$MNDY (+1.07%)

$PGY

$APO (-0.13%)

$ON (-2.59%)

$AMKR (-3.38%)

$MEDP (+0.65%)

$UPWK (+0.67%)

$ACGL (-0.2%)

$ACM (-0.6%)

$KO (-0.45%)

$SPOT (+2.81%)

$CVS (-0.6%)

$DDOG (+3.47%)

$FI (+0.19%)

$SPGI (+1.13%)

$RACE (-0.76%)

$AZN (-1.28%)

$MAR (+0.41%)

$OSCR (-2.52%)

$HOOD (-3.16%)

$ALAB (-4.01%)

$F (-3.06%)

$LYFT (-3.83%)

$UPST (-0.27%)

$NET (+0.53%)

$GILD (+0.02%)

$EW (-2.21%)

$SHOP (-0.04%)

$VRT (-3.22%)

$HUM (-1.96%)

$KHC (-0.33%)

$MCD (-0.76%)

$9ZX1

$TMUS (+1.74%)

$APP (+1.41%)

$CSCO (+0.57%)

$ALB (-6.21%)

$HUBS (+4.28%)

$TYL (+2.59%)

$NBIS (-2.59%)

$BN (-2.51%)

$CROX (-1.69%)

$ZTS (-1.49%)

$BIRK (-4.12%)

$COIN (-1.23%)

$ANET (-2.5%)

$RIVN (+3.11%)

$TOST (+3.36%)

$AMAT (-3.09%)

$DKNG (+3.81%)

$WEN (+0.38%)

$CCO (-4.69%)

$ENB (+1.23%)

- Markets

- Stocks

- AstraZeneca

- Forum Discussion

AstraZeneca

Price

Discussion about AZN

Posts

29Will the sell-off continue next week?

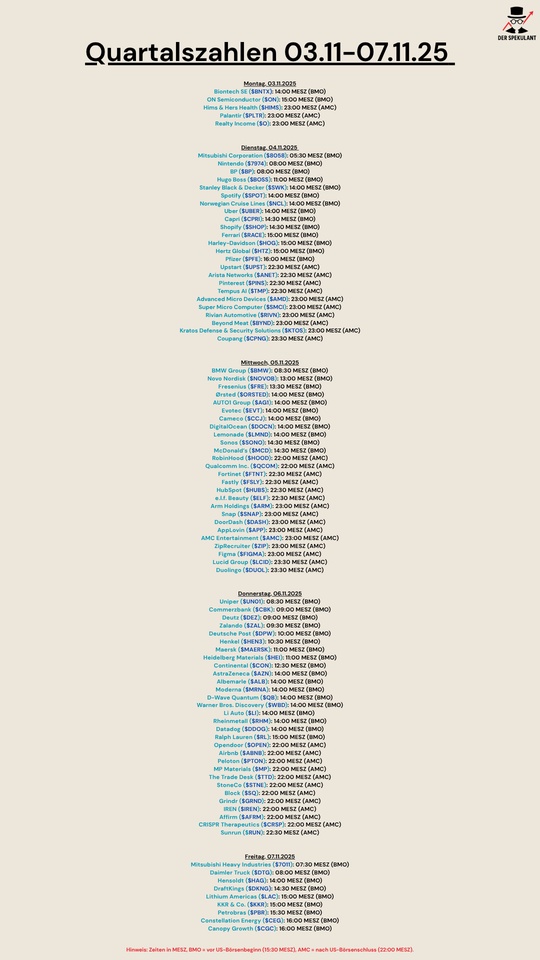

Quartalszahlen 03.11.25-07.11.15

$BNTX (-5.09%)

$ON (-2.59%)

$HIMS (-4.75%)

$PLTR (+0.93%)

$O (-0.67%)

$8058 (-4.82%)

$7974 (-3.64%)

$BP. (+0.44%)

$BOSS (-1.5%)

$SWK (-2.13%)

$SPOT (+2.81%)

$N1CL34

$UBER (+0.83%)

$CPRI (-1.15%)

$SHOP (-0.04%)

$RACE (-0.76%)

$HOG (+2.98%)

$HTZ (-0.82%)

$PFIZER

$UPST (-0.27%)

$ANET (-2.5%)

$PINS (+8.75%)

$TEM (-3.74%)

$AMD (-2.53%)

$SMCI (-2.56%)

$RIVN (+3.11%)

$BYND (-2.79%)

$KTOS (+1.75%)

$CPNG (-3.74%)

$BMW (-3.15%)

$NOVO B (-2.41%)

$FRE (-4.3%)

$ORSTED (-4.06%)

$AG1 (-2.09%)

$EVT (-6.25%)

$CCO (-4.69%)

$DOCN (-2.22%)

$LMND (-2.28%)

$SONO (-0.89%)

$MCD (-0.76%)

$HOOD (-3.16%)

$QCOM (-1.01%)

$FTNT (+3.73%)

$FSLY (-4.33%)

$HUBS (+4.28%)

$ELF (-0.39%)

$ARM (-2.25%)

$SNAP (-0.67%)

$DASH (-0.67%)

$APP (+1.41%)

$AMC (-0.97%)

$ZIP (-2.95%)

$FIG (+1.59%)

$LCID (+1.46%)

$DUOL

$UN0 (-0.8%)

$CBK (-4.32%)

$DEZ (-10%)

$ZAL (-3.39%)

$HEN (-3.56%)

$MAERSK A (+2.74%)

$HEI (-2.02%)

$CON (-3.66%)

$AZN (-1.28%)

$ALB (-6.21%)

$MRNA (-4.89%)

$QBTS (-1.72%)

$WBD (+0.32%)

$LI (-2.85%)

$RHM (-3.64%)

$DDOG (+3.47%)

$RL (+0.8%)

$OPEN (-2.43%)

$ABNB (+0.04%)

$PTON (+0.33%)

$MP (-1.29%)

$TTD (+2.27%)

$STNE (-11%)

$SQ (-1.11%)

$GRND (-1.53%)

$IREN (-3.98%)

$AFRM (+0.63%)

$CRISP (+12.56%)

$RUN (-4.26%)

$7011 (-7.91%)

$DTG (-4.62%)

$HAG (-2.54%)

$DKNG (+3.81%)

$LAC (-5.54%)

$KKR (-1.04%)

$PETR3 (-0.35%)

$CEG

$WEED (-1.77%)

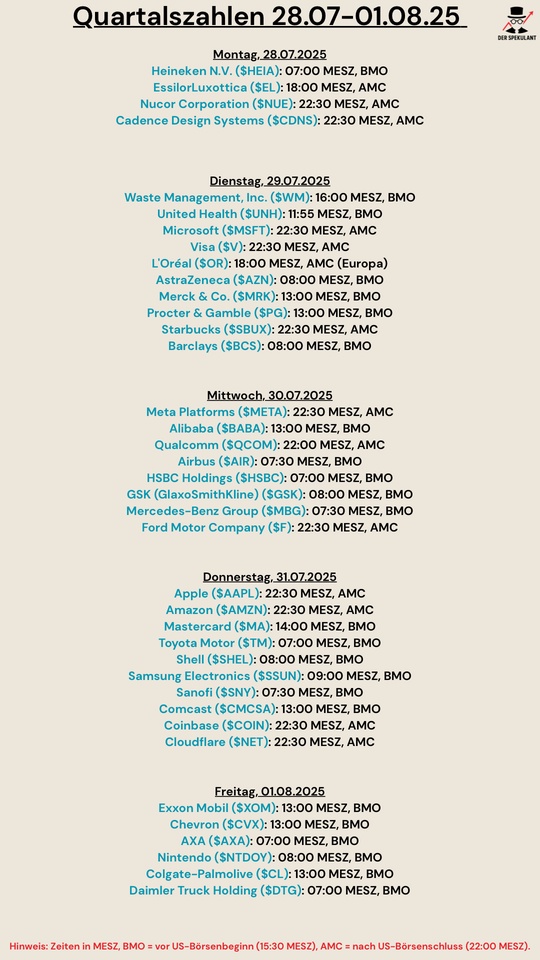

Quarterly figures 28.07-01.08

$HEIA (-2.53%)

$EL (-1.68%)

$NUE (-1.55%)

$CDNS (+0.28%)

$WM (+0.63%)

$MSFT (+1.64%)

$V (-0.06%)

$OR (-3.41%)

$AZN (-1.28%)

$MRK (+0.38%)

$PG (-1.49%)

$SBUX (-0.05%)

$BCS (-2.48%)

$META (+0.78%)

$BABA (-2.4%)

$QCOM (-1.01%)

$AIR (-2.02%)

$HSBC (-4.25%)

$GSK (-1.59%)

$MBG (-1.62%)

$F (-3.06%)

$AAPL (-0.18%)

$AMZN (+0.19%)

$MA (+0.36%)

$7203 (-5.13%)

$SHEL (-0.8%)

$005930

$SNY (-2.44%)

$CMCSA (+1.13%)

$COIN (-1.23%)

$NET (+0.53%)

$XOM (-0.32%)

$CVX (+1.46%)

$CS (-3.47%)

$NTDOY (-3.38%)

$CL (-0.94%)

$DTG (-4.62%)

$UNH (-1.28%)

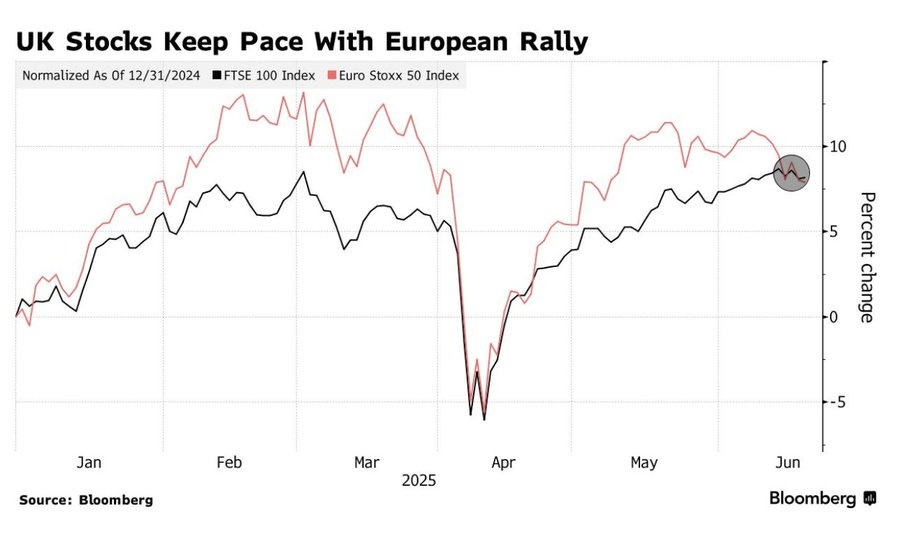

HennRes | British hedge against the Middle East

The $C (+0.07%) currently recommends the FTSE 100, as it is well suited as a hedge against the risk in the Middle East. This is illustrated by 3 factors.

- The FTSE 100 is driven by energy companies such as $SHEL (-0.8%) and $BP. (+0.44%) dominated. These benefit from geopolitical tensions and thus provide a natural hedge.

- The FTSE has a high weighting in defensive sectors such as pharmaceuticals, such as $AZN (-1.28%) and consumer goods, such as $ULVR (-2.64%) as. These sectors are historically resilient to geopolitical problems.

- Many companies in the FTSE 100 generate the majority of their sales outside the UK. This makes them less vulnerable to domestic risks and more resilient to global uncertainties.

𝖢𝗂𝗍𝗂𝗀𝗋𝗈𝗎𝗉 𝗌𝗂𝖾𝗁𝗍 𝖻𝗋𝗂𝗍𝗂𝗌𝖼𝗁𝖾 & 𝖲𝖼𝗁𝗐𝖾𝗂𝗓𝖾𝗋 𝖠𝗄𝗍𝗂𝖾𝗇 𝗌𝗈𝗐𝗂𝖾 𝖤𝗇𝖾𝗋𝗀𝗒 𝗎𝗇𝖽 𝖽𝖾𝖿𝖾𝗇𝗌𝗂𝗏𝖾 𝖲𝖾𝗄𝗍𝗈𝗋𝖾𝗇 𝖺𝗅𝗌 𝗉𝗈𝗍𝖾𝗇𝗓𝗂𝖾𝗅𝗅𝖾 𝖮𝗎𝗍𝗉𝖾𝗋𝖿𝗈𝗋𝗆𝖾𝗋, 𝖿𝖺𝗅𝗅𝗌 𝖽𝗂𝖾 𝗀𝗅𝗈𝖻𝖺𝗅𝖾𝗇 𝖱𝗂𝗌𝗂𝗄𝖾𝗇 𝗐𝖾𝗂𝗍𝖾𝗋 𝗌𝗍𝖾𝗂𝗀𝖾𝗇.

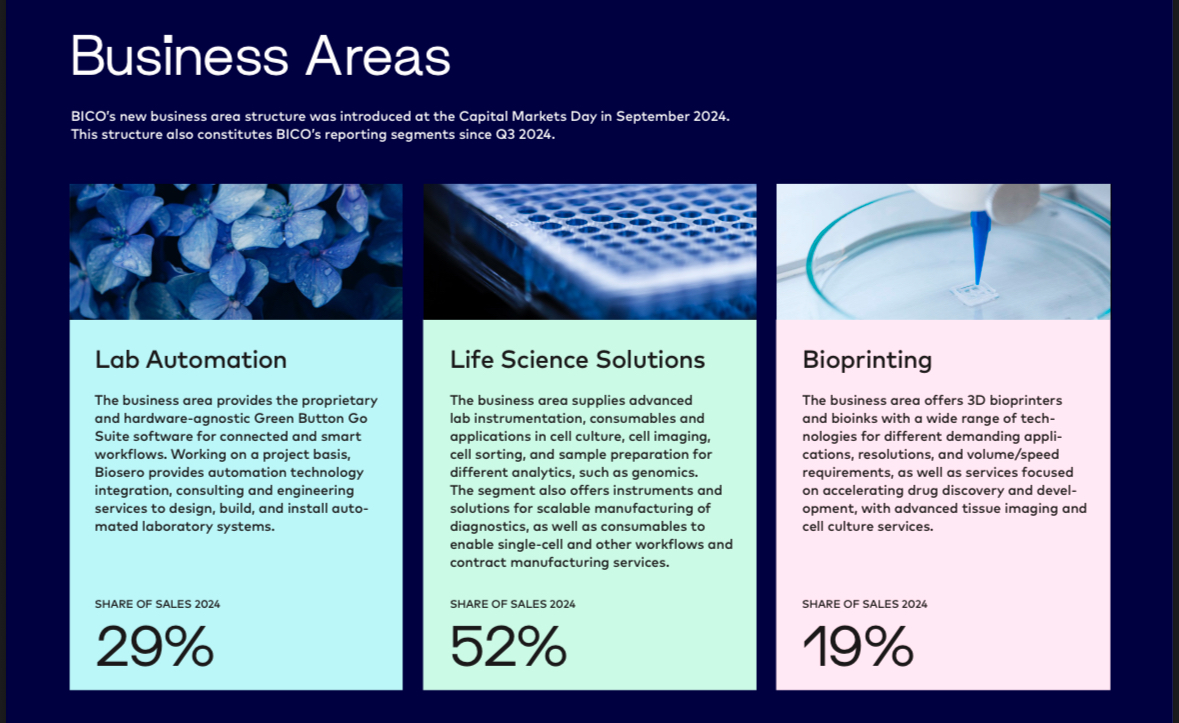

Cells, numbers, doubts: What will BICO print next? (Deep Dive)

🧬 BICO

$BICO (-4.48%) has been on my watchlist since my early days on getquin.

In 2021, the company was on everyone's lips, celebrated as the company of the future in bioprinting.

But what followed was a classic hype cycle: the share price rose rapidly, was cheered by quite a few "finfluencers" and then plummeted just as sharply.

Many people got their fingers burnt back then. What remains is the image of an overvalued tech fantasy, fueled by empty promises and loud voices without substance.

And yet: The company has remained. So has the vision, and in recent months a lot seems to have changed structurally.

Today, more than 80 % below its all-time high, the question arises anew:

Is BICO simply an overrated stock market experiment...

... or is the current valuation realistic for the first time and BICO on the way to translating its technological substance into a genuine business model?

Over the past few weeks, I have been taking a closer look at the company's structure, history and current developments, including the latest figures [1] and the earnings call [2] from 29.04.25.

In this article, I share my collected insights, thoughts and assessments for those who also have the company on their watchlist.

As always:

No investment advice. I don't want to contribute to more burnt fingers, but to encourage reflection.

Have fun!

BICO Group AB (formerly CELLINK) is a Swedish life science company founded in 2016.

The original innovation: a biocompatible ink for 3D printing of living cells, a small revolution in research.

Today, BICO stands for a big goal: Bioconvergence.

This means merging biology, technology, software and automation to make research, diagnostics and drug development faster, cheaper and more efficient.

What is the vision and how does BICO make money?

The vision: The laboratory of the future. Automated, networked, efficient with AI, robotics and bioprinting.

This is how BICO earns money today:

- Bioprinting3D printing of living cells & tissue (CELLINK) read more...

- Diagnostic solutions & microdosing (SCIENION)

- Lab AutomationFully automated workflows through software such as Green Button Go® (Biosero)

- Consumables & services for laboratories and research facilities

Share of Sales 2024:

Excursus

Bioprinting:

BICO was with CELLINK was one of the first suppliers worldwide to offer bioprinters plus matching "bioinks" commercially.

The basic idea:

- A 3D printer (e.g. the CELLINK BIO X6) prints cells in layers, similar to how a normal 3D printer layers plastic.

- Instead of plastic, a special "ink" is used: Bioink.

Bioink and what it is made of:

Bioink is a gel-like substance that is mixed with living cells. It contains, for example:

- Alginate (from algae)

- gelatine

- collagen

- hyaluronic acid

- Cell nutrient solutions

This matrix keeps the cells alive and makes it possible to print biologically active structures, e.g. tissue samples, tumor models or skin structures.

Is this already being done today or is it all future?

Yes, it is being done, but not clinically.

Bioprinting is currently being used, for example:

- Cell models for drug testing (in research & at pharmaceutical companies)

- printing tumor tissue to better test therapies

- Tissue samples used for toxicology tests (e.g. skin, cartilage, blood vessels)

What is not yet possible:

- Complete organs (hearts, livers, kidneys) for transplants

Because...

- Organs are extremely complex (blood vessels, nerves, functions)

- Currently lack the ability to keep them alive in the long term

- This is also a huge step in regulatory terms

🔮 Future potential: unrealistic or groundbreaking

If bioprinting really breaks through in medicine, we will be talking about one of the biggest breakthroughs of the 21st century:

- organs on demand (no donor needed)

- personalized medicine

- Animal-free drug development

RealisticFirst functional organs could be available in 10 -20 years clinically relevant, but first in small pilot studies or animal models.

Are there any research results or publications on this?

Yes, BICO (especially CELLINK) is a regular co-author or technology partner in publications.

Especially in areas such as:

- Tumor models

- tissue modeling

- biocompatibility

- Skin and cartilage models

Several universities and research institutions use the BIO X printers, including for example MIT and Harvard

Trusted partners:

- Sartorius$SRT (-2.82%) (has taken over MatTek/Visikol, remains cooperation partner)

- AstraZeneca $AZN (-1.28%)

- Pfizer $PFE (-1.12%) (individual case studies)

- Top 20 pharmaceutical companies with Biosero projects (Lab Automation)

- Research centers worldwide

- Cooperation with Sartorius in the APAC region (e.g. Japan, South Korea)

Digression Conclusion

Bioprinting sounds like science fiction and yes, it is a long way from everyday transplantation. But in research and diagnostics it is real, applicable and in demand.

- BICO is not selling promises for the future, but tools that are used in leading laboratories today. The big leap is yet to come, but the foundations have been laid.

__________

History in brief From bioink to platform

- 2016: Founded as CELLINK, the first bioink worldwide

- 2020: Renamed BICO (for Bio Convergence)

- 2021-202315+ acquisitions (including SCIENION, Biosero, MatTek)

- 2024-2025: Streamlining of the structure (sales to Sartorius), withdrawal from non-strategic areas

- 2025: Focus on automation, diagnostics and bioprinting with a clear industry orientation

New CEO since 2024: Maria Forss

- PredecessorErik Gatenholm (co-founder & CEO for many years)

- Change: Gatenholm stepped down in fall 2023, Maria Forss officially became CEO in January 2024

Maria Forss brings decades of experience from leading life science companies:

At Vitrolife (2018 - 2023), she led global expansion and M&A projects, including the billion-euro deal with Igenomix. Prior to that (2014 - 2018), she was at Elekta (radiotherapy, oncology) where she was responsible for global marketing and product strategies.

She started her career at AstraZenecawhere she gained international experience in sales, regulatory affairs and market launch. There she learned what makes large pharmaceutical companies tick, particularly in terms of approval, market launch and regulatory navigation

She is an expert in:

- Business Development

- transformation & strategy

- international expansion

The retirement of founder Gatenholm points to a clear change in strategy, away from visionary, growth-driven development and towards cost control, profitability and integration.

In the Earnings Call Q1 2025 Forss emphasizes several times:

"We have implemented a new operational structure, are harmonizing global functions and are focusing on efficiency and selected growth areas."

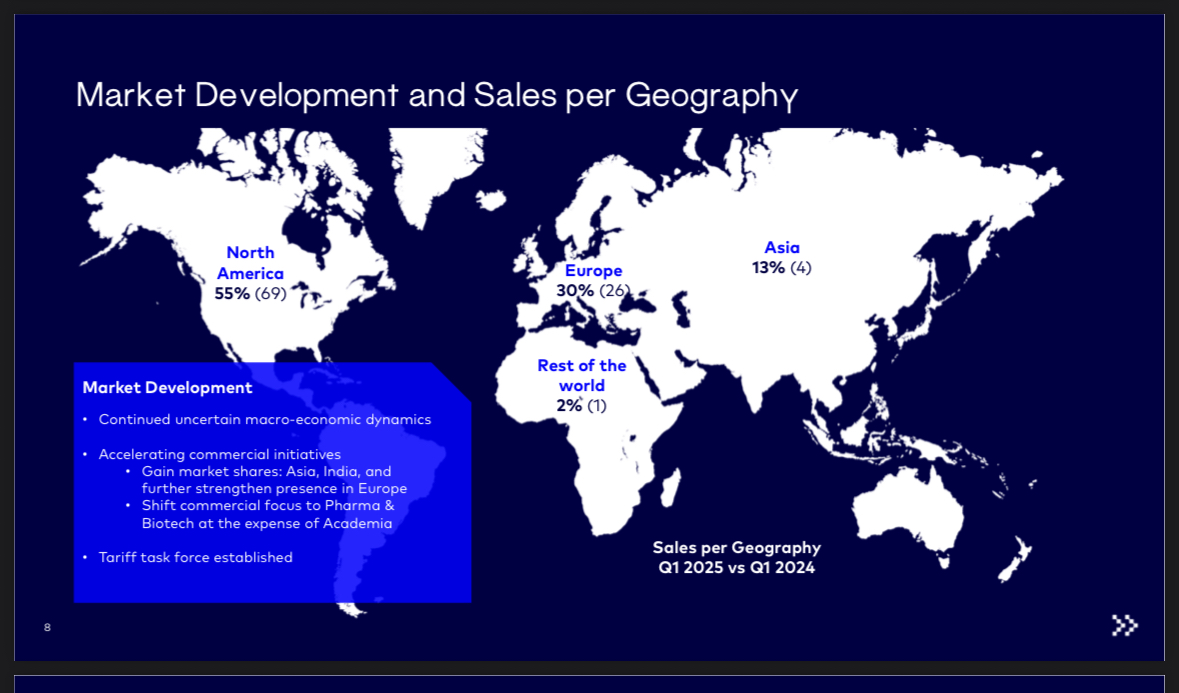

📊 Q1 2025 in figures and what's really behind it (Caution currency: Swedish krona, 1 SEK ~ 0.10 USD)

- TurnoverSEK 389 million (-17 %)

- Organic growth: -19 %

- EBITDASEK -12 million

- Cash flow from operating activitiesSEK +77 million

- Net lossSEK -235 million

- Cash positionSEK 684 million

- Convertible bondSEK 1.1 bn outstanding (maturity: March 2026)

Supplement:

Q1 is seasonally weak as many customers (especially in research) do not make large investments at the beginning of the year. At the same time, Q4 was strong, which pulled sales forward.

Comparison of the three previous segments (Q1 2025)

With a view to organic growth:

👩🔬 Life Science Solutions:

- SalesSEK 191 million

- Organic growth: +4 % 👀

- ApplicationsDiagnostics, cell research, microdosing

🧬 Bioprinting:

- Sales105 million SEK

- Organic growth: +41 % 👀

- Applications: 3D cell printing, bioinks, in-vitro models

🔬Lab Automation:

- SalesSEK 94 million

- Organic growth: - 58 %

- ApplicationsAutomation of complete laboratory processes

What do the individual divisions do?

👩🔬 Life Science Solutions:

This is where BICO develops laboratory technologies for diagnostics and cell research, such as devices for high-precision dosing of tiny quantities of liquids, consumables and special analysis platforms.

Examples:

Cancer diagnostics:

- SCIENION devices help to precisely apply tumor markers to test chips, the basis for modern blood tests for early detection.

Allergy tests:

- Using microdosing technology, mini test fields are loaded with allergens to create personalized skin or blood tests.

Genetic testing & DNA analysis:

- Systems from BICO precisely dose minute amounts of liquid onto gene chips, which then analyze intolerances or genetic risk factors, for example.

Point-of-care diagnostics:

- Production of compact rapid test cartridges (e.g. for influenza, RSV, bacterial infections) for home use or the doctor's surgery.

🧬 Bioprinting (see excursus above)

- BICO sells 3D printers for living cells (e.g. from CELLINK) and bioinks, i.e. cell carrier gels for printing tissue.

- ApplicationResearch, drug testing, animal-free toxicology

🔬 Lab automation

This is about the complete automation of laboratories, e.g. robots that create cell cultures, carry out analyses or coordinate samples. Everything is controlled centrally via the Green Button Go® software from Biosero.

💰 How profitable is BICO currently?

BICO is not yet profitable in the traditional sense, as EBIT (operating result) was clearly negative at SEK -290 million in 2024.

However, the operating cash flow a completely different picture: this was 2024 positive at SEK +259 million, as well as in Q1 2025 at +77 MSEK.

This means that BICO is now earning money in its core business, meaning that liquidity is flowing into the company.

The EBIT is still burdened by high depreciation and amortization on earlier acquisitions, research expenditure and, in some cases, one-off restructuring costs.

Conclusion

up to here:

BICO is not yet "through", but the path to operational profitability is recognizable. The company is heading in the right direction, now it depends on whether it can stabilize its operating base and continue to scale its high-margin business areas.

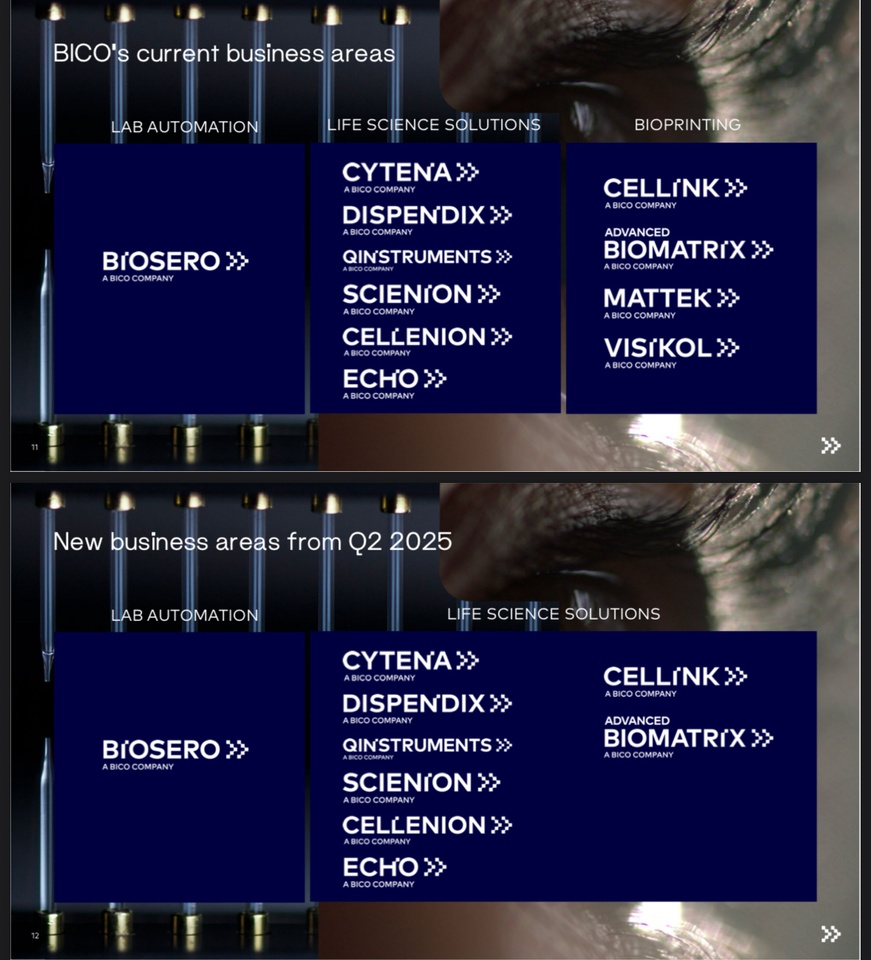

🤝 Business divisions & restructuring (from Q2 2025)

BICO previously operated in 3 segments:

- Bioprinting (e.g. CELLINK)

- Life Science Solutions (e.g. SCIENION)

- Lab Automation (e.g. Biosero)

New from Q2 2025:

Only two divisions, as Bioprinting will be integrated into "Life Science Solutions". Why?

Because CELLINK & Co. are now closely interlinked with diagnostics and consumables. The new setup is intended to increase efficiency, leverage synergies and simplify reporting.

📊 Classification of the figures and why Lab Automation is not growing, even though it is strategically so important

Bioprinting & Life Science Solutions show positive organic growth, while Lab Automationthe third-largest division, shrank massively (-58%).

Automation in particular is one of the main growth drivers in the bioconvergence strategy.

Explanation according to earnings call:

Q1 2024 (PY) was an upward outlier:

- An exceptionally large order from Biosero was booked at that time (project business).

- This effect distorts the basis for comparison, which exaggerates the decline in 2025.

Fewer project starts and completions in Q1 2025:

- Projects in Lab Automation are not distributed linearly, but are completed in phases

- There were simply fewer completed milestones in Q1 = less sales.

Macro-related reluctance on the part of major customers (pharma):

- Investment decisions were delayed, not canceled.

According to CEO Maria Forss:

"The underlying demand for Lab Automation continues to be strong."

"Project cycles are longer - but demand from pharma remains intact."

Project business is naturally volatile:

- Lab Automation is not recurring, but order-based.

- This leads to strong quarterly fluctuations - even with a stable order backlog.

BICO's strategic response

Standardization of project packages:

- Shorter durations, modular solutions to cushion order fluctuations

Strengthening project management:

- To better control time delays and resource commitment

Focus on pharmaceutical customers:

- Cooperation with "Top 20 Pharma Companies" is being expanded, geographically flexible (USA, EU, Asia)

➡️ The decline in sales in Lab Automation looks dramatic, but is primarily due to timing and not a structural problem.

BICO is responding with strategic adjustments to its product portfolio and points to continued strong demand, only with longer lead times.

For investors, this means that the decline is unfavorable but explainable, not alarming

Further statements from the earnings call

CEO Maria Forss:

"Despite a decline in sales, Life Science Solutions and Bioprinting are showing positive development. Our strategy adjustment is taking effect."

- Bioprinting is booming: +41 % organic, CELLINK +130 % (on a low basis)

- SCIENION stabilizes Diagnostics: Miniaturization & home testing drive demand

- USA weakness in research: Reluctance to invest among academic customers due to uncertain NIH funding

- Tariffs & macro volatility: BICO has shifted production out of China, flexed supply chain

- Divestments: MatTek & Visikol sold, enables net cash position in Q2 2025

Why is bioprinting booming right now?

- New regulatory trends: FDA allows animal testing alternatives

- Increasing demand for in-vitro tissue models

- International expansion (e.g. India, Asia)

- Favorable product mix (bioinks, consumables)

Excursus in-vitro tissue models:

"In vitro" means: outside the living body, e.g. in a petri dish, on a chip or in a laboratory device.

Tissue models are replicated biological structures that resemble real human (or animal) tissue.

Example:

A skin tissue printed with cells that is used for cosmetic or drug tests, without animal testing.

What's the point?

- Safety & efficacy tests (e.g. for drugs, chemicals)

- Disease models (e.g. tumor tissue for cancer research)

- Personalized medicine (tissue from own cells)

In vitro tissue models are an ethically and scientifically attractive alternative to animal testing and BICO supplies the printing technology for this, among other things.

Is BICO a unique company in bioprinting?

No, but one of the pioneers with a broad portfolio.

There are competitors such as Allevi, Aspect Biosystems and Organovo, but BICO combines hardware, software and services under one roof - a strategic advantage.

Where does the market currently stand and what does the future look like?

- The market for bioconvergence is still young, provocatively speaking perhaps comparable to the cloud in 2010

- Applications such as automated laboratories, in-vitro models and AI-supported diagnostics are in their infancy

- Long-term demand is enormous for personalized medicine, increased efficiency and ethics (e.g. avoidance of animal testing)

Possible future scenarios

1 . BICO becomes a global playerBICO continues to grow, automates laboratories worldwide

2 . BICO becomes a takeover candidate: Groups such as Sartorius $SRT (-2.82%) , Danaher $DHR (-1.25%) or Thermo Fisher $TMO (-0.17%) could strike

3 . BICO remains niche leader: Focused on profitable segments with high innovation density

Risks & critical voices

- Unprofitable: No sustainable EBIT coverage yet

- Convertible bond (SEK 1.1bn, equivalent to USD 114m): Maturity 2026, repayment depends on cash flow & divestments

- Risk of dilution if convertible bond is serviced via shares

- Strong dependence on projects -> sales fluctuations

- Competitive pressure from large corporations

The topic of the convertible bond has made me sit up and take notice again; here are some more deep dives:

What's the deal with BICO's convertible bonds until 2026?

Convertible bonds are a kind of hybrid between a bond and a share. They work like this:

- Investors lend money to BICO (e.g. SEK 1,000)

- BICO pays interest in return

At the end of the term (March 2026), investors receive either:

- the money back

- or can convert the bond into shares - depending on the agreed price

The whole thing is attractive for companies because they:

- only have to pay interest at first, no return of capital

- and can often offer a lower interest rate because the conversion option is attractive

What this means in concrete terms:

- BICO originally had convertible bonds with a volume of over SEK 1.5 billion

- SEK 394 million have already been repurchased in 2024 & 2025

- Currently open (as of Q1 2025): SEK 1.106 billion (114.5 million USD)

- Maturity date: March 2026

Why is this an issue for investors

1 . Repayment or dilution:

If BICO cannot repay the amount, new shares must be issued, this is called dilution because your stake in the company decreases.

2 . Cash flow burden:

If BICO wants to repay the amount from its own resources, it needs a lot of liquidity, which can slow down other investments.

3 . Refinancing risk:

If the market is weak in 2025/26, refinancing could become expensive or not possible at all.

What is the current situation?

Positive:

- BICO currently has SEK 684m in cash (USD 71m)

- The sale of MatTek & Visikol will put BICO in a net cash position in Q2 2025

- Target: Early extinguishment of convertible bond 2026

Statement on financing / repayment

CFO Jacob Thornberg said:

"The closing of the divestment of MatTek and Visikol for USD 80 million is expected to take place during Q2 2025 [...]

The proceeds from the transaction will be used to resolve the outstanding convertible bond, which matures in March 2026."

Translated:

The entire proceeds from the sale of MatTek & Visikol to Sartorius (USD 80 million) are earmarked for the repayment of the convertible bond.

Management's assessment of the financial position:

"We expect to move into a net cash position during Q2 2025."

This means:

- After the transaction, BICO will have more cash and cash equivalents than debt

- These funds should enable repayment in 2026 without further dilution

Assessment: How credible is this?

Positive:

- BICO shows clear plan: repayment of convertible bond is top priority

- Cash position Q1: SEK 684m

- Sale of MatTek & Visikol: approx. SEK 870m (converted)

-> Repayment can be financed if no new setback occurs

But:

- The operating business is not yet making a stable contribution to financing

- New investments or declining sales could jeopardize the plan

- Market environment remains volatile (interest rates, project delays, etc.)

➡️ Management is actively pursuing the plan to redeem the convertible bond in full before maturity in 2026 without dilution.

The sale of MatTek & Visikol has freed up concrete capital for this.

The direction is right, but BICO remains a risky stock with operational debt.

More on profitability:

In the Q1 2025 Earnings Call BICO's management did not give a specific date for break-even or profitability

... which is typical for growth companies with highly volatile project business.

What was said instead?

On profitability in Q1 itself:

EBITDA was negative (SEK -12m), but:

"Adjusted EBITDA was in line with Q1 2024 due to the positive development in Life Science Solutions and Bioprinting."

-> Improvement due to mix effects and operational measures

- The positive margins from Q4 2024 could not be maintained, mainly due to Lab Automation weakness.

Long-term statements?

No specific annual figure or guidance on profitability. But:

"We have launched a new operating model [...] to achieve improved commercial as well as operational efficiencies."

"We will continue to optimize our cost base and drive efficiency through integration."

Interpretation:

- Management is actively working on profitability

The focus is on the short term:

- Cash flow

- Efficiency gains

- Segment focus

Butunfortunately no clear words like: "We plan to be profitable in 2025 or 2026." 😬

Will BICO be the company that prints organs, or is it more likely to be taken over?

Technologically, BICO is very well positioned today when it comes to bioprinting infrastructure:

- Hardware (BIO X printers)

- Bioinks (cell-compatible inks)

- Software & automation

- Worldwide customer base

ButPrinting fully functional organs for clinical applications is a gigantic leap, not only technologically, but also in regulatory, medical and logistical terms. This is what is needed:

- billions in long-term capital

- Clinical studies over many years

- integration into healthcare systems and transplant networks

These are competencies that are more common in corporations like Johnson & Johnson $JJ, Medtronic $MDT (-0.95%) , GE Healthcare $GEHC (-2.69%)

, Siemens Healthineers $SHL (-2.85%) or Thermo Fisher $TMO not a smaller platform provider like BICO.

Which is more likely?

1 . BICO remains the "toolmaker" of the bioprinting world:

Just like ASML for semiconductors or Illumina for genomics, but without building drugs/organs itself.

2 . BICO will be taken over when the topic becomes clinically concrete:

For example, when the first major organ projects enter the clinical phase, it is likely that a giant will strike to secure access to the technology.

3 . BICO remains an enabler, but not the final provider of clinical bioprinted organs

When organs are actually printed, will BICO become the global market leader?

🏷️ Unlikely.

➡️ More realistic is that BICO becomes one of the key technology suppliers or is taken over by one of the big players beforehand.

This can still be highly attractive for investors. After all, whoever supplies technology will be needed, regardless of who ends up operating on the patient.

Should we now focus on BICO or rather on a large corporation with bioprinting potential? 🤔

1 . Buy BICO for speculative returns

Pros:

- Favorable valuation after the "crash/hype" (more than 80 % below all-time high)

- One of the technology leaders in bioprinting

- Strategic focus, efficiency program, divestments, clear direction

- Enabler position in a highly scalable future market

- Possible takeover candidate = extra share price potential

Contra:

- Not yet profitable, operational risks exist

- Market for organs is still many years away

- Capital structure (convertible bond) is a medium-term uncertainty factor

- If large investors fail to materialize, BICO could be technologically overtaken

2 . Alternatively: back a large corporation for more stability

Which big players have the potential to drive bioprinting forward (or take over BICO)?

Sartorius

- Already has close cooperation with BICO (and acquired MatTek/Visikol)

- Focus on cell biology, diagnostics & laboratory automation

- Strong in APAC region and with biotech customers

-> Best-case candidate for takeover or joint venture

Thermo Fisher Scientific

- Global leader in laboratory equipment, genomics, diagnostics

- Great financial strength, active M&A strategy

- So far, however, more focused on classic diagnostics

-> Comes into play when bioprinting is more closely integrated into pharmaceutical production

Danaher

- Parent company of brands such as Cytiva and Beckman Coulter

- Very active in diagnostics and research technology

- M&A-driven, high margin focus

-> Could strike when the market matures, but rather late and strategically

3D Systems / Stratasys

- Directly active in 3D printing

- Have already acquired bioprinting units (e.g. Allevi)

- Fluctuating in strategy & implementation

-> Riskier than classic medtechs, but a direct bioprinting play

Personal classification: substance or science fiction on credit?

What makes more strategic sense? Which investment is "the right one"?

- High potential return and very high risk tolerance: Then BICO

- Takeover speculation: Then BICO or e.g. Sartorius

- Stable yield and dividend: Then Sartorius, Dabaher or Thermo Fisher

- Bet on "market leader of the future": Then wait and see, today there is no clear bioprinting world leader

OR

Combination strategy:

I invest a small position in BICO as a "moonshot", combine this with a solid underlying position in Sartorius or Thermo Fisher and cover the technology and protect the capital if BICO fails.

The two underlying positions mentioned can of course also represent a global ETF.

My personal assessment of BICO currently fluctuates between cautious optimism and realistic doubt.

On the one hand, I see a clear technological lead and a strategy that, unlike a year or two ago, now appears more well thought-out and focused. Partnerships with established players such as Sartorius also give me the feeling that BICO is not operating alone in a vacuum.

On the other hand, the operational foundation is still shaky. Profitability has not been achieved and the issue of the 2026 convertible bond hangs over the company.

Without sufficient cash flow or fresh capital, the ambitious vision could stumble, and despite all the enthusiasm for bioprinting and automation, we should always be aware of this.

BICO is not a stock for quiet nights, but for visionaries with patience it may be a ticket to the future of medicine.

I am currently waiting for an entry opportunity with a good feeling. The goal could be a portfolio share of up to approx. 3-4%, which then remains in place and is reduced in the future through portfolio growth without selling.

Thanks for reading! 🤝

______________

Sources:

[1] https://storage.mfn.se/5a3030c0-d13b-4177-80d0-94da59c7302d/bico-q1-2025-eng.pdf

[2] https://bico.events.inderes.com/q1-report-2025/register

/ https://web.quartr.com/link/companies/4484/events/247443/transcript?targetTime=0.0

More:

https://www.sartorius.com/en/company/investor-relations

I've been in BICO before and looked into it a bit back then. However, I got in at the wrong time and bought a bit on the dip, as it happens XD. At some point I threw the position out at a loss, BUT I still like it and keep it on my watchlist.

I don't see any "good" reason to get in right now. If you want to gamble, now would of course be a better time than back then. But it is what it is, and if you're looking for excitement and thrills, you've come to the right place. But then don't invest more than you think is appropriate for a rollercoaster for fun....

They don't have a long cash runway, as you describe, and still have a lot to do to reposition themselves after all the acquisitions. They are currently restructuring themselves, that's true, but in my view there's nothing to be said against waiting until there are the first signs that this will lead to something.

You say below that it is not a stock for quiet nights but for "visionary investors with patience". I would question whether the visionary investor "with patience" should not simply stay tuned at this point and patiently inform himself about the company and leave it on the WL until then...

PS: I also have something in my portfolio that has more in it because I enjoy finding out about the company and it's kind of nice to be in it. But it's not an investment case, it's more of a hobby and an emotion, inspired by an interesting idea etc....

AstraZeneca: Positive news for breast cancer drug

The AstraZeneca share $AZN (-1.28%) is currently in a positive state. The pharmaceutical company has published promising results on a new drug for the treatment of breast cancer, Camizestrant. These data come from a phase III trial and show a significant extension of the period without disease progression.

The trial is still ongoing and it is likely to be some time before approval. However, analysts are optimistic and forecast sales of USD 1.5 billion (EUR 1.4 billion) for Camizestrant by 2030.

AstraZeneca even expects peak annual sales of USD 5 billion for the drug, which would be a great success. Group CEO Pascal Soriot recently emphasized that the company's drug pipeline is well on track, which is reflected in sales growth of 18% in 2024 to over USD 54 billion.

AstraZeneca shares rose by 1.5% to £120.32 in London trading. It remains exciting to see how developments will continue! 📈

Analyst updates, 13.01.25

⬆️⬆️⬆️

- GOLDMAN raises the price target for SIEMENS ENERGY from EUR 56 to EUR 60. Buy. $ENR (-4.43%)

- BARCLAYS raises the target price for MERCEDES-BENZ from EUR 48.50 to EUR 50. Underweight. $MBG (-1.62%)

- JEFFERIES upgrades SMA SOLAR from Hold to Buy and raises target price from EUR 14 to EUR 20. $S92 (-8.49%)

- GOLDMAN raises the price target for DEUTSCHE BÖRSE from EUR 226 to EUR 231. Neutral. $DB1 (+2.55%)

- BOFA upgrades BBVA from Neutral to Buy and raises target price from EUR 11 to EUR 13. $BBVA (-4.45%)

- WARBURG RESEARCH upgrades FUCHS SE from Hold to Buy. Target price EUR 50. $FPE

- GOLDMAN raises the price target for FLATEXDEGIRO from EUR 17 to EUR 18. Buy. $FTK (+2.23%)

- BERENBERG raises the target price for IBERDROLA from EUR 12.30 to EUR 14. Hold. $IBE (-3.74%)

- JEFFERIES upgrades PVA TEPLA from Hold to Buy and raises target price from EUR 12 to EUR 19. $TPE (-0.29%)

- JEFFERIES raises the price target for FRIEDRICH VORWERK from EUR 23 to EUR 30. Hold. $VH2 (+0.74%)

- JEFFERIES raises the price target for ZEAL NETWORK from EUR 45 to EUR 58. Buy. $TIMA (+0.81%)

- JEFFERIES raises the price target for ADESSO from EUR 75 to EUR 85. Hold. $ADN1 (-0.24%)

- JEFFERIES upgrades NEL from Underperform to Hold. Target price NOK 3. $NEL (-3.73%)

⬇️⬇️⬇️

- BERENBERG lowers the price target for RWE from EUR 46.50 to EUR 42. Buy. $RWE (-3.03%)

- GOLDMAN lowers target price for EON from EUR 17.50 to EUR 17. Buy. $EOAN (-3.55%)

- HAUCK AUFHÄUSER IB downgrades AIXTRON from Buy to Hold and lowers target price from EUR 26.40 to EUR 13.80. $AIXA (-0.99%)

- METZLER lowers the price target for DWS from EUR 41 to EUR 40.50. Hold. $DWS (-3.13%)

- GOLDMAN lowers the price target for ASTRAZENECA from GBP 159.55 to GBP 155.58. Buy. $AZN (-1.28%)

- TD COWEN downgrades STMICRO to Hold. Target price EUR 24.50. $STM (-4.88%)

- JPMORGAN downgrades CONSTELLATION BRANDS to Neutral. Target price USD 203. $STZ (+0.52%)

- JEFFERIES lowers the price target for DOCMORRIS from CHF 65 to CHF 39. Buy. $DOCM (-1.79%)

- JEFFERIES lowers the price target for ATOSS SOFTWARE from EUR 112 to EUR 108. Hold. $AOF (+0.63%)

- JEFFERIES lowers the price target for JENOPTIK from EUR 34 to EUR 29. Buy. $JEN (-4.8%)

- JEFFERIES lowers the price target for KONTRON from EUR 29 to EUR 27. Buy. $KTN (-2.55%)

- JEFFERIES lowers the price target for SILTRONIC from EUR 95 to EUR 90. Buy. $WAF (-3%)

- JEFFERIES downgrades VERBIO from Buy to Hold and lowers target price from EUR 22 to EUR 11. $VBK (-6.17%)

- JEFFERIES downgrades SGL CARBON from Buy to Hold and lowers target price from EUR 9.50 to EUR 4.40. $SGL (-4.91%)

⬆️⬆️⬆️

- BOFA raises the price target for WALMART from USD 95 to USD 105. Buy. $WMT (+0.62%)

- JEFFERIES raises the price target for WALMART from USD 100 to USD 105. Buy. $WMT (+0.62%)

- HAUCK AUFHÄUSER IB raises the target price for RHEINMETALL from EUR 680 to EUR 750. Buy. $RHM (-3.64%)

- WARBURG RESEARCH raises the target price for RHEINMETALL from EUR 600 to EUR 700. Buy. $RHM (-3.64%)

- JPMORGAN raises the price target for SALESFORCE from USD 310 to USD 340. Overweight. $CRM (+2.21%)

- WARBURG RESEARCH raises the target price for LEG IMMOBILIEN from EUR 81.60 to EUR 90.50. Hold. $LEG (-2.95%)

- DEUTSCHE BANK RESEARCH raises the price target for HEIDELBERG MATERIALS from EUR 116 to EUR 137. Buy. $HEI (-2.02%)

- KEPLER CHEUVREUX raises the price target for GFT TECHNOLOGIES from EUR 31 to EUR 32. Buy. $GFT (+0.2%)

- ODDO BHF raises the target price for TALANX from EUR 76 to EUR 78. Underperform. $TLX (-2.18%)

- KEPLER CHEUVREUX raises the target price for THYSSENKRUPP from EUR 3.70 to EUR 3.80. Hold. $TKA (-6.13%)

⬇️⬇️⬇️

- STIFEL lowers the price target for BAYER from EUR 36 to EUR 28. Hold. $BAYN (-5.71%)

- LBBW downgrades ENI from Buy to Hold and lowers target price from EUR 16.70 to EUR 15. $ENI (-1.23%)

- WARBURG RESEARCH lowers the target price for SFC ENERGY from EUR 29 to EUR 27. Buy. $F3C (-3.76%)

- WARBURG RESEARCH lowers the target price for TECHNOTRANS from EUR 23 to EUR 21. Buy. $TTR1 (-3.89%)

- DEUTSCHE BANK RESEARCH lowers the price target for CUREVAC from USD 3.90 to USD 2.50. Hold. $CVAC

- BERENBERG lowers the price target for ASTRAZENECA from GBP 150 to GBP 140. Buy. $AZN (-1.28%)

Was die europäischen Aktien am Morgen bewegt 🇪🇺👇🏼

Upside ⬆️

- Evotec $EVT (-6.25%) 20.0% (Halozyme confirms proposal to combine with Evotec for €11.00/shr in €2.0B All-Cash deal)

- TT Electronics $TTG (-2.54%) +38.5% (rejects offers to be acquired)

- Generali $G (-3.93%) +4.5% (9-month results)

- Aegon $AGN +2.5% (Q3 trading update)

- Aviva $AV. (-2.57%) +0.5% (HSBC raised to buy)

- Touax $TOX +1.0% (earnings)

Downside ⬇️

- ASML Holding $ASML (-3.32%) -2.5% (Applied Materials results)

- Sanofi $SAN (-2.14%) -3.5%, Astrazeneca $AZN (-1.28%) -2.5% (Trump taps vaccine skeptic RFK Jr. to head HHS)

- Bavarian Nordic $BAVA (-3.31%) -17.5% (Q3 results, heavily misses estimates; Trump taps vaccine skeptic RFK Jr. to head HHS)

- Nexans $NEX (-4.48%) -3.5% (Bpifrance confirmed selling 2.5% stake in Nexans)

- Givaudan $GIVN (-2.16%) -1.5% (Barclays cuts to underweight; accident)

- NKT $NKT (-3.04%) -1.5% (Danske Bank raised to buy)

Trending Securities

Top creators this week