$NOVN (+0.48%)

$ROG (-1.33%)

$SAN (-0.31%)

$YPSN (+3.52%)

$SFZN

$LONN (-1.86%)

$DESN (+1.52%)

$BANB

$BANB (-0.5%)

The USA is heavily dependent on imports for medicines. The Trump administration is pushing for manufacturers to expand their capacities in America. Even industry giants such as Roche and Novartis are under pressure to do so.

The name alone is frightening: the Swiss pharmaceutical companies, together with other drug manufacturers, are the target of a so-called Section 232 National Security Investigation. As part of this investigation, the US Department of Commerce wants to find out whether the national security of the USA is at risk due to excessive dependence on imported medicines.

The instrument is based on a law from 1962 that is still in force and was first used in the 1980s against manufacturers of machine tools, among other things. It is regarded as a broadly supported basis for justifying the imposition of tariffs.

Swiss industry association caught off guard

Drug manufacturers have only 21 days to participate in the consultation on the initiation of the investigation. The Swiss pharmaceutical industry appears to have been caught off guard by the request, which was published in the middle of this week on the website with the daily announcements of the US administration (Federal Register). The industry association Interpharma announced on request that it is currently clarifying with its member companies whether a submission would be expedient.

Novartis, the second-largest Swiss drug manufacturer, is also currently reviewing the announcement. Roche, Switzerland's largest pharmaceutical company, does not wish to comment on the issue. Lonza is also declining to comment at this time. Unlike Roche and Novartis, the Basel-based group does not have its own products, but manufactures drugs on behalf of numerous pharmaceutical and biotech companies.

Markus Blocher is not yet sure

A smaller competitor of Lonza, the Zofingen-based company Siegfried, is more talkative. It has confirmed that it will participate in the consultation process in the USA. Dottikon ES, another Swiss contract manufacturer of pharmaceutical products, says: "We will examine the documents and decide whether and how we will respond." Markus Blocher, Chairman of the Board of Directors, CEO and majority shareholder, adds that he cannot yet say whether he will make his decision public.

As part of the consultation process, not only Swiss pharmaceutical companies, but all drug manufacturers with business in the USA are invited to provide answers to ten different questions. From a Swiss perspective, question eight is particularly controversial: the companies are to state how they assess the feasibility of measures to expand American production capacities.

Other questions concern the role of foreign supply chains in the production of medicines for the American market or the influence of foreign subsidies on the competitiveness of the American pharmaceutical industry. The Department of Commerce also wants to know to what extent foreign governments can impair the supply of medicines to the United States with the help of export restrictions.

High US deficit in trade with medicines

The USA is by far the largest pharmaceutical market. Last year, it is estimated that over 460 billion dollars were spent on prescription drugs in the country. However, most medicines for the American market are imported from abroad.

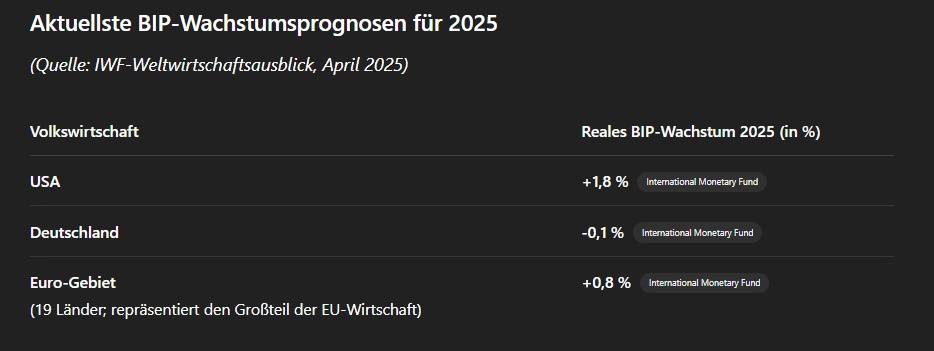

In 2024, the USA imported a total of 210 billion dollars worth of pharmaceutical products. Swiss exports of pharmaceutical products to the United States alone, including vitamins and diagnostics, amounted to almost CHF 32 billion. At the same time, American exports in the pharmaceutical sector amounted to only 95 billion dollars.

In the eyes of the new US administration, this represents an unacceptable imbalance. President Donald Trump is known for interpreting any trade deficit as a sign that the United States is being ripped off.

Trade Minister puts pressure on

Howard Lutnick, the new Secretary of Commerce, already indicated a week ago in an interview with the ABC television station that he saw national security being violated. He insisted that the United States must produce critical goods such as medicines itself.

Swiss pharmaceutical companies are therefore also faced with the question of how they could contribute to increasing the USA's own supply of medicines. Dottikon ES has to start practically from scratch. The company, which primarily supplies its active ingredients for tablets to American customers as well as European customers, has concentrated all its activities at its headquarters in Aargau. Whether this single-site strategy can be maintained in the face of growing political pressure from the USA is questionable.

Pharmaceutical companies that do not yet have a production facility in the USA could have certain production steps carried out by American partner companies. Another option would be to set up their own plant in the United States. However, this is likely to take several years and is associated with high investments in the USA, not unlike in Switzerland. Dottikon, for example, has invested 700 million Swiss francs in the expansion of its main plant in recent years in order to almost double its production capacity.

Siegfried considers itself to be in a comfortable position

Siegfried is in a better position with regard to American expectations. The company already generates the majority of its turnover with customers in the American market with services provided in the United States itself. The company estimates that only 20 percent of this contribution is imported into the USA.

Siegfried benefits from the fact that it only acquired a third American production site in the middle of last year. The company's management emphasizes that it will continue to expand its presence in the United States in the future, whether through its own efforts or with the help of acquisitions.

Basel-based competitor Bachem also wants to grow in America. According to a spokesperson, the company is planning to invest a significant double-digit million amount in the expansion of its plant in Vista, California.

How many billions will Roche raise?

Swiss pharmaceutical companies can try to score points in Washington with such announcements. Ultimately, however, only investments running into the billions are likely to alleviate the US government's concerns about dependence on imports.

The 23 billion dollars that Novartis announced last week in investments in the expansion of its production network and research activities in the USA fall into this category. Another major investment is expected from Roche in industry circles. There is also talk of a double-digit billion amount. Roche itself is keeping a low profile. A Group spokeswoman merely states that "something" is coming and that the company will comment on this in due course.

Tariffs on medicines probably unavoidable

The high export surplus achieved by local pharmaceutical companies in business with the USA is considered the main reason why the Trump administration has imposed "reciprocal" tariffs of 31% on Switzerland. It remains to be seen when the pharmaceutical industry will have to expect industry-specific tariffs on the import of medicines to America. When the "reciprocal" tariffs were announced on April 2, pharmaceutical products were explicitly exempted. This remained the case when Trump announced just one week later that the tariffs would be suspended for 90 days for all countries with the exception of China, with the exception of a minimum rate of 10 percent.

However, Lutnick made it clear in a television interview a week ago that there was no way around tariffs on pharmaceutical products. "They will come in the next month or two," said the trade minister. Donald Trump has also repeatedly repeated his threat to punish the pharmaceutical industry with tariffs in recent weeks. He has spoken of 25 percent or more.

At 25 percent, drug manufacturers would come off just as badly as car, steel and aluminum manufacturers. Trump had already had Section 232 investigations carried out against these industries during his first term as president. However, all three industries were only recently hit with the painful 25 percent rate. The Swiss pharmaceutical industry can now try to prevent the tariff hammer from coming down on them with clever answers.

https://www.nzz.ch/wirtschaft/roche-und-novartis-sollen-mehr-medikamente-in-den-usa-produzieren-ld.1880533