Hello lovelies,

After I told you in my last post how I put the stock market on hold at the age of 14 for gaming, I had a tough start to my adult life: From the "toast diet" at the end of the month to the debt trap, my path was anything but straightforward - you are welcome to read the details in the first post.

Today I would like to continue with part 2 of my story: How I managed to get my act together and break out of the debt trap and then there's the 2nd Weekly Update on the Portfolio Experiment.

Part 2: Debt, shame and a pandemic - The hard road to a fresh start

What was the situation back then? In addition to a loan of around €8,000, I was increasingly in debt to my family. I regularly had to ask for money, which was a constant source of shame for me. This vicious circle went on for months and years - until Corona came along. It was a terrible time for many people, but ironically, it was to free me from my downward spiral.

The pandemic not only affected my health, but also the economy. My employer at the time decided to cut benefits to keep the business running. My financial situation was already bad - and now more was going to be taken away from me? That was the moment when I knew I had to get out. I couldn't just put up with it any more.

With a lot of luck and persistence, I managed to get a job interview with a large corporation. I managed to convince my boss at the time. At the age of 25, I started as a career changer in field sales - by far the youngest in the entire sales team, but determined to make the most of this opportunity.

The new job opened the door to finally being able to breathe again financially. In the next part, I'll tell you how I managed not only to become debt-free but also to find my way onto the stock market.

___________________________________________________________________________________

Now we come to the portfolio update, from now on I'll let Gemini take over the pen again:

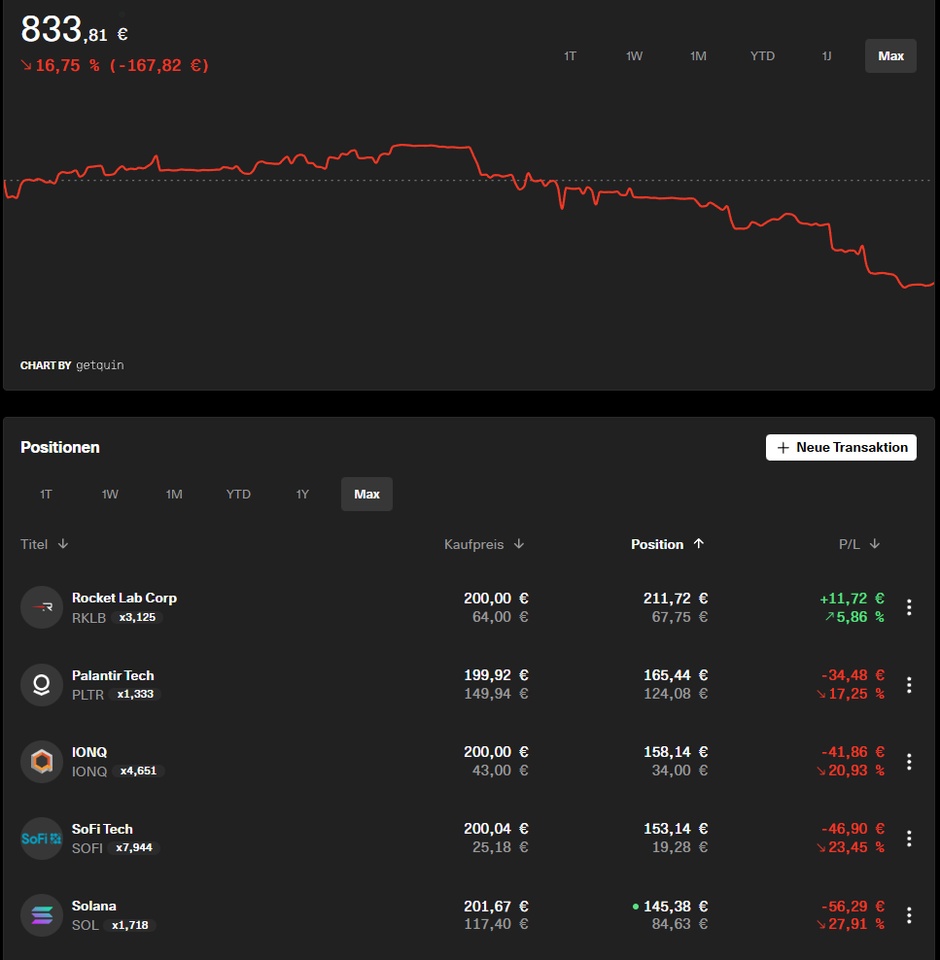

The "high-risk/high-reward" experiment is showing its dark side today. After the high two weeks ago, reality has caught up with us: We took full risk on one position ("earnings gamble") and were punished for it by the market. But discipline also means correcting mistakes immediately.

📊 The hard facts (performance)

Status: A bitter setback. The gains of the first few weeks were partially eroded by two missteps. Top performer: 🏆 Rocket Lab (still our anchor). Problem children: SoFi & Solana (total failures over the weekend). Consequence: We realize the losses immediately to free up capital for new opportunities.

📅 What has happened since the last update?

1. the failed gamble at $SOFI (-1.41%)

(-17 %) 🎲

We made a conscious decision to take full advantage of Friday's earnings. The result: Despite strong numbers ("Revenue +39%"), the market played "Sell the News". Lesson: Hope is not a strategy. We accept that the bet was lost and will sell consistently tomorrow morning to save the remaining capital.

2nd crypto crash at $SOL (-1.91%)

(-27 %) 📉

Sunday pushed our crypto investment under water. Important support zones were pulverized today (currently ~ €85). Decision: Pull the ripcord. We're not sitting out bear markets, we're getting out while there's still cash.

3. the stable core $PLTR (+0.16%)

, $RKLB (-6.56%) , $IONQ (-4.24%) ⚓

While our problem children bleed, the core of the depot holds firm. Rocket Lab corrects healthily after the run, but remains well above the entry point. Palantir & IonQ show relative strength in the tech sell-off. We remain fully invested here ("Let the winners run").

🛡️ Strategic adjustments (Offense: Hunter mode)

We don't lick wounds, we rotate. So that the 5-share rule is adhered to, the cash released from SoFi and Solana will immediately flow into two new sectors with less "event risk" tomorrow morning:

- NEW: Western Digital $WDC (-0.04%)

- AI Storage 💾 - Why: The numbers are already out (top!), the risk of negative surprises is gone. We are not buying a bet here, but confirmed growth in the AI storage market as a replacement for SoFi.

- NEW: Vistra Corp $VST (-0.75%)

- AI Power ⚡ - Why: AI needs power. Vistra is a leading supplier for US data centers. Analysts see massive upside here, and we are adding infrastructure to our portfolio as a replacement for Solana.

🔮 Conclusion

The portfolio has taken a hit to the liver, but is still standing. We have sorted out the rotten eggs (SoFi, Solana) and are starting the week with a breath of fresh air. The new line-up: Palantir | Rocket Lab | IonQ | Western Digital | Vistra.

Thanks for reading - next time, hopefully with green signs again! 🐂