Hello and have a nice evening,

I would like to ask you for a portfolio evaluation and suggestions for improvement 👀

Or roast me and tell me just one ETF...🙂↔️

Objective:

Long-term wealth accumulation

(Reach the 100k for now - I'm only at 2k but that will bestimmt🤝🏼)

About me:

20Y savings sum 150-200€ month

Trained as a real estate agent (therefore Realty haha)

Investing since the start of training 1.09.23

I wanted to go through my positions individually and tell you why I bought the position and what I think about it at the moment:

💚 - Stay in

( or convince me otherwise)

💛- Divided

MSCI ACWI - $ACWI 💚

An Etf solution - core of the portfolio should make up ~ 40-50% of the portfolio in the long term

MSCI India - $QDV5 (+1.98%) 💚

deliberate doubling with share in ACWI - see great potential and economic growth here

Deka Fond - 💚

I know, no savings bank funds, but these are my VWL and they are worthwhile for me - very tech-heavy and currently yielding good returns

Realty - $O (+1.13%) 💚

Solid monthly payer with great upside potential if interest rates fall

BAT - 💛 $BATS (+2.33%)

Great upside potential - comeback if new tobacco-free products conquer the market

+ High dividend

DHL - 💚 $DHL (+0.52%)

Burggraben - DE - Dividend - Industry pick

Blackrock 💚- $BLK

Burggraben - Great market power + growth + dividend(growth)

United Health 💚 - $UNH (-0.11%)

Moat + dividend growth + stability + growth

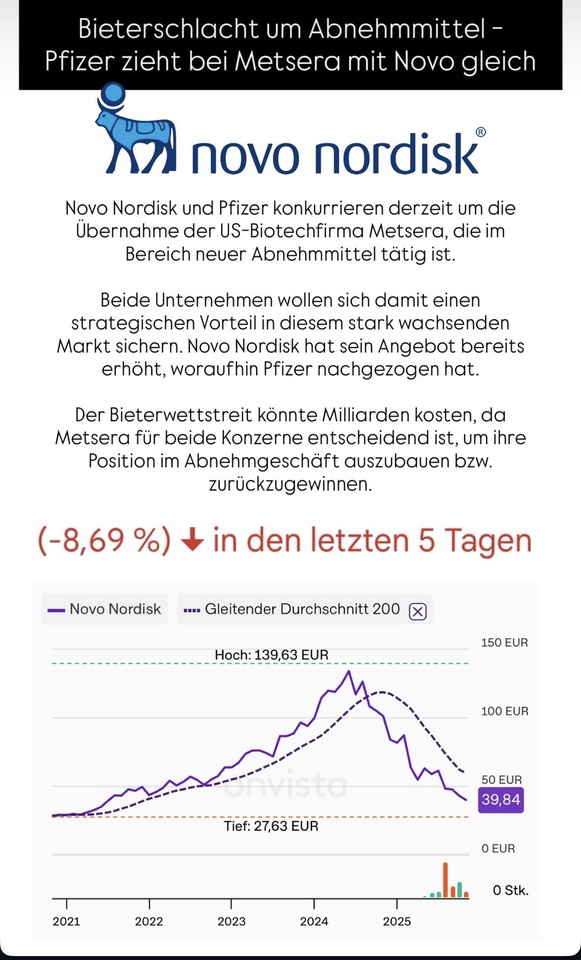

Pfizer 💛 - $PFIZER

Big pharma company + comeback potential + dividend

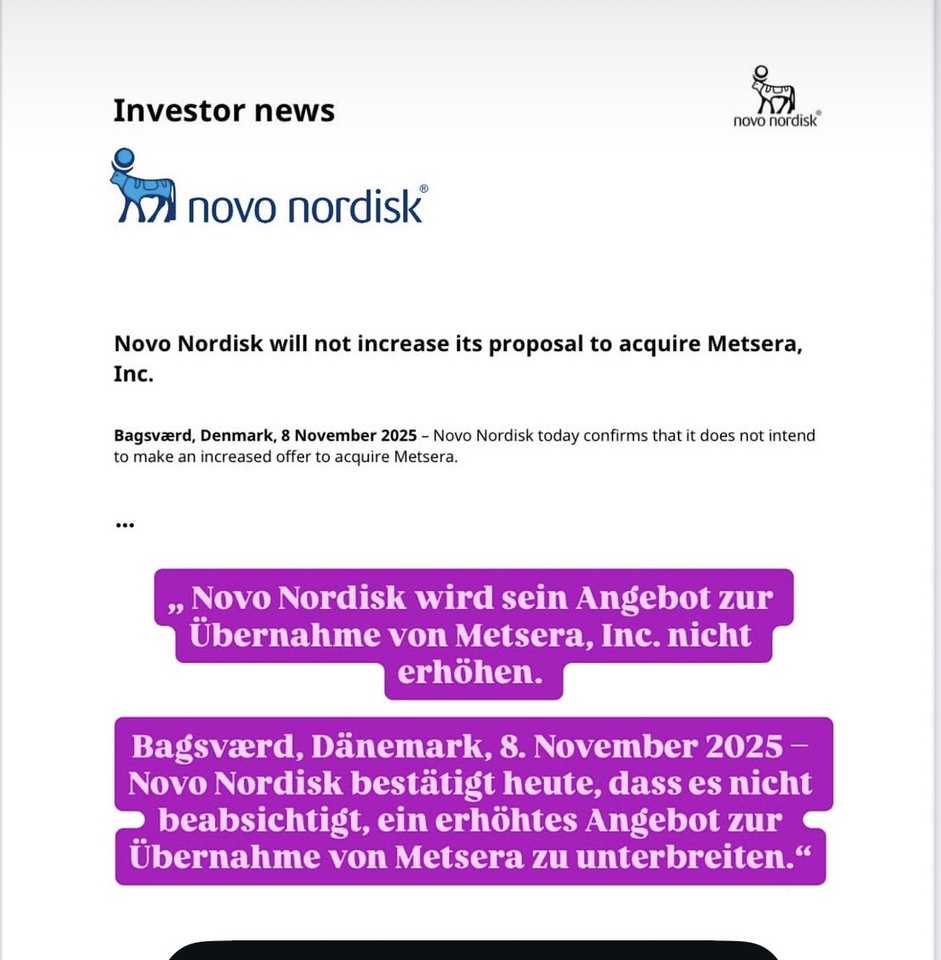

(I will probably sell - possibly buy diabetes pharma company $LLY (-1.18%)

$NOVO B (-2.32%)

Monster 💚 - $MNST (+1.52%)

Growth rocket 🚀 + brand power + no debt

Nextera 💚 - $NEE (+0.49%)

Monopoly position + benefits from falling interest rates + divi(-growth) + utility pick

Volkswagen 💛 - $VOW (+0.93%)

Brand power/portfolio - DE - Dividend - Comeback

ASML 💚💚 - - $ASML (+0.76%)

NL/EU - moat - growth rocket - great future potential

P&G💚 $PG (+0.98%)

Blue chip - Stability - Brand power/portfolio

My watchlist:

$MC (+4.98%)

$DE (+0.58%)

$V (+0.55%)

$META (+1.59%) + Pharma

I have now learned that dividends do not play a major role at my age (more focus on growth in the future), but they all motivate me at times💪.

Unfortunately, I have few tech companies, which has left me with a lot of returns...Tech/IT is still the largest sector in my portfolio with just under 20%🤡

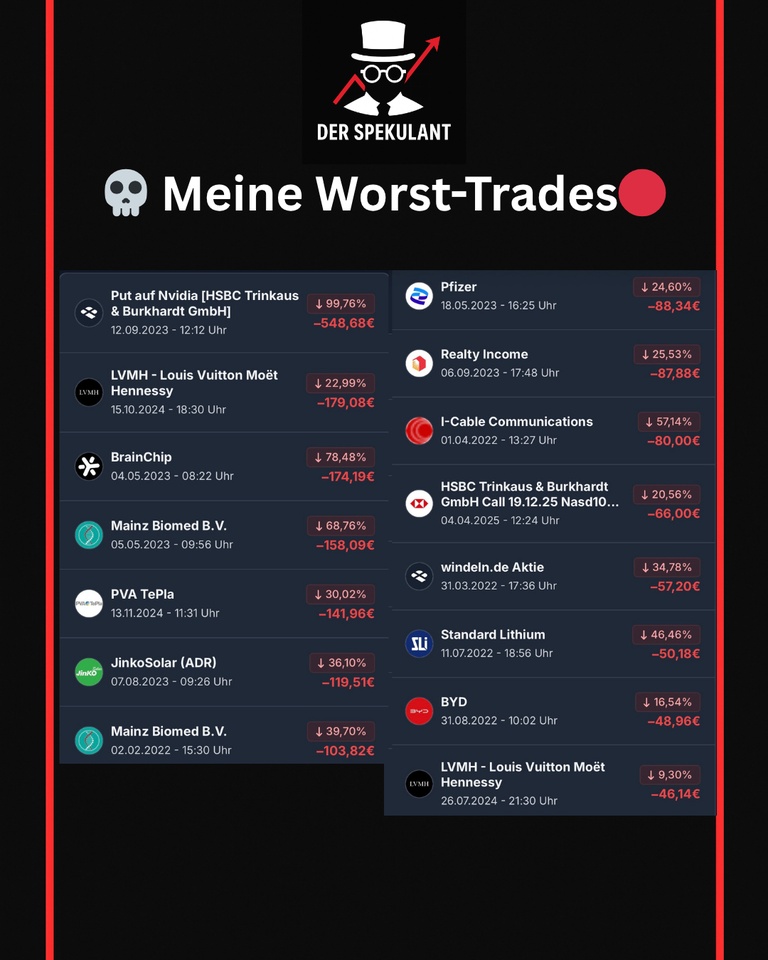

Initially paid a lot of learning money through MPT and too many positions - forgive me 🙈

I'm looking forward to your roast and hope for more than 1ETF solution ;)