+1.18%)

My 4 most expensive everyday mistakes and how they have affected my life

1 - Listen to friends and relatives. Impact: low.

It's a bit of a mixed bag. Sometimes, of course, it makes sense to listen to people if they are competent in an area. The problem is that in some areas, friends and family tend to give well-intentioned tips but actually have no idea at all. A good example of this would be that as an old computer nerd, I always wanted a desktop PC as a teenager, but my mother told me that a laptop would be so much more practical and would have many advantages. The problem was that they always broke down and it was just far too expensive and inconvenient to repair them, as the components couldn't be replaced easily. And let's not even start with tips on investments and the savings bank.

--> My learning: If you're not completely clueless in an area, you shouldn't listen to well-intentioned advice, but have confidence in your own abilities.

2 - Shopping in physical stores. Impact: medium

This is probably the most controversial point in the whole list, but I have to say that I have often had very negative experiences with buying something in a store instead of ordering online. It often starts with the price itself - but then there are often hidden costs that you don't even see. A real-life example would be the recent purchase of my Apple Watch at the local electronics store (please refrain from joking at this point that the purchase itself was already a mistake).

First of all, the thing costs a little less online at one or the other retailer, so you basically pay around €35 extra for the pleasure of buying from a specialist retailer or in the Apple Store (which doesn't exist locally). Incidentally, the Telekom store would have charged another €20 above the list price, which would have increased the Premium to €55.

That's the part of the cost that you can see directly. However, the electronics store didn't have the right bundle of watch + wristband in its range, so I decided to buy the watch without the wristband without further ado, as I could simply reorder it later. What no one says, however, is that the desired strap costs €200 instead of €100 if you buy it separately from the watch. This means that the additional cost is already €135.

To top it all off, the store doesn't accept American Express payments, which means I have to leave another €10 in refunds.

This is a very specific example, but just one of many. Local retailers also like to put up with complaints despite defective goods and a receipt. Even when I suggested a compromise by accepting a credit note or repair, I was once told at Saturn "Nope, we don't see it. What's in it for us?" after which I never again entered a $CEC (+0.23%) shop again.

--> My learning: I'm really sorry to say, but if you don't want to run an honorary charity organization to preserve German jobs, it's better to buy online, where prices are transparent and complaints are automated and digital.

3 - Take the easy route. Impact: difficult

One of the easiest ways to lose a lot of money is to stay in your comfort zone. If you never ask for discounts and deals, book package tours without comparing prices, prefer to call a cab on vacation instead of dealing with how the subway system actually works, pay bills in restaurants without reading through to see if you actually ordered the items, you are simply as cooked as it gets.

So here are a few self-reflected points where I (almost) wasted a lot of money. Firstly, I'm serious about the restaurant. I recently stayed at a really fancy establishment for my birthday and celebrated with my girlfriend. Although we really only had a few snacks, the bill for both of us came to around €400. Being the cool guy that I am, I naturally kept a straight face despite having a massive heart attack and already had my credit card in my hand - until my girlfriend noticed that they had swapped our table and I almost paid someone else's bill. All because I didn't want to make a drama out of it.

Another case was that I once sold my car to the well-known and popular company "wir klauen dein Auto" and was massively spammed by them because they simply ended up giving me several thousand euros below their estimated selling price. The reason for this was that the company's own "expert" thought he had discovered some defects and accident damage that simply didn't exist, without providing any evidence. In the end, I had to accept the deal anyway because I had already bought another car and now urgently needed the liquidity and thought to myself "there's a really easy way to get rid of your used car here without having to advertise and negotiate". But $AG1 (-2.35%) only said: "Fiddlesticks.

(In addition, too little liquidity is probably already a serious problem in itself)

4 - The classic - not starting to invest as early as possible. Impact: massive

And here comes the point that should of course never be missing from such a list and which everyone has already seen coming. As I've often mentioned, I've been involved in investing and retirement planning for over 10 years, but I only actually started investing real money when I was 27.

My thought process behind this was simply that I would invest as soon as possible once I had finished my studies and was earning money, because otherwise it wouldn't be worth it anyway. And that assessment was simply a disaster.

It's true that I had hardly any assets or free cash flow as a student, but I wasn't as completely burnt out as some others. So let's say I could have scraped together €3000-5000 real money somehow. I also tried my hand at investing with demo accounts back then and mainly invested in shares that I knew. These included many German stocks, which I assumed at the time were already good because Germany was good (back then). For example, something like Lufthansa, Siemens and Deutsche Bank. Among others, however, there was also NVIDIA - which was already a household name for me back then. If I had somehow invested even a small sum of maybe €500 there at the time, it would have turned into well over €100k. And it was entirely my mistake to think that it was pointless to invest my small amounts if I could only save a small sum every month. Even with an ETF, it would have made a lot of sense to simply put €1000 into it and invest it 10 years earlier.

--> My learning: Education is still the most precious commodity. It was so right to get involved with the topic as early as possible - but then you also have to go from theory to practice. Instead of always being afraid that my modest assets in the custody account would fluctuate compared to the current account. I should have seen it more as no downfall if I lost money on the market in the absolute worst case, as I could earn it back in 2-3 months after graduation.

I can agree on many points!

1. from my point of view, this is always a good idea:

Stay out of the financial affairs of friends and family in particular. No offers and no advice.

Even if I am explicitly asked for a tip, my answer is usually that you should educate yourself in order to help yourself.

When it comes to investments, the best advice I give is to go to $IWDA and even then I say: read up before you do anything.

Everything else leads to arguments.

There are experts in every field and you either pay these experts for their expertise or you have to live with the consequences if you don't do it.

2. here I also agree.

Maybe 10 years ago, my sister wanted a new laptop for surfing, for her browser games, for planting a garden, etc.

Just normal, simple things for which you don't need a performance monster.

So I went to the nearest Mediamarkt and thought I'd get an employee to show me the devices.

I'm not an IT nerd, but at least I know something about it.

So I told him my budget, the intended use and that it was for my sister.

Completely ignored, he led me to the mobile gaming machines from €2k upwards. I said several times that the thing wouldn't be used for gaming and that the budget wasn't there either.

As the gentleman was apparently only after his commission, I left the store and went to the nearby Saturn. Same game again.

Then again at MediMax. And the same thing happened again at Conrad.

So I got back in the car and ended up ordering a device from Amazon. I also saved over 10% on the price of the stationary retailer.

In the years that followed, I tried stationary retail again and again. Be it for furniture, carpeting, wood for furniture construction, wallpaper, etc.

Each time, they either tried to pull the wool over my eyes or didn't care what I wanted.

The fact that I save money in the process is a nice side effect.

(Not to mention the cases where people in stores have told me that there is no USB-C to jack, for example, or that there are no connectors or window ducts for satellite cables).

3. sometimes things like your experience in the restaurant are simply human error.

But often, like the provider with the annoying Ralf Schumacher commercial, they are also part of the business model.

I wanted to sell my mother's "old" Kia Carens because she was buying a new car but still wanted money for her old one.

Of course, our neighborhood dealers (I live near the Polish border) all had very nice prices, but they were primarily focused on their profits.

So I went to the named dealer on the Internet and got a quote.

The price was of course very good, although we had deliberately given the car a lower price than necessary.

On site, they then deducted "accident damage" that we had honestly stated online. (So something like the classic scratch on the rear fender from the shopping cart in the supermarket parking lot, etc.)

Well, then we drove off again without any discussion and ended up selling the car to a Berlin dealer who refurbished the car and then sold it in Eastern Europe.

They quoted a price, didn't negotiate for long and we got the cash on the claw.

I always find the price differences particularly glaring when traveling.

Same period, same hotel and same flights, but still 10-20% difference for the same services.

4. here I am personally somewhat ambivalent.

I myself started with smaller sums when I was 18, but as a student and self-employed person I naturally had to scrape together a lot of money to invest.

Sometimes it might have been better to "live" more.

Today I'm still in a similar position and almost 30.

My savings rate is quite decent, but I'm still trying to find a balance and just live, because we all have to die at some point and my big deposit won't be of any use to my family or anyone else in the end. Well, my heirs might be happy, but that shouldn't be the goal.

Incidentally, I invested far too much in penny stocks when I was young because I thought I was smarter than others. (Well, the bottom line is that I made a profit, but I still burned a lot of money. And in the end, I still think I'm smarter than most people...)

What I now clearly think, however, is that I should have paid much more attention to education when I was younger, instead of trying to make a killing on the stock market.

I only had a rough understanding of the whole thing, invested heavily in shares, options and derivatives, but honestly didn't understand many of the market mechanisms at all. Sometimes it was just more luck than sense.

Insights from the AUTO1 Group analyst conference - record results for 2024, profitability achieved, ambitious targets for 2025

A further summary of the conference call now follows from AUTO1 Group ($AG1 (-2.35%) ) on its results for the fourth quarter and full year 2024.

Christian Bertermann, the Co-Founder and CEO of AUTO1, spoke of a fantastic year 2024an important milestone on the path to profitable growth and underlined the strength of the vertically integrated business model and the performance of the digital commerce platform.

The results for the full year and the fourth quarter were outstanding and marked the best year best year in the company's 12-year history. This is a testament to the successful strategy, consistent execution and commitment of the teams. AUTO1 has leveraged the benefits of the integrated model while driving automation and advances in the field of artificial intelligence.

The figures were impressive: The Group sales rose to an all-time high of 690,000 vehiclesan increase of 18% compared to the previous year. The total gross profit exploded by more than 37% to 725 million euroswhich is almost 200 million euros more than in 2023. The gross profit per unit (GPU) also rose significantly by 17% to 1,049 euros (2023: 899 euros). Last year marked the sixth year in a row with sequential GPU increases at Group level. The adjusted EBITDA grew in each of the four quarters of 2024 and reached 109 million euros the company's best figure ever, an improvement of EUR 153 million compared to 2023. adjusted EBITDA margin climbed to 1.7 %, an increasewhich corresponds to an increase of 2.5 percentage points compared to 2023 and illustrates the significant operating leverage of the business model.

Bertermann emphasized that AUTO1 pursues a value-first strategy strategy in all segments and is strongly focused on creating value for all customers. Over the past year, the company has developed an even better understanding of customers' needs, expectations and priorities, resulting in superior demand demand.

Bertermann then went into more detail about the individual segments, starting with Merchant. Here it was an an exceptional year and a strong fourth quarter. quarter. In the year 2024 615,000 units were soldgrowth of 18% compared to the previous year. The fourth quarter continued with 163,000 units sold another record and accelerated growth to 24 % compared to the previous year. The gross profit in the Merchant segment reached 563 million euros for the year as a whole, an increase of 34%.

In the past year, products and services for partner merchants were further improved, always with the aim of delivering maximum value. The average delivery time was reduced by 4 dayswhich proves the effectiveness of the transport solutions. The AI recommendation algorithms have been improveddocument tracking has been optimized and the translation of equipment and vehicle condition has been refined to maximize convenience for partners. These advances led to a superior demand in the merchant segment. In total 44,600 partner dealers were served, 14% more than in 2023. average shopping basket grew by 3% last year to 13.8 vehicles. In the fourth quarter 27,500 dealers vehicles, compared to 23,700 in the same quarter of the previous year (up 16%).

A total of 114 new branches were opened in the purchasing areaan increase of 26% compared to the previous year. Together with this significant increase in the number of stores, the teams have improved the management of the purchasing operation and positioned it for sustainable long-term growth while maintaining strict cost control.

Next, Bertermann spoke about the Retail. This had set new records in 2024 new records in all key figures achieved. It sold 74,400 cars were sold in this latest division, an increase of 18% compared to the previous year. While the first quarter began with slightly declining sales figures, growth accelerated significantly in the following quarters. As a result of the strong growth in unit sales and GPU, the total gross profit in the Retail segment rose to 162 million eurosan increase of 49% compared to the previous year. In addition to the strong financial performance, it is particularly pleasing that AUTO1 continues to achieve high NPS values of around 70 from its customers.

The internal financing solution offers a seamless digitally integrated process with instant approval and customized payment plans for a first-class customer experience, which promotes trust and long-term loyalty and increases customer retention and repeat transactions. In the externally financed markets, the company works with over 30 strong partners to ensure maximum flexibility and attractiveness.

For the year 2025 CFO Boser gave a forecast for the year 2025: Between between 735,000 and 795,000 units to be sold, of whichof which 650,000 to 700,000 in the Merchant segment and 85,000 to 95,000 via Autohero. The gross profit should between 800 million and 875 million euros and the adjusted EBITDA is between 135 million and 165 million euros expected. The CapEx amounted to just over EUR 11 million in 2024, but is expected to rise to around EUR 22 million in 2025, as additional internal logistics capacities are to be built up and the usable processing capacities in the existing plants are to be expanded. A limited number of additional processing facilities at strategic locations may also be considered. Overall, Boser was very satisfied with the performance in the fourth quarter and in 2024 as a whole and will now invest profitably in the future to ensure that the level of growth and profitability achieved can be maintained and the increase in market share and margins can be driven forward.

In the subsequent question and answer session analysts asked various questions, which the management answered in detail:

Nizla Naizer from Deutsche Bank asked about the assessment of European used car price development in 2025. Christian Bertermann replied that after the very volatile years 2021-2023, 2024 had brought a much more stable environment with less volatility and a gradual, normal decline in used car prices. They are now back in normal waters, with used cars depreciating at a stable and normal rate, and expect this environment to continue in 2025, as no major volatility in new car volumes or other negative or positive factors are expected.

Naizer also asked about the

marketing efforts. Naizer praised the efficiency in 2024 and asked about the focus areas for 2025. Boser did not give a specific forecast for marketing, but pointed out that the operating costs per unit would increase slightly in the forecast. This is partly due to a mix shift towards Autohero where higher growth is expected, which tends to result in higher operating costs per unit.

Christopher Johnen from HSBC came to the operating costs (OpEx) and noted that the forecast OpEx growth of around 15% with an expected sales growth of also around 15% is well above the ratio of 8% OpEx growth to 18% sales growth in 2024. He asked whether this might be conservative given the increased focus on Autohero. Markus Boser confirmed that this reflects the increased investment in Autohero reflected the increased investment in Autohero. The company sees great opportunities here, but is also still in a learning phase.

Johnen asked about expectations for the development of the number of dealers and the use of merchant financing in 2025. Christian Bertermann replied that an increase in the number of increase in the number of merchantsusing merchant financing in line with the planned growth. Regarding the introduction of merchant financing in other markets Bertermann explained that this was taken into account in the forecast to the extent that it appeared planned and likely.

Andrew Ross from Barclays asked about the trends in sales figures in January and February, particularly especially in the retail sector, to get an idea of the sequential growth from Q4 to Q1. Christian Bertermann reported on a good start to the year. The first week was not optimal due to the holiday constellation, but after that we saw good momentum, which continued in February.

Ross also asked about the costs of customer acquisition in the retail sector and the conversion rate when ramping up the business, as well as the management of marketing costs and asset turn. Bertermann explained that the aim was to keep marketing costs in line with optimized costs. Slight increases of 10-15% are conceivable in individual markets. However, the company is continuously learning how this can be made more efficient and is gaining valuable insights into customer acquisition and retention. He expects marketing costs to remain stable or increase slightly.

James Tate from Goldman Sachs asked about the key factors for achieving the lower and upper end of the EBITDA guidance for 2025. Markus Boser explained that this essentially depends on the achieved gross profit figures (sales and GPU) and the control of expenses depend. The range reflects the uncertainties.

2024 was a record year for AUTO1 Group. record year with the best performance in the company's history. The company recorded all-time highs in Group sales (690,000 vehicles) and total gross profit (EUR 725 million), as well as a significant increase in the gross profit per unit (GPU).

For 2025, AUTO1 Group expects further growth in sales growth in sales and profitability . The company is optimistic about the future and is aiming for a higher market market share and an improved EBITDA margin in the in the long term.

Analyst updates, 17.12.

⬆️⬆️⬆️

- - UBS raises the price target for AMAZON from USD 230 to USD 264. Buy. $AMZN (-0.08%)

- - CITIGROUP raises the target price for ALLIANZ SE from EUR 286 to EUR 314.40. Neutral. $ALV (-0.54%)

- - BARCLAYS raises the target price for DHL GROUP from EUR 37.50 to EUR 38. Equal-Weight. $DHL (-3.74%)

- - DEUTSCHE BANK RESEARCH upgrades AIRBUS from Hold to Buy and raises target price from EUR 155 to EUR 185. $AIR (+2.72%)

- - BERENBERG raises the price target for MUNICH RE from EUR 525 to EUR 552. Hold. $MUV2 (-0.58%)

- - KEPLER CHEUVREUX raises the price target for ADESSO from EUR 80 to EUR 100. Hold. $ADN1 (+0%)

- - WARBURG RESEARCH raises the price target for FMC from EUR 31 to EUR 36. Sell. $FME (+0.59%)

- - DEUTSCHE BANK RESEARCH raises the target price for AUTO1 from EUR 12 to EUR 20. Buy. $AG1 (-2.35%)

- - DEUTSCHE BANK RESEARCH raises the price target for MTU from EUR 329 to EUR 337. Hold. $MTX (+0.36%)

- - DEUTSCHE BANK RESEARCH raises the price target for HENSOLDT from EUR 37 to EUR 41. Buy. $HAG (-1.9%)

- - DEUTSCHE BANK RESEARCH raises the target price for ROLLS-ROYCE from GBP 5.55 to GBP 6.30. Buy. $RR. (+0.89%)

- - BOFA raises the target price for INFINEON from EUR 36 to EUR 40. Buy. $IFX (+0.8%)

- - BOFA raises the price target for STMICRO from EUR 29 to EUR 30. Buy. $STMPA (+3.12%)

- - BOFA raises the target price for NOKIA from EUR 4.07 to EUR 4.58. Neutral. $NOKIA (-0.96%)

⬇️⬇️⬇️

- - JPMORGAN downgrades TRANSMEDICS from Overweight to Neutral and lowers target price from 116 USD to 75 USD. $TMDX (+1.23%)

- - BOFA lowers the price target for SILTRONIC from EUR 59 to EUR 46. Underperform. $WAF (-0.51%)

- - HSBC lowers the price target for CARL ZEISS MEDITEC from EUR 66 to EUR 54. Hold. $AFX (-0.81%)

- - KEPLER CHEUVREUX lowers the price target for HEIDELBERGER DRUCK from EUR 1.25 to EUR 1. Hold. $HBGRY (+0.87%)

- - KEPLER CHEUVREUX lowers the price target for EVONIK from EUR 25 to EUR 21. Buy. $EVK (+2.05%)

- - KEPLER CHEUVREUX lowers the price target for NORDEX from EUR 17 to EUR 14. Buy. $NDX1 (+0.12%)

Analsyst updates, 06.12.

⬆️⬆️⬆️

- BERNSTEIN raises the price target for SIEMENS from EUR 220 to EUR 227. Outperform. $SIE (-0.22%)

- JPMORGAN raises the target price for SIEMENS ENERGY from EUR 38.70 to EUR 44. Neutral. $ENR (-0.06%)

- JEFFERIES upgrades BMW from Hold to Buy and raises target price from EUR 80 to EUR 85. $BMW (+0.13%)

- ODDO BHF raises the price target for AURUBIS from EUR 70 to EUR 76. Neutral. $NDA (+0.77%)

- UBS raises target price for AUTO1 from EUR 9.80 to EUR 20.50. Buy. $AG1 (-2.35%)

- UBS raises the target price for NORDEA from SEK 144 to SEK 145. Buy. $NDA FI (-0.25%)

- DEUTSCHE BANK RESEARCH raises the price target for FREENET from EUR 34 to EUR 36. Buy. $FNTN (+0.29%)

- DEUTSCHE BANK RESEARCH raises the target price for DS SMITH from GBP 4 to GBP 5.80. Hold. $SMDS

- JPMORGAN raises the price target for THYSSENKRUPP from EUR 3.80 to EUR 4.10. Neutral. $TKA (+1.67%)

- JPMORGAN raises the target price for SALZGITTER from EUR 11.50 to EUR 14.10. Underweight. $SZG (+1.06%)

- JPMORGAN raises the price target for SCHNEIDER ELECTRIC from EUR 270 to EUR 275. Overweight. $SU (-0.72%)

- JPMORGAN raises the price target for KNORR-BREMSE from EUR 88 to EUR 92. Overweight. $KBX (+1.79%)

- MORGAN STANLEY upgrades HANNOVER RÜCK to Overweight. Target price EUR 292. $HNR1 (+0.08%)

- JPMORGAN raises the target price for COMMERZBANK from EUR 18.40 to EUR 19.50. Overweight. $CBK (-0.37%)

⬇️⬇️⬇️

- GOLDMAN lowers the price target for LVMH from EUR 770 to EUR 720. Buy. $MC (-0.32%)

- MORGAN STANLEY downgrades MUNICH RE to Equal-Weight. Target price 523 EUR. $MUV2 (-0.58%)

- JEFFERIES downgrades MERCEDES-BENZ from Buy to Hold and lowers target price from EUR 73 to EUR 60. $MBG (-0.42%)

- ODDO BHF lowers the price target for DELIVERY HERO from EUR 43 to EUR 38. Neutral. $DHER (+3.09%)

- WARBURG RESEARCH lowers the price target for COMPUGROUP from EUR 31 to EUR 24.50. Buy. $COP (-0.15%)

- JPMORGAN lowers the price target for VESTAS from DKK 143 to DKK 123. Neutral. $VWS (+0.76%)

- JPMORGAN lowers the price target for KION from EUR 44 to EUR 43. Overweight. $KGX (-0.37%)

- MORGAN STANLEY downgrades ORSTED to Equal-Weight. Target price DKK 480. $ORSTED (+0.45%)

Changes at Deutsche Börse:

The used car dealer Auto1 $AG1 (-2.35%) and the biotech company Evotec $EVT (+0.28%) return to the small cap index on 23.12.24 MDax of the German Stock Exchange. They will replace the metal recycler Befesa $BFSA (-0.8%) and the automotive and industrial supplier Stabilus $STM (-0.84%) which will be relegated to the small-cap index SDax, as announced by Deutsche Börse subsidiary ISS Stoxx on Wednesday evening.

Evotec was only forced to leave the MDax in September, but since then the shares have risen again in view of a possible sale of the company. Auto1, on the other hand, was previously listed on the MDax until spring 2022.

In addition, the SDAX also has three newcomers. The software company Nexus $NXU the scientific publisher Springer Nature

$SPG (+0.46%) and the biosimilars specialist Formycon $FYB (+0.68%) .

On the other hand, the telecom equipment supplier Adtran Holdings

$ADTN (-0.62%) the office furniture mail order company Takkt

$TTK (-2.79%) and the hydrogen specialist Thyssenkrupp Nucera

$NCH2 (+2.75%) .

In the DAX there are no changes.

The changes will take effect on December 23 of this year.

Handelsblatt

Analyst updates, 05.12.

⬆️⬆️⬆️

- HSBC upgrades SIEMENS to Hold. Target price EUR 185. $SIE (-0.22%)

- DEUTSCHE BANK RESEARCH raises the price target for MUNICH RE from EUR 450 to EUR 535. Hold. $MUV2 (-0.58%)

- DEUTSCHE BANK RESEARCH raises the price target for HANNOVER RÜCK from EUR 255 to EUR 294. Buy. $HNR1 (+0.08%)

- DEUTSCHE BANK RESEARCH raises the price target for TALANX from EUR 70 to EUR 76. Hold. $TLX (-0.47%)

- JEFFERIES raises the price target for ORACLE from 190 USD to 220 USD. Buy. $ORCL (+0.51%)

- HAUCK AUFHÄUSER IB raises the target price for MTU from EUR 264 to EUR 280. Sell. $MTX (+0.36%)

- BARCLAYS upgrades AUTO1 from Equal-Weight to Overweight and raises target price from EUR 9 to EUR 19. $AG1 (-2.35%)

- JPMORGAN raises the price target for HELLOFRESH from EUR 14 to EUR 16. Overweight. $HFG (+0.98%)

- JPMORGAN raises the target price for DELIVERY HERO from EUR 42 to EUR 55. Overweight. $DHER (+3.09%)

- JPMORGAN raises the price target for CTS EVENTIM from EUR 104 to EUR 112. Overweight. $EVD (+0.11%)

- JPMORGAN raises the target price for SCOUT24 from EUR 92 to EUR 105. Overweight. $G24 (-0.95%)

- JPMORGAN raises the target price for JUST EAT TAKEAWAY from GBP 16.02 to GBP 18.32. Overweight. $TKWY

- JPMORGAN upgrades DELIVEROO from Neutral to Overweight and raises target price from GBP 1.70 to GBP 1.92. $ROO

- JPMORGAN raises the price target for HEIDELBERG MATERIALS from EUR 150 to EUR 151. Overweight. $HEI (+1.5%)

- JPMORGAN raises the price target for FRAPORT from EUR 49 to EUR 59. Neutral. $FRA (+0.86%)

⬇️⬇️⬇️

- METZLER lowers the price target for HYPOPORT from EUR 220 to EUR 185. Sell. $HYQ (-0.9%)

- ODDO BHF lowers the target price for SCHOTT PHARMA from EUR 38 to EUR 37. Outperform. $1SXP (+0.78%)

- BARCLAYS lowers the target price for RIO TINTO from GBP 61 to GBP 60. Overweight. $RIO (-3.78%)

- JPMORGAN downgrades STRÖER from Overweight to Neutral and lowers target price from EUR 79 to EUR 57. $SAX (-4.74%)

05.12.2024

Bitcoin breaks through $100,000 + JPMorgan upgrades SAP to 'Overweight' + Jefferies raises Hellofresh to 'Buy' with target up to EUR 16.50 + Auto1 and Evotec return to MDax

Bitcoin $BTC (-0.45%)jumped above $100,000 during the night

- The $100,000 mark has been a mark that has been eagerly awaited in the crypto scene for years.

- Tonight, Bitcoin briefly jumped to $104,000.

- Now, of course, everyone is waiting to see what happens next. Will the journey continue or will the correction come now? What do you think?

JPMorgan sees SAP $SAP (+0.5%)as the favorite for 2025

- The US bank JPMorgan has left its rating for SAP at "Overweight" with a target price of 260 euros.

- Analyst Toby Ogg maintains his preference for SAP and Sage in his 2025 outlook for the software and IT industry, which was published on Wednesday.

- Both shares are also on the "Analyst Focus List".

- SAP's sales growth is likely to accelerate until 2028.

Jefferies raises Hellofresh $HFG (+0.98%)to 'Buy' - target raised to 16.50 euros

- The analyst firm Jefferies has more than doubled its price target for Hellofresh shares from 7.50 to 16.50 euros and upgraded the shares from "Hold" to "Buy".

- The cooking box mail order company is ending two difficult years with a new focus on operating profit and cash flow, wrote analyst Giles Thorne in his buy recommendation published on Thursday.

- These plans are underpinned by stabilized box sales and growth in the newer ready-to-eat segment.

- In addition, there are still opportunities for optimization.

Auto1 $AG1 (-2.35%)and Evotec $EVT (+0.28%)return to MDax - No changes in the Dax

- Hamburg-based Evotec was only forced to leave the MDax in September, but since then the shares have risen again in view of a possible sale of the company.

- Auto1 was already a member of the MDax until spring 2022.

- As expected, there are no changes in the leading Dax index of the 40 heaviest stocks.

- Three companies are moving up to the SDax: The software company Nexus is benefiting from a takeover bid worth around 1.1 billion euros from financial investor TA Associates, which caused its shares to rise sharply.

- The scientific publisher Springer Nature made the leap just over two months after its IPO.

- The changes will take effect on December 23, one day before Christmas Eve.

Thursday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

Qualcomm USD 0.85

- Quarterly figures / company dates USA / Asia

22:05 Hewlett Packard Enterprise Annual results

- Quarterly figures / company dates Europe

07:00 Aurubis detailed annual results and annual report

10:00 Merck KGaA: Media event "Artificial Intelligence at Merck"

11:00 KWS Saat AGM

14:00 Aurubis Analyst Conference | Safran Capital Markets Day

No time specified: Fuchs SE Capital Markets Day

- Economic data

08:00 DE: New orders October seasonally adjusted FORECAST: -2.0% yoy previous: +4.2% yoy

11:00 EU: Retail Sales October Eurozone FORECAST: -0.3% yoy previous: +0.5% yoy

14:30 US: Initial jobless claims (week) FORECAST: 215,000 Previous: 213,000

14:30 US: Trade Balance October FORECAST: -74.80 bn USD previously: -84.36 bn USD

⬆️⬆️⬆️

- GOLDMAN raises the price target for DELL from USD 155 to USD 165. Buy. $DELL (+0.26%)

- GOLDMAN raises the price target for ANALOG DEVICES from USD 247 to USD 261. Buy. $ADI (+0.23%)

- GOLDMAN raises the price target for HP INC from USD 35 to USD 38. Neutral. $HPQ (+0.27%)

- WARBURG RESEARCH raises the price target for VONOVIA from EUR 40.20 to EUR 42.30. Buy. $VNA (-0.47%)

- WARBURG RESEARCH upgrades STRATEC from Hold to Buy. Target price 40 EUR. $SBS4

- DEUTSCHE BANK RESEARCH raises the price target for DEUTSCHE BÖRSE from EUR 235 to EUR 237. Buy. $DB1 (-0.46%)

- MORGAN STANLEY raises the target price for DEUTSCHE TELEKOM from EUR 33 to EUR 38. Overweight. $DTE (+0.17%)

- GOLDMAN raises the price target for TRATON from EUR 31.80 to EUR 35.50. Neutral. $8TRA (+1.87%)

- GOLDMAN raises the price target for BRENNTAG from EUR 94 to EUR 95. Buy. $BNR (+0.03%)

- BERENBERG upgrades EQUINOR from Hold to Buy and raises target price from NOK 290 to NOK 325. $EQNR (-1.87%)

- JPMORGAN raises the target price for BEIERSDORF from EUR 150 to EUR 160. Overweight. $BEI (-0.37%)

- JPMORGAN upgrades HENKEL from Neutral to Overweight and raises target price from EUR 82 to EUR 100. $HEN (-0.49%)

- JPMORGAN upgrades BRITISH AMERICAN TOBACCO to Neutral. $BATS (-0.67%)

- JPMORGAN raises the price target for EON from EUR 15.50 to EUR 16. Overweight. $EOAN (+0.54%)

- JPMORGAN raises the target price for AUTO1 from EUR 12.10 to EUR 17.10. Overweight. $AG1 (-2.35%)

⬇️⬇️⬇️

- STIFEL lowers the price target for SIEMENS from EUR 207 to EUR 202. Buy. $SIE (-0.22%)

- JPMORGAN lowers the price target for HP INC from USD 41 to USD 40. Overweight. $HPQ (+0.27%)

- WARBURG RESEARCH lowers the price target for LANXESS from EUR 40 to EUR 37. Buy. $LXS (+0.03%)

- CITIGROUP lowers the price target for BASF from EUR 49 to EUR 46. Neutral. $BAS (+0.82%)

- RBC lowers the target price for COMMERZBANK from EUR 18 to EUR 17.25. Sector Perform. $CBK (-0.37%)

- RBC lowers the target price for ING from EUR 17.50 to EUR 16.75. Sector-Perform. $ING (+0%)

- RBC lowers the price target for BNP PARIBAS from EUR 79 to EUR 78. Outperform. $BNP (-0.87%)

- JPMORGAN lowers the price target for ELRINGKLINGER from EUR 6.70 to EUR 6. Neutral. $ELLRY (+1.9%)

- JPMORGAN lowers the price target for SYMRISE from EUR 130 to EUR 120. Overweight. $SY1 (+1.77%)

Trending Securities

Top creators this week