Brookfield $BN (-3.5%) delivered solid figures this week. As there is not yet such a detailed company presentation here on getquin, I would like to give you a brief overview:

Founded in 1899 as an energy supplier in Brazil, Brookfield Corporation

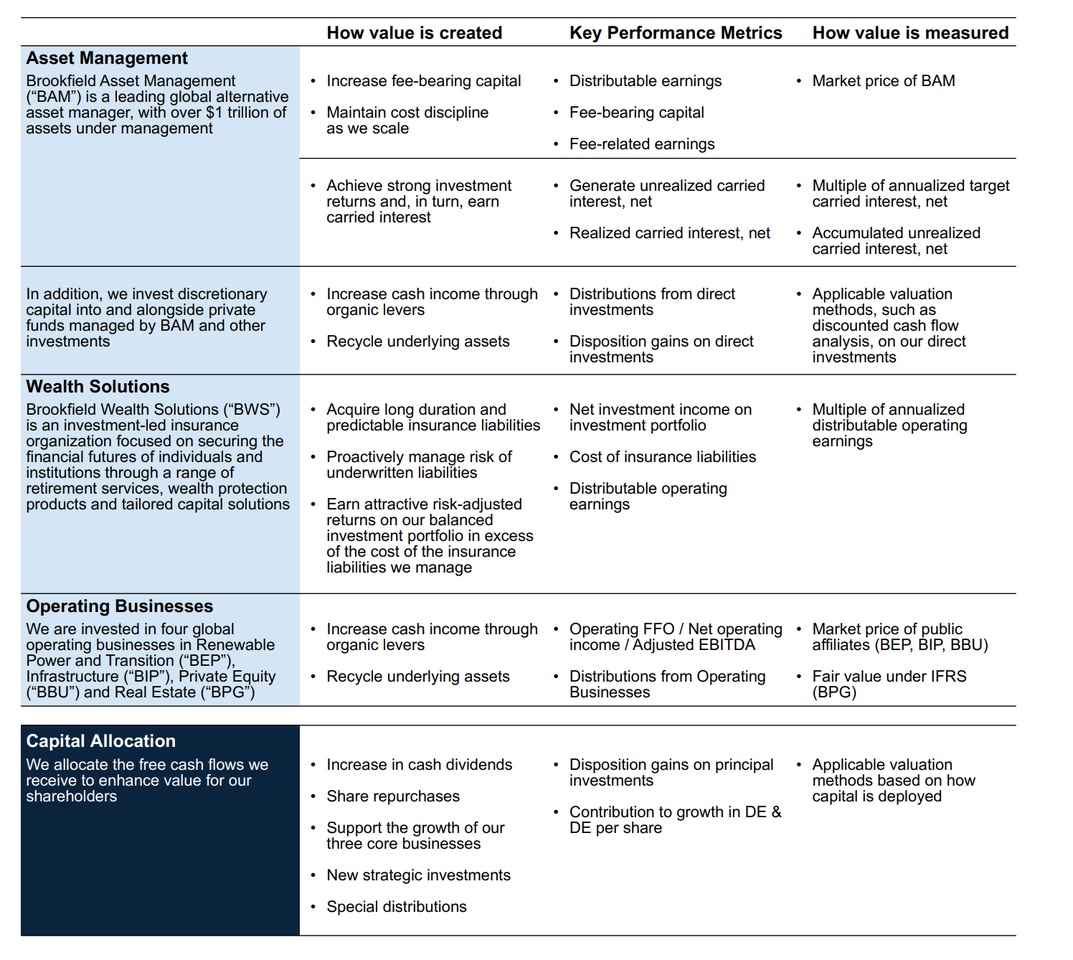

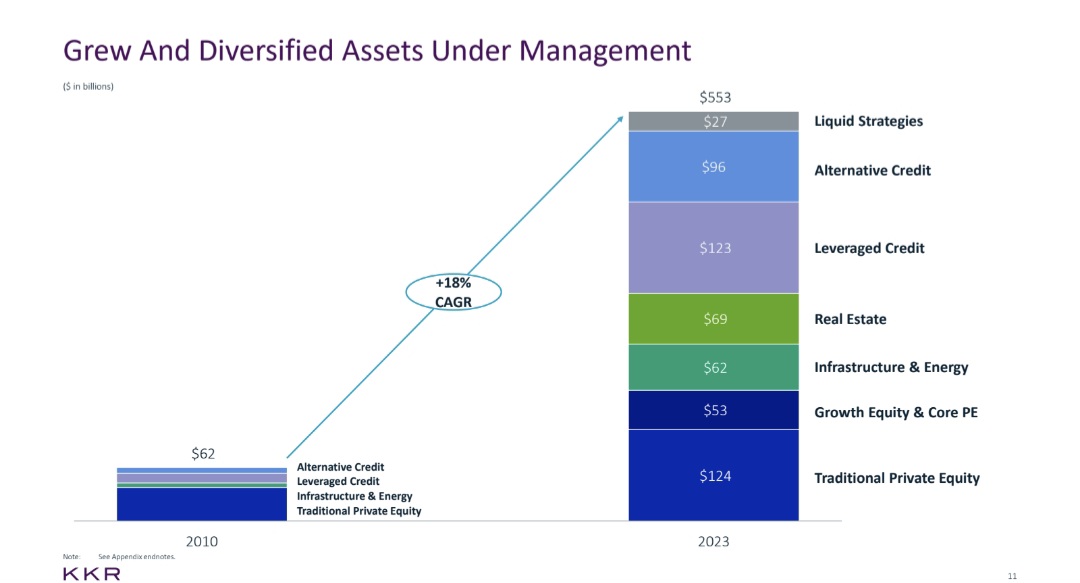

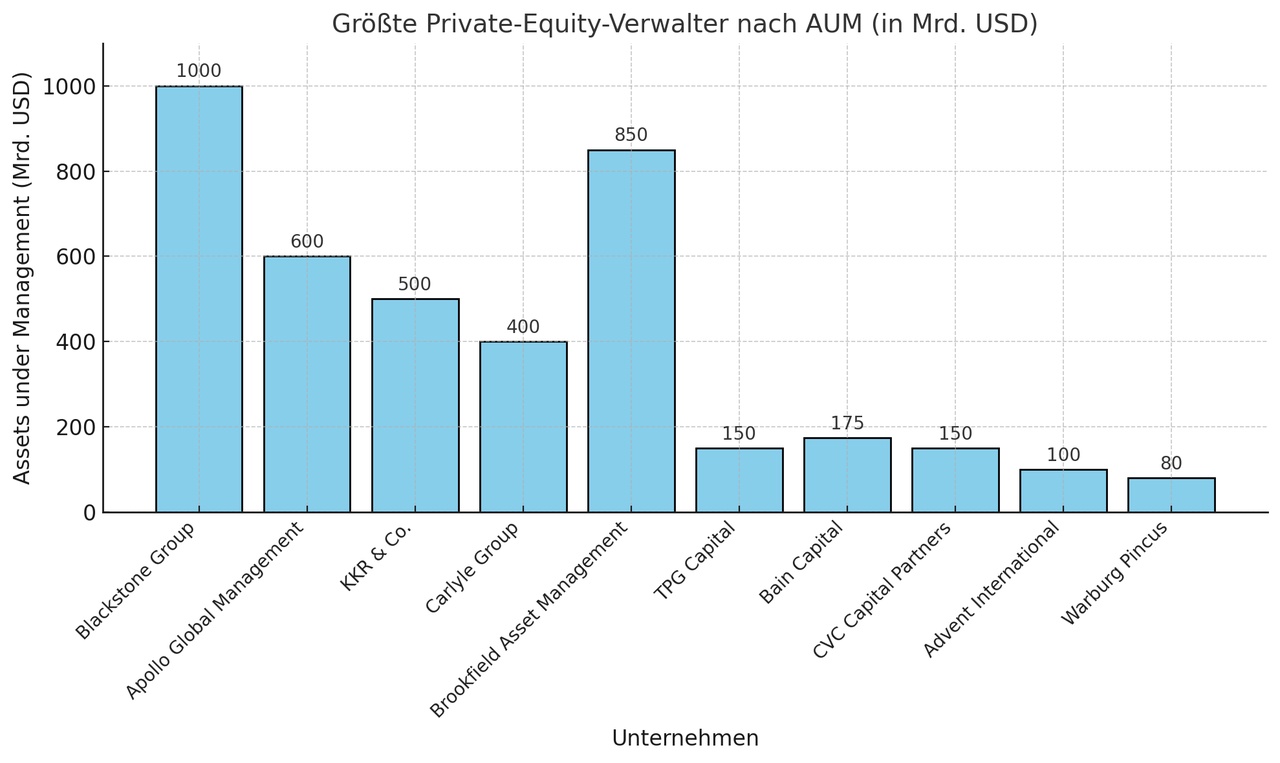

$BN (-3.5%) has developed into one of the world's most powerful alternative asset managers. With assets under management of over 1 trillion USD the company is the "backbone" of the global economy. The ecosystem rests on three pillars:

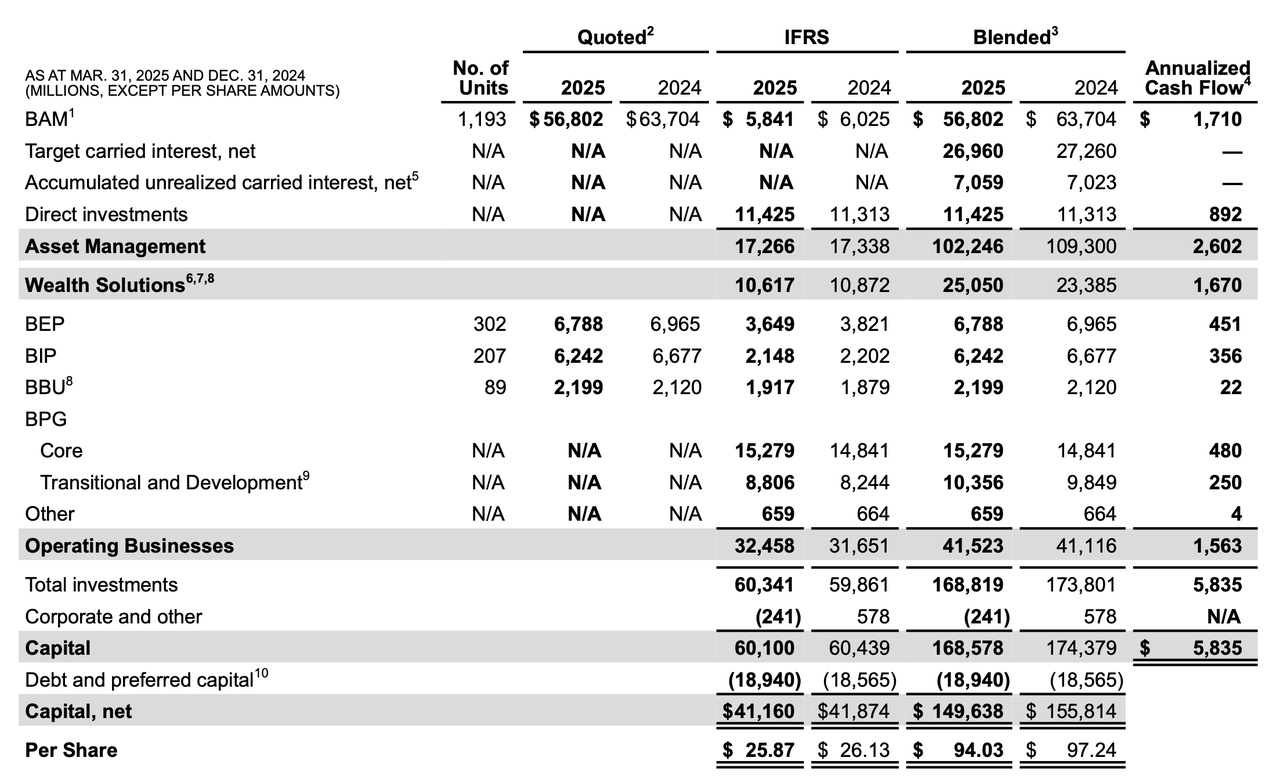

Asset management: Highly profitable fee income.

Wealth Solutions: A massive insurance arm that generates "float" capital.

Operating Businesses: Real tangible assets in renewable energy, infrastructure and real estate.

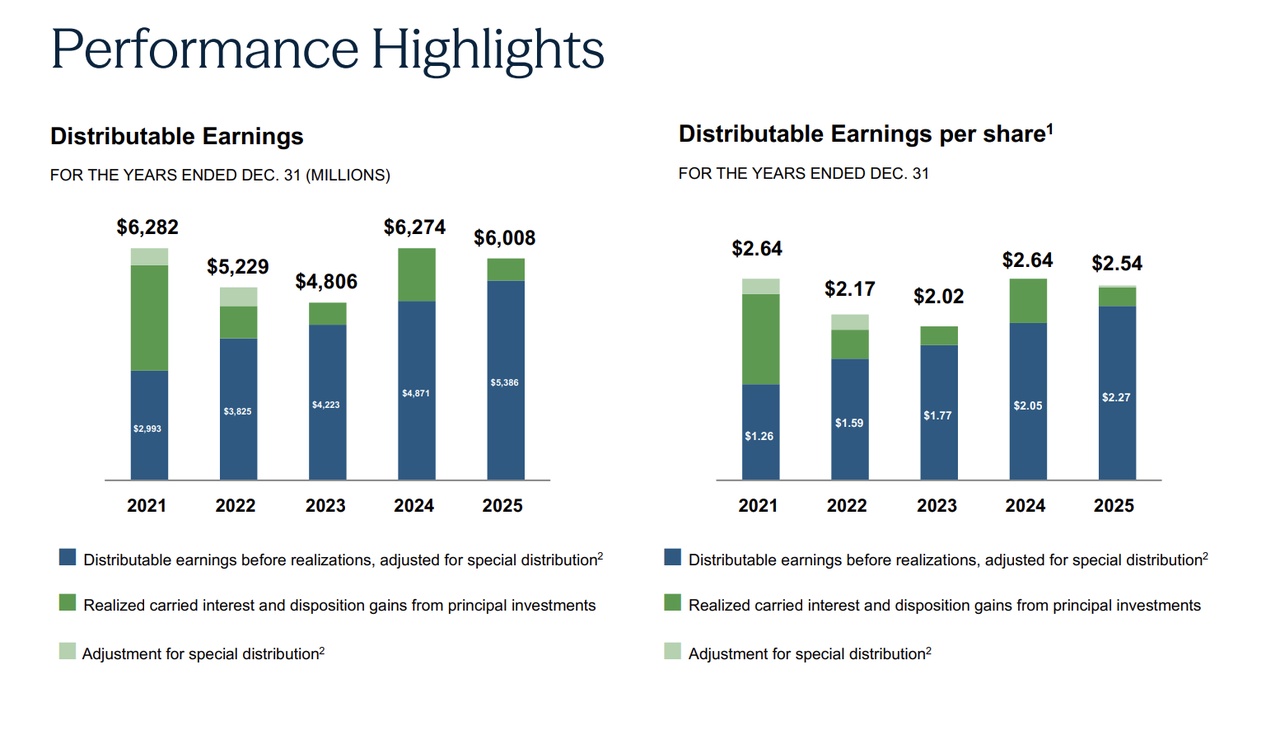

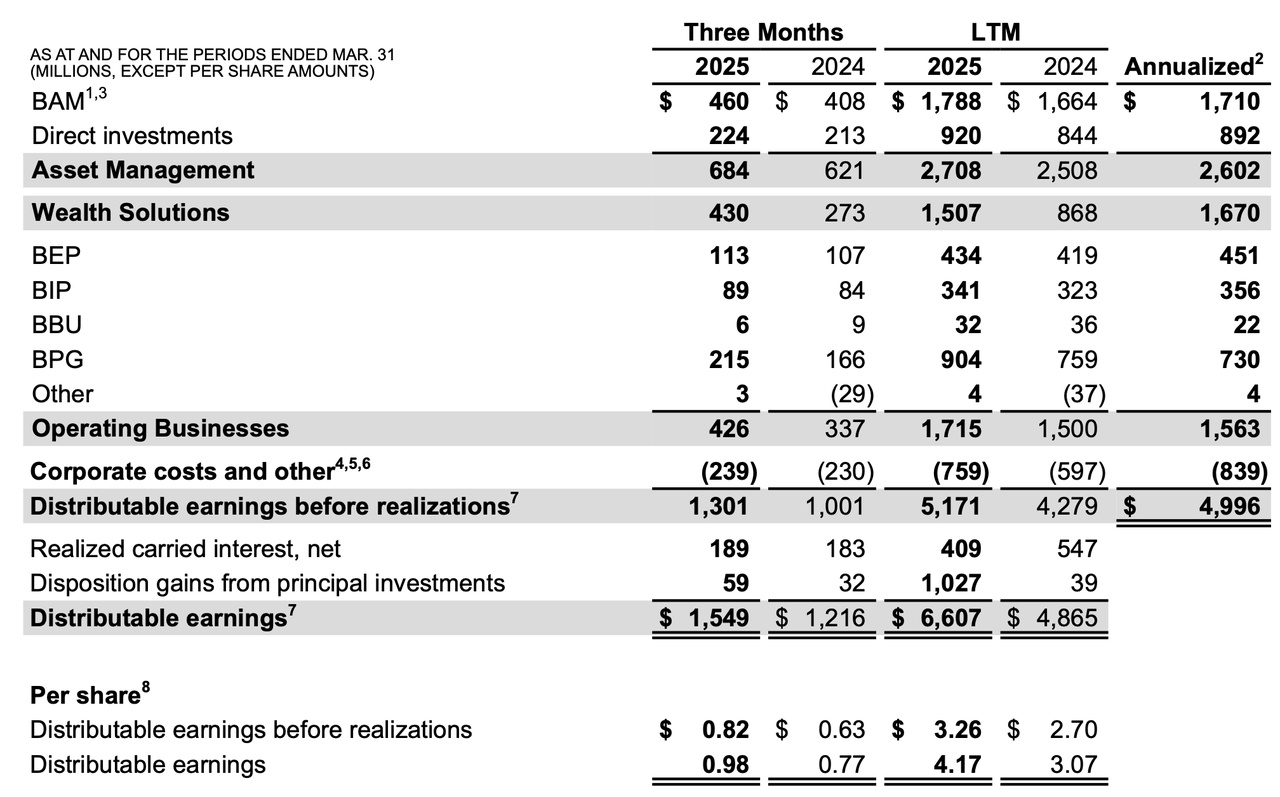

Distributable Earnings (DE) as a financial measure

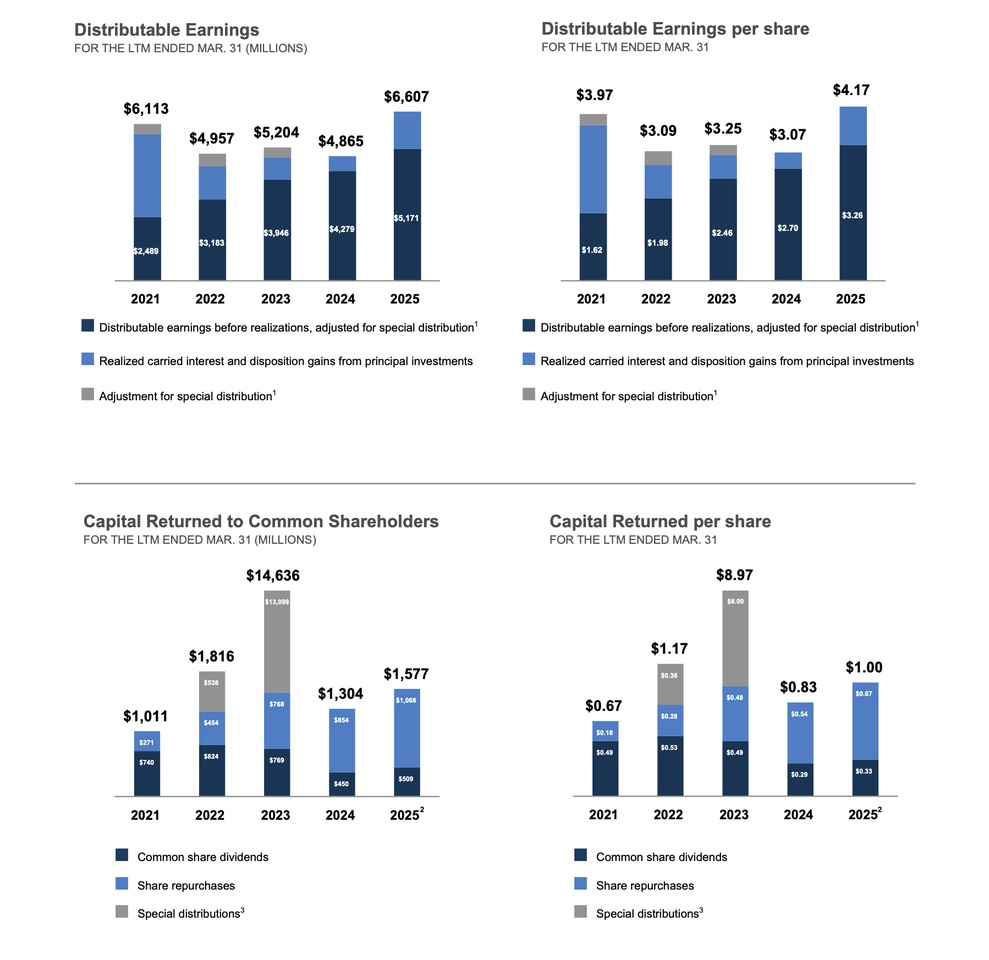

If you look at this clear chart, DE (Distributable Earnings) is mentioned again and again. For most companies, the net profit (net income) is the most important figure. Brookfield is different. Since Brookfield invests heavily in real assets such as real estate and infrastructure, they have to "depreciate" them every year according to accounting rules (GAAP/IFRS). This reduces the net profit on paper enormously, even though the buildings or power plants often increase in value in reality.

DE, on the other hand, shows the real cash flow that actually ends up in the bank account at the end of the day and can be used for three things:

Payment of dividends to us shareholders.

Repurchase of own shares.

Reinvestment in new, lucrative projects.

Brookfield also often distinguishes between "DE before realizations" (the stable cash flow from ongoing operations) and the "realizations" (the profits from the sale of completed projects).

Examples of European AI & infrastructure projects

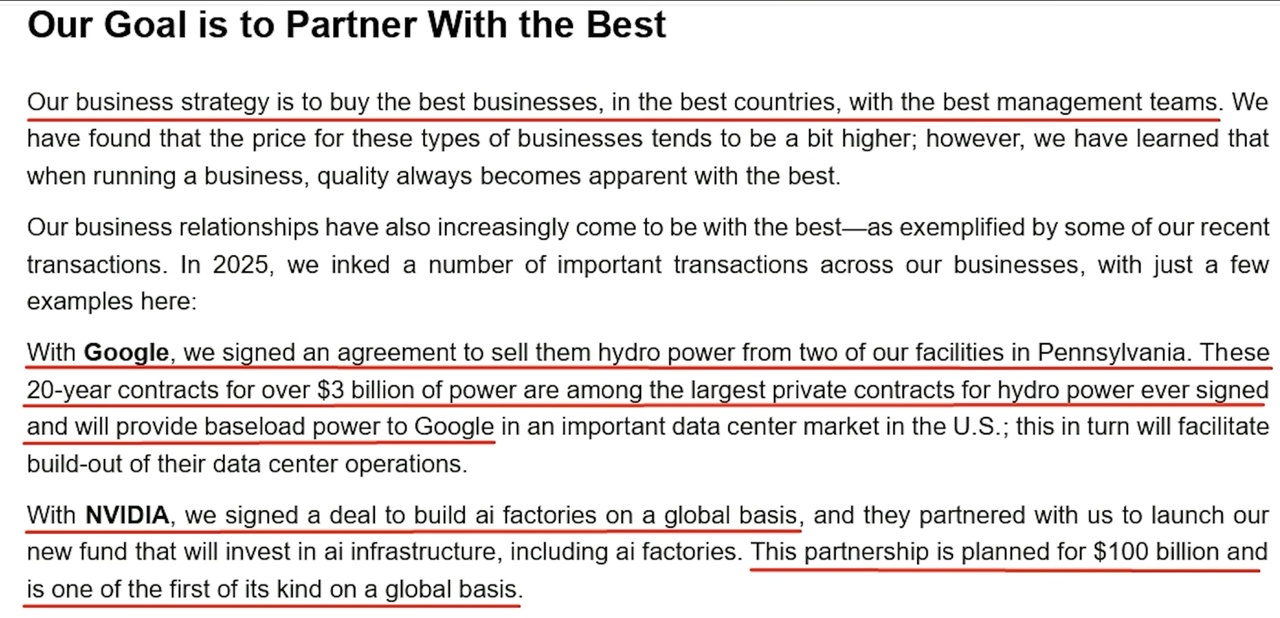

As mentioned at the beginning, Brookfield primarily wants to invest in critical infrastructure. This includes, for example, entire gas pipelines, nuclear power plants and data centers.

While many are talking about NVIDIA chips, Brookfield is building the "factories" for them. I personally find this extremely interesting, especially in Europe BN sets gigantic standards and (almost nobody) talks about it:

- France: A 20 billion euro programwhich includes the country's largest "AI Factory" (1 GW capacity).

- Sweden: An investment of 10 billion USD in a massive AI infrastructure hub in Strängnäs (750 MW capacity).

- Data center power: Via the platform Data4 platform, Brookfield operates more than 30 data centers in France, Spain, Italy and Luxembourg - all of which are currently being upgraded to meet the extreme requirements of AI.

- Partnerships: Deals with Nvidia and Google secure the purchase of gigawatts of green energy in Europe and the USA

Earnings check: Q4 2025 & outlook

The latest report shows a profit machine in ramp-up:

- Record results: Full-year distributable earnings (DE) rose to USD 5.4 billion (before realizations) - an increase of 11 % per share.

- Capital magnet: In 2025 alone, Brookfield raised USD 112 billion in new capital.

- The "carry" wave: For the years 2026-2028, management expects realized gains (carried interest) of USD 6 billion.

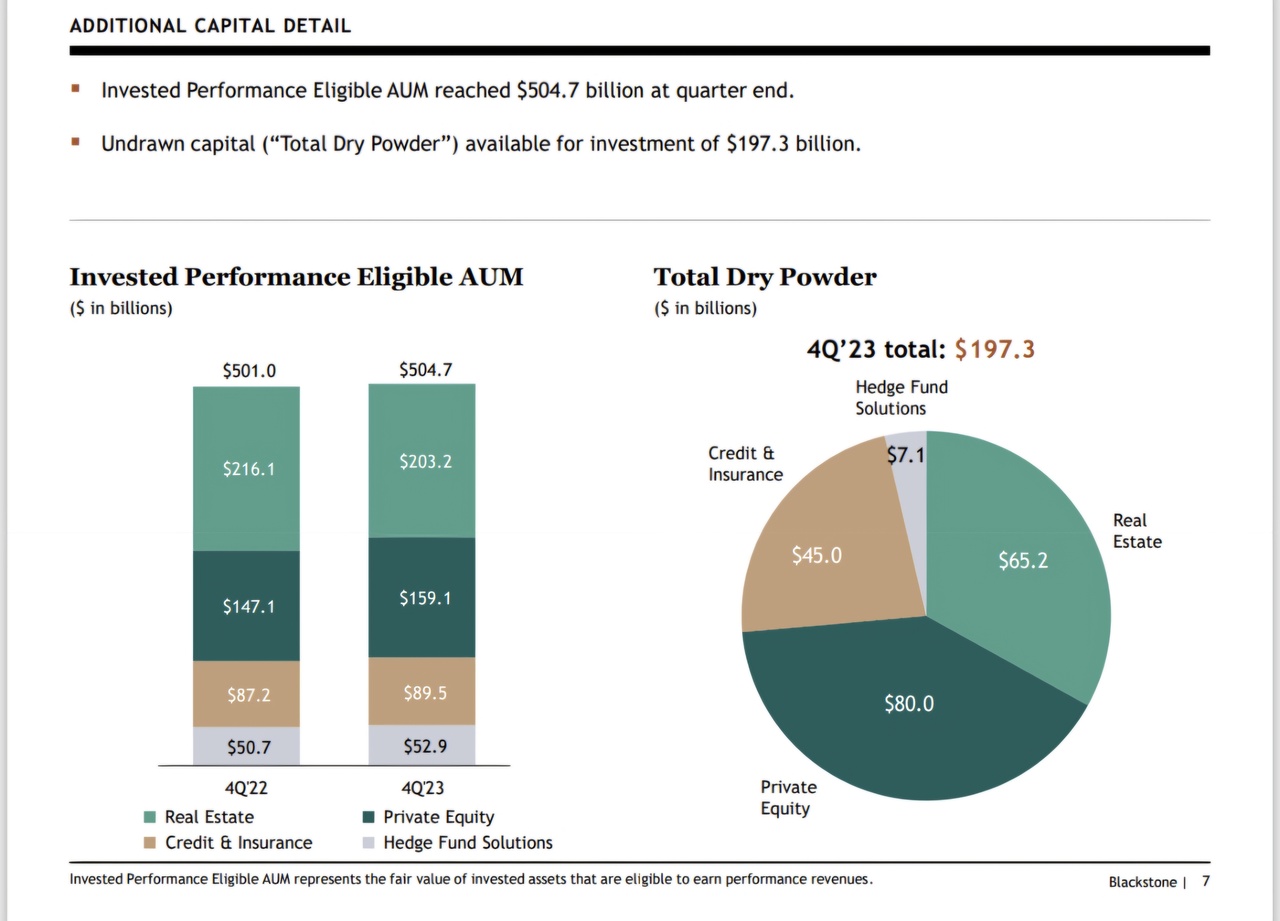

An alternative AI/energy/infrastructure investment

Brookfield is not a "quick trade", but a compound interest machine. With USD 188 billion in gunpowder for investment and positioning itself as a global power provider for the AI boom, BN is the ultimate infrastructure play for me. As an alternative asset manager, Brookfield has strong ties to various governments and always manages to position itself to secure 10, 15 and 20 year contracts with extremely good terms for itself and its shareholders. The management estimates the intrinsic value at 68 USD (currently 48$ -> approx. 40% upside) - at the current price I still see massive potential here. The more I deal with Brookfield and especially the CEO Bruce Flatt, the more I am convinced that this is a buy & hold candidate whose goal is to grow at least 15% per year.

That should be it for now with a small overview, I think I will make posts on specific projects in the near future from $BN (-3.5%)

https://bn.brookfield.com/sites/brookfield-bn-v2/files/BN-IR-Master/Supplemental-Information/2026/2025%20-%20Q4%20BN%20Supplemental_vF.pdf