In the face of escalating tensions in the Middle East, the price of oil rose by 10% and $GOLD gained 3.5%, confirming its traditional role as a safe haven - but Bitcoin is defying expectations, remaining stable and even attracting inflows. Investors appear to be using the correction as both an entry point and a hedge, pointing to a potentially growing role for cryptocurrencies in times of geopolitical uncertainty and volatile markets.

Geopolitics drives oil and gold higher

Geopolitics once again dominated the markets over the weekend after President #trump used Saturday to further escalate tensions. The withdrawal of British embassy staff from Iran had already indicated rising risks, so markets were not completely unprepared. The crucial question is not only whether the #iran can be contained, but also how quickly potential disruptions could spread. Iran controls the Strait of Hormuz, one of the world's most important energy routes. Withdrawals by insurers and visible congestion of tankers indicate that the situation is already operationally relevant and not just rhetorical. Drone activity and signals of support from Hezbollah and the Houthi militia increase the likelihood that the conflict will escalate. The 10% rise in the oil price reflects this fragility, while gold is fulfilling its traditional role as a safe haven with a gain of 3.5%.

Bitcoin defies uncertainty - inflows return

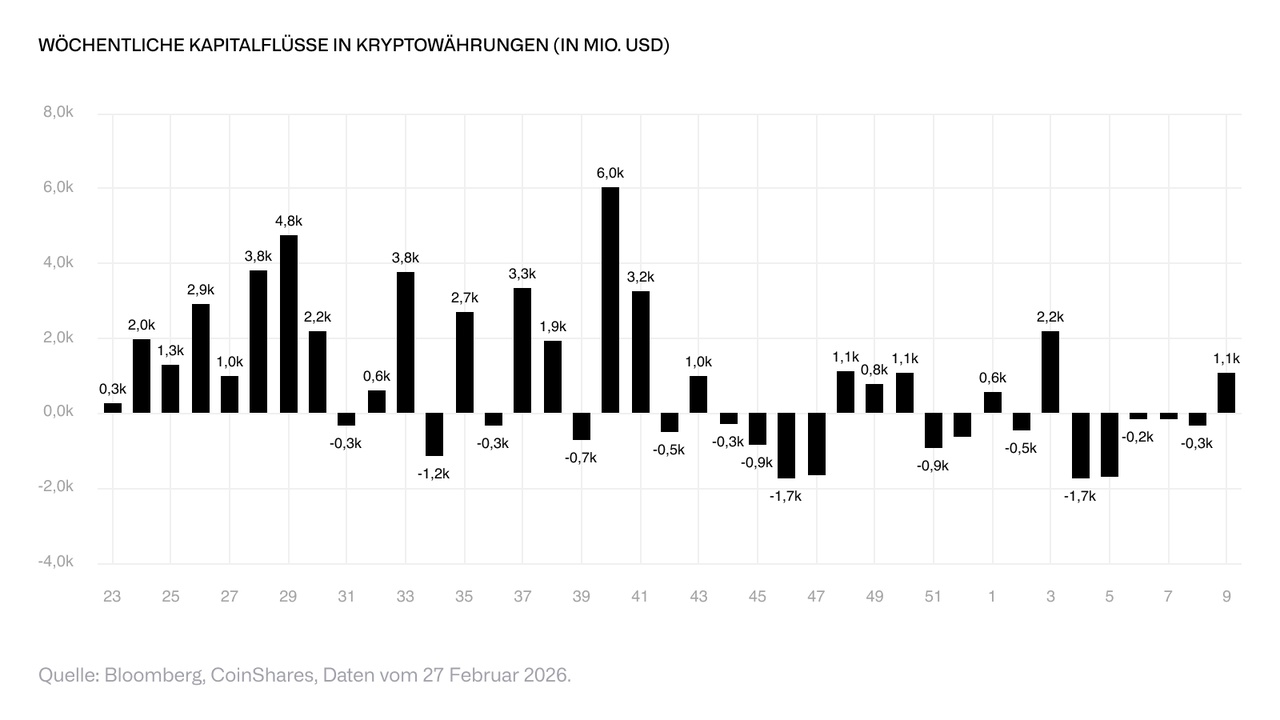

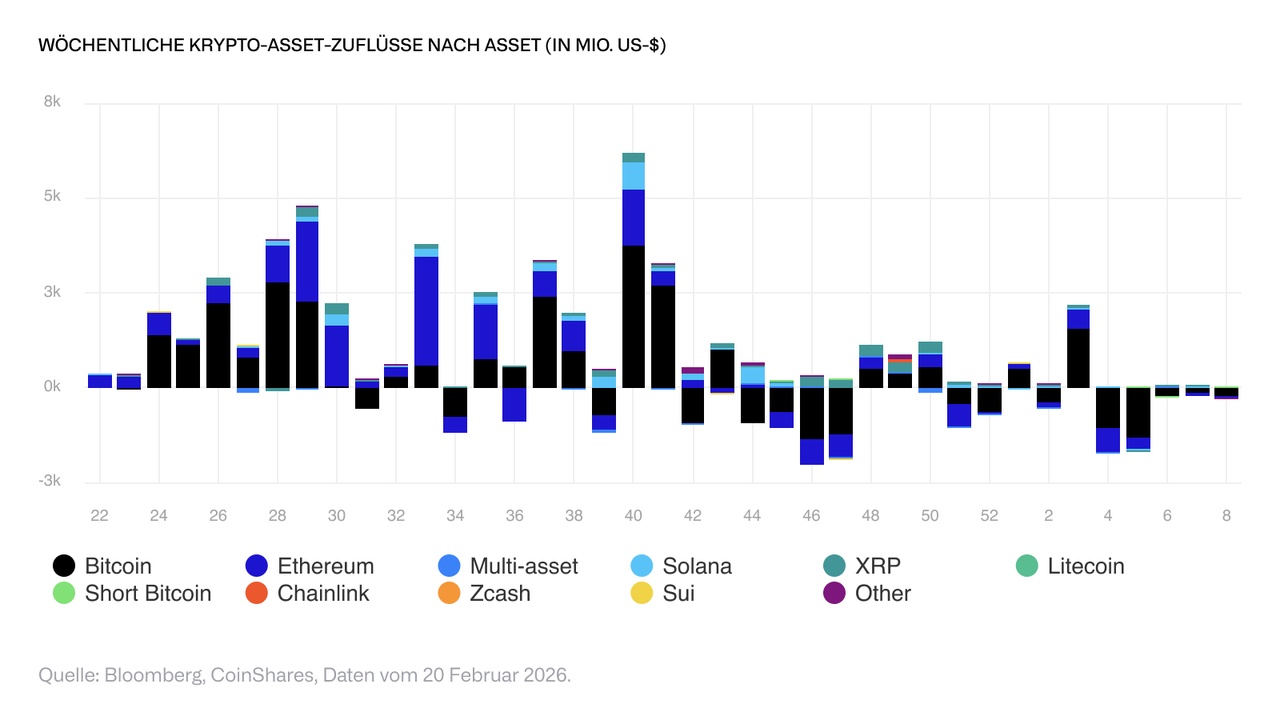

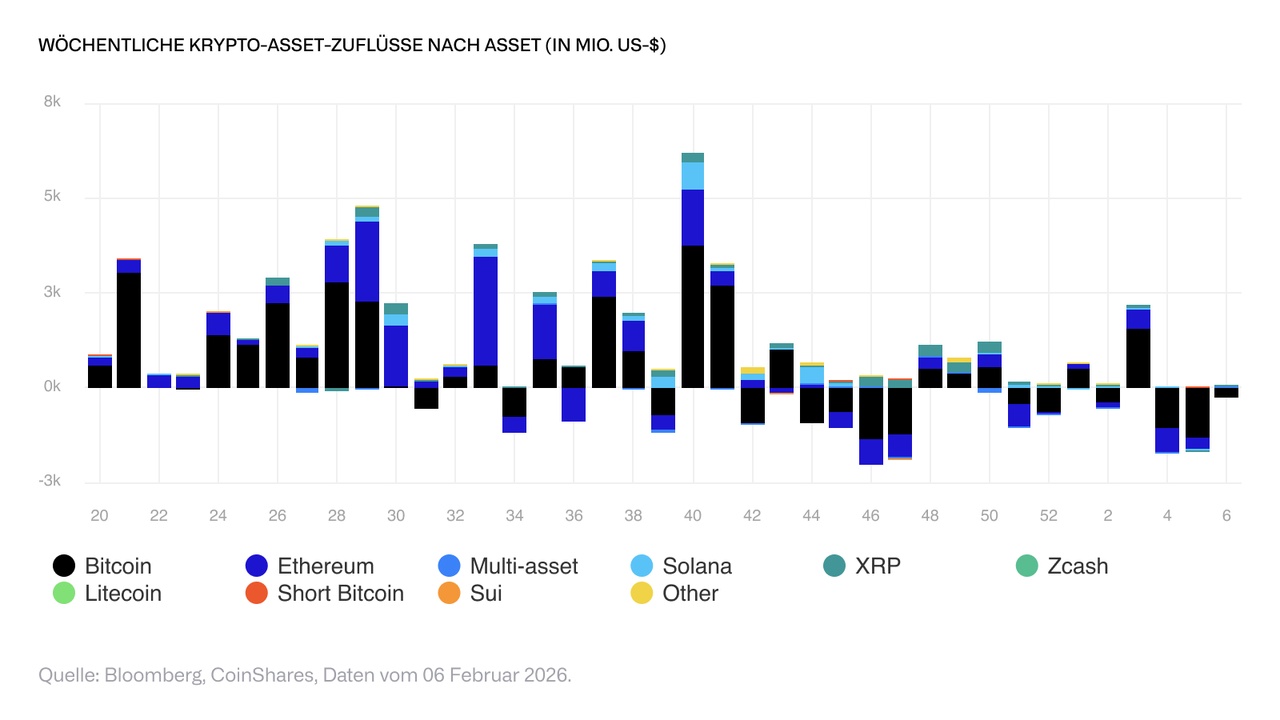

Even more remarkable is the reaction of Bitcoin. Historically, Bitcoin, as the only liquid asset that is also traded at the weekend, has usually reacted negatively in phases of forced risk reduction. This time, however, the cryptocurrency remained stable and even rose despite increasing uncertainty. The lack of significant liquidations despite rising yields and geopolitical tensions suggests that positioning is more balanced compared to previous episodes. Over the past five months, major market participants have turned over around USD 30 billion and technical and fundamental lows have already been reached. Last week, inflows returned: USD 1 billion flowed in after USD 4 billion had previously flowed out over five weeks, and a further USD 500 million was added on Monday alone. This suggests that investors see the correction as both an entry opportunity and a hedge in the current geopolitical situation.

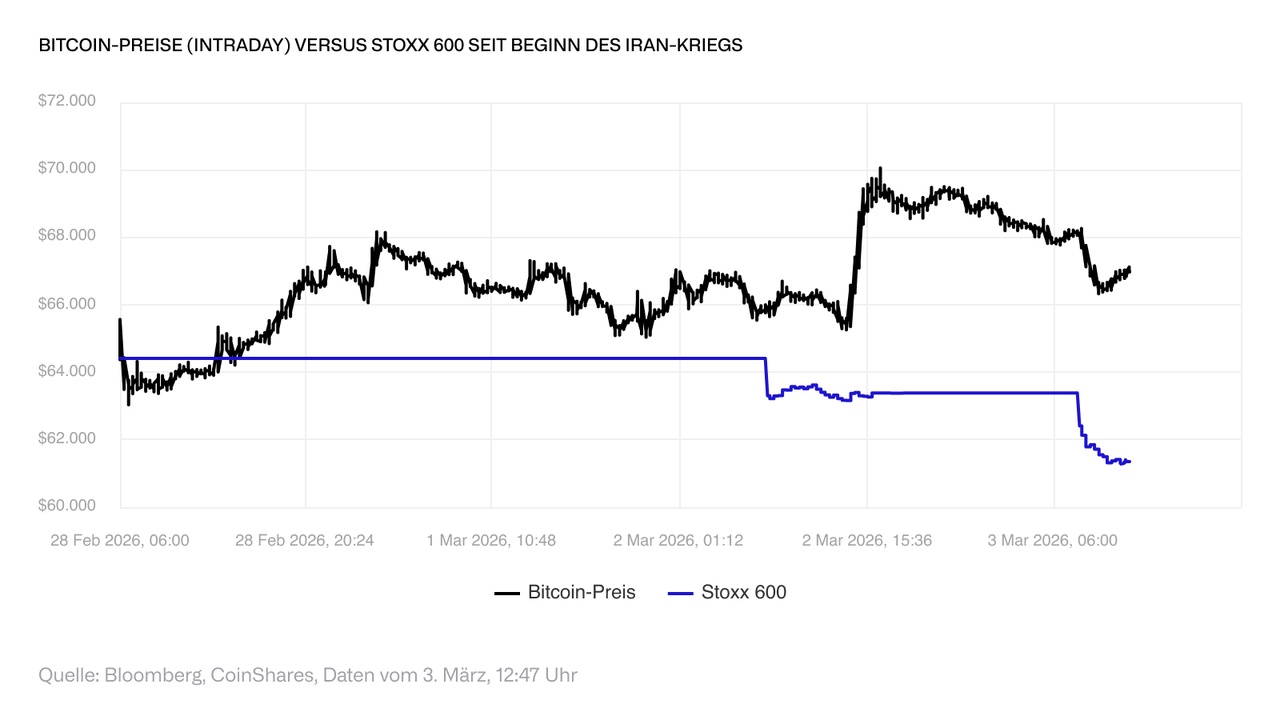

The chart shows the intraday price development of $BTC (-1.52%) from the start of the conflict at 6:15 GMT on February 28 to the current time, as well as the relative price performance of the Stoxx 600, illustrating the significant outperformance of Bitcoin since the outbreak of the conflict. The flat sections in the equity index reflect periods when exchanges were closed, highlighting the liquidity constraints of equities compared to continuously tradable Bitcoin.

Macroeconomics tighten financial conditions

The macroeconomic environment is making the situation even more difficult. The Producer Price Index rose by 0.5% month-on-month, above the expected 0.3%, while the core rate reached 0.8%, mainly driven by trade-related services. With energy prices now rising sharply, rate cut expectations are likely to be postponed further, tightening financial conditions compared to a few weeks ago. If energy-driven inflation delays monetary easing, traditional risk assets could come under pressure. However, if geopolitical tensions intensify and confidence in global financial and trade structures - particularly along critical routes such as the Strait of Hormuz - erodes further, scarce and non-government assets such as Bitcoin could benefit in the medium term.

Via the CoinShares Bitcoin ETP $BITC (-0.97%) you can also invest in Bitcoin.