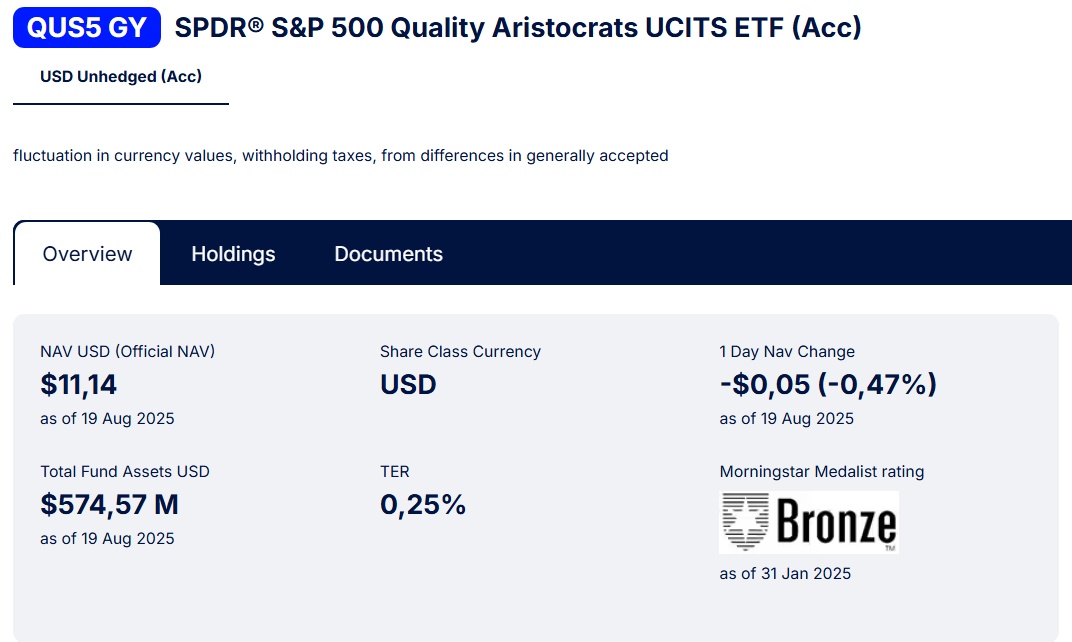

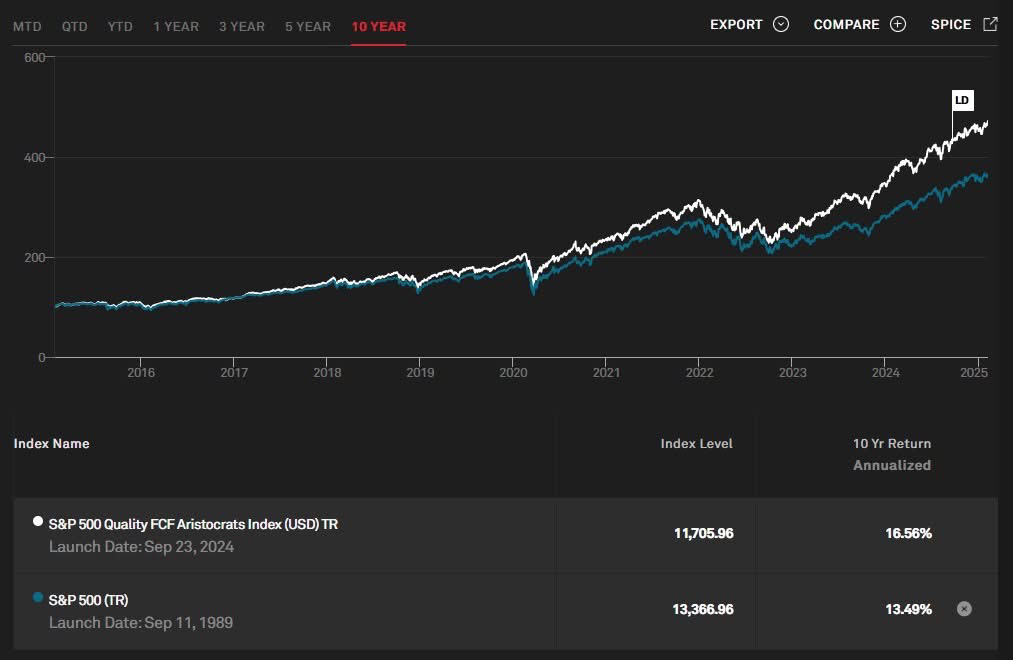

Following the rebalancing of the S&P Quality Aristocrats last Friday, the following stocks were removed from or added to my two ETF indices (50% weighting):

New additions:

$QDEV (-0.49%): $NOVN (+0.55%) , $REL (+0.37%) , $ITX (-0.64%) , $LSEG (+1.02%) , $DB1 (+0.85%) and more

$QUS5 (-0.27%): $BKNG (-0.19%) , $MRK (-0.65%) , $CRM (-0.78%) , $UNP (-0.09%) , $COR (+0.41%) , $CAH (-0.71%) and more

Kicked out of both indices and therefore according to S&P no longer Quality Aristocrats are among others: $BATS (+0.69%) , $7974 (+0.78%) , $HD (-0.62%) , $LOW (-0.23%) , $HLT (-0.29%)

In addition, the allocation of all individual stocks in the indices was reduced again to max. 5 % was limited.

Thanks to the recent rally of $$HY9H (-2.85%) my current top 10 weighting (ETFs+shares) is as follows:

3.48% Alphabet

3.04% SK Hynix

3.04% Broadcom

2.93% Meta

2.75% Microsoft

2.71% Apple

2.71% NVIDIA

2.55% Taiwan Semiconductor

2.13% Mastercard

2.08% Visa

New portfolio key figures:

P/E: 27.1 (<30) 🟢

Forward P/E: 21.1 (<25) 🟢

P/Β: 11.5 (<5) 🔴

EV/FCF: 28.7 (<25) 🟡

ROE: 42% (>15%) 🟢

ROIC: 19% (>15%) 🟡

EPS growth for the next 5 years: 15% (>7%) 🟢

Sales growth for the next 5 years: 9% (>5%) 🟡

My internal rate of return is currently 20.19%