$DIS (-0.78%)

$PLTR (-1.96%)

$SRT (-3.19%)

$NXPI (-0.58%)

$PYPL (-2.12%)

$PEP (+1.96%)

$TER (+4.78%)

$CPRI (+0.94%)

$MRK (+0.35%)

$PFE (-0.69%)

$TTWO (+0.65%)

$EA (+0.44%)

$AMD (+2.27%)

$MDLZ (+0.06%)

$LUMN (-0.75%)

$SMCI (-1.02%)

$7011 (-2.02%)

$6752 (-0.15%)

$6367 (-0.17%)

$UBSG (-1.36%)

$GSK (+0.55%)

$UBER (-1.91%)

$ABBV (-1.92%)

$LLY (+0.99%)

$GOOG (+0.92%)

$ELF (-8.43%)

$QCOM (+0.57%)

$SNAP (-2.92%)

$WOLF (+4.21%)

$ARM (-0.05%)

$VOLCAR B (-3.94%)

$6758 (-2.37%)

$SHL (-1.1%)

$SAAB B (+2.68%)

$5401 (+0.92%)

$MAERSK A (-4.56%)

$R3NK (-0.47%)

$BMY (+0.03%)

$BMW (-2.11%)

$EL (-3.75%)

$ROK (-0.58%)

$PTON (+1.2%)

$KKR (-2.32%)

$LIN (-0.34%)

$RL (-0.49%)

$AGCO (-1.85%)

$RBLX (-1.83%)

$FTNT (+0.13%)

$REDDIT (-0%)

$ILMN (-0.41%)

$WMG (-1.63%)

$IREN (+0.82%)

$MSTR (+3.02%)

$AMZN (-1.51%)

$KOG (+2%)

$ORSTED (+0.07%)

$PM (+1.1%)

$WEED (-2.96%)

- Markets

- Stocks

- NXP Semiconductors

- Forum Discussion

NXP Semiconductors

Price

Discussion about NXPI

Posts

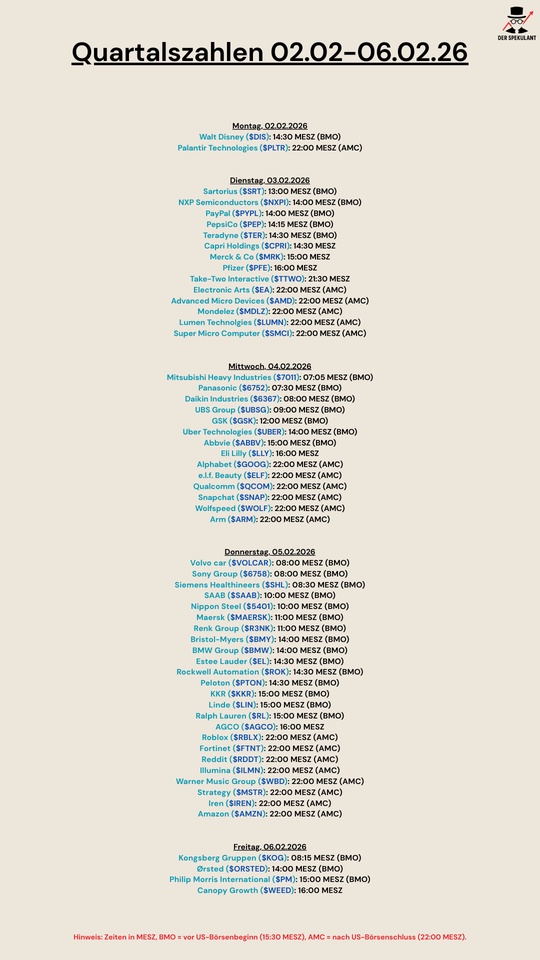

24Quarterly figures 02.02-06.02.26

Quarterly figures 27.10-31.10.25

$KDP (-0.83%)

$7751 (+0.21%)

$NXPI (-0.58%)

$WM (+0.31%)

$CDNS (-1.1%)

$BN (-1.05%)

$SOFI (-3.73%)

$UNH (-2.09%)

$AMT (-0.89%)

$UPS (-4.03%)

$BNP (-1.72%)

$NVS (+0.72%)

$DB1 (-0.64%)

$MSCI (-1.27%)

$ENPH (-0.77%)

$BKNG (-3.89%)

$LOGN (-0.64%)

$V (-1.09%)

$MDLZ (+0.06%)

$PYPL (-2.12%)

$000660

$MBG (-1.12%)

$BAS (-0.91%)

$UBSG (-1.36%)

$SAN (-1.15%)

$CVS (-1.12%)

$OTLY (-2.03%)

$GSK (+0.55%)

$ETSY (-3.15%)

$CAT (+1.54%)

$KHC (+0.45%)

$ADYEN (+0.66%)

$ADS (-2.36%)

$AIR (+0.27%)

$SBUX (-0.52%)

$CMG (-2.5%)

$META (-1.05%)

$KLAC (+2.71%)

$MELI (-1.64%)

$WOLF (+4.21%)

$GOOGL (+0.9%)

$EQIX (+0.05%)

$MSFT (-0.5%)

$CVNA (-1.86%)

$EBAY (-0.31%)

$005930

$6752 (-0.15%)

$KOG (+2%)

$VOW3 (-2.29%)

$GLE (-2.3%)

$LHA (-7.25%)

$STLAM (-3.59%)

$SPGI (-1.77%)

$MA (-1.51%)

$PUM (-2.77%)

$AIXA (-0.31%)

$FSLR (+1.52%)

$AAPL (+0.09%)

$REDDIT (-0%)

$AMZN (-1.51%)

$NET (+2.13%)

$MSTR (+3.02%)

$GDDY (-1.24%)

$TWLO (-1.63%)

$COIN (-0.35%)

$066570

$CL (-0.68%)

$ABBV (-1.92%)

$XOM (-0.02%)

The Humanoid 66 - The next industrial turning point

Good morning dear Getquin community 👋

Today I would like to introduce you to The Humanoid 66 and what it's all about. The market for humanoid robotics is just taking off and is facing one of the biggest upheavals since the advent of the automobile. Morgan Stanley and Goldman Sachs expect the market to be worth between 38 billion and three trillion US dollars by 2035. By 2050, over 60 million humanoid robots could be in use in the USA alone.

With The Humanoid 66, Morgan Stanley has compiled a list of 66 companies that are likely to benefit directly or indirectly from this development. These include not only the manufacturers themselves, but also suppliers and technology groups that provide the necessary infrastructure, from semiconductor and battery producers to sensor technology and software through to platform operators for artificial intelligence.

The leading players include $TSLA (-1.57%) Tesla with Optimus, Figure AI with Figure 02, Agility Robotics with Digit, Boston Dynamics with Atlas and Unitree with H1 and G1. Tesla is already planning to use more than a thousand Optimus robots in its own factories by 2024. The goal is clear: to make humanoid machines suitable for mass production at prices between 20,000 and 30,000 US dollars. Figure AI works closely with $MSFT (-0.5%) Microsoft, OpenAI and $BMW (-2.11%) BMW and was able to raise over 675 million US dollars in a financing round.

Technological progress is the key driver of this development. Multimodal generative AI enables humanoid robots to understand speech, communicate with humans and perform tasks autonomously. Advances in actuator technology, LiDAR systems, force sensors and battery technology are making the machines more efficient and more human-like. The energy density of modern lithium-ion cells is increasing by around 20 percent every two years, while the cost per kilowatt hour is expected to fall to 80 US dollars by 2030.

At the same time, wage costs for human labor are rising significantly. In the USA, they currently stand at just under 40 US dollars per hour, while in China they are around 6.50 US dollars and in India 4.45 US dollars. Studies show that automation can reduce labor costs in industrialized countries such as Germany, Japan and the USA by up to a third by 2025. Sectors such as agriculture, construction, care, logistics and manufacturing, where millions of jobs remain unfilled today, will be particularly affected.

The Humanoid 66 shows that this change goes far beyond individual companies. A new industrial ecosystem is emerging that links hardware, software, energy and data. Price reduction, scalability and integration into existing value chains will determine who will be among the winners.

Takeaway: Humanoid robotics is no longer a vision of the future, but the beginning of a structural reorganization of the global economy. Those who invest early in key areas such as AI chips, batteries, sensor technology and automation are positioning themselves in a sector that is likely to have a similarly profound impact as the invention of the car. The crucial question is just how far society is prepared to accept and integrate this new form of workforce.

For those who want to delve deeper: These are the companies featured in the Morgan Stanley report Humanoids @Tenbagger2024

@Multibagger

1. Tesla - USA - $TSLA (-1.57%)

2. Toyota - Japan - $7203 (-1.16%)

3. Xpeng - China - $XPEV (+6.39%)

4. Naver - South Korea - (not listed)

5. CATL - China - $3750 (+0.54%)

6. LG Energy Solution - South Korea - $373220 Subsidiary of LG

7. Samsung / Samsung SDI - South Korea - $SMSN (+0%)

8. SK Innovation - South Korea - $096770

9. HD Hyundai Infracore / Doosan (component) - South Korea - $042670

10. Hengli Hydraulic - China - $601100

11. NTN - Japan - $6472 (-3.76%)

12. NSK - Japan - $6471 (-2.65%)

13. Sanhua - China - $002050

14. Siemens - Germany - $SIE (-2.06%)

15. Top Group ("Topu") - China - $601689

16. Ambarella - USA - $AMBA (-1.18%)

17. Synopsys - USA - $SNPS (-1.02%)

18. NXP - Netherlands / USA - $NXPI (-0.58%)

19. Qualcomm - USA - $QCOM (+0.57%)

20. TSMC - Taiwan - $TSM (+0.69%)

21. Wolfspeed - USA - $WOLF

22. ARM - UK - $ARM (-0.05%)

23. onsemi - USA - $ON (+0.76%)

24. cadence - USA - $CDNS (-1.1%)

25. STMicroelectronics - Netherlands - $STM (+1.48%)

26. NVIDIA - USA - $NVDA (+1.1%)

27. SK hynix - South Korea - $HY9H (+1.09%)

28. sociionext - Japan - $6526

29. SMIC - China - $0981

30. infineon - Germany - $IFX (-0.9%)

31. Renesas - Japan - $6723 (-3.97%)

32. Dassault Systèmes - France - $DSY (-3.93%)

33. Mobileye - Israel / Intel ecosystem - $MBLY

34. Hexagon - Sweden - $HEXA B (-2.55%)

35. Knight Transportation - USA - $KNX (-1.02%)

36. DSV - Denmark - $DSV (-4.93%)

37. Werner Enterprises - USA - $WERN (-1.51%)

38. DHL Group - Germany / international - $DHL (-1.89%)

39. Kuehne + Nagel - Switzerland - $KNIN (-2.36%)

40. Obayashi - Japan - $1802 (-1.41%)

41. China State Construction Engineering Corporation (CSCEC) - China - $601668

42. RBG (presumably an Asian construction company) - (not listed)

43. Shimizu - Japan - $1803 (-1.46%)

44. Taisei - Japan - $1801 (-5.68%)

45. Baker Hughes - USA - $BKR (-0.55%)

46th SLB (Schlumberger) - USA - $SLB

47. Tenaris - Luxembourg / multinational - $TEN (+0.31%)

48. Halliburton - USA - $HAL (+0.49%)

49. amazon - USA - $AMZN (-1.51%)

50th Coupang - South Korea $CPNG (-3.16%)

51. JD.com - China - $JD (+1.18%)

52. BMW - Germany - $BMW (-2.11%)

53rd Mercedes-Benz - Germany - $MBG (-1.12%)

54th General Motors - USA - $GM (-2.52%)

55. BYD - China - $1211 (+6.04%)

56. Stellantis - NL / multinational - $STLAM (-3.59%)

57. Ford - USA - $F (-0.48%)

58. McDonald's - USA - $MCD (+0.25%)

59th Domino's - USA - $DPZ (+0.33%)

60. BGF Retail - South Korea - $282330

61. GS Retail - South Korea - $007070

62nd Lotte - South Korea - $004990

63. Yum China - China - $YUMC (+1.72%)

Source: Morgan Stanley Research Bluepaper Humanoids Investment Implications of Embodied AI and Stock3 drumbeat of Germany's humanoid robot manufacturers The Humanoid 66, 05.10.2025

"Morgan Stanley and Goldman Sachs expect the market to be worth between 38 billion and three trillion US dollars by 2035."

Wow. That's a really precise opinion. They must be some serious experts. Really now. Really. Honestly.

Is this the new Palantir of Europe?

Probably not quite, but I still see $CLAV (-0.73%) nevertheless great opportunities and yesterday I took my first position in the Swedish penny stock.

What is the idea behind investing in this still relatively unknown European cyber security company?

It's not that I want to satisfy my fanbase here on GQ who are panting for new top picks. 😂😂

First and foremost, I am looking for stocks for myself and my portfolio that have not yet been discovered by the broad market and therefore have the potential to multiply. Since I have also noticed from the reactions and many new follower requests that there is interest in my posts from a wide variety of investor types and that I enjoy exchanging ideas with you here, I share my ideas. But they are not investment recommendations and you make your own decisions. Just to say that again 😉😎

Now back to $CLAV (-0.73%) . My basic idea is that European authorities and defense companies do not want to rely on American cyber security companies on a large scale and become dependent on them. So they will look for companies that are based here in Europe and meet European security requirements in terms of Satan management, etc. etc. And if you then do some research, you come across the still small $CLAV (-0.73%) .

$CLAV (-0.73%) more than doubled its order intake in the first half of the year compared to the first half of 2008. The first order from a European law enforcement agency was landed. And the first key customer in the defense sector $BA. (+1.73%) was landed and I am convinced that more will follow.

Most recently, a cooperation was agreed with $NXPI (-0.58%) to jointly secure security solutions for the ever-increasing networking in the automotive industry.

So, let's start with the reasons why I got in with a first tranche. The price from $CLAV (-0.73%) here on GQ is not always up-to-date, which is due to the fact that the share is only traded in Frankfurt and Stockholm.

What do I think of this stock? Well, I always assume that such investments have a chance of at least doubling. That's what I see here over the next 6 months. My first medium-term target price is €2.

Do you know why they fell so sharply in 2017?

📊 NXP Semiconductors exceeds expectations in the second quarter of 2025

The Dutch semiconductor manufacturer NXP Semiconductors N.V. published its business figures for the second quarter of 2025 today - and was able to surprise on the upside.

💰 Turnover & result

With a quarterly turnover of 2.93 billion US dollars NXP was above the middle of its own forecast. Although this represents a year-on-year decline of 6%, all target markets performed better than expected.

The non-GAAP profit margin was 32,0 %the diluted earnings per share were 2.72 US dollars - a solid result in a challenging market environment.

📈 Cash flow & capital repayment

The operating cash flow amounted to 779 million US dollarsof which 696 million US dollars remained as free cash flow. Of this 66 % was returned to the shareholders - through share buy-backs of USD 204 million and dividend payments of USD 257 million.

🚗 Technological highlights

- May 8, 2025Presentation of the third generation of imaging radar processors for autonomous driving (Level 2+ to 4). The new S32R47 processors offer twice the computing power of the previous generation.

- June 12, 2025Cooperation with Rimac Technology to develop a software-defined vehicle architecture (SDV) based on the S32E2 processors.

- June 17, 2025: Completion of the acquisition of TTTech Autoa specialist for safety-critical middleware in SDVs.

🧠 CEO Kurt Sievers commented:

"Our guidance for the third quarter reflects both an incipient cyclical recovery and the strength of our company-specific growth drivers."

My Youtube channel for stock analysis: www.youtube.com/@Verstehdieaktie

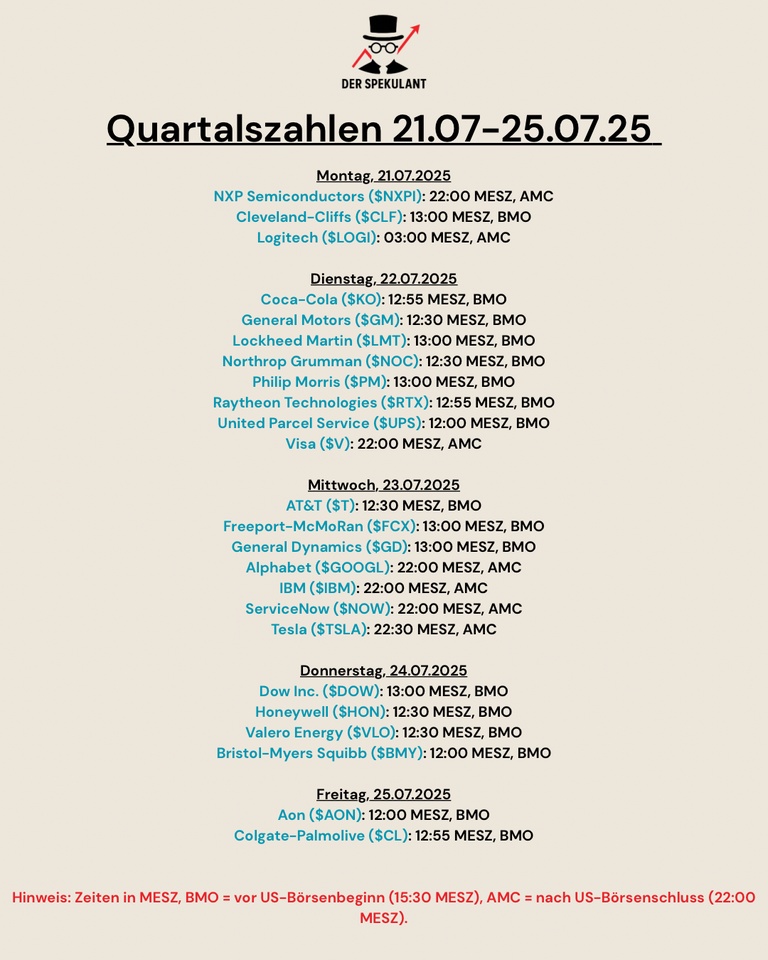

Quarterly figures 21.07-25.07.25

Here is a clear overview of the quarterly figures due next week.

$NXPI (-0.58%)

$CLF (-5.11%)

$LOGN (-0.64%)

$KO (+0.69%)

$GM (-2.52%)

$LMT (-0.2%)

$NOC (-0.03%)

$PM (+1.1%)

$RYTT34

$UPS (-4.03%)

$V (-1.09%)

$T (-2.92%)

$FCX (-1.97%)

$GD (-0.73%)

$GOOGL (+0.9%)

$IBM (-1.81%)

$NOW (-1.11%)

$TSLA (-1.57%)

$DOW (+6.82%)

$HON (+0.19%)

$VLO (-3.02%)

$BMY (+0.03%)

$AON (-1.01%)

$CL (-0.68%)

NXP Semiconductors reported earnings Q4 FY2024 results ended on December 31, 2024

- Revenue: $3.11B, -9% YoY

- Net income: $495M, -29% YoY

- Non-GAAP EPS: $3.18 vs $3.71 in Q4 2023

- Free cash flow: $292M vs $962M in Q4 2023

CEO Kurt Sievers: "NXP delivered resilient results throughout 2024, reflecting solid execution, consistent gross margin, and healthy free cash flow generation despite a challenging market environment. We rigorously focus on managing what is in our control, to navigate a soft landing while executing our growth strategy."

🌱Revenue & Growth

- Automotive: $1.79B, -6% YoY

- Industrial & IoT: $516M, -22% YoY

- Mobile: $396M, -2% YoY

- Communication Infrastructure: $409M, -10% YoY

- Full-year revenue: $12.61B, -5% YoY

💰Profits & Financials

- GAAP Gross Margin: 53.9% vs 56.6% in Q4 2023

- Non-GAAP Operating Margin: 34.2% vs 35.6% in Q4 2023

- Capital return to shareholders: $713M in Q4

- Cash and cash equivalents: $3.29B

📌Business Highlights

- Introduced S32J family of automotive Ethernet switches for software-defined vehicles

- Announced Audi adoption of Trimension UWB technology for secure car access

- Signed agreements to acquire Aviva Links ($242.5M) and TT Tech Auto ($625M)

🔮Future Outlook

- Q1 2025 revenue guidance: $2.725B-$2.925B, -13% to -6% YoY

- Q1 2025 non-GAAP gross margin: 55.8%-56.8%

- Q1 2025 non-GAAP EPS guidance: $2.39-$2.79

08.01.2025

NXP Semiconductors takes over Austrian software company + US blacklist weighs on sentiment in China + VW management level salary waiver of over 300 million euros

NXP $NXPI (-0.58%)Semiconductors takes over Austrian software company

- The European-American chip manufacturer NXP Semiconductors wants to take over the Austrian software company TTTech Auto.

- The semiconductor group is prepared to pay 625 million dollars for the purchase.

- The acquisition is intended to strengthen the automotive division.

- NXP is already one of the largest chip suppliers to the global automotive industry.

- TTTech Auto offers software for the digital control of cars.

- The start-up has its own development and program platform and is already working together with NXP.

- Together they develop programs for software-defined vehicles (SDV).

Markets in the US and Asia / US blacklist weighs on sentiment in China

- While the political tensions between Washington and Beijing are once again weighing on the Chinese stock markets, the Seoul stock exchange is also up significantly, supported by gains in the share price of heavyweight Samsung Electronics.

- The Tokyo stock exchange reacted to the negative cues from Wall Street with slight losses.

- In Shanghai, the Composite Index lost 1.2 percent after the US contradicted reports that the planned higher tariffs by the new US administration under Donald Trump could be less drastic than previously assumed.

- Technology stocks sold off after disappointing statements by Nvidia CEO Jensen Huang sent Nvidia shares $NVDA (+1.1%) had sent the Nvidia share plummeting.

- Tencent $TCEHY (+2.23%) remained under pressure and lost 2.6 percent.

- They had already fallen by over 7 percent the previous day after the USA blacklisted Tencent and other Chinese companies due to suspected links to the Chinese military.

VW $VOW (-1.79%)Management level salary waiver of over 300 million euros

- Volkswagen's management level is participating in the cost-cutting program by 2030 with a salary waiver of over 300 million euros, with the contribution of the Board of Management being disproportionately high, says Chief Human Resources Officer Gunnar Kilian.

- The restructuring program provides for the reduction of 35,000 jobs in Germany, with 29,000 jobs to be cut in Lower Saxony, without compulsory redundancies.

Wednesday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

- Comcast USD 0.31

- Quarterly figures / company dates USA / Asia

- No time specified: Samsung key data 2024

- Quarterly figures / company dates Europe

- 07:00 Grenke new business and contribution margin 4Q

- 08:00 Shell Q4 turnover

- Economic data

08:00 DE: New orders November seasonally adjusted FORECAST: 0.0% yoy previously: -1.5% yoy | Manufacturing sales November seasonally adjusted FORECAST: n.a. previous: -1.2% yoy

08:00 DE: Retail sales November seasonally adjusted real OUTLOOK: +1.0% yoy previous: -0.5% yoy

08:45 FR: Consumer Confidence December PROGNOSE: 90 previous: 90

11:00 EU: Producer Prices November Eurozone OUTLOOK: +1.0% yoy/-1.8% yoy previous: +0.4% yoy/-3.2% yoy

11:00 EU: Economic Sentiment Index December Economic Sentiment Eurozone Forecast: 95.6 Previous: 95.8 Eurozone Industrial Confidence Forecast: -12.1 Previous: -11.1 Eurozone Consumer Confidence Forecast: -14.5 Previous: -14.5 Previous: -13.8

14:15 US: ADP Labor Market Report December Private Sector Employment FORECAST: +136,000 Previous: +146,000 jobs

14:30 US: Initial jobless claims previous week FORECAST: 215,000 Previous: 211,000

20:00 US: Minutes of the December 17/18 FOMC meeting

21:00 US: Consumer Credit 11/24

From sand to chip: how is a modern semiconductor made?

Reading time: approx. 10min

1) INTRODUCTION

Since 2023 at the latest and the rapid rise of Nvidia $NVDA (+1.1%) semiconductors and "AI chips" in particular have been the talk of the town. Since then, investors have been chasing after almost every company that has something to do with the manufacture of chips, driving share prices to unimagined heights. However, hardly any investors really know how complex the value chain is within the production of modern chips.

In this article, I will give you an overview of the entire manufacturing process and the companies involved. Even if many of you have a vague idea that the production of modern chips is complex, you will certainly be surprised by how complex it really is in reality.

2) BASIC

The starting point for every chip are so-called wafers [1] - i.e. thin wafers, which usually consist of so-called high-purity monocrystalline silicon. In the field of power semiconductors, which primarily comprises chips for applications with higher currents and voltages, silicon carbide (SiC) or galium nitride (GaN) has recently also been used as the base material for the wafers.

In the so-called front end the actual core components of the chips - the so-called dies - are created and applied to the wafers. The dies are rectangular structures that contain the actual functionality of the later chip. The finished dies are then tested for their functionality and electrical properties. Each die that is found to be good is then integrated into the so-called backend where the individual dies are separated on the wafer. This is followed by the so-called packaging. The individual dies from the front end are then electrically contacted and integrated into a protective housing. In the end, this housing with the contacted die is what is usually called a chip chip.

Now that we have a rough overview of the overall process, let's take a closer look at the individual processes involved in producing the dies on the wafer. This is the area in which most highly complex machines are used and which is usually the most sensitive.

3) FROM SAND TO WAFER

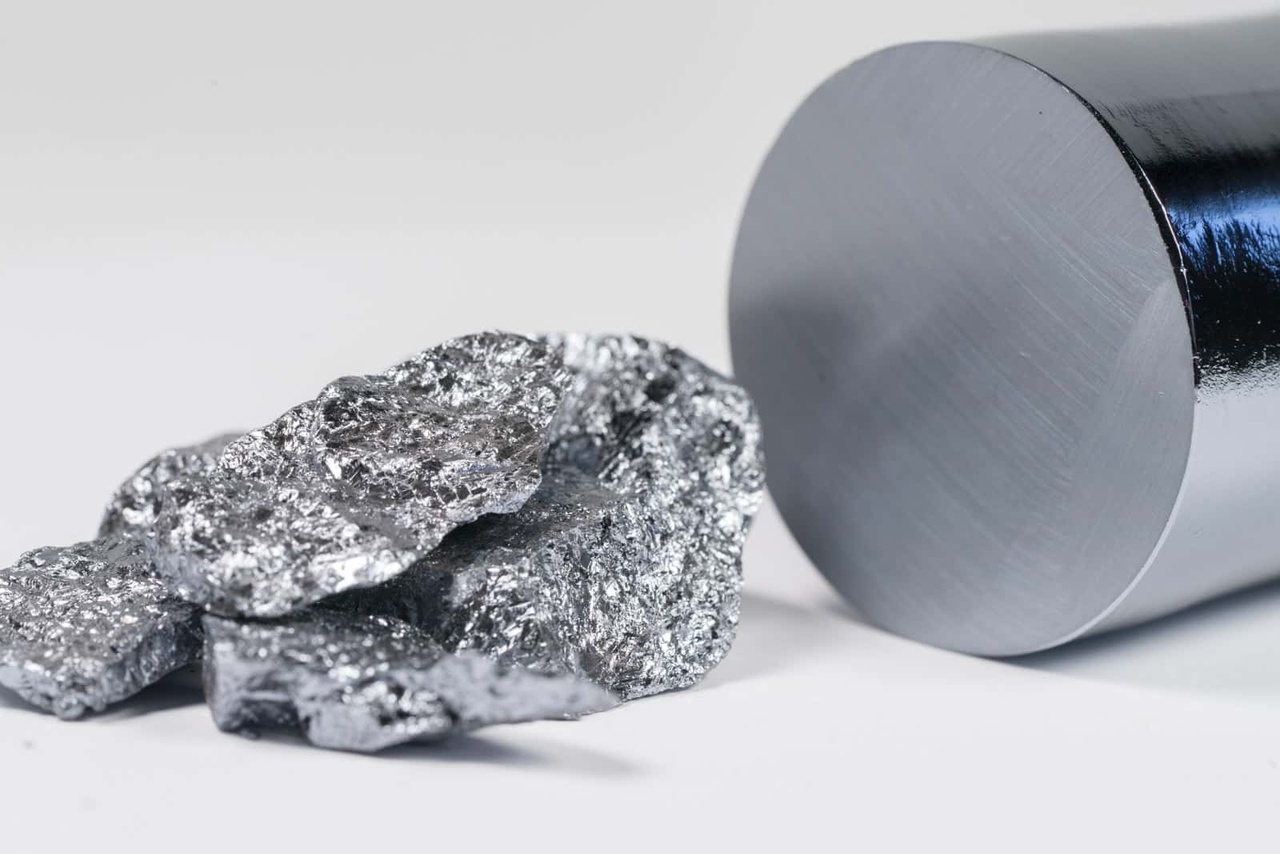

Before wafers made of high-purity silicon can even be produced and the actual process for manufacturing dies can begin, the actual wafer must first be manufactured in almost perfect quality. To do this, quartz sand, which consists largely of silicon dioxide, is reduced with carbon at high temperatures. This produces so-called raw siliconwhich, with a purity of around 96%, is not yet anywhere near the quality required for the production of wafers.

In several chemical processes, which are carried out by Wacker Chemie

$WCH (-1.54%) or Siltronic

$WAF (-1.79%) are used to turn the "impure" silicon into so-called polycrystalline silicon with a purity of 99.9999999%. For every billion silicon atoms, there is then only one foreign atom in the silicon. However, this pure polycrystalline silicon is still not suitable for the production of wafers, as the crystal structure in the silicon is not uniform enough. In order to create the right crystal structure, the polycrystalline silicon is then melted again and a so-called ingotwhich is made from monocrystalline silicon is produced. A comparison between raw silicon and the ingot can be found in the following image [3]:

This ingot is then sawn into thin slices, which are then the final wafers for semiconductor production. The best-known wafer producers are Shin Etsu

$4063, (-1.32%)

Siltronic or GlobalWafers

$6488.

4) FROM THE WAFER TO THE DIE

The wafers described in the previous section can now be used to produce dies. The overall process for producing dies basically consists of applying a large number of layers using various chemical, mechanical and physical processes. The overall process (depending on the product) takes approx. 80 different layers on the wafer, requiring almost 1000 different process steps and 3 months

non-stop production are required [4].

A macroscopic analogy is useful here, which I have also taken from [4]. You can compare the overall process for producing dies with baking a large multi-layer cake. This cake has 80 layers and the recipe for baking consists of 1000 steps. It takes 3 months to make the cake and if even one layer of the cake deviates from the recipe by more than 1%, the whole cake collapses and has to be thrown away.

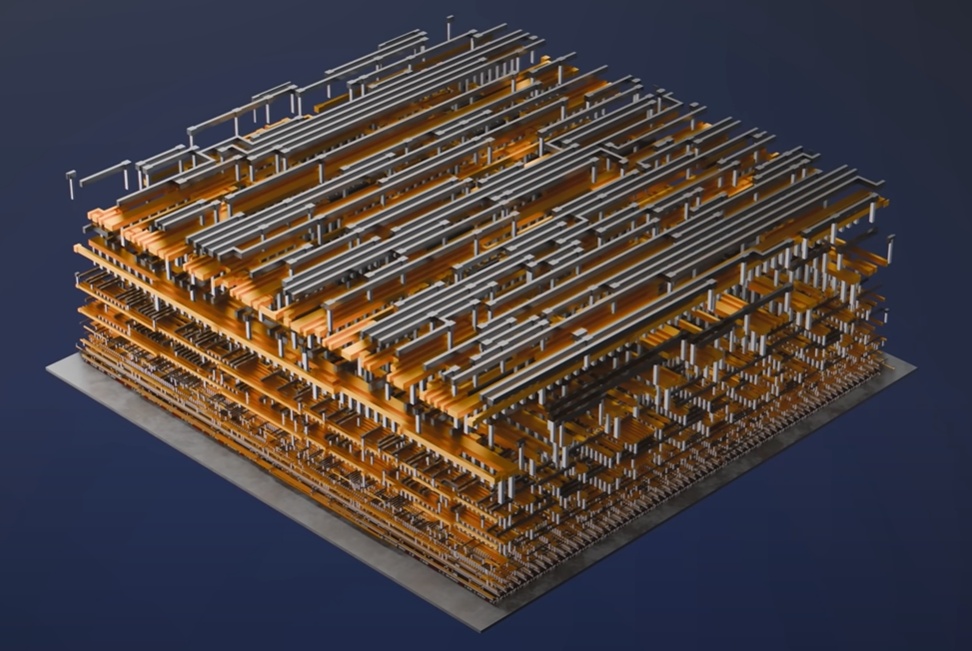

In the first process steps, the wafer is covered with billions tiny little transistors are created on the wafer, which are then all individually electrically contacted in the following steps. The final steps consist of electrically connecting the transistors to each other, resulting in a complete electrical circuit [4]:

Each individual layer of the approximately 80 layers in the die requires highly specialized processes, which can be roughly summarized as:

- Applying masks: Photolithography, photoresist coating (applying photoresist)

- Apply material: Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), Atomic Layer Deposition

- Remove material: Plasma annealing, Wet annealing, Chemical Mechanical Planarization (CMP)

- Modify material: Ion Implanting, Annealing

- Material cleaning

- Inspecting the layers: Optical, Microscopical, Focused Ion Beam, Defect Inspection

Apply masks

Ultimately, a mask can be thought of as an enlarged copy of the structure of a special layer in the die. These so-called photomasks are then scanned using so-called scanners or steppers "copied" in reduced size onto the wafer. The best-known manufacturer of such lithography systems is ASML

$ASML (+2.05%). It is currently the only producer of lithography systems that make it possible to produce structures smaller than 10 nanometers on the wafer. In today's powerful and modern chips, such as those found in smartphones, AI chips and processors, the smallest structures are around 3 nanometers in size. Other manufacturers of lithography systems for larger structures (10nm and larger) are Canon Electronics

$7739 or Nikon $7731 (-2.81%) .

The photomasks - i.e. the enlarged "copies" of the structures - are produced by companies such as Toppan $7911 (-6.01%) , Dai Nippon Printing

$7912 (-1.8%) or Hoya $7741 (-6.36%) manufactured. Systems for cleaning the photomasks or for applying the photoresist are produced, for example, by Suss Microtec

$SMHN (-0.97%) for example.

Apply/remove/modify/clean material

As can be seen in the overview above, there are a variety of methods and processes for modifying the material of a particular layer. As a result, there is a lot of different equipment that can handle a process very well with incredible specialization. The best-known and most successful equipment manufacturers include Applied Materials $AMAT (+0.45%), LAM Research

$LRCX (+2.45%), Tokyo Electron (TEL)

$8035, (-2.12%)

Suss Mictrotec, Entegris

$ENTG (+0.19%) and Axcelis $ACLS (+0.44%).

The material - for example, highly specialized chemicals - is of course also required for production. Companies such as Linde

$LIN (-0.34%), Air Liquide

$AI (-1.67%), Air Products

$APD (+0.66%) and Nippon Sanso

$4091 (-2.67%) are major manufacturers of process gases such as nitrogen, hydrogen and argon.

Inspect

As mentioned, every single layer in the manufacturing process of a die must be perfect in order to obtain a functional die at the end. Any small deviation or foreign particles can impair the functionality of the die. As the function of the die can only be checked precisely on the finished die, it is advantageous to inspect the individual layers for defects and deviations during production. Special machines are required for this, which must be able to do different things depending on the layer. Manufacturers of such machines include KLA

$KLAC (+2.71%) or Onto Innovation

$ONTO (+3.24%).

The following applies to almost all of the companies mentioned in this section: the companies are highly specialized and have quasi-monopolies on the machines for certain process steps. quasi-monopolies. Suitable equipment therefore usually costs several million dollars. In addition, some of the systems are so complex that they can only be serviced by the manufacturer's own service staff, which results in recurring service revenues for every machine sold. As a rule, each machine requires several highly specialized engineers to ensure long-term stable operation.

5) FROM THE DIE TO THE FINISHED CHIP

Once the wafer has been processed, the dies on the wafer are checked for functionality. There is highly specialized equipment for this, so-called probers. These probers test each individual chip several times, if necessary, to check the functionality implemented in the design. Manufacturers of such probers include Teradyne $TER (+4.78%), Keysight Technologies

$KEYS (+1.27%), Onto Innovation or Tokyo Electron. These probers have to control each individual die, some of which are only a few square millimetres in size, and contact the corresponding much smaller test structures with tiny needles. The testing process is sometimes outsourced to entire companies that offer die testing as a complete package. One example of such providers is Amkor Technology

$AMKR (-1.67%).

The processed and tested wafer is now sawn to obtain individual dies. The dies that are found to be good are then integrated into a protective housing in the backend. The dies that have not passed the functionality test are either sorted out or (depending on the error pattern) processed as a variant with reduced functionality similar to those with full functionality. After a final functional test in the package, the chip is ready for use.

6) FOUNDRIES, FABLESS & SOFTWARE

Now that we have an overview of the complex process of manufacturing a chip, let's zoom out a little further to understand which companies perform which tasks in the semiconductor industry.

It's funny that not once in the manufacturing process has the name Nvidia $NVDA (+1.1%) or Apple $AAPL (+0.09%) has been mentioned? Yet they have the most advanced chips, don't they?

The pure production of the chips is done by other companies - so-called foundries. Companies like Nvidia and even AMD $AMD (+2.27%) are in fact fablessThis means that they do not have their own production facilities but only supply the chip design and let the foundries manufacture the actual chip according to their design.

The design of a chip is like the blueprint for production - the foundries then take over the recipe creation and the actual production. There is special software for designing chips. Companies known for this software include Cadance Design

$CDNS (-1.1%) and Synopsys $SNPS (-1.02%). But also the industrial giant Siemens

$SIE (-2.06%) now also supplies software for designing integrated circuits. Synopsys also offers other software for data analysis within foundry production.

Speaking of foundries; the best known foundry is probably TSMC

$TSM, (+0.69%) which is the global market leader in foundries. TSMC designs itself no chips itself and specializes exclusively in the production of the most advanced generations of chips. Another major player that also masters the most advanced structure sizes is Samsung $005930. In contrast to TSMC manufactures Samsung also produces its own designs. Other large foundries are Global Foundries

$GFS, (-1.88%) which was originally a spin-off from AMD and the Taiwanese company United Micro Electronics

$UMC. (-0.3%)

The best-known fabless companies - i.e. companies without their own chip production - are Nvidia, Apple, AMD, ARM Holdings

$ARM, (-0.05%)

Broadcom $AVGO (+3.42%), MediaTek $2454 and Qualcomm $QCOM. (+0.57%) In the meantime Alphabet $GOOGL, (+0.9%)

Microsoft $MSFT, (-0.5%)

Amazon $AMZN (-1.51%) and Meta $META (-1.05%) have designed their own chips for certain functionalities and then have them manufactured in foundries.

In addition to foundries and fabless companies, there are of course also hybrid models, i.e. companies that take on both production and design. The best-known examples of this are, of course, companies such as Intel

$INTC (+1.8%) and Samsung. There is also a whole range of so-called Integrated Device Manufacturer (IDM)which for the most part only manufacture their own designed chips and do not accept customer orders for production. Well-known companies such as Texas Instruments

$TXN, (+0.08%)

SK Hynix

$000660,

STMicroelectronics

$STMPA, (+1.77%)

NXP Semiconductors

$NXPI, (-0.58%)

Infineon $IFX (-0.9%) and Renesas $6723 (-3.97%) are among the IDMs.

FINAL WORD

The aim of this article was to provide an overview of the complexity of the semiconductor industry. I do not, of course no claim to be complete, as there are of course many other companies that are part of this value chain. As Getquin thrives on active exchange, I'll give you some food for thought to discuss in the comments below the article:

- feel free to link any other companies in the comments if you think I've forgotten any relevant ones

- what was the most surprising new information for you from the article?

- which companies from the article have you never heard of?

- before reading the article, did you know approximately how a modern chip is produced and what steps are necessary for this?

In general, I can recommend the 20-minute YouTube video at [4] to any interested reader. It provides an excellent animated overview of the manufacturing process of modern chips.

Stay tuned,

Yours Nico Uhlig (aka RealMichaelScott)

SOURCES:

[1] Wikipedia: https://de.wikipedia.org/wiki/Wafer

[2] https://www.halbleiter.org/waferherstellung/einkristall/

[3] https://solarmuseum.org/wp-content/uploads/2019/05/solarmuseum_org-07917.jpg

[4] Branch Education on YouTube: "How are Microchips Made?" https://youtu.be/dX9CGRZwD-w?si=xeV0TYgJ2iwNOKyO

Trending Securities

Top creators this week