🛡️ Skyward Specialty Insurance $SKWD

- The niche king in the insurance sector

Hello my dears,

There have been a lot of great companies featured here lately like from @Shiya with $DCTH (+1.54%) or$HROW or stock presentations from dear @Tenbagger2024

Many ideas in the health sector or technologies

Today I would like to introduce you to a company, especially in a sector that not many people think about. The insurance sector 😬 and I have my eye 👀 on this small-cap company. small-cap company thrown.

TODAY IT'S ABOUT SKYWARD SPECIALTY INSURANCE $SKWD

$SKWD Skyward Specialty is not a traditional car or household insurer. The company is active in the Specialty Property & Casualty (P&C) where risks are complex, difficult to assess and often underinsured.

1. the business model: "Rule Our Niche" 🎯

The company pursues a clear strategy: Specialization instead of mass.

* Focus: They insure niches such as renewable energies, media criminal law, life sciences, construction and professional liability.

- Technology focus: Skyward makes extensive use of data analytics and AI (partnering with Sixfold) to price risks more accurately than large, sluggish competitors.

Agility: Due to its smaller size compared to giants like $CB (-0.36%) or $AIG (+0.52%) they can react more quickly to changes in the market.

- The "Apollo Group Holdings Limited" takeover (January 2026)

For the start of the new year 2026, they have acquired "Apollo Group Holdings Limited" for further growth drivers. Apollo (a Lloyd's of London syndicate) for further growth! This means for $SKWD

- Access to the world's most important marketplace for specialty insurance (Lloyd's).

- An immediate global presence instead of being limited to the US market.

The company offers insurance solutions for complex risks that are often avoided by standard insurers. They operate in eight core areas, including:

🏗️Bauwesen & Energy: Specialized solutions for high-risk industries.

🩺👨⚖️👷♂️ Professional liability: For doctors, lawyers and architects.

🌾Special programs: Tailor-made packages for very specific industries (e.g. transportation, agriculture).

- Transactional E&S: "Excess & Surplus" lines, i.e. risks that cannot be insured via the regular market.

👤 Management: who pulls the strings?

The success of an insurer stands and falls with discipline in underwriting (risk assessment). This is where the CEO comes into play:

- CEO: Andrew Robinson

- He took the helm in 2020🤝

- Robinson is an industry heavyweight. He previously held senior positions at The Hanover Insurance Group and as a consultant at Oak HC/FT.

- His strategy: He has radically trimmed Skyward for technology and data analytics. His focus is not on "size at any cost", but on profitability in segments that other insurers find too complicated.

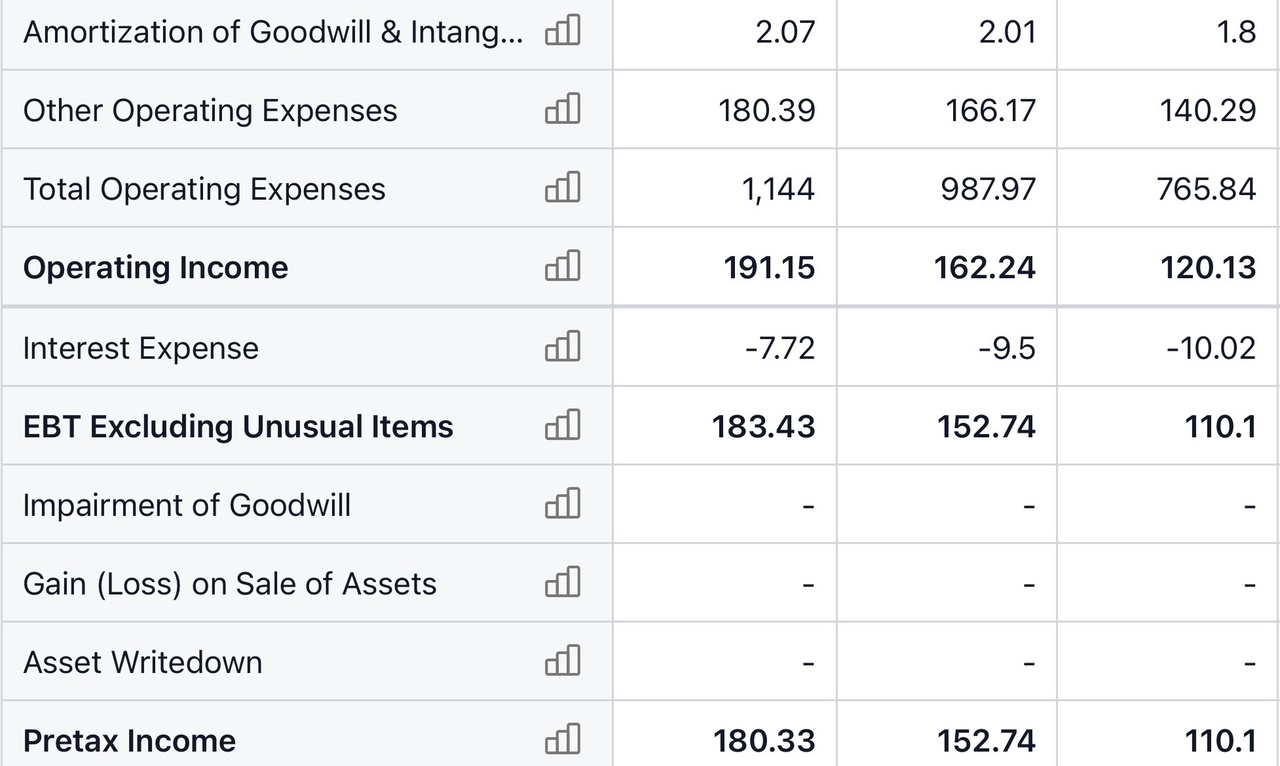

2. the key figures📊

- Market capitalization: Approx. USD 2.1 billion.

- Share price: current share price approx. USD 50.00

- P/E ratio (P/E ratio): approx. 13 - 15 (attractively valued for a growth stock in the insurance sector).

- Combined ratio: Is constant at approx. 91-92 %.

- For information: Anything below 100% means that the insurer is operating profitably (premiums > claims & costs). 91 % is an excellent value.

- Growth: Gross sales (written premiums) recently rose by over 50 % year-on-year (Q3 2025).

🟢 Growth turbo (revenue growth): In the last quarter (Q3 2025), gross premiums rose by a whopping 51,6 % compared to the previous year. This is exceptionally high organic growth for an insurer.

🟢 Profitability (combined ratio): With a value of 89,2 % in Q3 2025, Skyward has set a new company record. As a reminder: the lower this value is below 100%, the more profitable the core business is.

🟢Return on equity (ROE): The annualized return on equity currently stands at 19,3 %. This shows that the management is making highly efficient use of shareholders' capital (the benchmark in the sector is often closer to 12-15%).

🟢Increase in book value: The book value per share increased to September 2025 to 23,75 $ - an increase of 20 % since the beginning of 2025.

🟢Earnings per share (EPS) of 1.10 were massively above analysts' estimates (approx. 0.85). The main drivers were:

1. Strong new business in the areas of agriculture, credit insurance and specialty programs.

2. Higher investment income: Due to the interest rate environment, Skyward earned significantly more on its USD 1.6 billion portfolio (primarily bonds).

3. Lower catastrophe losses: Compared to the previous year, there were fewer claims from severe storms.

3. why is the share exciting? 🚀

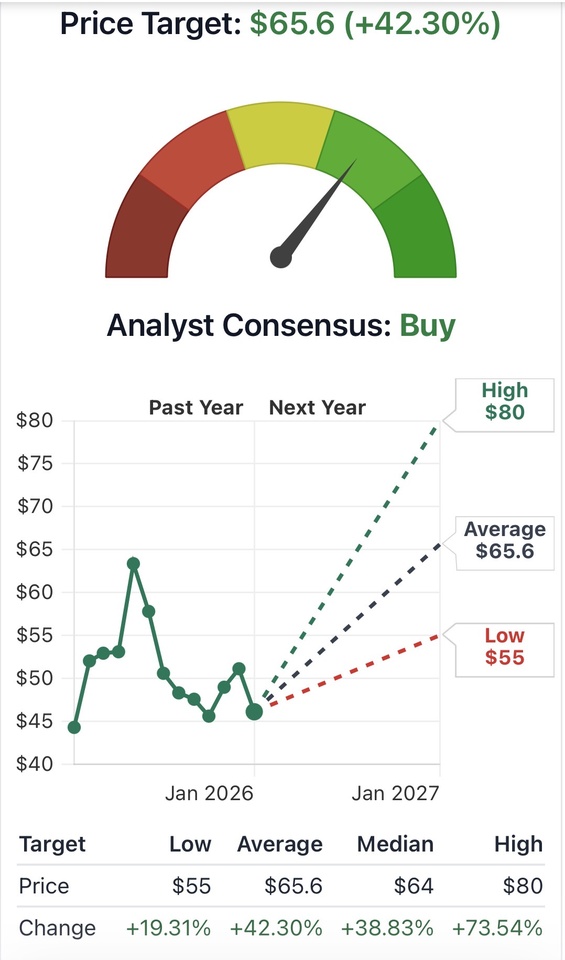

1. Enormous profit growth: Analysts expect profit growth of over 35% for 2026. The company regularly beats expectations✅

2.Skyward Speciality is currently delivering a rare combination of hyper-growth (premiums +50%) and operational excellence (combined ratio < 90 %) ✅

3.while established players such as $RLI (+0%) or $KNSL (-0.19%) , $WRB (+0.69%) are growing moderately (often in the single-digit or low double-digit range), Skyward is growing at +50 % is an absolute outlier. This shows that $SKWD is gaining massive market share.✅

4. High return on equity (ROE): With an ROE of over 17%, Skyward works very efficiently with shareholders' money.✅

5. Interest profit: As an insurer, Skyward holds billions in fixed-interest securities. The higher interest rate level ensures bubbling investment income.✅

6.Acquisition turbo: The integration of Apollo opens up access to the global Lloyd's market.✅

7.experienced management: Andrew Robinson has transformed the company from a problem child to a high performer in just 4 years.✅

4. risks ⚠️

- Inflation risk: Rising costs for repairs or legal proceedings (loss inflation) could squeeze margins.❗️

- Catastrophe risk: Although Skyward occupies niche markets, extreme weather events can weigh on results.❗️

- Interest rate sensitivity: If interest rates fall extremely quickly, investment returns from the portfolio will fall.❗️

5. conclusion & analyst rating 🧐

$SKWD Skyward Specialty is a classic growth growth story in a conservative sector. The share has significantly outperformed the S&P 500 in recent years.

Analysts' price target: The consensus is approx. 63 - 70 USDwhich corresponds to an upside potential of approx. 25-35 % ⬆️entspricht.

My personal conclusion ?

$SKWD is not a dividend payer like e.g. now a $ALV (+1.54%) or $MUV2 (+0.93%) but is $SKWD a highly exciting "quality-growth" stock. If you are looking for growth, this small-cap company could be a very interesting candidate.

Despite the sharp rise in the share price, I think the valuation is $SKWD fair to slightly undervalued, which is why I'm toying with the idea of going in with a tranche🤫

But as far as I know, the share is not tradable with many NeoBrokers 😅

What is your opinion of the company?

Would the share be something for your portfolio?

@Tenbagger2024