$UCG (-1.65%)

$MNDY (+0.97%)

$KER (-1.16%)

$BARC (-0.96%)

$OSCR (+0.42%)

$CVS (-0.23%)

$SPOT (-3.08%)

$DDOG (+1.65%)

$BP. (+1.26%)

$SPGI (-2%)

$HAS (-0.18%)

$KO (+0.68%)

$JMIA (-2.14%)

$MAR (-0.44%)

$RACE (-1.86%)

$UPST (-2.21%)

$NET (+2.29%)

$LYFT (+2.15%)

$981

$NCH2 (-2.58%)

$DSY (-3.62%)

$1SXP (-1.28%)

$HEIA (-1.7%)

$ENR (-1.07%)

$DOU (+1.56%)

$OTLY (-1.92%)

$TMUS (-0.9%)

$SHOP (+0.54%)

$KHC (+0.09%)

$FSLY (+6%)

$HUBS (-3.66%)

$CSCO (-3.08%)

$APP (+1.9%)

$SIE (-1.9%)

$RMS (+0%)

$BATS (-0.15%)

$MBG (-1.06%)

$TKA (-4.53%)

$VBK (-1%)

$DB1 (-0.51%)

$NBIS (+3.24%)

$ALB (+1.88%)

$BIRK (-1.25%)

$ADYEN (+0.93%)

$ANET (+1.4%)

$PINS (-2.04%)

$AMAT (+1.1%)

$ABNB (-0.97%)

$TWLO (-1.32%)

$RIVN (+2.48%)

$COIN (-0.57%)

$TOM (-3.16%)

$OR (-1.99%)

$MRNA (+2.51%)

$CCO (+3.75%)

$DKNG (-0.37%)

- Markets

- Stocks

- Schott Pharma

- Forum Discussion

Schott Pharma

Price

Discussion about 1SXP

Posts

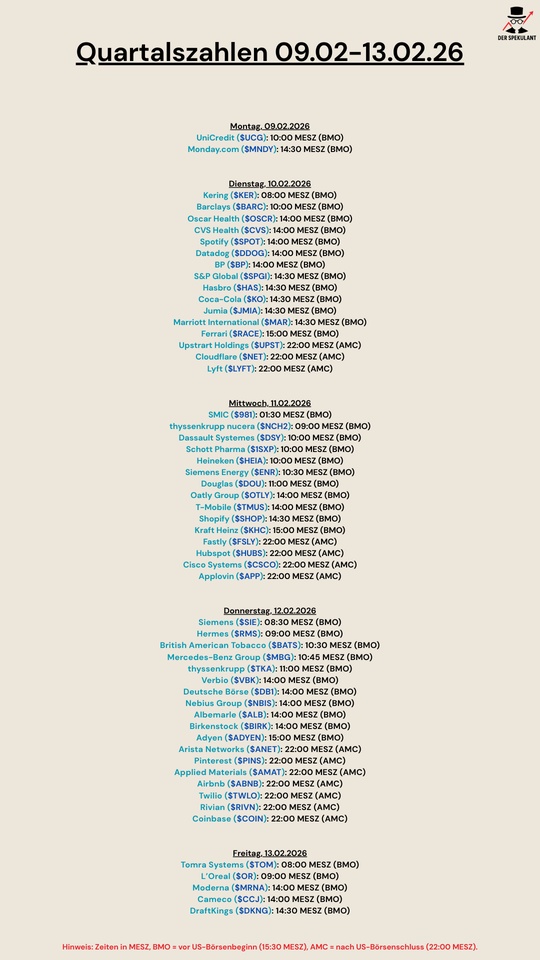

14Quarterly figures 09.02-13.02.26

Strategy presentation, feedback welcome

Hello everyone,

I have been following this forum for some time now and have decided to present my experiments and current strategies.

On the one hand, because I want to avoid losing track of things, and on the other hand, to prepare my thoughts for myself and also to get other perspectives and opinions.

Briefly about myself

I am 22 years old and graduated last year with a Bachelor of Engineering in Energy Technology.

I am currently working in a medium-sized company in the energy industry in Germany.

I have been rather frugal with money since I was a child. As I got older, my interest in increasing money wisely grew.

I was also lucky that my uncle opened a junior custody account for me when I was born. As a result, at the age of 18 I already had a small starting portfolio worth around 3,000 euros.

At the beginning, I focused intensively on precious metals and also invested in them. I don't plan to touch these holdings in the long term. If I don't need them, I see them more as a legacy for the next generation. I will buy more from time to time.

Basic start

As a first step, and I am aware that this will be assessed differently, I have taken out a unit-linked pension plan with the savings bank, which I save 150 euros per month.

I also took out a building society savings plan, as I basically want to buy my own home in the long term. I am currently renting.

The building society saver is also 150 euros per month per month.

At the same time, I have been working with neobrokers, from which my current portfolio has gradually developed.

Yes, there are still quite a few stocks in it at the moment. I will probably clean that up in the long term.

1st approach, accumulating ETFs

My first approach was to invest in classic accumulating ETFs.

- World, $XDWD (-0.16%)

- Emerging markets, $EIMI (+0.05%)

- AI and big data, $XAIX (-0.17%)

Smaller side bets were added later.

- Armaments, $DFEN (+1.81%)

- uranium, $U3O8 (+1.57%)

- batteries, $BATG (-0.71%)

I also bought my first individual shares to gain experience. Among other things, I had success with $RHM (+2.26%) . At the same time, I learned how quickly losses can occur if you are not sufficiently diversified, for example with $ABR (-0.47%) ,$1SXP (-1.28%) and other stocks.

This ultimately led me to my second approach.

2nd approach, dividend strategy

As I already have a pension plan through LBS and don't want to be the richest man in the cemetery, I focused more on a dividend strategy.

The first attempt consisted of the following combination

The idea came from a business magazine and was aimed at making monthly distributions as even as possible. I also added $QYLE (+0.29%) to gain initial experience with option strategies.

However, as this combination is only diversified to a limited extent and I deliberately wanted to move away from the USA, I adapted my strategy further.

Current strategy

Fixed savings rates

- LBS, retirement provision, 150 euros per month

- Building society, residual debt for future home ownership, 150 euros per month

Dividend strategy with 115.24 euros per month

- $XDWL (-0.21%) , 34 percent

- $IEEM (+0.85%) , 26 percent

- $XAIX (-0.17%) , 13 percent

- $EXSH (-1.05%) , 26 percent

Side bets with 81 euros per month

- $DFEN (+1.81%) , 62 percent

- $BATG (-0.71%) , 10 percent

- $QYLE (+0.29%) , 25 percent

Trading 212 experiment with 100 euros per month

Here I am pursuing the goal of bundling individual shares in a common pot, partially saving them and automatically reinvesting distributions in order to benefit from the compound interest effect in the long term.

I welcome tips and constructive criticism so that I can continue to improve my strategy.

Best regards

Mister Kimo

Perhaps it would make sense to think about liquidating all small positions (for example < 1%) and investing in a closed position

In itself, however, there is little wrong with the individual positions

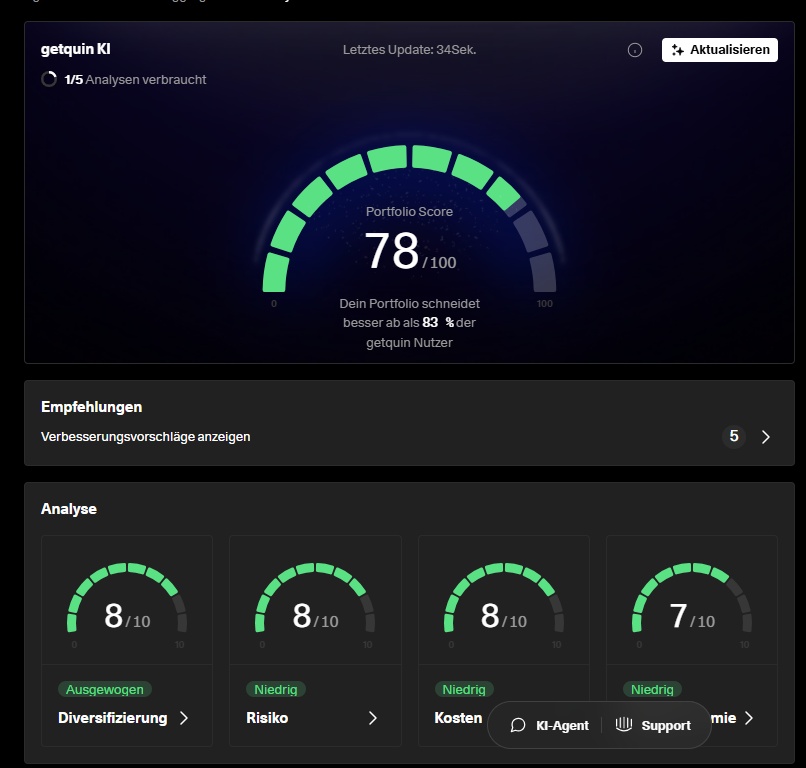

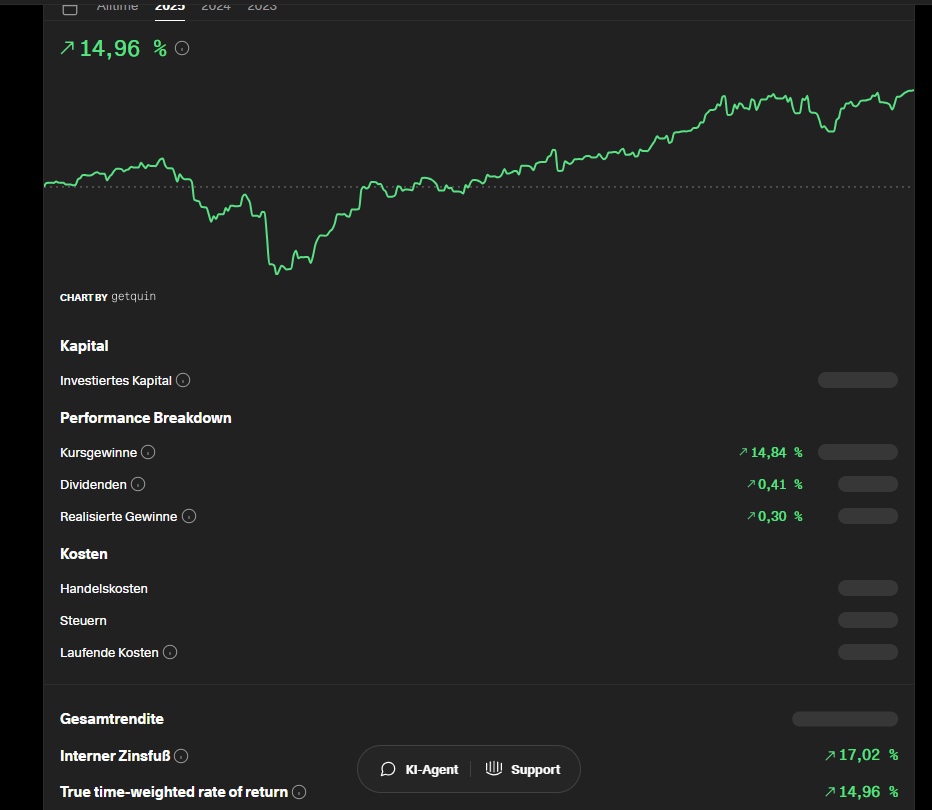

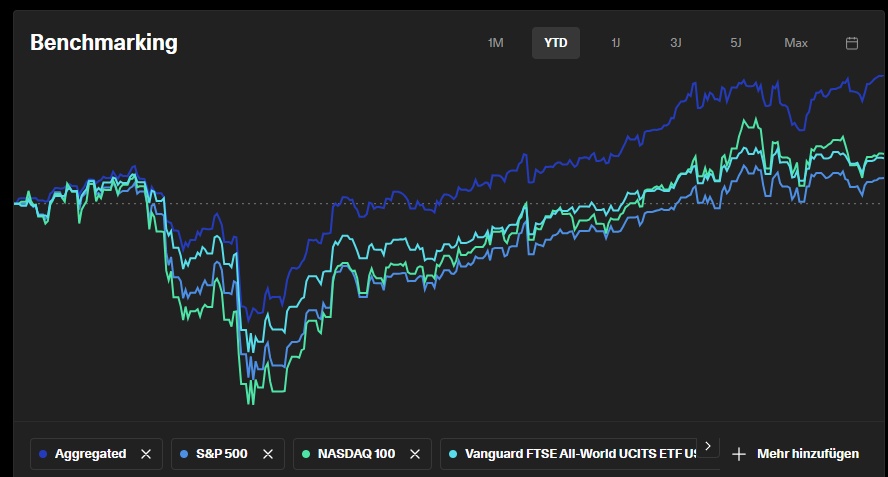

Performance 2025

Hello everyone,

I would like to wish everyone a happy holiday and a happy new year.

Here is my annual performance, which I am satisfied with, not only because of the return I achieved - some have achieved far more - but also because I was able to reduce my drawdown compared to my "comparison benchmarks".

I thought my 3 best stocks would be the ones I bought in the "Trump Crash". But the 3 best were the ones I bought before and simply held:

And also the ones I bought after the big carnage did well

However, the following did not go well at all

The surprise of the year for me was silver, which of course benefited my portfolio.

Best regards

Backgrounds Schott

$1SXP (-1.28%) Hi everyone, are you aware of the reasons why Schott is slumping - almost 25% in the last 3 months! Surely the figures are not that bad?

Quartalszahlen 11.08-15.08.2025

$SZG (-6.49%)

$HYQ (-4.1%)

$ABX (-0.86%)

$BBAI (-1.49%)

$PLUG (+1.32%)

$GPRO (-3.9%)

$TEG (-5.18%)

$1SXP (-1.28%)

$SE (-3.78%)

$ETOR (-2.2%)

$NCH2 (-2.58%)

$TUI1 (-4.96%)

$VWS (-1.83%)

$R3NK (-0.49%)

$EOAN (-0.41%)

$CSCO (-3.08%)

$SLI (+1.41%)

$HFG (-0.41%)

$HTG (+0%)

$HLAG (-3.44%)

$TKA (-4.53%)

$DOU (+1.56%)

$RWE (+1.01%)

$BIRK (-1.25%)

$9618 (+1.49%)

$DE (+0.57%)

$FR (-1.86%)

$NU (-1.04%)

Analyst updates, 03.01.25

⬆️⬆️⬆️

- Raymond James Upgrades Block Inc (SQ) to Outperform

Raymond James analyst John Davis upgraded Block Inc (NYSE: SQ) from Market Perform to Outperform with a price target of $115.00. $SQ (-2.36%)

- HAUCK AUFHÄUSER IB upgrades KNORR-BREMSE from Sell to Hold and raises price target from EUR 63.60 to EUR 65. $KBX (-2.87%)

- EXANE BNP upgrades UBS from Neutral to Outperform and raises price target from CHF 27 to CHF 35. $UBSG (-1.06%)

- BERENBERG raises the price target for TALANX from EUR 91.10 to EUR 95.30. Buy. $TLX (-2.03%)

- BERENBERG raises the price target for SNP from EUR 56 to EUR 61. Hold. $SHF (-0.37%)

⬇️⬇️⬇️

- UBS lowers the price target for ADOBE SYSTEMS from USD 525 to USD 475. Neutral. $ADBE (-0.77%)

- JEFFERIES lowers the price target for SCHOTT PHARMA from EUR 31.80 to EUR 26.34. Hold. $1SXP (-1.28%)

Analyst updates, 16.12.

⬆️⬆️⬆️

- JEFFERIES raises the price target for AMAZON from USD 235 to USD 275. Buy. $AMZN (-1.43%)

- CITIGROUP raises the price target for MUNICH RE from EUR 475 to EUR 522. Neutral. $MUV2 (-0.34%)

- BERENBERG raises the price target for RHEINMETALL from EUR 655 to EUR 750. Buy. $RHM (+2.26%)

- WARBURG RESEARCH raises the price target for PORSCHE SE from EUR 36 to EUR 37. Hold. $PAH3 (-3.79%)

- WARBURG RESEARCH raises the price target for HENSOLDT from EUR 40 to EUR 42. Buy. $HAG (+3.67%)

- JEFFERIES raises the target price for SHELL from GBP 31 to GBP 32. Buy. $SHEL (+1.87%)

⬇️⬇️⬇️

- BERNSTEIN lowers the price target for PORSCHE SE from EUR 46 to EUR 42. Market Perform. $PAH3 (-3.79%)

- HSBC downgrades SAP to Hold. Target price EUR 260. $SAP (-1.32%)

- LOOP CAPITAL downgrades NETFLIX to Hold. Target price 950 USD. $NFLX (-1.17%)

- EXANE BNP lowers the price target for MERCEDES-BENZ from EUR 57 to EUR 54. Underperform. $MBG (-1.06%)

- JEFFERIES downgrades FORD from Hold to Underperform and lowers target price from USD 12 to USD 9. $F (-0.58%)

- CITIGROUP lowers the price target for THYSSENKRUPP from EUR 5.80 to EUR 5.50. Buy. $TKA (-4.53%)

- STIFEL lowers the price target for AIXTRON from EUR 20 to EUR 18. Hold. $AIXA (-0.31%)

- PARETO downgrades TRATON to Hold. Target price EUR 32.50. $8TRA (-2.61%)

- DEUTSCHE BANK RESEARCH lowers the target price for KINGFISHER from GBP 3.50 to GBP 3.40. Buy. $KGF (-3.07%)

- METZLER lowers the price target for CARL ZEISS MEDITEC from EUR 104 to EUR 90. Buy. $AFX (-2.15%)

- BERENBERG lowers the price target for SCHOTT PHARMA from EUR 32 to EUR 28. Hold. $1SXP (-1.28%)

- CITIGROUP downgrades 1&1 to Neutral. Target price EUR 15. $1U1 (-2.55%)

12.12.2024

ECB interest rate decision today + Schott Pharma aims to generate more revenue with a similar margin

Little movement ahead of the ECB interest rate decision

- The DAX is likely to remain just below Monday's record high on Thursday morning.

- Investors are likely to await the interest rate decision of the European Central Bank (ECB) and the subsequent press conference. After an annual gain of around 22 percent in the DAX, they are sitting on a generous cushion that needs to be defended.

- Around an hour before the start of trading, the X-Dax, the indicator for the leading German index, signaled a fall of 0.2 per cent to 20,365 points.

- The Dax reached its most recent record high right at the start of the week at just under 20,462 points.

- The Eurozone's leading index, the EuroStoxx 50, is expected to post minimal gains on Thursday. Its annual gain is currently just under ten percent.

- Most economists expect the ECB to cut interest rates slightly by 0.25 percentage points after the central bank initiated the turnaround in June.

Schott Pharma $1SXP (-1.28%)wants to generate more revenue with a similar margin

- After leaps in sales and operating profit, the MDax climber Schott Pharma is aiming for further growth in the new financial year.

- In the twelve months to the end of September 2025, the Management Board intends to increase revenue in the high single-digit range after adjusting for currency effects, as the pharmaceutical supplier announced in Mainz on Thursday.

- In percentage terms, Schott Pharma should then retain roughly the same amount of this as earnings before interest, taxes, depreciation and amortization (EBITDA margin) as in the previous financial year.

- The margin was 26.9 percent, or 27.8 percent adjusted for currency effects.

- In the 2023/24 financial year, revenue climbed by seven percent to 957 million euros. The operating result rose by eight percent to 258 million euros.

- At the bottom line, Schott Pharma earned 150 million euros, two million euros less than in the previous year.

Thursday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

Associated British Foods 0.69 GBP

MPC Container Ships NOK 0.10

- Quarterly figures / company dates USA / Asia

15:00 Under Armour Investor Day

22:00 Broadcom | Costco Wholesale Quarterly figures

- Quarterly figures / Company dates Europe

07:00 Schott Pharma | Bertrandt Annual Results | Fraport Traffic Figures November

07:30 MVV Energie annual results and annual report

11:00 Schott Pharma Analyst Conference | Pirelli AGM

11:30 Siemens Capital Market Day Smart Infrastructure

No time specified:

- Siemens Energy Annual Report

- Hensoldt Capital Markets Day

- Economic data

09:30 CH: Swiss National Bank (SNB), outcome of the Monetary Policy Council meeting December key interest rate FORECAST: 0.75% previously: 1.00%

10:00 FR: IEA oil market report

10:30 DE: Ifo Institute for Economic Research, Pk on the Winter 2024 Economic Forecast, Berlin

14:15 EU: ECB, outcome of the Governing Council meeting and staff projection for growth and inflation in the eurozone Deposit rate FORECAST: 3.00% previously: 3.25%

14:30 US: Initial jobless claims (week) FORECAST: 220,000 previously: 224,000

14:30 US: Producer Prices November PROGNOSE: +0.2% yoy previous: +0.2% yoy Core rate (excluding food and energy) PROGNOSE: +0.2% yoy previous: +0.3% yoy

14:45 EU: ECB, press conference after Governing Council meeting

Analyst updates, 05.12.

⬆️⬆️⬆️

- HSBC upgrades SIEMENS to Hold. Target price EUR 185. $SIE (-1.9%)

- DEUTSCHE BANK RESEARCH raises the price target for MUNICH RE from EUR 450 to EUR 535. Hold. $MUV2 (-0.34%)

- DEUTSCHE BANK RESEARCH raises the price target for HANNOVER RÜCK from EUR 255 to EUR 294. Buy. $HNR1 (-1.12%)

- DEUTSCHE BANK RESEARCH raises the price target for TALANX from EUR 70 to EUR 76. Hold. $TLX (-2.03%)

- JEFFERIES raises the price target for ORACLE from 190 USD to 220 USD. Buy. $ORCL (-2.26%)

- HAUCK AUFHÄUSER IB raises the target price for MTU from EUR 264 to EUR 280. Sell. $MTX (-2.91%)

- BARCLAYS upgrades AUTO1 from Equal-Weight to Overweight and raises target price from EUR 9 to EUR 19. $AG1 (-2.82%)

- JPMORGAN raises the price target for HELLOFRESH from EUR 14 to EUR 16. Overweight. $HFG (-0.41%)

- JPMORGAN raises the target price for DELIVERY HERO from EUR 42 to EUR 55. Overweight. $DHER (-2.44%)

- JPMORGAN raises the price target for CTS EVENTIM from EUR 104 to EUR 112. Overweight. $EVD (-0.22%)

- JPMORGAN raises the target price for SCOUT24 from EUR 92 to EUR 105. Overweight. $G24 (-0.47%)

- JPMORGAN raises the target price for JUST EAT TAKEAWAY from GBP 16.02 to GBP 18.32. Overweight. $TKWY

- JPMORGAN upgrades DELIVEROO from Neutral to Overweight and raises target price from GBP 1.70 to GBP 1.92. $ROO

- JPMORGAN raises the price target for HEIDELBERG MATERIALS from EUR 150 to EUR 151. Overweight. $HEI (-1.89%)

- JPMORGAN raises the price target for FRAPORT from EUR 49 to EUR 59. Neutral. $FRA (-3.24%)

⬇️⬇️⬇️

- METZLER lowers the price target for HYPOPORT from EUR 220 to EUR 185. Sell. $HYQ (-4.1%)

- ODDO BHF lowers the target price for SCHOTT PHARMA from EUR 38 to EUR 37. Outperform. $1SXP (-1.28%)

- BARCLAYS lowers the target price for RIO TINTO from GBP 61 to GBP 60. Overweight. $RIO (-0.03%)

- JPMORGAN downgrades STRÖER from Overweight to Neutral and lowers target price from EUR 79 to EUR 57. $SAX (-0.82%)

Analyst updates, 04.12.

⬆️⬆️⬆️

- BARCLAYS raises the price target for SIEMENS from EUR 125 to EUR 130. Underweight. $SIE (-1.9%)

- BARCLAYS raises the target price for SIEMENS ENERGY from EUR 35 to EUR 36. Equal-Weight. $ENR (-1.07%)

- JEFFERIES raises the target price for ADYEN from EUR 1695 to EUR 1797. Buy. $ADYEN (+0.93%)

- JPMORGAN raises the target price for SALESFORCE from USD 340 to USD 380. Overweight. $CRM (-1.79%)

- HSBC raises the target price for ZALANDO from EUR 37 to EUR 40. Buy. $ZAL (-1.64%)

- JPMORGAN raises the target price for RHEINMETALL from EUR 680 to EUR 800. Overweight. $RHM (+2.26%)

- DEUTSCHE BANK RESEARCH raises the target price for COCA-COLA HBC from GBP 31.50 to GBP 32. Buy. $CCH (+0.83%)

- BARCLAYS raises the target price for KNORR-BREMSE from EUR 55 to EUR 60. Underweight. $KBX (-2.87%)

- BARCLAYS raises the price target for ABB from CHF 40 to CHF 42. Underweight. $ABBNY (-1.77%)

- BARCLAYS raises the price target for ALSTOM from EUR 8 to EUR 9. Underweight. $ALO (-3.88%)

- HSBC upgrades MERCK & CO to Buy. Target price USD 130. $MRK (+0.6%)

- JPMORGAN raises the target price for DSV from DKK 1685 to DKK 1800. Overweight. $DSV (-4.63%)

- JPMORGAN raises the target price for LUFTHANSA from EUR 4.80 to EUR 5.50. Underweig$LHA (-7.08%)

- UBS raises the target price for AROUNDTOWN from EUR 2 to EUR 3.30. Neutral. $AT1 (-8.98%)

⬇️⬇️⬇️

- JPMORGAN lowers the target price for DHL GROUP from EUR 47 to EUR 42.50. Overweight. $DHL (-1.75%)

- WARBURG RESEARCH lowers the target price for UNITED INTERNET from EUR 38.50 to EUR 37.30. Buy. $UTDI (-3.63%)

- WARBURG RESEARCH lowers the target price for 1&1 from EUR 23.50 to EUR 19.10. Buy. $1U1 (-2.55%)

- WARBURG RESEARCH lowers the target price for KWS SAAT from EUR 89 to EUR 88. Buy. $KWS (-0.39%)

- DEUTSCHE BANK RESEARCH downgrades HEINEKEN from Buy to Hold and lowers target price from EUR 95 to EUR 76. $HEIA (-1.7%)

- EXANE BNP lowers the price target for SCHOTT PHARMA from EUR 36 to EUR 28. Neutral. $1SXP (-1.28%)

- BARCLAYS downgrades SIGNIFY to Underweight. Target price EUR 18. $LIGHT (+0.24%)

- CFRA downgrades BRISTOL-MYERS SQUIBB to Hold. Target price USD 60. $BMY (-0.17%)

- MORGAN STANLEY downgrades MOLLER-MAERSK to Underweight. Target price DKK 12200. $AMKBY (-3.08%)

- BARCLAYS downgrades ANDRITZ to Underweight. Target price EUR 40. $ANDR (-2.23%)

- JPMORGAN lowers the price target for HAPAG-LLOYD from EUR 85 to EUR 80. Underweight. $HLAG (-3.44%)

Trending Securities

Top creators this week