- Markets

- Stocks

- Spotify Tech

- Forum Discussion

Spotify Tech

Price

Discussion about SPOT

Posts

139🎧 Spotify in a record rush: the Q4 figures are here!

$SPOT (-3.62%) has ended the year 2025 with a bang. The results published today for the fourth quarter show that the streaming giant is growing faster than ever before.

The highlights at a glance:

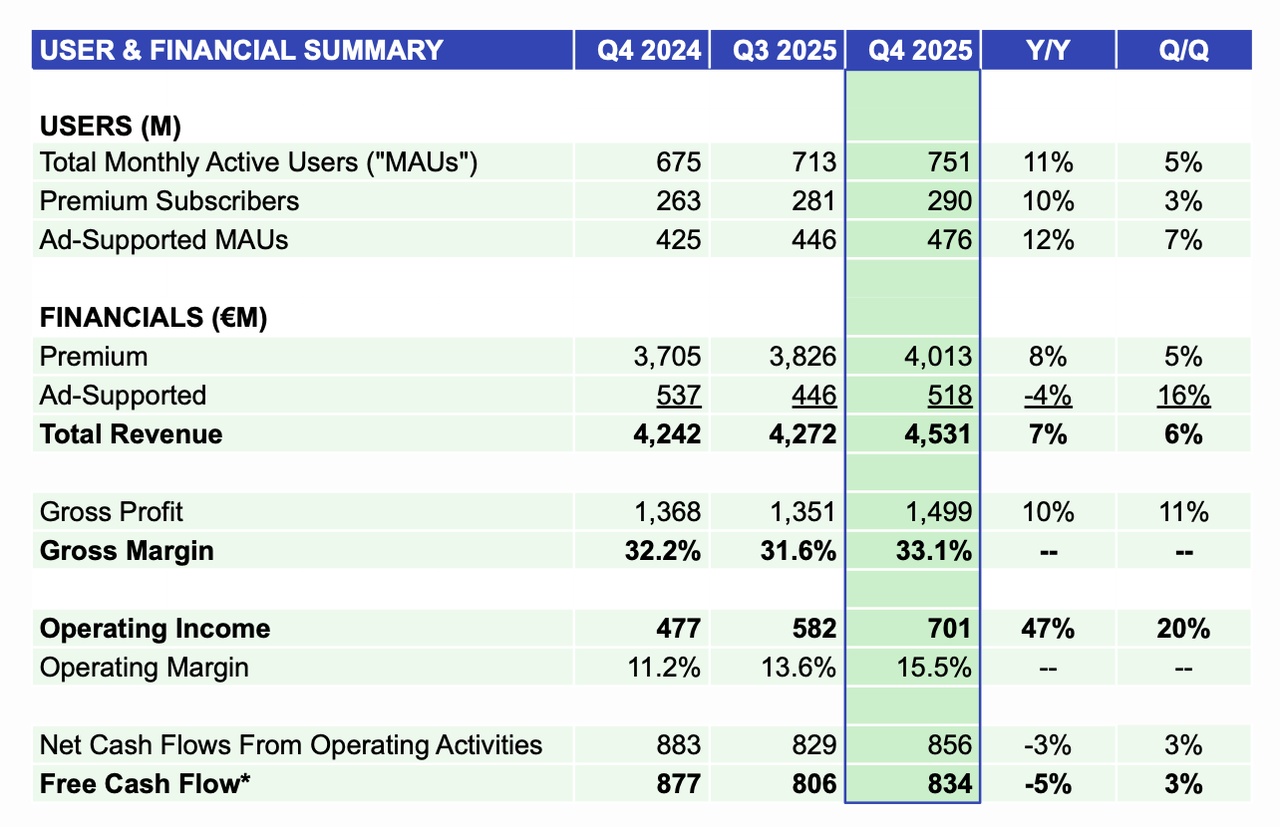

- 📈 Record number of users: Monthly active users (MAUs) climbed to 751 million (+11% YoY). With an increase of 38 million, it was the strongest quarter in the company's history!

- 💎 Premium growth: 290 million people now pay for their subscription (+10% YoY).

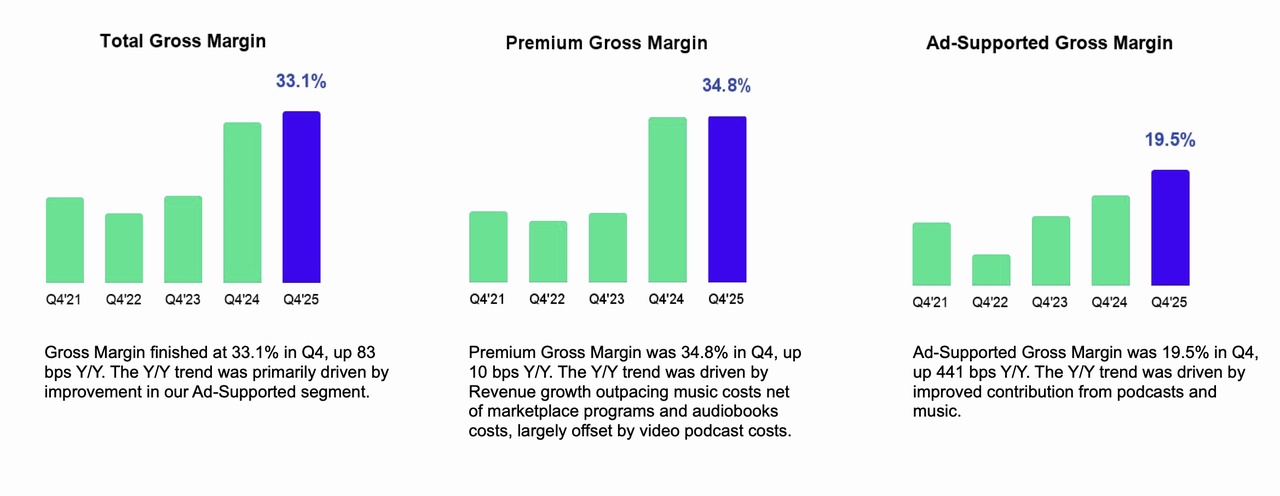

- 💰 Profitability: An operating profit of 701 million euros and a record gross margin of 33.1% show that Spotify has finally become a profit machine.

- 📊 Revenue: Quarterly revenue increased by 13% adjusted for currency effects to 4.5 billion euros.

Why are things going so well?

Especially the success of Spotify Wrapped (over 300 million users!) and the expansion of audiobooks and video podcasts have driven the figures upwards. The new co-CEO duo has declared 2026 to be the "year of ambition".

The stock market is celebrating: The share price has already reacted with a significant jump today. 🚀

#Spotify

#Earnings

#Streaming

#MusikBusiness

#Finanzen

#TechNews

#SpotifyWrapped

SPOTIFY Q4’25 EARNINGS HIGHLIGHTS

🔹 Revenue: €4.53B (Est. €4.52B) 🟢; +7% YoY

🔹 EPS: €4.43 (Est. €2.85) 🟢

🔹 MAUs: 751M (Est. 745.24M) 🟢; +11% YoY

🔹 Premium Subs: 290M; +10% YoY

🔹 OI: €701M; +47% YoY

Q1 Guide:

🔹 MAUs: 759M (Est. 752.45M) 🟢

🔹 Revenue: €4.5B (Est. €4.57B) 🟡

🔹 Premium Subs: 293M

🔹 Gross Margin: 32.8%

🔹 Operating Income: €660M

Other Metrics:

🔹 Gross Margin: 33.1%

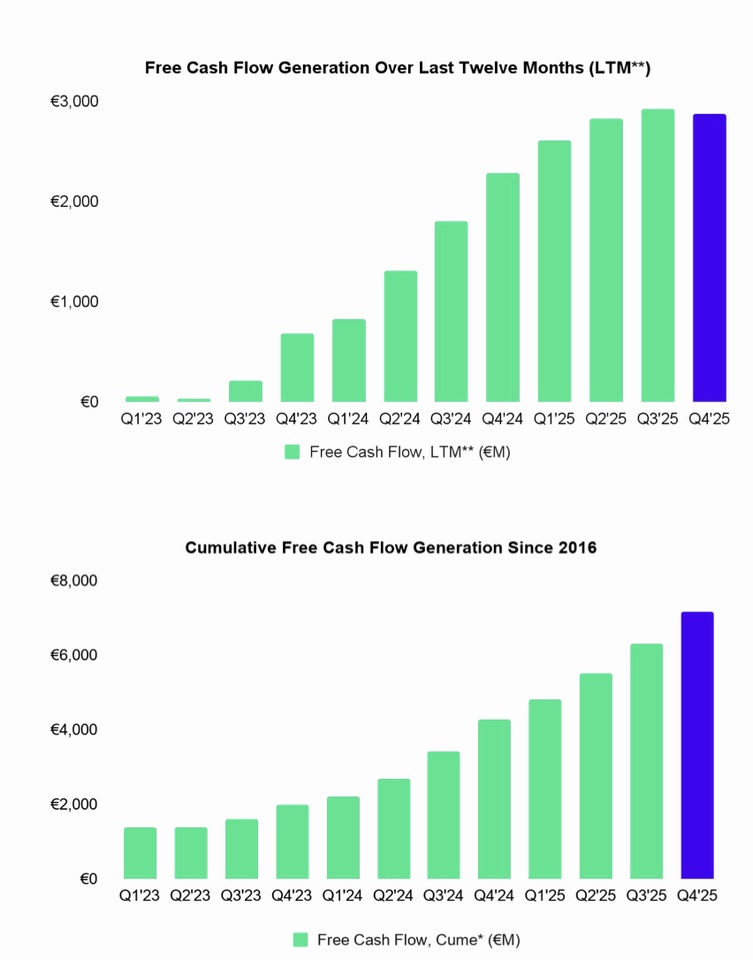

🔹 Free Cash Flow: €834M

Financials:

🔹 Net Income attributable to owners of the parent: €1,174M

🔹 Cash & Cash Equivalents: €5,258M

Capital Return:

🔹 Buybacks: $433M in Q4; $510M in FY25

Spotify Q4 Earnings Beat

$SPOT (-3.62%) exceeds analysts' expectations for Q4 earnings.

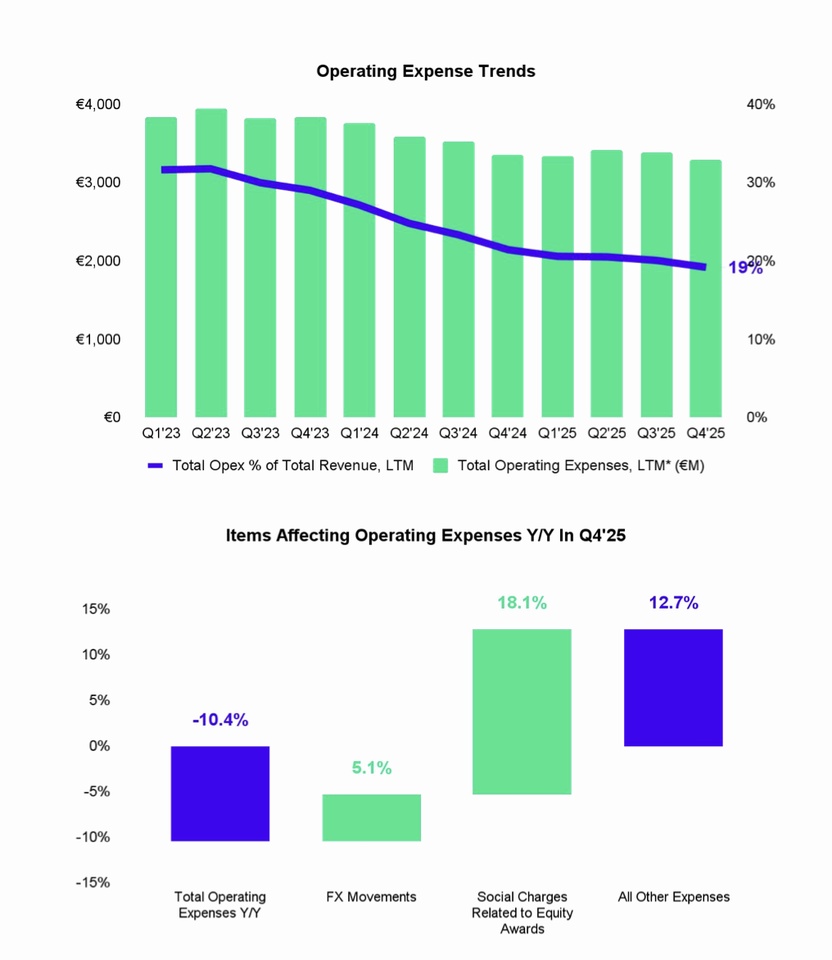

--> Operating income increases by 47% compared to the previous year.

--> Steadily decreasing operating expenses

--> Stable growth of "Premium" users

--> Rising FCF

Is the share already in your portfolio?

Quarterly figures 09.02-13.02.26

$UCG (+1.57%)

$MNDY (+2.7%)

$KER (+0.63%)

$BARC (+1.23%)

$OSCR (+0.63%)

$CVS (+0.21%)

$SPOT (-3.62%)

$DDOG (+2.04%)

$BP. (-1%)

$SPGI (-1.51%)

$HAS (+1.07%)

$KO (+0.63%)

$JMIA (+1.68%)

$MAR (+0.46%)

$RACE (-1.46%)

$UPST (+0.38%)

$NET (+3.55%)

$LYFT (+3.42%)

$981

$NCH2 (-1.96%)

$DSY (-1.07%)

$1SXP (-1%)

$HEIA (-0.04%)

$ENR (+2.1%)

$DOU (+3.9%)

$OTLY (-0.43%)

$TMUS (-2.19%)

$SHOP (+1.55%)

$KHC (-0.19%)

$FSLY (+8.56%)

$HUBS (-3.24%)

$CSCO (-3.32%)

$APP (+3.2%)

$SIE (+0.24%)

$RMS (+1.29%)

$BATS (+0.8%)

$MBG (+0.67%)

$TKA (-2.97%)

$VBK (-0.87%)

$DB1 (+0.64%)

$NBIS (+5.83%)

$ALB (+4.72%)

$BIRK (-0.98%)

$ADYEN (+1.71%)

$ANET (+3.05%)

$PINS (-1.75%)

$AMAT (+3.72%)

$ABNB (+0.8%)

$TWLO (-1.32%)

$RIVN (+2.64%)

$COIN (+1.32%)

$TOM (-1.67%)

$OR (-0.81%)

$MRNA (+5.42%)

$CCO (+5%)

$DKNG (-0.42%)

From Portfolio Cleanup to Adyen – My Bullish Take on Payments

Hello everyone,

Hope you’re all doing well!

After doing some research and reviewing my portfolio, I’ve decided to close a few small positions and open a new position in $ADYEN (+1.71%)

For those who might not be familiar, Adyen is a Dutch payment technology company that provides a unified platform for businesses to accept payments online, in-app, and in physical stores. The technology handles everything from payment processing and risk management to acquiring and reporting, all through one integrated system — which makes it attractive for both large global brands and fast-growing platforms.

What really appealed to me is the calibre of companies that rely on Adyen’s platform. Some prominent global customers include $UBER (-1.65%) , $SPOT (-3.62%) , $MSFT (-0.07%) , $EBAY (-0.38%) and $HM B (+1.06%) — all using $ADYEN (+1.71%) to streamline their payments infrastructure across markets.

Over the past few years, the stock price has been quite the rollercoaster, with significant volatility reflecting broader market trends as well as shifts in the payments landscape. That said, I believe the long-term growth opportunities remain strong. As digital payments continue to expand globally and more merchants look to unified payment solutions, Adyen appears well-positioned to benefit from this trend.

Given the company’s fundamentals and growth potential, I think there’s a nice run ahead toward €1,700, and I’d really like to be along for that journey.

Curious to hear your thoughts — what do you think about Adyen as an investment? Do you believe the company is well positioned for future growth, or are there other players in the market that you think might outperform it?

Looking forward to your insights!

Cheers! 🚀

Will the sell-off continue next week?

$MNDY (+2.7%)

$PGY

$APO (-0.47%)

$ON (+4.07%)

$AMKR (+3.2%)

$MEDP (+1.56%)

$UPWK (-1.58%)

$ACGL (-1.79%)

$ACM (-1.24%)

$KO (+0.63%)

$SPOT (-3.62%)

$CVS (+0.21%)

$DDOG (+2.04%)

$FI (-1.33%)

$SPGI (-1.51%)

$RACE (-1.46%)

$AZN (+0.03%)

$MAR (+0.46%)

$OSCR (+0.63%)

$HOOD (+3.45%)

$ALAB (+0.98%)

$F (+0.28%)

$LYFT (+3.42%)

$UPST (+0.38%)

$NET (+3.55%)

$GILD (+1.77%)

$EW (+2.75%)

$SHOP (+1.55%)

$VRT (+8.96%)

$HUM (-0.55%)

$KHC (-0.19%)

$MCD (+0.72%)

$9ZX1

$TMUS (-2.19%)

$APP (+3.2%)

$CSCO (-3.32%)

$ALB (+4.72%)

$HUBS (-3.24%)

$TYL (-1.12%)

$NBIS (+5.83%)

$BN (+0.42%)

$CROX (+1.62%)

$ZTS (+0.59%)

$BIRK (-0.98%)

$COIN (+1.32%)

$ANET (+3.05%)

$RIVN (+2.64%)

$TOST (-2.04%)

$AMAT (+3.72%)

$DKNG (-0.42%)

$WEN (-1.75%)

$CCO (+5%)

$ENB (-0.47%)

🎧 Premium share instead of just a Premium subscription: My entry into Spotify 🎧

Not just a Premium user, but from today also a proud co-owner. The best entry opportunities often arise in phases of uncertainty. That's why $SPOT (-3.62%) is a new addition to my portfolio as of today.

Why now? Here are 3 reasons why the share is currently a must-have for me:

1. the profitability machine is running 📈

Spotify is no longer just the app we all use - it's now a highly profitable company. With over 713 million users worldwide and a massive focus on expanding margins (audiobooks, podcasts, price increases), profits are booming. The operating result has recently beaten all expectations.

2. the "buy the dip" moment 📉

The share has corrected in recent months and is trading well below its all-time highs. Analysts (from Goldman Sachs to Deutsche Bank) see fair values at USD 750 and more in some cases. We are therefore currently getting the company at a substantial discount to "fair value". Technically speaking, the USD 400 area is an exciting zone to enter.

3. pricing power & innovation 💡

Whether price increases or new AI features: Users remain loyal. Cancellation rates are minimal, which shows how indispensable the service has become for us. That's the kind of moat I want to have in the depot.

The new figures will be published on February 10. I'm excited, but the long-term story is crystal clear to me: Spotify dominates the audio market.

What about you? Are you on Team Stream & Hold or are you still watching from the sidelines?

#Investing #Spotify #shares #stockmarket #finance #GrowthStocks #StockMarket #SPOT

Spotify: Entry opportunity for courageous investors?

Spotify has come under pressure and is back on the radar. Now things could get exciting again for anti-cyclical investors.

When anti-cyclical investing becomes a success story

It never ceases to amaze me how much time has passed since the last analysis of individual Aktien has passed since the last analysis. But during this time, the share was simply uninteresting for anti-cyclical investors.

However, there were times when it was completely different. From 2022 to 2024, I had written more than half a dozen Analysen written about Spotify. The share price then soared.

In fact, the share price has increased more than tenfold. It is a prime example of the success that is possible with anti-cyclical investments.

Of course, not every share works like this, but how many such bull's-eyes does an investor need? The most recent example is probably Micron.

However, Spotify has recently undergone another major correction, which could make things interesting again.

A whole range of growth drivers

The consumption of music is generally shifting away from physical data carriers to the internet.

The number of customers is therefore likely to continue to rise. The target is one billion monthly active users by 2030, compared to 713 million today.

At the same time, the subscription price will increase over time. There is also considerable growth in the advertising business.

A few quarters ago, this area hardly played a role, today it is a mainstay, but more on that later.

Spotify is now much more than just a music platform, even if the company is primarily perceived as such.

Podcasts and audio books are playing an increasingly important role. We have been aware of the sums earned in this area not only since Joe Rogan.

And of course Joe Rogan is just the tip of the iceberg. There are now countless, extremely successful podcasts on Spotify.

Worldwide, Spotify is probably in the top 3 of the largest podcast platforms in terms of listeners - in the USA it is number 1, ahead of Apple and Google.

We will see what market share can be secured in the audiobook sector in the future.

The figures speak for themselves

The bottom line is that Spotify has significantly increased its revenue from 7.88 to 15.67 billion euros over the past five years.

The free cash flow has been positive for many years, but this was simply ignored on the stock market as the reported profit up to and including 2023 was negative.

However, the tide has turned on this front too. In the 2024 financial year, earnings rose to USD 5.71 per share. This is likely to be followed by a 47% jump in earnings to USD 8.40 per share in the current financial year.

Spotify therefore has a P/E ratio of 60.4, which is not exactly low at first glance, but this estimate is put into perspective for two reasons.

In the 2026 financial year, earnings are expected to rise by 64% to USD 13.84 per share, which would reduce the P/E to 36.7.

In addition, free cash flow is still well above reported earnings. According to consensus estimates, free cash flow is expected to rise to USD 19 per share in financial year 2026, which would correspond to a multiple of 26.7.

Music streaming still a megatrend

The latest quarterly figures show that this is realistic. In Q3, the number of monthly active users increased by 11% to 713 million.

The number of subscribers climbed by 12% to 281 million.

Revenue from the subscription business climbed by 9% to EUR 3.83 billion. However, the advertising business declined by 6% to EUR 446 million - as is usual in the industry, this segment is subject to major fluctuations.

Nevertheless, gross profit increased by 9% to EUR 1.35 billion. The operating result even climbed by 28% to 582 million euros.

At EUR 806 million, free cash flow was well above the reported result and increased by 13% over the year as a whole

Spotify share: Chart from 16.01.2026, price: USD 508.04 - symbol: SPOT | source: TWS

Spotify has returned to the important support level of USD 500. It will now be exciting here. If a bottom is formed, this could enable a recovery towards USD 550.

A procyclical buy signal with possible price targets of USD 600 and USD 640 - 650 would be issued above this level.

However, if Spotify falls below USD 500, further price losses towards USD 450 should be expected.

There are too many of the portals.

The furnace hasn't been burning as hot as it was in the beginning for a long time.

You'd better look around for raw materials👍

Trending Securities

Top creators this week