After a few months, I closed my position in $HEN (-0.96%) closed. Not because the quality had diminished - on the contrary: strong brands, solid structures, reliable dividends. But I want my capital to work where I currently see more potential and momentum. A new idea convinces me more, offers clearer growth prospects and a more attractive return opportunity. Investing means setting priorities - and sometimes consciously reallocating in order to consistently exploit opportunities.

Henkel AG

Price

Discussion about HEN

Posts

26Cleaning products and more?

Good evening, dear colleagues.

Some time ago I dealt with 4 companies in the field of daily care etc.. $HEN (-0.96%) , $CL (+1.44%) , $PG (-0.28%) and $KMB (-0.34%)

There was a great desire for an analysis of Procter & Gamble, so I was happy to follow this request.

If you are interested, here is the video: https://youtu.be/i9Ms7MuTcNo

and here is the blog article: Dividenden-König im Angebot? - Finanzen Anders

Are you invested in Procter & Gamble? I am not (yet).

LG,

Angelo

https://youtu.be/RGxhve3D03c?si=uu_qb3mWdqAYJNYT

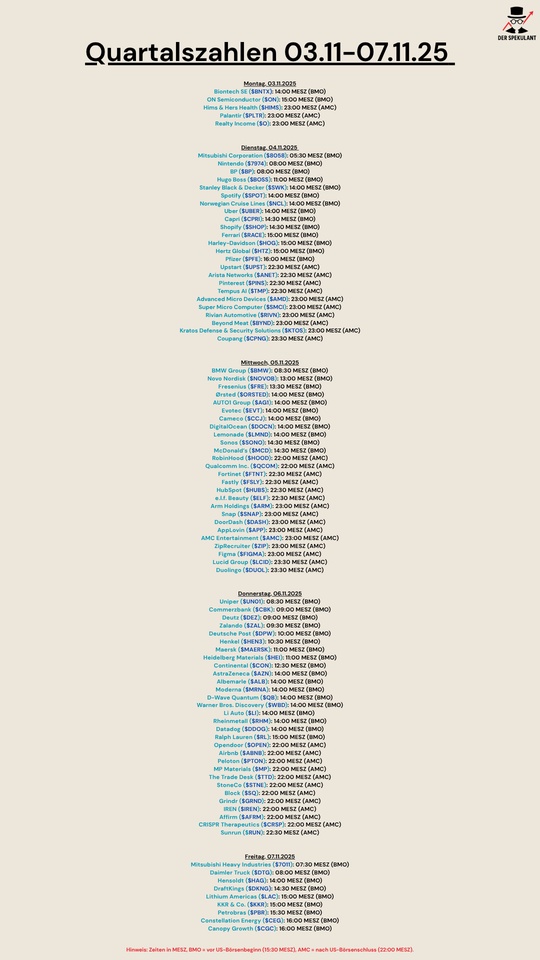

Quartalszahlen 03.11.25-07.11.15

$BNTX

$ON (-6.58%)

$HIMS (-1.1%)

$PLTR (+2.91%)

$O (+0.36%)

$8058 (-1.8%)

$7974 (-0.89%)

$BP.

$BOSS (-0.67%)

$SWK (-2.78%)

$SPOT

$N1CL34

$UBER (-0.62%)

$CPRI (-4.04%)

$SHOP (-3.23%)

$RACE

$HOG (+0.61%)

$HTZ (-3.52%)

$PFIZER

$UPST (-3.13%)

$ANET

$PINS (+1.78%)

$TEM (-1.1%)

$AMD (-3.16%)

$SMCI (-2.7%)

$RIVN (+2.15%)

$BYND

$KTOS (+2.28%)

$CPNG (-1.78%)

$BMW (-2.17%)

$NOVO B

$FRE (+0.25%)

$ORSTED (-2.5%)

$AG1

$EVT (-1.25%)

$CCO (-4.28%)

$DOCN (+0.26%)

$LMND (-0.17%)

$SONO (-6.11%)

$MCD (+0.3%)

$HOOD (-4.81%)

$QCOM (-1.01%)

$FTNT (-1.14%)

$FSLY (-1.93%)

$HUBS (+1.76%)

$ELF (+0.2%)

$ARM

$SNAP (-3.26%)

$DASH (-2.74%)

$APP

$AMC

$ZIP (+10.7%)

$FIG (-4.6%)

$LCID (-0.59%)

$DUOL

$UN0 (-0.29%)

$CBK

$DEZ (-4.01%)

$ZAL

$HEN (-0.96%)

$MAERSK A

$HEI (-3.17%)

$CON (-4.4%)

$AZN (-2.23%)

$ALB (-1.84%)

$MRNA (-2.04%)

$QBTS (-0.78%)

$WBD (-0.21%)

$LI (+1.2%)

$RHM (+1.13%)

$DDOG (+2.85%)

$RL (-4.22%)

$OPEN (-3.38%)

$ABNB

$PTON (-0.62%)

$MP (-5.64%)

$TTD (-2.17%)

$STNE

$SQ (-1.74%)

$GRND (+0.5%)

$IREN (-7.48%)

$AFRM

$CRISP (-0.61%)

$RUN (-3.45%)

$7011

$DTG (-1.94%)

$HAG

$DKNG (-1.05%)

$LAC (-1.26%)

$KKR (-4.41%)

$PETR3 (+4.2%)

$CEG

$WEED (+0.38%)

Shares, ETFs, savings plans & real estate - our freedom roadmap ✨📈

👋 Introduction & background

Hey everyone!

I'm 33, married and dad to two small children (18 months and 2 months old). I've been working in the automotive industry since 2011 and in management consulting since 2019. ⚙️🚗💼

My wife is an engineer and also works in the automotive industry. 👩🔧🚗

I've been with getquin since 2022, but so far I've been reading along rather than actively posting. 👀

My wife is currently on parental leave and receives parental allowance. I will go on parental leave in Q2 2026 (also with parental allowance), then she will start working again. This means that only one of us will receive a full salary until the end of 2026 - but we'll still be sticking to our savings and investment quota. 👶💶

💰 Current status:

A good mid-six-figure amount has already been saved in our custody accounts. 📈

👶 Children & investments

For each child, we invested €10,000 in the Vanguard FTSE All World ($VWRL) (-1.61%) invested. In addition, each child receives €150 per month in the same ETF - via junior custody accounts at ING. 📊

💍 My wife's investments

She invests monthly:

- 🌎 500 € in the MSCI World ($XDWL) (-1.18%)

- 💸 500 € in the Vanguard FTSE All World High Dividend ($VHYL) (-0.37%)

📈 My investment strategy

Long-term, diversified and with a focus on cash flow & wealth accumulation.

🔹Core portfolio (ETF & Bitcoin)

€1,000 flows in every month:

- 💵 €600 in SPDR S&P 500 ($SPY5) (-1.21%)

- 🌍 €200 in Vaneck Morningstar Developed Markets Dividend Leaders ($TDIV) (-0.25%)

- ₿ 200 € in Bitcoin ($BTC) (-0.34%)

🔹 Individual share savings plans (€25/ €600 each)

Target per company: €10,000 investment amount.

Currently participating:

$DB1 (+0.83%) , $UNP (-2.49%), $RACE , $MRK (-0.3%) , $MUV2 (-1.26%) , $DGE (+1.27%) , $DE (-0.25%) , $TXN (-2.62%) , $AWK (+1.85%) , $ADP (+1.65%) , $PLD (-2.05%) , $HEN (-0.96%) , $ITW (-2.81%) , $UNH (-0.68%) , $LLY (+0.32%) , $BEI (+2.28%) , $MCD (+0.3%) , $DTE (-0.64%) , $WMT (+0.18%) , $COST (+1.91%) , $WM (+1.3%) , $JPM (-1.48%) , $BLK (-8.13%) , $SY1 (-0.03%)

🔹 Cash reserve

💰 Set aside at least €1,000 every month to be able to strike flexibly when opportunities arise.

🏘️ Real estate strategy

We live in our own home and own a rental apartment that pays for itself. ✅

Further real estate purchases are planned. 🏡📈

🎯 Target (15-20 years)

Financial freedom - with the option of part-time or complete independence from employment. Focus on more time for family, projects and quality of life. ✨

How do you structure your portfolios? What is your strategy and what are your long-term goals?

I look forward to the exchange!

My portfolio is structured in

Normal risk sectors ETF and share savings plans

High risk with small caps

High risk leveraged with derivatives.

So fully focused on maximizing returns

Parents receive inheritance

Hello everyone!

My parents are in the process of selling my grandparents' house. It will probably fetch around €275,000. My parents will soon both be 60 years old.

They had initially considered buying another property nearby. But they have moved away again. The lack of flexibility and the time and risk involved with tenants put them off.

I also told them more about investing in the stock market. They were very open and interested, even though they said they had an unfounded fear of shares etc.

Now my question to you. What is the best way to invest the money? I think dividends would be very nice as my parents like the passive income like from a property. But it should also be very well diversified across countries and sectors.

I personally have developed 2 solutions. You can give your opinion as to whether you think the solutions are good or, of course, if you have completely different ideas.

1. the ETF solution

15% $XEOD (+0.03%) Call money ETF. Div. 1.9%

15% $TDIV (-0.25%) VanEck Divi Leaders. Div 3.5%

10% $TRET (-1.25%) Global Real Estate. Div. 3.7%

7,5% $VHYL (-0.37%) Allworld High Div Yi. Div 3.1%

7,5% $PEH (-0.73%) FTSE RAFI EM. Div 3.9%

5% $EWG2 (+0.5%) Gold

5% $SEDY (-0.45%) iShares EM Dividend. Div 8.0%

5% $JEGP (-0.32%) JPM Global Equity Inc Div 7.1%

5% $EEI (-0.01%) WisTree Europ Equity Inc Div 6.3%

5% $IHYG (-0.55%) High Yield Bond. Div 6.1%

5% $EXXW (-0.93%) AsiaPac Select Div50 Div 5.5%

15% Rest German Divi Shares approx. div 2.5%

=100% with 3.7% dividend.

275k ×3,7% = 10.175€

With full taxation 27.99% = 7327€

On average per month: 610€ dividend

With 2k tax-free allowance: 657€ dividend per month

I find it very well diversified, you have overnight money, you have the USA and Europe well represented, but also 12.5% emerging markets ETF. In terms of sectors, finance will be at the forefront. Followed by real estate and energy. I think that's fine.

2. the equity solution

I have selected 34 strong dividend stocks. In the list they are roughly divided into GICS sectors.

15% $XEOD (+0.03%) Overnight ETF. Div 1.9%

12% $EQQQ (-1.56%) Nasdaq100 ETF. Div 0.4%

5% $EWG2 (+0.5%) Gold

2% $O (+0.36%) Realty Income 6.0%

2% $VICI (-0.12%) Vici Properties 5.6%

2% $OHI (+0.88%) Omega Healthcare 7.2%

2% $PLD (-2.05%) Prologis 4.1%

2% $ALV (-1%) Allianz 4.35%

2% $HNR1 (-0.79%) Hannover Re 3.4%

2% $D05 (-0.04%) DBS Group 5.5%

2% $ARCC (-1.04%) Ares Capital 9.3

2% $6301 (-1.13%) Komatsu. 4,2%

2% $1 (+0.49%) CK Hutchison 4.6%

2% $AENA (-0.93%) AENA. 4,2%

2% $LOG (-0.75%) Logista 7.3%

1,5% $AIR (-2.51%) Airbus 1.8%

1,5% $DHL (+1.07%) DHL Group 4.8%

1,5% $8001 (-2.87%) Itochu 2.8%

2% $RIO (-0.64%) RioTinto plc 6.4%

2% $LIN (-1.42%) Linde 1.3%

2% $ADN (+0.47%) Acadian Timber 6.7%

3,5% $BATS (-1.48%) BAT 7.0%

2% $KO (+0.05%) Coca Cola 2.9

2% $HEN (-0.96%) Henkel 3.0%

2% $KVUE (+0.25%) Kenvue 4.1%

2% $ITX (-1.41%) Inditex 3.6%

2% $MCD (+0.3%) McDonalds 2.6%

2% $690D (+0.18%) Haier Smart Home 5.6

3,5% $IBE (-0.06%) Iberdrola. 4,1%

1,5% $AWK (+1.85%) American Water Works 4.4%

1,5% $SHEL (+1.73%) Shell 4.1%

1,5% $ENB (+0.28%) Enbridge 6.5%

2% $DTE (-0.64%) Deutsche Telekom 2.8%

2% $VZ (-0.34%) Verizon 6.8%

2% $GSK (-0.63%) GlaxoSmithKline 4.2

2% $AMGN (+0.33%) Amgen 3.5%

2% $JNJ (+0.26%) Johnson&Johnson 3.5%

= 100% with 3.5% dividend

275k ×3,5% = 9625€

With full taxation 27.99% = 6930€

On average per month: 577€ dividend

With 2k tax-free allowance: 624€ dividend per month

I also think this solution is cool because you can select the largest companies or strong dividend payers in the individual sectors or countries yourself. And of course you can also select shares with which you have a connection. However, I have focused on shares from the USA, England and Germany because of the withholding tax. Spain is also well represented because of my parents' ties to this country. It's also cool that the NasdaqETF also includes the Microsoft, Amazon, etc. compounders.

What do you think?

Sundays: Lost time for the economy - or for all of us?

$CEC (-0.86%)

$HBH (-0.55%)

$HEN (-0.96%)

$HM B (-1.05%)

Closed stores and dormant businesses on Sundays and public holidays are a tradition - but is this still in keeping with the times? For many working people, it means that shopping and errands are concentrated on Saturdays, which are already full. This leads to overcrowded stores, long queues and stress for customers and retail employees. But that's not all: private work is also restricted. Car washing, gardening or minor repairs are not permitted in many places. While online stores are selling around the clock, bricks-and-mortar stores remain closed. Should there be more flexibility to better balance business and everyday life? Or do the advantages of a common day of rest outweigh the disadvantages? What do you think?$

The Jews already knew back then that people need regular periods off work in order to survive.

1/7 turned out to be favorable. Approximately 1/7 is the statutory break working time. 1/7 of all working days are vacation, 1/7 of all years a sabbatical year is possible, 7x7 years are from 18 to retirement. All human brain cells are renewed every 7 years. The list goes on.

Shaking this up is dangerous for the human psyche.

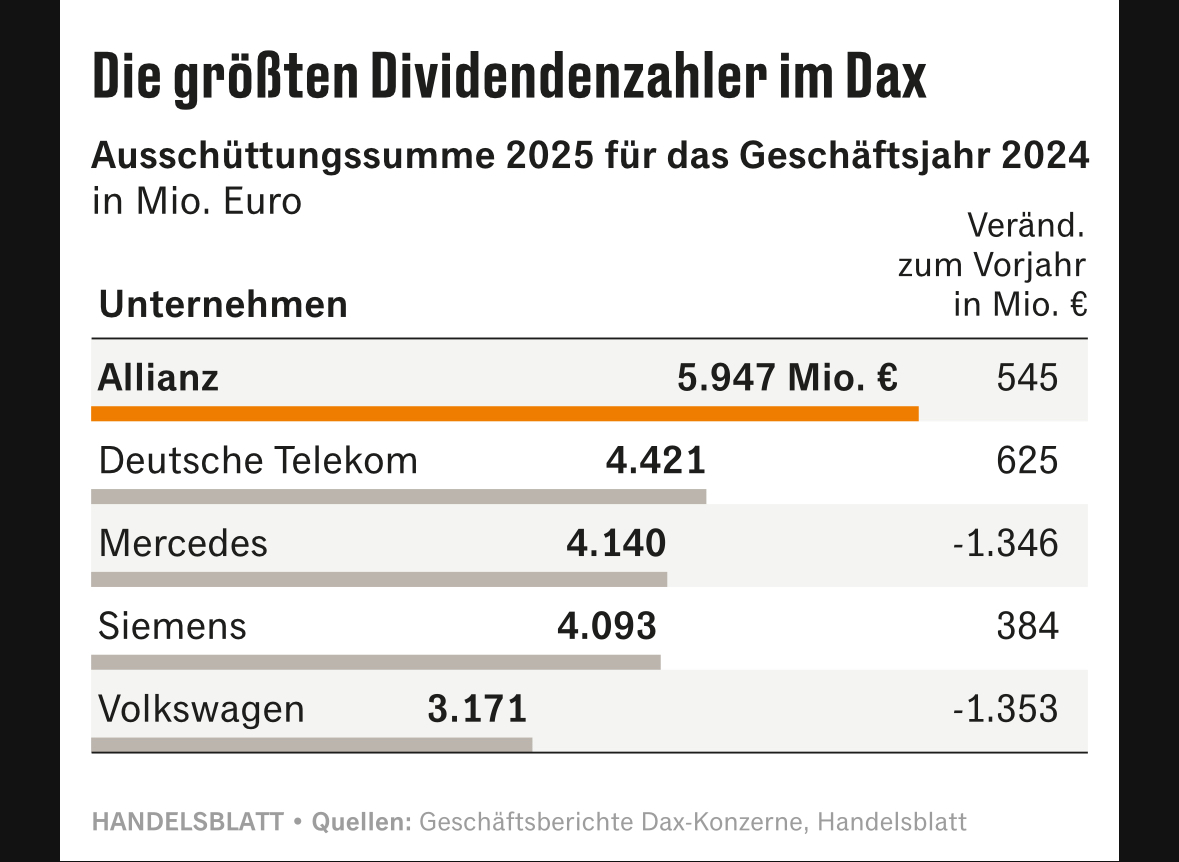

DAX companies' dividends - record high in sight

At 53 billion euros, the 40 DAX companies are likely to pay out almost one billion euros more this year than a year ago - more than ever before.

The reason for the strong development is high consolidated profits and unexpectedly rising dividends at a good dozen companies, including $ALV (-1%) Allianz, $MUV2 (-1.26%) Munich Re and $RHM (+1.13%) Rheinmetall.

At 109 billion euros net profit, the DAX companies are likely to have earned as much in 2024 as in the previous year, according to Handelsblatt calculations. Slump in earnings for the three car manufacturers $BMW (-2.17%) BMW, $MBG (-1.25%) Mercedes and $VOW (-3.38%) VW will be offset by companies in other sectors, in particular the major insurers Allianz, Munich Re and $HNR1 (-0.79%) Hannover Re, but also $DTE (-0.64%) Deutsche Telekom, $HEN (-0.96%) Henkel and $EOAN (-1.11%) Eon.

More than a dozen DAX companies have announced higher dividends than the market had previously expected. For example $ALV (-1%) 15.40 euros per share after 13.80 euros in the previous year. Analysts had forecast just under 15 euros. The insurer is thus distributing just under six billion euros. This is a record in the German corporate landscape.

The biggest jump is at $MUV2 (-1.26%) Munich Re: The reinsurer is increasing its dividend by five euros per share to 20 euros.

The two healthcare specialists $FRE (+0.25%) Fresenius and $FME (-0.8%) Fresenius Medical Care, the brand manufacturer $HEN (-0.96%) Henkel, the automotive supplier $BTR Continental, the $CBK Commerzbank, $RHM (+1.13%) Rheinmetall and $HNR1 (-0.79%) Hannover Re have raised their dividends, in some cases significantly more than expected. This is also due to rising profits, which justify a higher profit share for shareholders.

The largest dividend payers in the DAX are

Like the car manufacturers, a number of companies in the DAX remain below the usual international payout ratios, including the family-run groups $BEI (+2.28%) Beiersdorf and $MRK (-2.54%) Merck. They pass on less than 30 percent of their profits. This leaves enough of a buffer so that dividends do not have to be reduced immediately in more difficult times.

Germany's most valuable group, $SAP (+0.58%) SAP, with a payout ratio of 85%, is pushing the limit: net profit of 3.1 billion euros in the past year compares with a total dividend payout of 2.7 billion euros. However, the profit was burdened by a one-off effect.

So far, a total of 20 companies have increased their dividends, with only $BAS (-2.28%) BASF and the three car manufacturers. Four companies have yet to do so: $RWE (+0.32%) RWE, $SY1 (-0.03%) Symrise and $VNA (-0.63%) Vonovia are likely to increase their dividends, while analysts expect $PAH3 (-0.88%) analysts expect a reduction at Porsche Holding.

Source (excerpt) & chart: Handelsblatt, 15.03.25

11.03.2025

Tesla shares fall by more than 15 percent in one day + Tonner drones accelerate commercial development of INHIBITOR solution + Redcare hopes for strong sales growth + Henkel to invest one billion euros in share buyback + Deutsche Börse at record high + Apple has to work longer on new AI-Siri

Tesla share $TSLA (-2.04%)falls by more than 15 percent in one day

- The share price of Tesla, the electric car manufacturer led by Elon Musk, fell by more than 15 percent to 222 dollars on Monday, thus losing the last gains made after the US presidential election in November.

- Prior to the accelerated share price losses on Monday, another analyst had lowered the forecast for Tesla deliveries.

- The share price fell a further three percent after the close of trading.

- Since the record high in mid-December, the drop now amounts to more than 50 percent.

- Musk had become a close ally of the ultimately victorious Republican Donald Trump during the US election campaign.

- Following his triumph in the presidential election, Tesla shares soared.

- At its peak in mid-December, it was worth around twice as much as on election day on November 4.

- A downward slide then set in, which recently became steeper.

- After the share price plummeted, Trump claimed that "radical left-wing lunatics" were boycotting Tesla in order to harm Musk.

- He would buy a Tesla car on Tuesday as a sign of support for the "great American" Musk, the US President announced via the online platform Truth Social.

Tonner drones $ALDR (-5.76%)accelerates the commercial development of the INHIBITOR solution

- Tonner Drones ("the Company") announces that it is intensifying its efforts to commercialize its Inhibitor product.

- Tonner Drones holds valuable patents for stabilizing drones and counteracting the recoil effect.

- This technology can significantly improve the operation of drones after a target has been shot down.

- In light of the global increase in defense spending, Tonner Drones would like to take this opportunity to generate interest in the inhibitor patents from the parties.

- While Tonner Drones itself has no ambitions to develop the product, the company aims to optimize the value of the patents through sales or licensing agreements.

Redcare $RDC (-4.73%)hopes for strong sales growth

- The online pharmacy Redcare Pharmacy (formerly Shop Apotheke) is also aiming for strong growth in the current year.

- The MDax-listed company announced in Sevenum on Tuesday that sales are set to increase by at least a quarter.

- Based on sales of just under 2.4 billion euros last year, this would be 3.0 billion euros in the worst-case scenario, which is roughly what analysts surveyed by Bloomberg have in mind.

- In terms of profitability, however, the Dutch company could possibly disappoint again: The margin for adjusted earnings before interest, taxes, depreciation and amortization (ber EBITDA) is expected to improve slightly to between 2 and 2.5 percent.

- Analysts currently expect 2.3 percent. Redcare had already announced turnover figures in January.

- These have now been confirmed. The adjusted operating result fell by more than a third to 33.3 million euros, with the margin more than halving to 1.4 percent.

- The market had been expecting a less severe decline.

- In the final quarter, Redcare was even in the red in its day-to-day business.

- And the bottom line for shareholders in 2024 was again a loss: it increased to 45 million euros, compared to minus 12 million euros in 2023.

Henkel $HEN (-0.96%)wants to invest one billion euros in share buyback

- The consumer goods group Henkel has announced that it will buy back its own shares for up to one billion euros.

- The Dax-listed preference shares worth up to 800 million euros are to be acquired, as the company announced on Tuesday shortly before the announced presentation of the annual figures in Düsseldorf.

- The remaining 200 million euros are to be invested in the purchase of ordinary shares.

- "Based on the current share price, this corresponds to around 2.7 percent of the company's share capital."

- Henkel shares have significantly lagged behind the DAX in recent years.

- The company currently has a market capitalization of just under 36 billion euros.

German stock exchange $DB1 (+0.83%)at record high

- In a weak overall market, Deutsche Börse shares reached another record high on Monday.

- The increasing price fluctuations on the financial markets are likely to keep investors on their toes and ensure good turnover for stock exchange operators.

- The shares of the stock exchange operator rose by 2.9 percent to 264.80 euros at the peak in the afternoon.

- Deutsche Börse shares have climbed by almost 20 percent since the beginning of the year.

- The shares of counterparty Euronext had reached a high on Thursday.

- Not least the political developments since the election of Donald Trump as US President and his erratic actions are likely to force investors to constantly adjust their portfolios - with positive consequences for exchange operators.

- According to analyst Jochen Schmitt from Metzler Bank, turnover in interest rate products on the Eurex derivatives exchange and in cash trading on Xetra increased in January and February compared to the previous year.

- Deutsche Börse should benefit from the favorable capital market environment.

- Economies of scale would benefit the results, as the cost base is strongly determined by fixed costs.

Apple $AAPL (-1%)has to work longer on new AI-Siri

- Setback for Apple in the AI race with other tech giants: The iPhone company is taking longer than planned to develop its improved assistance software Siri.

- The new far-reaching functions with artificial intelligence will not be available until "next year", an Apple spokesperson told the website "Daring Fireball".

- The function was generally expected to be available this spring.

- Apple's plan is for the future Siri to be particularly helpful for users because the software has access to users' personal information and can be active across different apps.

- Rivals such as Google and Samsung also want to establish such functions in the everyday lives of users of their devices and software.

- Amazon will soon be opening advance access to an AI version of its Alexa assistance software in the USA. Apple has summarized its new AI offerings under the name "Apple Intelligence".

- So far, the software can reword and summarize texts and create new emoji from user descriptions, among other things.

- The first functions of "Apple Intelligence" are set to appear in Germany in April.

- The company is focusing on AI functions in the marketing of its current iPhone generation.

Tuesday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

- Novartis CHF 3.50

- Qantas Airways 0.10 AUD

- Spire 0.79 USD

- Quarterly figures / company dates USA / Asia

- 19:00 Eaton Investor Conference Call

- Quarterly figures / company dates Europe

- 06:45 Redcare Pharmacy NV, annual results

- 07:30 Gea Group | Henkel | Volkswagen annual results

- 09:00 Henkel Analyst Conference

- 09:30 Gea Group | Volkswagen BI-PK

- 11:00 Henkel BI-PK

Economic data

01:50 JP: GDP (2nd release) 4Q FORECAST: n.a. 1st release: +0.7% yoy previous: +0.4% yoy

08:00 DE: Labor Cost Index 4Q

15:00 US: Job Openings and Labor Turnover Survey (Jolts) January

No time specified:

- BE: Ecofin meeting of EU finance ministers

- CN: China's People's Congress, closing

What do you think of this ETF ?

⬆️⬆️⬆️

- GOLDMAN raises the price target for DELL from USD 155 to USD 165. Buy. $DELL (+0.16%)

- GOLDMAN raises the price target for ANALOG DEVICES from USD 247 to USD 261. Buy. $ADI (-4.3%)

- GOLDMAN raises the price target for HP INC from USD 35 to USD 38. Neutral. $HPQ (+0.65%)

- WARBURG RESEARCH raises the price target for VONOVIA from EUR 40.20 to EUR 42.30. Buy. $VNA (-0.63%)

- WARBURG RESEARCH upgrades STRATEC from Hold to Buy. Target price 40 EUR. $SBS4

- DEUTSCHE BANK RESEARCH raises the price target for DEUTSCHE BÖRSE from EUR 235 to EUR 237. Buy. $DB1 (+0.83%)

- MORGAN STANLEY raises the target price for DEUTSCHE TELEKOM from EUR 33 to EUR 38. Overweight. $DTE (-0.64%)

- GOLDMAN raises the price target for TRATON from EUR 31.80 to EUR 35.50. Neutral. $8TRA (-0.92%)

- GOLDMAN raises the price target for BRENNTAG from EUR 94 to EUR 95. Buy. $BNR (-2.55%)

- BERENBERG upgrades EQUINOR from Hold to Buy and raises target price from NOK 290 to NOK 325. $EQNR (+5.14%)

- JPMORGAN raises the target price for BEIERSDORF from EUR 150 to EUR 160. Overweight. $BEI (+2.28%)

- JPMORGAN upgrades HENKEL from Neutral to Overweight and raises target price from EUR 82 to EUR 100. $HEN (-0.96%)

- JPMORGAN upgrades BRITISH AMERICAN TOBACCO to Neutral. $BATS (-1.48%)

- JPMORGAN raises the price target for EON from EUR 15.50 to EUR 16. Overweight. $EOAN (-1.11%)

- JPMORGAN raises the target price for AUTO1 from EUR 12.10 to EUR 17.10. Overweight. $AG1

⬇️⬇️⬇️

- STIFEL lowers the price target for SIEMENS from EUR 207 to EUR 202. Buy. $SIE (-0.81%)

- JPMORGAN lowers the price target for HP INC from USD 41 to USD 40. Overweight. $HPQ (+0.65%)

- WARBURG RESEARCH lowers the price target for LANXESS from EUR 40 to EUR 37. Buy. $LXS (-18.72%)

- CITIGROUP lowers the price target for BASF from EUR 49 to EUR 46. Neutral. $BAS (-2.28%)

- RBC lowers the target price for COMMERZBANK from EUR 18 to EUR 17.25. Sector Perform. $CBK

- RBC lowers the target price for ING from EUR 17.50 to EUR 16.75. Sector-Perform. $ING (-2.58%)

- RBC lowers the price target for BNP PARIBAS from EUR 79 to EUR 78. Outperform. $BNP (-1.03%)

- JPMORGAN lowers the price target for ELRINGKLINGER from EUR 6.70 to EUR 6. Neutral. $ELLRY (+2.14%)

- JPMORGAN lowers the price target for SYMRISE from EUR 130 to EUR 120. Overweight. $SY1 (-0.03%)

Trending Securities

Top creators this week