In recent years, Dubai has established itself as a safe haven for money from conflict regions. This development is driven by two factors in particular:

- Russian capital flightSince the beginning of the Ukraine war in 2022, around 200k Russian citizens have settled in Dubai. These include oligarchs, wealthy businessmen and companies seeking to escape Western sanctions. This has led to a sharp increase in demand for luxury real estate, banking services & company registration.

- Sanctions evasion and trade boomThe United Arab Emirates (UAE) has refused to enforce Western sanctions against Russia*. This has allowed Dubai to establish itself as a major hub for Russian financial transactions through dirham-ruble transactions, re-export of oil and gold trading. For example, Russian oil shipments to the UAE's Fujairah terminal increased to 141,000 barrels per day (end of 2022), while Russian gold imports to the UAE rose from 1.3 tons (2021) to 96.4 tons (2022), i.e. 74 times more. 74-fold.

*Western sanctions would include: The exclusion of Russian banks from SWIFT, freezing of 300 billion euros in Central Bank reserves, import ban on Russian coal, investment restrictions in the energy sector, export bans on high tech, import bans on steel and luxury goods, asset freezes and travel bans on "elites", oligarchs and companies close to the government, EU port and airspace closures and EU broadcasting bans on Russian state media.*

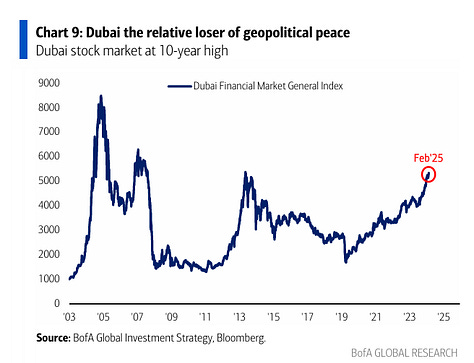

The Dubai Financial Market Index reached a ten-year high in December 2024. The main drivers of this development were real estate & banking stocks, such as Emaar Properties. This rise can be directly attributed to capital flows driven by geopolitical crises, for example.

Why peace could weaken Dubai

Dubai's dependence on Crisis Capital means that geopolitical easing brings economic risks. These can be explained by the following points:

- Should there be a peace agreement in the Ukraine war, many Russian investors could repatriate their capital or reinvest in Western markets. This would have a significant impact on Dubai's real estate and financial sector.

- If Western sanctions against Russia are eased, Dubai will lose its strategic importance as a financial and trading hub for Russian companies. Ruble-dirham settlements and trade in sanctioned goods such as semiconductors would be particularly affected.

- The value of real estate in Dubai has almost doubled since 2021. Analysts warn that a geopolitical normalization could lead to a sharp decline in demand from Russia, Ukraine and the Middle East, which would result in a real estate correction.

- While the DFMGI rose by 24.5 % in 2024, analysts expect weaker development in 2025. The reasons for this are uncertain $IOIL00 (+0.01%) prices, potential capital outflows and lower demand from crisis regions.

Dubai's role in geopolitical competition

In addition to economic implications, Dubai's position as a crisis profiteer also has diplomatic consequences.

The UAE has positioned itself as a mediator between Russia and Ukraine since 2022. Among other things, it has organized 9 prisoner exchanges and strengthened diplomatic relations. The most recent exchange took place on August 24, 2024, in which 115 prisoners were released. President Sheikh Mohamed bin Zayed Al Nahyan held talks with Vladimir Putin on bilateral relations and global developments. At the same time, he also received Ukrainian President Volodymyr Selensky. Peace would reduce this influence.

While Dubai benefits from ongoing crises, Saudi Arabia is increasingly focusing on peace initiatives and long-term investment programs. With the Vision 2030 Saudi Arabia is pursuing an ambitious reform program to reduce its dependence on oil and is planning significant investments in the mining sector and in foreign mining projects with the aim of strengthening its position in mineral supply chains. An easing of tensions would therefore further strengthen Saudi Arabia's position as a leading power in the region.

If the geopolitical situation stabilizes, European banks could expect cash in flows that are currently flowing to Dubai. According to $UBSG (+0.51%) European banks are heading for record years, with dividend payouts and share buybacks of over €120 billion over the next two years and the EY European Bank Lending Forecast forecasts significant growth in lending volumes in the Eurozone -3.1% for 2025 and 4.2% for 2026.