$UCG (+1.16%)

$MNDY (-0.84%)

$KER (+1.36%)

$BARC (+1.39%)

$OSCR (-3.64%)

$CVS (-0.72%)

$SPOT (+1.17%)

$DDOG (-4.15%)

$BP. (-1.45%)

$SPGI (-0.01%)

$HAS (+0.27%)

$KO (+0.78%)

$JMIA (-0.25%)

$MAR (-0.64%)

$RACE (-0.43%)

$UPST (-4.3%)

$NET (-7.53%)

$LYFT (+0.25%)

$981 (+0%)

$NCH2 (-0.32%)

$DSY (-0.14%)

$1SXP (+0%)

$HEIA (+0.43%)

$ENR (+0.35%)

$DOU (+2.68%)

$OTLY (-3.81%)

$TMUS (+0.47%)

$SHOP (+2.19%)

$KHC (+1.13%)

$FSLY (+0.79%)

$HUBS (-2.72%)

$CSCO (+1.04%)

$APP (-5.89%)

$SIE (+1.82%)

$RMS (+4.02%)

$BATS (+2.33%)

$MBG (+1.16%)

$TKA (+5.16%)

$VBK (-2.02%)

$DB1 (+1.23%)

$NBIS (-9.32%)

$ALB (-0.08%)

$BIRK (+0.75%)

$ADYEN (+0.81%)

$ANET (-3.29%)

$PINS (+5.61%)

$AMAT (+1.53%)

$ABNB (+1.55%)

$TWLO (+1.26%)

$RIVN (-1.6%)

$COIN (+3.15%)

$TOM (+0%)

$OR (+1.71%)

$MRNA (+0.22%)

$CCO (+2.34%)

$DKNG (-0.68%)

Heineken

Price

Discussion about HEIA

Posts

14Quarterly figures 09.02-13.02.26

🌎📈 Mercosur agreement: Mega free trade - opportunities for the stock market & potential profiteers

After more than 25 years of negotiations, the EU and the South American economic alliance Mercosur (Brazil, Argentina, Paraguay, Uruguay) have concluded a historic free trade agreement. This creates one of the largest free trade zones in the world - with over 700 million people and a combined economic area worth around 22 trillion USD.

This agreement could trigger global economic and stock market effects - for companies, industries and investors.

_________________________

🛃🚢 What will happen to the Mercosur agreement?

- Tariffs on up to 91% of EU exports and 92% of Mercosur exports are to be gradually eliminated.

- The aim is to create a larger single market, better market access, simplified rules and more stable trading conditions between Europe and South America.

- Until now, high tariffs have applied to cars (approx. 35%), machinery (14-20%) and chemical products (up to 18%).

_________________________

📊 Possible effects on the stock market

📈 1. industries with strong exports benefit from higher demand

Europe can sell its products more easily in South America:

- 👩🏭 Cars & car parts

- 🏭 Mechanical engineering

- 🧪 Chemicals & pharmaceuticals

- 🪄 Electronics & high-tech

The elimination of customs duties and fewer trade barriers will increase the margins and competitiveness of these industries.

Possible examples of Frofiteurs:

- VW $VOW (+0.93%) BMW $BMW (+0.52%) Daimler $DTG (+1.76%)

- Siemens $SIE (+1.82%)

- BASF $BAS (+0.7%) Covestro $1COV (-0.1%)

- SAP $SAP (+1.12%) , ASML $ASML (+0.76%)

➡️ Expected share price impetus from higher export revenues and capped production costs.

_________________________

🍖 2. agricultural & food sector in focus

The agricultural business is also becoming more closely networked on both sides:

- Tariffs on wine, oil, cheese, dairy products and luxury foods are being reduced or gradually created.

- EU producers will gain greater market access in South America; conversely, South American agricultural exports (e.g. beef, sugar) will have better access to the EU.

Possible beneficiaries:

- Nestlé $NESN (-0.62%) Danone $BN (-1.14%)

- Heineken $HEIA (+0.43%) AB InBev $ABI (-0.39%)

- FrieslandCampina $FCEPL

⚠️ However, critics point out that price pressure on local farmers* also arises and environmental risks can increase, for example due to cheaper imports.

_________________________

🚗 3. raw materials & energy: medium to long-term effects

Mercosur countries export large quantities of raw materials:

- Soy, sugar, coffee, ethanol, grain

- Brazil is also a major supplier of crude oil and minerals

One of the aims of the agreement is more stable commodity trade with fewer tariffs, which can influence commodity prices and move the shares of commodity and energy companies.

Possible beneficiaries:

- Vale $VALE3 (+2.93%) Petrobras $PETR3 (+0.64%)

- Bunge $BG (-1.38%) , ADM $ADM (-0.03%)

_________________________

🏦 4. finance & services sector

The agreement also facilitates:

- Market access for financial services

- Opening of telecom and transportation markets

- Opening of public procurement to EU suppliers

➡️ This could strengthen banks, insurers and logistics companies that operate across borders.

Possible beneficiaries:

- Allianz $ALV (+1.65%) Deutsche Bank $DBK (+2.11%)

- DHL/Deutsche Post $DHL (+0.52%) Kuehne + Nagel $KNIN (+1.03%)

_________________________

🔄 Short-term market risks

Not everything is automatically positive:

- 🇪🇺 Agricultural protests in Europe show resistance to cheap imports.

- Political uncertainties remain - many parliaments need to ratify.

- Sectors with low competitiveness could come under price pressure.

_________________________

📌 Conclusion

The Mercosur agreement could be an issue with far-reaching effects:

✅ Strong export industry gains new sales markets

✅ Agricultural and luxury food sector gains sales opportunities

✅ Financial and service sector benefits from market expansion

✅ Raw material exporting countries in South America could become more integrated

⚠️ At the same time, there are risks for local producers and price distortions that could have a regional impact on share prices

_________________________

Question for you: What is your opinion on the agreement? And in which sectors or listed companies do you see the biggest winners in the long term?

_________________________

Sources:

- 💶📈 Wirtschaftliche Chancen für EU-Exporteure und Importeure durch Zollerleichterungen

- ⚙️🚗 Branchenanalysen mit Zollabbau-Effekten für Maschinen, Autos, Chemie etc.

- 🌾🥩 Agrar- und Rohstoff-Impakte durch neue Marktchancen und Quotenregelungen

Thoughts on the situation of alcohol shares, same pattern as with tobacco back then?

$RI (+3.49%)

$DGE (+3.91%)

$CARL B (+0.32%)

$HEIA (+0.43%)

$ASBHY

$ABI (-0.39%)

Hey guys, I've had a look at the current situation surrounding alcohol stocks and would like your opinion on it.

The current valuation of alcohol stocks reminds me a lot of the tobacco industry a few years ago. Back then, many stocks were trading at all-time lows. Anyone who invested back then was even ridiculed.

Today, I see a similar pattern with alcohol stocks: changes in consumption, regulatory pressure, etc . The question is: is this a comparable opportunity to the one we experienced in the tobacco industry, or are the structural differences too serious this time?

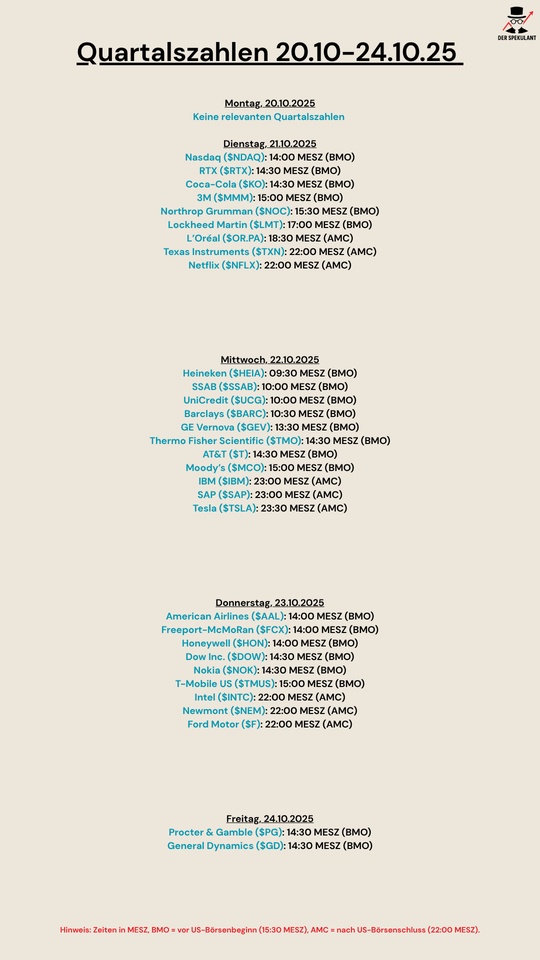

Quartalsberichte 21.10-24.10.25

$NDAQ (-0.3%)

$RTX (-0.09%)

$KO (+0.78%)

$MMM (+1.12%)

$NOC (-2.23%)

$LMTB34

$OR (+1.71%)

$TXN (+0.98%)

$NFLX (+1.88%)

$HEIA (+0.43%)

$SAAB B (-0.74%)

$UCG (+1.16%)

$BARC (+1.39%)

$GEV (-0.49%)

$TMO (-0.59%)

$T (+0.3%)

$MCO (+0.64%)

$IBM (+0.05%)

$SAP (+1.12%)

$TSLA (-0.19%)

$AAL (+1.14%)

$FCX (+2.99%)

$HON (+1.07%)

$DOW (-1.69%)

$NOKIA (+2.75%)

$TMUS (+0.47%)

$INTC (-1.11%)

$NEM (-2.5%)

$F (+1.37%)

$PG (+0.98%)

$GD (-0.45%)

Christmas cheer

$HEIA (+0.43%) Price is what you pay, value is what you get. A strategic purchase.

Value Stocks!

Last weeks value stocks bought such as Deutsche Telekom ($$DTE (+0.29%) ) Ahold $AD (+0.69%) Heineken $HEIA (+0.43%) and Engie $ENGI (-0.53%) . ASML $ASML (+0.76%) and ASMI $ASM (+1.04%) trimmed and sold to bring my tech weighting to around 25%. Cost some redemenent this week, but a more stable portfolio.

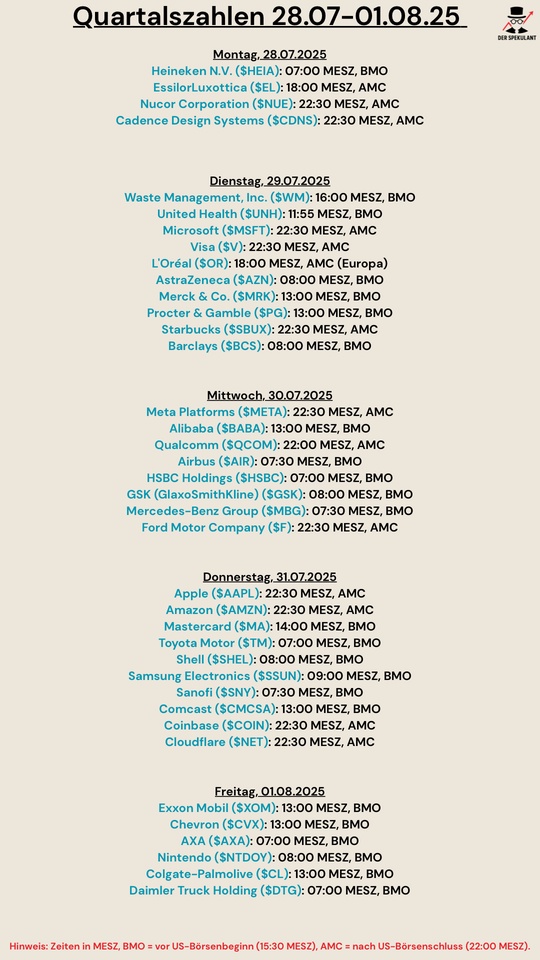

Quarterly figures 28.07-01.08

$HEIA (+0.43%)

$EL (+1.82%)

$NUE (-0.19%)

$CDNS (-0.71%)

$WM (-1.44%)

$MSFT (-0.3%)

$V (+0.55%)

$OR (+1.71%)

$AZN (+0.3%)

$MRK (+0.19%)

$PG (+0.98%)

$SBUX (+1.95%)

$BCS (+0.92%)

$META (+1.59%)

$BABA (+0%)

$QCOM (+1.33%)

$AIR (+0.87%)

$HSBC (+1.36%)

$GSK (-1%)

$MBG (+1.16%)

$F (+1.37%)

$AAPL (+1.51%)

$AMZN (+2.51%)

$MA (+1.25%)

$7203 (-1.49%)

$SHEL (-0.01%)

$005930

$SNY (-1.49%)

$CMCSA (-0.11%)

$COIN (+3.15%)

$NET (-7.53%)

$XOM (-2.45%)

$CVX (-0.5%)

$CS (+1.79%)

$NTDOY (+0%)

$CL (+0.82%)

$DTG (+1.76%)

$UNH (-0.11%)

I'm doing so well I'm flying to the Mediterranean to drink only mediocre Irish beer

More precisely Malta, normally you can use such posts to talk about local companies and stock corporations.

Unfortunately I have to disappoint you, I can't really tell from a normal vacation whether / which companies Malta has.

What I see here are an endless number of cars of all makes and construction sites, as well as $HEIA (+0.43%) .

Mini-conclusion I am currently here for the 4th of 7 days, I don't think I really need more days, the old town is very beautiful and I can also recommend the war museum. As well as general sightseeing and eating on the coast / promenade. I found the "party district" Paceville rather weak compared to the standard clubs in DE.

But well, now I'm here and enjoying some seafood and maybe reading "Intelligent Investing" by the pool, have a successful rest of the week.

Turn Around with non-alcoholic drinks?

Many breweries now do a large part of their business with non-alcoholic beers and even schnapps producers such as Berentzen

$BEZ (+0.28%) also want to score points with new non-alcoholic mixed drinks.

Producers of alcoholic beverages have been punished on the stock market in recent months. Anheuser-Busch $ABI (-0.39%) is down a good ten percent on the previous year. The brewery group owns brands such as Budweiser, Corona, Beck's and Löwenbräu. At its competitor Heineken

$HEIA (+0.43%) is in a similar position, down seven percent over the past twelve months. Also Molson Coors

$TAP (+2.74%) is also a good three percent below its value a year ago.

If you look at the past few weeks, you can see that the industry may have just managed to reverse the trend. Molson Coors is up a good six percent since the beginning of the year, Anheuser-Busch is even up over seven percent and Heineken has gained 17 percent since the beginning of the year.

Analysts from the broker eToro believe that the breweries' switch to non-alcoholic products and premium beers may still offer an opportunity: "The transformation has not yet been reflected in the share prices," they write. And: "The companies generate stable cash flows, often pay attractive dividends and benefit from a largely crisis-proof demand."

Source (excerpt) & image: Welt, 26.02.25

Trending Securities

Top creators this week