$UCG (-1.91%)

$MNDY (-1.74%)

$KER (-1.26%)

$BARC (-3.86%)

$OSCR (-3.43%)

$CVS (-0.52%)

$SPOT (+1.17%)

$DDOG (+1.58%)

$BP. (+2.4%)

$SPGI (-0.66%)

$HAS (-1.19%)

$KO (-0.13%)

$JMIA (-3.38%)

$MAR (-2.46%)

$RACE (-1.43%)

$UPST (-3.37%)

$NET (+1.43%)

$LYFT (-0.87%)

$981

$NCH2 (-2.91%)

$DSY (+1.87%)

$1SXP (-1.68%)

$HEIA (+0%)

$ENR (-5.27%)

$DOU (-5.06%)

$OTLY (-4.15%)

$TMUS (+1.23%)

$SHOP (-1.27%)

$KHC (+1.44%)

$FSLY (+3.81%)

$HUBS (-0.46%)

$CSCO (-1.1%)

$APP (-1.84%)

$SIE (-1.07%)

$RMS (-0.63%)

$BATS (-1.24%)

$MBG (-0.8%)

$TKA (-2.81%)

$VBK (-1.2%)

$DB1 (+0.62%)

$NBIS (-1.22%)

$ALB (-0.38%)

$BIRK (-2.78%)

$ADYEN (-0.47%)

$ANET (-1.43%)

$PINS (+0.89%)

$AMAT (-2.86%)

$ABNB (-1.5%)

$TWLO (+1.17%)

$RIVN (+2%)

$COIN (-4.5%)

$TOM (+1.01%)

$OR (-0.7%)

$MRNA (-3.1%)

$CCO (-2.21%)

$DKNG (-1.46%)

Cameco

Price

Discussion about CCO

Posts

41Quarterly figures 09.02-13.02.26

Infrastructure and waste disposal: The profiteers of the nuclear boom

Dear Community,

Where the hunger for energy is being met by nuclear power and the new generation of Small Modular Reactors (SMRs), a massive growth market for downstream services is inevitably emerging.

This applies above all to nuclear waste disposal, the professional dismantling of old plants and the recycling of fuels and water.

Since there is currently no pure "nuclear waste ETF" (at least that I am aware of), we investors must focus on specialized individual stocks that are global leaders in the disposal of uranium and contaminated components (including water).

1. the operational heavyweights for dismantling and disposal

- Veolia ($VIE (-0.99%)

): Although Veolia is primarily perceived as a global environmental services provider, it also operates a nuclear power plant with Veolia Nuclear Solutions a highly specialized division. As the global market leader in robot-assisted cleaning and the dismantling of highly radioactive sites (such as Fukushima), they are indispensable. They offer technologies for the vitrification of waste ("vitrification", the transformation of liquid or solid nuclear waste into a solid glass body) and for water treatment in contaminated areas. Veolia thus bridges the gap to the traditional water business and covers two key areas in its portfolio at the same time.

- Fortum ($FORTUM (+0%)

): The Finnish energy group is a hidden champion of nuclear aftercare. In addition to operating power plants, Fortum offers specialized services for the purification of radioactive liquids (NUKEM technology) and final disposal. They are a key player in European waste management standards.

- Jacobs Solutions ($J (-1.26%)

): The US engineering services giant manages major government nuclear sites such as Sellafield (UK) and Hanford (USA). Its focus is on program management for the long-term storage of fuel elements. The SMR connection is particularly exciting: Jacobs is already advising numerous developers on planning the entire life cycle, including disposal.

- Perma-Fix Environmental Services ($PESI (-4.13%)

): Perma-Fix is regarded as one of the few genuine "pure plays". The company operates its own facilities for the treatment of nuclear and mixed waste. Its core competence lies in massively reducing the volume of nuclear waste before it is transferred to a final repository.

2 The fuel cycle: Cameco and Westinghouse

Cameco ($CCO (-2.21%)

) is primarily known as a uranium producer, but together with Brookfield Asset Management holds a majority stake in Westinghouse Electric Corporation (electrical engineering). The company thus covers the entire cycle:

- Operations: Cameco produces uranium concentrate (yellowcake), while Westinghouse supplies the reactor technology and maintenance.

- Disposal expertise: Through Westinghouse, Cameco covers the lucrative "back end". This includes the decontamination of process water as well as the conditioning and volume reduction of of radioactive waste.

- Dismantling service: As a technological market leader, the team offers solutions for the dismantling (D&D) of old plants, using specialized filter systems to clean contaminated liquids.

- Market model: Sales are stable through long-term supply contracts. The service division makes the company less dependent on fluctuations in the uranium price, as maintenance and waste treatment are permanent tasks required by law.

Energy Fuels ($UUUU (-2.5%)

): This company occupies a strategic niche. In its White Mesa Mill they recover uranium from residual materials and waste from other industries. This positions Energy Fuels as a pioneer in "uranium recycling", which reduces dependence on primary extraction and makes waste streams economically viable.

3. specialty materials and water technology

In the nuclear industry, water is not only a coolant, but often also a transport medium for contaminants. This is where the technology leaders come into play:

- Xylem Inc. ($XYL (-3.44%)

): As a pure water technology company, Xylem supplies the heavy-duty pumping and filtration systems that are essential for the cooling circuits of modern reactors and subsequent wastewater treatment.

- Danaher Corporation ($DHR (-2.57%)

): Via the divested environmental division Veralto Danaher offers high-precision analytical instruments for monitoring water quality - a critical component for detecting leaks and contamination in real time.

- Umicore ($UMI (-4.47%)

): The materials technology group is pursuing a "closed-loop" model. In the long term, its expertise in recovering metals from complex industrial waste could play a role in the recycling of power plant components.

The new generation of reactors: SMR specialists in detail

When it comes to direct energy supply for the AI sector, two companies are in the spotlight:

- NuScale Power ($SMR

): The conservative pioneer relies on proven light water reactor technology (VOYGR™). As NuScale traditionally relies on water, the need for water technology (pumps, filters from suppliers such as Xylem) is extremely high. This makes NuScale an ideal partner for traditional infrastructure investors.

- Oklo Inc.$OKLO

): The radical innovator (supported by Sam Altman) develops "fast reactors". The key feature: these can be fueled with recycled nuclear waste (HALEU). Oklo transforms a disposal problem directly into an energy source and thus addresses the waste problem at its root.

Strategic conclusion

If you want to bridge the gap between water cooling and waste disposal, you will find in Veolia the most stable connection.

Jacobs Solutions and Perma-Fix are the most direct options for physical dismantling.

Energy Fuels offers an exciting bet on the recycling of uranium residues, while Xylem and Danaher provide the indispensable technological basis for water management in a nuclear renaissance.

However, the decisive strategic winner of the current nuclear renaissance could be the team of Cameco & Westinghouse ($CCO) (-2.21%) could be:

By merging uranium mining and reactor technology, they have created a vertically integrated business model. They not only profit from the sale of the fuel, but also control the entire downstream value chain via Westinghouse - from the purification of the process water to the final storage preparation.

As a result, Cameco has risen from a pure mining player to an indispensable infrastructure partner for the energy and AI economy.

In addition, the 80 billion dollar agreement with the US government agreed at the end of 2025 is likely to have cemented Cameco's long-term market leadership in the West (https://de.marketscreener.com/boerse-nachrichten/westinghouse-electric-cameco-und-brookfield-starten-80-milliarden-dollar-offensive-fuer-atomkraft-in-ce7d5ddcd88cf127).

Risk analysis

The nuclear renaissance is more real today than it was ten years ago, but as investors we need to look at two sides of the coin:

Opportunities through regulatory certainty: Waste disposal and dismantling are not "optional services", but permanent tasks prescribed by law. Financing is often already secured by existing provisions of the groups, which makes the service providers (Veolia, Jacobs, Perma-Fix) crisis-resistant.

Risks: Political risks remain. A change of government can delay approval processes for final storage facilities. In addition, the sector is highly emotional; ESG ratings often (still?!) determine how much capital actually flows into the shares.

Could water and waste management technology end up being the safer investment than the actual SMR builders, because it makes money from every technological outcome? How do you see the risk/reward ratio?

Best regards and thank you very much for the positive response and all the feedback on my previous and very first post ✌🏼

Anderlé

Personally, I am currently still playing the hype cycle around the manufacturers, as I expect a greater return here in the short term. In the long term, however, the music is at least as strong here.

Will the sell-off continue next week?

$MNDY (-1.74%)

$PGY

$APO (-2.15%)

$ON (-5.21%)

$AMKR (-3.58%)

$MEDP (+0.12%)

$UPWK (-5.18%)

$ACGL (-0.45%)

$ACM (-0.62%)

$KO (-0.13%)

$SPOT (+1.17%)

$CVS (-0.52%)

$DDOG (+1.58%)

$FI (-2.48%)

$SPGI (-0.66%)

$RACE (-1.43%)

$AZN (-2.17%)

$MAR (-2.46%)

$OSCR (-3.43%)

$HOOD (-2.89%)

$ALAB (+2.42%)

$F (-1.96%)

$LYFT (-0.87%)

$UPST (-3.37%)

$NET (+1.43%)

$GILD (-0.09%)

$EW (-2.84%)

$SHOP (-1.27%)

$VRT (-0.05%)

$HUM (+0.27%)

$KHC (+1.44%)

$MCD (-0.7%)

$9ZX1

$TMUS (+1.23%)

$APP (-1.84%)

$CSCO (-1.1%)

$ALB (-0.38%)

$HUBS (-0.46%)

$TYL (+1.92%)

$NBIS (-1.22%)

$BN (-4.19%)

$CROX (+1.7%)

$ZTS (-1.28%)

$BIRK (-2.78%)

$COIN (-4.5%)

$ANET (-1.43%)

$RIVN (+2%)

$TOST (-0.67%)

$AMAT (-2.86%)

$DKNG (-1.46%)

$WEN (+0.18%)

$CCO (-2.21%)

$ENB (+0.31%)

Part 6 - Recognizing market phases: Build-up, acceleration, euphoria, top

Reading time: approx. 6 minutes

Many market movements only seem irrational because they are taken out of context. In retrospect, they usually follow a clear logic. Markets do not develop in a linear fashion, but in phases. These phases do not arise by chance, but from the interplay of expectations, capital flows and psychology. This is precisely where the phase model comes in, which has already been implicit in the previous articles and is now being consciously elaborated.

It is worth naming this model explicitly for the sake of classification. Markets typically move through four states:

Build-up phase: Fundamentals improve without prices reacting to this. Expectations are low, skepticism dominates.

Acceleration phase: figures, expectations and capital flows begin to work in the same direction. Price rises become more stable and more broadly based.

Euphoria phase: valuations rise faster than operational progress. Narratives gain weight over hard figures.

Top: Expectations are so high that even good news loses its impact and disappointments have a disproportionate effect.

This sequence is not a rigid pattern, but a robust orientation framework for better categorizing market reactions.

The underlying mechanism is simple. Markets do not react to absolute developments, but to changes relative to what is already expected. As soon as this expectation framework shifts, the price logic also changes, even if the facts remain objectively positive. This is precisely the reason for the patterns that can be observed time and again over the years and across markets.

At the beginning of a cycle, there are often initial fundamental improvements that receive little attention. Cost structures stabilize, excess supply is reduced and cash flows become more predictable. At the same time, sentiment is still strongly influenced by the past. Capital remains cautious, narratives defensive, prices barely react or continue to fall. This phase requires patience and conviction because it provides little confirmation. This is precisely why it is difficult to endure, although this is where the most asymmetrical opportunities arise.

As confirmation increases, the market begins to rethink. Fundamental progress is taken seriously, capital flows back, price rises become more stable. Setbacks lose their terror, trends become established. In this phase, value is created primarily through real improvements. Valuations are often not yet ambitious, although prices have already risen significantly. For many investors, this market phase feels the most rational because fundamentals and price performance are in harmony.

Later, the focus shifts. When a topic is widely accepted, narratives come to the fore. Growth is considered further, risks lose weight, valuation benchmarks are stretched. Price gains are increasingly generated through higher multiples rather than operational progress. This phase feels easy because successes are quickly confirmed. At the same time, the risk increases as expectations leave hardly any buffer.

The actual top is rarely a single moment. It is a state in which expectations are so high that even good news loses its impact. Price reactions become more erratic, volatility increases and small disappointments are punished harshly. Fundamentally, a lot can still be right, but the market demands more than can realistically be delivered. Anyone relying solely on the story here is confusing tailwinds with substance.

This phase model is not an instrument for precise timing. Its value lies in its classification. It helps you to adjust your own expectations to the current market logic and avoid typical mistakes, such as becoming euphoric too late or avoiding early phases out of impatience.

Just how tangible this model is can be seen particularly clearly in the uranium market.

After the Fukushima accident, uranium was a market without an audience for years. Prices were below production costs, mines were shut down and investments were frozen. At the same time, the supply side gradually began to tighten. Projects were postponed or abandoned, capacities disappeared permanently. Fundamental improvements were available, but were ignored. The market was still mentally trapped in the old picture.

During this phase, producers and developers improved their structures. Companies such as $CCO (-2.21%) (Cameco) reduced costs and secured long-term purchase agreements. Developers such as $NXE (-1.4%) (NexGen Energy) positioned projects for a future supply deficit. Nevertheless, prices hardly reacted. Setbacks dominated, positive news fizzled out. This is typical of early market phases in which facts run ahead of perception.

The picture changed with the reassessment of energy policy. Rising demand for electricity, geopolitical risks and the return of nuclear energy as a base load led the market to reconsider its assumptions. Uranium prices rose, projects became financeable again and capital returned. Price rises during this phase were mainly driven by fundamentals. Stocks such as $DML (-2.7%) (Denison Mines) or $PDN (-8.32%) (Paladin Energy) did not benefit from euphoria, but from a real shift in supply and demand.

In my opinion, the uranium market is currently still in the acceleration phase, albeit at an advanced stage. The central structural drivers are real and continue to be effective, and many price movements can still be explained fundamentally. At the same time, the key arguments are well known and increasingly priced in. Setbacks are still being bought, but more selectively, and the spread between qualitatively strong producers and purely narrative stocks is widening. This pattern argues against pronounced euphoria, but clearly shows that the risk/reward ratio has shifted compared to the early phases.

The uranium example illustrates why market phases are practically relevant. The same asset can be fundamentally convincing and yet represent a completely different investment depending on the phase. Those who ignore market phases often misinterpret price reactions. Those who classify them act more calmly and with more realistic expectations.

The next step is no longer about individual market phases within a stable framework, but about the moment when this framework itself tips. After all, not only markets but also strategies move in cycles. Phases in which growth dominates alternate with periods in which value or substance is in demand. Small and large caps, risk-on and risk-off also rotate. These changes rarely occur by chance, but usually follow changes in interest rates, liquidity and political intervention. Those who recognize them understand why previously successful approaches suddenly no longer work - and why the biggest misjudgments arise at precisely these points.

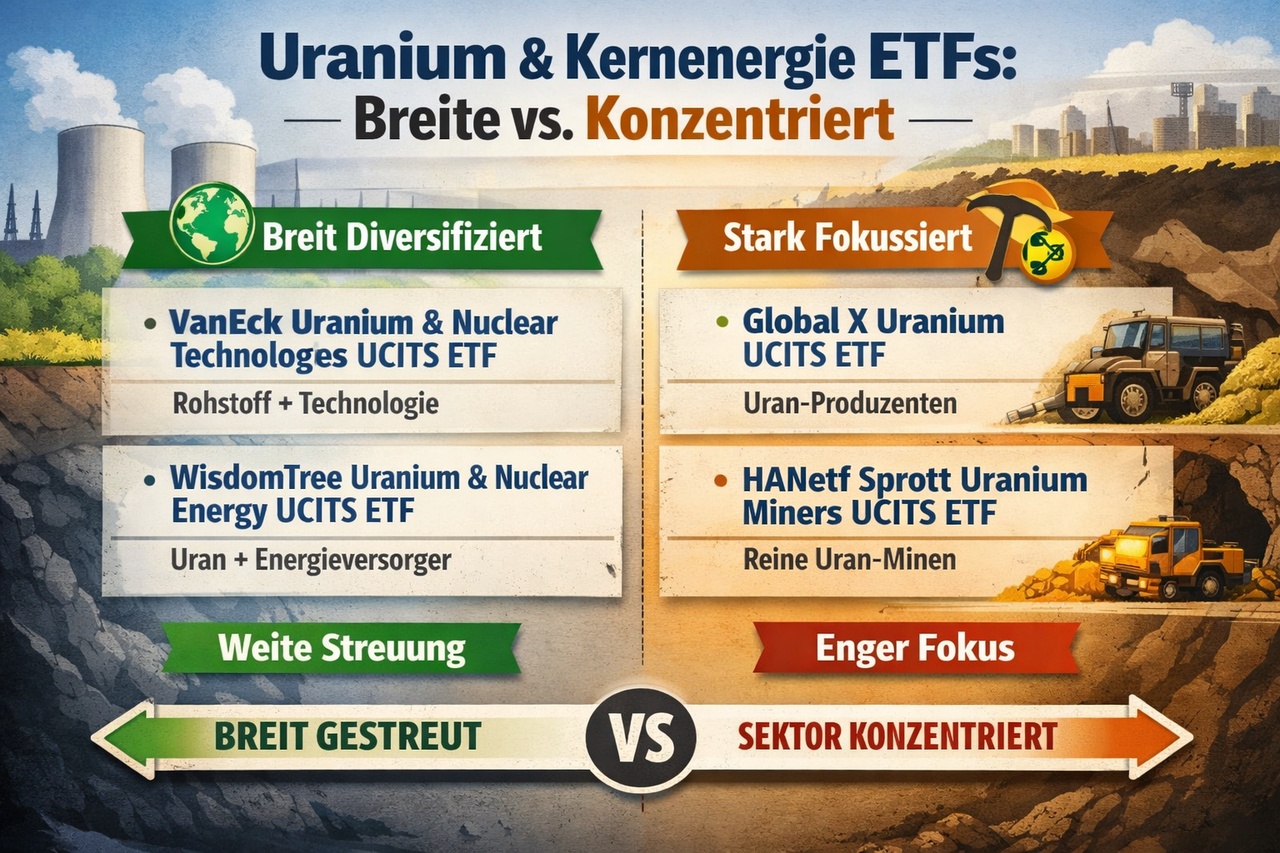

Uranium ETFs

Hello my dears,

I have now also realized that there is a lot of potential for the future in uranium energy and that there are some opportunities in the field of SMR mini-reactors. Since I want to invest more broadly in the field of uranium and do not want to and cannot deal with countless shares and areas of uranium, you are in demand.

Do you see more potential in the pure uranium mining or producer sector or would you diversify?

I have picked out several ETFs that I can trade on TR (please no hate for the platform😅).

My goal will be to invest 10k in the sector over the year, which is about 7% of my portfolio as of today.

I would also have the funds to invest in one go, but I sleep better if I spread it out over the next few months, or do you see so much potential in 2026 that you would invest it directly yourself?

Here is the selection of ETFs:

1. VanEck Uranium and Nuclear Technologies UCITS ETF

➡️ Broad thematically in the uranium/nuclear energy sector

👉 Mix of uranium producers, nuclear technology and energy/component companies → More diversification across sub-sectors

2nd Global X Uranium UCITS ETF

➡️ Commodity/producer-centric

👉 Strong focus on uranium mining, exploration and supporting components → More concentrated on commodity/producer sector

3rd HANetf Sprott Uranium Miners UCITS ETF

➡️ Very specialized in uranium miners

👉 Sector segment with a focus on mining and exploration companies → High concentration risk in one sector

4 WisdomTree Uranium and Nuclear Energy UCITS ETF

➡️ Broad across the nuclear energy ecosystem

👉 Includes mining, utilities, suppliers and technology → Broad diversification across different industries in the nuclear sector

$OKLO$CCO (-2.21%)

$UUUU (-2.5%)

$3842

$UEC (-1.13%)

$NXE (-1.4%)

$BWXT (+0.92%)

$CEG

$LEU (+0.93%)

On a mission for fission 💸💸💸

Basic knowledge - reading beta correctly: What your portfolio reveals about its market sensitivity

Reading time: approx. 5-6 minutes

Many of my recent articles have focused on key figures that help to clearly classify business models, risks and valuations. Beta is part of this series - and at the same time the key figure plays a special role. It is available everywhere and can be looked up quickly, but only becomes truly meaningful in the context of an entire portfolio. This is because beta does not describe the company itself, but the behavior of a share in interaction with the market.

Mathematically, beta measures the relationship between share returns and market returns. The basis is the covariance of these returns - and this is always based on historical data. However, the interpretation is inevitably forward-looking because past patterns are used to derive how a stock will typically behave in relation to the market in the future.

Formally, the key figure is

Beta = covariance(stock return, market return) / variance(market return)

In practical terms, this means that when the market moves, how much does the share typically move with it? Values around 1 mean market-like movements, higher values show stronger fluctuations, lower values a calmer behavior.

The reason why beta is often misinterpreted is that it is not stable. It depends heavily on the time period, the market phase and the chosen index. A company can continue to perform solidly, but suddenly have a different beta due to changes in interest rates or the risk environment. Beta therefore measures behavior - not quality.

To make it clearer how beta works in a portfolio, it is worth taking a look at my portfolio. It combines robust quality stocks such as Visa, Alphabet and Honeywell, growth-oriented technology stocks such as ASML, Nu Holdings and Innodata, defensive infrastructure and water stocks such as Consolidated Water, Energiekontor and Energy Recovery, the global ETF on the MSCI ACWI and a uranium block as a cyclical idea with Cameco, NexGen, Denison Mines, Paladin Energy and Yellow Cake. Bitcoin complements the whole as an independent, significantly more volatile component.

This mix shows well why beta is useful for me on a day-to-day basis. Different stocks can be fundamentally strong and yet contribute very differently to the fluctuation profile of the portfolio. Some positions smooth out, others strengthen - regardless of whether the companies are well managed or highly profitable. It's about market behavior, not balance sheet quality.

For the beta analysis, I use conservative, market-standard 3-5 year values of major providers. Most betas are calculated on the basis of daily or monthly returns over precisely such periods - long enough to be statistically stable and short enough to realistically reflect current market phases. Where there is no official data, suitable sector values are used.

The betas used are as follows:

Large Caps

- $ASML (-2.92%) : 1,25

- $GOOGL (-0.2%) : 1,05

- $V (-1.21%) : 0,95

- $HON (-1.23%) : 1,00

Midcaps / Infrastructure

- $CWCO (-7.03%) : 0,80

- $EKT (-1.37%) : 0,75

- $ERII (-0.64%) : 1,20

- $SOP (+4.05%) : 1,10

Small Cap / High Beta

- $INOD (+1.35%) : 1,80

Uranium segment (cyclical)

- $CCO (-2.21%) : 1,40

- $NXE (-1.4%) : 1,60

- $DML (-2.7%) : 1,70

- $PDN (-8.32%) : 1,50

- $YCA (-1.12%) 1,30

ETF

- $ISAC (-0.44%) : 1,00

Crypto

- $BTC (-3.86%) : 2,50

The only thing that counts for the portfolio beta is how large each position is in relation to the portfolio.

This is how the portfolio beta is determined:

You look at how large each position is in the portfolio, multiply this proportion by the beta of the respective share and add up all the contributions. Each position therefore contributes to the overall beta in exactly the same proportion as its weighting.

If you put the weightings of my portfolio in this context, the result is as follows: the portfolio has a beta of around 1.33. This value fits the structure: a stable base, several growth-oriented building blocks and a deliberately used uranium block as well as Bitcoin as a stronger lever.

A beta at this level means a fundamentally more offensive portfolio.

- In upward phases, it develops more momentum than the market.

- It reacts faster and more strongly in corrections.

- The strongest drivers are Bitcoin, Innodata, NexGen, Denison Mines and Paladin Energy.

- Counterweights are Visa, Consolidated Water, Energiekontor and the MSCI ACWI ETF.

This shows that beta is no substitute for fundamental analysis, but it makes it clear how a portfolio is moving and why. It helps to calibrate expectations, classify fluctuations and manage the structure more consciously. A beta of 1.33 is not a judgment of quality - it is a description of movement. The only important thing is whether this dynamic fits your own investment strategy.

Finally, two questions for you:

Do you know the beta of your portfolio?

And does it play a role for you in your portfolio strategy - or not?

However, my portfolio has been extremely nervous so far. 😂

Hare underground

Dear gq community,

Recently, raw materials have been an ever-growing topic here around $RIO (-3.51%) and co.

In a conversation with a friend, he told me about an actively managed fund with a TER of over 2% and a handsome return of just over 20% last year.

That sounded interesting, but given the high TER, I thought that a cheaper ETF must also work.

So the rabbit dug into the depths of the stock market and found this ETF $WMIN (-0.76%) with a TER of 0.50%, which is pleasantly broadly diversified across Canada, Australia, the USA, the UK and South Africa and therefore also in different currencies.

The ETF includes shares of $RIO (-3.51%) or also $CCO (-2.21%) .

As I am not yet so strongly represented in the commodities sector, I found this ETF interesting and added it to my portfolio.

Perhaps one or two people see it the same way as I do and don't want to try their luck in too many individual shares and find an investment in this ETF.

Greetings from your bunny 🐰

And here's a bit more :)

If I carry on like this, I won't be able to buy my boring railroad shares any time soon. But the share price keeps going in the wrong direction 💹

Well, I'm still amazed that most of the articles you read $CCO (-2.21%) more or less only see them as miners mainly.

Sorry about the property abuse @Simpson but it fits so well.

My weekly purchases and sales

On Monday I sold my Cameco $CCO (-2.21%) position at a profit and then, somewhat late, went short on Palantir $PLTR (+4.5%) went short. At the same time, I bought into SUSS MicroTec $SMHN (-8.43%) a clear no-brainer for me. The company is technologically well positioned, but completely undervalued by the market. I expect significantly higher prices here in the coming weeks.

Today I closed my short on Palantir and instead bought Cameco $CCO (-2.21%) and Rheinmetall $RHM (+1.19%) bought more. Both remain core stocks for me in the current environment.

I am not a classic buy-and-hold investor, but actively trade according to trends and momentum. My focus is currently clearly on the nuclear, AI & robotics and defense sectors, all areas with long-term tailwinds.

Palantir $PLTR (+4.5%) should still have some room to fall in the short term (possible setback towards €132), but remains a long-term winner in the AI ecosystem for me.

Postscript:

When actively trading, whether swing or day trading, it is crucial to set a clear maximum. Greed and fear have no place here.

My own experience: I shorted Thyssenkrupp 3 weeks ago, was right and unfortunately got out too late. Instead of 140% profit, I ended up with only 13%. Timing and discipline beat emotion every time.

What was your experience this week and in the past few weeks?

Trending Securities

Top creators this week