In terms of my portfolio performance/volatility, the last few weeks have probably been the craziest weeks since I started investing. Within a week, my portfolio lost over 100,000 euros in value during the precious metals crash only to gain back over 200,000 euros in value in the subsequent recovery by the end of February.

As a result, I reached a new milestone at the end of February. For the first time, the portfolio value exceeded the EUR 1.5 million mark. 😊

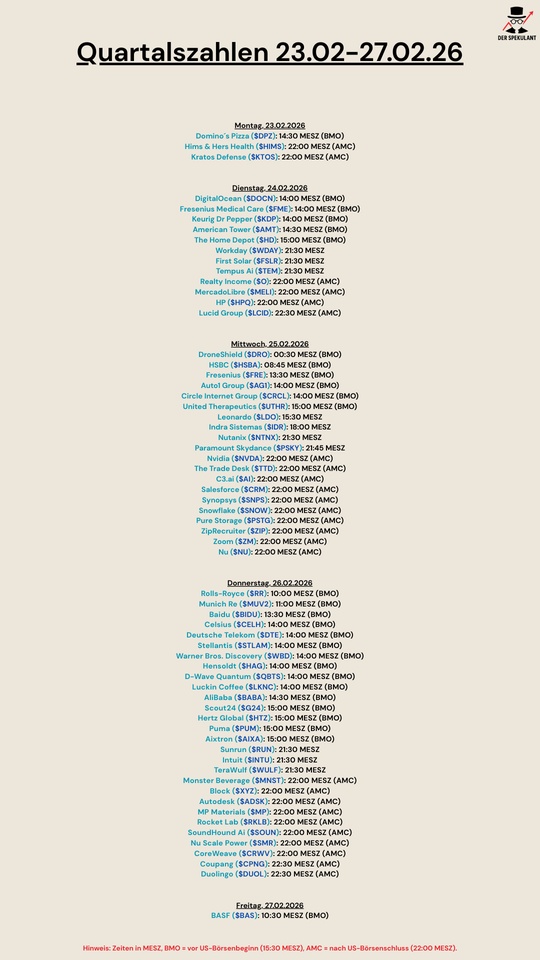

👉🏻 February:

Start: 1,368,240 euros + 100 cash

End: 1,559,4604 euros + 300 cash

Deposit: 5,400 euros

Profit: +186,020 euros (+13.59%)

The increase in value is mainly due to the good performance of my gold portfolio stocks (K92 Mining $KNT (+1.06%) and Equinox Gold $EQX (+2.36%) ). In the meantime, the gold price has slowly risen again and this is of course also reflected in the share prices. The two companies together now account for over 50% of my portfolio... This is actually an unreasonable ratio, but I am still convinced that there is still a lot of potential here. Both companies are in a great operational position, are debt-free and have even announced small dividend payments as a reward. 👍🏼

Otherwise, I continued to sell and buy here and there in February. I took profits on Puma $PUM (-3.4%) , Vonovia $VNA (-0.56%) , Henkel $HEN3 (-1.11%) , K+S $KSC , Target $TGT (-0.55%) and Western Union $WU (-0.89%) while I increased my position in SAP $SAP (-0.3%) , PayPal $PYPL (-1.95%) and Novo-Nordisk $NOVO B (-0.81%) further expanded.

The Iran war will certainly cause some turbulence on the stock market in the coming days. Experience shows that precious metals will benefit in times of uncertainty, but the oil price is also likely to receive a significant tailwind. With my high exposure to gold and my position in Occidental Petroleum $OXY (+2.33%) I believe I am well positioned, at least in the short term. 👍🏼

➡️🆓: On my way towards 4 million total assets, the target achievement level is now 49.8%.

Here's to good stock market trading and see you in a few days! 😊