$DIS (-1.07%)

$PLTR (+2.91%)

$SRT (-3.35%)

$NXPI (-4.14%)

$PYPL (-1.17%)

$PEP (-1.76%)

$TER (-10.17%)

$CPRI (-4.04%)

$MRK (-0.3%)

$PFE (+1.05%)

$TTWO (-0.31%)

$EA (-1.45%)

$AMD (-3.16%)

$MDLZ (+0.16%)

$LUMN (-2.89%)

$SMCI (-2.7%)

$7011 (-1.52%)

$6752 (-0.62%)

$6367 (-0.24%)

$UBSG (-2.9%)

$GSK (-0.63%)

$UBER (-0.62%)

$ABBV (-1.37%)

$LLY (+0.32%)

$GOOG (-0.74%)

$ELF (+0.2%)

$QCOM (-1.01%)

$SNAP (-3.26%)

$WOLF (-16.91%)

$ARM (-4.91%)

$VOLCAR B (-1.42%)

$6758 (+1.22%)

$SHL (-0.72%)

$SAAB B (+3.39%)

$5401 (-3.02%)

$MAERSK A (+1.35%)

$R3NK (+3.01%)

$BMY (-0.75%)

$BMW (-2.17%)

$EL (-5.99%)

$ROK (-2.36%)

$PTON (-0.62%)

$KKR (-4.41%)

$LIN (-1.42%)

$RL (-4.22%)

$AGCO (-2.91%)

$RBLX (-3.52%)

$FTNT (-1.14%)

$REDDIT (-0%)

$ILMN (-5.54%)

$WMG (-4.33%)

$IREN (-7.48%)

$MSTR (-4.74%)

$AMZN (-2.34%)

$KOG (+2.17%)

$ORSTED (-2.5%)

$PM (+0.1%)

$WEED (+0.38%)

- Markets

- Stocks

- GlaxoSmithkline

- Forum Discussion

GlaxoSmithkline

Price

Discussion about GSK

Posts

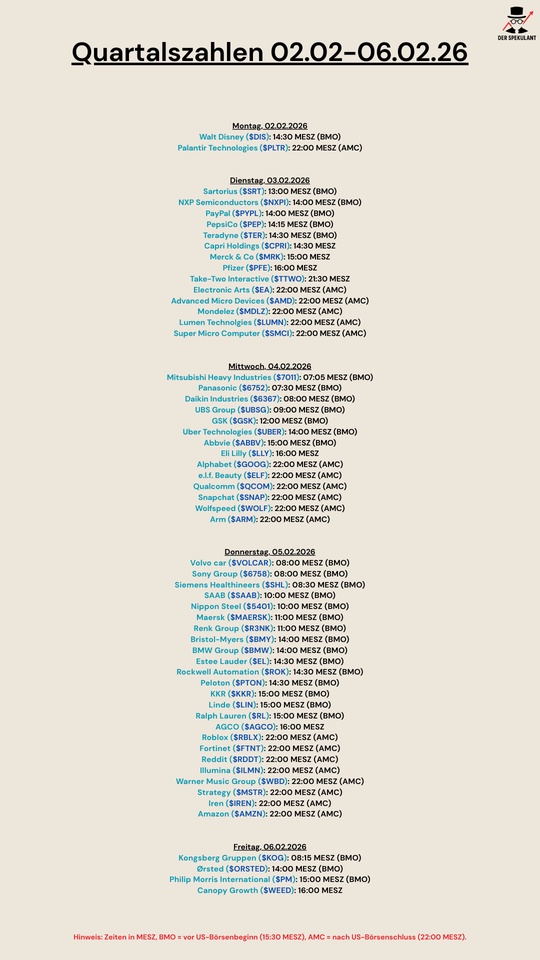

11Quarterly figures 02.02-06.02.26

Morningstar Best Stocks to own 2026

$ (+2.33%)TYL (+2.33%)

$GE (-1.24%)

$GD (+0.69%)

$CHRW (-3.13%)

$ROL (+0.3%)

$TW (+0%)

$CSGP (+0.41%)

$RKT (-1.83%)

$CLX (+1.02%)

$ROST (-1.5%)

$FAST (-0.84%)

$CSCO (-1.86%)

$YUMC (-0.9%)

$KOF (-1.1%)

$ORLY (+0.04%)

$KO (+0.05%)

$RY (-0.97%)

$MDLZ (+0.16%)

$IMBBY (+0.55%)

$A (-3.79%)

$IDXX (-1.76%)

$SONY (+0%)

$MSCI (+0.47%)

$SYY (-1.53%)

$VLTO WI (-1.15%)

$DPZ (+1.75%)

$IDEX (-0.4%)

$VRSN (+0.74%)

$COST (+1.91%)

$ITT (-3.92%)

$SHW (-1.72%)

$EPD

$SIE (-0.81%)

$CP (-2.73%)

$CTAS (+1.84%)

$ROG (-3.01%)

$BK (-0.95%)

$CNR (-2.86%)

$PM (+0.1%)

$TSM (-4.34%)

$ITW (-2.81%)

$APD (-1.12%)

$PG (-0.28%)

$AAPL (-1%)

$BAC (-2.65%)

$CPB (+2.15%)

$VRSK (+1.59%)

$HSY (-0.77%)

$GWRE (-0.26%)

$HII (+0.37%)

$GSK (-0.63%)

$SBUX (+0.38%)

$ALLE (-2.26%)

$INTU (+3.68%)

$MSI (-2.83%)

$GWW (-2.95%)

$UNP (-2.49%)

$WCN (-0.07%)

$WM (+1.3%)

$NOC (+1.96%)

$CAT (-3.78%)

$PAYX (+2.41%)

$ADP (+1.65%)

$MCO (-1.18%)

$SPGI (+0.21%)

$NDSN (-4.78%)

$WMT (+0.18%)

$OTIS (-1.68%)

$CL (+1.44%)

Best Companies to Own: Methodology

The companies on this list are covered by Morningstar Research Services’ equity analysts and have shares available to US investors. This means that Morningstar equity analysts have calculated fair value estimates for the shares of the companies that trade on US exchanges. As a result, most of the companies on this list are based in the US.

Within that coverage list, the best companies meet the following criteria:

- Wide Economic Moat. The Morningstar Economic Moat Rating summarizes the length of a company’s competitive advantages. An economic moat is a structural feature allowing a firm to generate excess profits over a long period. If Morningstar Research Services believes that excess returns will persist for 20 years or more, that company earns a wide moat rating.

- Standard or Exemplary Capital Allocation.The stock’s Morningstar Capital Allocation Rating is an assessment of the quality of management’s capital allocation, with particular emphasis on the firm’s balance sheet, investments, and shareholder distributions. Capital allocation is judged from an equity shareholder’s perspective, considering companies’ investment strategy and valuation, balance-sheet management, and dividend and share buyback policies on a forward-looking basis. A company can receive an Exemplary, Standard, or Poor Capital Allocation Rating.

- Low or Medium Fair Value Uncertainty. The fair value Morningstar Uncertainty Ratingrepresents the predictability of a company’s future cash flows and, therefore, the level of certainty in the fair value estimate of that company. The Uncertainty Rating for a company can be Low, Medium, High, Very High, or Extreme. It captures a range of likely potential intrinsic values for a company based on the characteristics of the business underlying the stock, including such things as operating and financial leverage, sales sensitivity to the economy, product concentration, and other factors. The more predictable cash flows, the smaller the range of potential intrinsic values, the lower the uncertainty.

What Gives a Company an Economic Moat?

Companies with moats have one or more of the following characteristics:

- Network Effect. Lots of people are using the service, which then makes the service more valuable to the people who use it.

- Intangible Assets. Patents, brands, regulatory licenses, and other intangible assets can prevent competitors from duplicating a company’s products or allow the company to charge a significant price premium.

- Cost Advantage. Firms with a structural cost advantage can either undercut competitors on price while earning similar margins or charge market-level prices while earning relatively high margins.

- Switching Costs. When it would be too expensive or troublesome to stop using a company’s products, the company often has pricing power.

- Efficient Scale. When a niche market is effectively served by one or a small handful of companies, there is no room or incentive for potential competitors to enter the market.

To maintain analysts’ independence, Morningstar Research Services does not publicly rate its parent company Morningstar Inc. Therefore, Morningstar, Inc. is not on the list of the best companies available to US investors.

https://www.morningstar.com/stocks/best-companies-own-2026-edition

Quarterly figures 27.10-31.10.25

$KDP (+0.74%)

$7751 (-0.81%)

$NXPI (-4.14%)

$WM (+1.3%)

$CDNS (-0.81%)

$BN (+0.1%)

$SOFI (-1.27%)

$UNH (-0.68%)

$AMT (+0.44%)

$UPS (-1.98%)

$BNP (-1.03%)

$NVS (-0.36%)

$DB1 (+0.83%)

$MSCI (+0.47%)

$ENPH (-2.21%)

$BKNG (-1.02%)

$LOGN (-0.05%)

$V (-0.47%)

$MDLZ (+0.16%)

$PYPL (-1.17%)

$000660

$MBG (-1.25%)

$BAS (-2.28%)

$UBSG (-2.9%)

$SAN (-1.18%)

$CVS (-0.97%)

$OTLY (-5.16%)

$GSK (-0.63%)

$ETSY (-0.43%)

$CAT (-3.78%)

$KHC (+2.07%)

$ADYEN (-0.8%)

$ADS (-1.52%)

$AIR (-2.51%)

$SBUX (+0.38%)

$CMG (-4.73%)

$META (-2.49%)

$KLAC (-4.77%)

$MELI (+0.44%)

$WOLF (-16.91%)

$GOOGL (-0.59%)

$EQIX (-2.46%)

$MSFT (-0.48%)

$CVNA (-3.86%)

$EBAY (-0.94%)

$005930

$6752 (-0.62%)

$KOG (+2.17%)

$VOW3 (-3.7%)

$GLE (-3.4%)

$LHA (-0.32%)

$STLAM (-3.71%)

$SPGI (+0.21%)

$MA (-0.55%)

$PUM (-3.68%)

$AIXA (-4.81%)

$FSLR (-1.68%)

$AAPL (-1%)

$REDDIT (-0%)

$AMZN (-2.34%)

$NET (+2.21%)

$MSTR (-4.74%)

$GDDY (+1.89%)

$TWLO (+1.91%)

$COIN (-4.39%)

$066570

$CL (+1.44%)

$ABBV (-1.37%)

$XOM (+0.63%)

Strong quarterly figures for GSK

Sales: £7.99 billion

→ Exceeded analysts' expectations of £7.80 billion and was up on the previous year's figure of £7.88 billion

- Net profit: £1.44 billion

→ Significant increase compared to £1.17 billion in the previous year

- Core operating profit: £2.63 billion

→ +12% at constant exchange rates

- Adjusted earnings per share (EPS): 46.5 pence

→ Above analysts' expectations

analysts

Outlook for the full year 2025:

- GSK now expects sales growth at the upper end of the 3-5% range

- Core operating profit growth is also expected at the upper end of the 6-8% range

Encouraged by surprisingly strong quarterly figures, GSK has forecast a full-year result at the upper end of the targeted range. The most important division, Specialty Medicines, had developed very well, said Emma Walmsley, the pharmaceutical group's CEO, on Wednesday.

Drugs for the treatment of respiratory diseases, cancer, inflammation and HIV had recorded double-digit growth rates.

In the second quarter, Group sales grew by six percent in constant currency to the equivalent of a good nine billion euros. Net profit amounted to 46.5 pence per share. GSK is forecasting sales growth of three to five percent for 2025. Net profit is expected to increase by six to eight percent. This outlook already takes into account the US tariffs, it said.

GSK shares were nevertheless unable to maintain their opening gains on the London Stock Exchange and lost around half a percent.

Some analysts will probably have to revise their forecasts downwards due to the expected negative impact of exchange rate effects, commented analyst Benjamin Jackson from investment bank Jefferies.

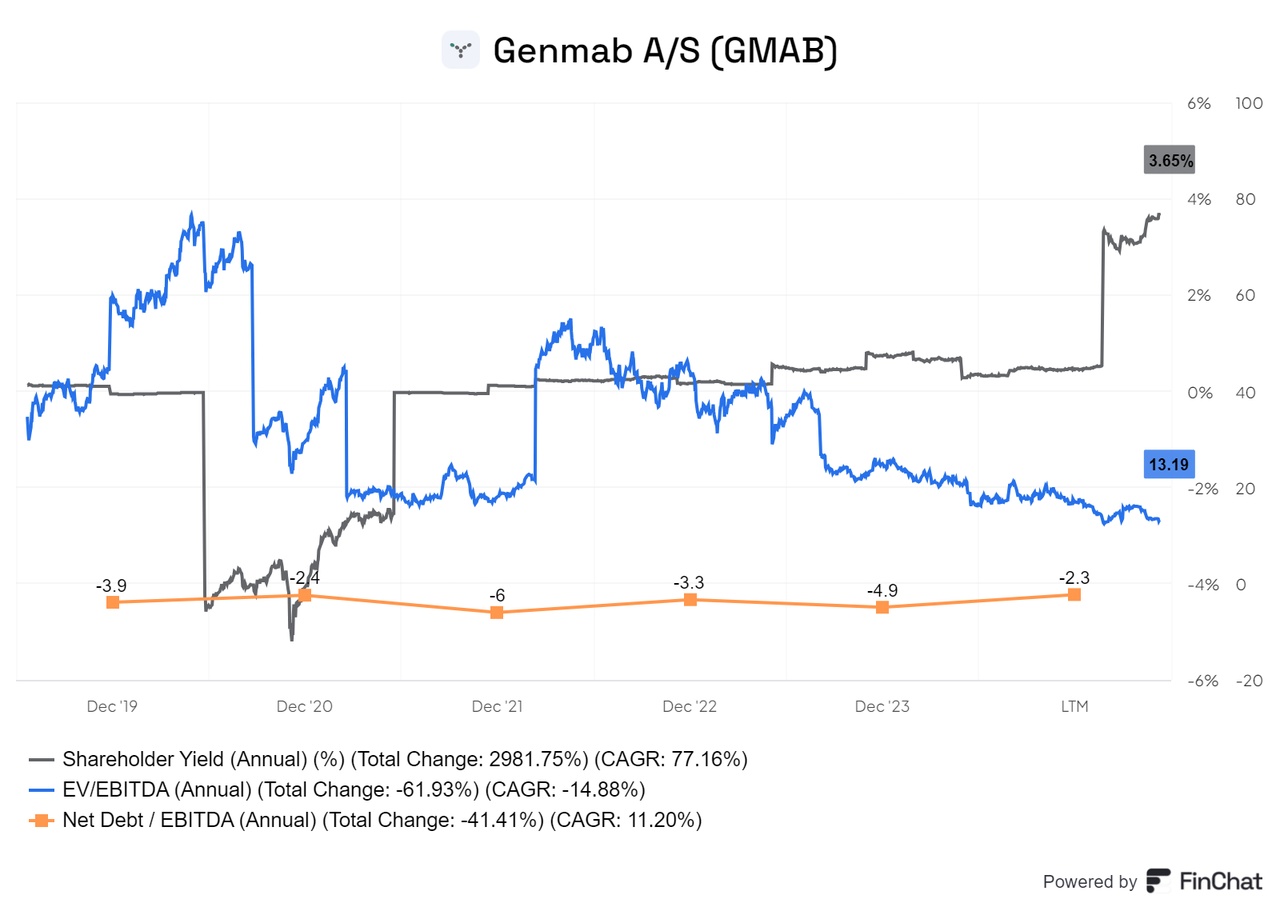

Quarterly figures 28.07-01.08

$HEIA (-0.11%)

$EL (-2.75%)

$NUE (-3.75%)

$CDNS (-0.81%)

$WM (+1.3%)

$MSFT (-0.48%)

$V (-0.47%)

$OR (-0.61%)

$AZN (-2.23%)

$MRK (-0.3%)

$PG (-0.28%)

$SBUX (+0.38%)

$BCS (-3.1%)

$META (-2.49%)

$BABA (+0.72%)

$QCOM (-1.01%)

$AIR (-2.51%)

$HSBC (-2.03%)

$GSK (-0.63%)

$MBG (-1.25%)

$F (-2.43%)

$AAPL (-1%)

$AMZN (-2.34%)

$MA (-0.55%)

$7203 (-0.87%)

$SHEL (+1.73%)

$005930

$SNY (-1.54%)

$CMCSA (+0.7%)

$COIN (-4.39%)

$NET (+2.21%)

$XOM (+0.63%)

$CVX (+0.14%)

$CS (-0.48%)

$NTDOY (-0.85%)

$CL (+1.44%)

$DTG (-1.94%)

$UNH (-0.68%)

Parents receive inheritance

Hello everyone!

My parents are in the process of selling my grandparents' house. It will probably fetch around €275,000. My parents will soon both be 60 years old.

They had initially considered buying another property nearby. But they have moved away again. The lack of flexibility and the time and risk involved with tenants put them off.

I also told them more about investing in the stock market. They were very open and interested, even though they said they had an unfounded fear of shares etc.

Now my question to you. What is the best way to invest the money? I think dividends would be very nice as my parents like the passive income like from a property. But it should also be very well diversified across countries and sectors.

I personally have developed 2 solutions. You can give your opinion as to whether you think the solutions are good or, of course, if you have completely different ideas.

1. the ETF solution

15% $XEOD (+0.03%) Call money ETF. Div. 1.9%

15% $TDIV (-0.25%) VanEck Divi Leaders. Div 3.5%

10% $TRET (-1.25%) Global Real Estate. Div. 3.7%

7,5% $VHYL (-0.37%) Allworld High Div Yi. Div 3.1%

7,5% $PEH (-0.73%) FTSE RAFI EM. Div 3.9%

5% $EWG2 (+0.5%) Gold

5% $SEDY (-0.45%) iShares EM Dividend. Div 8.0%

5% $JEGP (-0.32%) JPM Global Equity Inc Div 7.1%

5% $EEI (-0.01%) WisTree Europ Equity Inc Div 6.3%

5% $IHYG (-0.55%) High Yield Bond. Div 6.1%

5% $EXXW (-0.93%) AsiaPac Select Div50 Div 5.5%

15% Rest German Divi Shares approx. div 2.5%

=100% with 3.7% dividend.

275k ×3,7% = 10.175€

With full taxation 27.99% = 7327€

On average per month: 610€ dividend

With 2k tax-free allowance: 657€ dividend per month

I find it very well diversified, you have overnight money, you have the USA and Europe well represented, but also 12.5% emerging markets ETF. In terms of sectors, finance will be at the forefront. Followed by real estate and energy. I think that's fine.

2. the equity solution

I have selected 34 strong dividend stocks. In the list they are roughly divided into GICS sectors.

15% $XEOD (+0.03%) Overnight ETF. Div 1.9%

12% $EQQQ (-1.56%) Nasdaq100 ETF. Div 0.4%

5% $EWG2 (+0.5%) Gold

2% $O (+0.36%) Realty Income 6.0%

2% $VICI (-0.12%) Vici Properties 5.6%

2% $OHI (+0.88%) Omega Healthcare 7.2%

2% $PLD (-2.05%) Prologis 4.1%

2% $ALV (-1%) Allianz 4.35%

2% $HNR1 (-0.79%) Hannover Re 3.4%

2% $D05 (-0.04%) DBS Group 5.5%

2% $ARCC (-1.04%) Ares Capital 9.3

2% $6301 (-1.13%) Komatsu. 4,2%

2% $1 (+0.49%) CK Hutchison 4.6%

2% $AENA (-0.93%) AENA. 4,2%

2% $LOG (-0.75%) Logista 7.3%

1,5% $AIR (-2.51%) Airbus 1.8%

1,5% $DHL (+1.07%) DHL Group 4.8%

1,5% $8001 (-2.87%) Itochu 2.8%

2% $RIO (-0.64%) RioTinto plc 6.4%

2% $LIN (-1.42%) Linde 1.3%

2% $ADN (+0.47%) Acadian Timber 6.7%

3,5% $BATS (-1.48%) BAT 7.0%

2% $KO (+0.05%) Coca Cola 2.9

2% $HEN (-0.96%) Henkel 3.0%

2% $KVUE (+0.25%) Kenvue 4.1%

2% $ITX (-1.41%) Inditex 3.6%

2% $MCD (+0.3%) McDonalds 2.6%

2% $690D (+0.18%) Haier Smart Home 5.6

3,5% $IBE (-0.06%) Iberdrola. 4,1%

1,5% $AWK (+1.85%) American Water Works 4.4%

1,5% $SHEL (+1.73%) Shell 4.1%

1,5% $ENB (+0.28%) Enbridge 6.5%

2% $DTE (-0.64%) Deutsche Telekom 2.8%

2% $VZ (-0.34%) Verizon 6.8%

2% $GSK (-0.63%) GlaxoSmithKline 4.2

2% $AMGN (+0.33%) Amgen 3.5%

2% $JNJ (+0.26%) Johnson&Johnson 3.5%

= 100% with 3.5% dividend

275k ×3,5% = 9625€

With full taxation 27.99% = 6930€

On average per month: 577€ dividend

With 2k tax-free allowance: 624€ dividend per month

I also think this solution is cool because you can select the largest companies or strong dividend payers in the individual sectors or countries yourself. And of course you can also select shares with which you have a connection. However, I have focused on shares from the USA, England and Germany because of the withholding tax. Spain is also well represented because of my parents' ties to this country. It's also cool that the NasdaqETF also includes the Microsoft, Amazon, etc. compounders.

What do you think?

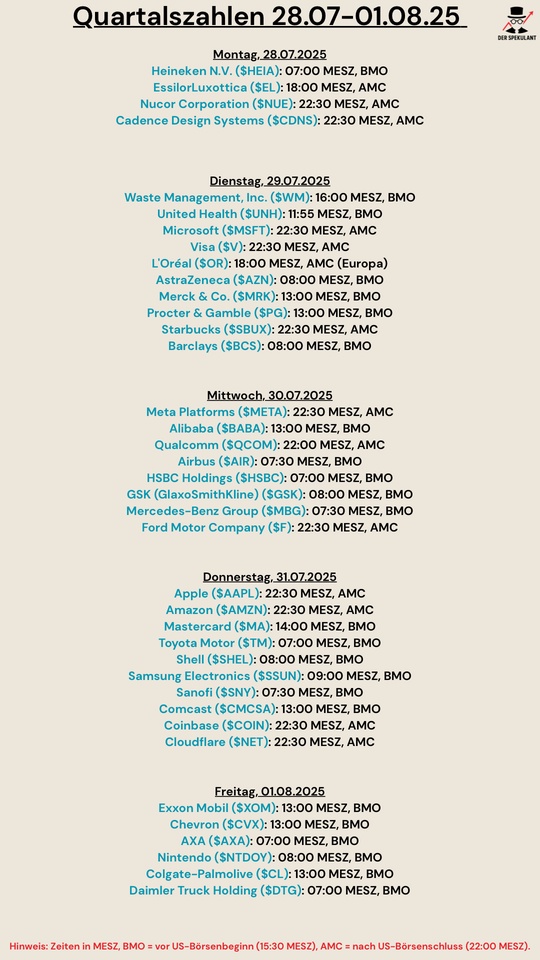

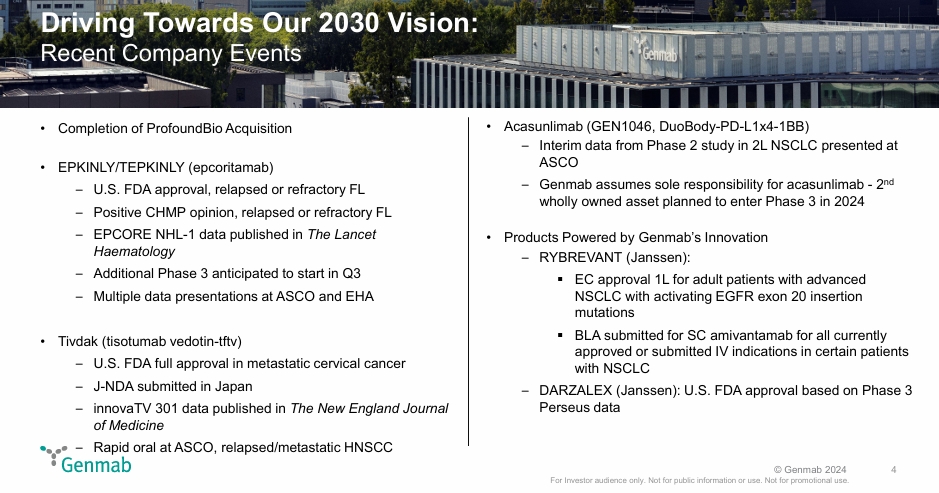

Genmab A/S

Company presentation

Genmab A/S is a Danish biotechnology company specializing in the development of innovative therapies to fight cancer. Founded in Copenhagen in 1999, the company is primarily dedicated to the research and production of monoclonal antibodies for oncology treatment. An outstanding product of $GMAB (-0.83%) is the proprietary Duobody® technology platform, which aims to optimize the treatment of various types of cancer.

Core business and key products

Genmab's core business is the development and commercialization of antibody therapies. Key products include:

- Darzalex (daratumumab): A monoclonal antibody for the treatment of multiple myeloma.

- DARZALEX FASPRO: A subcutaneous formulation of daratumumab.

- Duobody® technology platform: A proprietary platform for the development of bispecific antibodies.

Mission and vision

Genmab's mission is to develop innovative and differentiated antibody products that sustainably improve the lives of cancer patients. The company's vision is to be a leader in oncology through pioneering research and development in antibody therapy.

Historical development

Founded in 1999, Genmab went public on the Copenhagen and Frankfurt stock exchanges in 2000. The IPO raised 1.56 billion Danish kroner (approximately 209 million euros) for the company. In 2002, Genmab was delisted again in Frankfurt.

Business model & core competencies

Genmab's business model is based on the development and commercialization of innovative antibody therapies. The company's core competencies lie in the research of monoclonal antibodies and the Duobody® technology platform. This technological expertise gives Genmab a significant competitive advantage in the field of cancer therapies.

Future prospects & strategic initiatives

Genmab is continuously investing in the further development of its antibody technologies and the expansion of its product pipeline. This promising pipeline points to strong growth potential.

Market position & competition

Genmab has established itself as a major player in the field of antibody therapies. The company competes with large pharmaceutical companies such as $ROG (-3.01%) , $NOVN (-0.67%) and $GSK (-0.63%) , with which it also has development and marketing partnerships. Genmab's market position is strengthened by its innovative technologies and strong partnerships.

Total Addressable Market (TAM)

The global market for monoclonal antibodies in cancer therapy is growing steadily. In view of the increasing incidence of cancer and the growing demand for targeted therapies, Genmab has considerable growth potential.

Development

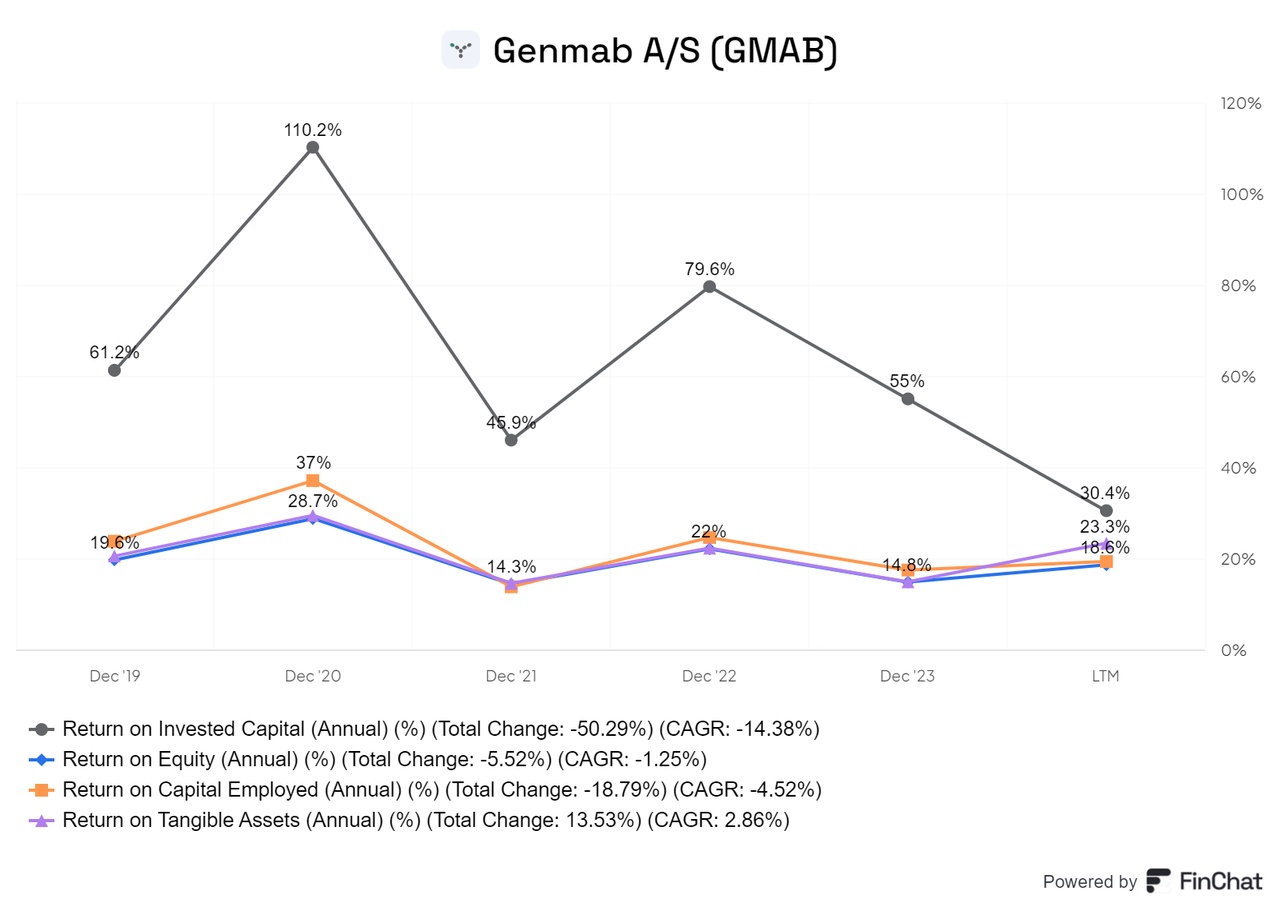

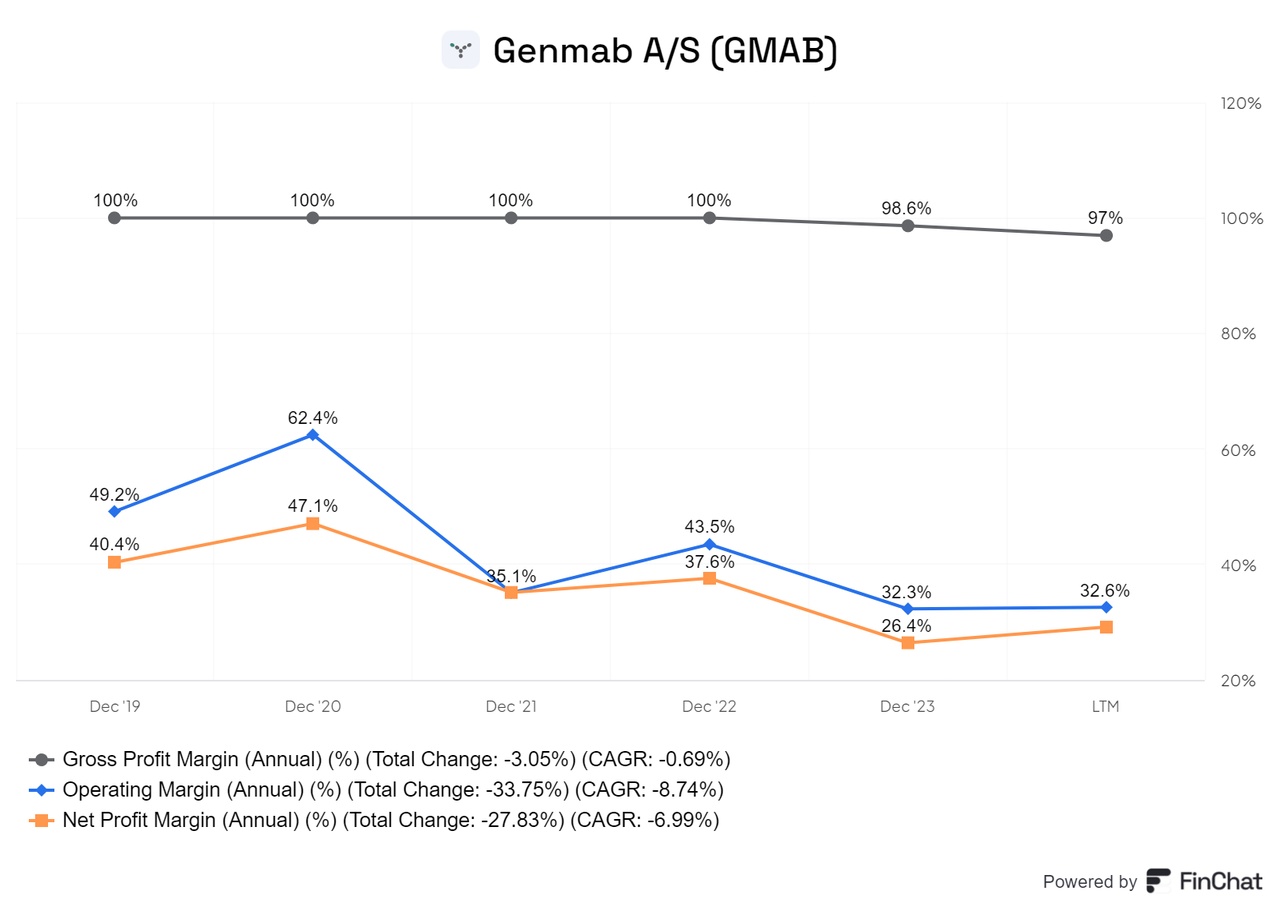

Sales are growing at a CAGR of 31%, while the gross margin is growing at a CAGR of 30%. EBIT shows a fluctuating but increasing development with a CAGR of 20%, and net profit is growing at a CAGR of 22%. The number of shares issued is also falling.

Darzalex is clearly the sales driver and therefore the company's most important product. Nevertheless, the other products are also making progress and growing steadily.

Licensing has enabled the company to maintain a gross margin of 100 % for a long time. However, as it is now beginning to take marketing into its own hands, this margin is expected to decline. At the same time, however, the operating and net profit margins should increase. Overall, however, the margins are encouraging, with a net profit margin of over 25%

SBC has risen well, but remains in line with the company's performance. Moreover, there is no dilution of shares due to the buybacks. The free cash flow (FCF) has also increased solidly, so there is nothing to complain about here.

The shareholder yield is just under 4%. The ratio of enterprise value (EV) to EBITDA falls when EBITDA rises and market capitalization falls. In addition, the ratio of net debt to EBITDA is negative, which is also positive.

Genmab's capital efficiencies are exceptional and are all above 10%.

Conclusion

Genmab A/S, with its focus on innovative antibody therapies and a promising product pipeline, is well positioned to capitalize on the growing opportunities in the field of cancer treatment. The company's solid financial performance and strategic partnerships highlight its potential for future growth and innovation in the biotechnology sector.

Although the share price has fallen recently, Genmab still has significant growth opportunities ahead. The promising pipeline and the upcoming launch of new products are expected to contribute significantly to operating income. In addition, the company has an impressive capital efficiency and benefits from the positive economic situation in Denmark.

Denmark has traditionally established itself as a center for medical technology and biotechnology. The explosive development of companies like Novo Nordisk could also have positive spillover effects for other medical companies, including Genmab. Overall, this is an interesting company that I believe is undervalued based on my DCF analysis.

+ 6

After the spin-off and the spin-off of the Consumer Health division, my investment case in GSK no longer fits.

Trending Securities

Top creators this week