$KSPI (+0.79%)

$NCLH (-4.26%)

$STNE (-1.16%)

$BEI (+2.09%)

$SE (-4.37%)

$ONON (-3.21%)

$TGT (-0.68%)

$GTLB (-2.05%)

$CRWD (-0.42%)

$BAYN (-3.23%)

$WIX (-1.37%)

$ADS (-1.48%)

$AVGO (+3.01%)

$DHL (+1.57%)

$R3NK (+3.68%)

$JD (+8.83%)

$BILI (-3.41%)

$1913 (-7.45%)

$MRK (-1.9%)

$MRVL (+10.36%)

$GPS (-5.74%)

$COST (+2.33%)

$IOT

$LHA (-0.05%)

Discussion about STNE

Posts

14Quarterly figures 02.03-06.03.26

2026 line-up with AI and fin(tech) wikifolios

Hello everyone, I follow your posts with great interest and despite more than 20 years of stock market experience, I have learned a lot from you regarding important key figures of growth companies. I have now applied this knowledge to identify companies in the Tech/AI, Fin(tech) and Biotech sectors that are typically underrepresented in ETFs.

All fulfill strict criteria such as

- Rule of 40 > 40

- PEG < 2

- 5y CAGR >10%

- Moderate valuation/undervaluation according to Investing.com

I have mapped the companies in two wikifolios:

wikifolio 1 focuses on profitable scaling ("Profitable Growth") and the infrastructure that makes modern technologies such as artificial intelligence possible: https://www.wikifolio.com/de/de/w/wf11ainfin

This contains the following stocks:

- AI Infrastructure: $CRWV (+4.06%)

$LITE (-6.59%)

$VRT (+0.45%)

$ANET (-1.26%)

$MU (-2.41%) - High-quality Fintech: $NU (-2.05%)

$STNE (-1.16%)

$HOOD (-2.94%) - Biotech-Compounder: $NBIX (-2.76%)

$VRTX

wikifolio 2 combines the exponential growth of digital fintech platforms with the cyclical earnings power of established capital market compounders. The approach relies on digital transformation (crypto integration, neobanking) and traditional institutional advisory (M&A, IPOs) outperforming together in a diversified financial ecosystem: https://www.wikifolio.com/de/de/w/wf11fintec

This contains the following values

- Digital Disruptors & Neo-Banking: $SOFI (-1.21%)

$COIN (-4.23%)

$NU (-2.05%) - Capital Market Architects: $EVR (-6.69%)

$PJT (-2.39%)

$MC (-3.68%)

$MS (-1.72%)

$JPM (-2.03%)

$EXX1 (-1.44%) - Financial Infrastructure (Defensive Moats): $MCO (-1.67%)

$MA (-1.61%)

Now I am curious about your opinion! What do you think of the wikifolios and would you invest in them? Which stocks would you replace, which are missing and which do you particularly like?

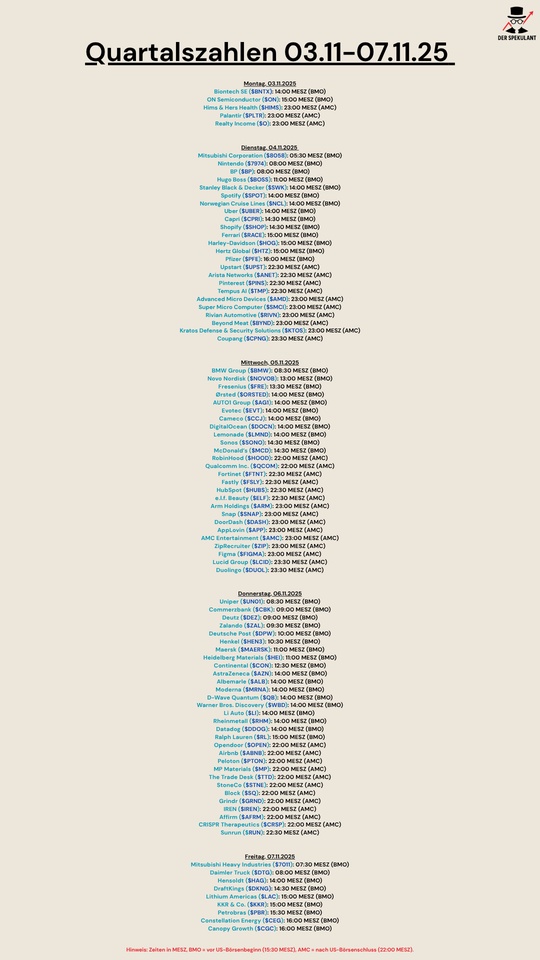

Quartalszahlen 03.11.25-07.11.15

$BNTX (-0.57%)

$ON (-4.95%)

$HIMS (-1.53%)

$PLTR (+4.2%)

$O (-0.26%)

$8058 (-3.8%)

$7974 (-0.17%)

$BP. (+2.37%)

$BOSS (-0.31%)

$SWK (-3.39%)

$SPOT (+0.9%)

$N1CL34

$UBER (-0.61%)

$CPRI (-2.75%)

$SHOP (-1.49%)

$RACE (-1.43%)

$HOG (-0.61%)

$HTZ (-2.36%)

$PFIZER

$UPST (-3.75%)

$ANET (-1.26%)

$PINS (+0.89%)

$TEM (+0%)

$AMD (-0.06%)

$SMCI (-0.61%)

$RIVN (+2%)

$BYND (-1.64%)

$KTOS (+5.79%)

$CPNG (-4.42%)

$BMW (-2%)

$NOVO B (-0.87%)

$FRE (+0.55%)

$ORSTED (-1.84%)

$AG1 (-1.88%)

$EVT (-1.3%)

$CCO (-2.04%)

$DOCN (-0.97%)

$LMND (+0.65%)

$SONO (-6.25%)

$MCD (-0.53%)

$HOOD (-2.94%)

$QCOM (+0.06%)

$FTNT (-1.29%)

$FSLY (+3.45%)

$HUBS (-0.44%)

$ELF (+0.65%)

$ARM (-2.98%)

$SNAP (-4.13%)

$DASH (-2.38%)

$APP (-1.9%)

$AMC (-6.62%)

$ZIP (+4.3%)

$FIG (-3.83%)

$LCID (+0%)

$DUOL

$UN0 (-0.07%)

$CBK (-3.36%)

$DEZ (-3.78%)

$ZAL (+0.3%)

$HEN (-0.82%)

$MAERSK A (+1.75%)

$HEI (-3.35%)

$CON (-3.89%)

$AZN (-2.23%)

$ALB (+0.35%)

$MRNA (-3.15%)

$QBTS (+3.3%)

$WBD (-0.09%)

$LI (+2.07%)

$RHM (+1.37%)

$DDOG (+1.62%)

$RL (-3.79%)

$OPEN (-2.31%)

$ABNB (-1.34%)

$PTON (-0.76%)

$MP (-2.63%)

$TTD (-3.38%)

$STNE (-1.16%)

$SQ (-2.06%)

$GRND (-0.5%)

$IREN (-2.55%)

$AFRM (-2.37%)

$CRISP (-7.38%)

$RUN (+0.01%)

$7011 (-1.52%)

$DTG (-1.81%)

$HAG (+0.81%)

$DKNG (-1.63%)

$LAC (+0.08%)

$KKR (-3.97%)

$PETR3 (+3.04%)

$CEG

$WEED (-1.62%)

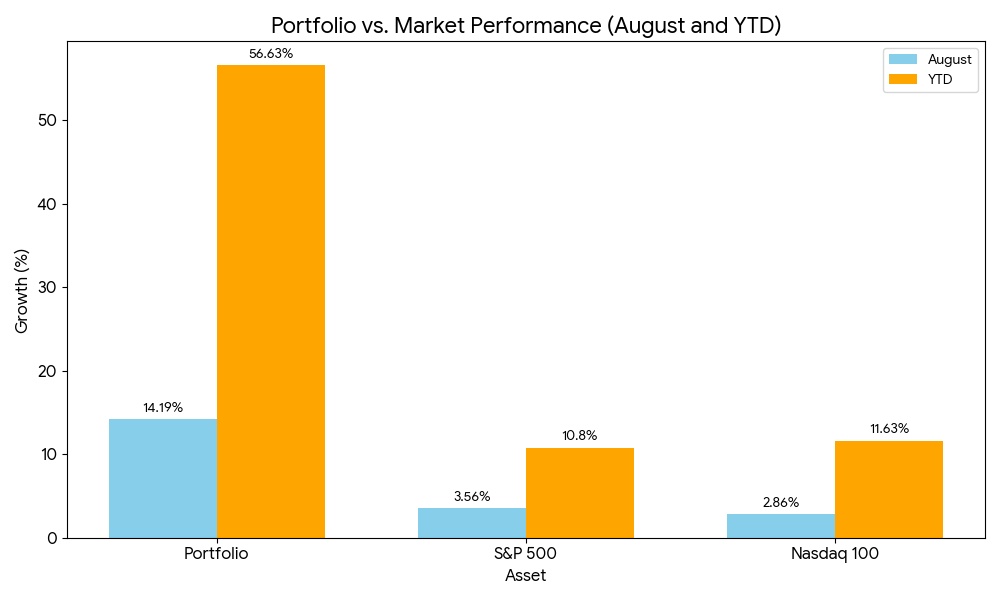

August 2025 Recap - And the winners are...

August was another outstanding month for my portfolio at eToro, closing with +14.19% growth.

S&P 500: +3.56% in August

Nasdaq 100: +2.86% in August

Looking at the bigger picture, my YTD performance is now +56.63%, while the:

S&P 500 is up around +10.80%

Nasdaq 100 is up around +11.63%

This clear gap shows that my investment formula – Fundamentals + Algorithm + Patience – is delivering results.

📈 Top performers in August:

Jumia ($DE000A2TSMN4 )

NIO ($9866 (+1.45%) )

Crypto.com ($CRO (-1.62%) )

PepsiCo ($PEP (-1.76%) )

StoneCo ($STNE (-1.16%) )

For September, my focus is on protecting the portfolio by diversifying further:

Expanding into Hong Kong

Adding exposure in Europe

Entering the UAE markets

This multi-market approach helps reduce risk while keeping opportunities open in different geographies.

👉 My strategy remains consistent: patience, fundamentals, and letting my algorithm highlight the right buying moments.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗲𝗿𝗳𝗲𝗰𝘁 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗰𝗼𝗽𝘆 𝗺𝗲 𝗼𝗻 𝗲𝗧𝗼𝗿𝗼—𝗱𝗼𝗻’𝘁 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗴𝗿𝗼𝘄 𝗮𝗹𝗼𝗻𝗴𝘀𝗶𝗱𝗲 𝗺𝘆 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice.

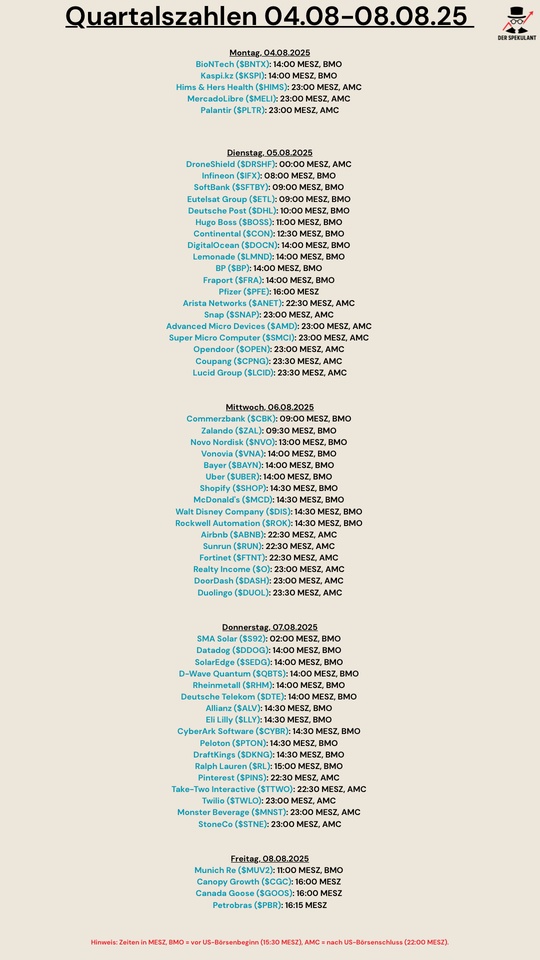

Quartalszahlen 04.08-08.08.2025

$BNTX (-0.57%)

$KSPI (+0.79%)

$HIMS (-1.53%)

$MELI (-0.5%)

$PLTR (+4.2%)

$DRO (+4.92%)

$IFX (-6.66%)

$9434 (+0.86%)

$FR0010108928

$DHL (+1.57%)

$BOSS (-0.31%)

$CONTININS

$DOCN (-0.97%)

$LMND (+0.65%)

$BP. (+2.37%)

$FRA (-0.1%)

$PFIZER

$SNAP (-4.13%)

$AMD (-0.06%)

$SMCI (-0.61%)

$OPEN (-2.31%)

$CPNG (-4.42%)

$LCID (+0%)

$CBK (-3.36%)

$ZAL (+0.3%)

$NOVO B (-0.87%)

$VNA (-0.52%)

$BAYN (-3.23%)

$UBER (-0.61%)

$SHOP (-1.49%)

$MCD (-0.53%)

$DIS (-1.46%)

$ROK (-2.12%)

$ABNB (-1.34%)

$RUN (+0.01%)

$FTNT (-1.29%)

$O (-0.26%)

$DASH (-2.38%)

$DUOL

$S92 (-1.86%)

$DDOG (+1.62%)

$SEDG (-1.86%)

$QBTS (+3.3%)

$RHM (+1.37%)

$DTE (-0.51%)

$ALV (-1.5%)

$LLY (+0.27%)

$CYBR

$PTON (-0.76%)

$DKNG (-1.63%)

$RL (-3.79%)

$PINS (+0.89%)

$TTWO (-1.22%)

$TWLO (+1.29%)

$MNST (-1.09%)

$STNE (-1.16%)

$MUV2 (-1.09%)

$WEED (-1.62%)

$GOOS (-4.48%)

$PETR3T

$ANET (-1.26%)

StoneCo Ltd. reported earnings Q4 FY2024 results ended on Dec 31, 2024

- Revenue: R$3.61B, +11.1% YoY

- Net Income: R$665.6M, +18.1% YoY

- Adjusted EPS: R$2.26, +25.8% YoY

CEO Pedro Zinner: "Despite a challenging macroeconomic environment, we successfully navigated market complexities, maintaining strong growth and improving profitability."

🌱Revenue & Growth

- Total TPV: R$143.9B, +16.1% YoY

- MSMB TPV: R$128.4B, +21.1% YoY

- Financial Services Revenue: R$3.19B, +11.2% YoY

- Software Revenue: R$416.6M, +14.7% YoY

💰Profits & Financials

- Gross Profit: R$1.70B, +12.9% YoY

- EBT: R$778.1M, +21.9% YoY

- Net Cash: R$4.70B, -6.9% YoY

- MSMB Take Rate: 2.20%, -7bps QoQ

📌Business Highlights

- MSMB Financial Services Take Rate improved to 2.55%, exceeding guidance

- Retail deposits surged to R$8.7B, +42% YoY

- Credit portfolio expanded nearly 4x to R$1.2B

- AI-powered customer service reduced call volumes by ~45%

- R$1.6B in share buybacks during 2024

🔮Future Outlook

- Preparing for higher long-term interest rates in 2025

- Expanding banking and credit services to drive further monetization

- Retail deposit growth expected to outpace TPV growth

- Focus on AI adoption for operational efficiency and customer engagement

Inter & Co - An underestimated fintech player from Brazil?

Inter & Co $INTR (-2.13%) is a Brazilian fintech company that started out as a digital bank and now offers a wide range of financial services. The company is listed on the Nasdaq and is one of the fastest growing digital banks in Latin America. But what makes Inter & Co special, how does it compare to the competition and what are the opportunities and risks?

Overview: What is Inter & Co?

Inter & Co started out as a traditional bank, but in recent years has transformed itself into a digital financial platform with a wide range of products:

🔘 Digital banking: free current account, credit cards, transfers

🔘 Loans & mortgages: consumer loans, SME financing

🔘 Investment & trading: shares, ETFs, cryptocurrencies

🔘 Insurance: Various policies for customers

🔘 E-commerce & cashback: Inter Shop combines online shopping with cashback systems

The business model aims to bundle as many services as possible in one app ("super app" approach), similar to Nubank or MercadoLibre with MercadoPago.

Competition: Who are the competitors?

Inter & Co is in direct competition with other digital banks and fintechs in Brazil and Latin America. The most important players are:

🔸Nubank $NU (-2.05%) The market leader with over 80 million customers in Brazil, Mexico and Colombia. Very strong in credit cards and loans.

🔸PagSeguro $PAGS (-3.68%) : Focus on payment services and small businesses.

🔸StoneCo $STNE: (-1.16%) Also strong in the payment sector, but with more focus on merchant solutions.

🔸Banco do Brasil $BBAS3 The traditional banks that are increasingly developing digital offerings.

Inter & Co is differentiated by its broad platform, which goes beyond banking and is strongly integrated into e-commerce and cashback.

Opportunities: Why is Inter & Co interesting?

🟢 Growth market Brazil: The digitalization of the financial sector is progressing rapidly in Latin America. Millions of people are still underserved and the demand for simple digital solutions is high.

🟢 Scalable model: Inter & Co has over 30 million customers (as of 2024) and continues to grow. The platform approach enables cross-selling of financial products and increases customer loyalty.

🟢 Profitability in sight: While many fintechs are making high losses, Inter & Co has its cost structure under control and could become profitable in the medium term.

🟢 Expansion potential: In addition to Brazil, Inter & Co is slowly expanding into other Latin American markets. If growth continues, the share could benefit from rising market shares in the long term.

🟢 E-commerce integration: The combination of banking and shopping platform (Inter Shop) brings additional sales potential. This model is unique in Brazil and could be a strong source of income in the long term.

Risks: What could go wrong?

⚠️Starker Competition: Nubank $NU (-2.05%) is an extreme competitor with massive financial resources. Traditional banks are also responding with digital offerings.

⚠️ Interest rate environment & loan defaults: Brazil traditionally has high interest rates. If the interest rate level continues to change, it could affect lending and therefore the profits of Inter & Co.

⚠️ Slow internationalization: While Nubank is already very active in Mexico and Colombia, Inter & Co has so far focused almost exclusively on Brazil. International expansion could prove difficult.

⚠️ Macroeconomic uncertainties: Brazil is susceptible to economic fluctuations and currency risks. A recession or inflation could have a negative impact on credit quality.

Conclusion: Is an investment worthwhile?

Inter & Co is definitely an exciting fintech with an innovative business model. The integration of banking, investments and e-commerce in one platform offers enormous potential. The market in Brazil continues to grow and the company has a solid customer base.

However, Inter & Co also faces major challenges: Competition is tough and expansion is slower than at Nubank. In addition, profitability and scaling have yet to be proven.

For risk-tolerant investors with a long-term horizon, Inter & Co could be an interesting turnaround opportunity - especially if the company continues to gain market share and becomes more profitable.

What do you think? Is Inter & Co a potential high-flyer or more of a risk investment? I look forward to hearing your opinions!

Hi All, After many months of playing around with options and bying into positions this is where I think I am going to land with my buy to hold portfolio with ideally a 10 year horizon. Any thoughts or observations welcome. Thank you.

Cash - 6%

$SUSW (-0.78%) MSCI WORLD SRI ETF - 10%

$XXSC (-0.12%) MSCI Euro Small Cap ETF - 5%

$CRWD (-0.42%) - 5%

$MSFT (+0.03%) - 4%

$SHOP (-1.49%) - 5%

$SMH (-1.13%) Semi Conductor ETF - 5%

$AAPL (-0.97%) Apple - 3%

$PAYC (-1.51%) Paycom - 2%

$PATH (-1.14%) UiPath - 2%

$VRTX (-1.73%) Vertex Pharma - 7%

$GILD (-0.38%) Gilead Sciences - 4%

$AZN (-2.23%) AstraZeneca - 3%

$CRSP (-3.22%) Crispr - 2%

$AMZN (-1.39%) Amazon - 5%

$MELI (-0.5%) Mercado Libre - 3%

$BKNG (-1.85%) Booking.com - 2%

$GOOGL (-0.25%) Alphabet - 3%

$META (-1.97%) Meta - 3%

$ADYEN (-0.4%) Adyen - 4%

$STNE (-1.16%) StoneC0 - 3%

$ISP (-2.75%) Intesa Sanpaolo - 3%

$ALPH Alpha Group International - 2%

$WHA (-2.42%) Wereldhave - 2%

$BYG (-0.89%) Big Yellow Group - 2%

$DHL (+1.57%) DHL - 2%

$UKW (+0.9%) Green Coat UKW - 2%

$ENPH (-0.2%) Enphase - 2%

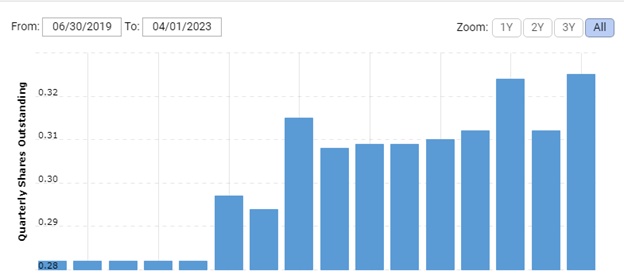

Stock analysis StoneCo

$STNE (-1.16%)

StoneCo Ltd. is a provider of financial services (84%) and software (15%). StoneCo is active in an exciting emerging market: Brazil.

But first, the key figures:

Price: $13.25 (YTD +40%) (-85% from ATH) (-58% IPO 2018).

KUV: 2

P/E RATIO: 4730

forward P/E ratio: ~18

Revenue growth yoy: +31% (Q1 2023)

5y avg. Revenue growth: +74.44%

EBIT growth yoy: 240.56%

5y avg. EBIT growth: 40.90%

I became aware of the company mainly due to the catastrophic development of the share price, which resulted in a (supposedly) favorable valuation of a fast growing company.

What happened?

In May 2021, StoneCO acquired a stake in Banco Inter for the equivalent of $471 million dollars. At the time, StoneCo had a valuation of approximately $20 billion (~$4.15 billion today). However, this stake rapidly depreciated, resulting in a -90% loss (StoneCo fully liquidated its stake in Banco in February 2023). Accordingly, the losses had a negative impact on the results of the last quarters and triggered a crash in the share price. StoneCo had not only bought a completely overpriced stake, but at the same time had borrowed in a foreign currency (dollars) with rising interest rates. The falling exchange rate of the Brazilian real to the U.S. dollar also played an important role here. To finance the deal, some new shares had to be issued (see picture no. 1).

Why should the company or the share be interesting at all?

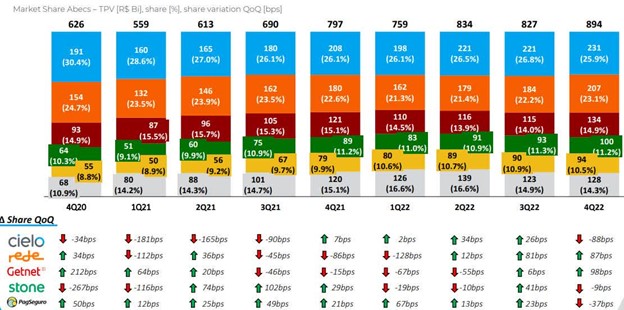

The management was gradually replaced after the gross blunder. A new CFO and a new CEO were hired. With Pedro Zinner, the company is now headed by an experienced CEO who had already achieved a successful turnaround at Envea.Although the Banco deal eroded StoneCo's fundamentals, the operating business continued to perform very well. StoneCo continues to record strong growth and is even gaining market share (see picture no.2). Profits are being written again and a large cash position is being built. The negative one-off effects that affected the results are now a thing of the past and nothing seems to stand in the way of strongly increasing profits. Measured against the growth rates, a forward P/E ratio of 18 is very favorable, even if growth is slowing down somewhat. Debt is now covered by assets again and the company is in a much better position than 2 years ago.Macro environment: The Brazilian Central Bank currently has an interest rate of 13.75% after strong interest rate hikes. Currently, inflation there is around 4%, close to the central bank's target of 3.25%. So a rate cut in the near future is definitely in the realm of possibility - which could provide further upside for the stock price.

Conclusion:

In my opinion, with StoneCo you get a fast-growing, yet profitable company in a fast-growing sector of an exciting emerging market. The downside is limited due to the crashed share price, currently the company is undervalued (by my personal valuation standards), but it also needs to win back investor confidence first. Nevertheless we are dealing here with a ailing company in a difficult market environmentwhich is also exposed to political risks in Brazil. So please inform yourself again intensively before you click here on buy :D

No investment advice and information to the best of my knowledge based on the sources.

Sources:

https://investors.stone.co/news-releases/news-release-details/completion-ceo-transition

https://investors.stone.co/static-files/c62e910c-9608-425f-9ff7-c56c335f0087

Also: MSN Finance, Yahoo Finance, MarketScreener

Trending Securities

Top creators this week