Spotify

https://open.spotify.com/episode/7MS29SzTbKFZhNfeVQoTda?si=gud77CYSQACHsufq01qRzw

YouTube

Apple Podcast

Posts

325

Brazilian digital lender Nubank has received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to establish a bank in the United States, the company said in a securities filing on Thursday.

* Nubank applied for a national banking license in the U.S. in September as it looks to expand beyond (link) Latin America.

* The digital lender still needs the necessary approvals from the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC), the company said.

* The banking license would allow Nubank to offer deposit accounts, credit cards, loans and custody of digital assets to U.S. customers, the lender said.

* Nubank said it is now in the "bank organization phase" and is working to meet other OCC conditions while it awaits the additional approvals.

* "During this phase, the company will focus on fully capitalizing the institution within 12 months and opening the bank within 18 months," it said.

Source: reuters.com

Hello everyone, I follow your posts with great interest and despite more than 20 years of stock market experience, I have learned a lot from you regarding important key figures of growth companies. I have now applied this knowledge to identify companies in the Tech/AI, Fin(tech) and Biotech sectors that are typically underrepresented in ETFs.

All fulfill strict criteria such as

I have mapped the companies in two wikifolios:

wikifolio 1 focuses on profitable scaling ("Profitable Growth") and the infrastructure that makes modern technologies such as artificial intelligence possible: https://www.wikifolio.com/de/de/w/wf11ainfin

This contains the following stocks:

wikifolio 2 combines the exponential growth of digital fintech platforms with the cyclical earnings power of established capital market compounders. The approach relies on digital transformation (crypto integration, neobanking) and traditional institutional advisory (M&A, IPOs) outperforming together in a diversified financial ecosystem: https://www.wikifolio.com/de/de/w/wf11fintec

This contains the following values

Now I am curious about your opinion! What do you think of the wikifolios and would you invest in them? Which stocks would you replace, which are missing and which do you particularly like?

Due to some partial profit-taking in the (US) tech/AI sector ($NBIS (-9.32%) / $AVGO (-0.41%) / $MPWR (+1.59%) / $AMD (-1.53%)) and OS selling ($RKLB (-6.56%) / $AMD (-1.53%)), the portfolio will be rebalanced and restructured. $RKLB (-6.56%) , $LMND (-7.45%) , $GOOG (+3.65%) and $9988 (-0.62%) but I'm not touching them (yet) 😀

Unfortunately, the entry prices for GQ have been completely messed up due to the recent transfer from TR to SC.

I am still undecided about the potential increase in $UBER (+0.99%) , $NU (+1.09%) , $ZTS (+1.27%) and $TTD (+0.14%) - and would be happy to hear a few opinions! I feel Nu and Uber are the most likely at the moment - although Waymo is accelerating well.

After the entry in October,

2 stop 🛑 loss sales in November

it continues to be very exciting for the stocks:

The portfolio of these stocks is now up +8% after 5 months.

@TradingHase had started the suggestion \ question here in September.

What's next? The stops will be raised slightly from -30% EK.

Stocks that are doing well and are >20% EK,

are hedged for profits.

As a non-premium member for several years and a profile stalker from the very beginning, I remember a post with the aim of receiving individual and high-quality feedback on your portfolio if you stick to a few basic steps. Now I think it's time to put this into practice for myself.

The idea for this approach came from some random jackass (@DonkeyInvestor ) who has been hanging around here forever. Imitation clearly recommended 😉. Here we go:

Investment horizon and goal

I am currently 34 years old, a house builder and father of two. My investment horizon is therefore long. I would even say that there is no time limit for me, as I now enjoy investing money and I always try to put more or less into my portfolio depending on the situation.

My goal is to make the remaining payment on the house in 16 years and build up a good cushion until I retire so that I can continue to live sensibly, continue to invest and bequeath a little.

Strategy and reason for the securities in the portfolio

The strategy can be described as a classic, equity-based core-satellite strategy, whereby my satellites are mainly dividend stocks. These are selected stocks that represent a low risk for me and should bring me a little cash flow every month as an addition to the monthly savings installment in the core ETF. (Good ideas for the stocks can be found at @Simpson or @GoDividend 🙂)

All stocks are capped at €1000, i.e. each dividend stock is saved with a savings plan/one-off payments up to a maximum of €1000. After that, a new one moves in. The securities that are in the red by up to approx. 30% over 1-2 years are sold. If a security doubles in value, the stake is taken out and reinvested in the core. The whole thing is perhaps not absolutely necessary, but I personally don't enjoy it that much without individual titles and I allow myself a little bit of playing around.

The core currently consists of the $VWRL (+0.63%) for well-known reasons. The overall market is performing continuously and upwards in the long term. Simple and straightforward and a good anchor for me, even if the USA is overweight. It doesn't matter to me and, like so many things, is only a temporary phenomenon.

With $NU (+1.09%)

$IREN (-6.41%)

$SOFI (-1.41%) and $LMND (-7.45%) the portfolio contains higher-risk stocks that I hope will generate above-average returns in the longer term and the proceeds can be reallocated to the core. In other words, gambling stocks as potential boosters for the core. As I have less time for research myself, I am grateful for the valuable contributions on the stocks from @Multibagger

@BamBamInvest

@Tenbagger2024 and @Derspekulant1 very grateful.

As a diversification to all this $EWG2 (+2.08%) and $BTC (+0.22%) / $XRP (+1.01%) / $ADA (-1.58%) other asset classes are included in small proportions for pure diversification and as a momentum booster for the portfolio. After all, you have to be a little bit prepared for everything in order to profit. $XRP (+1.01%) and $ADA (-1.58%) will be shifted into BTC in the long term, as I have less confidence in the long-term stability and performance here. $EWG2 (+2.08%) is chosen out of convenience (thanks to a great post on gold from @InvestmentPapa) as I have no desire to buy physical gold anywhere, nor do I want to have to store it in a high-security wing. The cost of a quality safe alone is worth the spread in my opinion.

Plan for expanding the portfolio

The ETF is mainly built up with 80% of my savings rate, 20% flows into the individual securities. As mentioned above, profits from shares or the mixed assets are realized from time to time and added to the core, as a kind of booster. The proportion of dividend stocks is built up in small steps and adjusted depending on losses or gains. This keeps the number of stocks at a relatively constant level and the one or other new stock maintains diversification among the individual stocks. Stocks with more risk should be added with a maximum of 5 positions. This is always an option but not a must.

Gold is saved selectively in favorable periods. Nothing is currently invested in crypto, perhaps also at a favorable time via one-off payments in BTC.

No-go in the portfolio

Actually bonds. I like to diversify, but they're just too boring and tedious for me. And I honestly have no idea what criteria are used to select them and what returns can be expected. I also don't think much of leveraged shares or ETFs. That's too much risk for me with my private background.

So now I'm looking forward to your opinions, criticism and suggestions!

Credit Scene

I would like to say a big thank you to the community, which helps me make progress here every day. Be it informative, funny or full of ideas. I have read so many posts here with interesting investment ideas, benefited from high-quality stock presentations, seen calculations for profit maximization or tax advantages and learned about strategies from which I could learn. I was able to pick a piece of every pie and make my own.

Alone it is hard, together it is so much easier. Thank you very much!

Hi everyone! I am currently considering building up a position in Nu Holdings ($NU (+1.09%) ). 🏦 The case looks great fundamentally with the expansion into Mexico and the massive EPS growth (+42% expected for 2026).

Nevertheless, I need your help:

1️⃣ Are you buying directly at the current price of USD 16.60 or are you waiting for a dip towards USD 15.50?

2️⃣ How do you rate the valuation? With a forward P/E ratio of around 21 and a PEG ratio of less than 0.6, the share looks almost "cheap" for the massive growth - am I missing something?

3️⃣ Is $NU (+1.09%) pure growth hype for you or a serious core for the portfolio? 📈💬

Last quarter I managed my options almost perfectly. I significantly reduced the number of positions. One of my favourite name $NU (+1.09%) , is still in the portfolio. This stock gives me a great balance: I can almost always identify the right strike price, it has excellent option volume, and it’s still growing at a reasonable pace.

I added $NOVO B (-2.32%) by removing some other stocks. I purchased 200 shares, which significantly boosted my monthly option premium. As expected, Novo started to grow from its recent bottom, so I had to make several adjustments to avoid getting called away.

Here are some results:

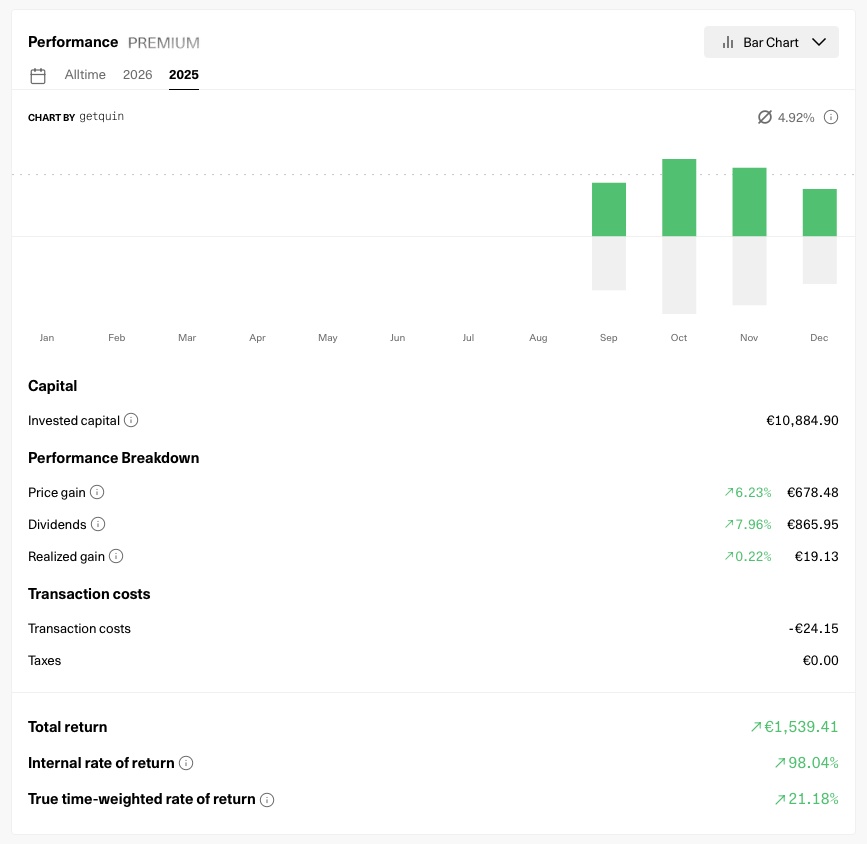

This journey started at Sept 2025

During this period, I invested a total of €13,875.

Unrealised price gain: €678

Dividends (this is also how I track my option premiums): €865

Realized gain: €19

That’s about a 11% return in 4 months. My normal price returns were almost doubled just by doing option trading as well.

What I really like is that these are not just unrealised gains. That €865 is already in my hands, not just on paper. I’m currently reinvesting this into $FWRG (+0.78%) . That said, this options portfolio has grown too large compared to my other investments, so I’ve already started to scale it down in January.

Efforts

I spent around 2–4 hours per week managing this portfolio, mostly because I’m still learning. Without prior experience, it can be tough to react properly when things move fast. Some stocks jump so high, so quickly, that you need to handle the time pressure well and roll or buy back your calls at the right moment.

A lot of the time, it feels like you’re missing out on gains. So the saying that selling call options limits your upside without protecting you from downside is partly true. However, in most cases these are actually good problems to have—you’ve already locked in a solid return, and you’re only missing some extra upside.

By understanding time, market behaviour, and the kind of spikes that can happen, I’ve learned that there are multiple ways to make back what you "missed". That’s why having a clear strategy is so important, and knowing exactly why you’re trading options in the first place. Patience and respect for the power of time make a big difference.

If you’re thinking about starting today, my recommendation is to start small—one or two stocks at most. Choose a stock that’s expected to grow, that you’d be happy to own anyway, and that has good option activity.

Accept that, especially at the beginning, your shares will get called away. Don’t get greedy, and aim for far out-of-the-money contracts to reduce this risk. Understand that time is your friend—you don’t need to pressure yourself into making mistakes. Sometimes the best move is simply to wait.

Read a lot, watch YouTube, and have deep conversations with AI tools about how options actually work to learn the mechanics. But it’s super important not to ask for recommendations, because those are usually wrong or missing some additional context you might not provide.

A reminder that within this period I’ve spent more than 50 hours actively trading, and at least the same amount of time just preparing and learning—and I still know very little and make mistakes.

Livia Chanes, CEO of Nubank Brazil, presented the company's recent successes and innovations in the first Nu Videocast 2026. Highlights include the launch of "Caixinhas Turbo" with higher returns and instant liquidity, as well as the most comprehensive debt restructuring program of 2025, which helped over 6 million customers stabilize their finances. Through strategic partnerships, such as with Uber, iFood and OpenAI, customers were able to save a total of 29 million US dollars in 2025. Chanes also emphasized Nubank's role as the most important taxpayer among financial institutions in Brazil and announced that it would continue to invest heavily in new products and customer segments.

Source: reuters.com

Another strong year with a lot of profit. After a return of around 40% in 2024, I was able to achieve another strong return of 26% in 2025. I was able to realize a large part of the profit with my two Tenbagger shares $RGTI (-4.09%) and $PLTR (+0.16%) but the rest also performed quite well.

Due to the high gains in the two individual stocks, the weighting in my portfolio shifted massively and I took this as an opportunity to really tidy things up.

Portfolio realignment 2026

I would like to share the strategy I am pursuing with you. I have not yet reached the desired weighting, but I am slowly getting closer again.

The strategy is based on 3 different pillars and looks as follows:

CORE: ALL WORLD AND SWITZERLAND(40%)

The core consists of the broadly diversified world ETF $VWRL (+0.63%) (approx. 30%) and with approx. 10% $CHSPI (+0.05%) as an overweight of the home market

GROWTH AND QUALITY (35%)

The second part consists of some quality stocks with solid growth or dividends such as $SREN (+1.28%)

$ROG (+0.49%)

$BION (+1.65%)

$MSFT (-0.3%)

$SIE (+1.82%) and the two trend tech ETFs $SMH (+0.6%)

$XAIX (+1%)

TENBAGGER SATS (20%)

Here I look for promising companies that have the potential to multiply and invest small amounts (currently max. CHF 1000). This is of course a high-risk investment, but I try to outperform with these stocks. By selling some of my tenbaggers, I was able to add new candidates to my portfolio.

These are all my potential price rockets:

$PLTR (+0.16%) : my first Tenbagger. Here I have already realized around ten times my investment through partial sales. The rest will remain in the long term.

$RGTI (-4.09%) : my second Tenbagger. I have realized approx. 8.5 times the stake through partial sales. The remainder is also left lying around.

$TER (+2.15%) Chip testing, benefits massively from the AI chip boom.

$CELH Fitness energy drinks with strong growth and expansion into the mass market.

$CRSP (-1.52%) Gene editing with huge health potential.

$MIPS (+6.59%) : Safety systems for helmets. The technology is licensed to numerous helmet manufacturers in the sports and industrial sectors.

$RKLB (-6.56%) : Rocket launches and satellites and established SpaceX chaser.

$JOBY (-3.45%) Pioneer in urban mobility with air cabs and vertical take-offs.

$NU (+1.09%) Digital neobank with enormous scaling potential in underserved markets such as Brazil, Mexico, etc.

$RBRK (-6.56%) Cybersecurity

$IONQ (-4.24%) Quantum computing. Highly speculative moonshot potential for computing power beyond classical computers.

I also hold approx. 5% in Bitcoin

Top creators this week