What are your gut feelings for tomorrow $BICO (-2.48%) ?

- Markets

- Stocks

- BICO Group

- Forum Discussion

Discussion about BICO

Posts

83BICO Group Q2 2025 Earnings

• Divested MatTek & Visikol to Sartorius for $80M, strengthening balance sheet

• Macroeconomic headwinds persist: NIH funding cuts, tariff turbulence delaying CapEx

• Life Science Solutions: mixed results; SCIENION showed healthy growth & profitability

• Lab Automation: high demand but fewer project starts and delays; leadership & process changes underway at Biosero

Q2 2025 (y/y)

• Net sales: SEK 324.2M (−23.4%)

• Organic growth: −17.0%

• Gross margin: 43.9% (↓ from 52.3%)

• Adj. EBITDA: SEK −48.8M (−15.1% margin)

• Net loss: SEK −181.7M (−2.55/share)

H1 2025 (y/y)

• Net sales: SEK 659.0M (−21.8%)

• Organic growth: −19.4%

• Gross margin: 50.4% (↑ from 49.1%)

• Adj. EBITDA: SEK −69.0M (−10.5% margin)

• Net loss: SEK −417.1M (−5.87/share)

• Operating cash flow: SEK +48.4M (vs −68.2M)

Post Q2 Events

• Completed MatTek & Visikol divestment; net proceeds $77.2M

• Repurchased SEK 98M convertible bonds

Cells, numbers, doubts: What will BICO print next? (Deep Dive)

🧬 BICO

$BICO (-2.48%) has been on my watchlist since my early days on getquin.

In 2021, the company was on everyone's lips, celebrated as the company of the future in bioprinting.

But what followed was a classic hype cycle: the share price rose rapidly, was cheered by quite a few "finfluencers" and then plummeted just as sharply.

Many people got their fingers burnt back then. What remains is the image of an overvalued tech fantasy, fueled by empty promises and loud voices without substance.

And yet: The company has remained. So has the vision, and in recent months a lot seems to have changed structurally.

Today, more than 80 % below its all-time high, the question arises anew:

Is BICO simply an overrated stock market experiment...

... or is the current valuation realistic for the first time and BICO on the way to translating its technological substance into a genuine business model?

Over the past few weeks, I have been taking a closer look at the company's structure, history and current developments, including the latest figures [1] and the earnings call [2] from 29.04.25.

In this article, I share my collected insights, thoughts and assessments for those who also have the company on their watchlist.

As always:

No investment advice. I don't want to contribute to more burnt fingers, but to encourage reflection.

Have fun!

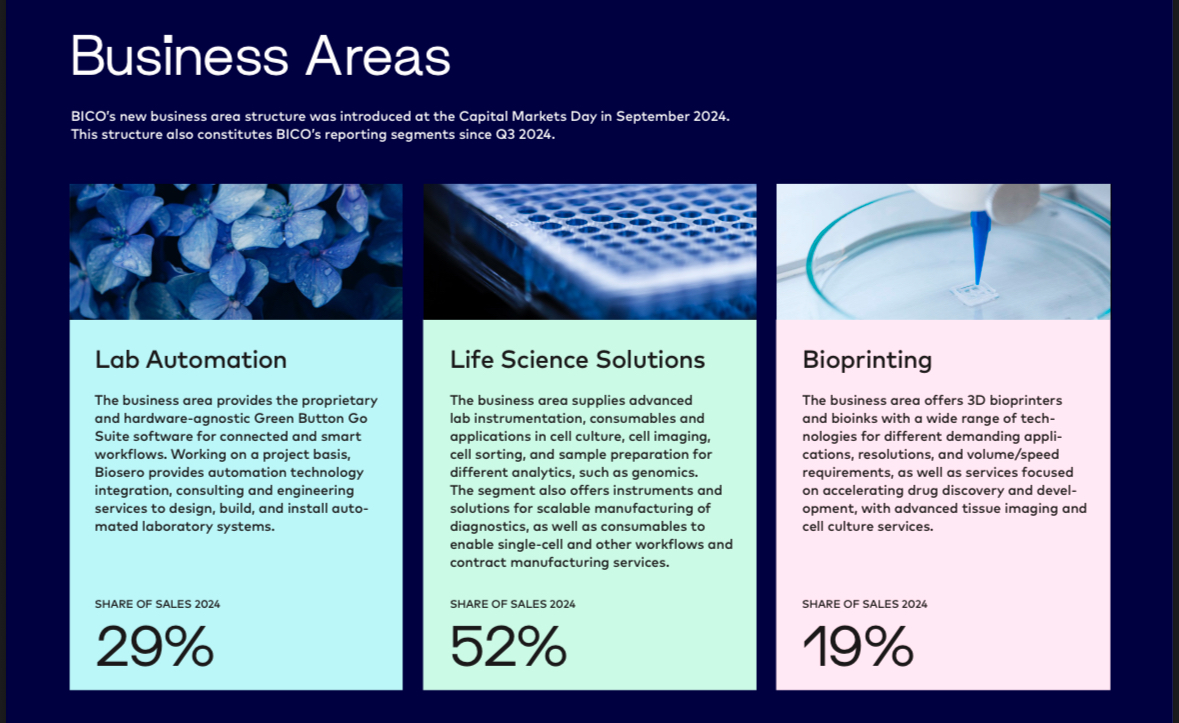

BICO Group AB (formerly CELLINK) is a Swedish life science company founded in 2016.

The original innovation: a biocompatible ink for 3D printing of living cells, a small revolution in research.

Today, BICO stands for a big goal: Bioconvergence.

This means merging biology, technology, software and automation to make research, diagnostics and drug development faster, cheaper and more efficient.

What is the vision and how does BICO make money?

The vision: The laboratory of the future. Automated, networked, efficient with AI, robotics and bioprinting.

This is how BICO earns money today:

- Bioprinting3D printing of living cells & tissue (CELLINK) read more...

- Diagnostic solutions & microdosing (SCIENION)

- Lab AutomationFully automated workflows through software such as Green Button Go® (Biosero)

- Consumables & services for laboratories and research facilities

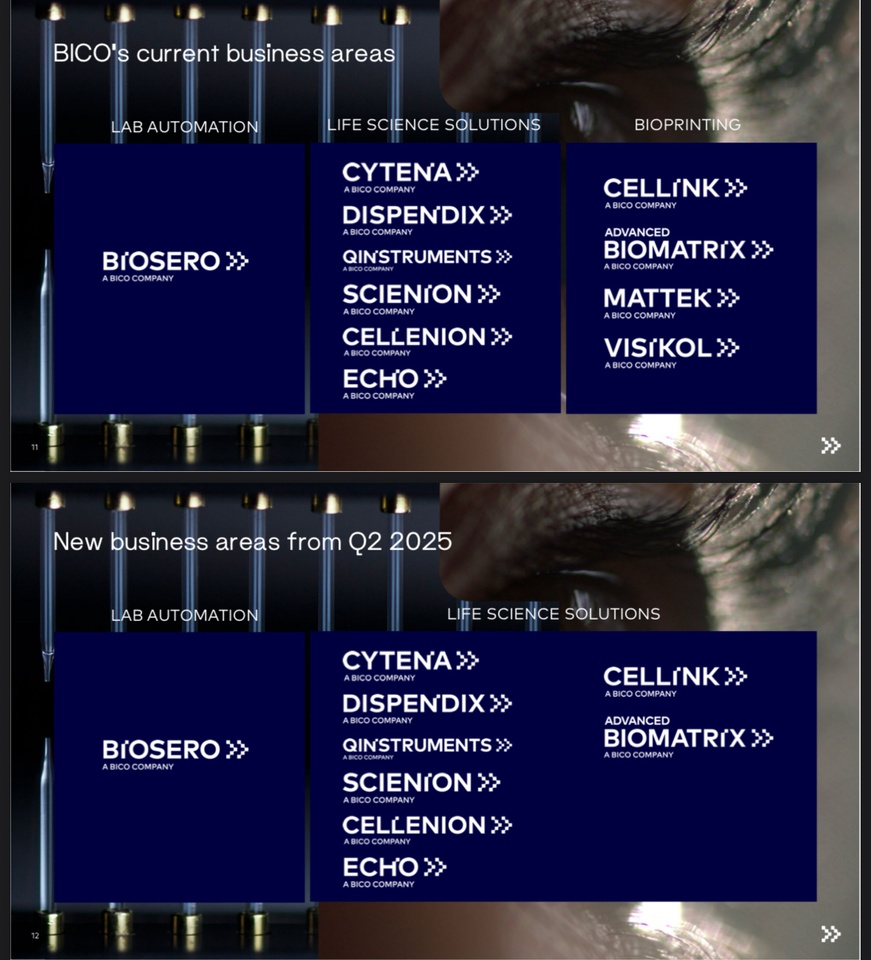

Share of Sales 2024:

Excursus

Bioprinting:

BICO was with CELLINK was one of the first suppliers worldwide to offer bioprinters plus matching "bioinks" commercially.

The basic idea:

- A 3D printer (e.g. the CELLINK BIO X6) prints cells in layers, similar to how a normal 3D printer layers plastic.

- Instead of plastic, a special "ink" is used: Bioink.

Bioink and what it is made of:

Bioink is a gel-like substance that is mixed with living cells. It contains, for example:

- Alginate (from algae)

- gelatine

- collagen

- hyaluronic acid

- Cell nutrient solutions

This matrix keeps the cells alive and makes it possible to print biologically active structures, e.g. tissue samples, tumor models or skin structures.

Is this already being done today or is it all future?

Yes, it is being done, but not clinically.

Bioprinting is currently being used, for example:

- Cell models for drug testing (in research & at pharmaceutical companies)

- printing tumor tissue to better test therapies

- Tissue samples used for toxicology tests (e.g. skin, cartilage, blood vessels)

What is not yet possible:

- Complete organs (hearts, livers, kidneys) for transplants

Because...

- Organs are extremely complex (blood vessels, nerves, functions)

- Currently lack the ability to keep them alive in the long term

- This is also a huge step in regulatory terms

🔮 Future potential: unrealistic or groundbreaking

If bioprinting really breaks through in medicine, we will be talking about one of the biggest breakthroughs of the 21st century:

- organs on demand (no donor needed)

- personalized medicine

- Animal-free drug development

RealisticFirst functional organs could be available in 10 -20 years clinically relevant, but first in small pilot studies or animal models.

Are there any research results or publications on this?

Yes, BICO (especially CELLINK) is a regular co-author or technology partner in publications.

Especially in areas such as:

- Tumor models

- tissue modeling

- biocompatibility

- Skin and cartilage models

Several universities and research institutions use the BIO X printers, including for example MIT and Harvard

Trusted partners:

- Sartorius$SRT (-3.35%) (has taken over MatTek/Visikol, remains cooperation partner)

- AstraZeneca $AZN (-2.23%)

- Pfizer $PFE (+1.05%) (individual case studies)

- Top 20 pharmaceutical companies with Biosero projects (Lab Automation)

- Research centers worldwide

- Cooperation with Sartorius in the APAC region (e.g. Japan, South Korea)

Digression Conclusion

Bioprinting sounds like science fiction and yes, it is a long way from everyday transplantation. But in research and diagnostics it is real, applicable and in demand.

- BICO is not selling promises for the future, but tools that are used in leading laboratories today. The big leap is yet to come, but the foundations have been laid.

__________

History in brief From bioink to platform

- 2016: Founded as CELLINK, the first bioink worldwide

- 2020: Renamed BICO (for Bio Convergence)

- 2021-202315+ acquisitions (including SCIENION, Biosero, MatTek)

- 2024-2025: Streamlining of the structure (sales to Sartorius), withdrawal from non-strategic areas

- 2025: Focus on automation, diagnostics and bioprinting with a clear industry orientation

New CEO since 2024: Maria Forss

- PredecessorErik Gatenholm (co-founder & CEO for many years)

- Change: Gatenholm stepped down in fall 2023, Maria Forss officially became CEO in January 2024

Maria Forss brings decades of experience from leading life science companies:

At Vitrolife (2018 - 2023), she led global expansion and M&A projects, including the billion-euro deal with Igenomix. Prior to that (2014 - 2018), she was at Elekta (radiotherapy, oncology) where she was responsible for global marketing and product strategies.

She started her career at AstraZenecawhere she gained international experience in sales, regulatory affairs and market launch. There she learned what makes large pharmaceutical companies tick, particularly in terms of approval, market launch and regulatory navigation

She is an expert in:

- Business Development

- transformation & strategy

- international expansion

The retirement of founder Gatenholm points to a clear change in strategy, away from visionary, growth-driven development and towards cost control, profitability and integration.

In the Earnings Call Q1 2025 Forss emphasizes several times:

"We have implemented a new operational structure, are harmonizing global functions and are focusing on efficiency and selected growth areas."

📊 Q1 2025 in figures and what's really behind it (Caution currency: Swedish krona, 1 SEK ~ 0.10 USD)

- TurnoverSEK 389 million (-17 %)

- Organic growth: -19 %

- EBITDASEK -12 million

- Cash flow from operating activitiesSEK +77 million

- Net lossSEK -235 million

- Cash positionSEK 684 million

- Convertible bondSEK 1.1 bn outstanding (maturity: March 2026)

Supplement:

Q1 is seasonally weak as many customers (especially in research) do not make large investments at the beginning of the year. At the same time, Q4 was strong, which pulled sales forward.

Comparison of the three previous segments (Q1 2025)

With a view to organic growth:

👩🔬 Life Science Solutions:

- SalesSEK 191 million

- Organic growth: +4 % 👀

- ApplicationsDiagnostics, cell research, microdosing

🧬 Bioprinting:

- Sales105 million SEK

- Organic growth: +41 % 👀

- Applications: 3D cell printing, bioinks, in-vitro models

🔬Lab Automation:

- SalesSEK 94 million

- Organic growth: - 58 %

- ApplicationsAutomation of complete laboratory processes

What do the individual divisions do?

👩🔬 Life Science Solutions:

This is where BICO develops laboratory technologies for diagnostics and cell research, such as devices for high-precision dosing of tiny quantities of liquids, consumables and special analysis platforms.

Examples:

Cancer diagnostics:

- SCIENION devices help to precisely apply tumor markers to test chips, the basis for modern blood tests for early detection.

Allergy tests:

- Using microdosing technology, mini test fields are loaded with allergens to create personalized skin or blood tests.

Genetic testing & DNA analysis:

- Systems from BICO precisely dose minute amounts of liquid onto gene chips, which then analyze intolerances or genetic risk factors, for example.

Point-of-care diagnostics:

- Production of compact rapid test cartridges (e.g. for influenza, RSV, bacterial infections) for home use or the doctor's surgery.

🧬 Bioprinting (see excursus above)

- BICO sells 3D printers for living cells (e.g. from CELLINK) and bioinks, i.e. cell carrier gels for printing tissue.

- ApplicationResearch, drug testing, animal-free toxicology

🔬 Lab automation

This is about the complete automation of laboratories, e.g. robots that create cell cultures, carry out analyses or coordinate samples. Everything is controlled centrally via the Green Button Go® software from Biosero.

💰 How profitable is BICO currently?

BICO is not yet profitable in the traditional sense, as EBIT (operating result) was clearly negative at SEK -290 million in 2024.

However, the operating cash flow a completely different picture: this was 2024 positive at SEK +259 million, as well as in Q1 2025 at +77 MSEK.

This means that BICO is now earning money in its core business, meaning that liquidity is flowing into the company.

The EBIT is still burdened by high depreciation and amortization on earlier acquisitions, research expenditure and, in some cases, one-off restructuring costs.

Conclusion

up to here:

BICO is not yet "through", but the path to operational profitability is recognizable. The company is heading in the right direction, now it depends on whether it can stabilize its operating base and continue to scale its high-margin business areas.

🤝 Business divisions & restructuring (from Q2 2025)

BICO previously operated in 3 segments:

- Bioprinting (e.g. CELLINK)

- Life Science Solutions (e.g. SCIENION)

- Lab Automation (e.g. Biosero)

New from Q2 2025:

Only two divisions, as Bioprinting will be integrated into "Life Science Solutions". Why?

Because CELLINK & Co. are now closely interlinked with diagnostics and consumables. The new setup is intended to increase efficiency, leverage synergies and simplify reporting.

📊 Classification of the figures and why Lab Automation is not growing, even though it is strategically so important

Bioprinting & Life Science Solutions show positive organic growth, while Lab Automationthe third-largest division, shrank massively (-58%).

Automation in particular is one of the main growth drivers in the bioconvergence strategy.

Explanation according to earnings call:

Q1 2024 (PY) was an upward outlier:

- An exceptionally large order from Biosero was booked at that time (project business).

- This effect distorts the basis for comparison, which exaggerates the decline in 2025.

Fewer project starts and completions in Q1 2025:

- Projects in Lab Automation are not distributed linearly, but are completed in phases

- There were simply fewer completed milestones in Q1 = less sales.

Macro-related reluctance on the part of major customers (pharma):

- Investment decisions were delayed, not canceled.

According to CEO Maria Forss:

"The underlying demand for Lab Automation continues to be strong."

"Project cycles are longer - but demand from pharma remains intact."

Project business is naturally volatile:

- Lab Automation is not recurring, but order-based.

- This leads to strong quarterly fluctuations - even with a stable order backlog.

BICO's strategic response

Standardization of project packages:

- Shorter durations, modular solutions to cushion order fluctuations

Strengthening project management:

- To better control time delays and resource commitment

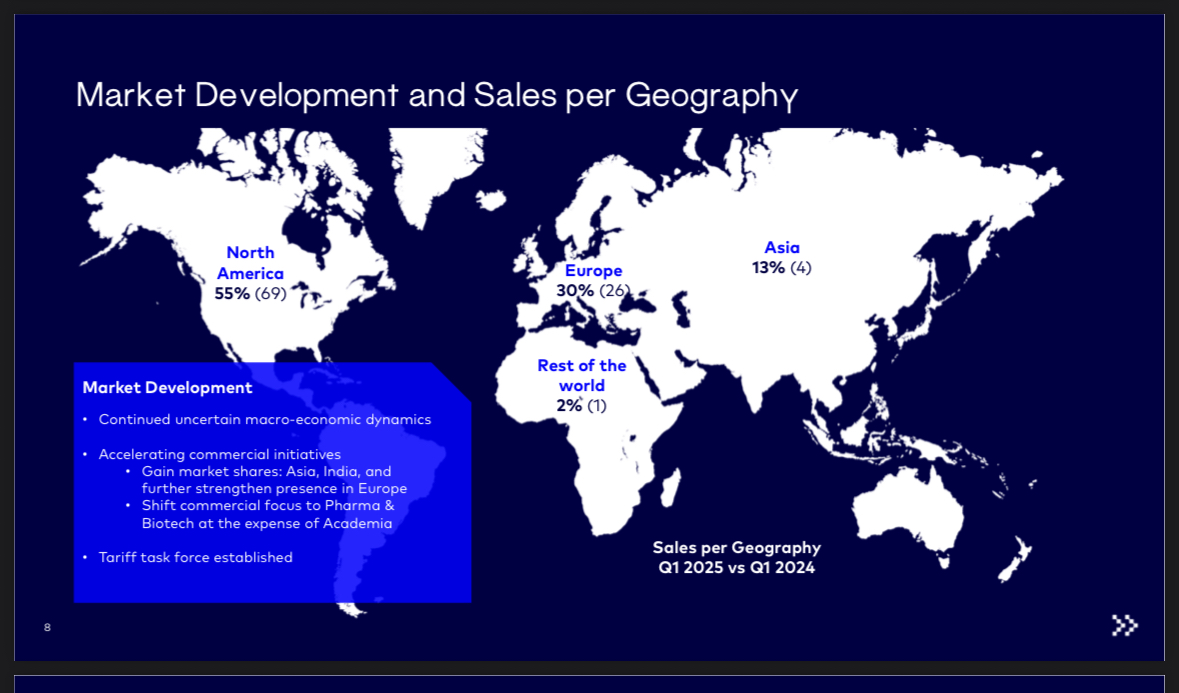

Focus on pharmaceutical customers:

- Cooperation with "Top 20 Pharma Companies" is being expanded, geographically flexible (USA, EU, Asia)

➡️ The decline in sales in Lab Automation looks dramatic, but is primarily due to timing and not a structural problem.

BICO is responding with strategic adjustments to its product portfolio and points to continued strong demand, only with longer lead times.

For investors, this means that the decline is unfavorable but explainable, not alarming

Further statements from the earnings call

CEO Maria Forss:

"Despite a decline in sales, Life Science Solutions and Bioprinting are showing positive development. Our strategy adjustment is taking effect."

- Bioprinting is booming: +41 % organic, CELLINK +130 % (on a low basis)

- SCIENION stabilizes Diagnostics: Miniaturization & home testing drive demand

- USA weakness in research: Reluctance to invest among academic customers due to uncertain NIH funding

- Tariffs & macro volatility: BICO has shifted production out of China, flexed supply chain

- Divestments: MatTek & Visikol sold, enables net cash position in Q2 2025

Why is bioprinting booming right now?

- New regulatory trends: FDA allows animal testing alternatives

- Increasing demand for in-vitro tissue models

- International expansion (e.g. India, Asia)

- Favorable product mix (bioinks, consumables)

Excursus in-vitro tissue models:

"In vitro" means: outside the living body, e.g. in a petri dish, on a chip or in a laboratory device.

Tissue models are replicated biological structures that resemble real human (or animal) tissue.

Example:

A skin tissue printed with cells that is used for cosmetic or drug tests, without animal testing.

What's the point?

- Safety & efficacy tests (e.g. for drugs, chemicals)

- Disease models (e.g. tumor tissue for cancer research)

- Personalized medicine (tissue from own cells)

In vitro tissue models are an ethically and scientifically attractive alternative to animal testing and BICO supplies the printing technology for this, among other things.

Is BICO a unique company in bioprinting?

No, but one of the pioneers with a broad portfolio.

There are competitors such as Allevi, Aspect Biosystems and Organovo, but BICO combines hardware, software and services under one roof - a strategic advantage.

Where does the market currently stand and what does the future look like?

- The market for bioconvergence is still young, provocatively speaking perhaps comparable to the cloud in 2010

- Applications such as automated laboratories, in-vitro models and AI-supported diagnostics are in their infancy

- Long-term demand is enormous for personalized medicine, increased efficiency and ethics (e.g. avoidance of animal testing)

Possible future scenarios

1 . BICO becomes a global playerBICO continues to grow, automates laboratories worldwide

2 . BICO becomes a takeover candidate: Groups such as Sartorius $SRT (-3.35%) , Danaher $DHR (-3.33%) or Thermo Fisher $TMO (-3.61%) could strike

3 . BICO remains niche leader: Focused on profitable segments with high innovation density

Risks & critical voices

- Unprofitable: No sustainable EBIT coverage yet

- Convertible bond (SEK 1.1bn, equivalent to USD 114m): Maturity 2026, repayment depends on cash flow & divestments

- Risk of dilution if convertible bond is serviced via shares

- Strong dependence on projects -> sales fluctuations

- Competitive pressure from large corporations

The topic of the convertible bond has made me sit up and take notice again; here are some more deep dives:

What's the deal with BICO's convertible bonds until 2026?

Convertible bonds are a kind of hybrid between a bond and a share. They work like this:

- Investors lend money to BICO (e.g. SEK 1,000)

- BICO pays interest in return

At the end of the term (March 2026), investors receive either:

- the money back

- or can convert the bond into shares - depending on the agreed price

The whole thing is attractive for companies because they:

- only have to pay interest at first, no return of capital

- and can often offer a lower interest rate because the conversion option is attractive

What this means in concrete terms:

- BICO originally had convertible bonds with a volume of over SEK 1.5 billion

- SEK 394 million have already been repurchased in 2024 & 2025

- Currently open (as of Q1 2025): SEK 1.106 billion (114.5 million USD)

- Maturity date: March 2026

Why is this an issue for investors

1 . Repayment or dilution:

If BICO cannot repay the amount, new shares must be issued, this is called dilution because your stake in the company decreases.

2 . Cash flow burden:

If BICO wants to repay the amount from its own resources, it needs a lot of liquidity, which can slow down other investments.

3 . Refinancing risk:

If the market is weak in 2025/26, refinancing could become expensive or not possible at all.

What is the current situation?

Positive:

- BICO currently has SEK 684m in cash (USD 71m)

- The sale of MatTek & Visikol will put BICO in a net cash position in Q2 2025

- Target: Early extinguishment of convertible bond 2026

Statement on financing / repayment

CFO Jacob Thornberg said:

"The closing of the divestment of MatTek and Visikol for USD 80 million is expected to take place during Q2 2025 [...]

The proceeds from the transaction will be used to resolve the outstanding convertible bond, which matures in March 2026."

Translated:

The entire proceeds from the sale of MatTek & Visikol to Sartorius (USD 80 million) are earmarked for the repayment of the convertible bond.

Management's assessment of the financial position:

"We expect to move into a net cash position during Q2 2025."

This means:

- After the transaction, BICO will have more cash and cash equivalents than debt

- These funds should enable repayment in 2026 without further dilution

Assessment: How credible is this?

Positive:

- BICO shows clear plan: repayment of convertible bond is top priority

- Cash position Q1: SEK 684m

- Sale of MatTek & Visikol: approx. SEK 870m (converted)

-> Repayment can be financed if no new setback occurs

But:

- The operating business is not yet making a stable contribution to financing

- New investments or declining sales could jeopardize the plan

- Market environment remains volatile (interest rates, project delays, etc.)

➡️ Management is actively pursuing the plan to redeem the convertible bond in full before maturity in 2026 without dilution.

The sale of MatTek & Visikol has freed up concrete capital for this.

The direction is right, but BICO remains a risky stock with operational debt.

More on profitability:

In the Q1 2025 Earnings Call BICO's management did not give a specific date for break-even or profitability

... which is typical for growth companies with highly volatile project business.

What was said instead?

On profitability in Q1 itself:

EBITDA was negative (SEK -12m), but:

"Adjusted EBITDA was in line with Q1 2024 due to the positive development in Life Science Solutions and Bioprinting."

-> Improvement due to mix effects and operational measures

- The positive margins from Q4 2024 could not be maintained, mainly due to Lab Automation weakness.

Long-term statements?

No specific annual figure or guidance on profitability. But:

"We have launched a new operating model [...] to achieve improved commercial as well as operational efficiencies."

"We will continue to optimize our cost base and drive efficiency through integration."

Interpretation:

- Management is actively working on profitability

The focus is on the short term:

- Cash flow

- Efficiency gains

- Segment focus

Butunfortunately no clear words like: "We plan to be profitable in 2025 or 2026." 😬

Will BICO be the company that prints organs, or is it more likely to be taken over?

Technologically, BICO is very well positioned today when it comes to bioprinting infrastructure:

- Hardware (BIO X printers)

- Bioinks (cell-compatible inks)

- Software & automation

- Worldwide customer base

ButPrinting fully functional organs for clinical applications is a gigantic leap, not only technologically, but also in regulatory, medical and logistical terms. This is what is needed:

- billions in long-term capital

- Clinical studies over many years

- integration into healthcare systems and transplant networks

These are competencies that are more common in corporations like Johnson & Johnson $JJ, Medtronic $MDT (-2.76%) , GE Healthcare $GEHC (-2.81%)

, Siemens Healthineers $SHL (-0.72%) or Thermo Fisher $TMO not a smaller platform provider like BICO.

Which is more likely?

1 . BICO remains the "toolmaker" of the bioprinting world:

Just like ASML for semiconductors or Illumina for genomics, but without building drugs/organs itself.

2 . BICO will be taken over when the topic becomes clinically concrete:

For example, when the first major organ projects enter the clinical phase, it is likely that a giant will strike to secure access to the technology.

3 . BICO remains an enabler, but not the final provider of clinical bioprinted organs

When organs are actually printed, will BICO become the global market leader?

🏷️ Unlikely.

➡️ More realistic is that BICO becomes one of the key technology suppliers or is taken over by one of the big players beforehand.

This can still be highly attractive for investors. After all, whoever supplies technology will be needed, regardless of who ends up operating on the patient.

Should we now focus on BICO or rather on a large corporation with bioprinting potential? 🤔

1 . Buy BICO for speculative returns

Pros:

- Favorable valuation after the "crash/hype" (more than 80 % below all-time high)

- One of the technology leaders in bioprinting

- Strategic focus, efficiency program, divestments, clear direction

- Enabler position in a highly scalable future market

- Possible takeover candidate = extra share price potential

Contra:

- Not yet profitable, operational risks exist

- Market for organs is still many years away

- Capital structure (convertible bond) is a medium-term uncertainty factor

- If large investors fail to materialize, BICO could be technologically overtaken

2 . Alternatively: back a large corporation for more stability

Which big players have the potential to drive bioprinting forward (or take over BICO)?

Sartorius

- Already has close cooperation with BICO (and acquired MatTek/Visikol)

- Focus on cell biology, diagnostics & laboratory automation

- Strong in APAC region and with biotech customers

-> Best-case candidate for takeover or joint venture

Thermo Fisher Scientific

- Global leader in laboratory equipment, genomics, diagnostics

- Great financial strength, active M&A strategy

- So far, however, more focused on classic diagnostics

-> Comes into play when bioprinting is more closely integrated into pharmaceutical production

Danaher

- Parent company of brands such as Cytiva and Beckman Coulter

- Very active in diagnostics and research technology

- M&A-driven, high margin focus

-> Could strike when the market matures, but rather late and strategically

3D Systems / Stratasys

- Directly active in 3D printing

- Have already acquired bioprinting units (e.g. Allevi)

- Fluctuating in strategy & implementation

-> Riskier than classic medtechs, but a direct bioprinting play

Personal classification: substance or science fiction on credit?

What makes more strategic sense? Which investment is "the right one"?

- High potential return and very high risk tolerance: Then BICO

- Takeover speculation: Then BICO or e.g. Sartorius

- Stable yield and dividend: Then Sartorius, Dabaher or Thermo Fisher

- Bet on "market leader of the future": Then wait and see, today there is no clear bioprinting world leader

OR

Combination strategy:

I invest a small position in BICO as a "moonshot", combine this with a solid underlying position in Sartorius or Thermo Fisher and cover the technology and protect the capital if BICO fails.

The two underlying positions mentioned can of course also represent a global ETF.

My personal assessment of BICO currently fluctuates between cautious optimism and realistic doubt.

On the one hand, I see a clear technological lead and a strategy that, unlike a year or two ago, now appears more well thought-out and focused. Partnerships with established players such as Sartorius also give me the feeling that BICO is not operating alone in a vacuum.

On the other hand, the operational foundation is still shaky. Profitability has not been achieved and the issue of the 2026 convertible bond hangs over the company.

Without sufficient cash flow or fresh capital, the ambitious vision could stumble, and despite all the enthusiasm for bioprinting and automation, we should always be aware of this.

BICO is not a stock for quiet nights, but for visionaries with patience it may be a ticket to the future of medicine.

I am currently waiting for an entry opportunity with a good feeling. The goal could be a portfolio share of up to approx. 3-4%, which then remains in place and is reduced in the future through portfolio growth without selling.

Thanks for reading! 🤝

______________

Sources:

[1] https://storage.mfn.se/5a3030c0-d13b-4177-80d0-94da59c7302d/bico-q1-2025-eng.pdf

[2] https://bico.events.inderes.com/q1-report-2025/register

/ https://web.quartr.com/link/companies/4484/events/247443/transcript?targetTime=0.0

More:

https://www.sartorius.com/en/company/investor-relations

I've been in BICO before and looked into it a bit back then. However, I got in at the wrong time and bought a bit on the dip, as it happens XD. At some point I threw the position out at a loss, BUT I still like it and keep it on my watchlist.

I don't see any "good" reason to get in right now. If you want to gamble, now would of course be a better time than back then. But it is what it is, and if you're looking for excitement and thrills, you've come to the right place. But then don't invest more than you think is appropriate for a rollercoaster for fun....

They don't have a long cash runway, as you describe, and still have a lot to do to reposition themselves after all the acquisitions. They are currently restructuring themselves, that's true, but in my view there's nothing to be said against waiting until there are the first signs that this will lead to something.

You say below that it is not a stock for quiet nights but for "visionary investors with patience". I would question whether the visionary investor "with patience" should not simply stay tuned at this point and patiently inform himself about the company and leave it on the WL until then...

PS: I also have something in my portfolio that has more in it because I enjoy finding out about the company and it's kind of nice to be in it. But it's not an investment case, it's more of a hobby and an emotion, inspired by an interesting idea etc....

19.02.2025

BICO Group AB has bought back convertible bonds + Intel in talks about the sale of Altera + Jefferies raises STMicro to 'Buy' with target up to 34 euros + AI and robotics hopes at Meta remain in focus + Exasol with preliminary consolidated figures for 2024

BICO Group AB $BICO (-2.48%)has repurchased convertible bonds worth SEK 276 million

- On March 19, 2021, BICO Group AB (publ) ("BICO" or the "Company") issued senior unsecured convertible bonds with an aggregate principal amount of SEK 1,500,000,000 (the "Convertible Bonds").

- On February 18, 2025, the Company repurchased Convertible Bonds with an aggregate principal amount of SEK 276,000,000 at a purchase price of 89.4719 percent (excluding accrued but unpaid interest) of the principal amount of the Convertible Bonds.

- The total purchase price for the repurchased convertible bonds thus amounted to SEK 246,942,500 (the "Repurchase").

- After the Repurchase and together with the Convertible Bonds repurchased by BICO on November 22, 2024 (as notified separately), the aggregate principal amount of Convertible Bonds repurchased by BICO amounts to SEK 394,000,000, leaving SEK 1,106,000,000 of Convertible Bonds outstanding.

- The reason for the repurchase was to optimize BICO's capital structure and was made possible by the company's strong liquidity position.

- BICO will continue to monitor the bond market and may repurchase additional convertible bonds in the market from time to time, depending on the company's liquidity needs.

- The repurchase was executed under a safe harbor approach with Carnegie Investment Bank AB (publ) as Dealer Manager.

Intel $INTC (-5.24%)in discussions regarding the sale of Altera

- Silver Lake is in talks to acquire a majority stake in Intel's Altera division.

- The chipmaker hired advisors last year to find private equity investors willing to build a significant stake in Altera.

- Intel acquired Altera in 2015 for around 17 billion US dollars.

- Intel believes that a share sale could increase the value of Altera and create the conditions for a complete exit.

- Altera has attracted interest from rival chipmakers, but Silver Lake, a US private equity firm, has emerged as Intel's preferred option, according to three people familiar with the matter.

(Financial Times)

Jefferies raises STMicro $STMPA (-7.25%)to 'Buy' - target up to 34 euros

- The analyst firm Jefferies has upgraded STMicroelectronics from "Hold" to "Buy" and raised its price target from 23 to 34 euros.

- The night is always darkest before the dawn, said analyst Janardan Menon above his buy recommendation on Wednesday.

- He no longer anticipates consensus corrections at the chip group, but expects growth to pick up from the second half of the year.

- The demand cycle for chips for industry and the automotive sector is picking up and deserves a revaluation

AI and robot hopes at Meta $META (-2.49%)remain in focus

- The prospect of bright business around AI technology has been driving the shares since mid-January - since then they have risen by around 20 percent.

- With AI, Meta has recently provided additional momentum for its important advertising business.

- However, AI is to be used much more widely.

- With a share price of just under 737 US dollars as at Friday's close, Meta now has a market capitalization of almost 1.9 trillion dollars.

- At the end of January, Meta CEO Mark Zuckerberg reaffirmed his ambitions in the artificial intelligence (AI) business when publishing his financial figures.

- He expects an "intelligent and personalized AI assistant to reach more than one billion people this year", he said.

- And this is likely to be the company's own Meta AI software.

- The provider of social networks and communication platforms such as Facebook, Instagram and WhatsApp plans to invest "hundreds of billions of dollars" in the expansion of its AI infrastructure over time, Zuckerberg said at the time.

- For this year alone, the company had announced investments of more than 60 billion dollars, primarily for data centers.

- Meta emphasizes that AI is driving the business forward, including through software that advertisers can use to create ads.

- The important business with advertisements that are personalized for individual users is booming. Revenue and profit increased significantly in 2024.

- The increased personalization of AI services is positive because it creates even stronger customer loyalty on the part of users and advertisers.

- The high inflow of funds in the advertising business also enables Meta to continue to bear losses in the billions in the digital worlds business, which is important to Zuckerberg.

- The Reality Labs division, which is primarily known for VR goggles, posted an operating loss of billions in the last quarter.

- In the long term, however, the high investments in the business should pay off.

- As the news agency Bloomberg reported at the end of last week, citing people familiar with the matter, Meta is creating a business unit in the Reality Labs division that will develop AI-driven humanoid robots that can assist people with physical activities.

- According to the report, Metatree is planning to develop its own humanoid robot hardware - initially with a focus on household tasks.

- The bigger goal, however, is to develop the underlying AI, sensors and software for robots.

- These are then to be manufactured and sold by a number of companies. Meta is already talking to robotics companies such as Unitree Robotics and Figure AI about its plans.

- With a price target of 765 dollars, the analysts at Bank of America see only limited upside potential.

- Expert Brent Thill from the investment firm Jefferies sees a little more room up to his target of 810 dollars.

Exasol $EXL (+3.01%)with preliminary Group figures for 2024

- Positive EBITDA, net income and cash flow for the first time since IPO

- Profit zone sustainably reached: EBITDA rises to EUR 2.0 million and is at the upper end of the forecast (EUR 1.5 to 2.0 million); positive consolidated net income of EUR 0.3 million

- Cash and cash equivalents increase by EUR 1.7 million to EUR 15.0 million and are well above expectations (forecast: EUR 11 to 13 million)

- Annual recurring revenue (ARR) increased by 3.7% to EUR 42.3 million, thus within the forecast range

- Strong growth in strategic focus industries (+19%) confirms focus on on-premise and hybrid solutions

- Forecast for 2025: EBITDA growth of at least 50% to EUR 3 to 4 million and mid-single-digit percentage revenue growth

- Sustained strong growth in the double-digit percentage range in focus sectors

Wednesday: Stock market dates, economic data, quarterly figures

Economic data

08:00 DE: Manufacturing orders on hand and order backlog December

08:00 UK: Consumer prices January

08:00 UK: Producer prices January

10:00 EU: ECB, Eurozone Current Account December

10:00 CH: WTO, General Council Meeting (since 18.02.)

14:30 US: Housing Starts/Permits January

19:00 DE: CDU leader Merz, CDU election campaign event, Vechta

20:00 US: Fed, minutes of the FOMC meeting on January 28/29

26.11.2024

BICO with poor quarterly figures + Trump's tariff threats weigh on stock markets + Tui wants to further reduce debt and invest

BICO Group

$BICO (-2.48%) delivers very poor quarterly figures

- Net sales amounted to SEK 495.5 million (587.6), which corresponds to a decline of -15.7% compared to the same quarter last year.

- Organic sales growth for the quarter amounted to -12.6% (16.7%). From Q1 2024, BICO reports all organic growth figures in constant currency

- The gross margin amounted to 53.1% (52.8%). As of Q1 2024, BICO has switched to functional reporting and the comparative figures have been adjusted

- Adjusted EBITDA amounted to SEK 39.6 million (94.7), which corresponds to a margin of 8.0% (16.1%)

- EBITDA amounted to SEK 37.0 M (89.5), which corresponds to a margin of 7.5% (15.2%).

- Net profit/loss for the quarter from continuing operations amounted to SEK -247.5 M (-40.1), which corresponds to earnings per share from continuing operations before and after dilution of SEK -3.49 (-0.57)

- Cash flow from operating activities amounted to SEK 45.0 million (3.6)

On his first day in office, US President-elect Donald Trump intends to impose high import tariffs on all goods from Mexico and Canada as well as additional tariffs on goods from China. This will be one of his first executive orders on January 20, Trump explained on the Truth Social platform, which he co-founded.

Tariffs of 25 percent are to apply to goods from Mexico and Canada. The US President-elect justified this with immigrants who bring crime and drugs across these two borders into the USA. Until this stops, the tariffs should remain in force. Both Canada and Mexico have the power to solve the problem. "We hereby call on them to use their power, and until they do, it's time for them to pay a very high price," Trump explained. Additional tariffs of ten percent are to apply to goods from China. Trump also justified this with the fact that drugs such as the deadly fentanyl were entering the USA from the country. Although China has announced that it will take action against this, it has not done so. US President Joe Biden, who is still in office, met China's head of state Xi Jinping on the sidelines of the Asia-Pacific Economic Community (Apec) summit in the Peruvian capital Lima just over a week ago. Xi had assured Biden there that he also wanted to work together with the future US administration under Trump.

With the share price of TUI $TUI1 (-1.06%) Sebastian Ebel is not satisfied. However, the Tui CEO will not be boosting the share price with a dividend payment for the time being; his focus in the use of free cash flow is on investments and debt reduction. "Our goal is to reduce our net leverage to well below 1x. When we present our figures for the financial year in December, you will see that we have already taken a big step towards this goal," Ebel told the Börsen-Zeitung. The rating has not yet returned to pre-crisis levels. "These components are the basis for formulating a sustainable dividend policy, which is an entrepreneurial decision that we will make in due course," said Ebel. (Börsen-Zeitung)

Tuesday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

Johnson & Johnson USD 1.24

Quarterly figures / company dates USA / Asia

13:00 Analog Devices quarterly figures

13:30 Abercrombie & Fitch quarterly figures

22:30 HP Inc quarterly figures

No time specified: Dell | Best Buy | Autodesk | Macy's Quarterly figures

Quarterly figures / Company dates Europe

07:00 Siemens Healthineers detailed annual results and annual report

Untimed: Stratec - Analyst conference on the occasion of the German Equity Forum

Economic data

- 11:00 FI: ECB Governing Council member Rehn, hearing in the parliament's economic committee

- 15:00 US: FHFA House Price Index 9/24

- 16:00 US: Consumer Confidence Index November PROGNOSIS: 113.0 previous: 108.7

- 16:00 US: New Home Sales October FORECAST: -2.4% yoy previous: +4.1% yoy

- 20:00 US: Fed, minutes of the FOMC meeting, November 6 and 7

Trending Securities

Top creators this week