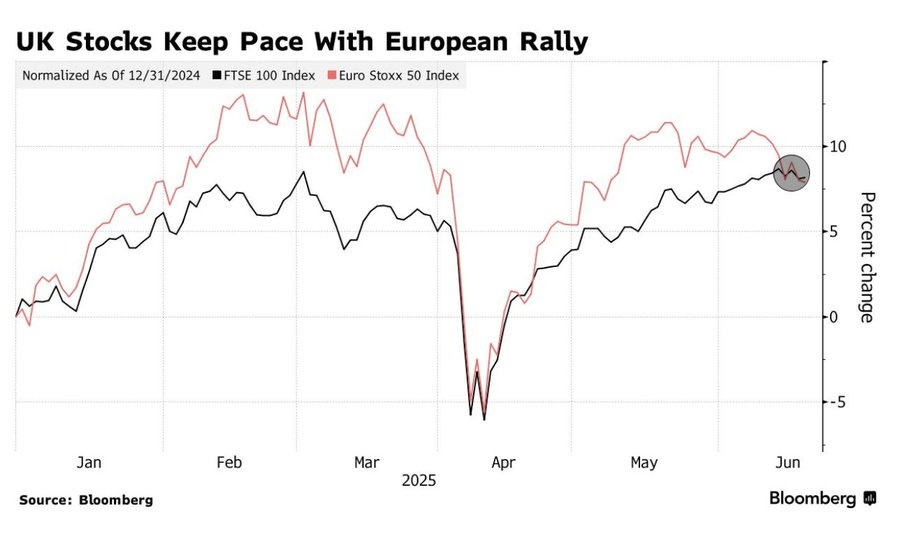

The $C (-0.08%) currently recommends the FTSE 100, as it is well suited as a hedge against the risk in the Middle East. This is illustrated by 3 factors.

- The FTSE 100 is driven by energy companies such as $SHEL (-0.74%) and $BP. (+0.46%) dominated. These benefit from geopolitical tensions and thus provide a natural hedge.

- The FTSE has a high weighting in defensive sectors such as pharmaceuticals, such as $AZN (-0.96%) and consumer goods, such as $ULVR (-2.6%) as. These sectors are historically resilient to geopolitical problems.

- Many companies in the FTSE 100 generate the majority of their sales outside the UK. This makes them less vulnerable to domestic risks and more resilient to global uncertainties.

𝖢𝗂𝗍𝗂𝗀𝗋𝗈𝗎𝗉 𝗌𝗂𝖾𝗁𝗍 𝖻𝗋𝗂𝗍𝗂𝗌𝖼𝗁𝖾 & 𝖲𝖼𝗁𝗐𝖾𝗂𝗓𝖾𝗋 𝖠𝗄𝗍𝗂𝖾𝗇 𝗌𝗈𝗐𝗂𝖾 𝖤𝗇𝖾𝗋𝗀𝗒 𝗎𝗇𝖽 𝖽𝖾𝖿𝖾𝗇𝗌𝗂𝗏𝖾 𝖲𝖾𝗄𝗍𝗈𝗋𝖾𝗇 𝖺𝗅𝗌 𝗉𝗈𝗍𝖾𝗇𝗓𝗂𝖾𝗅𝗅𝖾 𝖮𝗎𝗍𝗉𝖾𝗋𝖿𝗈𝗋𝗆𝖾𝗋, 𝖿𝖺𝗅𝗅𝗌 𝖽𝗂𝖾 𝗀𝗅𝗈𝖻𝖺𝗅𝖾𝗇 𝖱𝗂𝗌𝗂𝗄𝖾𝗇 𝗐𝖾𝗂𝗍𝖾𝗋 𝗌𝗍𝖾𝗂𝗀𝖾𝗇.