$DIS (-0.32%)

$PLTR (+2.06%)

$SRT (-2.44%)

$NXPI (-3.64%)

$PYPL (+2.65%)

$PEP (-0.72%)

$TER (-6.17%)

$CPRI (-2.03%)

$MRK (-0.58%)

$PFE (-1.42%)

$TTWO (+2.97%)

$EA (-0.07%)

$AMD (-3.3%)

$MDLZ (-2.06%)

$LUMN (+1.71%)

$SMCI (-2.98%)

$7011 (-7.91%)

$6752 (-5.73%)

$6367 (-5.16%)

$UBSG (-1.8%)

$GSK (-2.07%)

$UBER (+1.43%)

$ABBV (+0.5%)

$LLY (-0.82%)

$GOOG (-0.55%)

$ELF (-0.11%)

$QCOM (-1.45%)

$SNAP (+1.35%)

$WOLF (-1.92%)

$ARM (-1.88%)

$VOLCAR B (-2.67%)

$6758 (-3.88%)

$SHL (-2.21%)

$SAAB B (-0.22%)

$5401 (-1.48%)

$MAERSK A (+2.38%)

$R3NK (-3.27%)

$BMY (-1.39%)

$BMW (-2.46%)

$EL (-1.16%)

$ROK (-2.67%)

$PTON (+1.2%)

$KKR (+1.78%)

$LIN (-0.94%)

$RL (+2.58%)

$AGCO (-2.24%)

$RBLX (+0%)

$FTNT (+3.64%)

$REDDIT (-0%)

$ILMN (-1.81%)

$WMG (+0.53%)

$IREN (-5.79%)

$MSTR (-3.51%)

$AMZN (+0.57%)

$KOG (-2.37%)

$ORSTED (-3.69%)

$PM (-3%)

$WEED (-1.08%)

UBS

Price

Discussion about UBSG

Posts

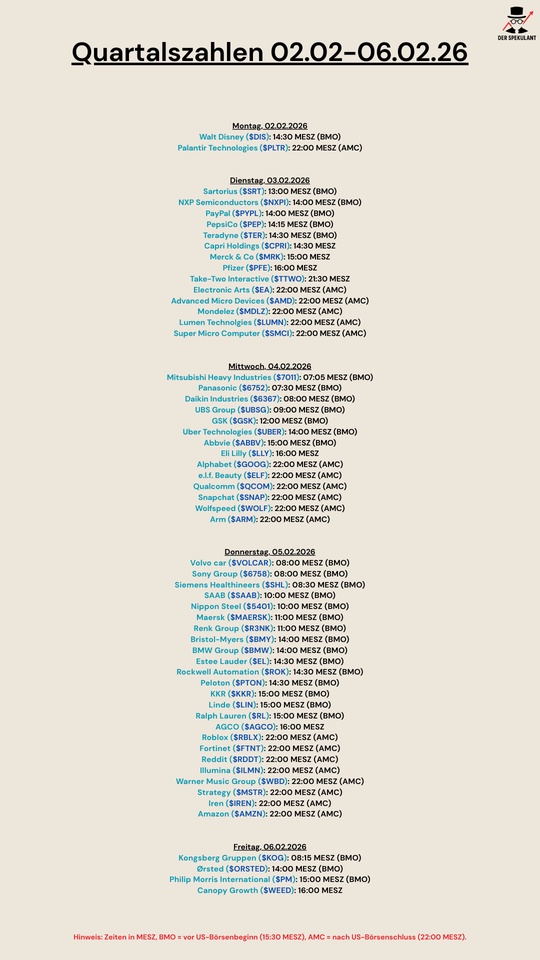

60Quarterly figures 02.02-06.02.26

Rio Tinto hires bankers for Glencore deal

The Rio Tinto Group $RIO (-4%)

$RIO (-4.71%) has contracted a team of bankers, including renowned dealmaker Simon Robey, to explore a potential transaction with Glencore $GLEN (-1.49%) with Glencore.

The mining company has enlisted the financial advisory services of Evercore, which recently acquired Robey's London-based boutique Robey Warshaw.

JPMorgan Chase & Co. and Macquarie Group are also advising Rio Tinto on the matter.

Rio Tinto is a leading global mining group focused on exploring, mining and processing the world's mineral resources. The company's mission is to produce materials that are essential for the progress of humanity.

UBS Group, a corporate broker for Rio Tinto, is currently not actively involved in the transaction. Citigroup, which has traditionally been closely linked to Glencore and has been involved in its recent transactions, is reported to have been in talks to secure a role in the potential deal.

Sources familiar with the matter have requested anonymity due to the confidentiality of the information.

In recent days, Citigroup $C (-0.11%), JPMorgan $JPM (+1.57%) and UBS $UBSG (-1.8%) have cut or suspended their ratings on Rio Tinto and Glencore shares, according to data compiled by Bloomberg.

Glencore is a multinational commodities trading and mining company. Its activities include the production and marketing of metals and minerals, energy products and agricultural products.

The potential deal and the appointment of financial advisers underline the strategic importance of the matter for Rio Tinto, although no formal offer has yet been announced. The involvement of top banks underlines the scale and complexity of the potential transaction between the two mining giants.

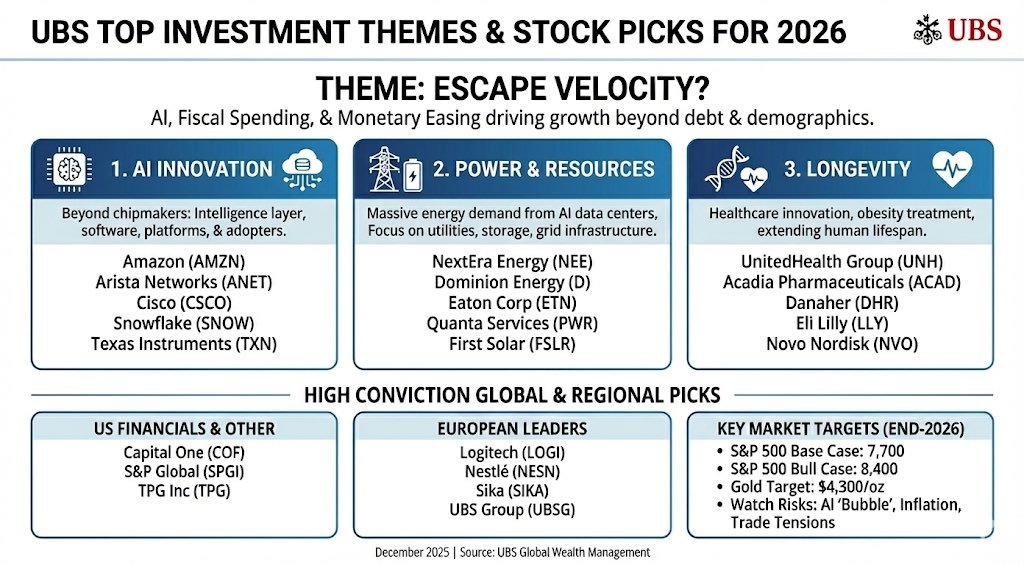

Which shares have potential for you in 2026?

I am realizing more and more that I am hardly interested in loud promises and short-term hypes anymore. When I think about 2026, I tend to ask myself: which companies will still be in a stable position - no matter what the market environment looks like?

I am currently attracted to companies that work quietly, do their homework and don't need a new story every week. Banks like $UBSG (-1.8%) or $UCG (-3.58%) have had difficult years and that's exactly what makes them interesting for me. Companies that get through periods of stress and learn from them often emerge stronger.

At the same time, I find companies whose business you can touch exciting. Raw materials, for example. Nothing works without them - neither industry nor the energy transition. That's not a trend, it's reality.

Ultimately, I'm not interested in predicting the next big thing. For me, it's about consistency, reliability and business models that are sustainable even when things get uncomfortable.

I would really be interested:

Which stock do you have on your radar for 2026 - and why exactly this one?

Equities | UBS Top Picks

The best shares for 2026 from the $UBSG (-1.8%)

$AMZN (+0.57%)

$ANET (-2.77%)

$CSCO (+0.21%)

$SNOW (-0.28%)

$TXN (-2.93%)

$NEE (+0.01%)

$D (-0.57%)

$ETN (-4.98%)

$PWR (-0.57%)

$FSLR (-1.05%)

$UNH (-1.16%)

$ACAD (-3.15%)

$DHR (-0.22%)

$LLY (-0.82%)

$NOVO B (-1.95%)

$COF (+0.6%)

$SPGI (+1.29%)

$TPG (+0.79%)

$LOGN (+1.21%)

$NESN (-0.99%)

$SIKA (-2.45%)

Commodities | Copper on the long lever

Copper is currently continuing its strong rally. Further price increases are now also expected from $C (-0.11%) expected. Citi expects a structural deficit resulting from strong demand from the USA & Europe, but also from limited supply expansion over the coming years. $UBSG (-1.8%) & $JPM (+1.57%) even expect 12-13k tons for the 2nd quarter of 2026. An increase in copper can have an inflationary effect due to the high import costs, while the direct economic benefit for the domestic industry is low. $965275 (-0.68%) would be burdened in the medium term under these circumstances, as the US economy benefits more from the positive effects, while Europe suffers more from the negative effects.

Quarterly figures 27.10-31.10.25

$KDP (-1.18%)

$7751 (-2.47%)

$NXPI (-3.64%)

$WM (+0.82%)

$CDNS (+0.56%)

$BN (-1.93%)

$SOFI (-0.68%)

$UNH (-1.16%)

$AMT (+0.53%)

$UPS (-0.9%)

$BNP (-2.56%)

$NVS (-1.05%)

$DB1 (+3.37%)

$MSCI (-0.77%)

$ENPH (-2.75%)

$BKNG (-0.22%)

$LOGN (+1.21%)

$V (+0.88%)

$MDLZ (-2.06%)

$PYPL (+2.65%)

$000660

$MBG (-0.99%)

$BAS (-2.95%)

$UBSG (-1.8%)

$SAN (-7.5%)

$CVS (-0.55%)

$OTLY (-1.8%)

$GSK (-2.07%)

$ETSY (+1.34%)

$CAT (-3.73%)

$KHC (-0.24%)

$ADYEN (-0.01%)

$ADS (-1.68%)

$AIR (-1.31%)

$SBUX (+0.63%)

$CMG (+0.73%)

$META (+0.82%)

$KLAC (-5.07%)

$MELI (-2.93%)

$WOLF (-1.92%)

$GOOGL (-0.68%)

$EQIX (+0.83%)

$MSFT (+1.87%)

$CVNA (-0.64%)

$EBAY (+1.61%)

$005930

$6752 (-5.73%)

$KOG (-2.37%)

$VOW3 (-2.86%)

$GLE (-3.58%)

$LHA (-3.21%)

$STLAM (-1.26%)

$SPGI (+1.29%)

$MA (+1.09%)

$PUM (-1.51%)

$AIXA (-0.45%)

$FSLR (-1.05%)

$AAPL (+0.14%)

$REDDIT (-0%)

$AMZN (+0.57%)

$NET (+0.27%)

$MSTR (-3.51%)

$GDDY (+1.99%)

$TWLO (+0.91%)

$COIN (-1.01%)

$066570

$CL (-1.12%)

$ABBV (+0.5%)

$XOM (-0.9%)

UBS to move to the us?

Colm Kelleher and Sergio Ermotti are secretly talking to members of the us administration. $UBSG (-1.8%)

https://www.blick.ch/fr/suisse/clash-ubs-vs-suisse-discussions-avec-ladministration-trump-id21231419.html

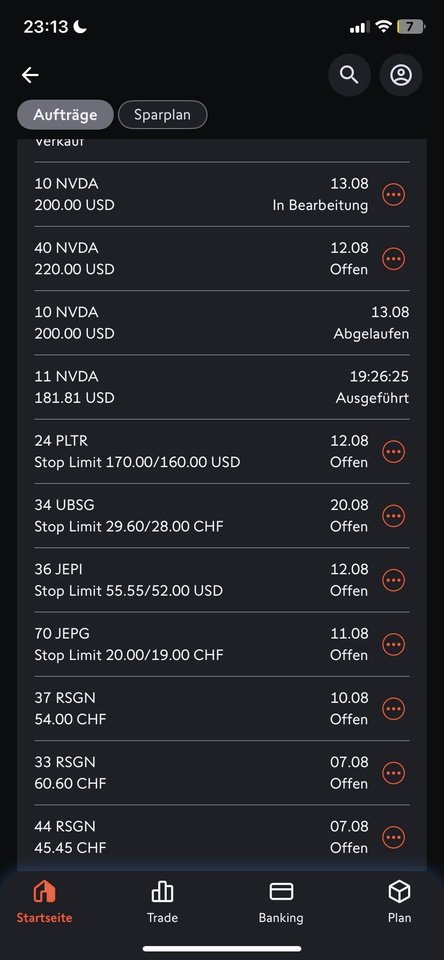

Sale & repayment

Small sale of $NVDA (-0.71%) .

129 shares and 200 stock options remain (2x long call contracts, 06.2026, 102 strike). So only 3% were sold.

Stop limit trades were also recorded.

The CC Funds ($JEPI

$JEGP) (-0.83%) have become too hot for me under Trump and expected strong setbacks if he intervenes even more in the markets simply do not work with CC Funds. Was planned for sideways markets.

$PLTR (+2.06%) is a "hot commodity".

$UBSG (-1.8%) I have a large residual position and will adjust it a little if necessary. If necessary, I'll tighten the stop.

$RSGN I will set stop trades at 45 from a price of 50. I think that's still within a year's time.

Primary reason for the general liquidation thoughts: Tw. repayment of the Lombard loan.

Lombard loan key data:

Portfolio value: 247k

Lombard loan: 27.1k remaining amount, 30k max. Value to date.

Interest in CHF: 3.0%, p.a.

So around 11% of the current portfolio, or 12.3% of the loaned assets.

Primarily taken out in mid-April - May, around 15% return on average assets since then.

Even better: The loan was primarily used to make 2 trades (NVDA calls, 6k stake (170% return currently) & RSGN, 7k stake (24% return currently), which contribute strongly to the overall performance.

Calculated with the 15%, in 4 months, the Lombard (30k) brought me an additional 4.2k.

I don't have to pay it back - let it run a little longer if necessary...

UBS quarterly figures

The big bank $UBSG (-1.8%) posted a profit of profit of 2.4 billion dollars which is twice as much as in the same period of the previous year. Adjusted for various special effects, this represents an increase of 2.68 billion (+30%). UBS has thus exceeded analysts' expectations.

Assets under management rose to USD 6618 billion (+7.8% compared to the first quarter).

With the integration of Credit Suisse, the bank is "still on track".

--> Bigger update as soon as I have time.

Source: FuW

Happy Investing

GG

Trending Securities

Top creators this week