We continue with insights into the goings-on of the dividend opi. If you missed the first part, you can find it here: Dividendenopi inside Teil 1 Dividendenopi Rewind2025

As the second part is less about shares, I'll at least start with the rest and the question from @Epi about the Zockeropi. I still have one position each in the, let's say, hidden area of $EKT (+4.36%) and $NOVO B (+4.62%) each. Neither trading nor dividend stocks as I see it, so they are bobbing around in the middle of nowhere. Both are currently in negative territory and have a current market value of around €30,000. To be honest, I still don't really know what I'm going to do with them. In my opinion, EKT is still a rock-solid value and clearly undervalued. Despite all my understanding for the delays, which are apparently through no fault of their own, they have to deliver this year. Otherwise I will actually realize the losses, but they are absolutely manageable. And about Novo, well, what more can I say... Ignored the warnings during the high phase and took the crash in its stride. Due to the recovery over the last few days, the share is moderately down by just over 10%. Depending on my mood on the day, however, this could quickly disappear.

And to ensure that my strategy as a whole doesn't get boring and that the gambling child in me is kept in mind so that it doesn't do anything stupid with larger investments, I have turned more intensively to short-term trades since the middle of last year. In June with $DEFI (+4.17%) and $HIMS (+3.94%) initial modest successes have encouraged and "hooked" me by, among other things @Multibagger one or two copy trades. My play money is strictly limited to a maximum of 5% of my total capital. I haven't invested that much yet, but despite everything $IREN (+13.85%) , $CIFR (+10.3%) and some other trades have brought me nice profits on the side. Most recently I closed yesterday $AII (+0.42%) closed yesterday with 40% plus. The largest position in the trading portfolio at the moment is again $IREN (+13.85%) with EK 35€ and a slight plus. The rest, $CA1 (-1.43%) , $DEFI (+4.17%) , $LYC (+2.42%) , $NB (+0.34%) and $null are not doing so well at the moment, which is why I am currently in the red. I currently have € 20,000 invested there, but the holding period for these shares and the long is also designed for a maximum of 6 months, so I will look again in April.

So far so good.... Now comes the outing and the boring part of my investments, which still make up the majority of the capital invested. Expiring fixed-term deposits have already been and will be put into the market. Due to my age, I tend to be a bit conservative when it comes to choosing my broker and would have a stomach ache with a neo-broker for this amount. For a while I had my investments diversified with S-Broker, ING and Consors. Overnight deposits at various institutions in recent years, where the best new customer offers were available. I'm still hopping and currently have a good €370,000 in call money. The best interest rate for 12 months until mid-26 is with BBVA, where I'm realizing 3.25% thanks to a promotional bonus. Volkswagenbank, Fordbank, Stellantisbank and Renaultbank are always offering special promotions for existing customers with interest conditions to compensate for inflation. The advantage of all the aforementioned banks is the monthly interest payout for regular income, and the trend at the moment is again towards higher offers for new customers of just under 3%, so I will be shifting around a little over the next few days and weeks. Longer-term fixed-term deposits will gradually expire over the next 2 years, where I have conditions from the beginning of 24, e.g. at Kommunal Kredit for 4.5%, the others are between 3.4 and 4.1%. In total, this currently amounts to € 125,000 with annual interest payments for further cash flow.

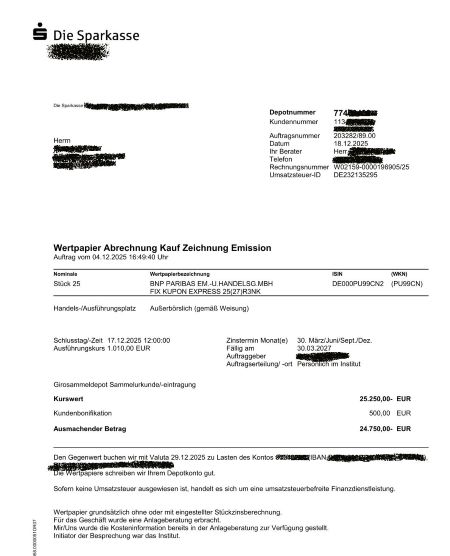

The third large chunk, and therefore the rest of my capital, is invested in bonds and certificates. More on this in a moment. Where do I have my securities account now? Drum roll... 😇😇At the savings bank, sic!🤷♀️ At a large savings bank in the big city around the corner as part of a private banking agreement. I have an all-in-fee that costs really fat fees every year. 1.25% of my average portfolio value p.a. And that's a four-figure sum at the top end. Before everyone faints or thinks I'm out of my depth, a few words of explanation and insight into my decision. I can trade where I want, as much as I want and what I want within the limits of these fees. Of course, I can also pay less for a used small car, but as I mentioned, it's just not for me. One of the reasons I took this route was because of the annual costs I would otherwise incur with ING and S-Broker. Given the trading volumes, that wasn't exactly low either. For me, these costs would have been costs anyway. The decisive advantage, in addition to almost 24-hour all-round support and a personal portfolio manager, lies in trading certificates. I like to use fixed coupon express certificates for cash flow. They are available on many stocks. This year I was / am invested in Siemens, LVMH, BMW, Daimler Truck, Vonovia, Renk, among others. They all had / have interest rates between 6.5% and 9.75%. Latest "deal" a certificate on $R3NK (+3.33%) on 29.12 with 11.7% and a new one now starting in January with 11.5%. The interest is paid out quarterly on a pro rata basis and makes a not insignificant contribution to my monthly income. I am always offered these certificates for subscription before they are issued, the issue premium is waived as part of my agreement and I receive a large part of the "internal commission" from the savings bank, which is called a customer bonus. I am attaching the statement of my Renk certificate from December 29th to make it easier to understand.

In this case, with an otherwise regular issue price of € 1,010 for a € 1,000 share, I have in any case already "recouped" part of my fees (saved issue premium plus lower subscription price), with other providers and lower interest rates this can be up to 2.5% and more. These express certificates usually come back in the next 6 to 9 months when the early payout levels are reached and I get back the € 1,000 nominal value, plus the interest accrued up to that point. Unfortunately, I have to pay tax on the difference between my cheaper purchase and the nominal value as a profit. The money is then immediately reinvested in corresponding new certificates. This means that I have a regular annual circulation with a corresponding volume, not every certificate is returned, and in total this recoups my fees. Sounds a bit like a milkmaid's calculation, but it works out. We can discuss this in more detail. For now, this is only part of my motivation. However, these certificates are one of the main pillars of my cash flow and are relatively default-proof thanks to downward barriers of 40 to 50%, but of course you have to look at the underlying securities.

Other investments are in capped bonus certificates with a barrier. These offer no ongoing cash flow, but "reward" you with decent returns if they perform well and are particularly suitable for sideways or slightly falling markets. For both variants, it must be said that dividends from the reference stocks are excluded and a strong upward trend in the individual underlying stocks does not lead to overperformance and in the latter case is also limited (capped) or leads to premature liquidation in the case of express certificates. If you keep abreast of the market, the risks are manageable and the maturities are limited to a maximum of 2 years, usually less.

There are other variants of these certificates, if there is interest I would present these in a separate series. They are not performance boosters, but with the right selection they can lead to stability and ongoing cash flow or pre-defined potential price gains even if the markets do not perform as everyone would like.

That's it from my side, I've let my pants down and shown how I, as an old fart with an appropriate amount of capital, try to structure my monthly returns without taking excessive risks and why and how I do it. Perhaps it will help some investors who are not so risk-averse to think about alternatives. I would like to thank everyone who has stuck with me to the end and see you soon. Your Dividend Topi