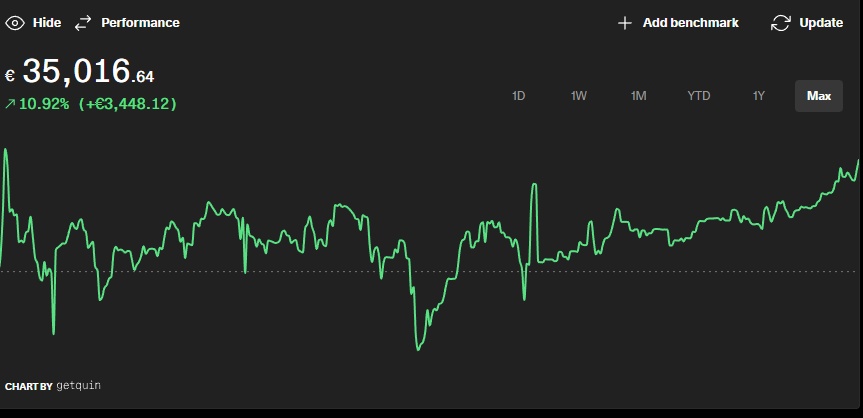

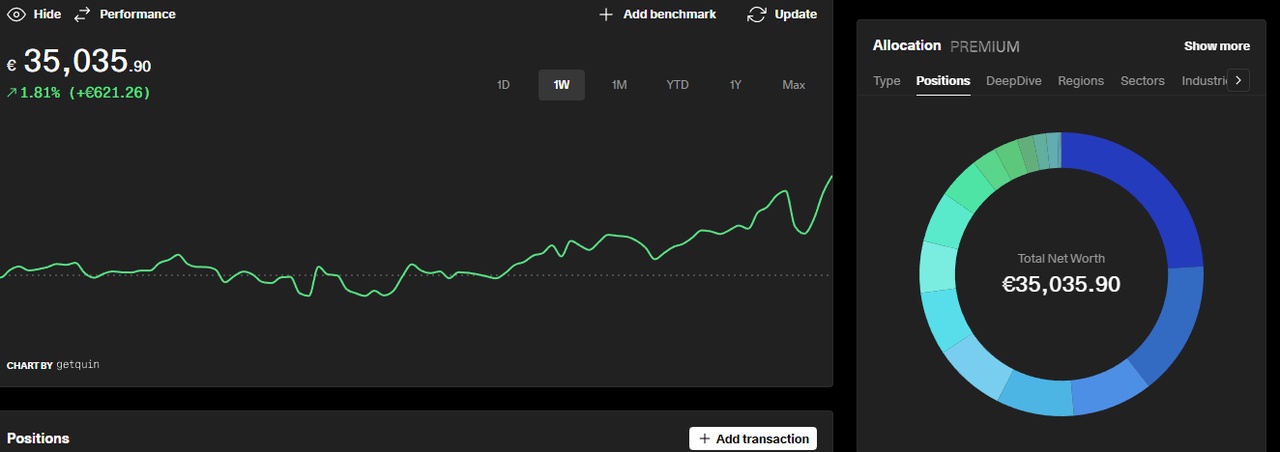

Today was a good day if you're invested in $AD (+1.22%) . The stock jumped 11% due to good year results. I bought AD 2 months in a row because I believed in my strategy and in the companies I selected. That's why I bought AD in my opinion for a steal.

Looking back it was a good decision to buy AD at the dip.

Trade is from 24-1.