- Markets

- Stocks

- Heidelberg Materials

- Forum Discussion

Heidelberg Materials

Price

Discussion about HEI

Posts

43🏗️ Heidelberg Materials - why I find the share exciting in the long term

Reading time approx. 6 min.

Last weekend I had to go to Stuttgart for business reasons. After my appointments were over, I had one or two days to explore Baden Württemberg. One of the places I visited was Heidelberg.

Since I Heidelberg Materials $HEI (-3.17%) had been on my watch list for some time, I took the opportunity to take a look at the company on site. (see pictures). On the way back, I couldn't stop thinking about the company. I took a closer look at the company, did some more research and took my time to think about it.

In the end, I came to the decision to make my first investment. It was precisely these considerations that led to this article.

For many people, Heidelberg Materials is "boring" at first - cement, concrete, building materials. But that's exactly the point. Without these materials, neither residential construction nor infrastructure can function, regardless of whether times are good or bad.

The company is one of the largest manufacturers of building materials in the world and has a very strong presence in many regions 🌍. Production is mostly organized locally, which gives it pricing power and protects it from international competitive pressure. For me, this is a solid foundation for a long-term investment 🧱📈.

📉 Falling interest rates as an important driver

A key issue for the coming years will be interest rates. The high-interest phase has hit the construction sector hard and many projects have been postponed or stopped altogether. This is exactly where I now see the turning point.

Falling interest rates mean:

📌 Construction projects are becoming affordable again

📌 Investors and local authorities are planning more long-term again

📌 Infrastructure programs are becoming more attractive

As soon as construction activity picks up again, companies like Heidelberg Materials benefit relatively directly. More construction, more cement, concrete and aggregates 🏗️. Historically, the interest rate environment has always been a decisive factor for the industry.

🌍 Infrastructure remains an ongoing issue

Irrespective of short-term economic cycles, there is a huge investment backlog:

🏗️ dilapidated roads and bridges

🏠 Lack of living space

⚡ Energy transition

🌱 Adaptation to climate change

These are not issues for one year, but for decades. Heidelberg Materials is right at the source here and is well positioned to benefit from these developments.

🇺🇦 Reconstruction of Ukraine as an additional long-term opportunity

Another point that is often discussed is the future future reconstruction of Ukraine. As soon as the conflict ends, massive investments will have to be made in housing, infrastructure and industry for many years to come.

This is not a short-term price driver, but it is an interesting prospect for long-term investors. Heidelberg Materials is present in Eastern Europe and has the necessary experience to play a role in such a reconstruction. For me, this is an additional upside option that should not be ignored 📈.

💰 Solid company with a focus on shareholders

What I also like:

💵 Stable cash flows

💶 regular dividend

⚙️ disciplined cost management

📊 Focus on profitability instead of blind growth

Overall, Heidelberg Materials appears to be very well managed and shows that it is possible to operate reliably even in a cyclical industry.

✅ Conclusion

For me, Heidelberg Materials is not a short-term gamble, but a calm, solid investment with good prospects for the coming years. Falling interest rates, rising construction activity, long-term infrastructure projects and the possible reconstruction of Ukraine together form an attractive overall picture 🧠📈.

With an investment horizon of 3 years or more I still consider the share to be exciting.

Energy 4.0 - The foundation of a new industry Part 1.2

Good morning, dear getquin community.

I've been looking closely at the CSP hybrid ecosystem from China recently and listened to an interesting article by futurologist Lars Thomsen. Today I would like to tell you why I think this system is one of the most exciting energy projects of the coming years. I don't want to withhold the results of this research from you.

Before we get into the topic, a quick word about the last post.

Thank you for your strong interaction, support, likes and participation. It was good to see that so many of you sent a clear signal to getquin to finally get things moving. It was just as nice to see that it @Tenbagger2024 motivated you to carry on and give new impetus. It's moments like this that keep the community together.

Speaking of momentum.

Today I'm giving you a new one. Because what is currently being built in China is more than just an energy project. It is a blueprint for an infrastructure that, in my eyes, puts coal and nuclear power plants in the shade.

Before we start, a quick note. I already wrote a first post on this topic. I'm now building on this, but in a much more comprehensive, clearly structured way and with more details so that the connections are easier for you to grasp.

I also @SAUgut777 had already addressed the topic back then, so I would like to mention him here as well. I'm including the link to my earlier article, China is reshaping the sun and Energy 4.0 Part 1. https://getqu.in/OIMCfh/

https://getqu.in/G4f1Tk/

The global energy transition will not be won by individual technologies but by integrative systems that must fulfill two decisive factors: Scalability and base load capability . What we are currently seeing in China is the construction of the most modern energy infrastructure that radically solves the decades-old problem of solar and wind volatility. Not with wind turbines and solar panels alone, but with a system that supplies base load, integrates storage and enables scaling. The centerpiece is the CSP Hybrid Ecosystemin which solar thermal energy, photovoltaics and gigantic battery storage units are combined to create a continuous 24/7 power source power source.

Technically explained: The new paradigm is the CSP hybrid ecosystem. It combines the rapidly erected photovoltaic (PV) fields with the thermal storage of Concentrated Solar Power (CSP) plants and complements both with massive Battery Energy Storage System (BESS). This intelligent coupling provides stable electricity 24 hours a day, 7 days a week and makes the system a direct and superior competitor to coal and nuclear power.

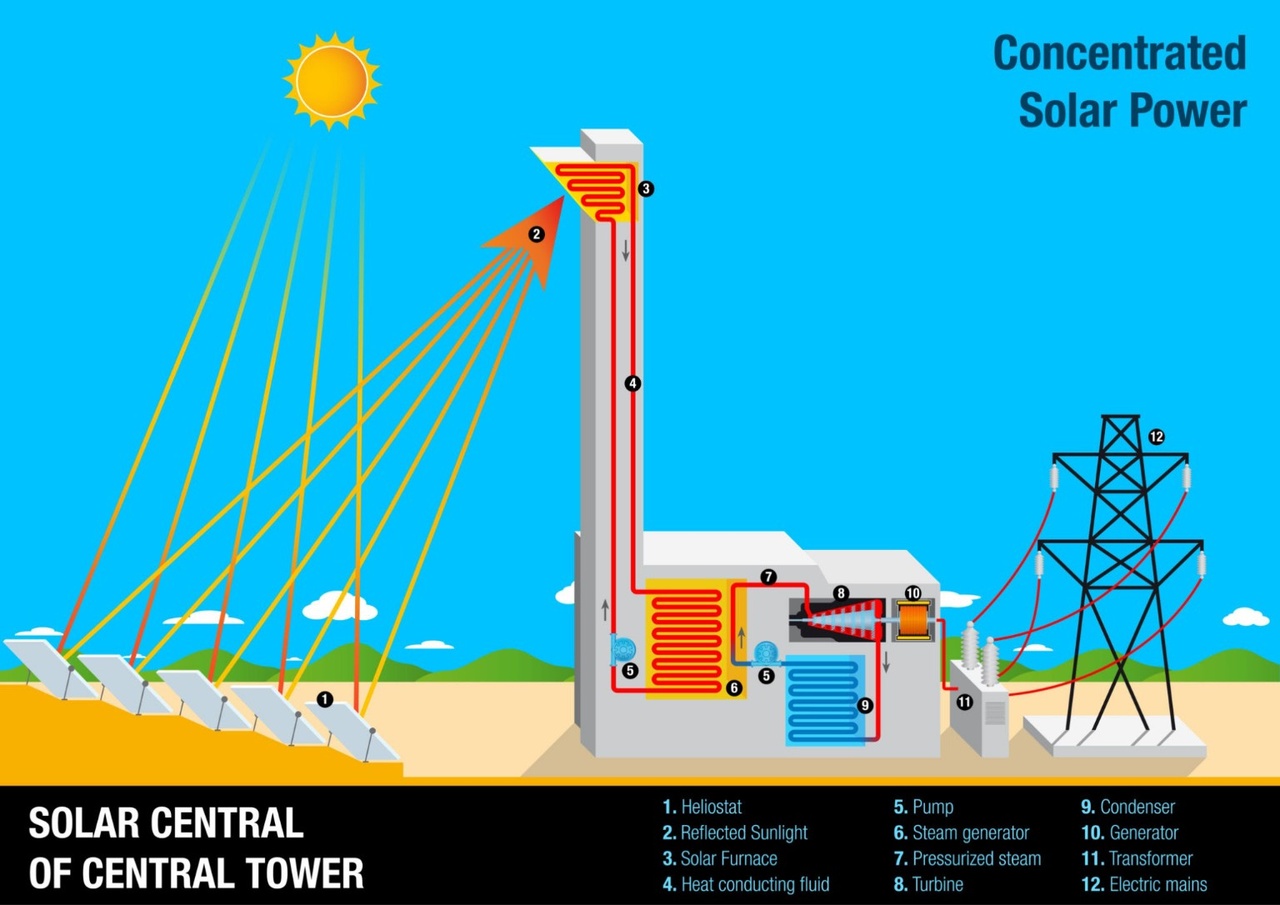

How the system works

1. mirrors collect sunlight

The surface at the bottom left consists of many movable mirrors (heliostats, point 1).

They are constantly aligned with the sun and focus the light onto the top of the tower (reflected sunlight, point 2).

2. the tower heats a heat medium

The solar oven (3) is located at the top of the tower.

There, the concentrated light hits a system of pipes through which a heat-conducting fluid runs (typically molten salts or oil).

This fluid becomes extremely hot, often several hundred degrees (4).

3. heat is converted into vapor

At the bottom of the building, the hot fluid transfers its energy to water in the steam generator (6), turning it into steam under high pressure (7). Pumps (5) keep the cycle going: hot fluid → cooled fluid → back up into the tower.

4. turbine and generator produce electricity

The pressurized steam drives a turbine (8). The turbine is connected to a generator (10), which converts the mechanical energy into electricity.

5. steam is liquefied again

The steam then enters the condenser (9), cools down and becomes water again. Then it goes back into the steam generator.

6. feed into the power grid

The electricity is brought to a higher voltage via a transformer (11) and fed into the grid via the high-voltage lines (12).

The gigawatt comparison and the true added value. A modern nuclear power plant constantly supplies around 1 GW to 1.6 GW of power. This output is continuous but extremely expensive, inflexible and ties up capital for over a decade. A CSP hybrid park in the Chinese desert can achieve a peak output of 5 GW. However, the real added value is the guaranteed base load capacity of 1 GW to 3 GW that can be called up 24/7 thanks to integrated thermal storage and batteries. This intelligent coupling provides stable electricity and makes the plant a direct and superior competitor to coal and nuclear power. This is the disruptive difference: the new generation delivers the same necessary base load but with much higher capital efficiency and 10 years shorter construction time. This makes nuclear power plants an outdated investment model.

The economic key lies in China Speed. It takes ten to 15 years for a nuclear power plant to produce any electricity at all. The Chinese mega bases reach base load capability in 18 to 24 months. This rapid time to market reduces capital costs and raises profitability to a level that is unattainable for traditional power generation.

🌍 Globalization of the Sun Belt: 8 investment pillars

China is exporting the hybrid model to the entire global sunbelt. MENA, North Africa, South America, Australia and Central Asia are among the new core markets. The pipeline is growing every year. The investment opportunities lie in the 8 fundamental pillars that make this infrastructure possible:

1. optics and mirror technology - These companies provide the optical basis for every CSP park

Big players

$SGO (-2.54%) Saint-Gobain (EPA: SGO) - France - World leader in specialty glass and high-tech materials. Supplies glass solutions and coatings for heliostats and CSP mirror systems.

Schott AG - Germany, private - Specialty glass and receiver tubes for many of the existing CSP plants. Key role in collector efficiency and lifetime.

Hidden champions

Rioglass Solar - Spain, private - Market leader for curved mirrors and receiver components especially for CSP parks. Strong in projects in Spain, MENA and Latin America.

Flabeg FE - Germany, private - High-precision mirrors for solar thermal energy. Supplies optics that directly determine the efficiency of power plants.

$000012 CSG Holding - China, Shenzhen - Large Chinese glass manufacturer with a growing focus on solar and CSP glass products.

2. storage chemistry and thermal media - They supply the chemical storage media for molten salt storage and heat transfer

Big player

$NTR (+2.58%) Nutrien (NYSE: NTR / TSX: NTR) - Canada - One of the largest fertilizer and nitrate suppliers in the world. Supplies nitrates for thermal storage and molten salt mixtures.

$YAR (+0.07%) Yara International (OSE: YAR) - Norway - Global fertilizer company. Produces nitrates and nitrogen chemicals that can be used in molten salt storage facilities.

$OCI (+0.72%) OCI N.V. (AMS: OCI) - Netherlands - Produces hydrogen and natural gas-based products, including nitrogen chemicals for thermal storage solutions.

Hidden Champions

$SQM (+0%) Sociedad Química y Minera (NYSE: SQM) - Chile - Lithium and specialty chemicals producer. Supplies lithium and nitrate salts for battery and thermal storage.

$MIN (-2.9%) Mineral Resources (ASX: MIN) - Australia - Combines lithium mining and processing. Important for lithium-based storage chains.

$SOLB (-1.66%) Solvay (EBR: SOLB) - Belgium - Specialty chemicals and heat transfer fluids, relevant for CSP and storage applications.

3. battery and energy storage systems (BESS) - The combination of BESS and thermal storage is the real 24/7 engine of CSP parks

Big player

$3750 (+1.65%) CATL - China - World market leader for EV batteries and large-scale storage. Supplies complete BESS systems for grids and CSP hybrid parks.

$1211 (-0.15%) BYD Co Ltd - China - Integrated battery and system provider. Provides energy storage systems for industrial and utility-scale applications.

$373220 LG Energy Solution (KRX: 373220) - South Korea - Global cell supplier with a strong focus on high-performance cells for e-mobility and stationary storage.

$SMSN (+0.58%) Samsung SDI (KRX: 006400) - South Korea - Premium cells and modular storage solutions for grid and industrial applications.

Hidden Champions

$FLNC (-5.2%) Fluence Energy (NASDAQ: FLNC) - USA - Joint venture between Siemens Energy and AES. Market leader in turnkey large-scale storage projects and operating software.

Powin Energy - USA, private - System integrator for utility-scale storage with a strong presence in North America and Asia.

$300274 Sungrow Power Supply (SZSE: 300274) - China - Well-known for inverters, growing strongly in the area of integrated BESS solutions for large-scale projects.

4. HVDC, cables and power transmission - HVDC turns desert power into exportable base load power

Big player

$HTHIY (-1.89%) Hitachi Energy - Switzerland / Japan, part of the Hitachi Group $HTHIY - World leader in HVDC converters, substations and grid control.

$PRY (+0%) Prysmian (BIT: PRY) - Italy - Largest manufacturer of high-voltage cables and submarine cables, central role in European HVDC projects.

$NEX (-3.75%) Nexans (EPA: NEX) - France - Specialized in power and submarine cables, important for long-distance transmission of desert electricity to Europe.

$ABBN (+0.72%) ABB (SWX: ABBN) - Switzerland - HVDC converters, switchgear and grid automation for large-scale projects.

Hidden Champions

$NKT (-1.72%) NKT A/S (CPH: NKT) - Denmark - Cable specialist with a focus on high-voltage and offshore wind connections.

Taihan - South Korea, private - Major Asian manufacturer of high-voltage cables with a growing export share.

$ANA (-4.81%) Acciona (BME: ANA) - Spain - Not only EPC, but also active in grid connections and infrastructure for large-scale renewable projects.

5. hydrogen and Power-to-X - Surplus electricity from hybrid parks is processed into green hydrogen

Big player

$LIN (-1.42%) Linde plc (NASDAQ: LIN) - Ireland / global - The world's largest industrial gases group. Plans, builds and operates large-scale electrolysis and liquefaction plants for green hydrogen.

$NCH2 (-2.77%) thyssenkrupp nucera (XETRA: NCH2) - Germany - Specialist for multi-gigawatt scale alkaline electrolyzers, key supplier for industrial H2 projects.

$NEL (+0.16%) Nel ASA (OSE: NEL) - Norway - Pure hydrogen player with focus on electrolyzers and H2 tank infrastructure.

Hidden Champions

$PLUG (-7.14%) Plug Power (NASDAQ: PLUG) - USA - PEM electrolysis, fuel cells and H2 infrastructure, increasingly involved in large-scale projects.

$BE (-13.46%) Bloom Energy (NYSE: BE) - USA - Develops higher efficiency solid oxide electrolyzers for industrial H2 generation.

$ITM (-5.5%) ITM Power (LSE: ITM) - United Kingdom - Focused on utility-scale PEM electrolysis, strong in European project business.

$HPUR (+12.71%) Hexagon Purus (OSL: HPUR) - Norway - Specialist in high-pressure tanks and transportation solutions for compressed hydrogen.

6. EPC, engineering and construction - These companies enable construction in less than two years

Big players

$601669 Power Construction Corporation of China (SSE: 601669) - China - One of the largest engineering and construction groups in the world. Builds dams, large-scale PV and CSP plants, including grid connection.

$601727 Shanghai Electric Group (SSE: 601727) - China - Full-service provider for CSP, turbines, storage integration and EPC services.

$ANA (-4.81%) Acciona (BME: ANA) - Spain - Global EPC player for solar, wind and CSP, strong in MENA and Latin America.

Hidden champions

SEPCO III - China, private - Highly specialized EPC for large power plants and CSP projects, often partner in Saudi Arabia and North Africa.

$WOR (-2.24%) Worley Limited (ASX: WOR) - Australia - Engineering and project services provider for energy infrastructure, including hybrid and storage projects.

$3996 (+2.75%) China Energy Engineering Corp (HKEX: 3996) - China - Large state-owned EPC group, active in the development of solar and grid projects in Asia, Africa and MENA.

7. turbines and power plant technology - CSP Hybrid is ultimately based on modern thermal power technology, only climate neutral

Big player

$ENR (-5.38%) Siemens Energy (XETRA: ENR) - Germany - Turbines, generators, switchgear and grid solutions. Core supplier for the thermal side of CSP hybrids.

$GE (-1.24%) General Electric (NYSE: GE) - USA - Steam turbines and power plant technology used directly in hybrid farms and thermal storage systems.

Hidden champions

$1072 (-3.33%) Dongfang Electric (HKEX: 1072) - China - Major turbine and power plant equipment supplier, strong in domestic market and MENA project.

$1133 (-3.9%) Harbin Electric (HKEX: 1133) - China - Manufacturer of turbines, generators and power plant components, active in large-scale conventional and renewable power plants.

8. blade manufacturers and construction materials for CSP hybrid parks

8.1 Construction and mining equipment

Big Player

$CAT (-3.78%) Caterpillar (USA, NYSE: CAT) - World's largest manufacturer of construction and mining equipment, dozers, excavators, dump trucks, generators. Provides heavy equipment for earthmoving, foundation construction and park infrastructure.

$6301 (-1.13%) Komatsu (Japan, TSE: 6301) - Number two worldwide in construction and mining equipment. Excavators, wheel loaders, large dump trucks and special machines used in desert projects and large construction sites.

$SAND (-2.05%) Sandvik (Sweden, OMX: SAND) - Drilling technology, rock processing, wear parts. Important for foundation construction, cable routes and the raw materials side of the value chain.

$EPI A (-2.09%) Epiroc (Sweden, OMX: EPI A) - Drilling rigs and underground equipment, wherever CSP infrastructure is built on difficult terrain.

Hidden champions

$6305 (-4.27%) Hitachi Construction Machinery (Japan, TSE: 6305) - Strong presence in Asia and MENA, large excavators and wheel loaders for deserts and large construction sites.

$DE (-0.25%) Wirtgen Group / John Deere $DE (USA) - Road construction, milling, compaction. Benefit from the expansion of access roads, platforms and logistics around CSP parks.

8.2 Steel, tubes and sections

Big player

$MT (-6.1%) ArcelorMittal (Luxembourg, NYSE: MT) - Global steel group with flat and long products. Supplies beams, sections and structural steel for tower structures, racks and infrastructure.

$5401 (-3.02%) Nippon Steel (Japan, TSE: 5401) - High-quality steel for energy and infrastructure applications, including heat-resistant steels.

$TEN (-0.18%) Tenaris (Luxembourg/Argentina, NYSE: TS) - Leading manufacturer of seamless steel tubes for energy, pipelines and high-pressure systems. Relevant for heat exchanger circuits, media pipelines and infrastructure in the CSP environment.

$VK (+0.13%) Vallourec (France, EPA: VK) - Specialty tubes and high-performance steels for energy projects, including high-temperature pipelines.

Hidden Champions

$5411 (-2.3%) JFE Holdings (Japan, TSE: 5411) - steels and tubes for large-scale projects, with a focus on Asia.

$TUB (-0.88%) Tubacex (Spain, BME: TUB) - Seamless stainless steel tubes for high temperature and corrosive environments, directly relevant for CSP heat and process piping.

$NXT Nextpower (USA) - Steel-intensive tracker systems for PV fields. Important in hybrid parks where PV and CSP are combined.

$ARRY (-5.69%) Array Technologies (USA) - Similar to Nextracker, focus on utility-scale tracking systems.

8.3 Cement, concrete and construction chemicals

Big player

$HOLN (-4.85%) Holcim (Switzerland, SIX: HOLN) - The world's leading supplier of cement and concrete. Supplies foundation concrete, specialty mortars and infrastructure construction materials for major projects, including desert locations.

$HEI (-3.17%) Heidelberg Materials (Germany, Xetra: HEI) - Strong player in Europe, North Africa and Asia. Cement, concrete and aggregates for foundations, turbine houses, storage blocks.

$CX (-7.14%) Cemex (Mexico, NYSE: CX) - Globally active in cement and concrete, supplier for infrastructure in MENA and the Americas.

$CRH (-4.27%) CRH plc (Ireland, NYSE: CRH) - Building materials group with a focus on infrastructure, road construction and precast concrete products.

Hidden Champions

$ULTRACEMCO UltraTech Cement (India, NSE) - India's largest cement manufacturer, relevant for CSP projects in the subcontinent and neighboring regions.

Votorantim Cimentos (Brazil, private / regionally listed) - Strong supplier in Latin America with a direct link to infrastructure and energy projects.

8.4 Industrial components, heat exchangers and process equipment

Big player

$ALFA (-1.86%) Alfa Laval (Sweden, OMX: ALFA) - Heat exchangers, pumps and separators. Key components for thermal storage, steam generation and process heat in CSP plants.

$FLS (-6.45%) Flowserve (USA, NYSE: FLS) - Pumps, valves and sealing systems for high-temperature and high-pressure circuits in energy plants.

$SPX (-2.89%) Spirax Group (UK, LSE: SPX) - Steam and condensate technology, control valves and heat exchange systems, important for the fine control of thermal circuits.

Hidden champions

$IMI (+2.19%) IMI plc (UK, LSE: IMI) - Specialty valves and control technology for the energy and process industries, especially for demanding media.

$KSB (-3.62%) KSB SE (Germany, Xetra) - Pumps and valves for the energy, water and process industries. Suitable for cooling water, heat transfer media and storage systems in CSP parks.

🎯 Conclusion and outlook

The CSP hybrid ecosystem eliminates the weaknesses of renewable energies and uses China Speed as an economic lever. This combination creates a capital efficiency that will overtake traditional energy generation in the long term. The investment opportunities range from the Asian battery giants to the European HVDC specialists.

The fundamental question is whether European regulators can adjust the speed of the approval process to allow the continent to keep up with the pace of the Sahara projects and the European EPC companies operating there, or whether the continent will be left behind in terms of energy self-sufficiency.

Takeaway

The real investment case lies in the efficiency superiority of the CSP hybrid system. The ability to provide gigawatts of base load within two years, coupled with thermal storage and BESS, makes this infrastructure one of the strongest energy models of the future. This benefits optics, chemistry, BESS, HVDC, hydrogen, EPC and turbine manufacturers.

Sources: own research + IEA, IRENA, NREL, Fraunhofer ISE, SolarPACES, World Bank, Ember Climate, company reports & technical documentation of the companies mentioned.

Image: https://videos.winfuture.de/27754.mp4

Getty Images, Illustrative image - JLStock / Shutterstock.com

What is risk? My strategy and portfolio - and your recommendations!

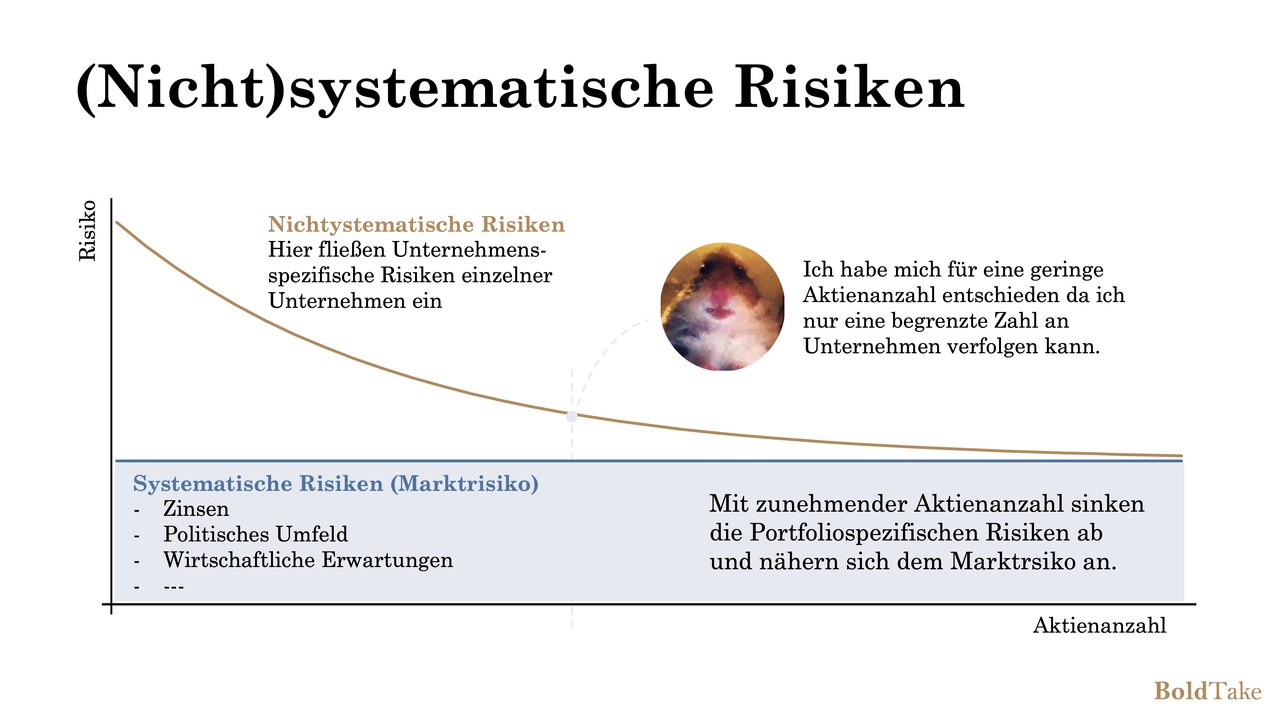

Everyone perceives risks individually. Everyone tries to independently assess the risk of a share or the current economic situation on the stock market.

In portfolio theory, risk is primarily measured using the standard deviation. In simple terms, this is the extent to which a share price moves. If this movement is correlated with the "market", this results in a beta. If this is < 1 bedeutet das, dass der Kurs einer Aktie geringer als der Markt schwankt. > 1, the result is a disproportionate fluctuation. The "market" is an elastic term. For example, an MSCI World, S&P 500 or the DAX can be used as a reference. The result is different betas depending on the index. However, I do not want to go into this topic any further at this point.

Why beta is not relevant for me

- Price fluctuations are not a problem in my current life situation (24 years old; student).

- Every share that grows faster than the market has a beta > 1. As my portfolio is set to grow, a high beta is desirable.

Diversification as a risk?

I often see portfolios with 30+ companies on Getquin. The aim behind this is to minimize risk. In my view, however, what gets lost in the process is the overview - or leisure time, because every share in the portfolio should be tracked and scrutinized.

I have therefore opted for a clearly structured portfolio. There are currently 11 companies (but the number is not set in stone). There are two reasons for this:

I want to know and follow each company in my portfolio well

The impact of a price increase should be significant

My strategy for less drawdown despite fewer shares

- Cover as many sectors as possible

- Consider regional sales distribution

- Know a company as well as possible

Why these companies?

- Heidelberg Materials $HEI (-3.17%). Local monopolies with strong pricing power

- Medpace$MEDP (+0.1%). Enabler of small research/pharma teams. Enables research outside of Big Pharma

- Hims and Hers$HIMS (-1.1%). Generics seller with "cool brand". Enables better margins in the long term.

- MercadoLibre $MELI (+0.44%). The Amazon and bank of Latin America. To benefit from the rise of emerging markets.

- Meta Platforms$META (-2.49%). Monopoly in communication/social media.

- Prada$1913 (-7.7%). One of the few luxury companies that is constantly growing (and not highly valued). More on this in my last post.

- BATS$BATS (-1.48%). Non-cyclical business model. Bought at the time due to significant undervaluation. Now I hold the share to stabilize the portfolio somewhat.

- Sanlorenzo$SL (-0.97%). Yacht manufacturer and thus part of the luxury sector, which I find attractive due to its high margin and low cyclicality.

- Solaria $SLR (-4.94%). My conservative bet on rising energy demand through AI.

- Metaplanet $3350 (-6.29%). Bitcoin gamble with play money.

My criteria for buying shares

Basically, I hardly set myself any limits when investing. I like to invest in shares that are rather unpopular at the time of purchase. The sector doesn't matter, although I prefer high-margin business models.

I like to buy cheap - high P/E ratios put me off (even if FOMO sometimes kicks in). I don't feel comfortable with it because of the potential drop.

Wow. Thank you for reading this!

Now that you know my strategy, I would really appreciate some stock tips tips, that could fit my strategy.

By the way, can you see the portfolio? Because it's my own post I can't check it👀

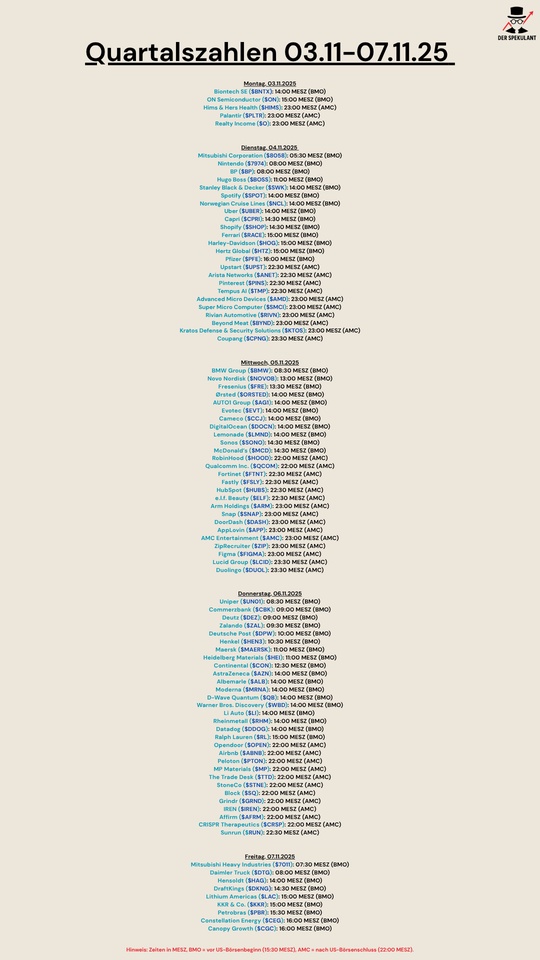

Quartalszahlen 03.11.25-07.11.15

$BNTX (-0.4%)

$ON (-6.58%)

$HIMS (-1.1%)

$PLTR (+2.91%)

$O (+0.36%)

$8058 (-1.8%)

$7974 (-0.89%)

$BP. (+2.63%)

$BOSS (-0.67%)

$SWK (-2.78%)

$SPOT (+2.85%)

$N1CL34

$UBER (-0.62%)

$CPRI (-4.04%)

$SHOP (-3.23%)

$RACE (-1.86%)

$HOG (+0.61%)

$HTZ (-3.52%)

$PFIZER

$UPST (-3.13%)

$ANET (-4.24%)

$PINS (+1.78%)

$TEM (-1.1%)

$AMD (-3.16%)

$SMCI (-2.7%)

$RIVN (+2.15%)

$BYND (+0%)

$KTOS (+2.28%)

$CPNG (-1.78%)

$BMW (-2.17%)

$NOVO B (-0.55%)

$FRE (+0.25%)

$ORSTED (-2.5%)

$AG1 (-1.73%)

$EVT (-1.25%)

$CCO (-4.28%)

$DOCN (+0.26%)

$LMND (-0.17%)

$SONO (-6.11%)

$MCD (+0.3%)

$HOOD (-4.81%)

$QCOM (-1.01%)

$FTNT (-1.14%)

$FSLY (-1.93%)

$HUBS (+1.76%)

$ELF (+0.2%)

$ARM (-4.91%)

$SNAP (-3.26%)

$DASH (-2.74%)

$APP (-1.53%)

$AMC (-7.04%)

$ZIP (+10.7%)

$FIG (-4.6%)

$LCID (-0.59%)

$DUOL

$UN0 (-0.29%)

$CBK (-2.79%)

$DEZ (-4.01%)

$ZAL (-0.42%)

$HEN (-0.96%)

$MAERSK A (+1.35%)

$HEI (-3.17%)

$CON (-4.4%)

$AZN (-2.23%)

$ALB (-1.84%)

$MRNA (-2.04%)

$QBTS (-0.78%)

$WBD (-0.21%)

$LI (+1.2%)

$RHM (+1.13%)

$DDOG (+2.85%)

$RL (-4.22%)

$OPEN (-3.38%)

$ABNB (-1.55%)

$PTON (-0.62%)

$MP (-5.64%)

$TTD (-2.17%)

$STNE (-0.59%)

$SQ (-1.74%)

$GRND (+0.5%)

$IREN (-7.48%)

$AFRM (-1.48%)

$CRISP (-7.37%)

$RUN (-3.45%)

$7011 (-1.52%)

$DTG (-1.94%)

$HAG (+0.71%)

$DKNG (-1.05%)

$LAC (-1.26%)

$KKR (-4.41%)

$PETR3 (+4.2%)

$CEG

$WEED (+0.38%)

Bank of America bets on 14 rising infrastructure stocks

Bank of America (BofA) has put together a basket of stocks to list the winners of the German infrastructure package.

The basket contains 14 stocks that the US bank expects to benefit in particular.

- The German technology group Siemens

$SIE (-0.81%) (weighted at 10.3 percent, as of August 21) - The French construction group Eiffage $FGR (-2.83%) (9 percent)

- The German building materials manufacturer Heidelberg Materials

$HEI (-3.17%) (8.8 percent) - The German energy technology group Siemens Energy $ENR (-5.38%) (8.6 percent)

- The German truck manufacturer Daimler Truck

$DTG (-1.94%) (8.4 percent) - The Italian building materials company Buzzi S.p.A.

$BZU (-4.8%) (7.9 percent) - The Swiss cement group Holcim $HOLN (-4.85%) (7.6 percent)

- The Swiss chemicals group Sika AG $SIKA (-3.2%)

(7.4 percent) - The German forklift manufacturer Kion

$KGX (-4.8%) (6.7 percent) - The French communications and energy company Spie $SPIE (-5.1%) (6.4 percent)

- The German industrial group Thyssen-Krupp $TKA (-3.05%) (6.4 percent)

- The German wind turbine manufacturer Nordex

$NDX1 (-4.82%) (4.6 percent) - The Swedish steel group SSAB $SSAB A (-3.16%)

(4.1 percent) - The German industrial services provider Bilfinger

$GBF (-3.65%) (4.0 percent)

Hopes for the infrastructure package have already caused the shares to rise significantly in some cases in recent months. Since the beginning of the year, the shares included in the basket have risen by around 47 percent. BofA has been offering the share basket to its major clients since the beginning of July.

Despite the jump in the prices of many infrastructure stocks in the first half of the year, BofA manager Klein is confident that the stocks in the basket will continue to rise. According to him, it now depends on when the investments really show up in the profits of the companies.

Oliver Schneider, portfolio advisor at US asset manager Wellington, says: "In the past six to nine months, investor interest in infrastructure stocks has grown rapidly." This is particularly true for European investors.

He cites two factors that he believes will drive infrastructure stocks worldwide in the future. Firstly, there is a great need to modernize infrastructure. Secondly, the demand for electricity is growing due to artificial intelligence. Schneider says: "This is a growth topic that will be with us for the next ten to 20 years."

Source: Text (excerpt) & graphic, Handelsblatt 01.09.25

Presentation of my depot - criticism, improvements etc. welcome

Good morning to the community.

I would also like to introduce my portfolio and share my thoughts and goals.

First of all, a bit about myself and how I got into trading:

I am 39 years old and have actually NEVER been interested in the stock market/shares. Through a lucky coincidence in the gambling sector, I suddenly had a 5-figure sum in my account. I then went on a kind of overnight interest rate shopping spree. At some point, however, there were no more offers that appealed to me and I ended up with TR call money. At first I didn't want to invest any money in shares or ETFs, but then I decided to take a look. That was in August 2024, when I caught the bug quicker than I would have liked and, thanks to a good friend, I was able to quickly gather some information and recognize the benefits of investing.

I've been invested ever since.

Now to the structure and goals of my portfolio:

The main focus is on an ACWI IMI in order to build up a certain amount of capital through compound interest. I am expecting an investment horizon of 20 - 25 years. The aim is to have built up a certain amount of capital by then so that I can make withdrawals later in and around retirement age and enjoy a good life in retirement without having to worry. The ACWI was the first major building block for diversification. However, I am honest and I was tempted to buy a portfolio with various individual shares. These are mainly dividend-oriented. Most of the positions pay stable dividends and have moderate growth. I deliberately chose many defensive stocks such as $MUV2 (-1.26%)

$ALV (-1%) or $JNJ (+0.26%) in my portfolio so as not to be too speculative. Classics like $KO (+0.05%)

$MCD (+0.3%)

$PG (-0.28%) round off the whole thing. I wanted to achieve an inflow of at least €100 per month over the entire year. Currently it's around €2150 for the whole year. I enjoy having a continuous inflow of dividends that I can reinvest freely. I really wanted to take this positive aspect of the investment with me. Accordingly, I also have very strong dividend payers in my portfolio, although they can be quite volatile and operate in a difficult market environment, e.g. $SHEL (+1.73%)

$PETR4 (+2.49%) or $MO (-0.92%) . In December, I invested in shares of $HOT (-2.62%) and $HEI (-3.17%) with the idea that these companies could possibly benefit from the reconstruction of war zones. (I know that's perhaps not the nicest thought and I'm not a friend of wars either, but you have to ignore that when it comes to profits) and the shares of both have done really well for me. That's why I'm also invested in 2 defense ETFs. Another ETF I have in my portfolio is a "tech/software" ETF, AI & Big Data. Individual stocks were too risky for me here and I preferred to take a broadly diversified approach. I also recently added the Germany All Cap to my portfolio, as I think that Germany will be on the rise again in the future. As a small stock with the hope of a real cracker for the future, I have $DEFI (-6.45%) in the portfolio. Let's see what happens. I'm currently running a savings plan of around 200 euros a month, as I don't have the funds to pump huge amounts of fresh money into my portfolio due to a house loan.

With this in mind, I would be grateful for any tips, suggestions and perhaps also positive words. If you have any questions, please let me know.

Kind regards

Now also Deutsche Bank

The German bank has now also used the coalition agreement and the associated special fund as the basis for a list of recommendations.

The result is a list of 10 potential profiteers.

The result:

$CBK (-2.79%) - Commerzbank

$ENR (-5.38%) - Siemens Energy

$VOS (-6.02%) - Vossloh

$HEI (-3.17%) - Heidelberg Materials

$EVK (-1.46%) - Evonik

$KGX (-4.8%) - Kion

$BC8 (+1.97%) - Bechtle

$COK (-1.24%) - Cancom

$VOW (-3.38%) - Volkswagen

$PAL (-3.71%) - Palfinger

Source: "Welt"

25.03.2025

US tariff threats send Hong Kong stock market plummeting + Novo Nordisk secures rights to weight loss and diabetes drugs + Hornbach defies weak consumer sentiment and increases earnings + Bayer is recommended to stop glyphosate sales in the USA + Heidelberg Materials wants to pay more dividends

US tariff threats send Hong Kong stock market plummeting

- Similar to the start of the week, stock markets in East Asia and Australia were mostly little changed on Tuesday.

- The very firm guidance from Wall Street fizzled out.

- In the US, share prices rose sharply on Monday, supported by media reports that the punitive tariffs announced by the Trump administration for the beginning of April will be less drastic than initially announced.

- The planned introduction date of April 2 also no longer appears to be set in stone.

- There is a sharp drop in Hong Kong, with the Hang Seng Index falling by 2 percent.

- Observers point to the US President's announcement to impose punitive tariffs of 25 percent on imports from countries that purchase oil from Venezuela.

- China is one of the countries affected, notes equity strategist Kai Wang from Morningstar.

- Although there is no direct correlation with the Hong Kong stock exchange, he admits, the market reaction could be a kind of "side effect" of the impending risks.

- Other market participants are talking about profit-taking, especially in the technology sector, which had recently benefited from AI fantasies.

- In Shanghai, meanwhile, the Composite Index is up 0.1 percent.

Novo Nordisk $NOVO B (-0.55%)secures rights to weight and diabetes medication

- The Danish pharmaceutical company Novo Nordisk has secured the rights to a potential next-generation weight loss drug for up to 2 billion US dollars.

- According to a statement on Monday, the Danes are paying an initial 200 million dollars (185 million euros) for the rights to the active ingredient UBT251 from the Chinese company United Laboratories.

- This excludes mainland China, Hong Kong, Macau and Taiwan.

- Depending on certain targets and possible sales figures, up to 1.8 billion dollars may be added at a later date.

- UBT251 is said to target three different mechanisms in the fight against obesity, diabetes and other diseases.

- Studies in early test phases are ongoing.

- It may therefore take some time before approval is granted for the various indications.

- The deal strengthens Novo Nordisk's pipeline of novel drugs for the treatment of diabetes and obesity.

- The Danes were the top dog for a long time, but competition in this lucrative business has been increasing rapidly for some time now.

Hornbach $HBH (-0.55%)defies weak consumer sentiment and posts surprisingly strong earnings growth

- The DIY group Hornbach Holding continued to struggle in the past 2024/25 financial year due to its customers' reluctance to spend.

- However, because the management kept costs firmly under control and lower commodity prices also had a favorable effect, the company increased its operating profit surprisingly significantly.

- In the twelve months to the end of February, earnings adjusted for special items (adjusted EBIT) climbed by 6 percent to 270 million euros, the SDax-listed company announced in Bornheim on Tuesday based on preliminary calculations.

- The Group thus exceeded analysts' profit expectations.

- Albrecht Hornbach, CEO of shareholder Hornbach Management AG, expressed his satisfaction.

- "We look back positively on the results of the past financial year", he said according to the press release.

- "Despite subdued consumer sentiment, especially in Germany, we successfully developed our business further.

- We were able to expand our market share in Germany and other important European markets."

- At EUR 6.2 billion, sales in the period under review were only slightly up on the previous year, meaning Hornbach performed in line with the revenue forecast lowered in December.

- As the largest operating subgroup, the DIY store business posted sales growth of 1.2 percent in the past year, while the builders' merchant business suffered losses of a good six percent due to the weak sector economy in Germany.

- The Board of Management will publish further details on the past financial year and its sales and earnings forecasts for the current year 2025/26 on May 21.

For will Bayer $BAYN (-2.91%)recommended a halt to glyphosate sales in the USA

- Due to the ongoing wave of glyphosate lawsuits, Markus Manns, fund manager at Union Investment, is recommending that Bayer stop selling glyphosate in the USA.

- "If there is no progress in the lobbying activities or the legislative proposals, or if the Supreme Court does not deal with the case, then Bayer must urgently consider stopping glyphosate sales in the USA," Manns told the Rheinische Post.

- "The company and its shareholders cannot tolerate any further large waves of lawsuits."

- Manns further emphasized: "The amount of damages in Georgia is astronomically high and a bitter setback for Bayer's litigation strategy.

- However, the amount will probably be significantly reduced by an appellate court."

- A jury in Georgia has just ordered Bayer to pay more than 2 billion US dollars to a man suffering from cancer. (Rheinische Post)

Heidelberg Materials $HEI (-3.17%)wants to pay more dividends

- The building materials group Heidelberg Materials wants to pay out more to its shareholders despite a decline in profits.

- A dividend of 3.30 euros per share is to be paid for 2024, as the DAX-listed company announced in its annual report on Tuesday.

- This is 30 cents more than in the previous year.

- Analysts had estimated an average of 3.25 euros.

- The company had already presented preliminary full-year figures in February and provided an initial outlook for the current year.

- As already announced, the bottom line for 2024 was a net profit attributable to shareholders of just under EUR 1.8 billion, compared to around EUR 1.9 billion in the previous year.

- The management confirmed the profit target for the current year.

- The Executive Board expects adjusted earnings before interest and taxes (EBIT) of 3.25 to 3.55 billion euros for 2025, compared to 3.2 billion euros in the previous year.

Tuesday: Stock market dates, economic data, quarterly figures

- Quarterly figures / Company dates Europe

- 07:00 TAG Immobilien detailed annual results and dividend

- 07:00 Hornbach Holding AG Trading Statement 2024

- 07:30 Jenoptik annual results | Indus Holding Capital Markets Day

- 07:50 Medios annual results

- 11:00 Jenoptik BI-PK

- Without time information: Heidelberg Materials | MTU Aero Engines Annual Report | Tui Capital Markets Day

- Economic data

06:00 EU: Acea, new car registrations, February

08:00 DE: Construction industry, new orders and sales January | Residential real estate prices (house price index) 4Q

10:00 DE: NordLB Norddeutsche Landesbank Girozentrale, annual results

10:00 DE: Ifo Business Climate Index PROGNOSE: 86.6 PREVIOUS: 85.2 Situation assessment PROGNOSE: 85.5 PREVIOUS: 85.0 Business expectations PROGNOSE: 88.0 PREVIOUS: 85.4

11:00 DE: Bundestag, Constituent Session, Berlin

11:30 EU: ECB, allotment of 7-day main refi tender

14:00 HU: Hungary's central bank PROGNOSE: n.a. previous: 6.50%

14:40 US: Fed Governor Kugler, speech on "Economic Landscape and Entrepreneurship"

15:00 BE: Business Climate Index March PROGNOSIS: n.a. previous: -12.3

15:00 US: Consumer Confidence Index March PROGNOSIS: 93.5 previous: 98.3

15:00 US: New Home Sales February FORECAST: +3.0% yoy previous: -10.5% yoy

Profiteer Construction Trade

Hochtief's share price has already gained almost 30 percent in 2025. Whether network centers in the USA or infrastructure in Europe, investors have been buying into the company with great enthusiasm. But in addition to the fantasy, the company is also fundamentally convincing.

In the 2024 financial year, turnover climbed by 20% to around EUR 33.3 billion. Consolidated operating profit rose by over 17% to EUR 625 million, exceeding the upper end of the forecast range of EUR 560 to 610 million. A further increase of 9% to 17% to EUR 680 to 730 million is planned for 2025.

Nobody currently doubts that these targets will be achieved. When US President Trump announced investments of USD 500 billion for AI infrastructure projects in January 2025, the share price rose significantly. This is because Hochtief has a strong presence in the USA. A data center is already being built in Ohio via the subsidiary Turner. The planned special fund for federal infrastructure projects was also a driver for the share price. However, there are two things to bear in mind here: Firstly, this special fund has not yet been approved by the Federal Council and secondly, Hochtief generates 95 percent of its sales outside Europe. For Germany, we estimate a sales share of only 1 to 2 percent.

But things are going well at Hochtief. The figures are impressive proof of this. It is possible that the planned investments by the German government will ensure that the company can benefit noticeably not only from US investments, but also from those in Germany. That would be the best-case scenario. Investors remain on board.

Trending Securities

Top creators this week