Besides $TEM (-1.1%) I now also welcome $3750 (+1.65%) as a new addition to my portfolio.

At the end of the month there will be further tranches in these two stocks and in $RBRK (+2.7%) will take place. 💪🏼

Posts

83Besides $TEM (-1.1%) I now also welcome $3750 (+1.65%) as a new addition to my portfolio.

At the end of the month there will be further tranches in these two stocks and in $RBRK (+2.7%) will take place. 💪🏼

》CATL subsidiary Era Electric is becoming the next important player after Nio《

At the end of January, Contemporary Amperex Technology $3750 (+1.65%) held its annual partner conference "Choco-Swap" in Xiamen.

The event went off without much media coverage or an extensive press campaign. However, in footage released later via the official video channel, familiar names appeared among the participants: Sinopec, Gresgying Digital Energy and Xiaoju Charging from Didi.

In purely formal terms, some of these companies appear to be competing with CATL's subsidiary Era Electric Service Technology, but on the ground, executives shook hands, smiled and made plans for collaboration in the coming year.

In China's new energy sector, competition and cooperation often overlap, and CATL is expanding its partner network to create a shared energy ecosystem rather than operating in isolation.

CATL has continued to build its electric vehicle traction battery business and the next target is charging infrastructure, although the company seems to recognize that it cannot achieve this alone.

》The plan is taking shape《

At the end of 2024, CATL's subsidiary Era Electric began the mass construction of Choco Swap stations. By the end of 2025, over 1,000 stations in 45 cities were already in operation.

By comparison, China has more than 100,000 filling stations nationwide. CATL has set itself the long-term goal of building 30,000 battery swap stations across the country.

Now that the first 1,000 stations are in operation, the pace is accelerating. Era Electric plans to open a further 2,000 Choco Swap stations in 2026, bringing the total number to over 3,000.

》What does 3,000 stations mean in concrete terms《

Nio $9866 (+1.23%)the car manufacturer most closely associated with battery swapping, currently operates around 3,700 such stations.

Building this network, which underpins the brand's premium positioning with a tank-like user experience, has required almost a decade of continuous investment.

Era Electric aims to reduce this timeframe to around a quarter.

》The infrastructure is complex《

Site selection, approvals and construction require time and capital. Qu Guojun, Head of Energy Development at Era Electric, explained that even the selection of suitable sites was a major challenge. "Over the course of 2025, we examined over 10,000 plots of land and ultimately secured around 1,000 sites," he said.

Charging and swapping infrastructure has become a focus for electric vehicle manufacturers. Tesla $TSLA (-2.04%), Li Auto $LI (+1.2%) and Xpeng $9868 (+6.04%) have each set up their own large-scale fast charging networks.

Nio, for example, has invested massively in exchange stations and, in addition to financial and human capital, such projects require outstanding implementation.

The construction of 1,000 Choco-Swap stations within a year demonstrates a high level of operational efficiency and organizational capability in this context.

Internally, this enabled Era Electric to establish mature operating systems and teams on site. Externally, it signaled commitment and removed doubts among industry partners, car manufacturers and consumers.

At CATL's 2024 Choco Swap Ecosystem Conference, Yang Jun, General Manager of CATL's battery swap business and CEO of Era Electric, outlined a phased plan: CATL would finance the first 1,000 stations and later work with partners to build 10,000 more. In the long term, the aim is to reach 30,000 stations through broader industry participation.

CATL wants to prove two things with Choco-Swap: that battery swapping is feasible on a large scale and that a shared ecosystem can be successful.

According to Deng Xu, Vice President of Era Electric, partnership requests are increasing and more and more vehicle models are compatible with Choco-Swap.

Hang Seng Indexes Company Limited (HSI) announced the results of its latest quarterly review on Friday, adding several well-known companies to major indices.

The battery manufacturer CATL $3750 (+1.65%) was added to the Hang Seng Index. The change will be implemented after market close on Friday, March 6, and will take effect on Monday, March 9.

CATL has been listed in Hong Kong since May 20, 2025 and has seen its share price rise by 75% since then. The market capitalization is HK$2.36 trillion (US$302 billion).

The company is the world's largest supplier of batteries for electric vehicles (EV). According to data from South Korean market research firm SNE Research, installed EV battery capacity will reach 464.7 GWh in 2025 - an increase of 35.7% compared to 342.5 GWh in the same period in 2024.

CATL maintained its global market leadership in 2025 with a market share of 39.2% and remains the only battery manufacturer with a global market share of over 30%.

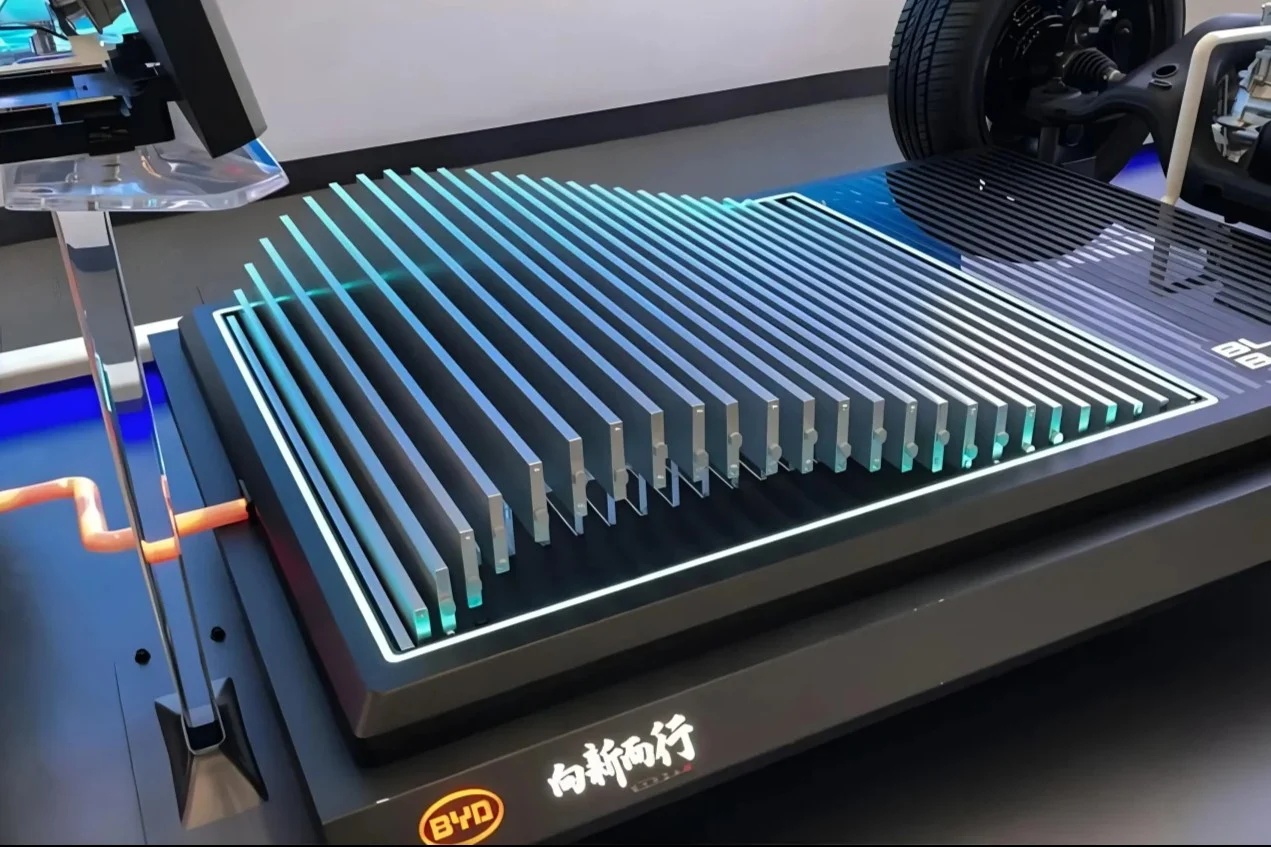

The Chinese car and battery manufacturer BYD $1211 (-0.15%) reports progress with new types of batteries that could make electric cars cheaper in the future.

This involves the third-generation sodium-ion platform on the one hand and sulphide solid-state batteries on the other.

Even though BYD is primarily known as an e-car manufacturer, the Shenzhen-based company is also the second largest battery producer in the world behind CATL $3750 (+1.65%)

According to market researcher SNE Research, BYD achieved an annual production of 194.8 GWh last year - 27.7 percent more than in 2024.

In order to remain at the top, BYD also maintains large research facilities for batteries, which have now reached important milestones.

On the one hand, this involves sodium-ion batteries, which are expected to bring about a clear cost reduction in the e-car sector. After all, the inexpensive sodium is replacing lithium, which has become very expensive.

However, sodium-ion batteries are known to have a lower energy density - and this is the challenge that BYD and other suppliers have to overcome.

The company is now said to be pressing ahead with the development of its third-generation sodium-ion platform. The technology is expected to enable up to 10,000 charging cycles, with the market launch depending on customer demand and deployment plans, as reported by Car News China.

This would be significantly more than with conventional LFP batteries, which manage 2,000 to 3,000 charging cycles. However, there is no further information on the specifications of the sodium-ion battery - and therefore also not on the important energy density.

What is known, however, is that BYD has already started building its first factory for sodium-ion batteries in Xuzhou at the beginning of 2024, which it intends to operate together with Huaihai, a manufacturer of electric two- and three-wheelers.

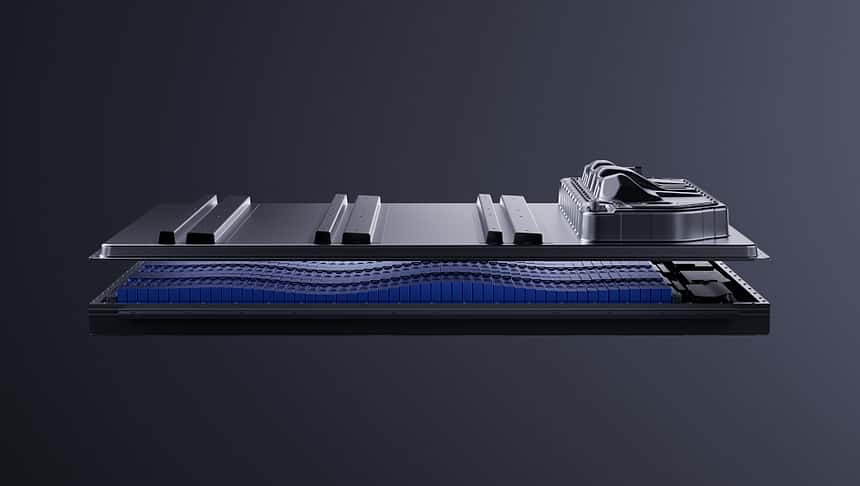

On the other hand, BYD is working on a sulfide solid-state battery and has apparently achieved important improvements here too, even if these are not disclosed in detail.

The sulphide solid-state battery is said to have the potential for ground-breaking advances in battery life and fast-charging capability and thus represents an important technological innovation.

Based on the current state of research and development, BYD expects to be able to produce its sulfide solid-state batteries on a small scale by 2027.

Solid-state batteries replace the liquid electrolyte with a solid one, which can improve safety, energy density and service life.

BYD is focusing on sulphide-based solid-state electrolytes as they promise high ionic conductivity and good processability. As Sun Huajun, CTO of the battery business, reported at an event in early 2025, the company has already produced its first solid-state cells with 20 Ah and 60 Ah on its pilot production line in 2024.

BYD is currently best known for its blade batteries with LFP cell chemistry.

These lithium iron phosphate cells are considered to be more robust and cheaper than cell chemistries based on nickel and cobalt, but generally have a lower energy density.

It must therefore be assumed that BYD will pursue several technology paths in the future - and will continue to serve the mass market with LFP batteries, while sodium and solid-state batteries will initially only be used in selected applications.

Hello my dears...

...have also been on the ball and as has just been announced, the shares of $3750 (+1.65%) has been released for trading again...

THE FOLLOWING INSTRUMENT(S) IS/ARE RESUMED TRADING WITH FOLLOWING TRADING SCHEDULE:

INSTRUMENT NAME ABBREVIATION/SHORTCODE ISIN

CONT.AMPEREX TECH. H HD 1 C7A0 CNE100006WS8

FROM/TO ONWARDS 09.02.2026 15:15 CET

...may still take some time with the individual brokers, but we are free again 🤫😉👍🏻

Hello my dears...

...I told you I would stay on the ball and so here is an update on the suspension of trading in the shares of $3750 (+1.65%) ...

...first of all, a big compliment to my broker (Smartbroker +), because despite the announcement that the waiting time in the loop would be longer due to a high sickness rate, it took just 1:53 minutes until I had someone knowledgeable on the line 👍🏻 ...MEGA customer service is really still alive 🫶

(If anyone wants to switch to an expert neobroker, with personal contact partners and the closest thing to a full broker, or create a new securities account, here is a reference link: https://www.smartbrokerplus.de/de-de/freunde-werben/?pid=User_invite&c=refer_a_friend&cr_id=5db67bf32792da8c4a015c1b6d3f2648b4d11e496aee9fc10fc85a40752cec45 so we both get a bonus of 30€)

But now on to the facts...

...The fact is that the shares can still be traded on the domestic stock exchanges (China/Hong Kong), as well as via Nasdaq or Nasdaq OTC, for example.

However, it is also a fact that the shares will remain suspended from trading in Europe for the time being due to the review of some transactions.

Conversely, this means that the share will neither be delisted nor permanently suspended from trading, but that certain transactions in the share will be reviewed in Europe...

...of course this may take some time, but it will continue despite everything.

At first I thought that it might also have something to do with the rumors about the takeover of the PV section of Huawei HK0000HWEI11 but this is not the case and well, a small drop of bitterness, the share of $3750 (+1.65%) is nevertheless continuing to rise and will remain an important player in the energy sector in the long term.

For those who have not yet noticed, European trading was suspended at $3750 (+1.65%) was suspended yesterday at 16:11.

THE FOLLOWING INSTRUMENT(S) IS/ARE SUSPENDED WITH IMMEDIATE EFFECT:

INSTRUMENT NAME ABBREVIATION/SHORTCODE ISIN UNTIL/UNTIL

CONT.AMPEREX TECH. A HD 1 C7A0 CNE100006WS8 BAW/UFN

No further information is available yet, but stay tuned.

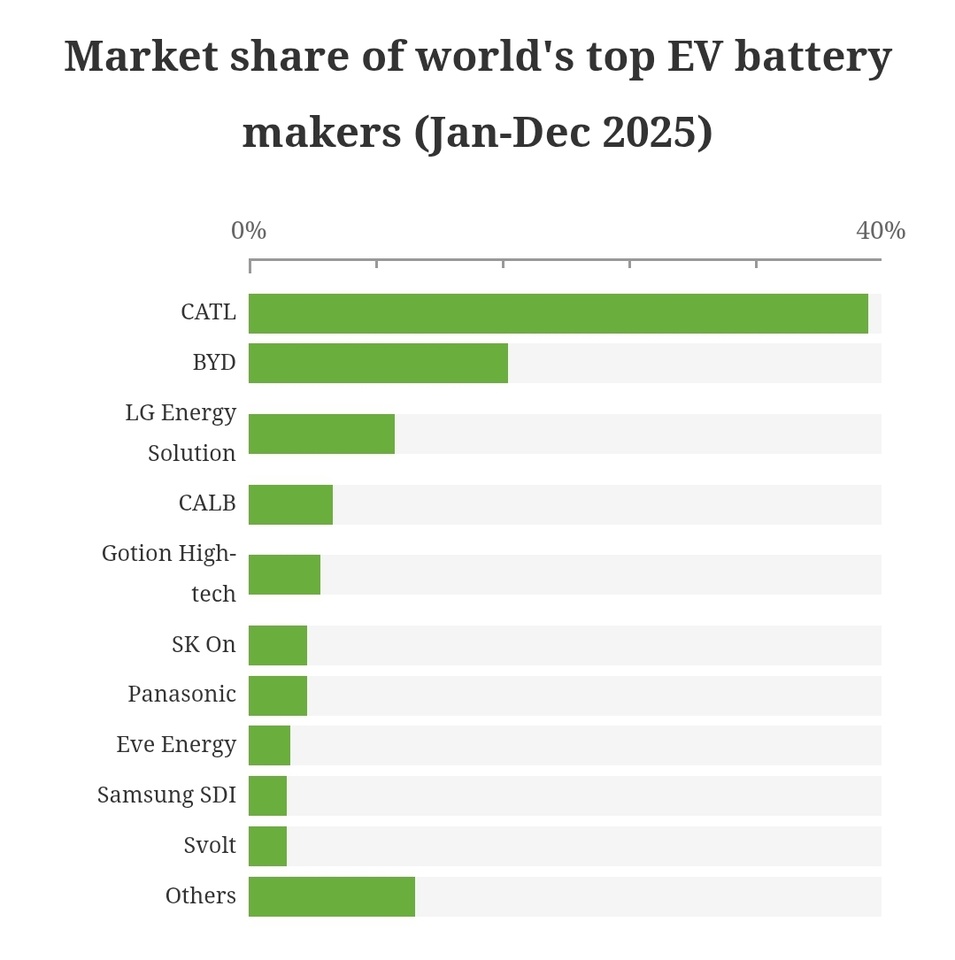

For the full year 2025, CATL and BYD dominated $3750 (+1.65%) and BYD $1211 (-0.15%) continue to dominate the global electric vehicle (EV) battery market with a combined market share of over 55%.

Global EV battery installations reached 1,187 GWh in 2025, up 31.7% from 901.4 GWh in the same period last year, according to data released by South Korean market research firm SNE Research on Wednesday.

CATL's EV battery installations totaled 464.7 GWh in 2025, up 35.7% from 342.5 GWh in the same period in 2024.

The Chinese battery giant maintained its position as the world's leading supplier in 2025 with a market share of 39.2%, remaining the only battery manufacturer worldwide with a market share of over 30%.

This exceeds its share of 38.0% in 2024 and also its share of 38.2% for January to November 2025.

BYD's EV battery installations reached 194.8 GWh in 2025, an increase of 27.7% compared to 152.6 GWh in the same period in 2024.

The company ranked second in 2025 with a share of 16.4%, down from 16.9% in 2024 and also below its share of 16.7% for January to November 2025.

The battery installations of LG Energy Solution $373220 reached 108.8 GWh in 2025, an increase of 11.3% compared to the previous year.

The South Korean company retained its third place in 2025 with a market share of 9.2%, down from 10.9% in the same period in 2024 and also below its share of 9.3% from January to November 2025.

The Chinese company CALB $3931 took fourth place with 62.8 GWh of installed capacity and a market share of 5.3 %.

The Chinese company Gotion High-tech US38349T1060

was in fifth place with a market share of 4.5%, while the South Korean company SK On KR7096770003 took sixth place with a market share of 3.7 %.

The Japanese company Panasonic $6752 (-0.62%)the Chinese company Eve Energy US29970N1046the South Korean company Samsung SDI $0L2T (-1.56%) and the Chinese company Svolt Energy US29268X1037 ranked seventh, eighth, ninth and tenth with market shares of 3.7 %, 2.6 %, 2.4 % and 2.4 % respectively in 2025.

It is worth noting that Svolt Energy took ninth place in the period from January to November with a share of 2.6%, putting it ahead of Samsung SDI.

For those who have not yet noticed, European trading was suspended at $3750 (+1.65%) was suspended yesterday at 16:11.

THE FOLLOWING INSTRUMENT(S) IS/ARE SUSPENDED WITH IMMEDIATE EFFECT:

INSTRUMENT NAME ABBREVIATION/SHORTCODE ISIN UNTIL/UNTIL

CONT.AMPEREX TECH. A HD 1 C7A0 CNE100006WS8 BAW/UFN

No further information is available yet, but stay tuned.

CATL $3750 (+1.65%) claims to have reached 1.8 million kilometers under certain conditions - 6 times the current industry standard.

CATL promises an electric car battery with a record-breaking service life in a new video. The Chinese manufacturer claims that its 5C batteries can last a million kilometers even with constant fast charging.

https://m.youtube.com/watch?v=XOEGg5jxZQk

5C means that the battery can be fully charged in around 12 minutes. This puts it in the "ultra-fast charging" category.

》80 percent capacity after 1,400 charging cycles《

Even under extreme conditions of 60 degrees Celsius - CATL is talking about summer temperatures in Dubai - the battery should still hold 80 percent capacity after 1,400 charging cycles. This corresponds to a total of around 840,000 kilometers.

Under moderate conditions, even 3,000 charging cycles should be possible before the battery falls below 80 percent of its original capacity. This corresponds to 1.8 million kilometers - 6 times the current industry standard, according to Car News China.

》Improvements to the battery《

In the promotional video, CATL justifies the progress with 3 innovations:

Firstly, a dense, uniform coating has been applied to the cathode. This prevents it from being damaged by intensive use.

Secondly, an additive has been added to the electrolyte that can repair microcracks and thus reduce the loss of lithium.

And thirdly, a temperature-sensitive coating on the separator layer between the battery poles slows down the migration of ions when temperatures rise in places.

This helps the battery to self-regulate and reduces the risk of a fatal "thermal runaway", in which the battery burns down explosively.

CATL is not yet sure when the new battery technology will go into mass production or in which vehicles it will be found. It will probably first be found in the high-end sector before it is used more widely.

The CATL $3750 (+1.65%) -subsidiary Contemporary Amperex Intelligence Technology, a provider of integrated intelligent chassis technology, has signed a strategic memorandum of understanding with Indonesia Battery Corporation (IBC) and other partners in Jakarta. The aim of the alliance is to explore local development and cooperation models for electric vehicles in Indonesia based on the integrated intelligent chassis.

Under the agreement, the partnership will focus on Contemporary Amperex Intelligence Technology's Integrated Smart Chassis Platform. This architecture combines core technologies - battery systems, electric drive, thermal management and intelligent chassis domain controls - into a powerful, highly integrated basis for vehicle manufacturing. At the same time, the Indonesian partners will leverage local resources to drive the localized production and operation of the jointly developed models, ensuring that the project moves from idea to reality.

The agreement is an important step in Contemporary Amperex Intelligence Technology's "1+1+1" global localization strategy, which combines technical support, local partnerships and joint operations to build new energy vehicle ecosystems worldwide.

For Indonesia, the collaboration is expected to shorten electric vehicle development cycles and drive coordinated growth in manufacturing and distribution. It also supports the country's broader efforts to build a complete local supply chain for NEVs and promote domestic brands.

As the global automotive industry accelerates its shift towards electrification and intelligence, Contemporary Amperex Intelligence Technology reaffirms its commitment to open collaboration.

The company aims to help its global partners develop smart electric mobility solutions tailored to local markets, driving the green transition and a sustainable future for the industry.

Top creators this week