What do you think?

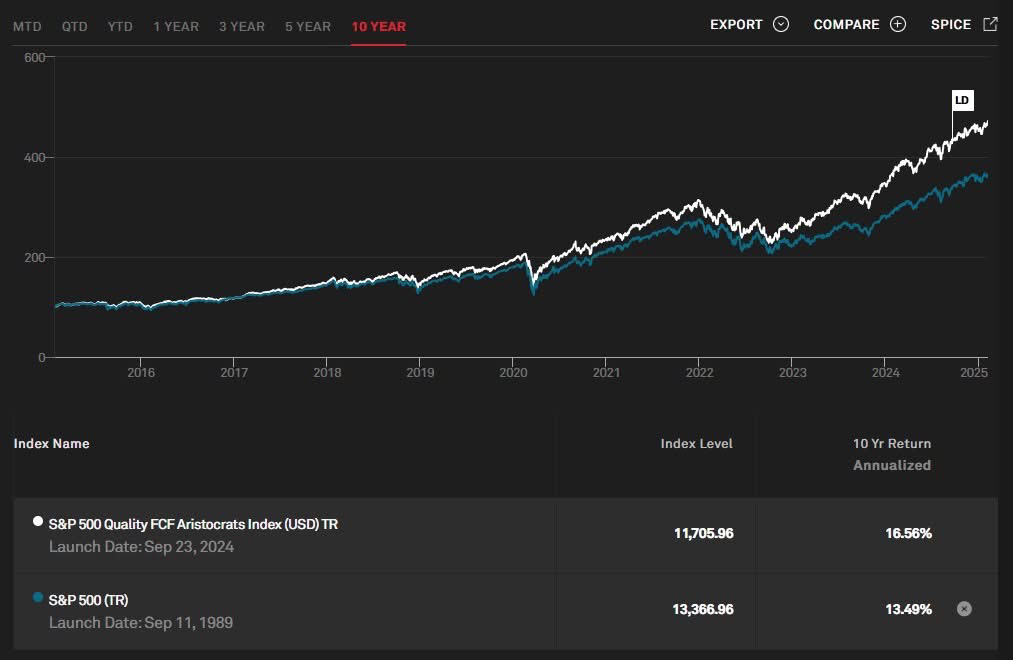

SPDR has recently created an ETF on the "S&P 500 Quality FCF Aristocrats" index, therefore factorial, with an annualized return of 16.56% (TR) over the last 10 years. ETF of two months and small, 6 million. (a normal S&P500 13.49%) It invests in stocks with positive and growing free cash flow which therefore suffer less from economic macrocycles and are in less cyclical sectors. Furthermore, having the constraint of 60% maximum for each nation exposes you less to the U.S. trend. While for U.S. stocks it takes them with the criteria indicated above and not by capitalization outperforming the normal S&P 500. The ETF that I linked above is in fact the same version, but limited to the U.S. and if you look at the graphs it outperforms the S&P 500 by a lot tr

FCF indicates with positive and growing cash flow over the last 5 years.

ISIN: IE000FJJZA01

There is also the world version

IE000IISJT64