18 x $EWG2 (-2.96%) against 18 x $VWCE (-1.34%)

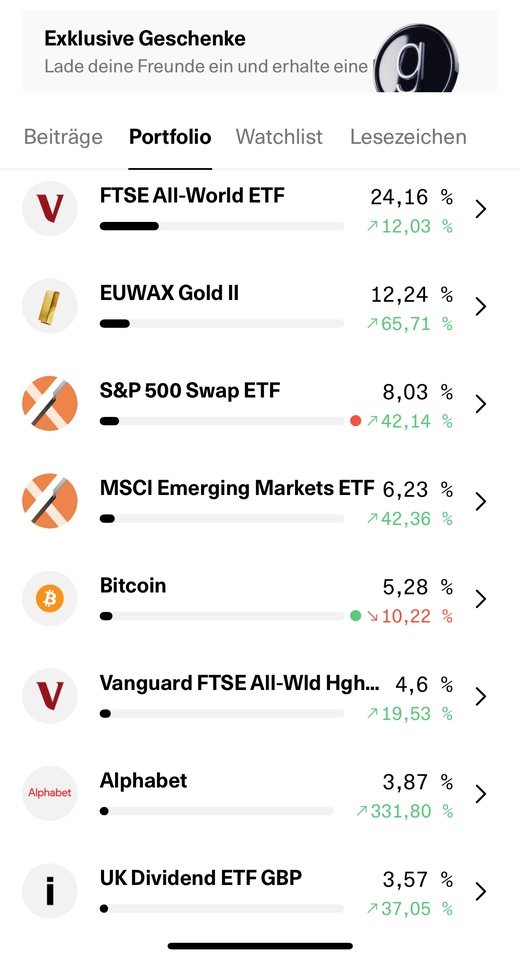

Weighting now as follows:

Posts

49518 x $EWG2 (-2.96%) against 18 x $VWCE (-1.34%)

Weighting now as follows:

Hi, I have been lent 5000€ for an indefinite period. I can/should invest the money as 0.5% in the current account is a bit low. I am aware that I am taking a risk by investing. However, I would also have the money myself, so I can pay it back at any time.

The question arises as to whether I could invest it in a $VWCE (-1.34%) could I invest it in an investment or perhaps $XEON (+0%) ? I'd love to hear your thoughts in the comments :)

depot significantly simplified.

Savings are now only $VWCE (-1.34%) and $VHYL (-3.1%)

Hello everyone

I (m, 30 years old) recently did another evaluation of my portfolio with the getquin-AI, as I was not exactly satisfied with a value of around 40/100.

About my investments: I buy CHF 100 per month in $VHYG (-1.7%) , $VWCE (-1.34%) , $ZGLD , $CHDVD and approx. 500 in selected individual shares. My investment horizon is 15 years +, if not 30 years until I retire. My aim is to build up assets and generate a certain cash flow.

Now the question arises for me - because the getquin-AI says I should not leave out emerging markets - whether I should invest in the Xtrackers MSCI Emerging Markets UCITS ETF $XMME (-4.3%) as a supplement. Through $VWCE (-1.34%) and $VHYG (-1.7%) I have already invested a certain amount in EM. Should I use the $XMME (-4.3%) buy a larger share or would that be unnecessary?

(I have already invested CHF 100 once this month and the points value went up from 40 to 60/100).

I appreciate your feedback.

Everyone has long been recommending to put most of your 'foundational ETF' money in some sort of All World ETF . For years this has been a great approach, and for good reason. It's easy, low cost, low maintenance. But times have changed and I've been noticing a decoupling between the US and the rest of the world. The US is overpriced and slowing down and the USD/EUR valuation sucks. So late last year I changed my strategy and decided that I wanted to build my own All World ex-US ETF, because I've always learned to trade the market you have, not the market you want.

So I sold my $VWCE (-1.34%) position and compiled my own ETF pack. Europe to start with, $SMEA (-2.48%) and $ESIN (-2.83%) , then Emerging Markets, Asia and the Pacific ex-Japan consisting of $IEMA (-4.07%) and $VAPU (-5.05%) , and Japan $VJPB (-3.57%) . I've been distributing these more or less equally to what the FTSE All World would have looked like without the US. It needs some restructuring every now and then but to me it's more than worth it when you look at the rewards:

I currently made a YTD performance of about 16% with my "custom ex-US ETF", compared to only 4.3% if I kept the $VWCE (-1.34%) or $ACWI as my foundation.

”Never bet against the US” is valid, until it isn’t! That’s my opinion. Trade the market you have, not the market you want. And when times change again, I will act accordingly. But for now, I'm happy I made this decision 😁

For the record: this is a post about my ETFs and their performance, NOT about my portfolio as a whole as 47% consists of individual stocks that aren’t doing so well at the moment.

I'm keen to hear what your thoughts on this are!

Hi 😊

Following another mention from a colleague (who, unlike me, knows his stuff 😂)

I started the first savings plan.

As we all know, money tends to be tight, but of course that shouldn't stop you from saving. After all, every little helps ☝🏻

50€ a month on our college $VWCE (-1.34%)

that is always feasible ☺️

Top creators this week