I think everyone is talking about the situation surrounding software companies at the moment 🗣️

"AI is killing the software sector" is what we have been hearing since the beginning of the year.

Some companies have recently presented their quarterly figures 📊 but I won't go into that in this article.

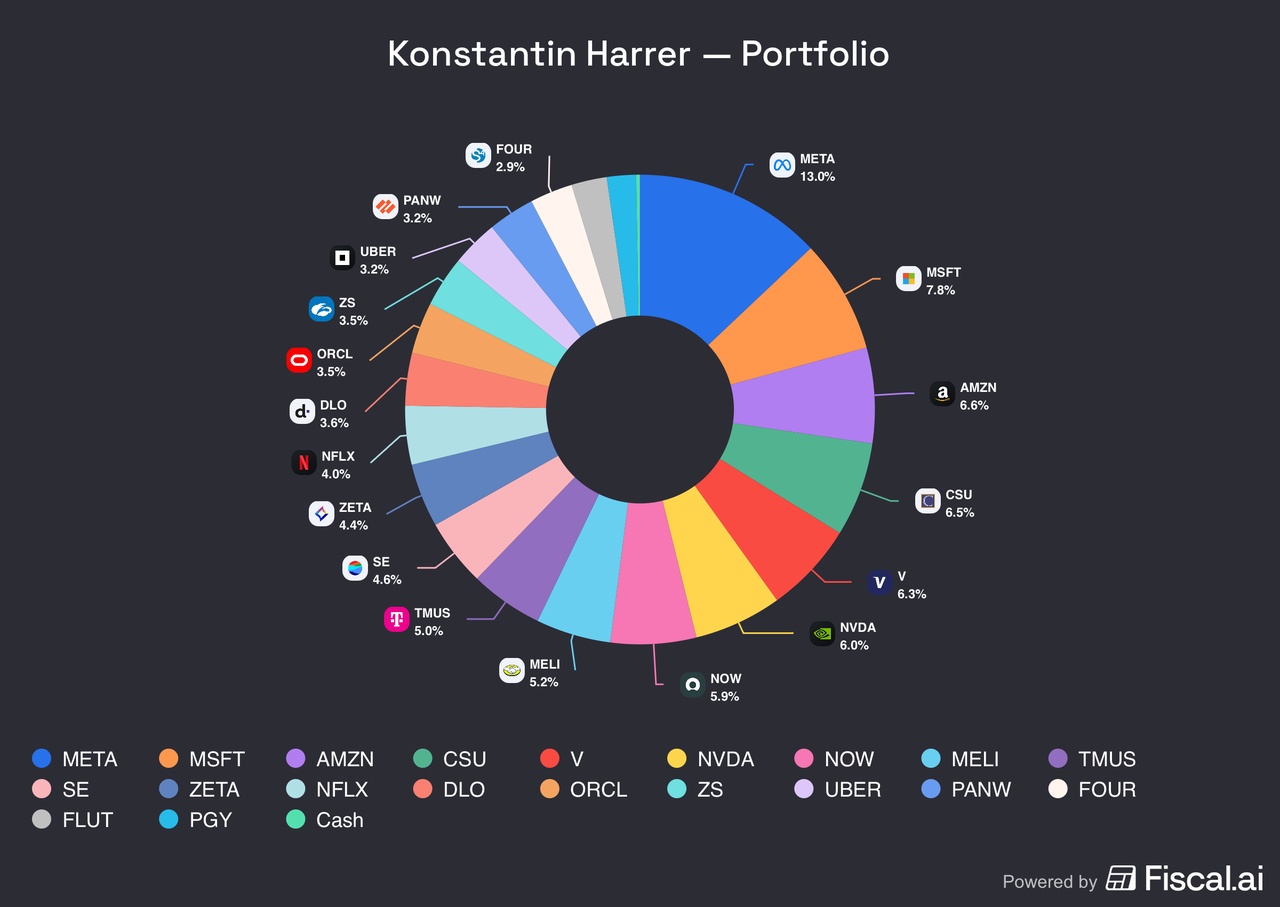

I have now taken a quick look at a few companies 🔬 that are also in my personal focus in order to supplement my portfolio 📊.

Let's see how future-oriented these companies are and whether this current pessimism is really justified.

How are the major software companies that have just published quarterly figures or are currently the focus of the markets actually doing?

Today's article focuses on the following companies:

SERVICENOW $NOW (+0.48%) - SALESFORCE $CRM (-1.37%) - SAP $SAP (-0.18%) - INTUIT $INTU (+1.48%) - CONSTELLATION SOFTWARE $CSU (+3.6%)

I have divided it into several categories:

- 1️⃣💪The strengths of AI and impact

- 2️⃣🏢Company quick check + 🏗️KI Implementation & integration

- 3️⃣🔄What impact could AI have on companies?

- 4️⃣🫥The weaknesses of AI

- 5️⃣🏁Conclusion

The software industry is currently experiencing one of its biggest upheavals in decades. The fact that companies like $SAP (-0.18%) SAP, $NOW (+0.48%) ServiceNow or $ADBE (+0.67%) Adobe are coming under pressure on the stock market is not because their software has become "worse" - but because AI is rewriting the basic rules of the industry 📝

Let's first take a look at why AI is currently bringing the entire software industry to its knees.

1️⃣💪THE STRENGTHS OF AI AND ITS EFFECTS 🧠

Here are the key strengths of AI that are currently making established software companies weak in the knees:

▶️ The end of the "pay-per-seat" model

Most software giants earn money per user license (seat-based pricing).

📈- The power of AI: It makes employees massively more efficient. If an AI agency does the work of three accountants or two programmers, the client company needs fewer licenses.

📉- The fear: The traditional business model based on the number of human heads is collapsing. Investors fear that the turnover of software companies will shrink because AI "eats employees".

▶️ "Vibe coding" and the democratization of development

Software development used to be a slow, expensive process carried out by highly specialized experts.

📈- The power of AI: Today, tools such as Cursor or GitHub Copilot make it possible for AI to already account for over 25 % to 30 % (with Google $GOOGL (+0.19%) even more) of the code. The so-called "vibe coding" allows even non-technicians to create functional prototypes using descriptions alone.

📉- The fear: Lower barriers for new competitors. Small start-ups can now build software with a minimal budget that used to require millions in investment.

▶️ AI agents instead of rigid dashboards

Traditional software is a toolbox with fixed menus and dashboards.

📈- The power of AI: Agentic AI (agentic AI) acts autonomously. It does not wait for a click, but recognizes tasks (e.g. "Book the trip and archive the receipts") and executes them across all tools.

📉- The

fear: If an AI completes tasks directly, users will no longer need to open the user interface (UI) of traditional software at all. The software becomes a pure "backend data supplier", loses direct contact with the customer and thus its market power.

▶️ Elimination of technical debt

Many established companies are dragging decades-old code (legacy code) that is difficult to maintain.

📈- The strength of AI: AI is extremely good at analyzing old code, documenting it and translating it into modern languages.

📉- The fear: The advantage of the "old hands" who use their complex systems as moats is dwindling. If AI makes it possible to modernize or replace a legacy system in weeks rather than years, market leaders will lose their protection against nimble newcomers.

--------------------------

--------------------------

2️⃣🏢The companies in the quick check + IMPLEMENTATION & AI INTEGRATION

⚪️🟢ServiceNow $NOW (+0.48%)

(The workflow specialist)

ServiceNow $NOW (+0.48%) is currently showing impressive growth - subscription revenues are increasing at double-digit rates, and AI-based offerings such as Now Assist are gaining in importance.

🦾- Strengths: "The operating system of IT". They connect different software islands within a company through automated workflows.

- Strategy:

Now Assist automates IT support and HR processes. They have recently integrated Moveworks to perfect voice control.

-Monetization: Introduction of "Pro Plus" packageswhich are significantly more expensive than standard licenses. Customers pay for the massive time savings (e.g. 50% faster ticket solution).

- AI potential: ServiceNow uses GenAI to automatically resolve IT tickets or finalize HR requests via chatbot.

🏗️🔁 IMPLEMENTATION & INTEGRATION WITH KI

Use of AI:

📽️-Self-Healing IT:

AI agents monitor server infrastructures. If the AI detects an imminent overload, it autonomously ramps up capacities or restarts services before a ticket is created.

🔍- Agentic HR workflows:

An employee wants to apply for parental leave? The AI agent checks leave entitlements, informs the insurance company, triggers the salary adjustment and sends confirmations - all in a closed process without HR employees.

🧑💻- Now Assist & Creator:

Employees can build their own mini-apps or automations using natural language, which reduces the IT backlog.

🆕Effect:

🏋️♀️-Productivity leap:

Customers report a reduction in ticket volumes of up to 50% as standardas standard requests (password reset, standard software) are resolved completely autonomously.

🔗- Upselling:

Customers switch from standard licenses to the significantly more expensive "Pro" and "Enterprise" versions to gain access to the AI functions.

🌱Net effect:

📈 Strong growth + 📈 Margins + 📈 Pricing power

-Extremely high margins, as automation increases the value of the software per employee.

-------------------------

⚪️🔵SAP $SAP (-0.18%)

(The "rock" in the back office)

SAP $SAP (-0.18%) is one of the largest European software groups with a long history in the enterprise segment. Cloud sales are growing strongly and increasingly include AI functions.

🦾- Strengths: World market leader in ERP software. Almost every business process (purchasing, HR, finance) runs via SAP.

- Strategy: Integration of Joule into all cloud solutions. In January 2026, it was announced that AI functions are included in two thirds of all new cloud contracts.

- Monetization: SAP uses a premium model. If you want to use the latest AI functions (such as "Deep Research" in Joule), you have to switch to the more expensive cloud edition packages (e.g. "RISE with SAP").

- AI potential: With the AI assistant Joule SAP automates complex tasks such as accounting or supply chain forecasts.

- Advantage: AI can analyze huge amounts of data in real time, for example to predict supply bottlenecks before they occur.

🏗️🔁 IMPLEMENTATION & INTEGRATION WITH KI

Use of AI:

🧑💻-Joule as a "dispute resolution agent":

In finance, the AI automatically reconciles unclear incoming payments with outstanding invoices and proactively clarifies differences with customers (e.g. in the event of discount errors).

🚚- Supply chain optimization:

AI analyzes real-time weather and traffic data to predict delivery delays and autonomously suggests alternative suppliers or routes.

🚨- Sourcing agent:

In SAP Ariba, AI automatically identifies potential savings in supplier contracts and prepares requests for proposals (RFPs).

🆕Effect:

☁️-Cloud migration:

AI functions are almost only available in the cloud (S/4HANA Public Cloud). This is forcing conservative major customers to modernize.

🌊- Process acceleration: Complex workflows (e.g. monthly closings) are accelerated by up to 75% faster.

🌱Net effect:

📈 Stabilization + 📈 Cloud growth

(but not an AI high-flyer)

-------------------------

🔵🔵Salesforce $CRM (-1.37%)

(The CRM pioneer)

Salesforce $CRM (-1.37%) the CRM giant, continues to show solid growth and raises forecasts several times due to the AI dynamics upwards.

🦾- Strengths: Dominates customer relationship management (CRM). Strong ecosystems through Slack and Tableau.

- Strategy: With Agentforce customers can build autonomous agents that solve 90% of customer support requests without humans, for example.

- Monetization: Salesforce is testing results-based pricing models. Customers pay per successfully completed conversation/task of an AI agent (approx. 2 $ per conversation).

- AI potential:

Agentforce enables companies to create autonomous AI agents that solve customer queries or prepare sales pitches without the need for human intervention.

- Advantage: Massive increase in productivity in sales and support.

Salesforce $CRM (-1.37%)

is currently

currently

the biggest change in strategy in its history: Away from the pure sale of software licenses for people, towards the sale of AI agents.

🏗️🔁 IMPLEMENTATION & INTEGRATION WITH KI

AI deployment:

📆-Agentforce SDR (Sales Development Rep): These AI agents research leads, write personalized emails, respond to objections and book appointments directly in the human sales rep's calendar.

📇- Marketing automation:

The AI no longer segments target groups according to rigid rules, but based on behavioral predictions (e.g. "Who will quit in the next 48h?") and creates the appropriate campaign for them

🗃️- Data cloud integration:

The AI accesses all data (emails, Slack chats, sales figures) in order to have a 360-degree view of the customer.

🆕Effect:

📊-Scaling: Companies can massively expand their sales without hiring new employees, as the AI takes over the "cold calling".

🗄️- Lock-in: The more company data flows into the Salesforce Data Cloud, the better the AI agent works - making it almost impossible to switch to another CRM.

🌱Net effect:

📈 Turnover + 📈 Efficiency + 📈 Cash flow

-------------------------

🔵⚪️Intuit $INTU (+1.48%)

(Finances for SMEs & private individuals)

Intuit $INTU (+1.48%) is best known for tax and financial software such as TurboTax, QuickBooks and Credit Karma. The latest quarterly figures show solid sales and profit growth - double-digit growth in revenue and earnings per share, also driven by AI functions in core products.

🦾- Strengths: Market leader for accounting (QuickBooks) and taxes (TurboTax). Also owns marketing data with Mailchimp.

- Strategy:

Intuit Assist takes over the tax return or bookkeeping almost completely autonomously.

- Monetization: Upselling in live services. AI does the preliminary work, and the customer pays for the certainty that an expert (AI-supported) will look over it at the end.

- Focus on numbers: TurboTax Live (AI + human) recently grew by 47%.

- Advantage: Tapping into the mid-market (Enterprise Suite), where AI cuts manual setup by 60%.

Makes complex financial topics easily accessible for non-experts and automates tedious bookkeeping.

🏗️🔁 IMPLEMENTATION & INTEGRATION WITH KI

AI deployment:

🔀- TurboTax

"Full service" AI: AI agents take over the "viewing" of receipts (OCR) and mapping to complex tax forms. The AI acts as a preparer for human experts, which drastically reduces the processing time per case.

📚-QuickBooks

"Digital workforce": In QuickBooks, AI agents act as virtual accountants. They not only categorize transactions, but also actively identify potential tax savings or late payments and draft reminders directly.

💸-Credit Karma Integration:

The AI analyzes tax data in real time to offer users suitable financial products (loans/insurance) at the exact moment of the tax refund.

🆕Effect:

⏰-Time saving: According to Intuit, SMEs save $INTU (+1.48%) up to 12 hours per month in bookkeeping.

🔁- Monetization: Thanks to the "full service" (AI + human), Intuit can $INTU (+1.48%) can charge higher fees than for the pure software, as the customer buys the result (finished tax), not the tool.

🌱 Net effect:

📈 Sales growth + 📈 Margins

-------------------------

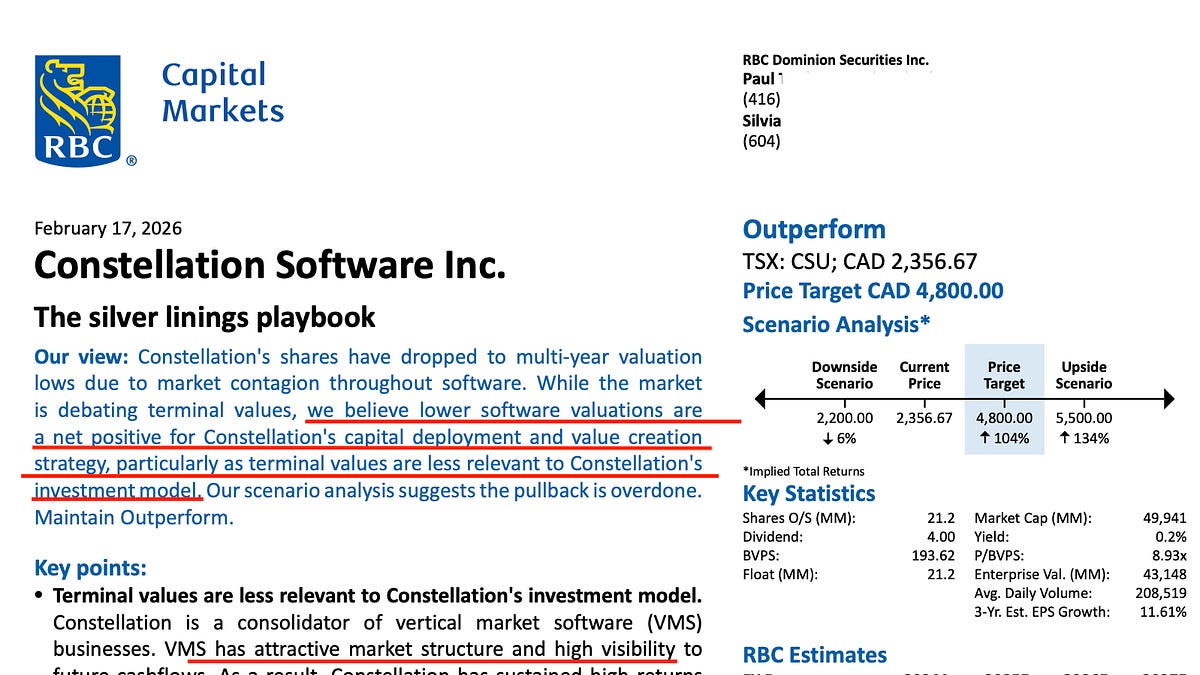

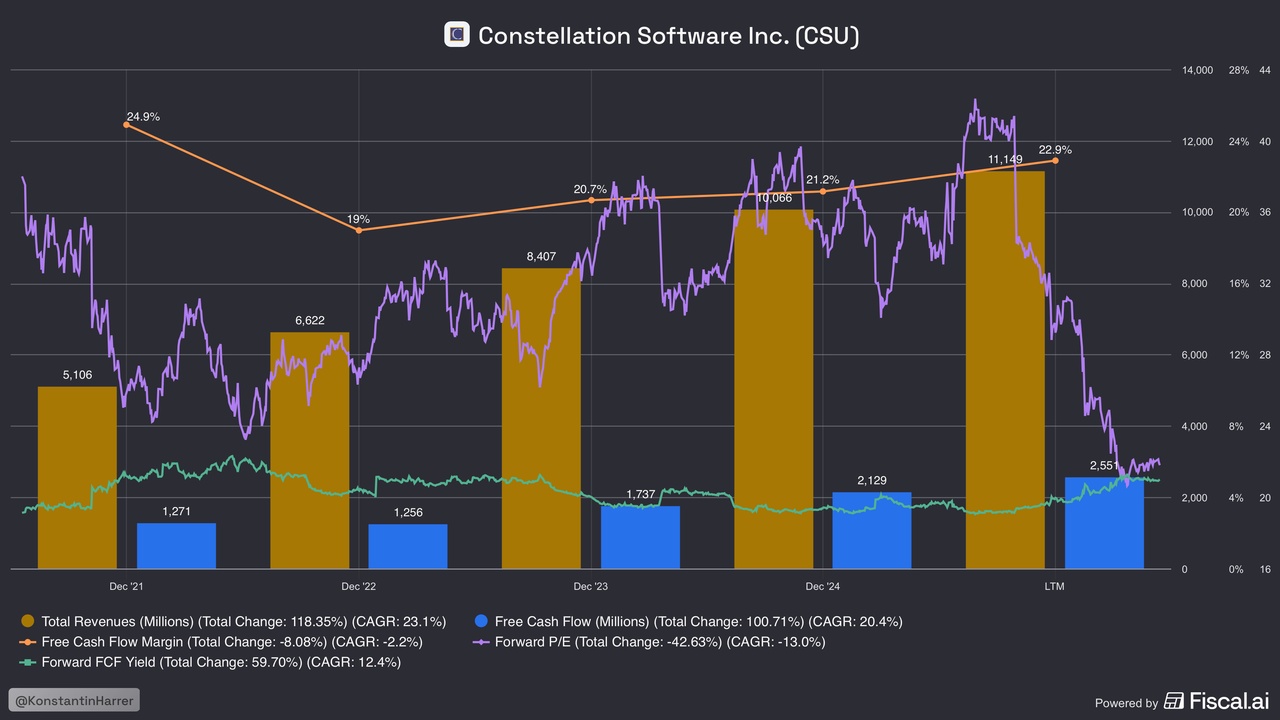

🟢Constellation Software $CSU (+3.6%)

(The "serial acquirer")

Constellation Software $CSU (+3.6%) is very different from the others as it is a diversifier and acquirer of specialized niche software companies. and acquirer of specialized niche software companies. Bershire hathaway in the tech sector

🦾- Strengths: Unique business model. They buy specialized niche software (VMS) that is indispensable for certain industries (e.g. libraries, transport companies).

- Strategy: Decentralized approach. Over 60% of their subsidiaries already use AI for internal R&D, 27% have AI products for end customers.

- Monetization: As $CSU (+3.6%) buys niche monopolies, they raise prices as soon as the software becomes more valuable through AI (higher efficiency for the customer = higher license fee).

- Special feature:

$CSU (+3.6%) Has seen share price fall in 2025/26 (partly due to founder Mark Leonard's resignation for health reasons), but free cash flow continues to grow at approx. 20%.

- AI potential: Constellation benefits indirectly. They can use AI to increase efficiency in their hundreds of subsidiaries without having to conduct expensive basic research themselves.

- Advantage: Extremely high customer loyalty in niche markets where there is hardly any competition.

Business model is designed for long-term retention and organic growth.

🏗️🔁IMPLEMENTATION & INTEGRATION WITH KI

Use of AI:

🌇-Code modernization:

Constellation is making massive internal use of AI to more efficiently maintain decades-old legacy code from its acquired companies or translate it into modern languages.

💾- Niche automation:

AI modules are being retrofitted into specialist software (e.g. for library management or parking lot management) to predict occupancy rates or automatically capture documents, for example.

🆕Effect:

🛡️-Margin protection: AI helps keep customer support and software maintenance costs low at subsidiaries while keeping prices stable.

⚔️- Capital allocation: Since Constellation doesn't chase the "AI hype", they often buy companies cheaper that others have labeled as "not AI-ready".

🌱Net effect:

📊 Stability > Growth

--------------------------

--------------------------

3️⃣🔄

What other impact could AI have on businesses?

AI works in three stages:

1. Automate (reduce costs)

2. Improve (increase productivity & quality)

3. Replace (certain activities / roles)

🧩 1. areas that AI can and will take over in the future

🔹 Customer service & support

🤖What AI will take over in the future:

-First-level support (tickets, chat, emails) -Standard questions, FAQs, status queries

-Password resets, simple configuration help

🔁Partially replaced:

-Call center staff

-Support agents for simple requests

Example:

- $NOW (+0.48%) ServiceNow → AI agents

- $CRM (-1.37%) Salesforce → Einstein GPT

- $SAP (-0.18%) SAP → Joule for internal support processes

📉 Effect on numbers:

✔ Costs down

✔ Scaling up

✔ Margin increases

🔹 Back office & administration

🤖What AI takes over:

-Invoice processing

-Contract review

-Data entry & reconciliation

-expense accounting

🔁Partially replaces:

-clerk

-accounting assistant

Typical in:

- $SAP (-0.18%) SAP (Finance, HR)

- $INTU (+1.48%) Intuit (accounting, tax processes)

📉 Effect:

✔ Faster processes

✔ Fewer errors

✔ Lower personnel costs

🚀 2. areas that AI IMPROVES (productivity levers)

🔹 Software development

🤖What AI improves:

-Code generation

-Code reviews

-Bug fixing

-test automation

❌Not replaced:

-Software architects

-System designers

-Product managers

👉 Developers become 10-30 % more productivebut not superfluous.

📈 Effect:

✔ Faster product cycles

✔ More features

✔ Better quality

🔹 Distribution (Sales)

🤖What AI improves:

-Lead scoring

-Purchase probabilities

-Personalized offers

-Forecasts

❌Does not replace:

-Key Account Manager

-negotiations

-Relationship management

Example:

- $CRM (-1.37%) Salesforce Einstein

- $NOW (+0.48%) ServiceNow sales workflows

📈 Effect:

✔ Higher closing rates

✔ Better predictable turnover

🔹 marketing

🤖What AI improves:

-Content creation

-Campaign optimization

-Target group analysis

-A/B testing in real time

🔁Partially replaces:

-Content Producer

-Performance marketing routines

📈 Effect:

✔ More output

✔ Lower marketing costs

✔ Higher conversion

⚠️ 3. areas that AI PARTLY REPLACES

🔹 Data analysis & reporting

🤖What AI replaces:

-Standard reports

-Dashboards

-Manual analyses

👨💻Bleibt human:

-Interpretation

-Strategic decisions

-context evaluation

📉 Effect:

✔ Faster decisions

✔ Fewer analysts per team

🔹 HR & recruiting

🤖What AI replaces:

-CV screening

-Scheduling

-Skill matching

👨💻Bleibt human:

-Interviews

-culture fit

-management selection

📉 Effect:

✔ Faster staffing

✔ Lower HR costs

🧠 4. areas that AI can NOT (yet) replace

❌ Corporate strategy

❌ Product vision

❌ Leadership & culture

❌ Creative innovation

❌ Responsibility & liability

--------------------------

--------------------------

4️⃣🫥 THE WEAKNESSES OF THE KI

This is the crucial point: while the strengths of AI are causing a stir on the stock market, it is its weaknesses that are currently still holding many companies back from fully embracing the technology.

AI is - ironically - brilliant, but often unreliable. Here are the biggest weaknesses:

1. the "hallucination" (fact-blindness)

AI models are statistical word-probability machines, not knowledge databases.

- The problem: An AI does not "know" anything; it calculates the next logical word. In doing so, it invents facts, court rulings or historical data with absolute conviction.

- The result: In areas where 100% accuracy is required (medicine, law, tax), AI without human control is a high risk.

2. the "black box" (lack of explainability)

We often do not know exactly why an AI has arrived at a certain result.

- The problem: Deep learning models are so complex that the decision path is not comprehensible.

- The consequence: In regulated industries (banks when granting loans or insurance companies), "The AI said so" is not legally tenable. Companies need Explainable AI (XAI) to clarify liability issues.

3. data hunger and copyright

AI learns from existing data - and this is a legal minefield.

- The problem: Most models have been trained with internet data without asking the originators. In addition, an AI in training "eats" vast amounts of energy and water to cool the data centers.

- The result: Lawsuits from artists, publishers and software developers are piling up. Companies risk copyright infringements if the AI reproduces protected content.

4. context window and "forgetfulness"

AI often has a limited short-term memory (context window).

- The problem: If you give an AI a 500-page manual, it sometimes loses the thread or ignores details in the middle of the text ("lost in the middle" phenomenon).

- The result: AI is often still too short-sighted for highly complex long-term projects.

--------------------------

--------------------------

5️⃣🏁CONCLUSION: Is the pessimism in the market justified?

In my opinion, the current pessimism towards the software industry is wildly exaggerated. AI is still at the very beginning of its journey - and yet the market is acting as if it will bombard the entire software sector overnight. Or does the market see something that I don't? In any case, this is exactly the scenario being played out at the moment. No matter how strong the figures are, they are being sold off mercilessly, without differentiation, without patience.

One thing is beyond question: AI is the future. But AI is nothing magical. It is only as good as the data it is fed with. And this is precisely the crucial point. Established software companies have a structural advantage that cannot simply be copied. They are sitting on decades of real process, customer and supply chain data - the collective memory of the global economy. A new AI start-up may shine with a fancy interface, but a corporation like $SAP (-0.18%) has over 30 years of historical corporate reality. That is power. That's the real treasure.

For me, the current phase feels less like an end - and more like a huge opportunity in the market. The software sector is currently - if not the - most interesting sector on which I have placed my focus.

*Forgive me if I have not mentioned one or two points in this article; it is quite possible that I have forgotten things, not described them in enough detail or described them incorrectly.

The information that I was able to quickly find out about the companies has only been summarized here in a rough and simplified form.

What is your assessment?

@Tenbagger2024

@Sansebastian

@Get_Rich_or_Die_Tryin

@Epi

@Crash-Propheteus

@Iwamoto

@Multibagger

@Klein-Anleger

Thanks for reading,

your stock master ✌️