Today I'm going to show you my best and worst trades since the start of my investment journey. No show, no excuses - just real numbers and learnings.

🟢 My top 15 trades

📈 From Rheinmetall to Palantir to Ferrari - some positions really took off.

Biggest single gain: +131 % for Rheinmetall💪

→ The majority came from strategically placed opportunities, not luck.

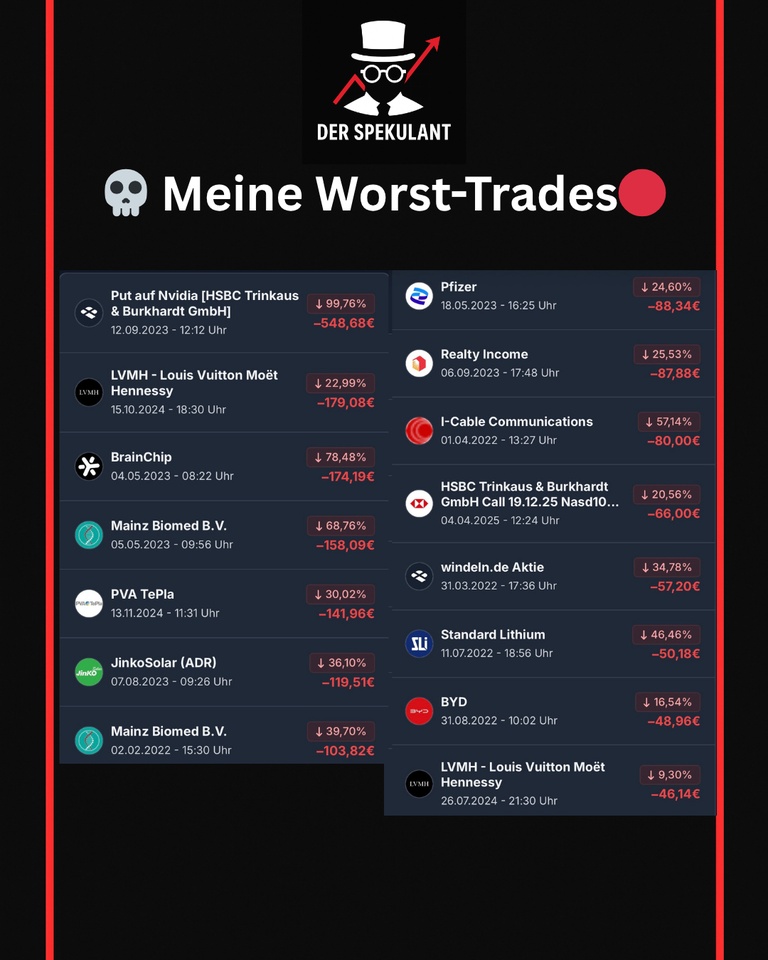

🔴 My flop 15 trades

📉 Nvidia put, Mainz Biomed, BrainChip... The biggest flop?

-99.76 % with a warrant on Nvidia 😬

→ The lesson: highly speculative bets quickly go against you - especially without a plan.

📘 My most important learning

I learned this lesson in my first year of investing:

Short-term trading may work from time to time - but not in the long term.

Today I have a clear strategy:

✅ Core-satellite

✅ Focus on quality

✅ Discipline & long-termism

🧠 Why am I sharing this?

Transparency is not a buzzword for me - it's a duty.

Losses are part of it. If you only talk about your profits, you're only telling half the truth.

#Trading

#Fehler

#Investieren

#Transparenz

#Learnings

#DepotEinblick

#DerSpekulant

#Getquin

$RHM (+0.94%)

$NVDA (-0.32%)

$MC (+1.27%)

$MYNZ

$BRN (+0.5%)

$COIN (-1.6%)

$RACE (+2.94%)

$TSLA (+0.01%)

$WDL1 (-3.17%)

$PLTR (-0.9%)

$PTON (+0.59%)

$9866 (+4.95%)

$MULN

$MRNA (+0.78%)

$VBK (+5.27%)

$JKS (+0.34%)

$TPE (+3.92%)

$PFIZER

$SLI (+1.24%)